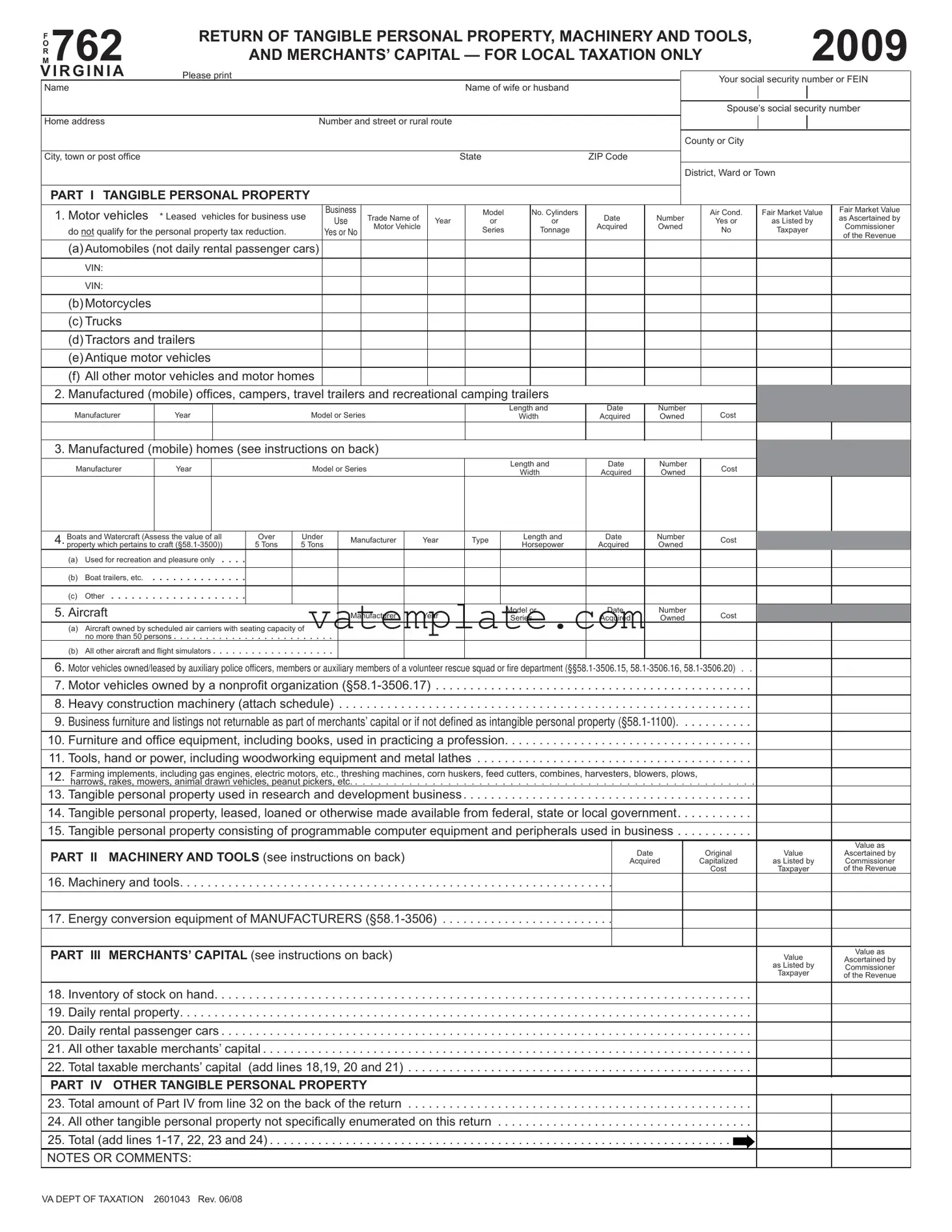

Fill Out a Valid 762 Virginia Template

Navigating the intricacies of local taxation in Virginia, especially when it comes to tangible personal property, machinery and tools, and merchants’ capital, could seem overwhelming without a clear roadmap. Enter Form 762 Virginia, a comprehensive document designed for the 2009 tax year, which requires diligent attention to detail and accuracy from taxpayers. This form serves as a detailed transcript of personal property ranging from motor vehicles and manufactured homes to boats, aircraft, and business furnishings. What makes this form particularly noteworthy is its exclusivity to local taxation purposes, emphasizing the need for residents and business owners in Virginia to report their possessions in a manner that is both thorough and law-abiding. The requirements stretch over multiple facets, including vehicles used for business, heavy construction machinery, office equipment, and even specified livestock. Besides the sheer variety of items to be accounted for, Form 762 also covers machinery and tools used in specific industries like manufacturing or broadcasting, making it a pivotal document for a wide swath of the Virginia business community. Additionally, instructions for declaring merchants' capital present another layer of complexity, requiring accurate reporting of inventory and rental property. With designated sections for executors, administrators, trustees, and other fiduciaries, this form is tailored to address the needs of various stakeholders, ensuring that all taxable personal property is duly recorded. The declaration section at the end emphasizes the legal responsibility of the taxpayer to provide true and full information, underscoring the form's importance in the broader context of compliance with Virginia's tax laws.

762 Virginia Example

F |

RETURN OF TANGIBLE PERSONAL PROPERTY, MACHINERY AND TOOLS, |

2009 |

|||||||||||

O |

|

|

|

|

|

|

|

|

|

|

|||

RM 762 |

AND MERCHANTS’ CAPITAL — FOR LOCAL TAXATION ONLY |

|

|||||||||||

VIRGINIA |

Please print |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your social security number or FEIN |

|||||

Name |

|

|

|

|

Name of wife or husband |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s social security number |

|||

Home address |

|

Number and street or rural route |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

County or City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City, town or post office |

|

|

|

|

State |

|

ZIP Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

District, Ward or Town |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PART I TANGIBLE PERSONAL PROPERTY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. Motor vehicles |

* Leased vehicles for business use |

Business |

Trade Name of |

|

Model |

No. Cylinders |

Date |

Number |

Air Cond. |

Fair Market Value |

Fair Market Value |

||

Use |

Year |

or |

or |

Yes or |

as Listed by |

as Ascertained by |

|||||||

|

|

Motor Vehicle |

Acquired |

Owned |

Commissioner |

||||||||

do not qualify for the personal property tax reduction. |

Yes or No |

|

Series |

Tonnage |

No |

Taxpayer |

|||||||

|

|

|

|

|

of the Revenue |

||||||||

(a)Automobiles (not daily rental passenger cars)

VIN:

VIN:

(b)Motorcycles

(c)Trucks

(d)Tractors and trailers

(e)Antique motor vehicles

(f)All other motor vehicles and motor homes

2. Manufactured (mobile) offi ces, campers, travel trailers and recreational camping trailers

Manufacturer |

Year |

Model or Series |

Length and |

Date |

Number |

Cost |

|

|

Width |

Acquired |

Owned |

|

|

||||

|

|

|

|

|

|

|

|

|

3. Manufactured (mobile) homes (see instructions on back)

Manufacturer |

Year |

|

|

Model or Series |

|

|

Length and |

Date |

Number |

Cost |

|

||

|

|

|

|

Width |

Acquired |

Owned |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Boats and Watercraft (Assess the value of all |

Over |

Under |

Manufacturer |

Year |

Type |

Length and |

Date |

Number |

Cost |

|

|

||

4. property which pertains to craft |

5 Tons |

5 Tons |

Horsepower |

Acquired |

Owned |

|

|||||||

|

|

|

|

|

|

||||||||

(a)Used for recreation and pleasure only . . . .

(b)Boat trailers, etc. . . . . . . . . . . . . . .

(c)Other . . . . . . . . . . . . . . . . . . . .

5. |

Aircraft |

|

Manufacturer |

Year |

Model or |

Date |

Number |

Cost |

|

|

|||

|

Series |

Acquired |

Owned |

|

|

||||||||

|

(a) Aircraft owned by scheduled air carriers with seating capacity of |

|

|

|

|

|

|

|

|

|

|

||

|

no more than 50 persons |

|

|

|

|

|

|

|

|

|

|

||

|

(b) All other aircraft and flight simulators |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|||||||

6. |

Motor vehicles owned/leased by auxiliary police officers, members or auxiliary members of a volunteer rescue squad or fire department |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||

7. |

Motor vehicles owned by a nonprofi t organization |

. . . . . . . . . . . . . . |

. . |

. . |

. . . . . . . . |

. . |

. . . . . . . . |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8. |

Heavy construction machinery (attach schedule) |

. . . . . . . . . . . . |

. . . . . . . . . . . . . . |

. . |

. . |

. . . . . . . . |

. . |

. . . . . . . . |

|

|

|||

|

|

|

|

|

|

|

|

||||||

9. |

Business furniture and listings not returnable as part of merchants’ capital or if not defined as intangible personal property |

. . . . . . . . |

|

|

|||||||||

10. |

Furniture and offi ce equipment, including books, used in practicing a profession |

. . . . . . . . . . . . . . |

. . |

. . |

. . . . . . . . |

. . |

. . . . . . . . |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

||

11. |

Tools, hand or power, including woodworking equipment and metal lathes . . . . |

. . . . . . . . . . . . . . |

. . |

. . |

. . . . . . . . |

. . |

. . . . . . . . |

|

|

||||

|

|

|

|

|

|

|

|

||||||

12. |

Farming implements, including gas engines, electric motors, etc., threshing machines, corn huskers, feed cutters, combines, harvesters, blowers, plows, |

|

|

|

|||||||||

|

harrows, rakes, mowers, animal drawn vehicles, peanut pickers, etc |

. . . . . . . . . . . . . . . . . . . . . . . |

. |

. . |

. . . . . . . . |

. . . . . . . . . |

|

|

|||||

13. |

Tangible personal property used in research and development business |

. . . . . . . . . . . . . . |

. . |

. . |

. . . . . . . . |

. . |

. . . . . . . . |

|

|

||||

|

|

|

|

|

|

|

|

||||||

14. |

Tangible personal property, leased, loaned or otherwise made available from federal, state or local government |

|

|

||||||||||

|

|

|

|

|

|

|

|

||||||

15. |

Tangible personal property consisting of programmable computer equipment and peripherals used in business |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Value as |

PART II |

MACHINERY AND TOOLS (see instructions on back) |

|

|

|

|

Date |

|

|

Original |

Value |

Ascertained by |

||

|

|

|

|

Acquired |

|

|

Capitalized |

as Listed by |

Commissioner |

||||

|

|

|

|

|

|

|

|

|

|

|

Cost |

Taxpayer |

of the Revenue |

16. |

Machinery and tools |

. . . . . . . . . . . . |

. . . . . . . . . . . . . . |

. . |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|||

17. Energy conversion equipment of MANUFACTURERS |

. . . . . . . . . . . . . . |

. . |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PART III MERCHANTS’ CAPITAL (see instructions on back) |

|

|

|

|

|

|

|

|

Value |

Value as |

|||

|

|

|

|

|

|

|

|

Ascertained by |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

as Listed by |

Commissioner |

|

|

|

|

|

|

|

|

|

|

|

|

Taxpayer |

|

|

|

|

|

|

|

|

|

|

|

|

|

of the Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18. |

Inventory of stock on hand |

. . . . . . . . . . . . |

. . . . . . . . . . . . . . |

. . |

. . |

. . . . . . . . |

. . |

. . . . . . . . |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19. |

Daily rental property |

. . . . . . . . . . . . |

. . . . . . . . . . . . . . |

. . |

. . |

. . . . . . . . |

. . |

. . . . . . . . |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20. |

Daily rental passenger cars |

. . . . . . . . . . . . |

. . . . . . . . . . . . . . |

. . |

. . |

. . . . . . . . |

. . |

. . . . . . . . |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

21. |

All other taxable merchants’ capital |

. . . . . . . . . . . . |

. . . . . . . . . . . . . . |

. . |

. . |

. . . . . . . . |

. . |

. . . . . . . . |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

22. |

Total taxable merchants’ capital (add lines 18,19, 20 and 21) . . |

. . . . . . . . . . . . |

. . . . . . . . . . . . . . |

. . |

. . |

. . . . . . . . |

. . |

. . . . . . . . |

|

|

|||

PART IV |

OTHER TANGIBLE PERSONAL PROPERTY |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23. |

Total amount of Part IV from line 32 on the back of the return . . |

. . . . . . . . . . . . |

. . . . . . . . . . . . . . |

. . |

. . |

. . . . . . . . |

. . |

. . . . . . . . |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

||

24. |

All other tangible personal property not specifi cally enumerated on this return . |

. . . . . . . . . . . . . . |

. . |

. . |

. . . . . . . . |

. . |

. . . . . . . . |

|

|

||||

25. Total (add lines

NOTES OR COMMENTS:

VA DEPT OF TAXATION 2601043 Rev. 06/08

FORM 762 (2009) |

|

Page 2 |

|

|

|

|

|

|

Fair Market Value |

Fair Market Value |

|

|

as Ascertained by |

||

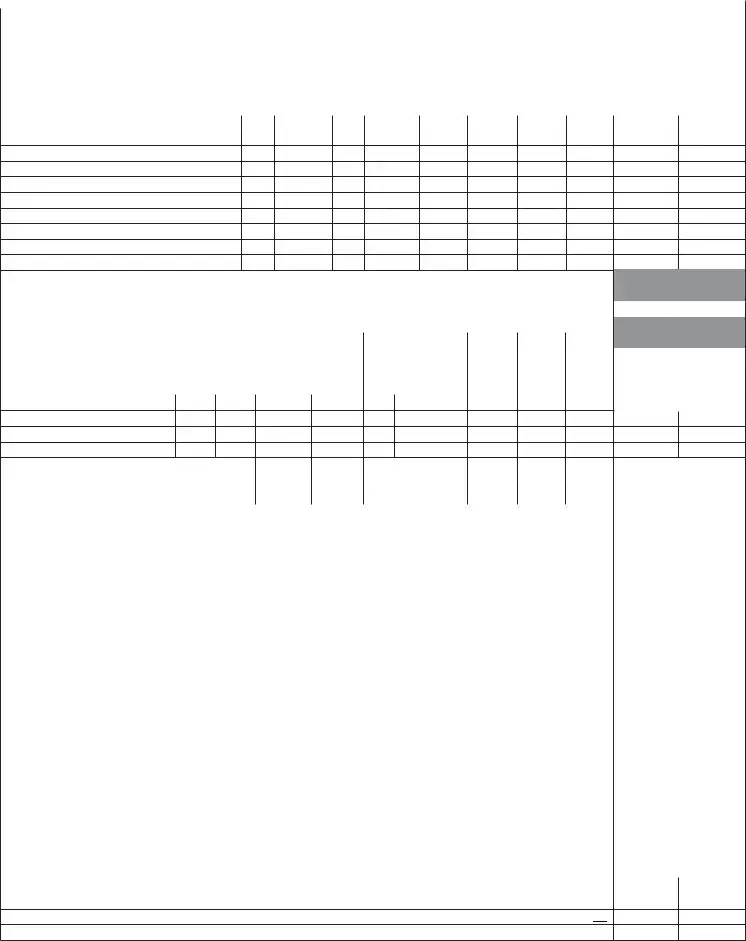

PART IV OTHER TANGIBLE PERSONAL PROPERTY |

as Listed by |

||

Commissioner |

|||

|

Taxpayer |

||

|

of the Revenue |

||

|

|

26.(a) Horses, mules and other kindred animals. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(b)Cattle. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Owned

(c)Sheep and goats. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(d)Hogs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Number

(e)Poultry — chickens, turkeys, ducks, geese, etc.. . . . . . . . . . . . . . . . . . . . . . . . . .

(f)Equipment used by farmers or cooperatives to produce ethanol derived primarily from farm products. . . . . . . . . . . . . . . . . .

(g)Grains and other feeds used for the nurture of farm animals . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(h)Grain, tobacco and other agricultural products in the hands of a producer . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(i)Equipment and machinery used by farm wineries in the production of wine . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

27.Felled timber, ties, poles, cord wood, bark and other timber products . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

28.(a) Refrigerators, deep freeze units, air conditioners and automatic refrigerating machinery . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(b)Vacuum cleaners, sewing machines, washing machines, dryers and all other household machinery . . . . . . . . . . . . . . . . . . .

(c)Pianos and organs, television sets, radios, phonographs and records and all other musical instruments. . . . . . . . . . . . . . . .

(d)Watches and clocks and gold and silver plates and plated ware . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(e)Oil paintings, pictures, statuary, and other works of art $ _______ books $ ________ . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(f)Diamonds, cameos and other precious stones and precious metals used as ornaments or jewelry . . . . . . . . . . . . . . . . . . . .

(g)Sporting and photographic equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(h)Firearms and weapons of all kinds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(i)Bicycles and lawn mowers, hand or power. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(j)Household and kitchen furniture (state number of rooms ______ ). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

29.Seines, pound nets, fykes, weirs and other devices for catching fi sh . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

30.Poles, wires, switchboards, etc., telephone or telegraph instruments, apparatus, etc., owned by any person, firm, association or company not incorporated .

31.Toll bridges, turnpikes and ferries (except steam ferries owned and operated by chartered company) . . . . . . . . . . . . . . . . . . . .

32.Total of Part IV (add lines 26 through 31 and enter on line 23) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

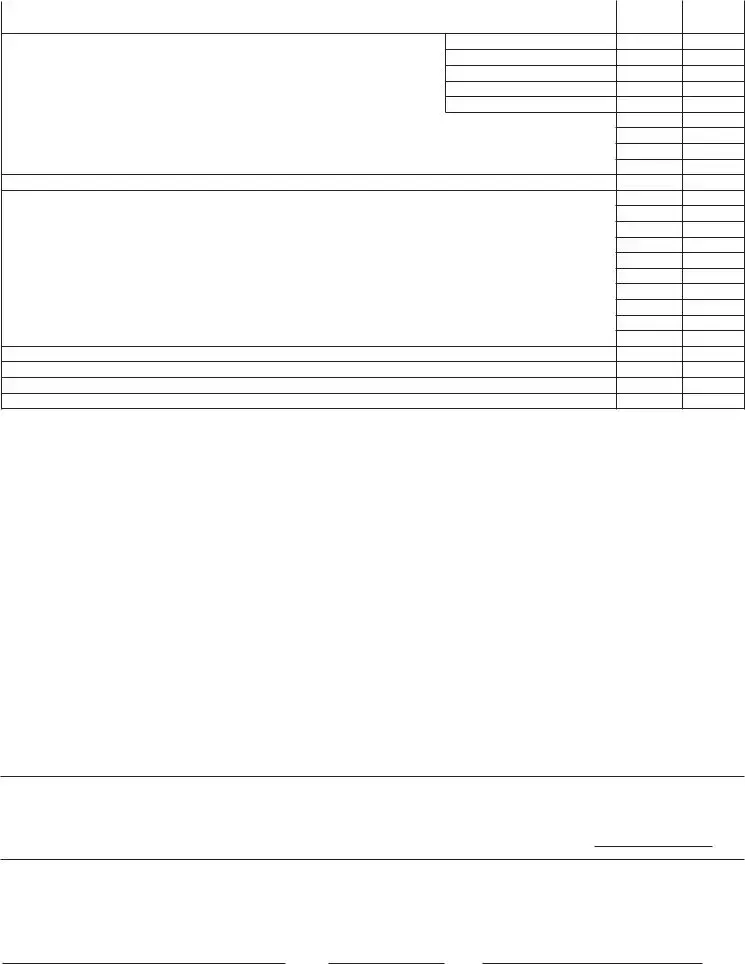

GENERAL INSTRUCTIONS: Complete Form 762, reporting property which you owned on January 1, 2009, then file it with the Commissioner of the Revenue of the County or City generally on or before May 1, 2009. Since some localities have due dates other than May 1, you may want to contact your local office to be sure of the proper due date. Write the word “None” opposite each item of property which you do not own. No property is assess- able as tangible personal property if defined by

DEFINITION OF MANUFACTURED HOMES (ALSO KNOWN AS MOBILE HOMES) FOR PART I, LINE 3

“Manufactured home” means a structure subject to federal regulation, which is transportable in one or more sections; is eight body feet or more in width and 40 body feet or more in length in the traveling mode, or is 320 or more square feet when erected on site; is built on a permanent chassis; is designed to be used as a

INFORMATION FOR PART II, MACHINERY AND TOOLS

If you are engaged in a manufacturing, mining, water well drilling, processing or reprocessing, radio or television broadcasting, dairy, dry cleaning or laundry business, report all machinery and tools used in manufacturing, mining, water well drilling, processing or reprocessing, radio or television broadcasting, dairy, dry cleaning or laundry business, such machinery and tools being segregated by

INFORMATION FOR PART III, MERCHANTS’ CAPITAL

If you are a merchant and if locality taxes the capital of merchants, report all other taxable personal property of any kind whatsoever, except money on hand and on deposit and except tangible personal property not offered for sale as merchandise, which tangible personal property should be reported as such on front of this return under the heading “TANGIBLE PERSONAL PROPERTY.”

FOR EXECUTORS, ADMINISTRATORS, TRUSTEES, COMMITTEES, GUARDIANS AND OTHER FIDUCIARIES

If this is the return of tangible personal property, machinery and tools, or merchants’ capital in the hands of an executor, administrator, trustee, committee, guardian or other fiduciary, such fiduciary must complete so much of both pages of this return as pertains to such property and, in addition, supply the information called for below:

1.Character of Fiduciary: Executor j Administrator j Trustee j Committee j Guardian j Other j

2.Name of Estate, Trust or Ward ________________________________________________________________________ |

(Specify) |

|

DECLARATION OF TAXPAYER

I declare that the statement and figures submitted on both pages of this return are true, full and correct to the best of my knowledge and belief. I certify that unless otherwise indicated as business use, the vehicles listed herein are for personal use.

NOTE — It is a misdemeanor for any person willfully to subscribe a return which he does not believe to be true and correct as to every material matter (Code of Virginia

(Signature of Taxpayer) |

(Date) |

(Taxpayer’s Phone Number) |

Executors, administrators, trustees and other fi duciaries must also supply information called for on this return.

Form Properties

| Fact | Detail |

|---|---|

| Form Purpose | Form 762 is used for the return of tangible personal property, machinery and tools, and merchants' capital for local taxation in Virginia. |

| Filing Requirement | Property owned on January 1, 2009, must be reported on Form 762. |

| Due Date | Generally, the form is due on or before May 1, 2009. Localities may have different due dates. |

| Sections Covered | The form includes sections on tangible personal property, machinery and tools, merchants' capital, and other tangible personal property. |

| Special Instructions for Manufactured Homes | Defines manufactured homes and specifies how they should be reported. |

| Special Category Reporting | Instructions are provided for reporting machinery and tools used in specific business activities. |

| Merchants' Capital | Describes what qualifies as merchants' capital and how to report it. |

| Fiduciaries | Instructions for executors, administrators, trustees, and other fiduciaries on how to file. |

| Governing Law | The form is governed by several sections of the Code of Virginia, including §§58.1-3500, 58.1-3506.15, 58.1-3506.16, 58.1-3506.17, 58.1-3506.20, 58.1-3507, 58.1-1100, and 36-85.3. |

Steps to Filling Out 762 Virginia

Filling out the Form 762 for Virginia, which is required for the return of tangible personal property, machinery and tools, and merchants’ capital for local taxation, can seem like a daunting task. It’s a comprehensive document designed to capture the details of various assets for tax assessment purposes. Understanding the components of this form is the first step towards completing it accurately and effectively. After collecting all the necessary information about your tangible personal properties, machinery, tools, and any merchants’ capital, follow the steps below to fill out the form.

- Start by entering your social security number or FEIN at the top of the form.

- Fill in your name, and if applicable, your spouse's name and social security number.

- Provide your home address, including the number and street or rural route, county or city, city, town or post office, state, and ZIP code. Don’t forget the district, ward, or town if it’s relevant.

- In Part I under TANGIBLE PERSONAL PROPERTY, list all motor vehicles, manufactured (mobile) offices, campers, travel trailers, recreational camping trailers, manufactured (mobile) homes, boats, watercraft, and aircraft. This includes the manufacturer, year, model or series, dimensions, the date acquired, number owned, and cost.

- For each entry under motor vehicles and other categories, specify the type and provide additional details like VIN, number of cylinders, tonnage, air conditioning presence, and the fair market value as listed and ascertained by the commissioner.

- In Part II concerning MACHINERY AND TOOLS, indicate the date acquired, original capitalized cost, and the value as ascertained by the commissioner for machinery, tools, and energy conversion equipment.

- Under Part III, report your MERCHANTS’ CAPITAL. Include values for inventory, daily rental property, daily rental passenger cars, and all other taxable merchants’ capital, both as listed and as ascertained by the commissioner.

- Part IV is about OTHER TANGIBLE PERSONAL PROPERTY. List items like agricultural products, household machinery, artworks, jewelry, sporting and photographic equipment, and furniture. Add details about seines, nets, communication equipment, toll bridges, etc. Include the number owned, cost, and fair market value where applicable.

- Finally, review the NOTES OR COMMENTS section and add any relevant details or explanations.

- If you’re acting in a fiduciary capacity, fill out the section for EXECUTORS, ADMINISTRATORS, TRUSTEES, COMMITTEES, GUARDIANS, AND OTHER FIDUCIARIES at the bottom of the form.

- Conclude by signing and dating the form at the bottom, ensuring that all the provided information is true and accurate to the best of your knowledge.

Ensure that this form is completed with attention to detail, as accuracy is essential for local tax assessment. After filling out the form, submit it to the Commissioner of the Revenue’s office in your locality, typically by May 1st of the tax year, though it’s a good idea to confirm the exact due date with your local office. Handling this form correctly is a crucial aspect of managing your tax responsibilities efficiently.

FAQ

What is Form 762 used for in Virginia?

Form 762 is utilized for the Return of Tangible Personal Property, Machinery and Tools, and Merchants’ Capital for local taxation purposes in Virginia. Individuals and businesses use this form to report personal property, such as vehicles, boats, manufactured homes, and business equipment, that is subject to local taxes. This form helps determine the tax liability based on the value of the reported items.

Who needs to file Form 762?

Any resident or business owner in Virginia possessing tangible personal property or machinery and tools used in business, or engaging in merchant activities within the locality, is required to file Form 762. This includes individuals with personal vehicles, boats, or manufactured homes, as well as businesses with equipment, inventory, or capital of merchants.

When is Form 762 due?

The filing deadline for Form 762 generally falls on May 1st of each year. However, due dates can vary by locality, so it's important to contact your local Commissioner of the Revenue Office to confirm the correct due date for your area.

What happens if you do not file Form 762?

Failing to file Form 762 can result in penalties and interest charges on the unpaid tax amount. Localities depend on this form to assess and collect taxes due for supporting municipal services. If not filed, the local tax authority may estimate a value and bill the taxpayer accordingly, which can lead to disputes and possible legal action.

Can Form 762 be filed electronically?

The availability of electronic filing for Form 762 depends on the locality. Some jurisdictions in Virginia may offer online filing options, while others may require the form to be submitted in paper format. It's best to check with the local Commissioner of the Revenue’s Office for specific filing options.

How is the fair market value of assets determined for Form 762?

The fair market value of assets reported on Form 762 is either ascertained by the taxpayer or listed by the Commissioner of the Revenue. For vehicles, standard industry guides may be used, while other assets like business equipment or boats may be valued based on original cost and depreciation or current market conditions.

What should you do if you disagree with the valuation or tax assessment?

If you disagree with the valuation or tax assessment based on your Form 762 filing, you have the right to appeal the decision. The process usually involves submitting a written appeal to the local Commissioner's Office, detailing why you believe the assessment is incorrect and providing evidence to support your case, such as independent valuations.

Common mistakes

Filling out the Form 762 for Virginia, which relates to the Return of Tangible Personal Property, Machinery and Tools, and Merchants’ Capital for local taxation, can be somewhat complex. Individuals often encounter errors during this process. Highlighted below are eight common mistakes to avoid for a smoother experience and to ensure accuracy in your filing.

- Not checking local due dates: While the general due date for filing Form 762 is May 1, some localities might have different deadlines. Failing to confirm the specific due date with your local office could lead to late submissions.

- Overlooking business usage of vehicles: A common error is not correctly identifying vehicles used for business purposes, which are ineligible for personal property tax relief under Virginia State Law.

- Incorrectly reporting leased vehicles: It's important to accurately report any leased vehicles, especially if the leasing company pays the tax without reimbursement from the individual, as these details affect tax relief eligibility.

- Misunderstanding the definition of manufactured homes: Form 762 requires specific information on manufactured (mobile) homes. Misinterpreting the legal definition can lead to incorrect reporting.

- Omitting or incorrectly detailing machinery and tools: For those engaged in eligible businesses, all machinery and tools used must be reported. Incorrect classification or omission can affect the tax assessment.

- Improperly listing merchants’ capital: Mistakes in reporting merchants’ capital, including inventory stock or tangible personal property not for sale, can lead to discrepancies in the tax liability.

- Failing to list all tangible personal property: Every item of personal or business-related tangible property must be listed. Often, individuals miss or incorrectly categorize items, impacting the accuracy of their return.

- Incorrectly classifying items in Part IV: The classification of additional tangible personal property in Part IV requires careful attention to detail. Common errors include misidentifying types of property or failing to report specific items such as firearms, jewelry, or household machinery.

To ensure accuracy and completeness of your Form 762 filing, take time to review each section carefully, consult the instructions on the form, and reach out to local tax officials if any clarification is needed. Avoiding these common mistakes can help streamline your filing process and potentially avoid delays or penalties associated with inaccurate reporting.

Documents used along the form

When dealing with the 762 Virginia Form, which is focused on the return of tangible personal property, machinery and tools, and merchants’ capital for local taxation, there are several other forms and documents that often accompany or support the information provided within it. Understanding these additional documents is essential for ensuring accurate and comprehensive tax reporting.

- Schedule of Assets: A detailed list of all tangible personal property and equipment owned by the individual or business, often required to substantiate the values reported.

- Business License Application: Application form for obtaining a business license in Virginia, which may need information on tangible personal property for tax assessment purposes.

- Personal Property Tax Relief Act Certification: A form that certifies eligibility for tax relief under the state act for personal vehicles.

- Lease Agreement(s): For leased business equipment or vehicles, a copy of the lease agreement helps determine the proper taxable values.

- Inventory Records: Detailed records of inventory, showing quantities and values, support the merchant’s capital section of the form.

- Federal Income Tax Returns: These may be required to cross-reference and verify income and depreciation claims related to business equipment and vehicles.

- Proof of Exempt Status Documentation: For organizations claiming exemption from personal property taxes, supporting documents must be provided.

- Machinery Purchase Receipts: Receipts or invoices showing the purchase prices and dates of machinery and tools are used to calculate depreciation.

- Vehicle Registration Documents: For motor vehicles listed on the form, registration documents help verify ownership and tax jurisdiction.

- Depreciation Schedules: These schedules, usually derived from federal tax returns, provide the basis for calculating the current value of business assets.

Accurate completion and submission of the Form 762 along with these associated documents ensure compliance with Virginia's local taxation requirements. It's crucial to maintain thorough records and understand the details of each supporting document to streamline the taxation process and avoid potential discrepancies.

Similar forms

The 762 Virginia form, used for the return of tangible personal property, machinery, and tools, as well as merchants' capital for local taxation, shares similarities with several other types of documents in its purpose and content. These include documents for personal property tax returns in other states, business property tax declarations, and similar tax forms focused on specialized assets like vehicles or manufacturing equipment. Each of these documents is tailored to collect specific details on assets subject to local or state taxation, often requiring information on the fair market value, acquisition date, and usage of the property.

One similar document is the Personal Property Tax Return forms used in other states. Like the 762 Virginia form, these forms are designed to capture details about personal properties that an individual or business owns. They include sections for declaring motor vehicles, manufactured homes, boats, aircraft, and other tangible personal properties. The primary similarity is in the structure of these forms, which systematically categorize different types of properties for tax purposes, making it easier for taxpayers to report and for tax authorities to assess liabilities accurately.

Another document sharing similarities is the Business Property Tax Declaration found in many jurisdictions. These declarations often focus on assets used in business operations, such as furniture, office equipment, tools, and machinery. Like the Virginia 762 form, they require the taxpayer to list the fair market value and other pertinent details about each asset. The main similarity lies in their goal to assess the value of property used for business purposes for accurate taxation, emphasizing the importance of detailed listings for fair tax calculations.

The 762 Virginia form also parallels specialized tax forms like Vehicle Tax Declarations and forms for Heavy Equipment. These specialized forms are more narrowly focused on particular types of property, such as vehicles used for business or heavy machinery used in construction and manufacturing. They require similar information, such as the make, model, year of acquisition, and fair market value, for accurate taxation. These forms share the 762 form’s objective of ensuring that all tangible assets, whether they are general personal property or specific types of equipment, are declared and taxed appropriately according to local statutes.

Dos and Don'ts

When you're filling out the 762 Virginia Form for Return of Tangible Personal Property, Machinery and Tools, and Merchants’ Capital, it’s crucial to pay close attention to details to ensure accuracy and compliance. Here are some essential things you should and shouldn't do:

- Do ensure that you report on all items that you owned as of January 1, 2009. This is critical for maintaining accuracy and compliance.

- Do write the word “None” opposite each item of property you don't own. This clarity is important.

- Do check if your motor vehicle qualifies for Car Tax Relief. Otherwise, it should be classified appropriately based on its use.

- Do report machinery and tools if you’re engaged in specific businesses such as manufacturing or broadcasting. Accuracy in this section is crucial for proper tax assessment.

- Do not ignore local due dates. While the general deadline is May 1, confirming with your local office is advisable to avoid penalties.

- Do not hesitate to attach a separate schedule if additional space is needed for any section. Proper documentation ensures that all necessary information is accurately conveyed.

Maintaining diligence and attention to detail when completing this form will ensure that your submission is both accurate and compliant with Virginia state requirements. If there's uncertainty at any point, referring to the instructions provided with the form or seeking further clarification can be highly beneficial.

Misconceptions

There are several misconceptions about the 762 Virginia form used for the Return of Tangible Personal Property, Machinery and Tools, and Merchants' Capital for local taxation. Here are ten of the most common misunderstandings:

Only for Businesses: While the form does include sections for business-related property, it is not solely for business use. Individuals owning tangible personal property or merchants' capital are required to report these items as well.

Personal Vehicles are Exempt: Many believe that personal vehicles do not need to be reported. However, all motor vehicles (including personal ones) must be declared unless specifically exempt under certain conditions outlined by the state.

Manufactured Homes are Excluded: Misunderstanding prevails that manufactured homes do not constitute tangible personal property and need not be reported. Contrary to this belief, they are clearly defined in the form and must be included if owned.

Machinery and Tools Only for Industrial Use: There's a misconception that only heavy industrial machinery and tools need to be reported. In reality, any machinery and tools used in a business, including those for agricultural purposes, should be declared.

Merchants' Capital is for Large Retailers Only: Some individuals assume that the section on Merchants' Capital applies only to large retail operations. It actually encompasses all merchants who hold inventory or goods for sale, regardless of size.

Online Businesses are Exempt: The belief that online businesses do not need to report tangible personal property is incorrect. If tangible personal property, machinery, or inventory is held within Virginia, it must be reported.

Leased Vehicle Tax Relief: A common misunderstanding is that leased vehicles for business use automatically qualify for personal property tax relief. Tax relief conditions do not apply the same way for leased business vehicles as they do for personally owned vehicles.

Filing is Optional: Some individuals under the mistaken belief that filing the 762 form is optional and based on voluntary compliance. Filing is mandatory for individuals and businesses owning taxable tangible personal property, machinery, tools, or merchants' capital within the locality.

Single Filing Covers All Localities: Owners of property in multiple localities may wrongly assume that a single filing covers all their property across Virginia. This form must be filed with each locality where the property is situated and subject to local taxation.

No Penalties for Late Filing: The misconception that there are no penalties for late filing or non-filing of this form is incorrect. Late filing or failure to file can result in penalties, interest, and in some cases, legal action.

Understanding the correct requirements and dispelling these misconceptions is crucial for compliance and avoiding penalties. Always refer to the latest guidelines from the Virginia Department of Taxation or consult a tax professional for advice specific to your situation.

Key takeaways

Filling out the 762 Virginia form correctly is vital for reporting tangible personal property, machinery and tools, and merchants' capital for local taxation. Here are key takeaways that should guide individuals and businesses through the process:

- Timely Submission: The form must be filed with the Commissioner of the Revenue of the County or City by May 1, 2009. However, since due dates can vary by locality, it's recommended to confirm the exact due date with the local office.

- Property Eligibility: Motor vehicles used for business purposes might not qualify for the personal property tax reduction, especially if the vehicle's usage aligns with certain business-related criteria outlined by the State Law.

- Distinct Sections for Different Properties: The form divides into several sections, each designed for specific types of property (e.g., tangible personal property, machinery and tools, merchants' capital). It's crucial to report under the correct section to ensure accurate taxation.

- Details Required for Manufactured Homes: Manufactured (mobile) homes are defined and must meet specific criteria to be reported as such on the form. The definition clarifies that these structures must adhere to federal regulation, highlighting their distinctions from other property types.

Filing this form accurately is important not just for compliance but also to ensure the correct tax liability is assessed based on the ownership and usage of various property types. Detailed instructions provided within the form, along with adherence to deadlines and definitions, help taxpayers navigate through the complexities of local taxation policies.

Other PDF Forms

Va4 Form - Facilitates individuals and departments in applying for exemptions from compulsory state training.

Wv Probate Laws - Details the final steps of recording the approved appraisement with the Clerk of the County Commission, marking the completion of this phase of estate administration.

Virginia Pd 207 - It is designed to provide detailed information that aids in a tailored response to alarms, considering any special conditions.