Attorney-Approved Deed Template for Virginia

In the realm of property transactions, the Virginia Deed form stands as a critical document, enabling the seamless transfer of real estate ownership from one party to another. This legal instrument, tailored specifically to meet the regulatory requirements of the Commonwealth of Virginia, encapsulates the essential details of the transaction, including the identification of the buyer and seller, a comprehensive description of the property, and the terms under which the property is to be transferred. Not only does it serve as a formal record of the exchange, but it also ensures that the transfer adheres to the state's legal standards, thereby providing a safeguard against potential disputes. Moreover, the form's multifaceted nature accommodates various types of property conveyances, from the straightforward sale of residential land to more complex arrangements involving commercial properties. Understanding the intricacies of the Virginia Deed form is paramount for anyone looking to navigate the nuances of real estate transactions within the state, highlighting its significance in the broader context of property law and ownership rights.

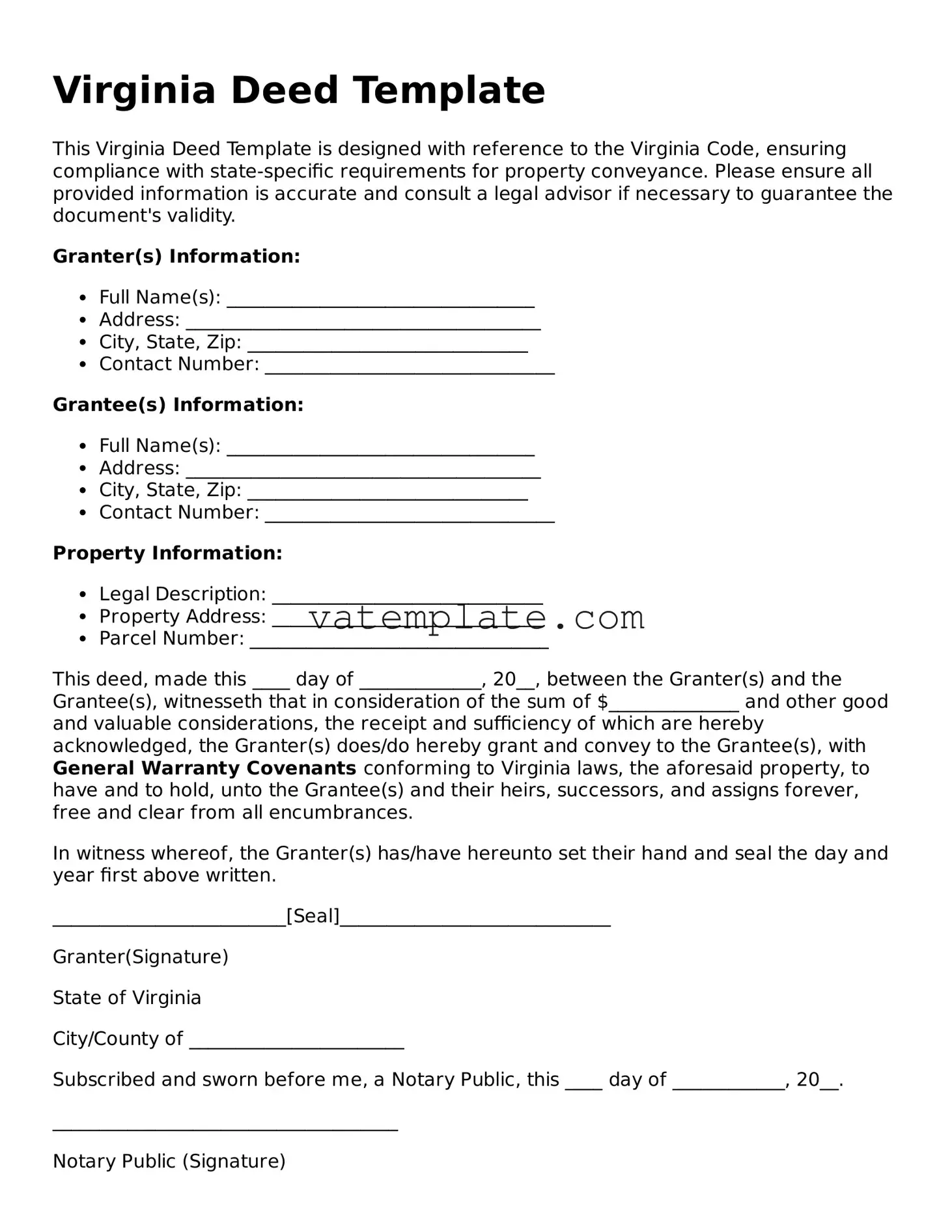

Virginia Deed Example

Virginia Deed Template

This Virginia Deed Template is designed with reference to the Virginia Code, ensuring compliance with state-specific requirements for property conveyance. Please ensure all provided information is accurate and consult a legal advisor if necessary to guarantee the document's validity.

Granter(s) Information:

- Full Name(s): _________________________________

- Address: ______________________________________

- City, State, Zip: ______________________________

- Contact Number: _______________________________

Grantee(s) Information:

- Full Name(s): _________________________________

- Address: ______________________________________

- City, State, Zip: ______________________________

- Contact Number: _______________________________

Property Information:

- Legal Description: _____________________________

- Property Address: _____________________________

- Parcel Number: ________________________________

This deed, made this ____ day of _____________, 20__, between the Granter(s) and the Grantee(s), witnesseth that in consideration of the sum of $______________ and other good and valuable considerations, the receipt and sufficiency of which are hereby acknowledged, the Granter(s) does/do hereby grant and convey to the Grantee(s), with General Warranty Covenants conforming to Virginia laws, the aforesaid property, to have and to hold, unto the Grantee(s) and their heirs, successors, and assigns forever, free and clear from all encumbrances.

In witness whereof, the Granter(s) has/have hereunto set their hand and seal the day and year first above written.

_________________________[Seal]_____________________________

Granter(Signature)

State of Virginia

City/County of _______________________

Subscribed and sworn before me, a Notary Public, this ____ day of ____________, 20__.

_____________________________________

Notary Public (Signature)

My Commission Expires: _______________

Document Details

| Fact | Detail |

|---|---|

| Type of Document | Virginia Deed Form |

| Purpose | Used to legally transfer property from one party to another in the state of Virginia. |

| Governing Law | Virginia Code Title 55.1 - Property and Conveyances |

| Common Types | General Warranty Deed, Special Warranty Deed, Quitclaim Deed |

| Must Include | Legal description of the property, grantor(s) and grantee(s) names, signature of the grantor(s) |

| Recording Requirement | Must be recorded with the local County Recorder's Office where the property is located. |

Steps to Filling Out Virginia Deed

When transferring property in Virginia, a vital step involves filling out a deed form correctly. This legal document secures the conveyance of real estate from one party to another. Ensuring every piece of information is accurately recorded on the form is crucial for a successful transfer. Below are the steps needed to complete the Virginia Deed form.

- Begin with the date of the deed at the top of the form.

- Enter the name(s) of the grantor(s) (the current owner(s) of the property) and their mailing address(es).

- Include the name(s) of the grantee(s) (the future owner(s)) and their mailing address(es).

- Specify the consideration, which is the amount of money being exchanged for the property. If the property is a gift, indicate a nominal amount or the actual value of the property.

- Provide a detailed legal description of the property. This may include lot numbers, subdivision names, street addresses, and geographic boundaries. If unsure, refer to a previous deed of the property or consult a professional.

- Specify any conditions or exceptions to the conveyance of the property. This could include easements, restrictions, or existing leases that will remain in effect.

- The grantor(s) must sign and date the form. This action typically needs to be witnessed and acknowledged before a notary public.

- Ensure all required witnesses (if applicable under Virginia law) sign the deed.

- Take the completed deed to the local courthouse or office where land records are kept in the county where the property is located. Pay any required filing or recording fees.

After the deed is correctly filled out and filed, the property will be officially transferred to the new owner(s). Remember, this form is a permanent record that changes the ownership of the property. It's recommended to seek advice from a legal professional if you have questions during this process. They can provide guidance tailored to your specific situation, ensuring the transfer is completed accurately and according to Virginia law.

FAQ

What is a Virginia Deed form?

A Virginia Deed form is a legal document used to transfer ownership of real property from one party (the grantor) to another (the grantee) in the state of Virginia. This document is crucial for the legal conveyance of real estate and must be properly executed, delivered, and recorded to effectuate the transfer. There are different types of deeds based on the guarantees the grantor can make to the grantee, including general warranty deeds, special warranty deeds, and quitclaim deeds, each providing varying levels of protection to the grantee.

What information is needed to fill out a Virginia Deed form?

To fill out a Virginia Deed form, several pieces of information are required, including:

- The full names and addresses of the grantor and grantee.

- The legal description of the property being transferred. This description is more detailed than an address and includes boundaries and measurements.

- The type of deed being executed. This determines the level of protection the grantor is providing to the grantee.

- The consideration or the amount of money being exchanged for the property. If the property is a gift, this should be stated as well.

- The signature of the grantor, which must be notarized. In Virginia, witnesses may also be required depending on the county.

How do you record a Virginia Deed form?

Once a Virginia Deed form is fully executed, it must be recorded with the Clerk of the Circuit Court in the county where the property is located. Recording the deed creates a public record of the property transfer and is essential for the protection of the grantee's rights. To record a deed in Virginia, the following steps are typically followed:

- Ensure the deed is complete, with all necessary information filled out and signatures notarized.

- Bring or send the original deed to the Clerk's Office of the Circuit Court in the appropriate county.

- Pay the required recording fees, which vary by county. Fees can include recording charges, grantor's tax, and other local fees.

It is advisable to contact the local Clerk’s Office beforehand to verify any specific requirements or changes to the process.

What are the consequences of not recording a Virginia Deed form?

Not recording a Virginia Deed form can have significant legal implications. While the transfer of ownership might still be valid between the grantor and grantee, failing to record the deed leaves the grantee vulnerable in several ways. For instance, without a recorded deed:

- The grantee's claim to the property might not be protected against claims made by third parties with an interest in the property.

- Future attempts to sell or mortgage the property could be complicated, as a clear title cannot be easily confirmed.

- Public records will not reflect the grantee as the legal owner, which can lead to disputes and challenges to ownership.

Hence, recording the deed as soon as possible after the transfer is not only beneficial but necessary for safeguarding the grantee's legal interest in the property.

Common mistakes

When it comes to transferring property ownership in Virginia, the deed form plays a critical role. It's a legal document that officially documents and recognizes the change in ownership. However, people often make mistakes when filling out this form, which can cause delays, legal complications, or even invalidate the transfer. Let's look at some common pitfalls to avoid.

Not Using the Correct Form: Virginia offers several types of deed forms depending on the situation – warranty deeds, special warranty deeds, and quitclaim deeds, among others. Choosing the wrong form can lead to inadequately protecting your rights or failing to meet your intended legal needs.

Incorrect or Incomplete Names: Every name on the document must match official records exactly. Typos, nicknames, or omitting middle names or suffixes can cause significant confusion or even contesting of the deed.

Failing to Include the Legal Description of the Property: A street address alone is not sufficient. The legal description, which includes boundaries and measurements, is critical and must mirror what's on the previous deed accurately.

Omitting Signatures or Notarization: All parties involved must sign the deed, and these signatures typically need to be notarized. Skipping these formalities may render the deed unenforceable.

Not Checking for Liens or Encumbrances: Failing to ensure that the property is free of liens or other encumbrances before transfer can lead to unpleasant surprises for the new owner.

Incorrectly Stating the Consideration: The deed must accurately describe the consideration, i.e., what is being exchanged for the property. Even if the property is a gift, this should be clearly stated to avoid future tax or legal issues.

Missing Witness Information: Depending on the type of deed and local requirements, having witnesses in addition to a notary might be necessary. Overlooking this requirement can invalidate the document.

Not Recording the Deed: A deed is not effective unless it is recorded with the appropriate county office. This crucial step in the process ensures that the public record accurately reflects the new ownership.

Properly completing and recording a deed is vital for the transfer of property to be legally recognized. By avoiding these common mistakes, parties can help ensure a smooth transition, protecting everyone's rights and interests.

Documents used along the form

When dealing with property transactions in Virginia, the Deed form plays a crucial role as it legally transfers the title of property from one party to another. However, to complete this transaction smoothly and effectively, other forms and documents are often needed alongside the Deed. These additional documents ensure that the process complies with legal requirements and supports the information provided in the Deed form. Below is a comprehensive list of commonly used forms and documents that play significant roles in property transactions in Virginia.

- Title Search Report: This document provides a detailed history of the property, including previous ownerships, existing liens, and any restrictions on the property. It is crucial for confirming the seller's right to transfer the property.

- Loan Payoff Statement: For properties that have an existing mortgage or loan, this statement specifies the amount required to pay off the loan in full. It ensures that the property can be transferred free of any outstanding mortgages.

- Property Tax Certificate: This certificate shows the current tax status of the property, including any delinquent taxes. It's important to ensure that all taxes are up to date before transferring ownership.

- Homeowners' Association (HOA) Documents: If the property is part of an HOA, these documents outline the covenants, conditions, and restrictions (CC&Rs) along with any HOA fees. They are necessary to inform the new owner about the rules and obligations of the community.

- Government ID: A valid government-issued identification of the parties involved in the transaction is often required to verify their identities during the signing of the Deed and other documents.

- Property Inspection Reports: These reports, including general home inspections, pest inspections, and others, provide the buyer with information on the condition of the property. They can impact negotiations and are crucial for the buyer's due diligence.

- Proof of Homeowners’ Insurance: This proves that the property is insured, which is often a requirement before a mortgage lender will fund the purchase. It protects the buyer and lender from potential losses.

- Settlement Statement: This document outlines all the costs associated with the transaction, including taxes, fees, and other charges. It's used at closing to ensure all financial aspects of the deal are clear to both buyer and seller.

- Power of Attorney: If one party cannot be present to sign the Deed or other documents, a Power of Attorney may be used to grant someone else the authority to sign on their behalf. This document must specify that it covers real estate transactions.

These documents, when used together with the Virginia Deed form, create a transparent and legally sound process for transferring property. Both parties involved benefit from the assurance that all legalities are addressed, making the property transaction a smoother experience. Remember, it is always recommended to consult with a legal advisor to ensure that all necessary documents are in order and appropriately executed according to Virginia law and any specific county requirements.

Similar forms

The Virginia Deed form is similar to other property transfer documents used across the United States, with each serving the purpose of legally transferring property ownership from one party to another. Provisions within these documents can vary by state, but their core functions align closely.

Warranty Deed: Like the Virginia Deed form, a Warranty Deed provides a guarantee that the seller holds clear title to a piece of real estate and has the right to sell it. This type of deed also ensures the property is free from any liens or claims. The primary distinction lies in the level of protection offered to the buyer; a Warranty Deer offers the strongest level of protection by including guarantees against any title issues, even those that predate the seller's ownership.

Grant Deed: Grant Deeds are also similar to the Virginia Deed form in that they transfer ownership and interest in property. However, they typically only guarantee that the property has not been sold to anyone else and that there are no undisclosed liens or encumbrances at the time of transfer. While similar in function to a Virginia Deed, a Grant Deed offers a medium level of protection compared to a Warranty Deed by not covering issues that may arise before the seller’s ownership.

Quitclaim Deed: Quitclaim Deeds, in comparison, offer the least protection of the three. They are used to transfer whatever interest the seller has in the property without making any guarantees or promises about the property's title. This means if the seller owns the property free and clear, then the buyer receives the full ownership. However, if the seller doesn’t have clear title, the buyer acquires whatever problems exist. Despite this difference, like the Virginia Deed form, Quitclaim Deeds are a legal document used for transferring ownership interests in property.

Dos and Don'ts

When preparing to fill out a Virginia Deed form, it is crucial to take careful steps to ensure the process is done correctly. Below are lists of recommended actions to take (dos) and practices to avoid (don'ts) for a smooth and legally sound process.

Do:

- Double-check the legal description of the property. This description must be accurate, including boundaries and lot numbers, to ensure the deed is correctly recorded.

- Consult with a legal professional. Understanding the legal implications of the deed and ensuring all Virginia state laws are followed is essential.

- Ensure all parties required by the deed are present during the signing. This usually includes the grantor(s) (seller) and grantee(s) (buyer).

- Notarize the deed. In Virginia, a deed must be notarized to be considered valid for recording in county records.

Don't:

- Leave blanks in the form. Unfilled sections can lead to questions about the deed's validity or challenges that could complicate property transfer.

- Forget to check for local requirements. Some counties may have additional requirements beyond state laws for deeds to be recorded.

- Use informal property descriptions. Phrases like "the house on Elm Street" are not sufficient. Legal property descriptions are required.

- Ignore the need for a witness. While not always a state requirement, having a witness can add an extra layer of validity to the document.

Misconceptions

When navigating the process of transferring property in Virginia, many people encounter a variety of misconceptions about the Virginia Deed form. Understanding these common misunderstandings can help streamline property transactions, ensuring they are conducted accurately and legally. Below are eight misconceptions clarified to help demystify the process.

All deeds are the same. A common misunderstanding is that all deeds serve the same purpose and are structured identically. In Virginia, there are several types of deeds, including General Warranty Deeds, Special Warranty Deeds, and Quitclaim Deeds, each serving different purposes and offering varying levels of protection to the buyer.

Filling out a deed form is all you need to transfer property. While completing a deed form is a crucial step, it's not the only requirement. The deed must be properly executed according to Virginia law, which includes signing in front of a notary and sometimes witnesses. Additionally, it must be recorded with the appropriate county to be considered valid.

You can use any state's deed form to transfer property in Virginia. This is not correct. Virginia has specific requirements for deed forms used within the state. Using a deed form from another state might not comply with Virginia laws, potentially making the deed invalid or causing legal complications.

A deed must include a specific sale price. While many deeds do include the sale price, it is not a legal requirement for all types of deeds. For instance, Quitclaim Deeds often do not specify a sale price but must still meet other legal criteria to be valid in Virginia.

Electronic signatures are not valid on Virginia Deed forms. Contrary to this misconception, Virginia is one of the states that recognize electronic signatures on legal documents, including deeds, as long as they comply with state laws and the federal Electronic Signatures in Global and National Commerce Act (E-SIGN Act).

You don't need a lawyer to prepare a deed. While it's true that a lawyer is not strictly necessary to prepare a deed, consulting with one is highly recommended. Deed preparation involves legal nuances that can have significant implications for both the grantor and the grantee. A lawyer can ensure the deed complies with all legal requirements, accurately reflects the parties' intentions, and protects your interests.

Once signed, a deed's terms cannot be changed. Amendments to a deed can be made after it is signed but require mutual agreement from the parties involved and may necessitate the preparation and recording of a new deed or an additional legal document.

Recording a deed immediately changes the property tax billing. The process of updating property tax records to reflect a new owner can take some time. Although recording the deed with the county is an essential step in transferring ownership, changes to tax billing and other official records may not be immediate and depend on the local processes and timelines.

Clearing up these misconceptions can facilitate a smoother and more informed property transfer process in Virginia. When dealing with property deeds, always ensure you are following the most current legal requirements and seek professional advice if you are uncertain.

Key takeaways

Filling out and using the Virginia Deed form is an important step in the process of transferring ownership of real estate. Here are key takeaways to ensure the procedure goes smoothly and legally:

- Ensure Accuracy of Information: Double-check all the details entered in the form such as names, addresses, and legal descriptions of the property to prevent any future disputes.

- Legal Description of the Property is Crucial: A precise legal description ensures the exact property being transferred is accurately identified, avoiding potential legal complications.

- Signatures Must Be Witnessed: Virginia law requires that the deed is not only signed by the grantor(s) but also witnessed by an uninvolved party to validate the authenticity of the document.

- Notarization is Required: A notary public must acknowledge the signing of the deed. This step confirms that the signatures on the document are legitimate.

- Understand the Type of Deed: Virginia offers different types of deeds (e.g., General Warranty, Special Warranty, Quitclaim). Knowing which one fits your needs is essential for the protection it offers.

- Consideration Statement: Clearly mention the consideration (value exchange) for the property transfer. This could be in monetary terms or other forms of compensation.

- Record the Deed: After all parties have signed, the deed must be recorded with the local county clerk's office to make the transaction public record and to protect the new ownership rights.

- Review by a Legal Professional: Even if the form seems straightforward, having a legal professional review the document can prevent overlooking critical aspects.

- Be Aware of Any Encumbrances: Ensure there are no liens, mortgages, or restrictions attached to the property that could affect the transfer.

- Transfer Taxes or Fees: Be prepared to pay any applicable transfer taxes or recording fees associated with filing the deed at the county clerk’s office.

Remember, a deed is a legally binding document. Its proper execution and recording are vital to the successful transfer of property ownership in Virginia.

Other Popular Virginia Templates

Residential Lease Agreement Form Free - It addresses legal compliance, ensuring the rental arrangement adheres to local housing laws and regulations.

Virginia Noncompete Law - This agreement is a precautionary measure for employers to maintain their competitive advantage and market position.

Non Disclosure Agreement - It ensures that sensitive information is only used for its intended purpose and not for gaining unfair competitive advantage.