Attorney-Approved Last Will and Testament Template for Virginia

When it comes time to plan for the future and lay out the final wishes regarding assets and guardianship, the Virginia Last Will and Testament form serves as an essential legal document. This comprehensive form allows individuals, known as testators, to designate beneficiaries to inherit their property, appoint an executor to manage the estate, and, if necessary, name a guardian for minor children. Understanding the components and legal requirements of this form is critical for ensuring that it is both valid and reflective of the testator’s intentions. With this in mind, the form must be created in accordance with Virginia state laws, which include stipulations about the testator's capacity, the signing process, and the necessity for witness signatures. By making informed decisions and following the proper legal procedures, individuals can provide clear instructions for the handling of their affairs, thereby minimizing potential disputes among heirs and ensuring a smoother transition during what is often a challenging time.

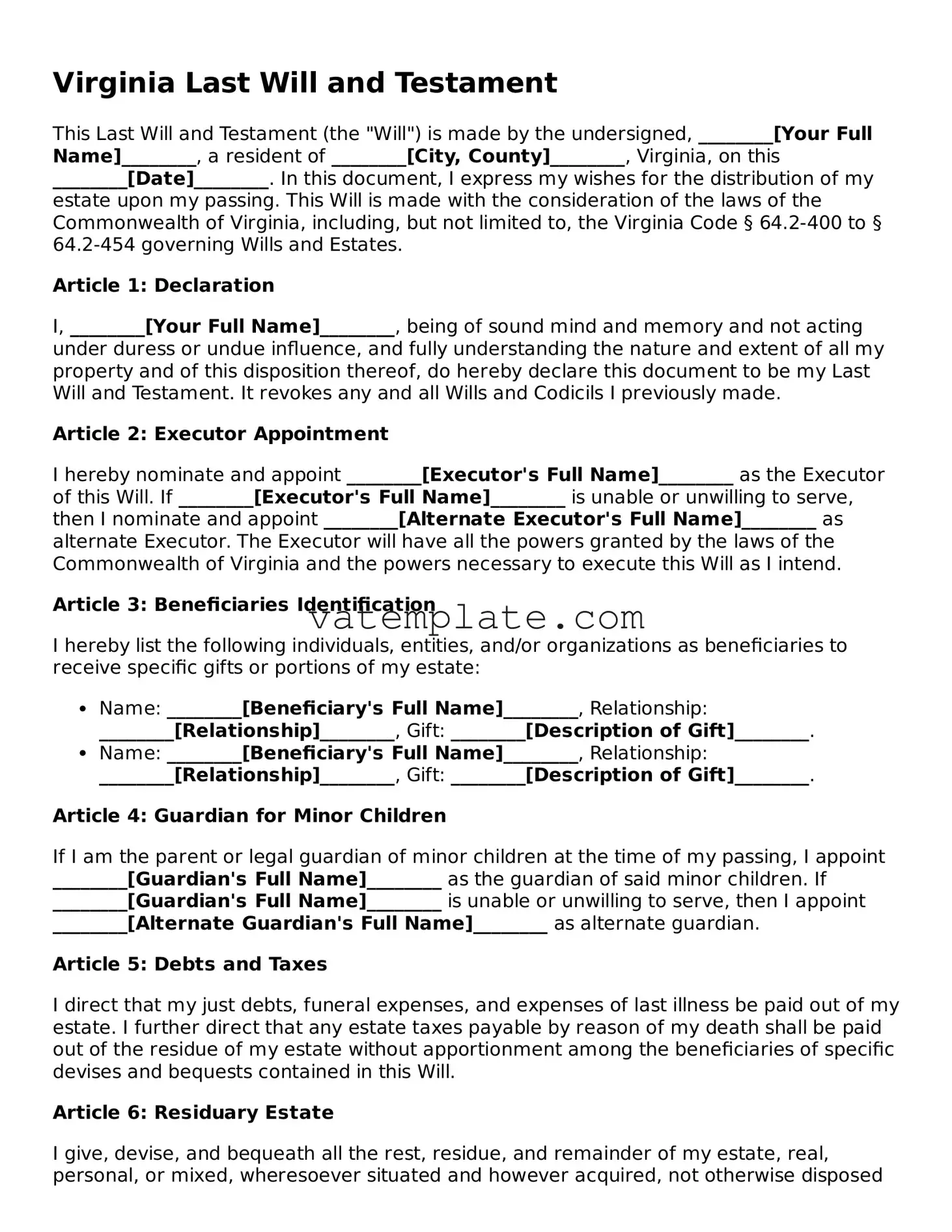

Virginia Last Will and Testament Example

Virginia Last Will and Testament

This Last Will and Testament (the "Will") is made by the undersigned, ________[Your Full Name]________, a resident of ________[City, County]________, Virginia, on this ________[Date]________. In this document, I express my wishes for the distribution of my estate upon my passing. This Will is made with the consideration of the laws of the Commonwealth of Virginia, including, but not limited to, the Virginia Code § 64.2-400 to § 64.2-454 governing Wills and Estates.

Article 1: Declaration

I, ________[Your Full Name]________, being of sound mind and memory and not acting under duress or undue influence, and fully understanding the nature and extent of all my property and of this disposition thereof, do hereby declare this document to be my Last Will and Testament. It revokes any and all Wills and Codicils I previously made.

Article 2: Executor Appointment

I hereby nominate and appoint ________[Executor's Full Name]________ as the Executor of this Will. If ________[Executor's Full Name]________ is unable or unwilling to serve, then I nominate and appoint ________[Alternate Executor's Full Name]________ as alternate Executor. The Executor will have all the powers granted by the laws of the Commonwealth of Virginia and the powers necessary to execute this Will as I intend.

Article 3: Beneficiaries Identification

I hereby list the following individuals, entities, and/or organizations as beneficiaries to receive specific gifts or portions of my estate:

- Name: ________[Beneficiary's Full Name]________, Relationship: ________[Relationship]________, Gift: ________[Description of Gift]________.

- Name: ________[Beneficiary's Full Name]________, Relationship: ________[Relationship]________, Gift: ________[Description of Gift]________.

Article 4: Guardian for Minor Children

If I am the parent or legal guardian of minor children at the time of my passing, I appoint ________[Guardian's Full Name]________ as the guardian of said minor children. If ________[Guardian's Full Name]________ is unable or unwilling to serve, then I appoint ________[Alternate Guardian's Full Name]________ as alternate guardian.

Article 5: Debts and Taxes

I direct that my just debts, funeral expenses, and expenses of last illness be paid out of my estate. I further direct that any estate taxes payable by reason of my death shall be paid out of the residue of my estate without apportionment among the beneficiaries of specific devises and bequests contained in this Will.

Article 6: Residuary Estate

I give, devise, and bequeath all the rest, residue, and remainder of my estate, real, personal, or mixed, wheresoever situated and however acquired, not otherwise disposed of by this Will to ________[Beneficiary's Full Name]________, ________[Relationship to You]________. If this beneficiary does not survive me, then I direct that the residuary estate shall pass to ________[Alternate Beneficiary's Full Name]________, ________[Relationship to You]________.

Article 7: Signatures

This Will was declared by ________[Your Full Name]________ as his/her Last Will and Testament in our presence, who in his/her presence and in the presence of each other, and at his/her request, have hereunto subscribed our names as witnesses on this ________[Date]________. The Testator is of legal age in this jurisdiction, is of sound mind, and under no constraint or undue influence.

______________________ [Signature of Testator]

______________________ [Printed Name of Testator]

Witnesses:

- Name: ________[Witness #1 Full Name]________, Address: ________[Address]________, Signature: ______________________, Date: ________.

- Name: ________[Witness #2 Full Name]________, Address: ________[Address]________, Signature: ______________________, Date: ________.

This document is intended to serve as my Last Will and Testament and shall be interpreted by the laws of the Commonwealth of Virginia.

Document Details

| Fact | Description |

|---|---|

| Governing Law | Virginia Code Title 64.2 - Wills, Trusts, and Fiduciaries |

| Age Requirement | The testator must be at least 18 years old. |

| Sound Mind Requirement | The testator must be of sound mind, understanding the nature of the act. |

| Witness Requirement | At least two competent witnesses must witness the will’s signing. |

| Writing Requirement | The will must be in writing to be considered valid. |

| Signature Requirement | The will must be signed by the testator or by someone else in the testator's presence and by the testator’s direction. |

| Holographic Wills | Handwritten (holographic) wills are recognized if wholly in the handwriting of the testator and proved by two disinterested witnesses. |

| Nuncupative (Oral) Wills | Oral wills are not recognized for the distribution of real estate but can be valid for personal property in certain situations. |

| Self-Proving Affidavit | A self-proving affidavit is not required but can simplify probate by verifying witnesses’ signatures. |

Steps to Filling Out Virginia Last Will and Testament

Creating a Last Will and Testament is a thoughtful way to ensure your wishes are honored after you pass away. In Virginia, like in many other states, the process of completing a Last Will and Testament form is straightforward but requires attention to detail. This document is crucial for anyone looking to have their assets distributed according to their wishes, providing peace of mind to both the person writing the will and their loved ones. Following the correct steps can help make this important task less daunting and ensure that the document is legally binding.

Here are the steps needed to fill out a Virginia Last Will and Testament form:

- Gather all necessary information: Before starting, collect all the information you will need, such as your full legal name, address, list of assets, and the names and addresses of beneficiaries and any guardians for minor children.

- Choose an Executor: Decide who will be responsible for managing your estate, ensuring your wishes are carried out as outlined in your will. Include the executor's full name and address.

- Select Beneficiaries: Clearly identify the people or organizations that will inherit your assets. Provide detailed information, including their full names and relationships to you.

- Appoint a Guardian for Minor Children (if applicable): If you have minor children, choosing a guardian for them is crucial. Include the guardian's full name and address.

- Detail Your Assets and Specific Bequests: List all of your assets, including money, real estate, and personal property, and state who will receive each item or asset.

- Review and Follow Signature Requirements: Virginia law requires your Last Will and Testament to be signed in the presence of two witnesses, who must also sign the document. Make sure to comply with this requirement to ensure the will’s validity.

- Store Your Will Safely: Once completed and signed, keep your will in a safe place and inform the executor of its location.

Completing a Last Will and Testament is a proactive step toward protecting your assets and supporting your loved ones' future. While this guide outlines the basic steps for filling out the form in Virginia, consulting with a legal professional can provide additional assurance that your will meets all legal requirements and accurately reflects your wishes.

FAQ

What is a Virginia Last Will and Testament?

A Virginia Last Will and Testament is a legal document that allows an individual, known as the testator, to designate the distribution of their estate to heirs and beneficiaries upon their death. This document also allows the testator to appoint an executor who will manage the estate until its final distribution.

Who can create a Last Will and Testament in Virginia?

In Virginia, any person who is at least 18 years old and of sound mind can create a Last Will and Testament. This means the individual must fully understand the extent of their assets, the nature of the document they are creating, and the identities of those who are to inherit their assets.

Does a Virginia Last Will need to be notarized?

No, a Last Will and Testament in Virginia does not need to be notarized to be valid. However, it must be signed by the testator in the presence of two competent witnesses, who must also sign the document. Adding a notarization can, however, make the will easier to probate by allowing it to be self-proving.

What is a "self-proving" will?

A "self-proving" will is one that includes a notarized affidavit from the witnesses, confirming their presence at the signing of the will and the testator’s state of mind. This step simplifies the probate process as the court can accept the will without needing to contact the witnesses.

Can I change my Last Will and Testament after creating it?

Yes, a Last Will and Testament in Virginia can be changed at any time by the testator as long as they are of sound mind. Changes can be made through a codicil, which is an amendment to the will, or by creating a new will. Both methods require the same formalities as creating a new will.

What happens if someone dies without a Last Will in Virginia?

If someone dies without a Last Will in Virginia, their estate will be distributed according to the state's intestacy laws. This usually means the assets will go to the closest relatives in a specific order, starting with the spouse and children, and then to other relatives if there is no spouse or children.

Can a Last Will and Testament be contested in Virginia?

Yes, a Last Will and Testament can be contested in Virginia on several grounds, including but not limited to undue influence, fraud, lack of testamentary capacity, or improper execution. Contesting a will typically requires the challenger to file a lawsuit in the probate court.

What should be included in a Virginia Last Will and Testament?

A Virginia Last Will and Testament should include:

- The full name and address of the testator

- A declaration that the document is the testator's will

- The appointment of an executor

- The names of the beneficiaries and details of the distributions to each

- The names of two witnesses

- Signatures of the testator and the witnesses

How is a Last Will and Testament executed in Virginia?

To execute a Last Will and Testament in Virginia, the testator must sign the will, or direct someone else to sign in their presence, in the presence of at least two competent witnesses. These witnesses must then sign the will as well. It is not required but recommended that the will is then made "self-proving" through the addition of a notarized affidavit.

Common mistakes

When preparing a Virginia Last Will and Testament, it's critical to approach the task with careful attention to detail. Nonetheless, mistakes can be common. Highlighting some of these errors can help ensure that your final wishes are respected and accurately reflected in this vital document.

Not adhering to Virginia-specific requirements: Each state has its own set of laws regarding Last Wills and Testaments. Failing to conform to the specific requirements in Virginia, such as the need for witnesses, can invalidate the document.

Using unclear language: Ambiguity in a will can lead to disputes among heirs and may require court intervention to interpret the testator’s intentions, leading to unnecessary delays and expenses.

Omitting a residuary clause: Without this clause, any assets not explicitly mentioned in the will might be distributed according to state intestacy laws, potentially contradicting the testator’s wishes.

Neglecting to appoint an executor: An executor plays a crucial role in managing and distributing your estate. Not naming one or choosing someone without the capacity or willingness to serve can complicate the probate process.

Forgetting to date and sign the will: This is a simple yet critical step. A will that isn't signed or dated according to legal standards might be considered invalid.

Failure to update the will: Life changes such as marriage, divorce, the birth of a child, or the death of a beneficiary require updates to your will to ensure it reflects your current wishes and circumstances.

Not explicitly disinheriting individuals: If you wish to prevent someone who would otherwise stand to inherit from receiving anything from your estate, you must clearly state this in your will. Merely omitting their name may not suffice.

Mistaking the purpose of a will: Some assets, like those in retirement accounts with named beneficiaries, pass outside of a will. Assuming a will covers all assets can lead to misunderstandings and overlooked estate planning opportunities.

Choosing witnesses improperly: Virginia law has specific requirements for who can serve as a witness, and selecting individuals who do not meet these criteria can lead to your will’s validity being questioned.

Attempting DIY without professional advice: While it’s possible to draft a will on one’s own, professional legal advice can prevent mistakes and ensure the document is both valid and effective in accomplishing your estate planning goals.

Accurately completing a Last Will and Testament involves more than filling out a form. It requires careful consideration of your assets, your beneficiaries, and Virginia law. Avoiding these common mistakes can help secure the future of your loved ones and the legacy you wish to leave.

Documents used along the form

When preparing a Virginia Last Will and Testament, there are several essential documents that are often used in conjunction with it to ensure a comprehensive estate plan. These documents complement the will by covering aspects of your estate and personal care that a will alone does not address. Including them in your estate planning can provide peace of mind and make things easier for your loved ones during difficult times.

- Advance Medical Directive: This document allows you to specify your preferences for medical care if you become unable to make healthcare decisions yourself. It typically includes a Living Will and a Medical Power of Attorney, which designate someone to make decisions on your behalf.

- Financial Power of Attorney: Through this document, you appoint an agent to manage your financial affairs, either immediately or in the event you become incapacitated. This can cover a broad range of actions, from paying bills to managing investments.

- Revocable Living Trust: A trust is a legal arrangement that lets you maintain control over your assets while you're alive but have them distributed according to the terms of the trust upon your death. This can help avoid probate and ensure privacy for your estate.

- Digital Asset Inventory: As much of our lives move online, it becomes crucial to account for digital assets like social media accounts, digital wallets, and online banking accounts. This document helps you list those assets and provide access information for your executors or heirs.

Including these documents with a Last Will and Testament ensures a well-rounded estate plan that addresses not just the distribution of your assets, but also your care and the management of your affairs if you're unable to do so. Consulting with a legal professional can help you understand how each document fits into your overall estate planning strategy.

Similar forms

The Virginia Last Will and Testament form is similar to several other legal documents, each playing a vital role within the sphere of estate planning and personal directives. Among these, a Living Will and a Power of Attorney stand out due to their function and significance, albeit serving different purposes.

Living Will: Much like the Last Will and Testament, a Living Will is a legal document; however, it serves a distinct role. While a Last Will and Testament comes into play after one's demise, detailing how one's assets should be distributed, a Living Will operates while a person is still alive but unable to make healthcare decisions for themselves due to incapacity. In essence, a Living Will provides directives regarding medical treatments and life-sustaining measures one wishes to receive or avoid in their end-of-life care. Transitionally, both documents echo the importance of personal directives, ensuring an individual's preferences are known and respected—either posthumously or during unforeseeable medical crises.

Power of Attorney: Another document sharing a kinship with the Last Will and Testament is the Power of Attorney (POA). Specifically, this linkage is through the durable or medical POA variants, which authorize someone else to make decisions on your behalf. The traditional Last Will distributes assets after death, whereas a POA assigns an “agent” or “attorney-in-fact” to make financial, legal, or health-related decisions while one is still alive but incapacitated. The common vein that runs between the Last Will and a POA is the emphasis on delegating decision-making authority according to the individual's wishes, which speaks to the fundamental drive for autonomy and preparation in the face of uncertainty.

Dos and Don'ts

When filling out the Virginia Last Will and Testament form, it's crucial to approach the task with diligence and attention to detail to ensure your final wishes are accurately documented and legally sound. To assist you in this process, here are six things you should do, followed by six things you shouldn't do:

Things You Should Do:

- Read all instructions associated with the form thoroughly to ensure you understand the requirements and implications of each section.

- Use black ink or type the information to ensure the will is legible and photocopies are clear.

- Clearly identify your assets and to whom you want them distributed. Being specific helps in avoiding confusion or disputes among beneficiaries.

- Choose an executor who is trustworthy and capable of managing your estate according to your wishes.

- Sign and date the document in the presence of at least two witnesses who are not beneficiaries of the will to ensure its validity under Virginia law.

- Store the will in a safe place and inform the executor and a trusted family member or friend of its location.

Things You Shouldn't Do:

- Don't leave any sections incomplete. If a section doesn't apply, mark it as “N/A” (not applicable) instead of leaving it blank.

- Don't use informal language or ambiguous terms. Legal documents require precision and clarity to be interpreted correctly.

- Don't choose an executor or witnesses who stand to benefit from the will, as this could lead to conflicts of interest and legal challenges.

- Don't forget to update the will after major life events, such as a marriage, divorce, birth of a child, or significant acquisition or loss of assets.

- Don't try to include instructions for your funeral or medical decisions. These should be addressed in separate legal documents.

- Don't attempt to handwrite amendments on the will after it has been finalized and signed. Amendments should be made through a codicil or by drafting a new will.

Misconceptions

When creating or managing a Virginia Last Will and Testament, many people encounter misconceptions that can significantly affect their estate planning. Understanding these misconceptions is crucial for anyone looking to effectively manage their assets and wishes for after they pass away. Here, we address five common misunderstandings:

- It must be notarized to be valid. Many believe that for a Last Will and Testament to be valid in Virginia, it must be notarized. However, while notarization can add a layer of authenticity, Virginia law requires the will to be signed in front of two competent witnesses, who must also sign the document. Notarization is not a legal necessity for validity.

- It covers all types of assets. Another common misconception is that a Last Will and Testament in Virginia can dictate the distribution of all types of assets. In reality, some assets, like those held in joint tenancy or designated with a beneficiary (such as life insurance policies and retirement accounts), pass outside of the will, directly to the named beneficiary or surviving joint tenant.

- You don’t need a lawyer to create it. While it's true that one can legally draft a Last Will and Testament without a lawyer’s assistance, consulting with a legal professional can ensure that the document fully captures one's intentions and adheres to Virginia law. Legal guidance can help avoid common pitfalls that might invalidate the will or cause disputes among heirs.

- <8>A Last Will and Testament becomes public record once it's filed with the Virginia probate court after the testator's death. Some people mistakenly believe that the contents of a will remain private. However, once it enters the probate process, it becomes accessible to the public, allowing others to see the distribution of your assets.>

- It can eliminate the need for probate. Lastly, there is a misconception that having a Last Will and Testament will bypass the probate process in Virginia. The reality is that the will typically must go through probate, which is the legal process of proving its validity and ensuring assets are distributed according to the testator’s wishes. However, certain planning methods and types of assets can minimize probate involvement.

Key takeaways

The Virginia Last Will and Testament form is a crucial document for residents wishing to ensure their property and assets are distributed according to their wishes after their passing. The importance of this document cannot be understated, as it serves as a person's final statements regarding their earthly possessions. The following takeaways provide guidance for anyone considering filling out and using this form.

- Understanding Legal Requirements: Familiarizing oneself with Virginia's legal requirements is essential prior to filling out the Last Will and Testament form. In Virginia, the individual creating the will (testator) must be at least 18 years old and of sound mind. The document must be written, signed by the testator, and witnessed by at least two individuals who are present at the same time and are not beneficiaries in the will.

- Choosing an Executor Wisely: Selecting a trustworthy and competent executor is crucial, as this person will be responsible for administering the estate according to the will's directives. The chosen executor should be made aware of their appointment and agree to undertake the responsibilities involved.

- Be Specific in Asset Distribution: Clearly specifying the distribution of assets can prevent misunderstandings and disputes among beneficiaries. Items and their intended recipients should be mentioned explicitly to avoid any ambiguity.

- Guardianship Considerations: For individuals with minor children, it is imperative to appoint a guardian in the will. This ensures that, in the event of the testator's death, the children will be cared for by a person the testator trusts.

- Signing in the Presence of Witnesses: Virginia law requires the will to be signed in the presence of at least two credible witnesses, who must also sign the document. These witnesses validate the authenticity of the will and the soundness of mind of the testator at the time of signing.

- Keeping the Document Secure: After completion, the will should be stored in a safe and secure location, with the executor and close family members informed of its whereabouts. Some people choose to keep their will in a safety deposit box or with their attorney.

- Regular Updates: Life changes, such as marriage, divorce, birth of a child, or acquisition of significant assets, necessitate updating the will. Regular reviews ensure that the document reflects current wishes and circumstances.

Ensuring that the Virginia Last Will and Testament form is filled out accurately and in compliance with state laws is essential for its intended purpose to be fulfilled. Taking these key considerations into account can greatly facilitate this process, providing peace of mind for the individual and their loved ones.

Other Popular Virginia Templates

Virginia Real Estate Purchase Agreement - This form acts as a legally binding contract between a buyer and seller, detailing the sale’s specifics, such as the purchase price and any contingencies.

Gift Deed Virginia - The form serves as proof of the donor's intention to make the gift and the acceptance by the donee, providing clarity and preventing future disputes.