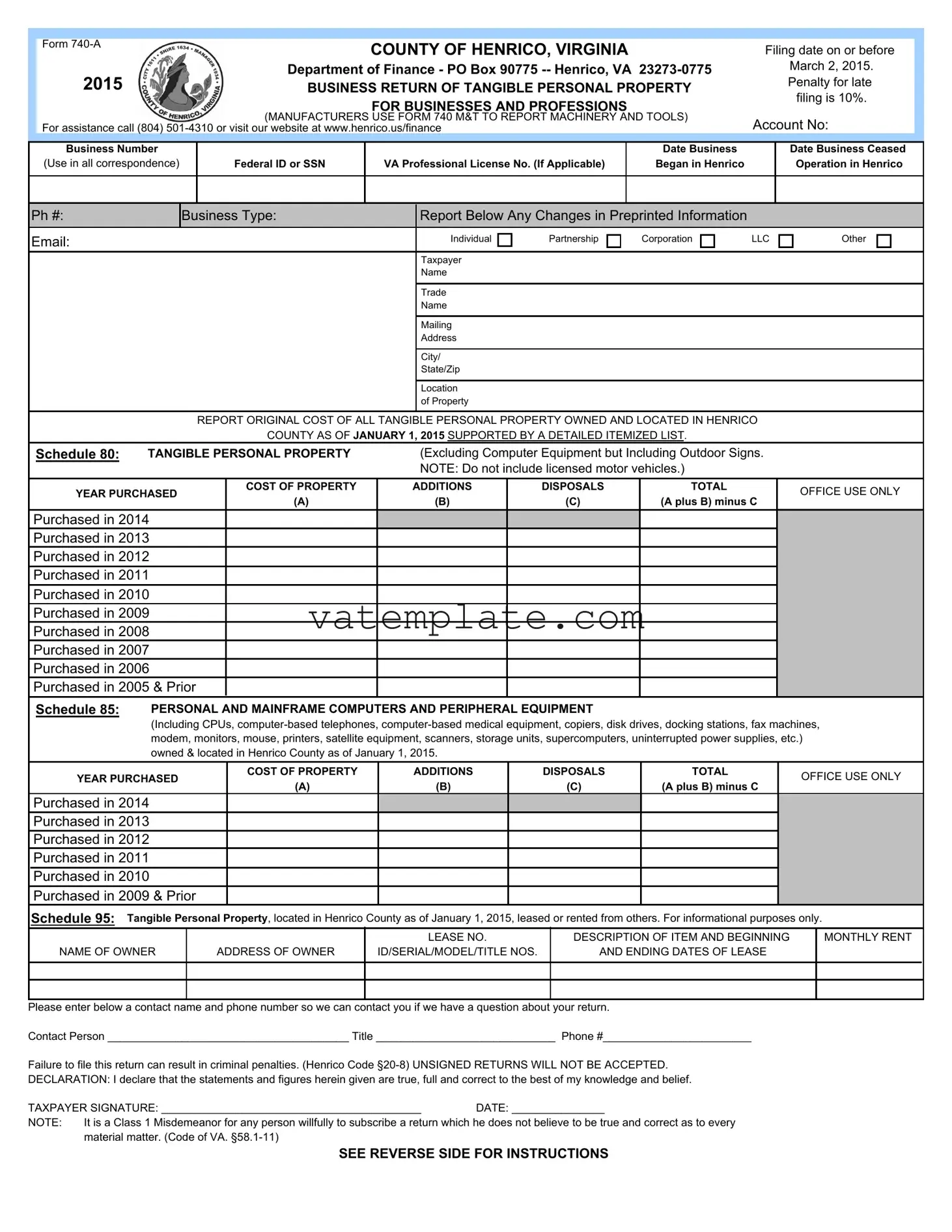

Fill Out a Valid 740 A Virginia Template

The Virginia Form 740-A serves as a vital document for businesses within Henrico County, guiding them through the process of reporting their tangible personal property for tax purposes. As mandated, companies need to disclose the original cost of all tangible personal property located in Henrico County as of January 1, 2015, which excludes licensed motor vehicles but includes a comprehensive range such as furniture, fixtures, personal and mainframe computers, peripheral equipment, and outdoor signs. This form also covers items leased or rented from others, necessitating a detailed accounting that plays a crucial role in the financial management and tax compliance of a business. With the deadline set for filing this return on March 2, 2015, failure to comply results in a late filing penalty of 10%, highlighting the importance of prompt and accurate submission. Additionally, the form prompts businesses for updates on any changes in previously reported information, ensuring that the county's records remain current. The instructions provided detail the need for supporting documents, such as an itemized list of all tangible personal property, and outline the penalties for unsigned or improperly completed returns, emphasizing the seriousness of this obligation. Manufacturers have distinct reporting requirements and must use a separate form, indicating the tailored approach Henrico County employs to cater to different business operations. Overall, the Form 740-A is instrumental in maintaining the fiscal responsibilities of businesses within Henrico County, ensuring fair and equitable taxation based on accurately reported property values.

740 A Virginia Example

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form |

|

|

|

|

|

COUNTY OF HENRICO, VIRGINIA |

|

Filing date on or before |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

2015 |

|

|

|

|

Department of Finance - PO Box 90775 |

|

|

March 2, 2015. |

|

|

|||||||||

|

|

|

|

|

|

BUSINESS RETURN OF TANGIBLE PERSONAL PROPERTY |

|

Penalty for late |

|

|

|||||||||||

|

|

|

|

|

|

|

|

filing is 10%. |

|

|

|||||||||||

|

|

|

|

|

|

|

|

FOR BUSINESSES AND PROFESSIONS |

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

(MANUFACTURERS USE FORM 740 M&T TO REPORT MACHINERY AND TOOLS) |

Account No: |

|

||||||||||||

|

For assistance call (804) |

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business Number |

|

|

|

|

|

|

|

|

|

Date Business |

|

|

Date Business Ceased |

||||||

|

(Use in all correspondence) |

|

Federal ID or SSN |

|

VA Professional License No. (If Applicable) |

|

Began in Henrico |

|

|

Operation in Henrico |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ph #: |

|

Business Type: |

|

|

Report Below Any Changes in Preprinted Information |

|

|

|

|

|

|

||||||||||

Email: |

|

|

|

|

|

|

|

Individual |

Partnership |

Corporation |

LLC |

|

Other |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Taxpayer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trade |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State/Zip |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Location |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

of Property |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

REPORT ORIGINAL COST OF ALL TANGIBLE PERSONAL PROPERTY OWNED AND LOCATED IN HENRICO |

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

COUNTY AS OF JANUARY 1, 2015 SUPPORTED BY A DETAILED ITEMIZED LIST. |

|

|

|

|

|

|

||||||||

Schedule 80: |

TANGIBLE PERSONAL PROPERTY |

|

|

(Excluding Computer Equipment but Including Outdoor Signs. |

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

NOTE: Do not include licensed motor vehicles.) |

|

|

|

|

|

|

|||||

|

|

YEAR PURCHASED |

|

COST OF PROPERTY |

|

ADDITIONS |

|

DISPOSALS |

TOTAL |

|

|

OFFICE USE ONLY |

|||||||||

|

|

|

(A) |

|

|

(B) |

|

|

(C) |

(A plus B) minus C |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Purchased in 2014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Purchased in 2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Purchased in 2012 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchased in 2011 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchased in 2010 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Purchased in 2009 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Purchased in 2008 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Purchased in 2007 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Purchased in 2006 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Purchased in 2005 & Prior |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Schedule 85: |

PERSONAL AND MAINFRAME COMPUTERS AND PERIPHERAL EQUIPMENT |

|

|

|

|

|

|

|

|||||||||||||

|

|

|

(Including CPUs, |

||||||||||||||||||

|

|

|

modem, monitors, mouse, printers, satellite equipment, scanners, storage units, supercomputers, uninterrupted power supplies, etc.) |

||||||||||||||||||

|

|

|

owned & located in Henrico County as of January 1, 2015. |

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

YEAR PURCHASED |

|

COST OF PROPERTY |

|

ADDITIONS |

|

DISPOSALS |

TOTAL |

|

|

OFFICE USE ONLY |

|||||||||

|

|

|

(A) |

|

|

(B) |

|

|

(C) |

(A plus B) minus C |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Purchased in 2014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Purchased in 2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Purchased in 2012 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Purchased in 2011 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Purchased in 2010 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Purchased in 2009 & Prior |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Schedule 95: |

Tangible Personal Property, located in Henrico County as of January 1, 2015, leased or rented from others. For informational purposes only. |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

LEASE NO. |

|

DESCRIPTION OF ITEM AND BEGINNING |

|

MONTHLY RENT |

|||||||

|

NAME OF OWNER |

|

ADDRESS OF OWNER |

|

ID/SERIAL/MODEL/TITLE NOS. |

|

AND ENDING DATES OF LEASE |

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Please enter below a contact name and phone number so we can contact you if we have a question about your return.

Contact Person _______________________________________ Title _____________________________ Phone #________________________

Failure to file this return can result in criminal penalties. (Henrico Code

DECLARATION: I declare that the statements and figures herein given are true, full and correct to the best of my knowledge and belief.

TAXPAYER SIGNATURE: __________________________________________ |

DATE: _______________ |

|

NOTE: |

It is a Class 1 Misdemeanor for any person willfully to subscribe a return which he does not believe to be true and correct as to every |

|

|

material matter. (Code of VA. |

|

SEE REVERSE SIDE FOR INSTRUCTIONS

GENERAL INFORMATION FOR BUSINESS |

|

RETURN OF TANGIBLE PERSONAL PROPERTY |

2015 |

|

1.Returns must be filed by March 2, 2015. In accordance with

2.Business personal property required to be reported on this form is not subject to proration.

3.Contractors should report all business personal property which is physically located in Henrico County as of January 1, 2015.

4.Machinery and tools used in manufacturing, mining, processing or reprocessing, radio or television broadcasting, dairy and dry cleaning are reported on Form 740 M&T.

5.All reported amounts are subject to audit for the current year and the three years last past. Application for adjustment to an assessment can be made for the current year and the three years last past, or within one year from the date of assessment, whichever is later.

6.Failure to file by the due date of March 2, 2015, results in a late filing penalty of 10% of the tax due.

7.Payment due dates are June 5, 2015, and December 5, 2015. Bills will be mailed prior to due dates. Failure to pay will result in a late payment penalty of 10% of the tax due. Interest at the rate of 4% per annum accrues on all unpaid balances.

8.Formula for Assessment: To determine the assessment, multiply reported purchase cost by year acquired by percentages shown below.

Schedule

Year |

80 |

85 |

2014 |

80% |

66% |

2013 |

73% |

43% |

2012 |

63% |

27% |

2011 |

54% |

16% |

2010 |

46% |

10% |

2009 |

39% |

4% |

2008 |

33% |

4% |

2007 |

28% |

4% |

2006 |

23% |

4% |

2005 & Prior |

12% |

4% |

ACCOUNT INFORMATION

1.Please enter your federal identification number or social security number if not preprinted.

2.Carefully review the preprinted information and make applicable changes in the spaces provided.

SCHEDULES 80 & 85

1.Enter total original cost (whether capitalized or expensed) in the appropriate schedule by year of purchase for furniture & fixtures (including

2.Include cost of construction in progress on all equipment, machinery, etc.

3.Round totals to the nearest dollar.

4.Any difference in figures from those reported last year MUST BE explained.

5.A DETAILED ITEMIZED LISTING of all tangible personal property, including leasehold improvements, located in Henrico County on January 1, 2015, MUST BE ATTACHED. (Henrico County Code

6.Fully depreciated items MUST also be included if still owned and being used by your business on January 1, 2015.

7.Enter all required information including cost figures. DO NOT WRITE "SAME AS LAST YEAR" or "SEE ATTACHED." Penalties may be incurred if form is not properly completed and signed.

8.If "NONE" or "NO PROPERTY TO REPORT," an explanation of why there is no property to report MUST be included. Most businesses normally require the use of personal property in their operation. ALL PERSONAL PROPERTY USED IN A BUSINESS IS TAXABLE.

9.Manufacturers who lease their manufactured products shall report such property at the retail selling price in effect at the time of manufacture.

SCHEDULE 95

1.List or attach schedule of all personal property leased from others in accordance with Virginia State Tax Code

2.Furnish lease number, description of item, beginning and ending dates of lease, monthly rent, and the complete name and address of the lessor. THIS IS FOR INFORMATIONAL PURPOSES ONLY.

Questions? Call (804)

Fax (804)

Or Visit Our Website at www.henrico.us/finance

Form Properties

| Fact | Detail |

|---|---|

| Filing Requirement | Businesses must file Form 740-A by March 2, 2015, reporting all tangible personal property located in Henrico County as of January 1, 2015. |

| Governing Law | The form is governed by §58.1-3503 of the Virginia Tax Code. |

| Non-Prorated Property | Business personal property reported on this form is not subject to proration. |

| Late Filing Penalty | A late filing penalty of 10% of the tax due is imposed for returns filed after the due date. |

| Payment Due Dates | Payment due dates are June 5, 2015, and December 5, 2015. Late payments incur a penalty of 10% of the tax due. |

| Assessment Formula | The assessment is calculated by multiplying the reported purchase cost by the year acquired by percentages as stated in the form's schedules. |

| Required Documentation | A detailed itemized list of all tangible personal property, including leasehold improvements located in Henrico County as of January 1, 2015, is required to be attached. |

| Leased Property Information | Form 740-A requires information on personal property leased from others, in line with Virginia State Tax Code §58.1-3518, for informational purposes only. |

Steps to Filling Out 740 A Virginia

Completing the 740 A Virginia Form for the business return of tangible personal property is a crucial step in ensuring compliance with the County of Henrico's tax requirements. The document demands accurate and detailed information about your business's tangible assets as of January 1, 2015. A thorough and precise completion of this form is essential to avoid potential penalties, as it helps the Department of Finance accurately assess taxes due on these assets. Follow the steps below to navigate through the form completion process effectively.

- Locate your Account No. and ensure it matches your records. If not preprinted, enter it at the top of the form.

- Review the preprinted information regarding your business, including taxpayer name, trade name, and contact details. Update any changes in the provided spaces.

- Enter your Federal ID or Social Security Number along with your VA Professional License No. if applicable.

- Specify the Date Business Began in Henrico, and if relevant, the Date Business Ceased Operations in the area.

- Select your Business Type (Individual, Partnership, Corporation, LLC, Other) and provide a brief description.

- Under Schedule 80, list all tangible personal property (excluding computer equipment but including outdoor signs) owned as of January 1, 2015. Input the year purchased, cost of property, any additions, and disposals to calculate the total value.

- For Schedule 85, focus on personal and mainframe computers and peripheral equipment. Again, fill in the year of purchase, cost, additions, and disposals.

- If applicable, complete Schedule 95 by listing tangible personal property you leased from others, providing lease numbers, item descriptions, beginning and monthly rent, and owner information.

- Provide a contact name and phone number for any questions or clarifications needed regarding your return.

- Review all information for accuracy and completeness. Any explained discrepancies from the previous year or omissions can lead to penalties.

- Sign and date the declaration at the bottom of the form, thereby attesting to the truth and accuracy of the information provided. Note that unsigned returns will not be accepted and can result in penalties.

Once the form is completed, it should be filed with the Henrico Department of Finance by March 2, 2015, to avoid a late filing penalty. It is important to attach any required detailed, itemized lists of tangible personal property, including those fully depreciated but still in use. This comprehensive approach ensures that all relevant assets are accounted for, providing a clear and accurate representation of your business's property for tax purposes.

FAQ

What is Form 740-A and who needs to file it?

Form 740-A is a Business Return of Tangible Personal Property required to be filed by businesses operating within Henrico County, Virginia. It is used to report all tangible personal property owned and located in Henrico County as of January 1 of the filing year. Businesses, including contractors but excluding manufacturers (who use Form 740 M&T for machinery and tools), must file this form to account for furniture, fixtures, personal and mainframe computers, peripheral equipment, and any leased equipment.

What is the deadline for filing Form 740-A?

The form must be submitted by March 2, 2015. Filing after this date will result in a late filing penalty of 10% of the tax due. It’s crucial to file on time to avoid unnecessary penalties.

What happens if I fail to file Form 740-A or pay the tax due on time?

Late filing of Form 740-A results in a penalty of 10% of the tax due. Additionally, late payment of taxes also incurs a 10% penalty on the tax amount due. Interest at a rate of 4% per annum is charged on all unpaid balances. Ensuring timely filing and payment is essential to avoid these penalties and interest charges.

How is the tax assessed on reported property in Henrico County?

Tax is assessed by multiplying the reported purchase cost of the property by the year acquired and applying specific percentages listed on the form. These percentages vary by year and by schedule (Schedule 80 for Tangible Personal Property and Schedule 85 for Computers and Peripheral Equipment), reflecting different rates of depreciation.

What information should I include and what should I avoid on Form 740-A?

- Enter the total original cost of all items, including incidental costs like freight and installation.

- Do not include licensed vehicles or application software.

- Round totals to the nearest dollar and explain any discrepancies from the previous year's report.

- Include a detailed itemized list of all tangible personal property and ensure fully depreciated items still in use are listed.

- Do not write "Same as last year" or "See attached" without including detailed listings.

- If you have no property to report, provide a clear explanation.

What should manufacturers report on Form 740-A?

Manufacturers are directed to use Form 740 M&T for reporting machinery and tools. However, for manufacturers leasing their manufactured products, such items should be reported on Form 740-A at the retail selling price in effect at the time of manufacture.

Where can I get help or more information about Form 740-A?

For assistance with Form 740-A, you can call the Henrico Department of Finance at (804) 501-4310 or visit their website at www.henrico.us/finance. Here, you can find contact information, additional FAQs, and resources to help you accurately complete and file your form.

Common mistakes

-

One common misstep is not entering the total original cost of all tangible personal property. People sometimes only provide partial information, forgetting that the form requires the inclusion of all acquisition-related costs, such as freight, installation, and sales tax, for furniture, fixtures, computers, and peripheral equipment. This omission can lead to inaccurate tax assessments.

-

A frequently seen mistake is neglecting to attach a detailed itemized list of the tangible personal property located in Henrico County as of January 1, 2015. This list is crucial for validating the reported values and ensuring that all relevant items have been accounted for in the submission.

-

Some businesses forget to include fully depreciated items that are still owned and used in the operation as of January 1. It's important to remember that even fully depreciated items remain taxable if they are actively used in the business.

-

Another easily overlooked step is failing to review and update the preprinted information. It's necessary to make any applicable changes directly on the form to ensure that all account details are accurate and current. This includes business name changes, addresses, and operation status.

-

Writing "Same as last year" or "See attached" instead of entering all required cost figures directly on the form. This approach can lead to confusion and potential penalties for incomplete submissions. All required information, including cost figures, must be explicitly entered on the form.

-

Failure to sign the declaration section of the form is a crucial error that results in the rejection of the return. Unsigned returns are not accepted, highlighting the importance of reviewing and officially acknowledging the accuracy of the form before submission.

-

Lastly, a significant mistake is not explaining any discrepancies in figures from the previous year's report. If there are differences in reported amounts, a clear explanation must be provided to avoid audit red flags or unnecessary follow-up inquiries from the tax authorities.

By sidestepping these pitfalls, businesses can ensure a smoother, more accurate process when completing the Form 740 A for Henrico County, Virginia. Attention to detail and thoroughness are key in avoiding complications, late filing penalties, and ensuring compliance with local tax obligations.

Documents used along the form

When filing the Form 740-A for the County of Henrico, Virginia, businesses often need to complement it with other forms and documents to ensure compliance and accuracy in their reporting. These additional documents provide detailed information about various business assets, helping assessors accurately determine tax liabilities. Understanding each document's purpose and requirement can streamline the filing process and help businesses avoid penalties associated with late or incorrect filings.

- Form 740 M&T: Used specifically by manufacturers to report machinery and tools. This form is essential for any business in the manufacturing sector, ensuring the correct assessment of heavy equipment used in production.

- Detailed Itemized List of Property: Accompanies the primary form to provide a breakdown of all tangible personal property, excluding licensed vehicles and application software but including leasehold improvements.

- Business License Application/ Renewal Form: Required for operating legally in Henrico County. It must be up-to-date and reflects the business's current operational status.

- Federal Tax Return: Including the most recent tax return can help verify the financial statements and values reported on the Form 740-A.

- Lease Agreements: For businesses leasing property or equipment in Henrico County, including contracts and lease agreements helps support the reported values and clarify ownership.

- Construction in Progress (CIP) Documentation: Provides details on any ongoing construction projects, which are pertinent for accurately reporting the cost of equipment or assets not yet in use.

- Schedule of Depreciation: Even fully depreciated items must be reported if they are still in use. A current schedule aids in identifying these assets for accurate reporting.

- Virginia State Business Registration: Proof of registration with the Virginia State Corporation Commission (or appropriate state agency) is required to confirm the legitimacy of the business.

- Vehicles Registration Documents: While licensed motor vehicles are excluded from Form 740-A, accompanying registration documents may be necessary for distinguishing these assets from those needing to be reported.

- Proof of Payment for Previously Assessed Taxes: Including receipts or documents showing payment of last year’s business personal property taxes can help reconcile past and current filings.

Accurately compiling and submitting these forms and documents alongside Form 740-A can significantly impact a business's tax responsibilities and compliance status in Henrico County. Timely attention to detail in gathering and presenting this information is crucial to prevent errors that could lead to penalties or audits. Moreover, it ensures that businesses can confidently support their reported values, minimizing the risk of discrepancies that could affect their tax assessments.

Similar forms

The 740 A Virginia form, essential for businesses in Henrico County to report tangible personal property, bears resemblance to several other documents utilized within different jurisdictions or for varied purposes related to the assessment and taxation of business property. These documents, while tailored to specific local or state requirements, share common features in structure and objective with the Form 740 A.

The IRS Form 4562, for instance, is utilized for reporting depreciation and amortization. This federal form and the 740 A Virginia form are alike in that they both require detailed lists of property, the year of purchase, and the cost. However, Form 4562 is focused on depreciation deductions for tax purposes on a national level, whereas the 740 A is specific to tangible personal property tax responsibilities for businesses in Henrico County, Virginia, without a primary focus on depreciation.

Another document, the Personal Property Tax Return common in many other counties, shares a similar purpose to the 740 A form. This type of return is used by businesses to declare the value of their tangible personal property held within a jurisdiction for taxation purposes. Like the 740 A, these returns typically require information about the property, including description, year of purchase, and cost, to calculate taxes owed. Each jurisdiction's personal property tax return form, while possibly differing in layout and specific instructions, serves the goal of assessing tax on business personal property, illustrating the core similarity with Henrico County's Form 740 A.

The Uniform Commercial Code (UCC) financing statement, although differing in primary function, also shares certain similarities with the 740 A form. The UCC financing statement is filed to perfect a security interest in a debtor's collateral, including tangible personal property. This filing requires descriptions of the collateral, akin to how the 740 A requires detailed lists of tangible personal assets. The major difference lies in the intent behind the documents: the UCC financing statement is for securing interests in the case of default, while the 740 A is specifically for property tax assessment purposes.

Dos and Don'ts

Filling out the Form 740-A for the County of Henrico, Virginia, is vital for businesses to ensure accurate reporting of tangible personal property for tax purposes. To assist, here are essential guidelines to follow:

Do's:- Review and update pre-printed information: Carefully check the preprinted information for accuracy. Any changes in address, business type, or other vital details should be corrected on the form.

- Include a detailed itemized list: Attach a comprehensive list of all tangible personal property owned as of January 1, 2015. This includes furniture, computer equipment, and leased items, ensuring nothing is missed.

- Report original cost fully: Enter the total original cost of each item in the relevant schedule section by the year of purchase. Include all incidental costs such as freight, installation, and sales tax.

- Explain any discrepancies: Address any differences between the figures reported this year and those from previous years. Auditors seek clarity, and unexplained variances could trigger further investigation.

- Sign the form: Ensure the form is signed. An unsigned return is not valid and will be rejected, possibly leading to penalties.

- File by the due date: Submit the return by March 2, 2015, to avoid a 10% late filing penalty. Timeliness is crucial in fulfilling tax obligations.

- Include leased property details: List all tangible personal property leased from others, even though it’s for informational purposes only. Complete details about the lease, including lease number and lessor information, are necessary.

- Avoid estimating costs: Do not estimate or round off the original purchase costs of items. Accurate figures are essential for correct tax assessments.

- Don't omit fully depreciated assets: Even if fully depreciated, items still in use as of January 1, 2015, must be reported. Overlooking this can undervalue your taxable assets.

- Don't leave sections blank: If a section does not apply, specifically indicate with “NONE” or “NO PROPERTY TO REPORT,” and provide a reason. Blank sections can raise red flags.

- Don't avoid attaching documentation: Failure to attach the detailed itemized list of property or other required documentation can lead to penalties. This oversight can also delay processing.

- Don't write "same as last year": Each filing year requires precise and current data. Simply referring to a previous year's return does not fulfill this requirement.

- Avoid late payment: Pay attention to due dates for tax payment to avoid late payment penalties. Timely payments are as vital as timely filing.

- Don't file an incorrect form: Ensure you’re using Form 740-A specifically for businesses and professions, excluding manufacturers who should use Form 740 M&T for machinery and tools.

By adhering to these do's and don'ts, businesses can navigate the complexities of tax reporting, avoid common pitfalls, and ensure compliance with Henrico County’s requirements.

Misconceptions

Understanding tax forms can sometimes be a daunting task, leading to misconceptions and inaccuracies. Below are five common misconceptions about the Form 740-A specifically used in Henrico County, Virginia, for the business return of tangible personal property:

- Misconception 1: "The form is only for businesses owning large quantities of tangible personal property." This is not accurate. Every business operating in Henrico County, regardless of its size, must report all tangible personal property owned and located in the county as of January 1, 2015. This includes small, home-based businesses and larger enterprises alike.

- Misconception 2: "Computer equipment is not considered tangible personal property for this form." In fact, Schedule 85 of Form 740-A specifically requires businesses to report personal and mainframe computers and peripheral equipment. This includes a wide range of computer-related items, from CPUs and monitors to printers and scanners, clearly highlighting the necessity to report computer equipment as tangible personal property.

- Misconception 3: "If property is fully depreciated, it doesn't need to be reported." This is incorrect. The form instructions explicitly state that fully depreciated items must also be included if they are still owned and being used by the business on January 1, 2015. The tax assessment considers the existence and use of the property, not its depreciation status on your business's books.

- Misconception 4: "Licensed vehicles need to be reported on Form 740-A." Vehicles are one of the exceptions to what needs to be reported on this form. While nearly all physical assets used in the operation of a business must be reported, licensed motor vehicles are excluded from this requirement. This distinction helps to simplify the reporting process for businesses.

- Misconception 5: "Payment of the tax can be delayed without penalties if the filing is on time." Although timely filing is necessary, it alone does not eliminate the risk of penalties. Payment due dates are explicitly mentioned within the form's instructions, with bills mailed prior to these dates. Late payment will incur a penalty of 10% of the tax due, in addition to interest accruing on all unpaid balances at a rate of 4% per annum. It is important for businesses to both file and pay by the respective due dates to avoid these additional costs.

Correctly understanding the requirements and instructions of Form 740-A is crucial for businesses to ensure compliance and avoid unnecessary penalties. Whether new to business in Henrico County or reviewing the form for another year of operation, being aware of these misconceptions can guide more accurate and efficient tax reporting.

Key takeaways

Understanding the 740 A Virginia form and its implications for businesses operating within Henrico County requires careful attention to detail and adherence to specific guidelines. Below are seven key takeaways for businesses when filling out and utilizing this form.

- The due date for filing the 740 A form is March 2, 2015. Late submissions are subject to a 10% penalty of the tax due, emphasizing the importance of timely filing.

- This form specifically targets business personal property, excluding real estate and certain other assets like licensed motor vehicles. It's critical for businesses to accurately report all tangible personal property located in Henrico County as of January 1, 2015.

- Manufacturers and certain other categories of businesses use a different form (Form 740 M&T) for reporting specific assets such as machinery and tools.

- Accuracy is paramount. The form requires a detailed, itemized list of tangible personal property, with costs supported by initial purchase prices. This includes assets irrespective of whether they have been fully depreciated if they are still in use by the business.

- Adjustments to assessments can be requested for the current year and up to three years retroactively but must be made within one year from the date of the latest assessment. This allows businesses a window to rectify any discrepancies or to update their reported values.

- The inclusion of a contact name and phone number is not optional; it is a necessity. This facilitates communication between the Department of Finance and the business should any questions arise about the return.

- There is a specific formula for the assessment of reported property, applying different percentages based on the year of acquisition. This method of calculation underscores the need for accurate and comprehensive record-keeping by businesses regarding the acquisition dates and costs of their assets.

Failure to adhere to these guidelines can result in penalties, including late fees and interest on unpaid taxes, or even criminal charges in cases of willful misreporting. Therefore, accurate and timely compliance with the 740 A form is not only a legal requirement but also a critical component of responsible business ownership in Henrico County.

Other PDF Forms

Virginia Sales Tax Exemption - Authorizes tax-free transactions for a broad spectrum of tangible assets, facilitating operational readiness and public service delivery.

Filing Status 3 - Requesters must specify their reason for needing this certificate, emphasizing the importance of the information for personal or legal matters.