Attorney-Approved Operating Agreement Template for Virginia

When embarking on the journey of creating a Limited Liability Company (LLC) in Virginia, one crucial step that should not be overlooked is drafting an Operating Agreement. This document, though not mandated by state law, plays a pivotal role in the foundational structure of your business. It serves as a blueprint, detailing the operational procedures, financial decisions, and governance of the LLC, ensuring that all members are on the same page regarding the company's daily operations and long-term strategies. The Virginia Operating Agreement goes beyond mere formality; it is a tool for preventing misunderstandings among members by clearly outlining each member's rights, responsibilities, and shares in the profits and losses. Furthermore, it heightens the credibility of your business, provides flexibility in business management, and most importantly, reinforces the legal protections that come with the LLC structure. By clearly stating that members are not personally liable for the company's debts and actions, it significantly contributes to the peace of mind of the business owners.

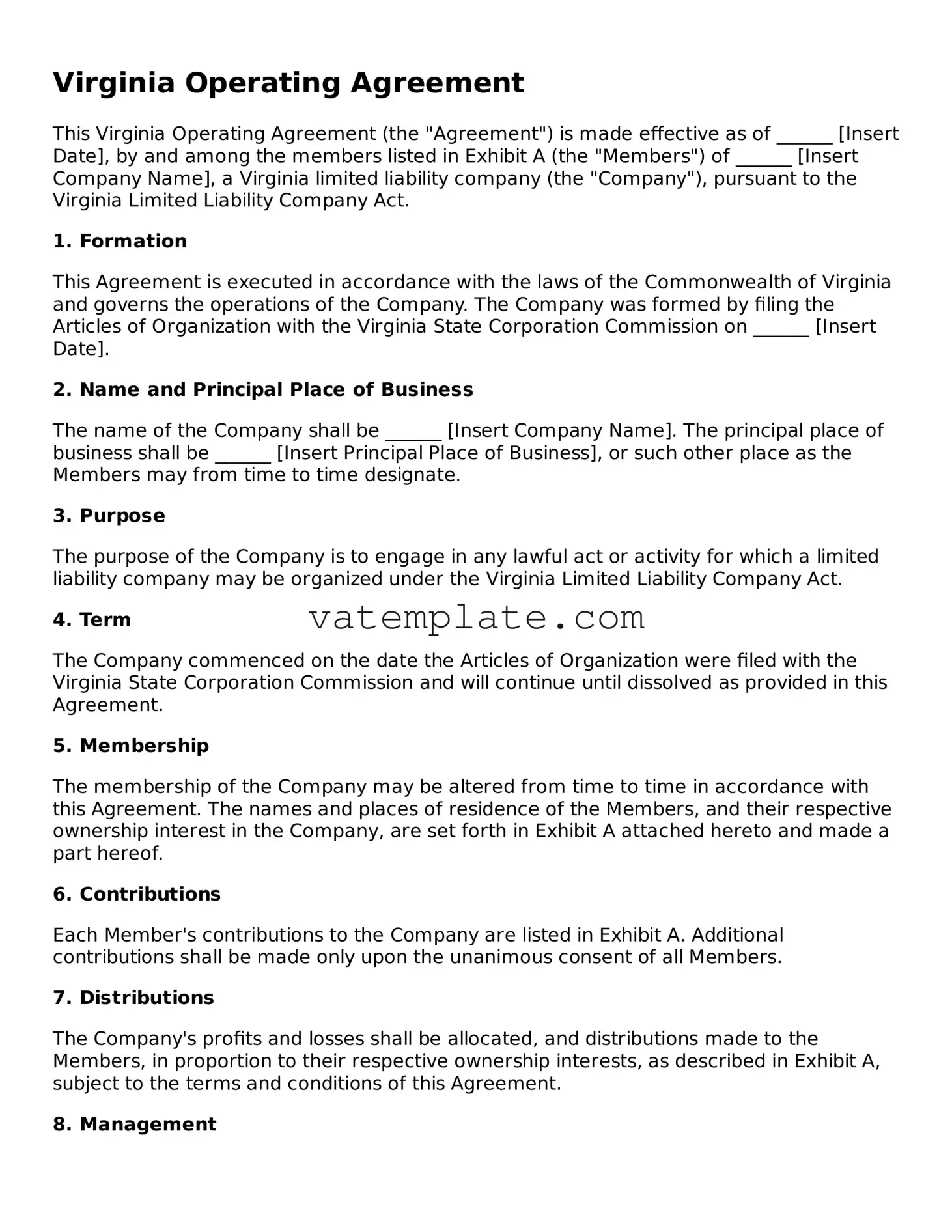

Virginia Operating Agreement Example

Virginia Operating Agreement

This Virginia Operating Agreement (the "Agreement") is made effective as of ______ [Insert Date], by and among the members listed in Exhibit A (the "Members") of ______ [Insert Company Name], a Virginia limited liability company (the "Company"), pursuant to the Virginia Limited Liability Company Act.

1. Formation

This Agreement is executed in accordance with the laws of the Commonwealth of Virginia and governs the operations of the Company. The Company was formed by filing the Articles of Organization with the Virginia State Corporation Commission on ______ [Insert Date].

2. Name and Principal Place of Business

The name of the Company shall be ______ [Insert Company Name]. The principal place of business shall be ______ [Insert Principal Place of Business], or such other place as the Members may from time to time designate.

3. Purpose

The purpose of the Company is to engage in any lawful act or activity for which a limited liability company may be organized under the Virginia Limited Liability Company Act.

4. Term

The Company commenced on the date the Articles of Organization were filed with the Virginia State Corporation Commission and will continue until dissolved as provided in this Agreement.

5. Membership

The membership of the Company may be altered from time to time in accordance with this Agreement. The names and places of residence of the Members, and their respective ownership interest in the Company, are set forth in Exhibit A attached hereto and made a part hereof.

6. Contributions

Each Member's contributions to the Company are listed in Exhibit A. Additional contributions shall be made only upon the unanimous consent of all Members.

7. Distributions

The Company's profits and losses shall be allocated, and distributions made to the Members, in proportion to their respective ownership interests, as described in Exhibit A, subject to the terms and conditions of this Agreement.

8. Management

Management of the Company is vested in the Members. Decisions shall be made by a majority vote of the Members except as otherwise required by this Agreement or by law.

9. Assignability

Interest in the Company may be assigned only with the unanimous consent of all Members. Any attempted assignment without such consent will be void.

10. Dissolution

The Company may be dissolved with the unanimous consent of all Members, or as required by the Virginia Limited Liability Company Act. Upon dissolution, the Company's assets will be distributed according to the Members' ownership interests after all debts and liabilities have been settled.

11. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the Commonwealth of Virginia, without regard to its conflict of laws provisions.

12. Amendments

This Agreement may be amended only by a written document signed by all Members.

13. Exhibits and Attachments

The following exhibits and attachments are included as part of this Agreement: Exhibit A - List of Members and their respective contributions and ownership interests.

IN WITNESS WHEREOF, the undersigned have executed this Agreement as of the date first above written.

_________________________

Member Signature

_________________________

Printed Name

_________________________

Date

Document Details

| Fact Number | Detail |

|---|---|

| 1 | The Virginia Operating Agreement is a legal document that outlines the operations of an LLC in Virginia. |

| 2 | It's not mandatory to file this document with the Virginia State Corporation Commission. |

| 3 | Despite not being required by law, creating an operating agreement is highly recommended for establishing clear rules and procedures among members. |

| 4 | This document helps protect members' personal assets from the company's debts and obligations. |

| 5 | The agreement can be amended as the needs of the LLC or its members change. |

| 6 | It covers essential aspects like ownership structure, member roles and responsibilities, and how profits and losses are allocated. |

| 7 | Having a written agreement can prevent misunderstandings among members by providing clear guidelines for managing the LLC. |

| 8 | This document gives the LLC credibility and shows that it is operating in a professional and organized manner. |

| 9 | The Operating Agreement can include provisions for the dissolution of the LLC, offering a plan for an orderly shutdown. |

| 10 |

Steps to Filling Out Virginia Operating Agreement

Operating agreements serve as essential documents for Limited Liability Companies (LLCs), detailing the business structure, financial and functional decisions among members. It is a critical step in establishing the organization's operating procedures and ensuring all participants are on the same page regarding the company's management and policies. Despite its significance, the process of completing an operating agreement can be straightforward, provided you follow a series of methodical steps.

- Gather necessary information, including the business name, principal place of business, member details, and capital contributions.

- Clearly specify the LLC's name, ensuring it complies with Virginia’s state requirements and includes an appropriate designator (e.g., LLC, L.L.C., Limited Company).

- Enter the principal place of business. This should be the primary location where your business operates or intends to operate.

- List all members of the LLC, including their full legal names and addresses. This step ensures every member is properly documented and recognized.

- Detail each member's contribution to the LLC's initial capital. Contributions can be in the form of cash, property, or services, and should be accurately documented to reflect ownership percentages.

- Define the management structure of the LLC. Specify whether it is member-managed or manager-managed, and list the names and roles of the managers if applicable.

- Outline the voting rights of members. This includes how votes are allocated, what constitutes a majority, and the process for making major decisions.

- Describe the process for admitting new members, including any required approval by existing members and contributions for entry.

- Include provisions for the allocation of profits and losses. Typically, this is proportionate to a member’s ownership percentage unless stated otherwise.

- Detail the procedures for member withdrawal, LLC dissolution, and asset distribution upon dissolution. These provisions should address the steps to follow if a member leaves or if the LLC is being wound down.

- Sign and date the agreement. All members of the LLC should sign the document to indicate their agreement and acknowledgment of the terms.

Once the operating agreement is filled out, it does not need to be filed with the state. However, keeping it on file with your business records and ensuring all members have a copy is essential for future reference. The document can be amended as needed, allowing the business to adapt to new circumstances or to incorporate changes agreed upon by its members.

FAQ

What is an Operating Agreement in Virginia?

An Operating Agreement in Virginia is a legal document that outlines the operating procedures, financial arrangements, and ownership details of a Limited Liability Company (LLC). It serves as a guide for decision-making and conflict resolution within the LLC. While it is not legally required in Virginia, having an Operating Agreement is highly recommended to ensure clarity and protection for all members involved.

Why is an Operating Agreement important for a Virginia LLC?

An Operating Agreement is crucial for a Virginia LLC for several reasons:

- Clarity of Financial and Operational Procedures: It details the guidelines for the LLC's daily operations, including financial management and distribution of profits and losses.

- Legal Protection: The agreement can provide protection to the members by limiting their personal liability.

- Conflict Resolution: It outlines processes for handling disputes among members, saving the LLC from potential legal battles.

- Flexibility: LLCs are prized for their operational flexibility, and an Operating Agreement allows members to customize their operating rules.

- State Regulations: It helps ensure that the LLC's practices are in compliance with Virginia's specific legal requirements and regulations.

What should be included in a Virginia Operating Agreement?

While each Virginia Operating Agreement can be unique, certain essential elements are commonly included:

- The LLC's name and primary address.

- The names and addresses of the members.

- The LLC's duration, if not perpetual.

- The purpose of the business.

- How new members may be admitted.

- The capital contributions of each member.

- Details on profit sharing and loss distribution.

- Management structure and voting rights of the members.

- The procedures for meetings and taking votes.

- Guidelines for amending the Operating Agreement.

- The dissolution process for the LLC.

Do I need a lawyer to create an Operating Agreement in Virginia?

No, you do not need a lawyer to create an Operating Agreement in Virginia; however, consulting with one is strongly recommended. A lawyer can ensure that your Operating Agreement is comprehensive and complies with Virginia state law, potentially saving you from future legal and financial issues. They can also provide tailored advice based on your LLC's specific needs.

How do I make changes to an Operating Agreement in Virginia?

To make changes to an Operating Agreement in Virginia, follow these general steps:

- Review the current Operating Agreement to understand the existing provisions for amendments. Most agreements require a vote or consensus among members.

- Propose the changes to all members in writing, outlining the reasons and benefits of the proposed amendments.

- Hold a meeting with all members to discuss and vote on the amendments, as required by your Operating Agreement.

- Once the amendments are approved, document the changes and have all members sign the revised Operating Agreement.

- Store the updated document securely with your other official LLC records.

How does an Operating Agreement impact the relationship with banks, investors, and other external parties?

An Operating Agreement can significantly impact an LLC's relationship with banks, investors, and other external parties in several ways:

- Investors may review the Operating Agreement to understand the structure of the LLC, the roles of members, and how decisions are made before committing funds.

- Vendors and partners may also request to see the Operating Agreement to establish trust and verify the legitimacy of the business.

- Having a well-drafted Operating Agreement demonstrates professionalism and can offer more confidence to external parties about the LLC's stability and governance.

Common mistakes

When setting up an LLC in Virginia, completing the Operating Agreement is a critical step that ensures the smooth operation and management of the business. However, it's common for individuals to encounter pitfalls during this process. Below are nine frequent mistakes made when filling out the Virginia Operating Agreement form:

Failing to tailor the agreement to the specific needs of the business. A generic template might not cover unique aspects or future growth considerations.

Not defining the management structure clearly. Whether the LLC will be member-managed or manager-managed needs to be specified to prevent conflicts.

Overlooking the detailing of member contributions. It's vital to explicitly state each member's capital contribution to avoid future disputes.

Ignoring how profits and losses will be distributed. The agreement should detail the methodology to ensure expectations are managed.

Omitting procedures for adding or removing members. As businesses evolve, the membership may change, so a process should be in place.

Forgetting to outline the process for dissolving the business. The agreement should include steps for a potential winding-up to prevent legal complications.

Not updating the agreement as the business grows. It's not uncommon for business needs to change, and the agreement should reflect that evolution.

Sidestepping dispute resolution methods. Highlighting a mechanism for resolving internal conflicts can save significant time and resources.

Misunderstanding the importance of the Operating Agreement. Some might view it as unnecessary paperwork, not realizing its potential in legal protection and operational clarity.

Being mindful of these common errors and taking steps to prevent them can save business owners from possible legal headaches and ensure their LLC operates as smoothly as possible. Drafting a comprehensive and clear Operating Agreement is foundational to setting the stage for future success.

Documents used along the form

When forming a business entity such as a Limited Liability Company (LLC) in Virginia, the Operating Agreement is a fundamental document that outlines the ownership structure and operational procedures of the company. However, it's not the only document that business owners should be aware of. There are several other forms and documents often used in conjunction with the Virginia Operating Agreement form to ensure that all legal, operational, and financial aspects of the business are adequately addressed. Below is a list and brief description of these forms and documents.

- Articles of Organization: This is a critical document required to form an LLC in Virginia officially. It includes essential information about the LLC, such as its name, principal address, registered agent, and whether it will be managed by its members or managers.

- Employer Identification Number (EIN) Application: An EIN, also known as a Federal Tax Identification Number, is required for an LLC to open a bank account and hire employees. It is obtained from the IRS.

- Business License Application: Depending on the nature of the business and its location within Virginia, the LLC may need to obtain one or more business licenses to operate legally.

- Annual Report Submission Form: Many states require LLCs to submit an annual report to update their operational and contact information. In Virginia, this is known as the Annual Registration Fee.

- Operating Agreement Amendment Form: In case there are changes in the LLC's operation or its members, this form is used to officially record and incorporate those changes into the existing Operating Agreement.

- Membership Certificates: These certificates serve as a physical representation of each member's ownership interest in the LLC, similar to stock certificates in a corporation.

- Membership Interest Assignment Agreement: If a member of the LLC wishes to transfer their ownership interest to another person, this document outlines the terms and conditions of the transfer.

- Meeting Minutes Template: Even though LLCs in Virginia are not required to hold meetings, maintaining records of significant decisions made by its members or managers helps in operational transparency and legal compliance.

- Dissolution Form: Should the members decide to close the business, this form is used to officially dissolve the LLC in accordance with Virginia law.

These documents complement the Virginia Operating Agreement, each serving a unique purpose in the life cycle of an LLC. Properly completing and submitting these forms when necessary helps in maintaining the LLC's legal compliance, managing its operations smoothly, and ensuring the protection of its members' assets and interests. It's always a good idea to consult with legal professionals to make sure all of your paperwork is in order.

Similar forms

The Virginia Operating Agreement form is similar to the Articles of Organization in several ways. Both documents are crucial for establishing a business entity, but they serve different purposes. The Articles of Organization officially register the business with the state, making its existence legal and public. On the other hand, the Operating Agreement outlines the internal operations and procedures, defining the roles, responsibilities, and shares of each member. This agreement offers a clear guide for managing the business, highlighting the importance of both documents in the foundation of a company.

Additionally, the Virginia Operating Agreement shares similarities with Corporate Bylaws. While Operating Agreements are used by limited liability companies (LLCs), Corporate Bylaws fulfill a similar purpose within corporations. Both set forth the governing practices, policies, and structure of the business. They detail the decision-making processes, outline the distribution of profits and losses, and set conditions for adding or removing members or shareholders. By creating a framework for operations and conflict resolution, these documents help ensure smooth business operations.

Furthermore, the Virginia Operating Agreement resembles a Partnership Agreement in certain aspects. Both are internal documents that lay out the workings of the business, though the Partnership Agreement is used by partnerships instead of LLCs. These agreements define the responsibilities and profit shares of the partners, dictate the management structure, and explain procedures for resolving disputes among partners. The main similarity lies in their role in setting expectations and providing a roadmap for business operations, making them essential for the respective business types they serve.

Dos and Don'ts

When preparing the Virginia Operating Agreement form, members of a Limited Liability Company (LLC) should approach the process with a clear understanding of what is expected to ensure both legal compliance and the protection of all parties involved. Below, find essential guidelines split into actions you should take and those best avoided to facilitate a smooth documentation process.

What You Should Do

- Ensure all members' information is accurately and fully included. Details such as names, addresses, and contribution amounts should be detailed without any omissions to prevent future disputes or confusion.

- Review Virginia's specific requirements for LLC Operating Agreements. State laws vary, and adherence to Virginia's regulations is crucial for the validity of your document.

- Consider legal consultation. Even if the process seems straightforward, obtaining advice from a legal expert can provide insights into complex legal language and help tailor the agreement to your specific business needs.

- Keep the document accessible to all members of the LLC. Once completed, share the Operating Agreement with all members, ensuring that everyone understands their rights, responsibilities, and the operational structure of the company.

What You Shouldn't Do

- Don’t skip discussing and documenting any potential scenarios or disputes. Thinking ahead can help manage future disagreements or operational challenges by providing clear guidelines within the agreement.

- Avoid using vague language. Clarity in the Operating Agreement prevents misunderstandings and establishes a solid foundation for business operations.

- Resist the temptation to use a one-size-fits-all template without customization. While templates can provide a good starting point, tailoring the document to fit the specific needs of your LLC is vital.

- Do not forget to update the agreement as necessary. As your business grows and evolves, revisiting and revising the Operating Agreement ensures it remains relevant and accurate.

Misconceptions

When it comes to the Virginia Operating Agreement form, there are several misconceptions that often circulate among business owners and entrepreneurs. Clearing up these misunderstandings is vital for ensuring that your business operates smoothly and complies with Virginia state laws. Below, we explore ten common misconceptions about the Virginia Operating Agreement form.

It's Mandatory for Every Business: In Virginia, not every business is legally required to have an Operating Agreement. While highly recommended, especially for LLCs (Limited Liability Companies), it's not a mandatory document for all business types.

One Size Fits All: There is no one-size-fits-all Operating Agreement. Every business is unique, and the Operating Agreement should be tailored to suit its specific needs, objectives, and the requirements of Virginia law.

Only for Multi-member LLCs: Even if you are a sole proprietor of an LLC, an Operating Agreement can be extremely beneficial. It provides clarity on the operation of the business and helps in establishing the structure of your single-member LLC.

Legal Representation Not Necessary: While it's possible to draft an Operating Agreement without legal help, consulting with a legal professional can ensure that the document is comprehensive, complies with Virginia laws, and adequately protects your interests.

It’s Only About Ownership and Profit Shares: An Operating Agreement covers more than just the ownership and profit shares amongst members. It also addresses operational procedures, member roles and responsibilities, dispute resolution methods, and more.

Unalterable Once Signed: Operating Agreements should evolve along with your business. In Virginia, members can amend the Agreement as the business grows and changes, provided all members agree to the amendments and they are documented properly.

Only Useful if Disputes Arise: While an Operating Agreement is indeed essential in resolving disputes, its value extends beyond that. It serves as a foundational document that guides daily operations, decision-making, and strategic planning.

It’s Public Record: Operating Agreements in Virginia are private documents. Unlike the Articles of Organization, an Operating Agreement does not need to be filed with the state and is not part of the public record, ensuring privacy for your business operations.

No Standard Format: Although Operating Agreements are flexible and customizable, they should still follow a standard format to ensure all critical aspects of your business are covered. This typically includes sections on membership, management, finances, and operations.

Irrelevant for Tax Purposes: Contrary to this belief, an Operating Agreement can play a significant role in your tax planning and liabilities. It can dictate how the business is taxed and outline the financial arrangements among members, influencing overall tax obligations.

Understanding these misconceptions about the Virginia Operating Agreement form can help business owners ensure that their company not only complies with legal requirements but is also positioned for success. Customizing your Operating Agreement to fit your business's needs, consulting with legal professionals, and keeping the document updated can provide a solid foundation for your business operations.

Key takeaways

The Virginia Operating Agreement form is a crucial document for anyone who is establishing or running a Limited Liability Company (LLC) within the state of Virginia. It outlines the operational procedures, financial decisions, and overall structure of the business. Although the form's content is not provided, there are several key takeaways regarding its completion and utilization:

- Not Legally Required, But Highly Recommended: In Virginia, creating an Operating Agreement for your LLC is not mandated by law. However, having one is strongly advised as it provides a clear framework for the business's operations and decision-making processes.

- Provides Legal Protection: An Operating Agreement can offer legal protection to the members of the LLC. It helps in distinguishing personal liabilities from those of the business, which can be indispensable in legal matters.

- Clarifies Verbal Agreements: This document puts all verbal agreements between members into writing, thus avoiding misunderstandings and conflicts regarding the operations and financial arrangements of the LLC.

- Flexible Structure: The Operating Agreement allows LLC members to structure their business in a way that best suits their needs, rather than adhering strictly to the default state laws governing LLCs.

- Mandatory for Multi-Member LLCs: For LLCs with more than one member, an Operating Agreement is essential for clarifying each member's investment, responsibilities, profit shares, and voting rights, thus ensuring smooth business operations.

- It Should Be Updated Regularly: As the business grows and evolves, so should the Operating Agreement. Regular updates will ensure that the document accurately reflects current business operations and member agreements.

- Must Be Compliant with Virginia Laws: While drafting the Operating Agreement, it's crucial to ensure that all provisions are in compliance with relevant Virginia laws to avoid any legal issues.

Investing the time to create and maintain a comprehensive Operating Agreement can significantly contribute to the clarity, stability, and success of an LLC in Virginia. It serves as a solid foundation upon which business operations and relationships can be built and maintained effectively.

Other Popular Virginia Templates

Sample Separation Agreement Virginia - It includes a detailed arrangement for handling taxes, including claims and liabilities during separation.

Do Not Resuscitate Form Virginia - A statement of intent from a patient, refusing specific medical treatments like mechanical ventilation or intubation.

Do You Need a Bill of Sale in Virginia - An official record that captures the agreement of selling an RV, including price and identification details.