Attorney-Approved Articles of Incorporation Template for Virginia

When starting a corporation in Virginia, completing the Virginia Articles of Incorporation form is a crucial first step. It lays the foundation on which your corporation will be built, by defining its identity, purpose, and structure. This document requires detailed information, including the corporation’s name, the number of authorized shares, the names of the initial directors, and the registered agent’s information. Filing the Articles of Incorporation with the Virginia State Corporation Commission is essential for official recognition, and it sets the wheels in motion for your business's legal and financial affairs. Without this formal acknowledgment, a corporation cannot operate legitimately within the state. Understanding each section of the form and ensuring accurate completion is key to successfully registering and establishing your corporation in Virginia.

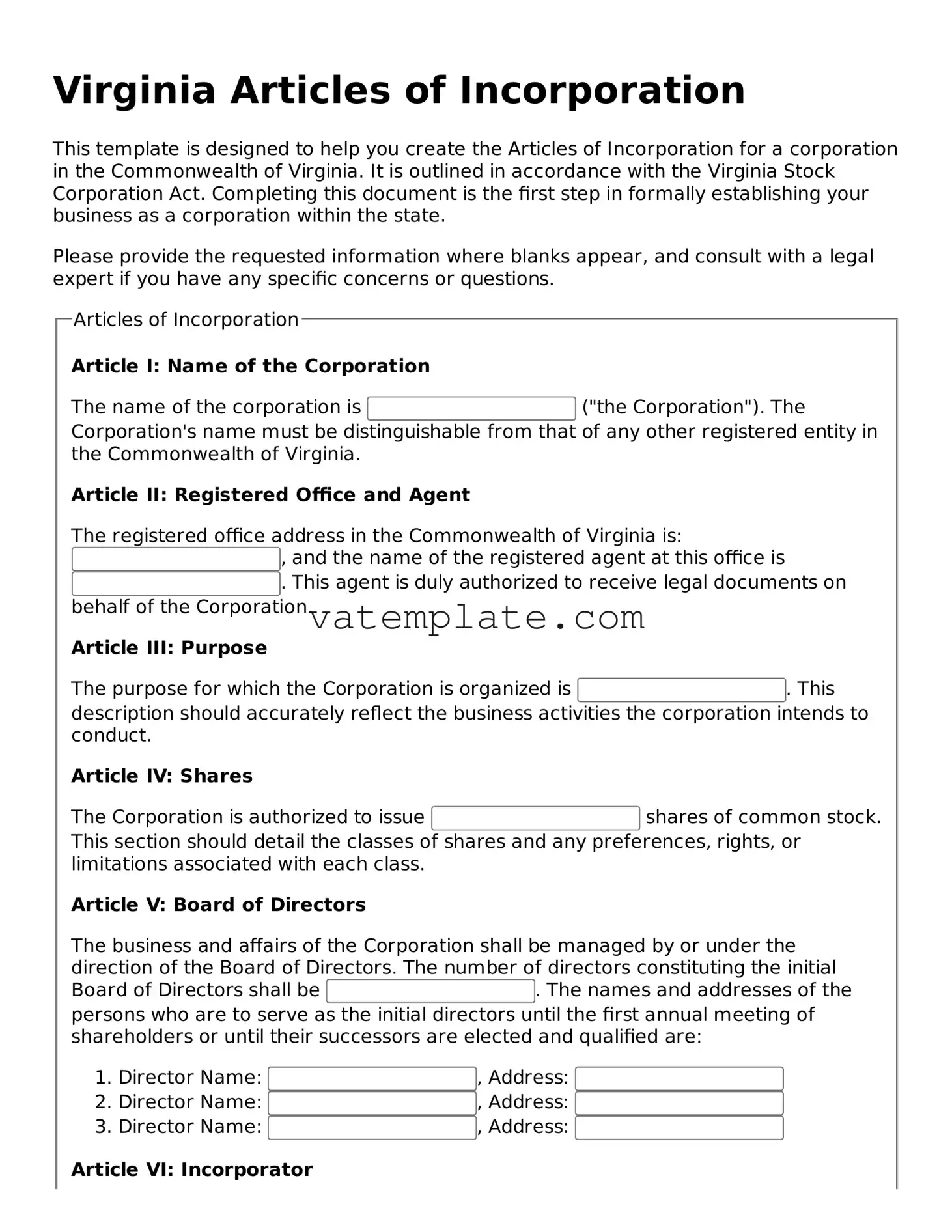

Virginia Articles of Incorporation Example

Virginia Articles of Incorporation

This template is designed to help you create the Articles of Incorporation for a corporation in the Commonwealth of Virginia. It is outlined in accordance with the Virginia Stock Corporation Act. Completing this document is the first step in formally establishing your business as a corporation within the state.

Please provide the requested information where blanks appear, and consult with a legal expert if you have any specific concerns or questions.

Document Details

| Fact | Detail |

|---|---|

| Governing Law | The Virginia Articles of Incorporation are governed by the Virginia Stock Corporation Act, Title 13.1, Chapters 9 and 10 of the Code of Virginia. |

| Filing Authority | The Virginia State Corporation Commission (SCC) is responsible for the filing and maintenance of Articles of Incorporation in Virginia. |

| Online Filing Option | Virginia offers an online filing option through the SCC's eFile system for a more convenient filing process. |

| Required Information | Filers must provide the corporation's name, registered agent's name and address, number of shares authorized to issue, and the name(s) of the incorporator(s). |

Steps to Filling Out Virginia Articles of Incorporation

Once a decision is made to form a corporation in Virginia, the next critical step is completing the Articles of Incorporation. This document, crucial for the establishment of any corporation, requires careful attention to details to ensure compliance with state laws. The process, while straightforward, mandates accuracy and completeness to avoid potential legal hurdles or delays. Following the steps below will guide individuals through the necessary areas to fill out the Virginia Articles of Incorporation, ensuring a smooth path toward officially formalizing a corporation.

- Begin by providing the name of the corporation. Ensure that the name complies with Virginia state law, including the appropriate corporate suffix.

- Specify the purpose for which the corporation is being formed. This should be a brief description outlining the principal business activity.

- Indicate the number of shares the corporation is authorized to issue. This should reflect the corporation's financing structure.

- Provide the registered office's physical address in Virginia, including street address, city, and zip code. This cannot be a P.O. Box.

- List the name and physical Virginia address of the registered agent. The agent must be authorized to transact business in Virginia and capable of receiving legal documents on behalf of the corporation.

- If the corporation will have a board of directors, provide the number of directors. Include names and addresses if they are determined at the time of filing.

- Include the name, address, and signature of each incorporator. An incorporator is responsible for executing the Articles of Incorporation.

- Decide on the corporation's duration. If it is not meant to be perpetual, specify the duration.

- State the effective date of incorporation if it is not intended to be effective upon the filing of the Articles of Incorporation.

- Lastly, provide any additional articles or provisions necessary for the operation of the corporation that are not covered by the standard form.

After completing these steps, review the document for accuracy and completeness. Once satisfied, submit the form along with the required filing fee to the Virginia State Corporation Commission. The submission can be made online, by mail, or in person. Upon approval, the corporation will receive a certificate of incorporation, marking the official start of its legal existence.

FAQ

What are the Virginia Articles of Incorporation?

The Virginia Articles of Incorporation is a legal document required to officially register a corporation in the state of Virginia. This form outlines the primary details of the company, including its name, purpose, registered agent, principal office address, and information about its shares and initial directors.

Who needs to file the Virginia Articles of Incorporation?

Any group or individual wishing to form a corporation in Virginia must file the Virginia Articles of Incorporation with the Virginia State Corporation Commission (SCC). This is a mandatory step to legally operate as a corporation within the state.

What information is required to complete the Articles of Incorporation?

Completing the Articles of Incorporation requires several key pieces of information, including:

- The corporation's name.

- The corporation's purpose.

- Name and address of the registered agent.

- The principal office address of the corporation.

- Number of shares the corporation is authorized to issue.

- Names and addresses of the initial directors.

Can I file the Virginia Articles of Incorporation online?

Yes, the Virginia State Corporation Commission offers an online filing option. This method is often faster and can be more convenient than mailing a paper form.

What are the fees to file the Articles of Incorporation in Virginia?

The filing fees for the Articles of Incorporation in Virginia vary based on several factors, including the number of authorized shares. It's important to check the current fees directly on the Virginia State Corporation Commission's website for the most accurate information.

How long does it take to process the Virginia Articles of Incorporation?

Processing times can vary. If you file online, the process is typically faster, and you might receive confirmation in a few days. Paper filings can take several weeks. For the most current processing times, it's best to consult the Virginia State Corporation Commission's website.

Do I need an attorney to file the Virginia Articles of Incorporation?

While it's not mandatory to have an attorney to file the Articles of Incorporation, consulting with a legal professional can help ensure that your paperwork is in order, especially if your corporation has complex needs or structure.

What happens after I file the Articles of Incorporation?

Upon approval, your corporation will be officially registered in the state of Virginia. You'll need to follow up with other requirements such as obtaining a federal Employer Identification Number (EIN), setting up a corporate records book, and holding an initial meeting with your board of directors.

Can the Virginia Articles of Incorporation be amended after filing?

Yes, if there are changes to your corporation's information or structure, you can file an amendment with the Virginia State Corporation Commission. There is a process and a fee associated with filing amendments.

What if my Articles of Incorporation are rejected?

If your Articles of Incorporation are rejected, the Virginia State Corporation Commission will typically provide a reason for the rejection. You will have the opportunity to correct any issues and resubmit your application. It's important to address any concerns promptly to proceed with forming your corporation.

Common mistakes

Not providing a distinct name for the corporation. Every corporation must have a unique name that is not already in use by another business entity in Virginia. It's important to conduct a thorough search of the Virginia State Corporation Commission's records before deciding on a name. A lack of originality in the name can result in the rejection of the Articles of Incorporation.

Forgetting to appoint a registered agent. The role of the registered agent is vital, as this is the person or business entity authorized to receive legal papers on behalf of the corporation. Failing to designate a registered agent, or providing incorrect information about the agent, can lead to significant legal and operational problems down the line.

Omitting the number of authorized shares. A corporation must declare the number of shares it is authorized to issue. This detail plays a key role in the structuring and potential growth of the company. Neglecting to include this information can result in processing delays or even rejection of the application.

Leaving out the purpose of the corporation. Although Virginia law allows a broad statement of purpose, explicitly stating the primary activities or objectives of the corporation is beneficial. This helps in ensuring that all stakeholders understand the core intentions of the business. A vague or missing purpose statement can cause confusion and potential legal complications.

Ignoring filing fee requirements. Submitting the Articles of Incorporation without the appropriate filing fee or with an incorrect amount can stall the formation of the corporation. It's critical to verify the current fee and ensure that the payment accompanies the submission of the form.

Avoiding these common mistakes can smooth the path for your corporation's establishment in Virginia. Paying close attention to detail and carefully reviewing the form before submission can save time, effort, and potential legal issues. While the process may seem daunting, a careful and methodical approach will lead to successful registration and the beginning of a corporation's operations.

Documents used along the form

Starting a business in Virginia is an exciting venture, but it requires thorough preparation and understanding of the legal documents involved beyond just the Articles of Incorporation. The Articles of Incorporation form is fundamental for establishing a corporation in Virginia, serving as the official registration of your business with the state. However, to fully comply with Virginia's legal and business requirements, and to ensure the smooth operation of your corporation, several other forms and documents are frequently used alongside the Articles of Incorporation. Here are some important ones you should be aware of:

- Bylaws: This internal document outlines the corporation's governance, including the roles of directors and officers, meeting procedures, and how decisions are made. Bylaws don't need to be filed with the state; however, they are crucial for the organization's functioning and legal compliance.

- Initial Corporate Resolutions: These are written decisions made by the board of directors or shareholders at the beginning of the corporation’s life. These resolutions often include the appointment of officers, setting up a corporate bank account, and authorizing the issuance of shares.

- SS-4 Form: Also known as the Application for Employer Identification Number (EIN), this IRS form is necessary for tax administration for any entity operating a business. The EIN is like an individual's Social Security number but for your business, required for hiring employees and opening business bank accounts.

- Business License Application: Depending on the type of business and its location, various local and state business licenses may be required. This application is crucial for legally operating your business in Virginia.

- Annual Reports: Virginia requires corporations to file an annual report to remain in good standing. This report updates the state on any changes in address, changes to directors or officers, and other relevant information.

- Stock Certificates: Although not a legal requirement, issuing stock certificates is a tangible way to represent ownership in the corporation. These documents specify the number of shares owned by a shareholder.

- Shareholder Agreement: This document outlines the rights and obligations of the shareholders regarding share transfers, vote casting, and how the business is run, providing clarity and preventing conflicts.

- Professional Licenses: Some businesses, especially those in specialized fields like healthcare, legal, or certain trades, require professional licensing. These licenses prove the business and its employees have the necessary qualifications and permission to operate in their sector.

Together with the Articles of Incorporation, these documents and forms provide a solid foundation for your corporation's legal structure, operational guidelines, and compliance. While the process might seem complex, each document plays a critical role in protecting the interests of the business and its owners, ensuring that all corporate actions are in line with state laws and regulations. Being proactive and well-informed about these requirements can significantly smooth the journey of launching and running a successful business in Virginia.

Similar forms

The Virginia Articles of Incorporation form is similar to several other legal documents used in the business formation process, although each serves its own unique purpose and has its own specific requirements. These documents are essential for businesses not only in the initial setup phase but also for maintaining legal compliance and governance throughout the lifecycle of the business.

Articles of Organization for LLCs: This document shares similarities with the Virginia Articles of Incorporation in that it is the foundational legal filing required to establish a limited liability company (LLC) in many states. Just like the Articles of Incorporation lay the groundwork for a corporation's legal structure, the Articles of Organization do the same for LLCs. Both documents typically include basic information such as the name of the entity, principal place of business, the registered agent information, and the names of the founders or initial members/managers. However, while the Articles of Incorporation are for corporations, the Articles of Organization specifically cater to the formation of an LLC, reflecting the differences in management structure and operational flexibility between the two types of entities.

Bylaws and Operating Agreements: After filing the Articles of Incorporation, corporations are often required to create bylaws, which are similar in purpose to an LLC's operating agreement. Both set forth the internal rules and procedures for managing the business affairs but are tailored to the entity type's unique needs. For instance, bylaws for a corporation would detail the governance structure, including the roles and duties of directors and officers, meeting schedules, and shareholder voting rights. An operating agreement for an LLC provides comparable details but is customized for the flexible nature of LLCs, such as profit sharing, member duties, and the process for adding or removing members. Neither bylaws nor operating agreements are typically filed with the state; however, they are crucial for the efficient and effective governance of the business entity.

DBA Filing (Doing Business As): Sometimes, a business operates under a different name than the one registered with the Articles of Incorporation or the Articles of Organization. In such cases, a DBA (Doing Business As) filing is necessary. This does not create a separate legal entity but allows the corporation or LLC to conduct business under another name, which is crucial for branding and marketing purposes. The process of filing a DBA is simpler and requires less information than the Articles of Incorporation or Articles of Organization. However, it's an essential step for businesses looking to operate under a name different from their legal name, ensuring transparency and accountability in business operations.

Dos and Don'ts

When filling out the Virginia Articles of Incorporation form, it's essential to follow some fundamental guidelines to ensure that the process goes smoothly and your corporation starts on a solid legal foundation. Here are seven do's and don'ts to consider:

- Do check for the availability of your corporation name before you fill out the form. Virginia requires that your business name be distinguishable from the names of other businesses already on file.

- Do make sure to specify the number of shares the corporation is authorized to issue, as this is a critical aspect of the Articles of Incorporation.

- Do include the name and address of the registered agent for your corporation. This is mandatory as the registered agent will receive legal documents on behalf of the corporation.

- Do attach any necessary additional articles or provisions that apply to your corporation, especially if there are specific requirements in your industry.

- Don't leave any required fields blank. Incomplete forms may lead to delays in the processing of your Articles of Incorporation.

- Don't sign the form without reviewing it for accuracy. Once submitted, any errors may require filing additional documentation to correct.

Misconceptions

When forming a corporation in Virginia, the Articles of Incorporation play a critical role. Misunderstandings about this document can create confusion and potentially delay the incorporation process. Here, we address five common misconceptions to provide clarity and facilitate a smoother filing experience.

All businesses must file Articles of Incorporation. Not every business needs to file Articles of Incorporation. This requirement is specific to businesses wishing to register as a corporation. Other business structures, such as sole proprietorships and partnerships, have different requirements.

Filing the Articles of Incorporation protects the business name exclusively in Virginia. While filing does reserve the business name in the state, it does not offer nationwide protection. For broader protection, consider trademarking your business name.

The Articles of Incorporation are the only document needed to start a corporation. Beyond these articles, corporations might need to file additional documents or obtain licenses and permits at the local, state, and federal levels. Articles of Incorporation are a critical step, but often just the beginning.

Once filed, the Articles of Incorporation cannot be amended. Changes in the corporation, such as amendments to the business name or corporate purpose, can be made. However, these changes require filing an Articles of Amendment form with the state.

There is no need to renew the Articles of Incorporation. While it's true that the Articles of Incorporation do not require renewal, corporations must file annual or biennial reports (depending on state requirements) and pay the necessary fees to remain in good standing.

Understanding these misconceptions can help aspiring and current business owners navigate the initial stages of forming a corporation in Virginia more effectively. When in doubt, consulting with a legal professional experienced in business law can provide personalized guidance tailored to specific needs.

Key takeaways

When it comes to incorporating a business in Virginia, the Articles of Incorporation form plays a pivotal role. This document is the first step in officially establishing your company's legal existence under state law. Here are six key takeaways for filling out and using the Virginia Articles of Incorporation form:

- Complete all required fields accurately: Virginia's Articles of Incorporation form requires specific information about your business. This includes the company name, the number of shares the corporation is authorized to issue, the name and address of the initial registered agent, and the names of the incorporators. Double-check all entries for accuracy to prevent delays or rejection.

- Select a unique name for your company: Your business name must be distinguishable from other business names already registered with the Virginia State Corporation Commission. You can check the availability of a name through the Commission's website to ensure your chosen name is accepted.

- Appoint a registered agent: A registered agent is responsible for receiving legal documents on behalf of your corporation. The agent must have a physical address in Virginia (P.O. Boxes are not acceptable) and be available during normal business hours.

- Decide on the stock structure: The Articles of Incorporation will ask you to specify the amount and type of stock your corporation is authorized to issue. Think carefully about your current financial needs and future growth plans when deciding on these numbers.

- Understand the filing fees: Filing the Articles of Incorporation in Virginia requires a fee. This fee varies depending on the number of shares your corporation is authorized to issue. Check the latest fee schedule on the Virginia State Corporation Commission's website to ensure you're prepared to cover the cost.

- Know the annual requirements: After your corporation is formed, there will be annual requirements such as filing an annual report and paying an annual registration fee. Familiarize yourself with these obligations to maintain good standing with the state.

Filling out and filing the Articles of Incorporation is a crucial step toward legitimizing your business in the eyes of the law. By paying attention to these key takeaways, you'll navigate the process with greater ease and confidence, laying a strong foundation for your business's future success.

Other Popular Virginia Templates

Poa Virginia - It acts as a preventative measure, securing your financial legacy and ensuring decisions are made swiftly and in accordance with your preferences.

How to Write an Independent Contractor Agreement - The document sets forth payment schedules and methods, ensuring the contractor is paid timely and agrees to the manner of compensation, be it hourly rates or project-based pay.

Making a Will in Virginia - It's a straightforward tool that can prevent your assets from entering a prolonged probate process.