Attorney-Approved Promissory Note Template for Virginia

In the realm of financial agreements, the Virginia Promissory Note form stands out as a pivotal document that embodies the essence of trust between parties, typically involving a borrower and a lender. This form, adhering to the legal framework set forth by the Commonwealth of Virginia, meticulously outlines the expectations, obligations, and conditions underpinning the monetary exchange. It is meticulously crafted to ensure clarity and enforceability, addressing critical facets such as the loan amount, interest rates, repayment schedule, and potential collateral. Additionally, it serves a dual purpose by not only providing a legal foundation for recovering funds lent but also offering a borrower the opportunity to demonstrate credibility and trustworthiness. Intriguingly, it encapsulates both the rigidity of a contract and the flexibility to accommodate the unique aspects of the financial agreement it represents. As such, this form is a quintessential tool in the landscape of personal and business finance within Virginia, safeguarding the interests of all involved parties while fostering a culture of accountability and financial integrity.

Virginia Promissory Note Example

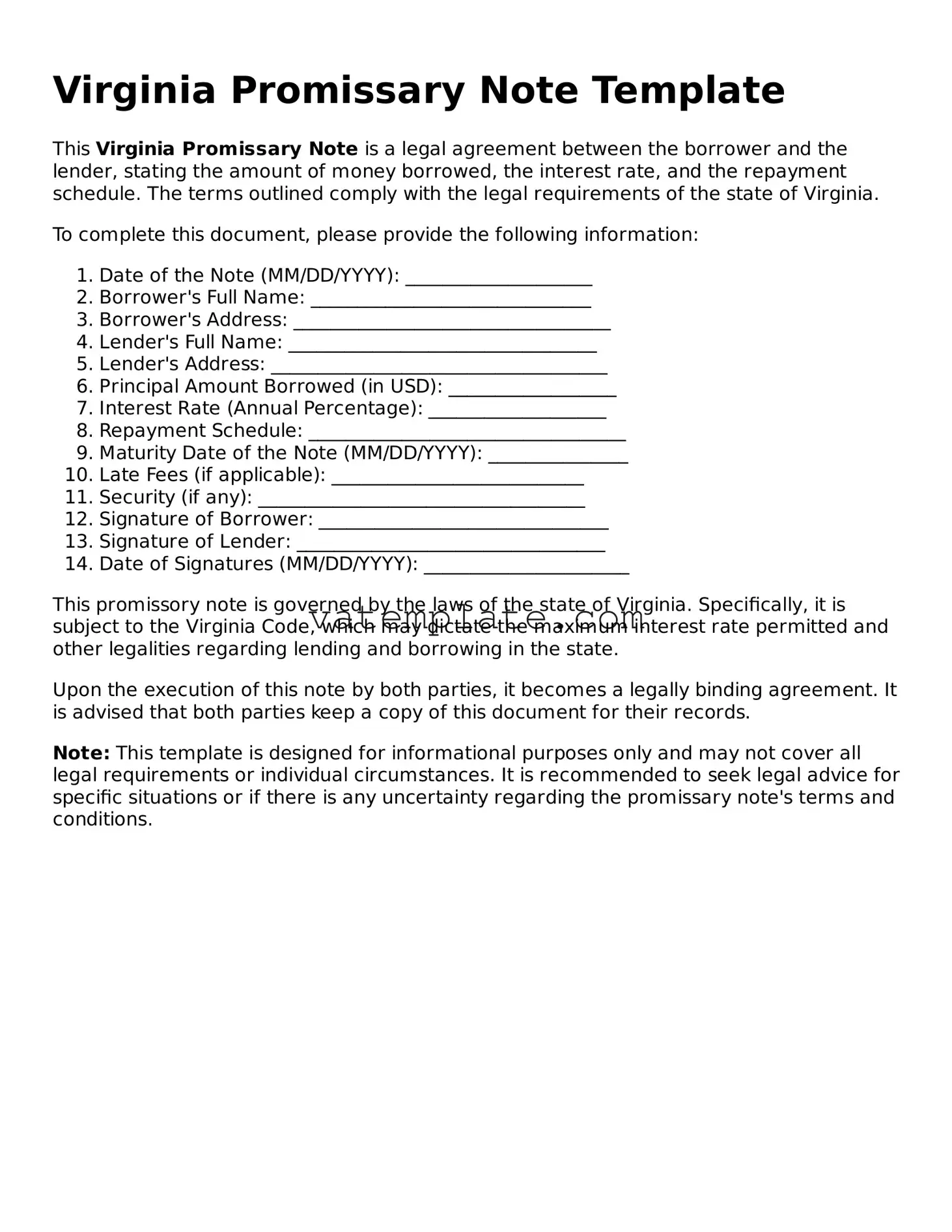

Virginia Promissary Note Template

This Virginia Promissary Note is a legal agreement between the borrower and the lender, stating the amount of money borrowed, the interest rate, and the repayment schedule. The terms outlined comply with the legal requirements of the state of Virginia.

To complete this document, please provide the following information:

- Date of the Note (MM/DD/YYYY): ____________________

- Borrower's Full Name: ______________________________

- Borrower's Address: __________________________________

- Lender's Full Name: _________________________________

- Lender's Address: ____________________________________

- Principal Amount Borrowed (in USD): __________________

- Interest Rate (Annual Percentage): ___________________

- Repayment Schedule: __________________________________

- Maturity Date of the Note (MM/DD/YYYY): _______________

- Late Fees (if applicable): ___________________________

- Security (if any): ___________________________________

- Signature of Borrower: _______________________________

- Signature of Lender: _________________________________

- Date of Signatures (MM/DD/YYYY): ______________________

This promissory note is governed by the laws of the state of Virginia. Specifically, it is subject to the Virginia Code, which may dictate the maximum interest rate permitted and other legalities regarding lending and borrowing in the state.

Upon the execution of this note by both parties, it becomes a legally binding agreement. It is advised that both parties keep a copy of this document for their records.

Note: This template is designed for informational purposes only and may not cover all legal requirements or individual circumstances. It is recommended to seek legal advice for specific situations or if there is any uncertainty regarding the promissary note's terms and conditions.

Document Details

| Fact | Detail |

|---|---|

| Type of Document | Promissory Note |

| Purpose | It is used to document a loan between two parties, outlining the terms for the repayment of said loan. |

| Governing Law | Virginia promissory notes are governed by Virginia's state laws, including statutes relating to interest rates and the statute of limitations on debt. |

| Interest Rate Limits | In Virginia, the legal maximum interest rate unless otherwise agreed upon is 8% per annum. The parties may agree in writing to a rate exceeding 12% per annum. |

| Statute of Limitations | For written contracts, including promissory notes, the statute of limitations in Virginia is 5 years. This means that any lawsuit to recover the debt must be filed within 5 years of the breach of the note's terms. |

Steps to Filling Out Virginia Promissory Note

Completing the Virginia Promissory Note form is a crucial step in formalizing the agreement between a borrower and lender. It outlines the repayment terms, interest rates, and other conditions related to a loan. Carefully filling out this form ensures clarity and legal enforceability of the financial arrangement. The following instructions are designed to guide through this important process smoothly.

- Start by stating the date of the promissory note agreement at the top of the form.

- Enter the full legal names and addresses of the borrower and the lender in the designated sections.

- Specify the principal loan amount in U.S. dollars.

- Detail the interest rate per annum. Ensure this rate complies with Virginia’s legal maximum to avoid usury violations.

- Choose the type of repayment schedule (e.g., lump sum, installments, interest only) and specify the terms. Include the number of payments, frequency (monthly, quarterly), and start date of repayment.

- Include any agreed upon prepayment terms. Clarify if the borrower is allowed to pay the loan off early without facing penalties.

- If applicable, describe the security or collateral that will be used to secure the loan.

- Detail the actions to be taken in case of a default, specifying any grace period for late payments and the consequences of failing to repay the loan.

- Both the borrower and the lender should carefully review the completed form. It's essential to ensure all the information is accurate and reflective of the agreement.

- Finally, the borrower and the lender must sign and date the form. Witness signatures might be required depending on the legal requirements in Virginia.

After these steps are completed, the Virginia Promissory Note form will be fully executed, making it a legally binding agreement. It's advisable for both parties to keep a copy of the signed form for their records. This document serves as a formal record of the loan and the terms under which it was provided, helping to protect the interests of both the borrower and the lender.

FAQ

What is a Virginia Promissory Note?

A Virginia Promissory Note is a legal document where a borrower promises to repay a loan to a lender according to agreed terms. It outlines the loan's amount, interest rate, repayment schedule, and any other conditions related to the borrowing and repayment process. This document is binding and enforceable in the state of Virginia.

Who needs to sign the Promissory Note?

Both the borrower and the lender must sign the Virginia Promissory Note. In some cases, a co-signer may also be required to sign, especially if the borrower's creditworthiness is in question. The co-signer guarantees that the loan will be repaid if the borrower fails to make payments.

What are the legal requirements for a Promissory Note in Virginia?

In Virginia, a Promissory Note must include:

- The full names and addresses of both the borrower and the lender.

- The principal loan amount.

- The interest rate, which must comply with Virginia's usury laws.

- A clear repayment schedule, including due dates and amounts.

- Any collateral securing the loan, if it is a secured note.

- The signatures of the involved parties.

Is a Promissory Note the same as a loan agreement?

No, a Promissory Note is not the same as a loan agreement, though they are related documents. A Promissory Note is a promise by the borrower to repay the loan under the specified terms. A loan agreement is more comprehensive and may include additional clauses about the obligations and rights of each party, representations, warranties, and conditions of the loan.

Can a Virginia Promissory Note be modified?

Yes, a Virginia Promissory Note can be modified, but any changes must be agreed upon by both the borrower and the lender. The modifications should be made in writing, and both parties should sign the updated document to avoid future disputes.

What happens if the borrower fails to repay the loan as agreed?

If the borrower fails to repay the loan according to the agreed terms in the Promissory Note, the lender has the right to pursue legal action to recover the debt. This may include initiating a lawsuit to enforce the document. If the note is secured with collateral, the lender might also have the right to take possession of the collateral as outlined in the document.

Common mistakes

When it comes to legal documents, the devil is often in the details. The Virginia Promissory Note form is no exception. Whether it's for personal loans or business dealings, this form serves as a crucial agreement between a lender and a borrower. However, people frequently stumble in a few common areas while filling it out. Below, we discuss six key mistakes often made, providing insights to help navigate these pitfalls more effectively.

- Not specifying the interest rate. Sometimes, individuals neglect to state the interest rate explicitly. This omission can lead to confusion or disputes about how much extra the borrower owes beyond the principal amount.

- Failing to outline the repayment schedule. It's essential to detail when payments are due, be it monthly, quarterly, or on another basis. Without this, enforcing timely payments becomes challenging.

- Omitting the late fee details. Should a borrower miss a payment, clearly defined late fees ensure they are aware of the consequences. Skipping this step can lead to disagreements over additional charges.

- Forgetting to include the names and addresses of all parties. This may seem like a minor detail, but it’s vital for legal clarity. The document should state who is involved and how they can be contacted.

- Ignoring the governing state law provision. Since laws can vary significantly by state, particularly regarding interest rates and debt collection, specifying that Virginia law governs the note is crucial for clarity and enforcement.

- Neglecting to have the document witnessed or notarized. While not always a legal requirement, having a third party witness or notarize the signing can add a layer of validity and deter potential disputes.

Beyond these errors, it's also useful to present a checklist that helps ensure all your bases are covered:

- Confirm that all personal information is accurate and complete.

- Double-check the interest rate and repayment terms for clarity and fairness.

- Review the document with all parties involved before signing, to ensure mutual understanding and agreement.

- Make copies of the signed document for all parties to keep as a record.

To avoid these common mistakes, attention to detail and a thorough understanding of both the document and the implications of each clause are paramount. By doing so, you can secure a legally binding promissary note that protects both lender and borrower throughout the duration of the loan.

Documents used along the form

When dealing with financial agreements, such as a Virginia Promissory Note, it's common to encounter several other forms and documents that help ensure a comprehensive and secure transaction. These documents serve various purposes, from securing the loan to detailing the terms of repayment. Understanding these accompanying documents can provide a clearer view of the borrowing process and help protect the interests of all parties involved.

- Loan Agreement: This is a detailed contract between the borrower and lender that outlines the terms and conditions of the loan. It typically includes the amount of money being lent, the interest rate, repayment schedule, and what happens in case of a default.

- Security Agreement: If the loan is secured, this document provides the lender with a security interest in a specific asset of the borrower. It describes the collateral that secures the loan, ensuring the lender can seize the asset if the loan is not repaid.

- Guaranty: A guaranty is a promise by a third party, known as a guarantor, to pay the loan if the original borrower fails to do so. This additional security helps lenders by providing another means of repayment.

- Amortization Schedule: This is a table that breaks down the loan payments over time, showing how much of each payment goes toward the principal amount and how much toward interest. It provides a clear timeline of the debt repayment.

- Mortgage: In the case of real estate loans, a mortgage document is used to secure the loan with the purchased property as collateral. It outlines the legal terms under which the property is mortgaged to the lender.

- Deed of Trust: Similar to a mortgage, a deed of trust is used in some states, including Virginia, as a means of securing a real estate loan. It involves a trustee, who holds the property title until the loan is fully repaid.

- Promissory Note Endorsement: This is an addition to the original promissory note where the holder can transfer their rights to another party, effectively endorsing over the note and the rights to collect under it.

- Release of Promissory Note: Once the loan is fully repaid, this document is issued by the lender to officially release the borrower from their obligations under the promissory note. It serves as proof that the debt has been satisfied.

The promissory note is just the beginning of a financial journey that involves careful documentation and clear communication between borrower and lender. By familiarizing oneself with these associated documents, individuals can navigate their financial dealings with greater confidence and security, ensuring all legal and personal interests are well protected.

Similar forms

The Virginia Promissory Note form is similar to other loan agreements and IOUs, although it possesses distinct features that set it apart. These documents, including the Virginia Promissory Note, play pivotal roles in formalizing financial transactions between parties, ensuring clarity and enforceability. They aim to mitigate risks and foster trust, yet their applicability and formalities differ, catering to a range of needs from casual loans to detailed financial agreements.

Bearing resemblance to a generic loan agreement, the Virginia Promissory Note outlines the amount of money borrowed, the interest rate, and the repayment terms. However, the promissory note is typically more straightforward and less comprehensive. Loan agreements often include detailed provisions regarding the consequences of default, collateral security, and the obligations of guarantors. In contrast, promissory notes focus on the essential terms, making them suitable for less complex transactions where a detailed elaboration of terms is not necessary. This distinction allows individuals and entities to choose the most appropriate document for their needs, balancing thoroughness with simplicity.

Similarly, an IOU (I Owe You) shares common ground with the Virginia Promissory Note by acknowledging a debt owed. Nonetheless, the promissory note goes a step further by specifying repayment terms, including the repayment schedule, interest rate, and due date. An IOU, conversely, is a simpler acknowledgment of debt without the detailed repayment terms, often used in informal situations or as a preliminary acknowledgment of debt before formalizing the agreement. Therefore, while both documents signify acknowledgment of debt, the Virginia Promissory Note offers a more comprehensive framework for repayment, legally fortifying the lender's position in case of disputes.

Dos and Don'ts

Filling out a Virginia Promissory Note form is a critical process that involves a clear agreement between the borrower and the lender regarding the loaned amount, the interest rate, and the repayment schedule. It is a legal document that binds both parties to the agreed terms and conditions, hence, it’s crucial to approach this task with diligence and thoroughness. Below are essential dos and don'ts to guide you through the process:

Things You Should Do

- Review state laws: Before filling out the form, familiarize yourself with Virginia's specific laws regarding promissory notes to ensure compliance and understand your rights and obligations.

- Include all necessary details: Clearly state the full names and addresses of both the borrower and the lender, loan amount, interest rate, repayment schedule, and any collateral securing the loan.

- Specify the interest rate: Make sure to specify the agreed-upon interest rate, ensuring it adheres to Virginia’s usury laws to avoid legal issues.

- Outline the repayment schedule: Detail the start date, frequency of payments (monthly, quarterly, annually), and the due date for the final payment to avoid any ambiguity.

- Sign in the presence of a witness or notary: Though not always required, having the signatures witnessed or notarized can add a layer of validity and enforceability to the document.

- Keep copies for both parties: After signing, ensure both the borrower and the lender retain a copy of the promissory note for their records.

- Consult with a professional: Consider having a legal expert review the document before finalization to ensure that it meets all legal requirements and protects your interests.

Things You Shouldn't Do

- Leave blank spaces: Do not leave any sections blank; this could lead to alterations or misunderstandings later on. If a section does not apply, write "N/A".

- Ignore the interest rate: Failing to specify the interest rate can lead to it being set at the legal maximum or interpreted unfavorably by a court.

- Omit the repayment terms: Avoid vague terms. Clearly outline the repayment schedule to prevent disputes on when or how the lender expects to be repaid.

- Forget to include a late payment policy: Specify any late fees and grace periods to manage expectations and enforce timely payments.

- Sign without reading: Never sign the promissory note without reading and understanding every part of it to avoid agreeing to unfavorable terms.

- Skip having witnesses or notarization: Though it might not be compulsory, skipping this step could undermine the document's legal strength in case of a dispute.

- Assume verbal agreements are enforceable: Always include all agreements in writing in the promissory note, as verbal agreements are challenging to enforce and prove in court.

Misconceptions

When dealing with the Virginia Promissory Note form, several misconceptions can lead to confusion. Understanding these can help avoid common mistakes when creating or signing this type of document.

Only formal loans require a Promissory Note. Many people believe that promissory notes are only necessary for formal loan arrangements, such as those with banks or financial institutions. However, promissory notes are useful for any lending situation, including personal loans between friends or family members, to provide a clear record of the loan's terms and conditions.

Verbal agreements are just as binding. While verbal agreements can be legally binding, proving the terms of the agreement and ensuring enforcement can be exceptionally challenging without written documentation. A promissory note serves as a tangible agreement that details the borrower's promise to repay, making it easier to enforce than a verbal contract.

All Promissory Notes must be notarized to be valid. It's a common misunderstanding that for a promissory note to be legal in Virginia, it must be notarized. While notarization can add an extra layer of authenticity and help protect against claims of forgery, it is not generally a legal requirement for the validity of a promissory note in Virginia.

There's no need to include interest rates if the loan doesn't have one. Even if no interest is being charged on the loan, it should still be explicitly stated in the promissory note. This clarification ensures both parties understand the agreement fully and helps prevent any potential disputes about the terms of the loan. Documenting a 0% interest rate demonstrates the agreement was indeed for no interest, providing clarity and legal protection for both parties involved.

Key takeaways

When filling out and using the Virginia Promissory Note form, individuals should keep several key details in mind to ensure that the document is legally binding and serves its intended purpose effectively. Here are seven crucial takeaways:

- Understand the Types: Knowing whether you need a secured or unsecured promissory note is vital. A secured note is backed by collateral that the lender can claim if the borrower defaults, while an unsecured note is not protected by collateral.

- Clearly Identify the Parties: The names and addresses of the borrower and lender should be explicitly mentioned to avoid any confusion about the parties involved.

- Specify the Loan Amount and Terms: The exact amount being lent and the repayment terms, including the interest rate, should be stated clearly. This helps in ensuring that there is no ambiguity regarding the amount owed.

- Detail the Repayment Schedule: A detailed repayment schedule, including due dates and the amount due at each period, should be included. This schedule will guide the borrower on when and how much to pay, preventing misunderstands.

- Include the Interest Rate: The interest rate must be clearly stated and agreed upon by both parties. It's important to note that Virginia law might limit the maximum interest rate chargeable.

- Note Any Prepayment Terms: If the borrower is allowed to repay the loan early, any terms or penalties associated with prepayment should be mentioned.

- Understand the Legal Consequences: Both parties should know the legal obligations and consequences involved, including what happens in the case of a default. This might include late fees, penalties, and the legal recourse available to the lender.

It's essential for both parties to review the Virginia Promissory Note form thoroughly before signing. For further legal assurance, consulting with a legal professional can ensure that the form complies with Virginia laws and that the rights and responsibilities of both parties are adequately protected.

Other Popular Virginia Templates

Making a Will in Virginia - A Last Will and Testament can address debts and taxes, providing instructions for their payment from the estate.

Sample Bill of Sale for Car Virginia - Filling out this form accurately helps to ensure all important vehicle and sale details are documented, minimizing the risk of future legal complications.

Example of a Quit Claim Deed Completed Virginia - It’s an efficient way to handle property transfers in non-sale situations, where a comprehensive guarantee of title is not necessary.