Attorney-Approved Gift Deed Template for Virginia

When individuals decide to transfer property to another person as a gift, in the state of Virginia, this gesture necessitates the completion of a Virginia Gift Deed form. This document is essential for the official and legal transfer of any property without financial consideration. Its structure aims to ensure clarity regarding the donor's intent, the description of the gifted property, and the absence of any expectation of compensation. Moreover, the Virginia Gift Deed form serves as a public record once filed, providing valuable protection against future disputes over the property's ownership. It is a legal instrument that carefully considers the mutual interests of both the donor and the recipient, making the process of gifting seamless and secure. Shielded by the form's legal bindings, the giver can have peace of mind knowing that their gift will be respected and upheld according to their wishes. The form is thus a critical document for anyone looking to reaffirm their generosity through the gift of property, ensuring that the gesture is not only understood and appreciated but also legally recognized and preserved.

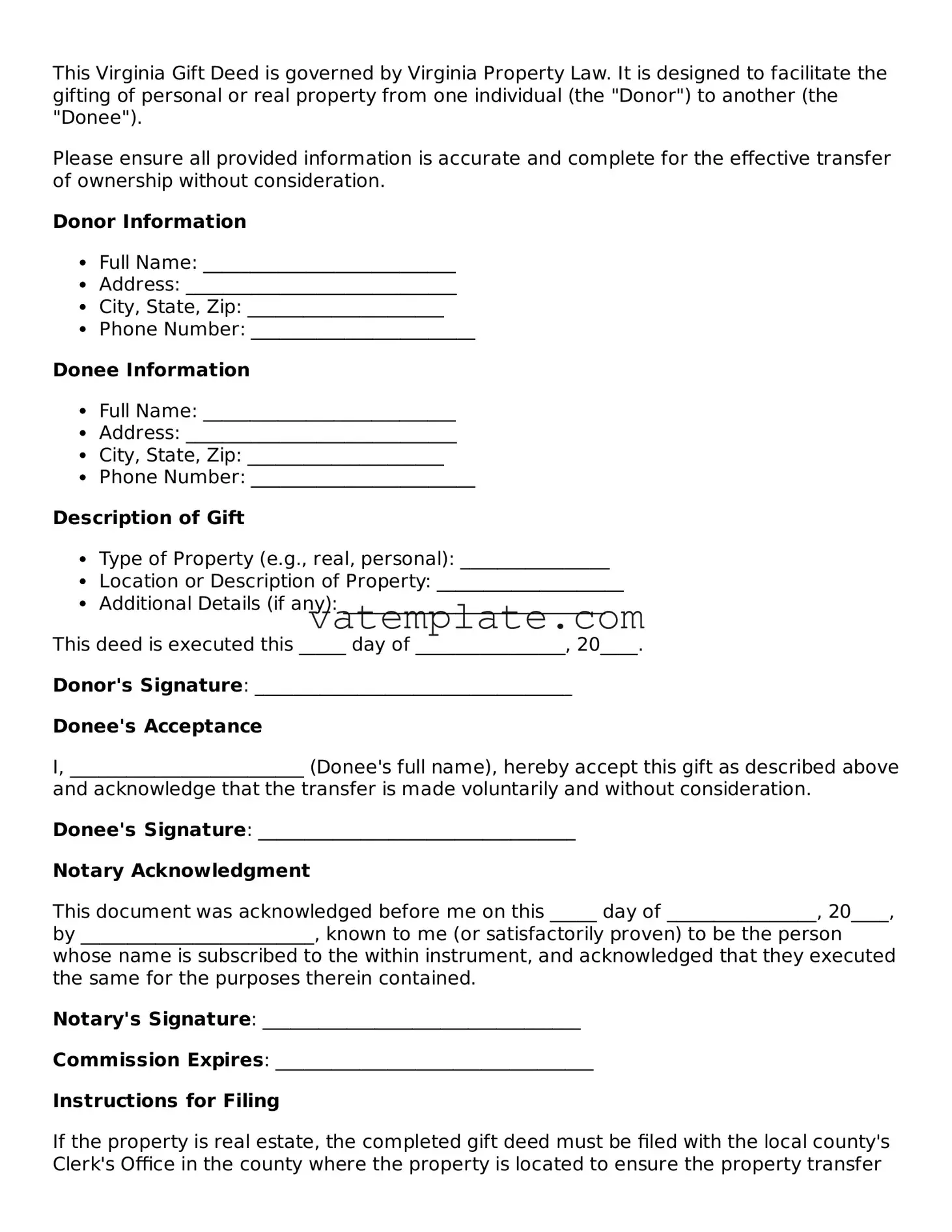

Virginia Gift Deed Example

This Virginia Gift Deed is governed by Virginia Property Law. It is designed to facilitate the gifting of personal or real property from one individual (the "Donor") to another (the "Donee").

Please ensure all provided information is accurate and complete for the effective transfer of ownership without consideration.

Donor Information

- Full Name: ___________________________

- Address: _____________________________

- City, State, Zip: _____________________

- Phone Number: ________________________

Donee Information

- Full Name: ___________________________

- Address: _____________________________

- City, State, Zip: _____________________

- Phone Number: ________________________

Description of Gift

- Type of Property (e.g., real, personal): ________________

- Location or Description of Property: ____________________

- Additional Details (if any): ____________________________

This deed is executed this _____ day of ________________, 20____.

Donor's Signature: __________________________________

Donee's Acceptance

I, _________________________ (Donee's full name), hereby accept this gift as described above and acknowledge that the transfer is made voluntarily and without consideration.

Donee's Signature: __________________________________

Notary Acknowledgment

This document was acknowledged before me on this _____ day of ________________, 20____, by _________________________, known to me (or satisfactorily proven) to be the person whose name is subscribed to the within instrument, and acknowledged that they executed the same for the purposes therein contained.

Notary's Signature: __________________________________

Commission Expires: __________________________________

Instructions for Filing

If the property is real estate, the completed gift deed must be filed with the local county's Clerk's Office in the county where the property is located to ensure the property transfer is legal and binding.

Disclaimer: This template is provided as is, without any guarantee of completeness, accuracy, or timeliness. If you require legal advice, please consult with a qualified attorney in your jurisdiction.

Document Details

| Fact | Description |

|---|---|

| 1. Definition | A Virginia Gift Deed is a legal document used to transfer real estate ownership from one person to another without any purchase price or consideration. |

| 2. Governing Law | It is governed by the Virginia Code, specifically § 64.2-100 and following, which covers the general provisions of transfers concerning real property. |

| 3. Tax Considerations | Gift Deeds may be subject to federal gift tax, depending on the value of the property transferred and the donor's use of the lifetime exemption. |

| 4. Recording Requirement | The deed must be recorded with the local county's Clerk of the Court to be effective and to provide public notice of the transfer. |

| 5. Signature Requirements | The donor must sign the Gift Deed in the presence of a notary public for the document to be legally binding. |

| 6. Revocability | Once a Gift Deed is executed and delivered, it is irrevocable without the consent of the recipient. |

| 7. Benefit | This form of property transfer is beneficial for estate planning, helping to avoid probate upon the donor's death. |

Steps to Filling Out Virginia Gift Deed

When preparing to transfer property as a gift in Virginia, the Gift Deed form is used to document the transfer from the donor (the person giving the gift) to the donee (the recipient of the gift). This legal document helps facilitate the process, ensuring it's recognized under state law. It's crucial to fill out this form accurately to ensure the gift transfer is valid and legally binding. Below are clear steps on how to complete the Virginia Gift Deed form.

- Begin by entering the date of the gift deed at the top of the form. This should reflect the day the transfer is to become effective.

- Fill in the full legal name and address of the donor in the designated sections.

- Insert the complete legal name and address of the donee next, ensuring accuracy for proper identification.

- If applicable, specify the relationship between the donor and the donee (such as parent to child, friend, etc.).

- Describe the property being gifted in detail. This section should include a thorough description, including any identifiers like parcel numbers or legal descriptions found in property records, to accurately identify the property.

- Determine if there are any conditions attached to the gift and clearly state them. If the gift is unconditional, state this explicitly.

- The donor must sign the form in front of a notary public to affirm the document's authenticity and their intent to gift the property. Ensure the donor’s signature is witnessed by the notary.

- Have the form notarized. The notary public will fill out their section, including their seal or stamp, to officially notarize the Gift Deed.

- Finally, submit the completed and notarized Gift Deed form to the appropriate Virginia local county recorder’s office for filing. There may be a filing fee, so it's advisable to contact the office in advance to confirm.

Following these steps carefully will aid in the proper completion and filing of the Virginia Gift Deed form. Remember, this is an important legal document that facilitates the gifting of property, and attention to detail is crucial for its acceptance and validity under Virginia law.

FAQ

What is a Virginia Gift Deed form?

A Virginia Gift Deed form is a legal document used to transfer property from one person (the donor) to another (the recipient) without any payment or consideration in return. It's a way to give a gift of real estate, while formally documenting the transfer and the intention behind it for legal purposes.

Who can use a Virginia Gift Deed form?

Any person or entity owning real property in Virginia can use a Gift Deed to transfer such property to another person or entity. The donor must be mentally competent and not under undue influence or duress at the time of gift giving.

Are there any specific requirements for a Virginia Gift Deed to be valid?

Yes, for a Gift Deed to be considered valid in Virginia, several requirements must be met, including:

- The deed must be in writing and describe the property being given.

- It should clearly state the donor's intention to give the property as a gift.

- The deed must be signed by the donor in the presence of a notary public.

- It needs to be delivered to, and accepted by, the recipient.

Does a Virginia Gift Deed form need to be recorded?

Yes, after the Gift Deed has been properly executed, it needs to be recorded with the local County Recorder’s Office where the property is located. Recording the deed helps protect the recipient's interest in the property and ensures the change of ownership is properly documented in public records.

Is there a tax implication for using a Virginia Gift Deed?

Gifts of real estate in Virginia may have tax implications for both the donor and the recipient. While there is no specific gift tax in Virginia, the donor may be responsible for filing a federal gift tax return if the value of the property exceeds the annual exclusion limit set by the IRS. The recipient may also face capital gains tax implications when they choose to sell the property.

Can you revoke a Gift Deed after it has been executed and recorded in Virginia?

Once a Gift Deed is executed, delivered to the recipient, and recorded, it is generally irrevocable, meaning the donor cannot take back the gift. To ensure certainty in the transfer of property, the law favors the finality of gift deeds. Therefore, it is crucial for the donor to be sure of their decision before completing the process.

What is the difference between a Gift Deed and a Will in Virginia?

A Gift Deed is used to transfer property immediately and without compensation, while a Will is a document that outlines how a person's property should be distributed upon their death. Unlike a Will, a Gift Deaid results in an immediate change of ownership and does not go through probate.

Can you use a Gift Deed to transfer property to a minor in Virginia?

While a property can technically be gifted to a minor using a Gift Deed in Virginia, it is advisable to do so through a trust or by appointing a guardian to manage the property until the minor reaches legal age. This is because a minor might not be able to manage the property or understand the responsibilities that come with ownership.

Does the recipient of a gift property need to pay for the Gift Deed in Virginia?

No, the recipient of the gift property does not need to pay the donor for the transfer. However, they may be responsible for certain fees associated with recording the Gift Deed, as well as any future taxes or maintenance costs related to the property.

How long does it take to complete a Gift Deed transaction in Virginia?

The completion time for a Gift Deed transaction can vary. Once the donor has signed the deed in front of a notary and it has been delivered and accepted by the recipient, the next step is to record it with the local County Recorder’s Office. The speed of this process depends on the efficiency of the office and the correctness of the deed documentation. It's advisable to allow several weeks for the entire process to be finalized.

Common mistakes

Filling out the Virginia Gift Deed form might seem straightforward, but it's easy to make mistakes that could have implications for the validity of the document or even tax repercussions. It's crucial to approach this task with care to ensure that the gift deed is completed correctly and effectively transfers property without unwanted consequences. Below are six common mistakes people often make when filling out this form:

Not specifying the relationship between the donor and the recipient: One critical detail often overlooked is the need to clearly outline the relationship between the parties involved. This context can have implications for tax treatments and must be accurately documented.

Incorrectly describing the property: A precise description of the property being gifted is essential. Vague or incomplete descriptions can lead to disputes or challenges to the deed's validity. It's necessary to include all relevant details to avoid ambiguity.

Omitting any existing encumbrances on the property: Failure to disclose any liens, mortgages, or other encumbrances on the property is a significant oversight. Such information must be fully reported to ensure the recipient understands the responsibilities along with the ownership they're accepting.

Not using the full legal names of all parties: Using nicknames, abbreviations, or incomplete names can invalidate a gift deed. The full legal names of both the donor and the recipient are required to ensure the document is legally binding.

Failing to sign and date the form in the presence of a notary: For a Virginia Gift Deed to be legally recognized, it must be signed by the donor in the presence of a notary public. Overlooking this step can result in the deed not being legally enforceable.

Forgetting to file the gift deed with the local land records office: After the notarization, the gift deed must be filed with the appropriate local government office. This filing makes the transfer public record and completes the legal transfer process. Failing to do so can cause significant legal and tax complications down the line.

Awareness and avoidance of these common errors can significantly streamline the process of transferring property via a gift deed, safeguarding both the giver's and receiver's interests. As simple as it might seem to complete the Virginia Gift Deed form, attention to detail and adherence to the required steps are essential for a smooth and legally sound transfer.

Documents used along the form

When it comes to transferring property, the Virginia Gift Deed form is a vital document that signifies the transfer of property from one individual to another without any exchange of value. However, its effective use often necessitates additional forms and documents to ensure that the entire process is legally compliant and comprehensively documented. Here is a list of six key documents that are commonly used alongside the Virginia Gift Deed form.

- Affidavit of Consideration: This document, often required by the county, states the actual consideration for the property if it's being transferred for less than its fair market value. It helps clarify that the transaction is a gift.

- Real Estate Transfer Tax Declaration: In some jurisdictions, even when a property is gifted, a declaration must be filed to account for the transfer and determine if any transfer tax is applicable.

- Title Search Report: While not a document to be filed, a title search is crucial before transferring property to ensure that the title is clear of any liens, encumbrances, or claims that might affect the transfer.

- Real Property Tax Form: Local tax authorities might require a form to be submitted to reassess the property tax or simply to update the ownership records in their database.

- Mortgage Satisfaction Document: If the property being gifted is currently under a mortgage, a mortgage satisfaction document will be needed to show that the mortgage has been fully paid off before the property can be transferred.

- Recording Cover Sheet: Most counties require a cover sheet to be submitted along with the Gift Deed when recording the transfer. This document summarizes the transaction and helps the clerk's office process the documents efficiently.

Using these documents in conjunction with a Virginia Gift Deed not only secures the legality of the property transfer but also ensures a smoother process for both the giver and the receiver of the gift. It's important to consult with a legal professional to understand the specific requirements for each document based on local laws and the specifics of the property involved. By doing so, individuals can safeguard their interests and avoid potential legal issues down the line.

Similar forms

The Virginia Gift Deed form is similar to other estate planning documents in various ways, making it a critical tool for asset management and future planning. Each similar document shares some characteristics with a Gift Deed yet serves its unique purposes. Understanding the nuances of each can provide clearer insights into effective estate planning.

Warranty Deed: Like the Virginia Gift Deed, a Warranty Deed is used to transfer property ownership. However, the Warranty Deed comes with a guarantee from the seller to the buyer that the title is clear; that is, free from any liens or claims. While both documents facilitate property transfer, the Gift Deed is typically used when the property is given without any payment or consideration, whereas the Warranty Deed is used in traditional sales transactions. The commitment to a clear title is what sets the Warranty Deed apart.

Quitclaim Deed: This document also facilitates the transfer of property rights, akin to the Gift Deed and the Warranty Deed. However, a Quitclaim Deed does not guarantee that the property title is clear of liens or other encumbrances. It merely transfers whatever interest the grantor has in the property, if any, to the grantee. This makes it significantly different from a Gift Deed, which is used for gifting property with the presumption of no encumbrances, even though this isn't always explicitly guaranteed as with a Warranty Deed.

Living Trust: Living Trusts are another estate planning tool similar to Gift Deeds in the way they manage asset distribution. Both allow for the transfer of property and assets, but a Living Trust does so in a manner that avoids probate after the grantor's death. This is a crucial difference; while a Gift Deed transfers ownership immediately and irrevocably, a Living Trust holds the assets in trust until distributed by the trustee following the terms set forth by the grantor. This distinction makes Living Trusts particularly valuable for more comprehensive estate planning.

Last Will and Testament: Perhaps the most well-known estate planning tool, a Last Will and Testament, like a Gift Deed, concerns the future distribution of assets. Both documents ensure that a person's wishes regarding their estate are respected and executed upon their demise. However, the crucial difference lies in when the transfer of assets occurs. With a Gift Deed, the transfer is immediate and irreversible, whereas with a Will, asset distribution does not occur until after the individual has passed away. Furthermore, assets transferred via a Will go through probate, unlike those transferred through a Gift Deed.

Dos and Don'ts

When filling out the Virginia Gift Deed form, there are key steps to follow and pitfalls to avoid. This document, crucial for the transfer of property as a gift, requires accuracy and completeness to ensure its legality and effectiveness. Below are guidelines that outline what you should and shouldn't do during this process.

What You Should Do

- Ensure all parties' names are spelled correctly and match their official identification. This establishes clear identification of both the giver and the receiver of the gift.

- Provide a complete legal description of the property being gifted. This includes not only the address but any identifying details used in property records to avoid any confusion regarding what is being transferred.

- Sign the document in the presence of a notary public. This step is crucial for the document to have legal standing, as it verifies the identity of the parties and their agreement to the gift without coercion.

- File the completed deed with the Virginia land records office in the county where the property is located. This public recording formalizes the transfer and protects the new owner's interests.

What You Shouldn't Do

- Leave any sections blank. Incomplete forms can lead to misunderstandings or a rejection of the document for recording, delaying the gift process.

- Forget to check for any county-specific requirements. While the Virginia Gift Deed form is standardized, some counties may have additional stipulations or forms that need accompanying submissions.

- Overlook the need for witness signatures, if required. Some jurisdictions may necessitate witnesses in addition to notarization, failing which the deed could be considered invalid.

- Ignore tax implications. It's important for both parties to be aware of any federal or state tax responsibilities associated with gifting property, even though the primary intent is not a sale.

Misconceptions

When it comes to transferring property, a Virginia Gift Deed form often comes into play. However, several misconceptions surround its use and implications. Understanding these common misunderstandings helps clarify the process, making it smoother for all parties involved.

All property can be gifted through a Virginia Gift Deed. This is not entirely accurate. While many types of property, such as real estate or vehicles, can be transferred using a Gift Deed, some assets, like certain financial accounts or retirement benefits, require different forms of transfer documentation.

No taxes are involved in gifting property. Although Virginia does not impose a state gift tax, givers must be aware of the federal gift tax. Property transfers might require the giver to file a federal gift tax return if the value of the gift exceeds the annual exclusion limit set by the IRS. Additionally, there may be implications for the giver's estate tax in the future.

A Virginia Gift Deed negates the need for a will. This misconception could lead to complications. A Gift Deed only covers the transfer of specific property from the giver to the receiver. It does not replace a will, which covers a wider range of estate planning issues, including the distribution of property not covered by Gift Deeds and the appointment of an executor.

Witnesses or notarization are not required for a Virginia Gift Deed to be valid. Virginia law requires that Gift Deeds be signed in the presence of a notary public to be legally effective. Depending on the circumstances, additional witnesses may also be required to ensure the deed's validity and to protect against claims of fraud or undue influence later on.

Key takeaways

When preparing to fill out and use a Virginia Gift Deed form, it is essential to understand its purpose and requirements to ensure the process is carried out efficiently and legally. A Gift Deed is a document that facilitates the transfer of ownership of property from one person (the donor) to another (the recipient) without any exchange of value. Here are key takeaways to guide you:

- Ensure that all parties involved are correctly identified, including full legal names and addresses of both the donor and the recipient.

- Verify that the description of the property being gifted is accurate and complete. This includes physical addresses, legal descriptions, and any other identifying information pertaining to the property.

- Confirm that the Gift Deed is executed in the presence of a Notary Public to ensure its validity. The notarization is a critical step in the process.

- Understand that a Gift Deed, once completed and delivered to the recipient, is irrevocable. The donor cannot reclaim the gifted property without the recipient's consent.

- Be aware of the potential tax implications. While Virginia does not impose a gift tax, there may be federal tax obligations for the donor. Consultation with a tax professional is advisable.

- Consider the need for filing the Gift Deed with the local county’s Clerk’s Office where the property is located. This step is necessary for the deed to be legally recognized and to ensure the proper transfer of title.

- Review the form for any special conditions or stipulations that may apply. These should be clearly stated on the deed to avoid any future disputes or misunderstandings.

- Understand that a Gift Deed may impact the recipient's eligibility for certain forms of public assistance, depending on the value of the property. It's important to consider this before proceeding.

- Ensure that both the donor and recipient retain copies of the notarized Gift Deed for their records. This document serves as proof of the property transfer should any questions arise in the future.

By following these key points, individuals can navigate the process of completing and using a Virginia Gift Deed form with confidence and legal integrity. It's always beneficial to seek legal advice to address any concerns or complications during this process.

Other Popular Virginia Templates

Virginia Dmv Power of Attorney - Grants specified powers to an individual to deal with the complexities of vehicle ownership on your behalf.

Va Small Estate Affidavit - It aids in the swift distribution of personal property, excluding real estate, to heirs based on statutory guidelines.