Fill Out a Valid R 5 Virginia Template

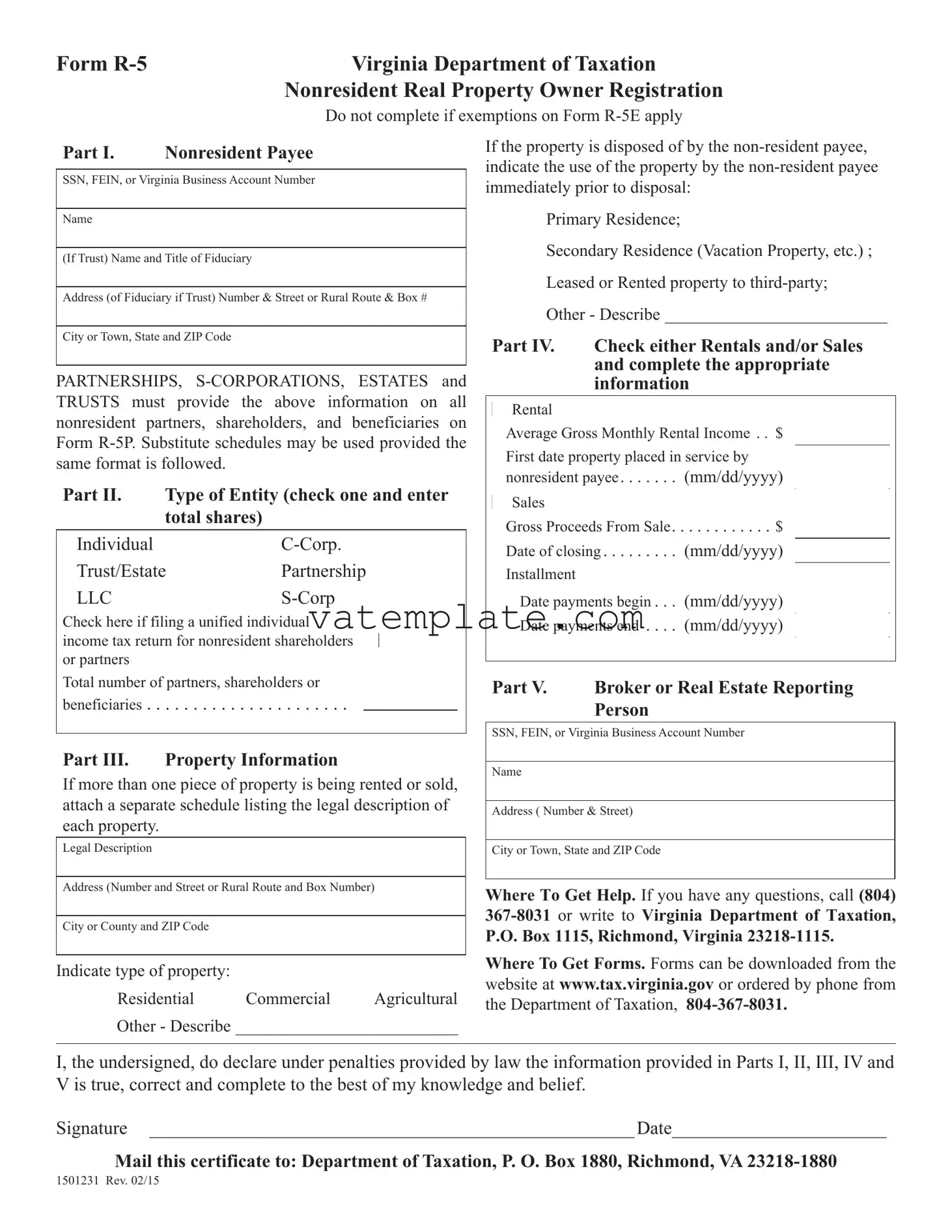

In navigating the intricacies of real estate transactions, particularly those involving nonresident owners, the Virginia Department of Taxation provides a critical tool through the Form R-5. This form, officially titled "Nonresident Real Property Owner Registration," is designed to streamline the regulatory requirements for nonresident individuals and entities owning real property in Virginia. It captures essential information about the property owner(s), the nature of the property, and detailed transactional data for rentals or sales activities. Additionally, the form mandates the disclosure of financial identifiers and the legal description of the property in question, offering a comprehensive view of the ownership and fiscal responsibilities associated with nonresident-owned real estate. Specific sections are dedicated to various types of entities, including individuals, corporations, trusts, estates, partnerships, and limited liability companies, ensuring a tailored approach to each ownership structure. The form also outlines the obligations of brokers and real estate reporting persons managing or facilitating these real estate transactions, emphasizing compliance with registration requirements and facilitating accurate tax reporting. Penalties are prescribed for non-compliance, underlining the importance of timely and accurate submission of the Form R-5 to the Commonwealth of Virginia. This procedural necessity serves not only as a regulatory compliance measure but also as a facilitator of clear, organized transactions in the state's vibrant real estate market.

R 5 Virginia Example

Form |

Virginia Department of Taxation |

|

Nonresident Real Property Owner Registration |

|

Do not complete if exemptions on Form |

Part I. Nonresident Payee

SSN, FEIN, or Virginia Business Account Number

Name

(If Trust) Name and Title of Fiduciary

Address (of Fiduciary if Trust) Number & Street or Rural Route & Box #

City or Town, State and ZIP Code

PARTNERSHIPS,

Part II. Type of Entity (check one and enter total shares)

Individual |

|

Trust/Estate |

Partnership |

LLC |

Check here if filing a unified individual income tax return for nonresident shareholders or partners

Total number of partners, shareholders or beneficiaries. . . . . . . . . . . .

Part III. Property Information

If more than one piece of property is being rented or sold, attach a separate schedule listing the legal description of each property.

Legal Description

Address (Number and Street or Rural Route and Box Number)

City or County and ZIP Code

Indicate type of property: |

|

|

Residential |

Commercial |

Agricultural |

Other - Describe___________________________

Other - Describe___________________________

If the property is disposed of by the

Primary Residence;

Primary Residence;

Secondary Residence (Vacation Property, etc.) ;

Secondary Residence (Vacation Property, etc.) ;

Leased or Rented property to

Leased or Rented property to

Other - Describe___________________________

Other - Describe___________________________

Part IV. |

Check either Rentals and/or Sales |

|

and complete the appropriate |

|

information |

Rental

Rental

Average Gross Monthly Rental Income . . $

First date property placed in service by nonresident payee. . . . (mm/dd/yyyy)

Sales

Sales

Gross Proceeds From Sale. . . . . . . $ Date of closing. . . . . (mm/dd/yyyy) Installment

Date payments begin. . (mm/dd/yyyy) Date payments end . . . (mm/dd/yyyy)

Part V. Broker or Real Estate Reporting Person

SSN, FEIN, or Virginia Business Account Number

Name

Address ( Number & Street)

City or Town, State and ZIP Code

Where To Get Help. If you have any questions, call (804)

P.O. Box 1115, Richmond, Virginia

Where To Get Forms. Forms can be downloaded from the website at www.tax.virginia.gov or ordered by phone from the Department of Taxation,

I, the undersigned, do declare under penalties provided by law the information provided in Parts I, II, III, IV and V is true, correct and complete to the best of my knowledge and belief.

Signature _____________________________________________________ Date_______________________

Mail this certificate to: Department of Taxation, P. O. Box 1880, Richmond, VA

1501231 Rev. 02/15

Nonresident Real Property Owner Registration Instructions

General

Fee for preparation of Form

Rentals

Brokers (as defined in IRS Code Sec. 6045) managing Virginia rental properties must request registration from all existing clients.

Future clients must be requested to register when they engage the broker to manage rental property.

Brokers must file on behalf of nonresidential property owners (payees) who do not furnish the requested forms within 60 days. Brokers are only responsible for the information available in their records.

Nonresident owners previously registered may furnish subsequent brokers with a copy of current registration form in lieu of completing a new form. These copies do not need to be filed with the Department by the broker.

Nonresident owners of rental properties not managed by a broker also must comply with the registration requirement.

Sales

Real estate reporting persons (as defined in IRS Code Sec. 6045) must request registration forms from all nonresident sellers upon closings.

If a client does not complete the form at closings, the real estate reporting person must complete a form on the client’s behalf. Real Estate reporting persons are only responsible for information that is available in their files.

Sales exempt from federal and state income tax are also exempt from registration; an exemption certificate must be completed and given to the real estate reporting person.

Filing Information

Brokers and real estate reporting persons are required to transmit the registration forms by the 15th of the month following the month in which the closing occurred (sales) or the form was received from the nonresident property owner (rentals).

The penalty to the broker or real estate reporting person for failure to file is $50 per month up to a maximum of six months.

Nonresident payees are:

•Individuals who are not domiciled in Virginia or who do not live in Virginia for more than 183 days during a year;

•Corporations not organized under Virginia law;

•Estates and Trusts (1) which consists of real property belonging to a nonresident individual (or Decedent), or (2) that are being administered outside of Virginia

•Partnerships, Limited Liability Corporations, and

Completing the Form

Items not specifically mentioned below are self- explanatory on the form. Each section, Parts

If the nonresident payee does not use the services of a broker or real estate reporting person, Part V should not be completed. The nonresident payee should mail the Form

Gross Proceeds and Closing Date - The amount of gross proceeds and the closing date are the same as the information reported on Federal Form

Installment Sale - Generally - If at least one payment is to be received after the close of the taxable year in which the sale occurs (see IRS Code Sec. 453 (b)), list the dates payments will be made.

Form Properties

| Fact | Detail |

|---|---|

| Form Title | Form R-5 Virginia Nonresident Real Property Owner Registration |

| Purpose | To register nonresident owners of real property in Virginia for taxation purposes |

| Issued By | Virginia Department of Taxation |

| Fee | The maximum charge for completing the form is $10 |

| Required Filers | Nonresident individuals, corporations, estates and trusts, partnerships, LLCs, and S-Corporations owning real property in Virginia |

| Exemptions | Filers meeting certain conditions may use Form R-5E to claim exemptions |

| Governing Laws | Sections 6.1-2.23:2, 58.1-316, and 58.1-317 of the Code of Virginia |

| Filing Requirement for Brokers | Brokers managing rental properties must file this form on behalf of their nonresident clients if not submitted within 60 days |

| Filing Requirement for Real Estate Reporting Persons | Required to request and submit forms for nonresident sellers at property closing times |

| Penalty for Failure to File | $50 per month, up to a maximum of six months |

| Contact Information | Department of Taxation, P.O. Box 1115, Richmond, VA 23218-1115 |

Steps to Filling Out R 5 Virginia

Filling out the Form R-5 for the Virginia Department of Taxation is a crucial step for nonresident real property owners. This ensures compliance with state tax laws regarding rental or sale of property. Precise details must be provided to avoid any legal or financial repercussions. Follow these steps closely to ensure the form is completed accurately and submitted on time.

- Begin with Part I. Enter the nonresident payee's Social Security Number (SSN), Federal Employer Identification Number (FEIN), or Virginia Business Account Number, whichever is applicable.

- For trusts, input the name of the trust and the name and title of the fiduciary. Enter the fiduciary's address, including the number and street or rural route and box number, city or town, state, and ZIP code.

- In Part II, check the box that corresponds to the type of entity (Individual, C-Corp, Trust/Estate, Partnership, LLC, S-Corp). If filing a unified individual income tax return for nonresident shareholders or partners, check the indicated box. Enter the total number of partners, shareholders, or beneficiaries.

- For Part III, provide the property information. If there are multiple properties, attach a separate schedule with the legal description of each property. Include the property's legal description, address, city or county, ZIP code, and type of property (Residential, Commercial, Agricultural, or Other - with a description).

- Indicate the use of the property by the nonresident payee immediately prior to disposal: Primary Residence, Secondary Residence, Leased or Rented property, or Other - with a description.

- In Part IV, select either Sales and/or Rentals by checking the appropriate box and complete the information required:

- For Rentals, enter the Average Gross Monthly Rental Income and the first date the property was placed in service by the nonresident payee.

- For Sales, provide the Gross Proceeds From Sale and Date of Closing.

- If it's an Installment Sale, list the dates payments begin and end.

- Part V asks for the Broker or Real Estate Reporting Person’s details. This includes their SSN, FEIN, or Virginia Business Account Number, name, address, city or town, state, and ZIP code.

- Review the form thoroughly to ensure all information provided is true, correct, and complete. Sign at the bottom to declare the information's accuracy under penalties provided by law. Note the maximum fee allowed for completing this form is $10.

- Mail the completed form to the Department of Taxation at the provided address: P.O. Box 2390, Richmond, VA 23218-2390.

Upon completion and submission, the form facilitates the registration of nonresident owners with the Virginia Department of Taxation for properties being rented or sold. It is imperative to stay vigilant throughout the process to prevent any errors that could delay compliance or incur penalties.

FAQ

What is the Form R-5 in Virginia?

Form R-5 is a document required by the Virginia Department of Taxation, designed for nonresident real property owners to register their property. If you own real estate in Virginia but do not reside there, or if your business entity has nonresident partners, shareholders, or beneficiaries with property in Virginia, you're likely required to complete this form. However, there are exemptions detailed on Form R-5E.

Who needs to complete the Form R-5?

Nonresident payees such as individuals not living in Virginia for more than 183 days a year, corporations not organized under Virginia law, estates, and trusts administrated outside of Virginia, as well as partnerships, LLCs, and S-Corporations with nonresident members receiving income from Virginia property, are required to complete Form R-5. It's also important for brokers and real estate reporting persons managing or closing properties on behalf of nonresidents.

What is the maximum charge for completing the Form R-5?

The code of Virginia sets a limit on the fee for preparing Form R-5 at $10. This rule ensures that settlement agents cannot charge nonresident property owners excessively for complying with this registration requirement.

What information is required on the Form R-5?

The form collects details on the nonresident payee, the type of entity owning the property, specifics about the property including its use and income generated from it, and information regarding sales and/or rentals. Part V of the form, which collects broker or real estate reporting person information, should be completed only if the services of such professionals are used.

How do I submit Form R-5 to the Virginia Department of Taxation?

After duly completing the Form R-5, mail it to the Department of Taxation at the address provided at the bottom of the form: P.O. Box 2390, Richmond, VA 23218-2390.

What happens if a broker does not file the Form R-5 on behalf of a nonresident?

Brokers managing rental properties or real estate reporting persons handling closings for nonresidents are mandated to submit the Form R-5 by the 15th of the month following the month of closing (for sales) or form receipt (for rentals). Failure to file results in a $50 penalty per month, up to six months.

Are there any exemptions to filing Form R-5?

Yes, sales exempt from federal and state income tax do not require the submission of Form R-5. For these situations, an exemption certificate must be completed and given to the real estate reporting person. Details on exemptions can be found on Form R-5E.

What should I do if I have multiple rental properties in Virginia?

If you own more than one property, attach a separate schedule to Form R-5 listing the legal description of each property. This ensures that all owned properties are properly registered with the state.

Can the Form R-5 be completed by someone other than the property owner?

Yes, brokers or real estate reporting persons can complete the form on behalf of the nonresident property owner. Nonresident owners are also encouraged to furnish new brokers with a copy of their current registration to avoid duplicating the registration process.

Where can I get assistance or more information about Form R-5?

For further assistance, you can write to the Department of Taxation's Office of Customer Services at P.O. Box 1115, Richmond, VA 23218-1115, call at 804-367-8031, or visit the Virginia Department of Taxation website at www.tax.virginia.gov. For obtaining forms, the numbers to call are 804-236-2760 or 2761.

Common mistakes

Filling out Form R-5, the Nonresident Real Property Owner Registration form required by the Virginia Department of Taxation, appears straightforward at first glance. However, certain common mistakes can lead to complications or delays. Understanding these pitfalls can streamline the process for nonresident property owners. Here's a breakdown of five frequent missteps:

- Not providing information on all nonresident partners, shareholders, or beneficiaries. Part I of the form requires full details for partnerships, S-corporations, estates, and trusts on all nonresident entities. Failing to include this information or using incorrect formats might cause processing delays or requests for additional information.

- Incorrectly identifying the type of entity in Part II. The form segments property owners by entity type (individual, C-corp, trust/estate, etc.). A common mistake is misidentifying the entity type or inaccurately entering the total number of partners, shareholders, or beneficiaries, leading to confusion about the property's ownership structure.

- Omitting details in the Property Information section. Part III demands a comprehensive legal description and address of the property. Owners often neglect to attach a separate schedule for multiple properties or incorrectly describe the property type, impacting the department's ability to accurately assess and register the property.

- Inaccurate financial information in the Sales and/or Rentals section. Part IV necessitates specific financial details, including gross monthly rental income, property service dates, gross proceeds from sales, and installment sale data. Misrepresentations or inaccuracies here can affect tax obligations and lead to potential penalties.

- Overlooking the Broker or Real Estate Reporting Person section. When applicable, Part V must be completed with the contact information of the broker or real estate reporting person. Nonresident owners sometimes miss this requirement, especially if they are managing the property independently, but this section is crucial when brokers are involved in managing or selling the property.

Understanding these common errors and approaching the form with attention to detail can significantly streamline the registration process for nonresident property owners in Virginia. It's recommended to review all parts of the form thoroughly before submission, ensuring that all applicable sections are accurately filled to comply with Virginia tax laws.

Documents used along the form

When dealing with real estate transactions, especially concerning nonresident property owners in Virginia, the Form R-5 is crucial. However, this form often works alongside other forms and documents to ensure compliance and thoroughness in financial and legal matters. Understanding these related documents can streamline the process and offer clarity to those involved.

- Form R-5E: This form serves as the exemption certificate for nonresident real property owners. It's used when the sale or rental of the property does not necessitate the completion of Form R-5 due to specific exemptions outlined by Virginia law. This might include cases where the sale or income is already exempt from federal and state income tax.

- Form 1099-S: The Proceeds from Real Estate Transactions form is used to report the sale or exchange of real estate. For nonresident property owners who sell property in Virginia, the information regarding gross proceeds and the closing date on this form should match those reported on Form R-5. It is an essential document for tax reporting purposes and helps to ensure that all capital gains from the sale are accounted for correctly.

- Form R-5P: This form is for partnerships, S-corporations, estates, and trusts that have nonresident partners, shareholders, or beneficiaries. It captures the same information as Form R-5, but for all nonresident individuals involved. This ensures that each nonresident's share of income or proceeds from the real property is correctly registered and reported to the Virginia Department of Taxation.

- Schedule E (Form 1040): For individual property owners, Schedule E is used to report income and expenses from rental real estate. If a nonresident owns rental property in Virginia, this federal form complements the R-5 by detailing the income generated from the property. It helps in preparing accurate tax returns, especially when reporting rental income to both federal and state tax authorities.

The interplay between these documents ensures proper registration, tax compliance, and reporting for nonresident real property owners in Virginia. Each form collects different but complementary pieces of information, making the process transparent and streamlined for all parties involved. By understanding and utilizing these forms correctly, nonresident property owners can navigate the complexities of real estate transactions within Virginia efficiently and effectively.

Similar forms

The R-5 Virginia form, designed for Nonresident Real Property Owner Registration, shares similarities with several other documents crucial for tax and property management purposes. These documents include, but are not limited to, Federal Form 1099-S and IRS Form W-9. Each of these forms plays a unique role in the financial and legal processes related to property ownership and income reporting.

Starting with Federal Form 1099-S, this form is used to report proceeds from real estate transactions. Similarities with the R-5 Virginia form include the requirement to provide detailed information on the sale of properties, such as gross proceeds and the date of closing. Both forms are integral in ensuring accurate reporting of income or losses from real estate for tax purposes. While the R-5 focuses on the registration and acknowledgment of nonresident property owners in Virginia, Form 1099-S serves a broader role in capturing financial transactions for the IRS, making both crucial for comprehensive tax compliance.

Another document, the IRS Form W-9, Request for Taxpayer Identification Number and Certification, also shares similarities with the R-5 Virginia form. While the R-5 form collects identification information such as Social Security Number (SSN), Federal Employer Identification Number (FEIN), or a Virginia Business Account Number for property owners, Form W-9 is used to gather taxpayer identification information for individuals or entities engaging in financial transactions that necessitate reporting to the IRS. Both documents ensure that the correct taxpayer identification is on file to prevent tax evasion and to facilitate the proper reporting and withholding of taxes. The synergy between these forms highlights the interconnected nature of financial and tax-related regulatory requirements.

Dos and Don'ts

When it comes to filling out the R-5 Virginia Nonresident Real Property Owner Registration form, attention to detail and accuracy are your keys to a smooth submission process. Whether you're a broker, property owner, or a representative, understanding the nuances of this form can save you from unnecessary headaches. Here are six dos and don'ts to guide you through the completion and filing of this form:

- Do ensure all personal and property information is filled out completely. Omissions can result in processing delays or a denial of the registration.

- Do check the appropriate boxes under Part II to correctly indicate the type of entity you are registering as: Individual, C-Corp, Trust/Estate, Partnership, LLC, or S-Corp. Accurate classification is crucial for tax purposes.

- Do attach a separate schedule if you are registering more than one piece of property, as required in Part III. This ensures all properties are accurately accounted for and correctly registered under the nonresident owner's name.

- Don't leave the gross proceeds and closing date sections in Part IV blank if they are applicable. These figures must align with those reported on Federal Form 1099-S, if applicable, to ensure consistency with federal tax reporting.

- Don't neglect the requirement for installment sales. If applicable, accurately list the dates when payments will begin and end in Part IV to comply with IRS Code Sec. 453(b). This information is crucial for tax assessment purposes.

- Don't exceed the maximum charge allowed for completing this form, which is $10, as stated in the general instructions. Charging more than this amount is not permissible and is strictly monitored by the Virginia Department of Taxation.

Filling out the R-5 form with attention to these details not only fulfills a legal requirement but also facilitates a smoother real estate transaction process for nonresident owners. Whether you're dealing with rentals, sales, or managing multiple properties, the accuracy and completeness of this registration are of paramount importance. By following these guidelines, you can ensure that your submissions are compliant and processed without delay.

Misconceptions

Misconceptions abound when it comes to the Form R-5, the Nonresident Real Property Owner Registration form required by the Virginia Department of Taxation. Understanding the specifics can clear up confusion and ensure compliance with Virginia’s tax code. Here are nine common misconceptions:

- Form R-5 is only for individuals. This belief overlooks the fact that Form R-5 must also be completed by various types of entities, including partnerships, S-corporations, estates, and trusts. The form captures details on all nonresident partners, shareholders, and beneficiaries.

- It’s complex and expensive to file Form R-5. Contrary to this notion, the maximum charge allowed by law for the preparation of this form is merely $10. This fee cap makes the process both affordable and accessible.

- The form is optional for property managers and real estate agents. In reality, brokers managing Virginia rental properties and real estate reporting persons handling sales must ensure nonresident owners are registered. They have specific responsibilities to request and file Form R-5 on behalf of their clients if not furnished within required timelines.

- All sales and rental properties are covered. This is inaccurate as certain exemptions apply. Sales exempt from federal and state income tax, for instance, do not require registration. An exemption certificate is instead provided to the real estate reporting person.

- Nonresident owners can bypass the broker or agent to file. While nonresident owners can indeed submit the form themselves, brokers or real estate reporting persons still play a crucial role in ensuring compliance. Those managing or selling properties without homeowner compliance must file on their client's behalf.

- Filing deadlines are flexible. The truth is far stricter. Brokers and real estate reporting persons must transmit the registration forms by the 15th of the month following the closing (for sales) or receipt of the form from the property owner (for rentals). Penalties apply for late filings.

- Any part of the form can be left incomplete if information is unknown. In fact, the form requests that all relevant parts be completed fully. The only exception is for Part V if a nonresident owner does not use the services of a broker or real estate reporting person.

- Details about the property’s use are optional. On the contrary, the form requires specific information regarding the use of the property by the nonresident owner prior to selling or renting it out. This includes whether it was a primary residence, secondary residence, rented/leased property, or other.

- The form applies only to income-producing properties. While much of the form concerns rental income and sales proceeds, it is a requirement for all nonresident real property owners, whether or not the property generates income. It ensures tax compliance for all nonresident owners, capturing a broad range of property types and uses.

Clearing up these misconceptions ensures that nonresident property owners and their representatives fully understand their obligations under Virginia’s tax laws. Compliance benefits all parties, ensuring smooth real estate transactions and adherence to state requirements.

Key takeaways

When filling out and using the R-5 Virginia form, understanding its purpose and the required information is critical for compliance. Here are five key takeaways to guide individuals and entities through this process:

- Who Needs to File: Nonresident owners of real property in Virginia are required to register using the R-5 form, except in cases where exemptions listed on Form R-5E apply. This includes individuals, corporations not organized under Virginia law, estates and trusts not administered within Virginia, and partnerships, LLCs, and S-Corporations with nonresident members or shareholders who receive income from the property.

- Type of Properties Covered: The form applies to various types of real property, including residential, commercial, and agricultural. It must also be used to report changes in the use of the property, such as a shift from a primary residence to a rental property.

- Role of Brokers and Real Estate Reporting Persons: Brokers managing rental properties and real estate reporting persons handling property sales for nonresidents are responsible for ensuring the completion and submission of the R-5 form if the nonresident owner fails to provide it within 60 days for rentals or at the closing for sales. Brokers can also file on behalf of the owner based on the information available in their records.

- Registration Deadlines and Penalties: For rental properties, the R-5 form should be submitted by a broker within 60 days if not provided by the owner. For sales, the reporting person must submit the form by the 15th of the month following the closing. A failure to file carries a $50 per month penalty, with a maximum penalty of six months.

- Filing Procedure and Fee: The R-5 form requires complete information about the property and its owners. Part V should only be filled if a broker or real estate reporting person is involved. A maximum fee of $10 is allowed for completing this form, reinforcing the need for cost-effective compliance. The completed form should be mailed to the Department of Taxation at the specified address.

By adhering to these guidelines, nonresident property owners, their brokers, and real estate reporting persons can ensure compliance with Virginia's taxation requirements. Timely and accurate filing of the R-5 form is essential to avoiding penalties and streamlining the management of real property in Virginia. Remember, consulting a professional for assistance with this or any legal document can provide further clarity and ensure compliance.

Other PDF Forms

Virginia Court Forms - Instructs on the initial filing requirements, including the Complaint for Divorce, VS-4 Form, and the Domestic Case Coversheet.

West Virginia Cd 3 - Requires taxpayers to renounce any right to contest the compromised tax amount once the offer is accepted.

How to Become a Certified Tattoo Artist - Unlock the essentials of applying for a tattoo apprenticeship in Virginia and step confidently towards your certification.