Fill Out a Valid No Broker Residential Sales Virginia Template

When engaging in residential real estate transactions in Virginia without the involvement of a real estate broker, parties rely on the No Broker Residential Sales Virginia form, an explicit agreement outlining the terms and conditions of the property sale between the buyer and seller. This detailed document, often referred to as the Residential Sales Contract, covers a wide array of critical aspects, including but not limited to the identification of the property and parties involved, the sales price, down payment requirements, financing details, and any seller subsidies. Furthermore, it incorporates contingencies, notably financing, and delineates the obligations of each party regarding the deposit, with clear instructions on its handling and circumstances under which it may be disbursed or must be returned. Settlement procedures are meticulously spelled out, advising on the selection of settlement agents and the legal mandates surrounding the Virginia Real Estate Settlement Agents Act. Moreover, the contract addresses the due process for the delivery of all necessary disclosures, adhering strictly to the Virginia Residential Property Disclosure Act, Virginia Property Owners' Association Act, and Virginia Condominium Act, ensuring buyers are well-informed and protected through statutory rights, including the right to cancel the contract under specific conditions. Each element of this comprehensive form serves as a cornerstone for conducting a clear, legally binding real estate transaction, devoid of brokerage intermediation, while upholding the interests and security of both the buyer and seller in the Commonwealth of Virginia.

No Broker Residential Sales Virginia Example

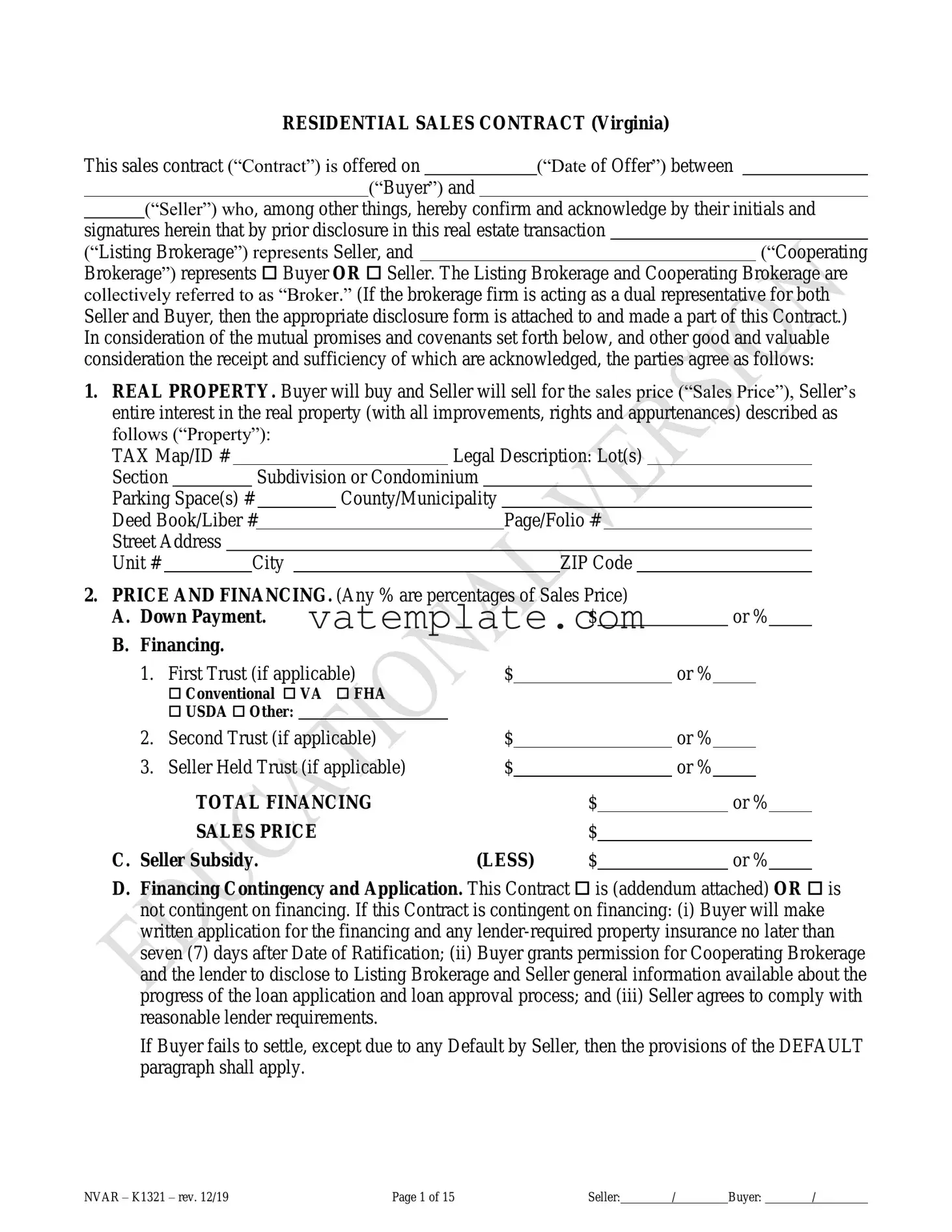

RESIDENTIAL SALES CONTRACT (Virginia)

This sales contract (“Contract”) is offered on |

|

(“Date of Offer”) between |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

(“Buyer”) and |

|

|

|

|

|

||

|

(“Seller”) who, among other things, hereby confirm and acknowledge by their initials and |

||||||||

signatures herein that by prior disclosure in this real estate transaction |

|||||||||

(“Listing Brokerage”) represents Seller, and |

|

|

|

|

|

(“Cooperating |

|||

Brokerage”) represents Buyer OR Seller. The Listing Brokerage and Cooperating Brokerage are collectively referred to as “Broker.” (If the brokerage firm is acting as a dual representative for both Seller and Buyer, then the appropriate disclosure form is attached to and made a part of this Contract.) In consideration of the mutual promises and covenants set forth below, and other good and valuable consideration the receipt and sufficiency of which are acknowledged, the parties agree as follows:

1.REAL PROPERTY. Buyer will buy and Seller will sell for the sales price (“Sales Price”), Seller’s

entire interest in the real property (with all improvements, rights and appurtenances) described as

follows (“Property”): |

|

|

|

|

|

|

|

|

|

|||||||

TAX Map/ID # |

|

|

|

|

|

Legal Description: Lot(s) |

|

|||||||||

Section |

|

|

|

Subdivision or Condominium |

|

|||||||||||

Parking Space(s) # |

|

County/Municipality |

|

|||||||||||||

Deed Book/Liber # |

|

|

|

|

Page/Folio # |

|||||||||||

Street Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Unit # |

|

|

City |

|

|

|

|

|

|

ZIP Code |

|

|||||

2.PRICE AND FINANCING. (Any % are percentages of Sales Price)

A. Down Payment. |

$ |

|

|

|

or % |

||

B. Financing. |

|

|

|

|

|

|

|

1. First Trust (if applicable) |

$ |

|

|

or % |

|

|

|

Conventional VA FHA

USDA Other:

2. |

Second Trust (if applicable) |

$ |

|

|

|

or % |

|

|

||

3. |

Seller Held Trust (if applicable) |

$ |

|

|

|

or % |

|

|

||

|

TOTAL FINANCING |

|

|

$ |

|

|

|

or % |

||

|

SALES PRICE |

|

|

$ |

|

|

|

|

|

|

C. Seller Subsidy. |

(LESS) |

$ |

|

|

|

or % |

|

|||

D.Financing Contingency and Application. This Contract is (addendum attached) OR is not contingent on financing. If this Contract is contingent on financing: (i) Buyer will make written application for the financing and any

If Buyer fails to settle, except due to any Default by Seller, then the provisions of the DEFAULT paragraph shall apply.

NVAR – K1321 – rev. 12/19 |

Page 1 of 15 |

Seller: |

/ |

Buyer: |

/ |

3. DEPOSIT. Buyer’s deposit (“Deposit”) in the amount of $ |

|

|

|

|||||||

funds; and/or $ |

|

by note due and payable on |

|

|

|

|

shall be held |

|||

by |

|

|

|

|

(“Escrow Agent”). Buyer has |

|||||

delivered Deposit to Escrow Agent OR will deliver Deposit to Escrow Agent by |

|

days after |

||||||||

Date of Ratification. |

|

|

|

|

|

|

|

|

||

If the Escrow Agent is a Virginia Real Estate Board (“VREB”) licensee, the parties direct Escrow Agent to place Deposit in an escrow account by the end of the fifth business banking day following receipt or following Date of Ratification, whichever is later. If Escrow Agent is not a VREB licensee, Deposit will be placed in an escrow account of Escrow Agent after Date of Ratification in conformance with the laws and regulations of Virginia and/or if VA financing applies, as required by Title 38 of the U.S. Code. This account may be interest bearing and all parties waive any claim to interest resulting from Deposit. Deposit will be held in escrow until: (i) credited toward Sales Price at Settlement; (ii) all parties have agreed in writing as to its disposition; (iii) a court of competent jurisdiction orders disbursement and all appeal periods have expired; or, (iv) disposed of in any other manner authorized by law. Seller and Buyer agree that Escrow Agent will have no liability to any party on account of disbursement of Deposit or on account of failure to disburse Deposit, except in the event of Escrow Agent’s gross negligence or willful misconduct.

4.SETTLEMENT. Seller and Buyer will make full settlement in accordance with the terms of this

Contract (“Settlement”) on, or with mutual consent before,(“Settlement

Date”) except as otherwise provided in this Contract. If Settlement Date falls on a Saturday, Sunday, or legal holiday, then Settlement will be on the prior business day.

NOTICE TO BUYER REGARDING THE REAL ESTATE SETTLEMENT AGENTS ACT (“RESAA”) Choice of Settlement Agent: You have the right to select a Settlement agent to handle the closing of this transaction. The Settlement agent’s role in closing your transaction involves the coordination of numerous administrative and clerical functions relating to the collection of documents and the collection and disbursement of funds required to carry out the terms of the contract between the parties. If part of the purchase price is financed, your lender will instruct the Settlement agent as to the signing and recording of loan documents and the disbursement of loan proceeds. No Settlement agent can provide legal advice to any party to the transaction except a Settlement agent who is engaged in the private practice of law in Virginia and who has been retained or engaged by a party to the transaction for the purpose of providing legal services to that party.

Variation by agreement: The provisions of the Real Estate Settlement Agents Act may not be varied by agreement, and rights conferred by this chapter may not be waived. The Seller may not require the use of a particular settlement agent as a condition of the sale of the property. Escrow, closing and Settlement service guidelines: The Virginia State Bar issues guidelines to help Settlement agents avoid and prevent the unauthorized practice of law in connection with furnishing escrow, Settlement or closing services. As a party to a real estate transaction, you are entitled to receive a copy of these guidelines from your Settlement agent, upon request, in accordance with the provisions of the Real Estate Settlement Agents Act.

Buyer designates(“Settlement Agent”).

Buyer agrees to contact Settlement Agent within 10 Days of Date of Ratification to schedule Settlement. Settlement Agent shall order the title exam and survey if required.

To facilitate Settlement Agent’s preparation of various closing documents, including any Closing Disclosure, Buyer hereby authorizes Settlement Agent to send such Closing Disclosure to Buyer by

NVAR – K1321 – rev. 12/19 |

Page 2 of 15 |

Seller: |

/ |

Buyer: |

/ |

electronic means and agrees to provide Settlement Agent Buyer’s electronic mail address for that purpose only.

5.DOWN PAYMENT. The balance of the down payment will be paid on or before Settlement Date by certified or cashier’s check or by

6.DELIVERY. This paragraph specifies the general delivery requirements under this Contract. For delivery of property or condominium owner’s association documents see the VIRGINIA

PROPERTY OWNERS’ ASSOCIATION ACT and/or VIRGINIA CONDOMINIUM ACT paragraphs of this Contract. Delivery of the Notice pursuant to the Virginia Residential Property Disclosure Act is addressed in the VIRGINIA RESIDENTIAL PROPERTY DISCLOSURE ACT paragraph.

Delivery (“Delivery,” “delivery,” or “delivered”) methods may include

Deliveries will be sent as follows:

A.Addressed to Seller at Property address unless otherwise specified below by United States mail, hand delivery or courier service OR fax OR email (check all that apply):

To Seller:

B.Addressed to Buyer by United States mail, hand delivery or courier service OR fax OR email (check all that apply):

To Buyer:

No party to this Contract will refuse Delivery in order to delay or extend any deadline established in this Contract.

7.VIRGINIA RESIDENTIAL PROPERTY DISCLOSURE ACT. The Virginia Residential Property Disclosure Act requires Seller to deliver a disclosure statement prior to the acceptance of this Contract unless the transfer of Property is exempt. The law requires Seller, on a disclosure statement provided by the Real Estate Board, to state that Seller makes no representations or warranties concerning the physical condition of the Property and to sell the Property “as is,” except as otherwise provided in this Contract.

If the disclosure statement is delivered to Buyer after Date of Ratification, Buyer’s sole remedy shall be to terminate this Contract at or prior to the earliest of (i) three (3) days after delivery of the disclosure statement in person; (ii) five (5) days after the postmark if the disclosure statement is sent by United States mail, postage prepaid, and properly addressed to Buyer; (iii) settlement upon purchase of Property; (iv) occupancy of Property by Buyer; (v) Buyer making written application to a lender for a mortgage loan where such application contains a disclosure that the right of termination shall end upon the application for the mortgage loan; or (vi) the execution by Buyer after receiving the disclosure statement of a written waiver of Buyer’s right of termination separate from this Contract.

Written Notice of termination may be (i) hand delivered; (ii) sent by United States mail, postage prepaid, provided that Buyer retains sufficient proof of mailing, which may be either a United States

NVAR – K1321 – rev. 12/19 |

Page 3 of 15 |

Seller: |

/ |

Buyer: |

/ |

postal certificate of mailing or a certificate of service confirming that such mailing was prepared by Buyer; (iii) sent by electronic means to the facsimile number or electronic mailing address provided by Seller in the DELIVERY paragraph, provided that Buyer retains sufficient proof of the electronic delivery, which may be an electronic receipt of delivery, a confirmation that the notice was sent by facsimile, or a certificate of service; (iv) overnight delivery using a commercial service or the United States Postal Service.

Any such termination shall be without penalty to Buyer, and any deposit shall be promptly returned to Buyer.

8.VIRGINIA PROPERTY OWNERS’ ASSOCIATION ACT. Seller represents that the Property is OR is not located within a development that is subject to the Virginia Property Owners’ Association Act (“POA Act” or “Act” solely in this Paragraph). Section

Subject to the provisions of subsection A of

For delivery of the Packet or the Notice of

if hard copy.

The Act further provides that for purposes of clause (iii), the association disclosure packet shall be deemed not to be available if (a) a current annual report has not been filed by the association with either the State Corporation Commission pursuant to

The Act further provides that if the contract does not contain the disclosure required by subsection B of

The Act further provides that the information contained in the association disclosure packet shall be current as of a date specified on the association disclosure packet prepared in accordance with the Act; however, a disclosure packet update or financial update may be requested in accordance with subsection G of

NVAR – K1321 – rev. 12/19 |

Page 4 of 15 |

Seller: |

/ |

Buyer: |

/ |

disclosure packet will not be available, or receives an association disclosure packet that is not in conformity with the provisions of

The Act further provides that Notice of cancellation shall be provided to the lot owner or his agent by one of the following methods: (a) Hand delivery; (b) United States mail, postage prepaid, provided the sender retains sufficient proof of mailing, which may be either a United States postal certificate of mailing or a certificate of service prepared by the sender confirming such mailing; (c) Electronic means provided the sender retains sufficient proof of the electronic delivery, which may be an electronic receipt of delivery, a confirmation that the notice was sent by facsimile, or a certificate of service prepared by the sender confirming the electronic delivery; or (d) Overnight delivery using a commercial service or the United States Postal Service.

The Act further provides that in the event of a dispute, the sender shall have the burden to demonstrate delivery of the notice of cancellation. Such cancellation shall be without penalty, and the seller shall cause any deposit to be returned promptly to the purchaser.

The Act further provides that whenever any contract is canceled based on a failure to comply with subsection B or D of

The parties specify that such funds shall immediately be returned pursuant to the VOID CONTRACT paragraph of this Contract.

The Act further provides that any rights of the purchaser to cancel the contract provided by this chapter are waived conclusively if not exercised prior to settlement.

The Act further provides that except as expressly provided in the Act, the provisions of

The Act further provides that failure to receive copies of an association disclosure packet shall not excuse any failure to comply with the provisions of the declaration, articles of incorporation, bylaws, or rules or regulations.

9.VIRGINIA CONDOMINIUM ACT. Seller represents that the Property is OR is not a condominium unit. The Virginia Condominium Act (the “Condominium Act” or “Act” solely in this

Paragraph), requires the following contract language:

In the event of any resale of a condominium unit by a unit owner other than the declarant, and subject to the provisions of subsection F and subsection A of

NVAR – K1321 – rev. 12/19 |

Page 5 of 15 |

Seller: |

/ |

Buyer: |

/ |

certificate will not be available, (iv) if the purchaser has received the resale certificate, the purchaser has a right to request a resale certificate update or financial update in accordance with

For delivery of the Certificate or the Notice of

delivery atif electronic or if hard copy.

The Act further provides that for purposes of clause (iii), the resale certificate shall be deemed not to be available if (a) a current annual report has not been filed by the unit owners’ association with either the State Corporation Commission pursuant to

The Act further provides that if the contract does not contain the disclosure required by subsection B of

The Act further provides that the information contained in the resale certificate shall be current as of a date specified on the resale certificate. A resale certificate update or a financial update may be requested as provided in

The Act further provides that the purchaser may cancel the contract (i) within three days after the date of the contract, if on or before the date that the purchaser signs the contract, the purchaser receives the resale certificate, is notified that the resale certificate will not be available, or receives a resale certificate that does not contain the information required by

The Act further provides that Notice of cancellation shall be provided to the unit owner or his agent by one of the following methods: (a) Hand delivery; (b) United States mail, postage prepaid, provided the sender retains sufficient proof of mailing, which may be either a United States postal certificate of mailing or a certificate of service prepared by the sender confirming such mailing; (c) Electronic means provided the sender retains sufficient proof of the electronic delivery, which may be an electronic receipt of delivery, a confirmation that the notice was sent by facsimile, or a certificate of service prepared by the sender confirming the electronic delivery; or (d) Overnight delivery using a commercial service or the United States Postal Service.

The Act further provides that in the event of a dispute, the sender shall have the burden to demonstrate delivery of the notice of cancellation. Such cancellation shall be without penalty, and the unit owner shall cause any deposit to be returned promptly to the purchaser.

NVAR – K1321 – rev. 12/19 |

Page 6 of 15 |

Seller: |

/ |

Buyer: |

/ |

The Act further provides that failure to receive a resale certificate shall not excuse any failure to comply with the provisions of the condominium instruments, articles of incorporation, or rules or regulations.

The Act further provides that except as expressly provided in the Act, the provisions of the Act shall not be varied by agreement, and the rights conferred by the Act shall not be waived.

10.PROPERTY MAINTENANCE AND CONDITION. Except as otherwise specified herein, Seller will deliver Property free and clear of trash and debris, broom clean and in substantially the same physical condition to be determined as of Date of Offer OR Date of home inspection OR

Other: . Seller will have all utilities in service through Settlement or as otherwise agreed.

Buyer and Seller will not hold Broker liable for any breach of this Paragraph.

Buyer acknowledges, subject to Seller acceptance, that this Contract may be contingent upon home inspection(s) and/or other inspections to ascertain the physical condition of Property. If Buyer desires one or more inspection contingencies, such contingencies must be included in an addendum to this Contract.

This Contract is contingent upon home inspection(s) and/or other inspections. (Addendum attached)

OR

Buyer waives the opportunity to make this Contract contingent upon home inspection(s).

Buyer acknowledges that except as otherwise specified in this Contract, Property, including electrical, plumbing, existing appliances, heating, air conditioning, equipment and fixtures shall convey in its

11.ACCESS TO PROPERTY. Seller will provide Broker, Buyer, inspectors representing Buyer, and representatives of lending institutions for Appraisal purposes reasonable access to the Property to comply with this Contract. In addition, Buyer and/or Buyer’s representative will have the right to make

12.UTILITIES, WATER, SEWAGE, HEATING AND CENTRAL AIR CONDITIONING. (Check all that apply)

Water Supply: |

Public |

Private Well |

Community Well |

|

|

|

|

|||||

Hot Water: |

Oil |

Gas |

Elec. |

Other |

|

|

|

|

|

|

|

|

Air Conditioning: |

Oil |

Gas |

Elec. |

Heat Pump |

Other |

|

Zones |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Heating: |

Oil |

Gas |

Elec. |

Heat Pump |

Other |

|

Zones |

|

||||

|

|

|

|

|

|

|

|

|

||||

Sewage Disposal: |

Public |

Septic for # BR |

|

Community Septic Alternative Septic for # BR: |

|

|||||||

Septic Waiver Disclosure provided by Seller (if applicable) per VA Code

13.PERSONAL PROPERTY AND FIXTURES. Property includes the following personal property and fixtures, if existing:

NVAR – K1321 – rev. 12/19 |

Page 7 of 15 |

Seller: |

/ |

Buyer: |

/ |

The items marked YES below are currently installed or offered.

Yes No # Items |

|

Yes No # |

Items |

|

Yes No # Items |

|

___ Alarm System |

___ |

Freezer |

___ Satellite Dish |

|||

___ |

___ |

Furnace Humidifier |

___ Storage Shed |

|||

___ Ceiling Fan |

___ |

Garage Opener |

___ Stove or Range |

|||

___ Central Vacuum |

___ |

w/ remote |

___ Trash Compactor |

|||

___ Clothes Dryer |

___ |

Gas Log |

___ Wall Oven |

|||

___ Clothes Washer |

___ |

Hot Tub, Equip & Cover ___ Water Treatment System |

||||

___ Cooktop |

___ |

Intercom |

___ Window A/C Unit |

|||

___ Dishwasher |

___ |

Playground Equipment |

___ Window Fan |

|||

___ Disposer |

___ |

Pool, Equip, & Cover |

___ Window Treatments |

|||

___ Electronic Air Filter |

___ |

Refrigerator |

___ Wood Stove |

|||

___ Fireplace Screen/Door |

___ |

w/ ice maker |

|||||

OTHER |

|

|

|

|

|

|

|

|

|

|

|

|

|||

FUEL TANKS. Fuel Tank(s) Leased # |

|

Fuel Tank(s) Owned (Fuel Tank(s), if |

|||||

owned, convey) # |

|

. Unless otherwise agreed to in writing, any heating or cooking fuels |

|||||

remaining in supply tank(s) at Settlement will become the property of Buyer.

LEASED ITEMS. Any leased items, systems or service contracts (including, but not limited to, fuel tanks, water treatment systems, lawn contracts, security system monitoring, and satellite contracts) DO NOT convey absent an express written agreement by Buyer and Seller. The following is a list of the leased items within Property:

14.IRS/FIRPTA – WITHHOLDING TAXES FOR FOREIGN SELLER. Seller is OR is not a

“Foreign Person,” as defined by the Foreign Investment in Real Property Tax Act (FIRPTA). If

Seller is a Foreign Person, Buyer may be required to withhold and pay to the Internal Revenue Service (IRS) up to fifteen percent (15%) of the Sales Price on behalf of the Seller and file an IRS form which includes both Seller and Buyer tax identification numbers. The parties agree to cooperate with each other and Settlement Agent to effectuate the legal requirements. If Seller’s proceeds are not sufficient to cover the withholding obligations under FIRPTA, Seller may be required to pay at Settlement such additional certified funds necessary for the purpose of making such withholding payment.

15.BUYER’S REPRESENTATIONS. Buyer will OR will not occupy Property as Buyer’s principal residence. Unless specified in a written contingency, neither this Contract nor the financing is dependent or contingent on the sale and settlement or lease of other real property. Buyer acknowledges that Seller is relying upon all of Buyer’s representations, including without limitation, the accuracy of financial or credit information given to Seller, Broker, or the lender by Buyer.

16.SMOKE DETECTORS. Seller shall deliver Property with smoke detectors installed and functioning in accordance with the laws and regulations of Virginia.

17.TARGET

NVAR – K1321 – rev. 12/19 |

Page 8 of 15 |

Seller: |

/ |

Buyer: |

/ |

1978, then, unless exempt under 42 U.S.C. 4852d, Property is considered “target housing” under the statute and a copy of the “Sale: Disclosure and Acknowledgment of Information on

18.

90 days prior to Settlement showing that all dwelling(s) and/or garage(s) within Property (excluding fences or shrubs not abutting garage(s) or dwelling(s)) are free of visible evidence of live wood- destroying insects and free from visible damage. Any treatment and repairs for damage identified in the inspection report will be made at Seller’s expense and Seller will provide written evidence of such treatment and/or repair prior to date of Settlement which shall satisfy the requirements of this Paragraph.

19.DAMAGE OR LOSS. The risk of damage or loss to Property by fire, act of God, or other casualty remains with Seller until the execution and delivery of the deed of conveyance to Buyer at Settlement.

20.TITLE. The title report and survey, if required, will be ordered promptly and, if not available on the Settlement Date, then Settlement may be delayed for up to ten (10) business days to obtain the title report and survey after which this Contract, at the option of Seller, may be terminated and Deposit will be refunded in full to Buyer according to the terms of the DEPOSIT paragraph. Fee simple title to Property, and everything that conveys with it, will be sold free of liens except for any loans assumed by Buyer.

Seller will convey title which is good, marketable, and insurable by a licensed title insurance company with no additional risk premium. In case action is required to perfect the title, such action must be taken promptly by Seller at Seller’s expense. Title may be subject to commonly acceptable easements, covenants, conditions and restrictions of record, if any, as of Settlement Date. If title is not good and marketable, and insurable by a licensed title insurance company with no additional risk premium, on Settlement Date, Buyer may at Buyer’s option either (a) declare the Contract void in writing, or (b) pursue all available legal and equitable remedies. Nothing herein shall prohibit the parties from mutually agreeing to extend Settlement Date under terms acceptable by both parties.

Seller will convey Property by general warranty deed with English covenants of title (“Deed”). The manner of taking title may have significant legal and tax consequences. Buyer is advised to seek the appropriate professional advice concerning the manner of taking title.

Seller will sign such affidavits, lien waivers, tax certifications, and other documents as may be required by the lender, title insurance company, Settlement Agent, or government authority, and authorizes Settlement Agent to obtain

NVAR – K1321 – rev. 12/19 |

Page 9 of 15 |

Seller: |

/ |

Buyer: |

/ |

21.NOTICE OF POSSIBLE FILING OF MECHANICS’ LIEN. Code of Virginia Section

22.POSSESSION DATE. Unless otherwise agreed to in writing between Seller and Buyer, Seller will give possession of Property at Settlement, including delivery of keys, key fobs, codes, digital keys, if any. If Seller fails to do so and occupies Property beyond Settlement, Seller will be a tenant at sufferance of Buyer and hereby expressly waives all notice to quit as provided by law. Buyer will have the right to proceed by any legal means available to obtain possession of Property. Seller will pay any damages and costs incurred by Buyer including reasonable attorney fees.

23.FEES. Fees for the preparation of the Deed, that portion of Settlement Agent’s fee billed to Seller, costs of releasing existing encumbrances, Seller’s legal fees and any other proper charges assessed to

Seller will be paid by Seller. Fees for the title exam (except as otherwise provided), survey, recording (including those for any purchase money trusts) and that portion of Settlement Agent’s fee billed to Buyer, Buyer’s legal fees and any other proper charges assessed to Buyer will be paid by Buyer. Fees to be charged will be reasonable and customary for the jurisdiction in which Property is located. Grantor’s tax and Regional Congestion Relief Fee (for Alexandria City, Arlington, Fairfax,

Loudoun and Prince William Counties and all cities contained within) shall be paid by Seller. Buyer shall pay recording charges for the Deed and any purchase money trusts.

24.BROKER’S FEE. Seller irrevocably instructs Settlement Agent to pay Broker compensation (“Broker’s Fee”) at Settlement as set forth in the listing agreement and to disburse the compensation offered by Listing Brokerage to Cooperating Brokerage in writing as of the Date of Offer, and the remaining amount of Broker’s compensation to Listing Brokerage.

25. ADJUSTMENTS. Rents, taxes, water and sewer charges, condominium unit owners’ association, homeowners’ and/or property owners’ association regular periodic assessments (if any) and any other operating charges, are to be adjusted to the Date of Settlement. Taxes, general and special, are to be adjusted according to the most recent property tax bill(s) for Property issued prior to Settlement Date, except that recorded assessments for improvements completed prior to Settlement, whether assessments have been levied or not, will be paid by Seller or allowance made at Settlement. If a loan is assumed, interest will be adjusted to the Settlement Date and Buyer will reimburse Seller for existing escrow accounts, if any.

26.ATTORNEY’S FEES.

A. If any Party breaches this Contract and a

NVAR – K1321 – rev. 12/19 |

Page 10 of 15 |

Seller: |

/ |

Buyer: |

/ |

Form Properties

| Fact | Detail |

|---|---|

| 1. Parties Involved | The contract is between the Buyer and Seller with representation specified for each by Listing Brokerage for Seller and Cooperating Brokerage for Buyer or Seller. |

| 2. Property Description | Includes tax map/ID number, legal description of the lot(s), section, subdivision or condominium, parking spaces, and detailed location including street address, unit number, city, county/municipality, and ZIP code. |

| 3. Sales Price and Financing | Details include down payment, types of financing (Conventional, VA, FHA, USDA, etc.), total financing, and seller subsidy. Also outlines conditions if the contract is contingent on financing. |

| 4. Deposit | Specifies the deposit amount, form, and holder, which is the Escrow Agent. Terms include handling and potential disbursement of the deposit. |

| 5. Settlement | Explains the settlement terms including the settlement date and conditions affecting it. Acknowledges the Real Estate Settlement Agents Act and the right to choose a Settlement Agent. |

| 6. Down Payment | Terms for the balance of the down payment to be paid by a certain date via certified checks, cashier checks, or bank-wired funds, with an assignment of funds requiring Seller's consent. |

| 7. Delivery of Documents | Outlines methods of delivery for various documents related to the contract, including the method and presumed date of delivery. |

| 8. Virginia Residential Property Disclosure Act | Outlines Seller's obligations under the Act to provide a disclosure statement, with specifics on Buyer's right to terminate the contract based on receipt or non-receipt of this statement. |

| 9. Virginia Property Owners’ Association Act | Seller’s disclosure responsibilities about the property being within a development subject to this Act. Includes rights of the Buyer regarding the association disclosure packet. |

| 10. Virginia Condominium Act | Details the Seller’s obligations if the property is a condominium unit, including the requirement to provide a resale certificate and the Buyer's right to cancel the contract upon review of the certificate. |

Steps to Filling Out No Broker Residential Sales Virginia

Filling out the No Broker Residential Sales Virginia form is a critical step in proceeding with a real estate transaction without the involvement of a broker. This process requires attention to detail and a clear understanding of the agreement between the buyer and seller. Below are step-by-step instructions to accurately complete this crucial document.

- Start by entering the Date of Offer at the top of the form to solidify the commencement of this agreement.

- In the section provided, clearly print the names of the Buyer and the Seller to specify the parties involved.

- Check the appropriate box to indicate whether the Listing Brokerage represents the Buyer, Seller, or if it acts as a dual representative. Attach the necessary disclosure form if there is dual representation.

- Under REAL PROPERTY, describe the property that is being sold by including its TAX Map/ID #, legal description, lot(s), section, subdivision or condominium, parking space(s) #, county/municipality, deed book/liber #, page/folio #, street address, unit #, city, and ZIP code.

- For PRICE AND FINANCING, enter the agreed Sales Price and details concerning the down payment, type of financing, and seller subsidy, if applicable.

- Indicate whether the contract is or is not contingent on financing, and provide details on the financing contingency and application process as required.

- Fill in the details regarding the Deposit, including the amount and whether it will be in check/bank-wired funds or by note. Specify the Escrow Agent responsible for holding the Deposit.

- Determine the Settlement Date and specify any arrangements related to it. Remember to designate a Settlement Agent and note the preference for handling closing documents and disclosures.

- Detail how the remainder of the down payment will be paid by the Settlement Date, in compliance with the requirements specified by the Settlement Agent.

- Address delivery methods for all necessary documents under the DELIVERY section, choosing from hand-carried, courier service, United States mail, facsimile, or email transmission, and specify the delivery information for both the Seller and Buyer.

- Under the VIRGINIA RESIDENTIAL PROPERTY DISCLOSURE ACT section, acknowledge the Seller's obligation to deliver a disclosure statement or indicate the exemption and the Buyer's rights concerning the disclosure.

- If applicable, complete the section related to the VIRGINIA PROPERTY OWNERS’ ASSOCIATION ACT and the VIRGINIA CONDOMINIUM ACT by indicating whether the Property is part of an association or a condominium and detailing the requirements for disclosure packets.

- Finish the form by having both Buyer and Seller initial each page and sign the final page, confirming agreement to the terms and conditions set forth in the Contract.

Once the form is fully completed and signed by both parties, the next steps include finalizing financing (if applicable), conducting necessary inspections, and preparing for the Settlement. It’s important to adhere closely to the timelines and conditions detailed in the form to ensure a smooth transaction and to protect the interests of both the Buyer and Seller. Engagement of legal counsel is advisable to review the contract before finalization to ensure all legal requirements are met and rights protected.

FAQ

What is a No Broker Residential Sales Contract in Virginia?

In Virginia, a No Broker Residential Sales Contract is an agreement used for the sale of residential property where no real estate broker is involved in the transaction. This type of contract outlines the agreement between the buyer and the seller for the purchase and sale of a home, including terms such as price, financing, and the conditions under which the sale will occur. It's designed to ensure both parties clearly understand their rights and responsibilities without the mediation of a real estate agent.

How does the financing section work under this contract?

The financing section of the contract details the terms under which the purchase will be financed. This includes:

- The down payment amount, either as a dollar value or percentage of the sales price.

- The type and amount of financing, such as conventional loans, VA loans, FHA loans, USDA loans, or other types specified.

- Details about any second trust or seller-held trust, if applicable.

- The total amount of financing and how it relates to the sales price.

- A clause stating whether the contract is contingent on obtaining financing, including the buyer’s obligations to apply for financing and the timeline for doing so.

This section ensures clarity on how the buyer intends to fund the purchase and any steps they must take to secure their financing.

What is the role of the deposit in this contract?

The deposit serves as the buyer’s initial commitment to the purchase. Details include:

- The amount of the deposit and its form (check, wire transfer, etc.).

- Instructions on when and to whom the deposit should be delivered.

- How the deposit will be held, typically in an escrow account, until settlement.

- The conditions under which the deposit can be credited to the sales price, returned, or otherwise disposed of.

This ensures both parties understand the purpose of the deposit and what happens to it throughout the transaction process.

What does the Settlement section entail?

The Settlement section specifies the terms and conditions under which the final transaction will be completed, including:

- The scheduled date for settlement and provisions for rescheduling, should it fall on a non-business day.

- Information about the buyer's right to choose a settlement agent.

- Details that ensure compliance with the Real Estate Settlement Agents Act, including guidelines to prevent unauthorized legal advice.

This part of the contract is critical for arranging the final transfer of property ownership in a manner that is agreeable and clear to both buyer and seller.

How are the Virginia Property Owners’ Association Act and the Virginia Condominium Act addressed?

These laws are incorporated into the contract to ensure that buyers know their rights regarding the property’s homeowners or condominium association:

- If the property falls under an association, sellers must disclose this and provide the relevant association disclosure packet.

- Buyers have specific periods during which they can cancel the contract upon reviewing the association disclosures.

- Details on how and when these disclosures must be delivered and received are specified, ensuring transparency and compliance with state laws.

These provisions protect the buyer by providing them with important information about the association governing the property they are purchasing.

Common mistakes

Filling out the No Broker Residential Sales Virginia form can sometimes be a complex task, leading some individuals to make errors that could affect the transaction. Below are nine common mistakes people make when completing this form:

- Incorrectly filling in the "Date of Offer," which is crucial as it marks the beginning of the contractual timeline.

- Failing to correctly identify whether the "Listing Brokerage" represents the Buyer, Seller, or both, thus not clarifying the dual representation if applicable. This oversight can lead to confusion regarding the interests the brokerage is representing.

- Omitting or inaccurately describing the "Property" including the legal description, tax map/ID number, and address information which ensures the exact piece of real estate being transacted is clearly identified.

- Not specifying the correct "Price and Financing" details, such as the down payment amount, type of financing (e.g., FHA, VA, Conventional), and any seller subsidy. These elements determine the financial obligations and the structure of the purchase.

- Overlooking the "Financing Contingency and Application" section, which might lead to misunderstandings about the buyer's obligations to secure financing and the potential consequences of not meeting these requirements.

- Incorrectly dealing with the "Deposit" details, such as the amount, form (check, wired funds, note), and timing for delivery to the Escrow Agent. Misunderstandings here can affect the validity of the offer and the earnest money at risk.

- Misunderstanding the "Settlement" terms, including failing to acknowledge that the Settlement Date may adjust if it falls on a non-business day. Knowing the scheduled settlement day is crucial for both planning and contractual compliance.

- Ignoring or mishandling the requirements of the "Virginia Residential Property Disclosure Act" and "Virginia Property Owners’ Association Act"/"Virginia Condominium Act", which can lead to the cancellation of the contract if the buyer's right to terminate based on the disclosures or lack thereof is not correctly understood or exercised.

- Not properly designating or communicating with the "Settlement Agent" as required, potentially delaying the closing process and lead to misunderstandings about the obligations and rights concerning the title exam and survey.

It's essential that all parties involved in filling out the No Broker Residential Sales Virginia form pay careful attention to each section and seek clarification when needed to ensure the integrity of the contract and the smooth progression of the property sale.

Documents used along the form

When engaging in residential sales in Virginia without a broker, parties often use a variety of forms and documents alongside the No Broker Residential Sales Virginia form to ensure a thorough and legally compliant transaction. These documents cover a range of purposes, from mandatory disclosures to financing, and they help both buyers and sellers understand their rights, responsibilities, and the specifics of the property itself.

- Title Search and Title Insurance Commitment: This crucial document examines the property's historical records, ensuring the seller can legally transfer ownership and revealing any liens, encumbrances, or claims. Title insurance protects against future discovery of financial losses due to title defects.

- Loan Application/Documents: If the buyer is obtaining financing, a loan application and supporting documents will be necessary. These detail the buyer's financial status and terms of the mortgage, establishing their ability to finance the purchase.

- Home Inspection Report: A comprehensive assessment of the property's current condition, identifying repairs and maintenance issues that might need to be addressed before closing.

- Appraisal Report: Conducted by a professional appraiser, this report determines the property's fair market value based on its condition, location, and comparable sales, which is crucial for mortgage financing.

- Homeowners' Association (HOA) or Condo Documents: If the property is within an HOA or condominium, governing documents, financial statements, and potential assessment notices will be required. These reveal rules and financial health of the community.

- Home Warranty Policy: This optional insurance policy covers repair and replacement of major home system components and appliances, providing peace of mind to the buyer.

- Seller and Buyer Identification: Legally required identification (usually government-issued) to prevent fraud and ensure that all parties are legally capable of entering the transaction.

- Closing Disclosure: A document that outlines the final transaction details, including the sales price, loan terms, closing costs, and the distribution of funds among parties, which the buyer typically receives at least three days before closing.

Together, these documents complement the No Broker Residential Sales Virginia form by providing a comprehensive overview of the legal, financial, and physical condition aspects of the real estate transaction. Proper use and understanding of these forms ensure that the buyer and seller are well-informed, reducing the risk of disputes and facilitating a smooth property transfer process.

Similar forms

The No Broker Residential Sales Virginia form is similar to the Standard Residential Purchase Agreement used in various states across the U.S. Both documents are instrumental in guiding the sale process from offer to closing, outlining the terms agreed upon by the buyer and seller, including purchase price, financing terms, and contingencies. The No Broker Residential Sales Virginia form, like its counterparts, details the obligations of both parties and sets forth provisions for the handling of earnest money deposits, inspections, and disclosures. These agreements ensure buyers and sellers have a clear, legal understanding of their rights and responsibilities, minimizing potential disputes. The transparency and structure provided by such documents are essential for a smooth real estate transaction.

Similarities can also be found between the No Broker Residential Sales Virginia form and the Real Estate Purchase and Sale Agreement widely used for commercial transactions. Despite the different nature of the properties involved, both forms facilitate the negotiation process by specifying terms like the property description, sales price, and closing details. They set parameters for due diligence periods, allowing the buyer to verify information about the property and secure financing. Additionally, these agreements discuss provisions related to breach of contract and remedies, illustrating their role in safeguarding the interests of both parties. By laying out complex terms in a structured manner, these documents help demystify the buying and selling process, ensuring all parties are well-informed.

Dos and Don'ts

When dealing with the No Broker Residential Sales Virginia form, there are several dos and don'ts to ensure the process proceeds smoothly. Below are essential pointers to guide you:

- Do thoroughly read the entire contract before filling it out to ensure you fully understand the terms and are aware of all the requirements.

- Do accurately provide all the required information regarding the property, including the tax map/ID number, legal description, and all pertinent financing details.

- Do use clear and precise language to fill out the form to avoid any misunderstandings or ambiguities regarding the agreement terms.

- Do check the appropriate boxes that apply to your situation, especially in sections concerning broker representation, financing contingency, and property disclosures.

- Don't leave any sections blank that apply to your transaction; incomplete forms can lead to delays or disputes about the terms of the sale.

- Don't forget to include the deposit amount and ensure the funds are correctly transferred or noted as per the contract's instructions.

- Don't hesitate to seek professional legal advice if there are any parts of the contract you do not understand.

By carefully following these dos and don'ts, parties involved in a No Broker Residential Sales in Virginia can navigate the process more effectively, ensuring a smoother transaction that respects all legal requirements.

Misconceptions

When it comes to the No Broker Residential Sales Virginia form, there are several misconceptions that can lead to misunderstandings between buyers and sellers. These misunderstandings can complicate the path to a successful real estate transaction. Let's clear up some common misconceptions:

- The form is only for use when no real estate agents are involved. While it's true that this form is designed for transactions without a listing or selling agent (referred to as "Broker" in the document), it's crucial to understand that it also outlines the roles of a Listing Brokerage and a Cooperating Brokerage when they are part of the transaction. The form accommodates various configurations of agent representation, including dual agency.

- All terms of the sale are final once the contract is signed. While the contract does set forth the principal terms of the sale, certain contingencies, such as financing and inspection, may still allow for amendments to the contract or even for the contract to be terminated under specified conditions.

- The seller determines the Settlement agent. According to the Real Estate Settlement Agents Act (RESAA) noted within the contract, it is actually the buyer who has the right to select the Settlement agent. This provision ensures that the buyer can choose a trusted party to manage the closing process.

- The Deposit is always forfeited if the buyer decides not to proceed. The fate of the Deposit is contingent upon several factors and conditions outlined within the contract. There are scenarios, especially those involving the exercise of lawful contingencies, where the buyer may be entitled to a refund of their deposit.

- Financing details are merely a formality. The contract stipulates explicit steps and timelines related to financing, including the necessity for a financing contingency and what happens if the buyer fails to secure financing. These details are far from being mere formalities; they are essential terms that can impact the execution of the sale.

- Escrow Agent responsibilities are limited. Contrary to what some might think, the Escrow Agent plays a pivotal role in holding and disbursing the deposit, in line with the contract's terms and applicable legal requirements. Their responsibilities are significant and include ensuring the deposit is handled in accordance with Virginia law and the specific terms of the contract.

- Settlement must happen on the specified Settlement Date. While the contract does set a date for Settlement, it also provides for adjustments. For instance, if the specified Settlement Date falls on a weekend or a public holiday, the Settlement is then scheduled for the preceding business day. This flexibility is built into the contract to accommodate unforeseen scheduling conflicts.

Understanding the complexities of the No Broker Residential Sales Virginia form is crucial for both buyers and sellers. It is a comprehensive document designed to cover various scenarios and protect the interests of all parties involved. Misinterpretations can lead to unnecessary confusion and complications, underscoring the importance of consulting with a knowledgeable professional when navigating residential real estate transactions in Virginia.

Key takeaways

Understanding the No Broker Residential Sales Virginia form is essential for a smooth real estate transaction. Whether you're a buyer or a seller, knowing these key takeaways will guide you through the process efficiently:

- The form initiates the agreement between the buyer and the seller, detailing their mutual intention to engage in the sale and purchase of residential real estate.

- It specifies the roles of the listing and cooperating brokerages, if any, and outlines their relationship with both parties.

- A detailed description of the property, including tax information, legal description, and the physical address, is a critical component of the contract. This ensures clarity on what is being bought or sold.

- Financial terms, including the sales price, down payment, and any financing details, must be clearly stated. This section also addresses the seller subsidy and the implications if the contract is contingent on financing.

- The deposit amount and the conditions under which it is held and can be disbursed are outlined, highlighting the role of the Escrow Agent in managing these funds.

- Settlement details, including the date and the selection of a settlement agent, underscore the buyer's rights in the process and the importance of compliance with the Real Estate Settlement Agents Act.

- The delivery clauses specify how notices and documents should be exchanged between the parties. This is crucial for maintaining an effective and time-sensitive communication line.

- Disclosures mandated by the Virginia Residential Property Disclosure Act, Virginia Property Owners’ Association Act, and Virginia Condominium Act are integral. These laws ensure that the buyer is fully aware of the property’s status, the seller's legal obligations, and any association-related rights or restrictions.

Adherence to these components not only facilitates a legally compliant and equitable transaction but also aids in reducing uncertainties and potential disputes between the involved parties. Hence, all individuals partaking in the sale or purchase of residential real property in Virginia should thoroughly review and understand these key aspects.

Other PDF Forms

Virginia Withholding - Following the 2014 Appropriation Act, the VA-6H form, along with W-2 copies, must be filed by January 31 each year.

Wv Divorce Papers - For corporate entities, clarify stock ownership to assess any potential conflicts of interest.