Attorney-Approved Independent Contractor Agreement Template for Virginia

In the evolving world of work, businesses often need to hire professionals who operate outside the traditional employer-employee framework. Here, the Virginia Independent Contractor Agreement form plays a crucial role. This document outlines the working arrangement between a company and a self-employed individual, ensuring clear understanding and expectations from both parties right from the start. It covers essential details such as the nature of the work to be done, duration of the contract, compensation, and confidentiality requirements, among others. Moreover, it's designed to provide a legal safeguard, protecting both the business and the contractor by defining their relationship in clear, unambiguous terms. Proper use of this form can significantly reduce the risk of misunderstandings and disputes, making it an indispensable tool for businesses looking to harness the flexibility and expertise of independent contractors while adhering to Virginia's specific legal guidelines.

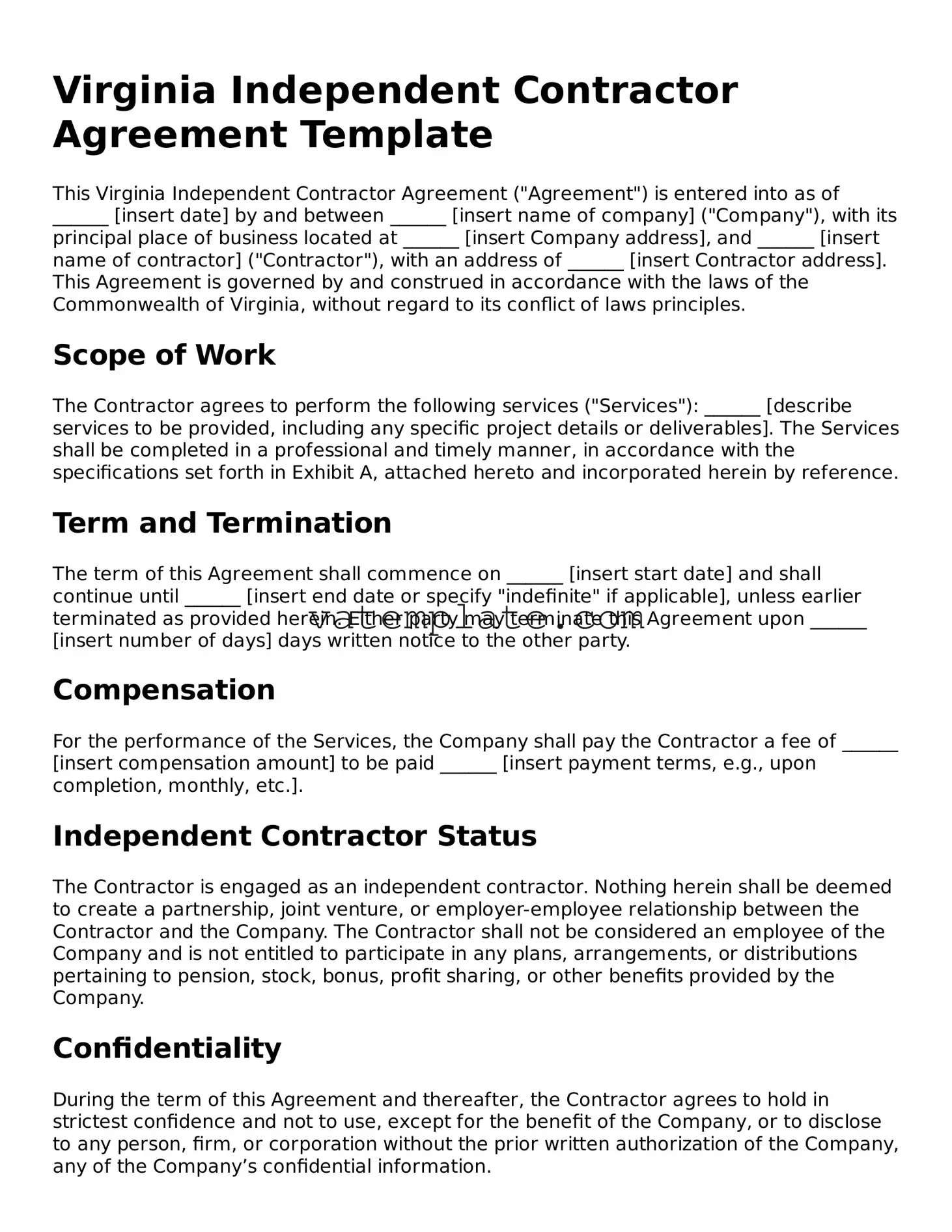

Virginia Independent Contractor Agreement Example

Virginia Independent Contractor Agreement Template

This Virginia Independent Contractor Agreement ("Agreement") is entered into as of ______ [insert date] by and between ______ [insert name of company] ("Company"), with its principal place of business located at ______ [insert Company address], and ______ [insert name of contractor] ("Contractor"), with an address of ______ [insert Contractor address]. This Agreement is governed by and construed in accordance with the laws of the Commonwealth of Virginia, without regard to its conflict of laws principles.

Scope of Work

The Contractor agrees to perform the following services ("Services"): ______ [describe services to be provided, including any specific project details or deliverables]. The Services shall be completed in a professional and timely manner, in accordance with the specifications set forth in Exhibit A, attached hereto and incorporated herein by reference.

Term and Termination

The term of this Agreement shall commence on ______ [insert start date] and shall continue until ______ [insert end date or specify "indefinite" if applicable], unless earlier terminated as provided herein. Either party may terminate this Agreement upon ______ [insert number of days] days written notice to the other party.

Compensation

For the performance of the Services, the Company shall pay the Contractor a fee of ______ [insert compensation amount] to be paid ______ [insert payment terms, e.g., upon completion, monthly, etc.].

Independent Contractor Status

The Contractor is engaged as an independent contractor. Nothing herein shall be deemed to create a partnership, joint venture, or employer-employee relationship between the Contractor and the Company. The Contractor shall not be considered an employee of the Company and is not entitled to participate in any plans, arrangements, or distributions pertaining to pension, stock, bonus, profit sharing, or other benefits provided by the Company.

Confidentiality

During the term of this Agreement and thereafter, the Contractor agrees to hold in strictest confidence and not to use, except for the benefit of the Company, or to disclose to any person, firm, or corporation without the prior written authorization of the Company, any of the Company’s confidential information.

Intellectual Property Rights

All works of authorship, inventions, developments, ideas, and innovations created by the Contractor in the course of performing the Services under this Agreement, which are related to the business of the Company or result from the use of its premises or property, shall be the sole property of the Company.

Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the Commonwealth of Virginia.

Amendment

No amendment, change, or modification of this Agreement shall be valid unless in writing signed by both parties.

Entire Agreement

This Agreement constitutes the entire understanding between the parties hereto and supersedes any and all prior agreements, understandings, and discussions whether electronic, oral, or written regarding the subject matter hereof. There are no representations, agreements, arrangements, or understandings, either oral or written, between and among the parties relating to the subject matter of this Agreement which are not fully expressed herein.

Signature

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first above written.

Company: ______ [insert Company name]

By: ______ [insert printed name and title]

Date: ______ [insert date]

Contractor: ______ [insert Contractor name]

Signature: ______ [insert signature]

Date: ______ [insert date]

Document Details

| Fact | Detail |

|---|---|

| Definition | In Virginia, an independent contractor agreement is a legal document that outlines the terms of a working relationship between a contractor (not an employee) and a client. It specifies the services to be provided, compensation, and the terms and conditions under which the work is to be performed. |

| Governing Law | Virginia law governs the creation and interpretation of independent contractor agreements within the state, including but not limited to the Virginia Code and relevant case law. |

| Importance of Classification | Correctly classifying a worker as an independent contractor or employee is crucial under Virginia law to ensure proper tax treatment, liability, and compliance with state labor laws. |

| Key Components | An effective agreement typically includes details such as the nature of the services provided, the duration of the agreement, payment details, confidentiality clauses, and provisions for termination. |

| Liability and Risk | Independent contractors in Virginia assume responsibility for their own business risks and liabilities, distinct from employees who may be covered by their employer’s insurance and protections. |

| Dispute Resolution | The agreement often outlines how disputes between the client and the independent contractor will be resolved, potentially including arbitration or court jurisdiction specifications. |

| Tax Implications |

Steps to Filling Out Virginia Independent Contractor Agreement

Completing the Virginia Independent Contractor Agreement form is an essential step for individuals and businesses entering into a contractor relationship. This document outlines the terms, expectations, and responsibilities of both parties, ensuring clarity and legal protection. Below are the steps to fill out this form accurately, making sure that every detail is covered for a clear and effective agreement.

- Start by entering the full legal name of the hiring party or company in the space designated for the "Client" at the beginning of the agreement.

- Fill in the full legal name of the independent contractor, ensuring that it matches the name used for tax and professional purposes.

- Specify the services that the independent contractor will be providing. Be as detailed as possible to avoid any confusion or misinterpretation in the future.

- Indicate the duration of the contract. State the starting date and, if applicable, the ending date. If the agreement is ongoing or has a scope-based termination, specify the conditions clearly.

- Outline the payment details. This section should include the amount the independent contractor will be paid, the schedule of payments (e.g., upon completion, monthly), and any other compensation specifics, such as reimbursement for expenses.

- Discuss and specify any terms related to confidentiality, non-disclosure, and the ownership of work product. This ensures that both parties understand their rights and responsibilities about sensitive information and outputs generated during the contract period.

- Detail the terms regarding termination of the agreement. Clearly state how either party can terminate the agreement and any notice period required.

- Include a clause about dispute resolution. Specify how disputes related to the agreement will be resolved, preferring negotiation, mediation, or arbitration before any legal action.

- If there are any additional terms or conditions not covered by standard sections of the agreement, add them in the designated "Additional Terms" section. This could include specific legal obligations, insurance requirements, or subcontracting policies.

- Both parties should review the entire agreement carefully. Any questions or concerns should be addressed before signing.

- Lastly, the client and the independent contractor must sign and date the agreement. It's recommended to keep copies of the signed agreement for both parties' records.

After completing these steps, both parties will have a clear, legally binding document that protects their interests and lays the groundwork for a productive working relationship. This formality not only secures professional dealings but also helps in preventing future disputes by providing a comprehensive reference to the agreed-upon terms.

FAQ

What is a Virginia Independent Contractor Agreement?

An Independent Contractor Agreement in Virginia is a legal document that outlines the working arrangement between a contractor (not an employee) and a client. This agreement details the services to be provided, the terms of compensation, the duration of the contract, and other essential aspects of the working relationship.

Who needs a Virginia Independent Contractor Agreement?

This agreement is needed by any individual or business looking to hire an independent contractor in Virginia. It is also necessary for contractors who wish to clearly define their work terms with a client, ensuring there is a mutual understanding of each party's expectations and responsibilities.

What are the key elements of this agreement?

The key elements of a Virginia Independent Contractor Agreement include the following:

- The names and contact information of the parties involved.

- A detailed description of the services to be provided.

- Payment details, including amounts, schedules, and methods.

- Terms covering confidentiality, intellectual property, and non-compete clauses, if applicable.

- The duration of the contract with start and end dates.

- Termination conditions.

- Signatures of both parties, indicating their agreement.

Are there any specific requirements for these agreements in Virginia?

While Virginia law does not prescribe a specific format for independent contractor agreements, it does require that the agreement clearly define the relationship between parties as independent contractors rather than employer-employee. Additionally, it's important that the contract adheres to all relevant state laws regarding work arrangements, compensation, and taxes.

How does an Independent Contractor Agreement protect both parties?

For clients, this agreement ensures that the work will be performed as specified, providing a legal remedy if the terms are not met. For contractors, it guarantees payment for services rendered and helps define the scope of work, preventing scope creep. It also clarifies that the contractor is not an employee, which has tax and benefit implications for both parties.

Can the terms of the agreement be modified?

Yes, the terms of a Virginia Independent Contractor Agreement can be modified if both parties agree to the changes. Any modifications should be made in writing and signed by both the contractor and the client to be legally binding.

What happens if there is a dispute over the agreement?

In the event of a dispute, the agreement itself usually outlines the process for resolution, which may include mediation or arbitration. If the dispute cannot be resolved through these means, parties may resort to litigation. Understanding and clearly defining the dispute resolution process in the agreement is crucial for both parties.

Does this agreement need to be notarized or witnessed in Virginia?

While notarization is not a requirement for the agreement to be legally binding in Virginia, it can add an extra layer of authenticity and may be useful in legal disputes. Having the agreement witnessed, similarly, is not required but can help in affirming the validity of the signatures if ever questioned.

How can one terminate an Independent Contractor Agreement in Virginia?

Termination provisions are usually included within the agreement and can vary based on what both parties decide. Common reasons for termination include completion of the specified work, mutual agreement to end the contract, breach of contract, or expiration of the contract term. Notice requirements and any applicable penalties for early termination should also be clearly stated within the agreement.

Common mistakes

Filling out a Virginia Independent Contractor Agreement form requires attention to detail. People often overlook critical aspects, leading to mistakes that can have legal consequences. Here are five common pitfalls encountered:

Not specifying the scope of work in detail. When parties fail to clearly define the work to be done, misunderstandings can arise. The agreement should include a detailed description of services to avoid ambiguity and ensure both parties have the same expectations.

Overlooking the payment terms. It's not uncommon for individuals to provide incomplete information about payment schedules, amounts, and methods. Precise terms about when and how the contractor will be paid are essential to prevent disputes.

Forgetting to address intellectual property rights. In the absence of clear guidance, issues regarding who owns the work product—the contractor or the client—can occur. The agreement should specify how intellectual property rights are handled to protect both parties’ interests.

Ignoring the need for a confidentiality clause. When confidentiality clauses are omitted, sensitive information might be inadequately protected. Including such provisions helps safeguard business secrets and proprietary information.

Failure to include a termination clause. Without a clear termination clause, ending the contract might become complicated. This section should outline how either party can terminate the agreement, under what conditions, and any required notice periods.

Avoiding these mistakes can lead to a more robust and effective agreement. It’s important for both parties to carefully review all sections of the contract before signing. Being thorough ensures that the interests of both the independent contractor and the client are well-protected.

Documents used along the form

When engaging in professional relationships, particularly in the state of Virginia, a robust legal framework is essential for clarity, compliance, and protection of all parties involved. Besides the Virginia Independent Contractor Agreement form, which establishes the relationship between a contractor and their client, several other forms and documents are commonly utilized to ensure thoroughness and legal adherence. The incorporation of these documents can provide a comprehensive legal foundation that supports various needs from tax compliance to confidentiality.

- W-9 Form: Used to provide the employer with the contractor's tax identification number or Social Security number for taxation purposes.

- NDA (Non-Disclosure Agreement): Protects proprietary information. It prevents the contractor from sharing any confidential information learned during the course of their work.

- Scope of Work Document: Details the specific tasks, deadlines, and deliverables expected from the contractor, providing clear guidelines and expectations for the project.

- 1099-MISC Form: Required for the client to report payments made to the contractor to the IRS, assuming the payment exceeds $600 in a fiscal year.

- Business License: Depending on the nature of the work, the contractor might need to submit a copy of their local or state business license.

- Insurance Certificate: Demonstrates that the contractor has liability insurance, offering protection against potential legal or medical bills resulting from workplace accidents.

- Service Agreement: Similar to the Independent Contractor Agreement but often more detailed, covering aspects such as dispute resolution and termination clauses.

- Performance Evaluation: Used to assess the contractor’s work at the project's conclusion, aligning outcomes with the initially set expectations.

- Change Order Form: Utilized to document any changes to the scope of work, ensuring both parties agree on adjustments to tasks or compensation.

- Project Completion Form: Signifies the end of the project, confirming that all work has been completed to the client's satisfaction and that the contractor is released from further obligations.

Employing these documents in conjunction with a Virginia Independent Contractor Agreement not only reinforces the legal structure of the professional relationship but also ensures a smoother workflow and provides safeguards for both the client and the contractor. By being proactive and organized in the preparation of these documents, parties can focus on achieving their project goals with peace of mind, knowing that their interests are well-protected.

Similar forms

The Virginia Independent Contractor Agreement form is similar to various other documents used in the formation of business and working relationships, each catering to specific needs and regulations. While they share commonalities, understanding their unique features and applications is crucial for ensuring compliance and protecting the interests of all parties involved.

The Freelance Contract shares similarities with the Virginia Independent Contractor Agreement, as both serve to outline the terms and conditions between a service provider and their client. The Freelance Contract, like the Virginia Independent Contractor Agreement, typically includes sections on the scope of work, payment terms, confidentiality, and liabilities. However, it is often tailored for the creative industry, focusing more on project-based assignments such as writing, designing, and other creative tasks. This specialization makes it particularly adept at addressing concerns like intellectual property rights, revisions, and credits.

The Employment Agreement is another document related to the Virginia Independent Contractor Agreement but serves a different purpose. While the Independent Contractor Agreement specifies that the individual is not an employee and outlines their project-based or time-bound task, the Employment Agreement is used to establish an ongoing employer-employee relationship. It contains details on salary, benefits, job responsibilities, and termination conditions. Despite these differences, both agreements are crucial for delineating the nature of the work relationship, expectations, and responsibilities.

A Consultancy Agreement often mirrors the structure and purpose of the Virginia Independent Contractor Agreement, focusing on providing expert advice or services in a professional or technical domain. Like the Independent Contractor Agreement, Consultancy Agreements outline the scope of the project, deliverables, timelines, payment schedules, confidentiality, and termination clauses. They are particularly used when a business needs specialized knowledge or skills that are not available within the organization, emphasizing the consultant's advisory role in contrast to the direct service or labor focus seen in other agreements.

Dos and Don'ts

When filling out the Virginia Independent Contractor Agreement form, it's important to approach the task with attention to detail and a clear understanding of the agreement's purpose. This document establishes a legal relationship between a contractor and a client, focusing on the expectations, rights, and obligations of both parties. To ensure the process is completed smoothly and effectively, here are some key do's and don'ts to keep in mind.

Do:

- Review the entire form before starting to fill it out, to ensure a comprehensive understanding of the sections and information required.

- Provide accurate and detailed information about the services to be rendered, including scope, duration, and compensation. This clarity helps prevent misunderstandings and sets a clear pathway for the project.

- Consult with a legal professional if there are any terms or clauses that are unclear. Their expertise can help clarify legal language and ensure both parties' interests are protected.

- Sign and date the agreement in all designated areas to validate the contract. A witness or notary public may also be required, depending on the specific requirements of your agreement and local laws.

Don't:

- Leave any sections blank. If a section doesn't apply, it's advisable to note it as "N/A" (not applicable) rather than leaving it empty. This prevents any later claims that the agreement was incomplete or not read thoroughly.

- Assume verbal agreements or understandings are enforceable. The written document should fully reflect all agreed-upon terms for it to be legally binding.

- Forget to specify the conditions under which the agreement can be terminated or modified, including notice requirements and any potential penalties for early termination.

- Overlook the need for both parties to have a copy of the signed agreement. This ensures that each has a reference document for their records, which can be crucial for resolving any disputes that might arise.

Misconceptions

When considering using the Virginia Independent Contractor Agreement form, it's crucial to understand the document correctly to ensure it's filled out and applied appropriately. There are several common misconceptions surrounding this agreement that need clarification.

Only the nature of the work needs to be detailed. A common misunderstanding is that the agreement only needs to detail the nature of the work to be performed. However, it should also specify the terms of payment, confidentiality, non-compete clauses (if applicable), and the term of the contract, providing a comprehensive outline of the relationship between the parties.

An attorney's review is not necessary. While it might seem straightforward, consulting with an attorney before finalizing the agreement is highly advisable. This ensures that the contract complies with current Virginia laws and adequately protects both parties’ interests.

It automatically grants independent contractor status under the law. Simply signing an independent contractor agreement does not define the actual relationship under the law. The behavior of the parties and the actual practice of their work together are critical in determining the legal classification.

The terms are fixed and non-negotiable. Each independent contractor agreement can be customized. The terms, including payment schedules, project scope, and responsibilities, are negotiable before signing. Understanding this can lead to a more favorable agreement for both parties.

A template will suit all situations. While templates can be a good starting point, each working relationship has unique aspects that may not be covered by a generic form. Tailoring the agreement to the specific working arrangement ensures that all pertinent details are addressed and legally binding.

Key takeaways

The Virginia Independent Contractor Agreement form is essential for clearly setting the terms between a contractor and a client. It serves as a binding document that outlines the scope of work, compensation, duration, and other vital terms of the contract. The following points highlight the key takeaways for effectively filling out and using this agreement.

- Ensure all parties accurately provide their full legal names, contact information, and any other identifying details to avoid confusion and to establish the professionalism of the engagement.

- Clearly define the scope of the work to be done, including specific tasks, deadlines, and deliverables. Ambiguities in this section can lead to disputes and misunderstandings, thus clarity is paramount.

- Outline the compensation structure in detail, including the total amount, payment schedule, and any conditions related to bonuses or penalties. This helps in preventing disputes related to payment.

- Specify the term of the contract with clear start and end dates. If the arrangement is ongoing, mention the conditions under which the contract can be terminated.

- Include a clause about confidentiality to protect sensitive information. This is crucial for maintaining trust and integrity in dealings that involve sharing of proprietary information or trade secrets.

- State the legal status of the independent contractor to emphasize that the relationship does not constitute an employer-employee relationship. This clarification helps in avoiding potential legal and tax complications.

Both parties should review the agreement thoroughly before signing to ensure all terms are understood and agreed upon. Remember, this document not only serves to outline the expectations and responsibilities of each party but also provides legal protection in the event of a dispute. Consequently, it may be prudent to consult with a legal professional to ensure the agreement complies with Virginia laws and adequately covers all aspects of the contractual relationship.

Other Popular Virginia Templates

Sample Separation Agreement Virginia - The agreement covers debt allocation, deciding who is responsible for existing financial obligations.

Virginia Living Will Pdf - Some states have specific forms or registries for living wills, making it easier for healthcare providers to access and adhere to your documented wishes.

Virginia Prenup Agreement - With a prenuptial agreement, couples can outline how debts, assets, and financial responsibilities will be handled during the marriage and in the event of dissolution.