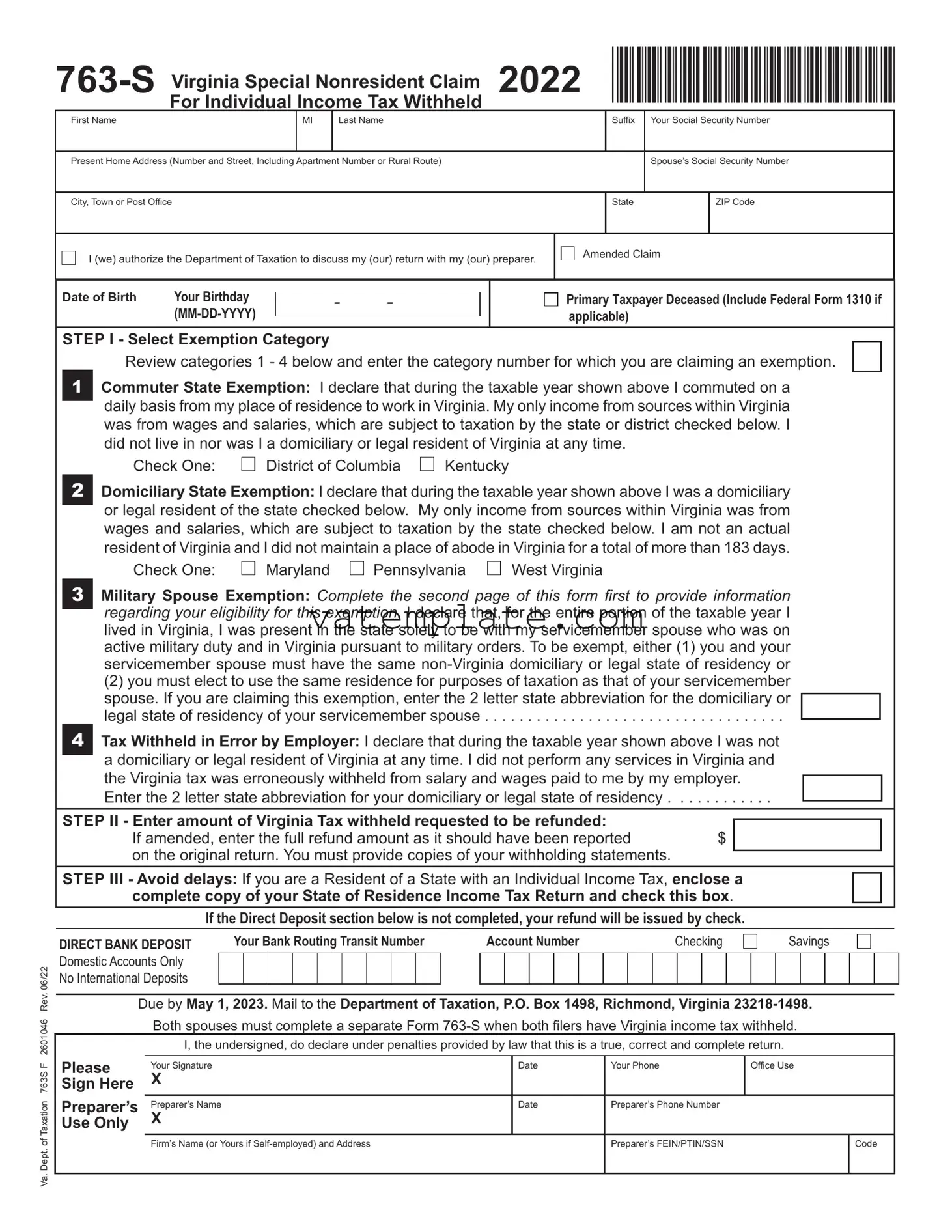

Fill Out a Valid 763 S Virginia Template

The 763-S Virginia form, formally known as the Special Nonresident Claim form for 2021, is a document crucial for individuals who have had Virginia state income tax withheld but believe they qualify for an exemption. Catering primarily to nonresidents, this form lays out four distinct exemption categories: the Commuter State Exemption for daily commuters not residing in Virginia, the Domiciliary State Exemption for those legally residing in another state, the Military Spouse Exemption tailored for nonresident spouses of service members stationed in Virginia, and a provision for those whose employers erroneously withheld Virginia state tax. Applicants must meticulously indicate their exemption category, detail the Virginia tax withheld they seek to reclaim, and attach supportive documents including withholding statements and, if applicable, their state income tax return. Additionally, the form emphasizes prompt and accurate submissions to facilitate the refund process, offers an option for direct bank deposits, and requires thorough documentation for military spouse exemptions to prevent delays. By complying with these requirements and submitting by the specified deadline, individuals set forth their claim for a rightful refund, ensuring adherence to both state and federal guidelines.

763 S Virginia Example

|

*VA763S122888* |

||||||

For Individual Income Tax Withheld |

|

|

|

|

|||

First Name |

MI |

Last Name |

|

Suffix |

Your Social Security Number |

||

|

|

|

|

|

|

|

|

Present Home Address (Number and Street, Including Apartment Number or Rural Route) |

|

|

Spouse’s Social Security Number |

||||

|

|

|

|

|

|

|

|

City, Town or Post Office |

|

|

|

|

State |

|

ZIP Code |

|

|

|

|

|

|

|

|

I (we) authorize the Department of Taxation to discuss my (our) return with my (our) preparer. |

|

Amended Claim |

|||||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

Va. Dept. of Taxation 763S F 2601046 Rev. 06/22

Date of Birth |

Your Birthday |

- |

- |

Primary Taxpayer Deceased (Include Federal Form 1310 if |

|

||||

|

|

|

applicable) |

|

|

|

|

STEP I - Select Exemption Category

Review categories 1 - 4 below and enter the category number for which you are claiming an exemption.

1Commuter State Exemption: I declare that during the taxable year shown above I commuted on a daily basis from my place of residence to work in Virginia. My only income from sources within Virginia was from wages and salaries, which are subject to taxation by the state or district checked below. I did not live in nor was I a domiciliary or legal resident of Virginia at any time.

Check One: |

District of Columbia |

Kentucky |

2Domiciliary State Exemption: I declare that during the taxable year shown above I was a domiciliary or legal resident of the state checked below. My only income from sources within Virginia was from wages and salaries, which are subject to taxation by the state checked below. I am not an actual resident of Virginia and I did not maintain a place of abode in Virginia for a total of more than 183 days.

Check One: |

Maryland |

Pennsylvania |

West Virginia |

3Military Spouse Exemption: Complete the second page of this form first to provide information regarding your eligibility for this exemption. I declare that, for the entire portion of the taxable year I lived in Virginia, I was present in the state solely to be with my servicemember spouse who was on active military duty and in Virginia pursuant to military orders. To be exempt, either (1) you and your servicemember spouse must have the same

(2) you must elect to use the same residence for purposes of taxation as that of your servicemember spouse. If you are claiming this exemption, enter the 2 letter state abbreviation for the domiciliary or legal state of residency of your servicemember spouse . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4Tax Withheld in Error by Employer: I declare that during the taxable year shown above I was not a domiciliary or legal resident of Virginia at any time. I did not perform any services in Virginia and the Virginia tax was erroneously withheld from salary and wages paid to me by my employer.

Enter the 2 letter state abbreviation for your domiciliary or legal state of residency . . . . . . . . . . . .

STEP II - Enter amount of Virginia Tax withheld requested to be refunded:

If amended, enter the full refund amount as it should have been reported $ on the original return. You must provide copies of your withholding statements.

STEP III - Avoid delays: If you are a Resident of a State with an Individual Income Tax, enclose a complete copy of your State of Residence Income Tax Return and check this box.

If the Direct Deposit section below is not completed, your refund will be issued by check.

DIRECT BANK DEPOSIT |

Your Bank Routing Transit Number |

Account Number |

|

|

Checking |

|

|

Savings |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Domestic Accounts Only |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

No International Deposits |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Due by May 1, 2023. Mail to the Department of Taxation, P.O. Box 1498, Richmond, Virginia

Both spouses must complete a separate Form

I, the undersigned, do declare under penalties provided by law that this is a true, correct and complete return.

Please |

Your Signature |

Date |

Your Phone |

Office Use |

|

Sign Here |

X |

|

|

|

|

|

|

|

|

|

|

Preparer’s |

Preparer’s Name |

Date |

Preparer’s Phone Number |

|

|

Use Only |

X |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Firm’s Name (or Yours if |

|

Preparer’s FEIN/PTIN/SSN |

|

Code |

|

|

|

|

|

|

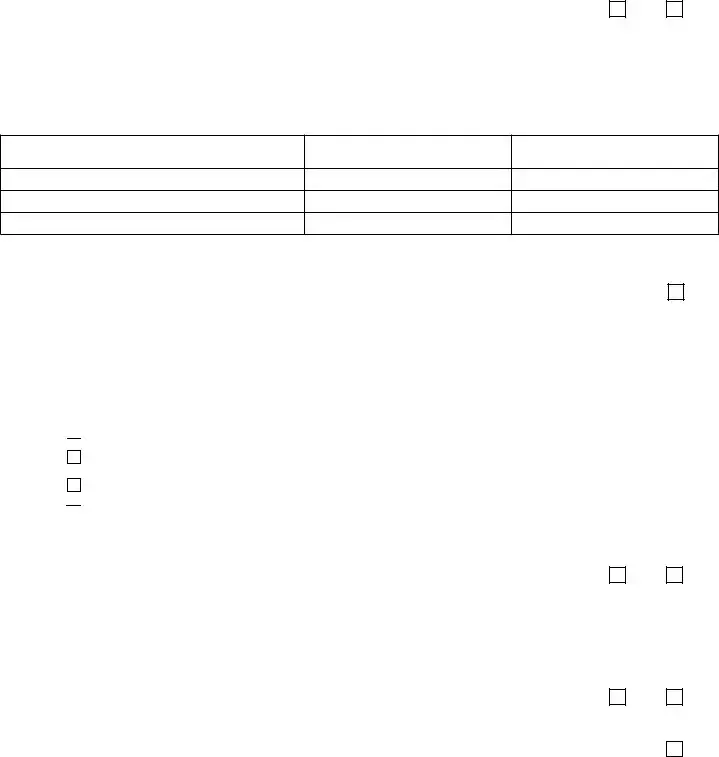

Military Spouse Qualification

Complete each question below and provide copies of the requested documentation before claiming Exemption Category 3 on the front of this form. Incomplete responses or missing documentation could cause your refund to be delayed. The provisions of the Servicemember Civil Relief Act apply only to spouses of military servicemembers and do not apply to dependents.

I.Your spouse is a member of the armed forces present in Virginia in compliance with military orders.

1. Was your spouse in active military service for the taxable year in question?

Yes

No

a. If your spouse was discharged from |

|

the date your spouse left the service? |

_________________ |

|

MM/DD/YYYY |

b.If your spouse was in the military at any time for the taxable year in question, provide his or her duty station(s) for the taxable year. Additional rows are provided in case your spouse had more than one duty station during the taxable year.

Location of Duty Station (include country if not USA)

Date Assignment Started

MM/DD/YYYY

Date Assignment Ended

MM/DD/YYYY

2. Where and when were you and your spouse married? |

State ______________ _________________ |

|

MM/DD/YYYY |

3.Enclose a copy of your military ID card. This would be a military identification card issued to spouses of military personnel. If a military identification card has not been issued, check here.

4.What is your spouse’s state of domicile or legal state of residency? (Enter here and on Line 3 on

the first page of this return) |

_________________ |

Enclose a copy of one or more of the following documents showing the military servicemember’s domicile or legal state of residency

(check the appropriate boxes to indicate which documents you are providing).

Leave & Earning Statement (LES) for the year in question

Leave & Earning Statement (LES) for the year in question

Current driver’s license from the military servicemember’s domicile state

DD Form 2058 (State of Legal Residence Certificate)

Other _______________________________________________________________________________

Other _______________________________________________________________________________

II.You are present in Virginia solely to be with your spouse.

5. Do you own a business or any income producing property in Virginia?

Yes

No

a.If yes, please describe. ___________________________________________________________________

III.You have the same

6.Did you file a state income tax return for the year in question with the state reported under question 4 above?

If you answered yes, enclose a copy of your state income tax return for the year in question. If your state of residency for tax purposes does not have an income tax, check here.

Yes

No

Note: A copy of documents requested above will assist the Department in speeding up the issuance of the refund.

Form Properties

| Fact | Detail |

|---|---|

| Purpose of Form 763-S | Allows special nonresidents to claim a refund for Virginia income tax withheld. |

| Governing Law | Subject to regulations by the Virginia Department of Taxation. |

| Eligibility Categories | Commuter State Exemption, Domiciliary State Exemption, Military Spouse Exemption, Tax Withheld in Error. |

| Submission Requirement | Must include copies of withholding statements and, for residents of states with income tax, a complete copy of the state of residence income tax return. |

| Direct Deposit Option | Refunds can be directly deposited into a domestic bank account. |

| Deadline for Submission | Due by May 1 following the tax year in question. |

| Military Spouse Documentation | Requires proof of the servicemember's active duty status, marriage, and the couple's shared non-Virginia domicile or legal state of residency. |

Steps to Filling Out 763 S Virginia

When dealing with taxes, accuracy and understanding the purpose behind each form you fill out are crucial. The 763 S Virginia form, specifically designed for certain nonresidents who have had Virginia income tax withheld, follows this rule closely. It caters to individuals in unique situations, such as commuters from certain states, military spouses, and those who mistakenly had taxes withheld. Ensuring you provide accurate information will help avoid delays and potential issues down the line. Here's a detailed breakdown of how to fill out this form.

- Start with your personal information. Provide your first name, middle initial (MI), last name, and suffix if applicable. Also, add your social security number.

- Enter your present home address, including the apartment number or rural route if it applies.

- Next, fill in your spouse’s social security number if filing jointly.

- Add the city, town or post office, state, and ZIP code linked to your home address.

- In the section provided, authorize the Department of Taxation to discuss your return with your preparer by checking the box.

- Under the section marked "Amended Claim," if applicable, tick the box to indicate such status. Remember to include the Federal Form 1310 if the primary taxpayer is deceased.

- Fill in your date of birth in the format MM-DD-YYYY.

- In Step I, select your exemption category by reviewing the categories 1 through 4 and entering the correct category number for the exemption you’re claiming.

- For Step II, enter the amount of Virginia tax withheld that you're requesting to be refunded. If you're filing an amended claim, ensure to enter the corrected refund amount.

- To avoid delays, especially if you reside in a state with an individual income tax, attach a complete copy of your State of Residence Income Tax Return and check the box in Step III.

- If opting for direct bank deposit of your refund, provide your bank routing transit number, account number, and specify if it’s checking or savings. Note, it must be a domestic account.

- Sign and date the form at the bottom. Include your phone number for contact.

- If a tax preparer completed the form, they must also provide their signature, name, date, phone number, and their firm’s name (or personal name if self-employed) along with their address and either their FEIN, PTIN, or SSN.

- For those claiming the military spouse exemption, complete the second page first to provide necessary information about your eligibility for this exemption before selecting exemption category 3 on the front of the form. This includes details about your spouse’s military service, marriage, military ID, and domicile or legal state of residency, along with the required documentation.

After completing the form, review it for accuracy to ensure all necessary documents are attached and no sections have been missed. Mail it to the Department of Taxation by the due date to avoid any delays with your claim. This meticulous approach ensures that your nonresident claims are handled efficiently, providing peace of year during tax season.

FAQ

What is the 763-S Virginia Special Nonresident Claim form?

The 763-S Virginia Special Nonresident Claim form is a document designed for individuals who are not legal residents of Virginia but had income tax withheld from earnings received within the state. This form allows eligible individuals to request a refund of the Virginia income tax that was withheld.

Who should file the 763-S form?

Persons who meet any of the following conditions should file this form:

- Commuters from the District of Columbia, Kentucky, Maryland, Pennsylvania, or West Virginia who worked in Virginia but resided and paid income tax to their home state.

- Nonresidents who mistakenly had Virginia tax withheld from their earnings, without having worked or provided services in Virginia.

- Military spouses who resided in Virginia solely to be with their servicemember spouse under military orders.

What documents are required to support my claim?

You must provide copies of your withholding statements along with a complete and signed form. Additionally:

- For military spouses claiming exemption category 3, documentation such as a military ID card, and proof of the servicemember's domicile or legal state of residency are required.

- If claiming due to tax withheld in error, documentation from your employer may be needed.

- A complete copy of your State of Residence Income Tax Return is necessary if you reside in a state with individual income tax.

When is the form due?

The completed 763-S form should be mailed by May 1, following the tax year for which you are requesting a refund.

Where should I mail the completed form?

The completed form, along with all required documentation, should be mailed to the Department of Taxation, P.O. Box 1498, Richmond, Virginia 23218-1498.

Can both spouses file a single Form 763-S if both had Virginia income tax withheld?

No, each spouse must complete and file a separate Form 763-S if they both had Virginia income tax withheld and are eligible for a refund.

What if my refund is not processed or delayed?

To avoid delays, ensure you provide all required documentation and information accurately. Incomplete forms or missing documentation can lead to delays. If your refund is delayed significantly without reason, contacting the Virginia Department of Taxation for a status update is advised.

How do I authorize someone to discuss my return with the Department of Taxation?

You can authorize the Department of Taxation to discuss your return with your preparer by checking the appropriate box and providing your preparer’s details on your form.

Common mistakes

When individuals fill out the 763 S Virginia form, a variety of common mistakes can occur. Recognizing and avoiding these errors can streamline the process of claiming exemptions and ensure the accuracy of filed documents. Here is an overview of frequent mistakes:

- Not selecting the correct exemption category in Step I. Each exemption category has specific requirements, and choosing the wrong one may lead to processing delays or denial of the claim.

- Failure to include the social security number or providing an incorrect number. This essential piece of information is crucial for identification and processing.

- Inaccurate or incomplete personal information. Errors in names, addresses, or dates of birth can lead to complications in identifying the taxpayer and processing the claim.

- Omitting spouse’s details when necessary, especially in cases where both spouses have Virginia income tax withheld and are required to file separate Forms 763-S.

- Forgetting to attach copies of withholding statements in Step II. These documents are necessary to validate the amount of Virginia tax withheld being requested for refund.

- Not enclosing a complete copy of the state of residence income tax return when the taxpayer resides in a state with an individual income tax. This oversight can delay the processing of the refund.

- Incorrectly filling out the Direct Deposit section or leaving it blank, which can lead to delays in refund or the issuance of a check when direct deposit is preferred.

- Filing the form past the due date, which can result in processing delays or denial of the refund claim.

- Not signing the form or failing to include the date and contact information, which are necessary for the form’s validity and for any needed follow-up.

Addressing these errors beforehand can significantly reduce processing times, ensure accuracy, and facilitate a smoother refund process for individuals claiming exemptions on the 763 S Virginia form.

Documents used along the form

When dealing with the 763-S Virginia Special Nonresident Claim form, it's integral to have a comprehensive understanding of other documents and forms that may be necessary to support or supplement your claim. These documents are instrumental in ensuring the accuracy and completeness of your nonresident claim, potentially affecting the speed and success of your refund process. Below is an outline of other forms and documents often used in conjunction with the 763-S Virginia form.

- W-2 Form: This form reports an individual's annual wages and the amount of taxes withheld from their paycheck. It's provided by the employer and is essential for confirming the income and tax withheld that needs to be matched with the claim.

- 1040 Form (Federal Income Tax Return): A standard form used by individuals to file their annual income tax returns with the Internal Revenue Service. It provides a detailed account of the filer's income, which helps authenticate the information declared on the 763-S form.

- DD Form 2058 (State of Legal Residence Certificate): This document is crucial for military service members to declare their state of legal residency. For those claiming the military spouse exemption, this form substantiates the state of domicile or legal residency of the service member.

- State of Residence Income Tax Return: This document is vital for verifying that you have fulfilled your tax obligations in your state of residency, especially in the context of claiming exemptions related to domicile or residency status.

- Federal Form 1310 (Statement of Person Claiming Refund Due a Deceased Taxpayer): If the taxpayer has deceased, this form becomes necessary to authorize the refund to be issued to another person, such as the estate or surviving spouse.

- Power of Attorney Authorization: This legal document may be required if another individual or tax preparer will discuss or act on behalf of the taxpayer with the Virginia Department of Taxation.

- Lease Agreements or Residential Contracts: For some exemptions, particularly those involving domicile or residency disputes, it may be necessary to provide documentation proving where the taxpayer lived during the taxable year.

- Pay Stubs or Earnings Statements: These can be used to supplement W-2 forms if there are discrepancies or missing information. They provide detailed evidence of income and tax withheld.

- Military Identification Card: For those claiming a military spouse exemption, a copy of the military ID card may be requested to confirm eligibility based on military service member criteria.

Understanding and gathering the correct supplementary forms and documents are crucial steps in filing your 763-S Virginia Special Nonresident Claim form correctly. By ensuring that all necessary paperwork is complete and accurate, you greatly improve the likelihood of a favorable and timely response to your claim. Remember, the specific requirements may vary based on your individual circumstances, so it's important to consult the Virginia Department of Taxation or a tax professional if you're unsure about what is needed.

Similar forms

The 763-S Virginia Special Nonresident Claim form shares similarities with several other state-specific nonresident tax forms. These documents are designed for individuals who earn income in a state where they do not reside, offering a mechanism to claim exemptions or refunds for state taxes withheld in error. Essential features, such as sections for personal information, income details, and specific nonresidency qualifications, make these forms comparable. Each form requires thorough documentation to support the nonresident status and any claim for refund or exemption.

One comparable form is the California 540NR Nonresident or Part-Year Resident Income Tax Return. Like the 763-S, the 540NR allows individuals to report income earned in California while being nonresidents or residents for only part of the year. Both forms include sections where filers must detail their income sources within the state and provide personal identification information. They also require documentation to support residency status and any claim related to taxes withheld or paid. The key difference lies in state-specific guidelines and tax laws that define residency and nonresidency for tax purposes.

Another similar document is the New York IT-203 Nonresident and Part-Year Resident Income Tax Return. This form serves a similar purpose for those earning income in New York without being full-year residents. Like the Virginia 763-S, the IT-203 demands detailed income information, allows for deductions and exemptions based on nonresident or part-year resident status, and includes a section for taxpayers to declare their residency status. Claimants must provide proof of their primary residence and fulfill state-specific requirements to correctly file as nonresidents or part-year residents.

The Pennsylvania PA-40 NRC Nonresident Consolidated Income Tax Return is another counterpart, tailored for individuals who earned income in Pennsylvania but are not residents. Similar to the Virginia form, the PA-40 NRC walks filers through reporting income that is subject to state taxes, claiming any applicable credits or deductions, and certifying nonresident status. Both forms necessitate comprehensive declarations about the taxpayer's income, residency, and eligibility for refunds or exemptions, underscoring the emphasis on accurate, substantiated filing to avoid discrepancies or delays in processing.

Dos and Don'ts

Filling out the 763 S Virginia form is an important step for certain nonresidents to claim exemptions or seek refunds for Virginia income tax withheld. To ensure the process goes smoothly, here’s a list of things you should and shouldn't do:

- Do review all exemption categories carefully and select the one that accurately fits your situation.

- Do ensure your Social Security Number and any other required identification numbers are entered correctly to avoid processing delays.

- Do provide your complete present home address, including apartment number or rural route, if applicable, for accurate correspondence.

- Do attach copies of your withholding statements if you're requesting a refund due to taxes withheld in error.

- Do include a complete copy of your State of Residence Income Tax Return if you're a resident of a state with an individual income tax. This helps to verify your claim and avoid delays.

- Do fill out the Direct Deposit section thoroughly if you prefer to receive your refund via bank transfer, ensuring both the routing and account numbers are correct.

- Don't forget to sign and date the form. An unsigned form is considered incomplete and will not be processed.

- Don't overlook the requirement to submit a separate Form 763-S if both spouses have Virginia income tax withheld and both wish to claim exemptions or refunds.

- Don't leave any mandatory fields blank. Incomplete forms can lead to delays or even rejections of your claim.

- Don't assume the process is the same for every exemption category. Pay special attention to the documentation required for the Military Spouse Exemption, and ensure all supporting documents are enclosed.

By following these guidelines, you can streamline the process and help ensure your Form 763-S is processed accurately and efficiently.

Misconceptions

Understanding the nuances of tax forms can often lead to confusion and misconceptions, particularly with specialized documents like the 763-S Virginia Special Nonresident Claim form. It's essential to debunk these myths to ensure individuals accurately fulfill their tax obligations. Here are seven common misconceptions about the 763-S form:

- The 763-S form is for Virginia residents. Contrary to this belief, the 763-S form is specifically designed for nonresidents who have had Virginia state income tax erroneously withheld. It’s a way for individuals who do not reside in Virginia to claim a refund for taxes that should not have been deducted.

- Only workers in Virginia need to file this form. While it's true that many people filling out this form might have worked in Virginia, the form is also relevant for individuals who did not perform any services in Virginia but had state tax withheld erroneously. This includes remote workers or individuals incorrectly documented by their employers.

- Military spouses cannot use this form. In fact, one of the exemption categories (category 3) is specifically designed for military spouses. If they lived in Virginia solely due to being with their spouse who was stationed in Virginia for active military duty, they might qualify to use this form, assuming they meet other eligibility requirements related to residency.

- Every nonresident with Virginia income must file this form. This is incorrect. The form is intended for nonresidents who either had income withheld for Virginia taxes in error or qualify for one of the specific exemption categories outlined in the document. Not all nonresidents with Virginia income meet these criteria.

- You need to file this form annually. The necessity to file the 763-S form arises only under specific conditions, such as incorrect withholding or qualifying for an exemption in a given tax year. It is not an annual requirement for all nonresidents.

- Filing the 763-S form is complicated. While tax forms can be intimidating, the 763-S form guides the filer through the process. The form includes clear steps for selecting exemption categories, entering refund amounts requested, and supplies specific instructions for military spouses, making it more manageable than assumed.

- The form does not require documentation. Contrary to this belief, filers should be prepared to submit supporting documentation with their 763-S form, especially if claiming the military spouse exemption. Documentation not only supports the claim but also assists in speeding up the refund process.

Correctly understanding the requirements and exemptions of the 763-S Virginia Special Nonresident Claim can significantly impact individuals' tax filing processes, ensuring they receive any refunds due without unnecessary delays.

Key takeaways

Filling out the 763 S Virginia form, specifically designed for individuals who are not residents of Virginia but have had state income tax withheld, requires careful attention to detail and an understanding of eligibility criteria. Here's a summary of key takeaways to guide you through the process:

- Understanding Eligibility: Before filling out the form, identify under which exemption category you fall. The form lists four specific categories, such as the Commuter State Exemption, Domiciliary State Exemption, Military Spouse Exemption, and an exemption for Tax Withheld in Error by Employer. Your eligibility for refunds and the necessary documentation will significantly depend on the category that applies to your situation.

- Importance of Documentation: Supporting documents are critical, especially if filing under the Military Spouse Exemption. Required documents include a copy of the military ID card, your state of residency income tax return if applicable, and any documentation that can substantiate your spouse’s state of domicile or legal residency. Without the proper documentation, the processing of your claim might face unnecessary delays.

- Deadline and Submission: Timeliness is crucial as the form must be submitted by the specified deadline, which is typically May 1 following the tax year in question. Late submissions might risk processing delays or affect your refund eligibility. Ensure that the form, along with all necessary documentation, is sent to the correct address or as directed by the Department of Taxation.

- Refund Process and Direct Deposit: For faster refund processing, consider opting for a direct bank deposit by accurately filling out the banking details section. However, ensure your account can accept domestic deposits only, as international deposit options are not available. If the direct deposit information is incomplete or incorrect, the refund will be issued by check, which may lead to additional delays.

By paying close attention to these key points, you can navigate the complexities of the 763 S Virginia form more smoothly, ensuring you meet all requirements and maximize your chances of a timely and accurate refund.

Other PDF Forms

Wv Business License - Essential documentation for businesses to demonstrate their legal and financial integrity to the West Virginia Tax Department.

Form 502 Virginia - Compliance with fixed date conformity adjustments ensures that entities’ tax liabilities reflect Virginia’s specific tax policy preferences.