Attorney-Approved Real Estate Purchase Agreement Template for Virginia

In the realm of real estate transactions, the Virginia Real Estate Purchase Agreement stands as a pivotal document, guiding both buyers and sellers through the process of transferring property ownership. This comprehensive form not only delineates the price agreed upon by both parties but also outlines the terms and conditions under which the sale will proceed. It is meticulously designed to ensure all legal requirements are met, serving as both a blueprint for the sale and a legally binding contract once signed. The form covers a wide array of crucial elements, including but not limited to, the identification of the property, the financial stipulations of the deal, and any contingencies that might affect the finalization of the purchase. Furthermore, it addresses the responsibilities of both the buyer and the seller, the allocation of closing costs, and stipulates the closing date, making it an indispensable tool for a seamless real estate transaction in Virginia. Through its thoroughness, the Virginia Real Estate Wax Purchase Agreement encapsulates the complexities of property dealings, providing a structured pathway towards the successful exchange of real estate.

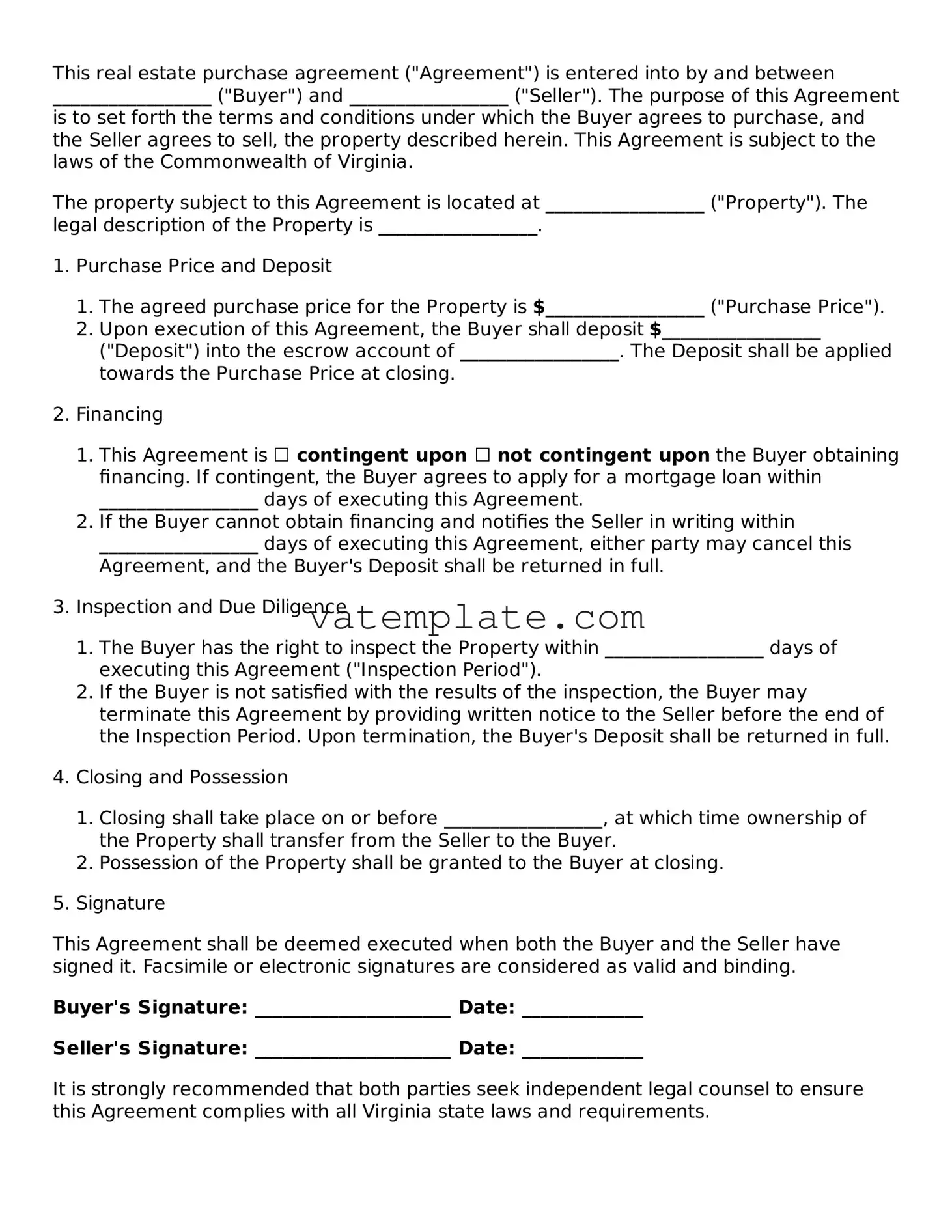

Virginia Real Estate Purchase Agreement Example

This real estate purchase agreement ("Agreement") is entered into by and between _________________ ("Buyer") and _________________ ("Seller"). The purpose of this Agreement is to set forth the terms and conditions under which the Buyer agrees to purchase, and the Seller agrees to sell, the property described herein. This Agreement is subject to the laws of the Commonwealth of Virginia.

The property subject to this Agreement is located at _________________ ("Property"). The legal description of the Property is _________________.

1. Purchase Price and Deposit

- The agreed purchase price for the Property is $_________________ ("Purchase Price").

- Upon execution of this Agreement, the Buyer shall deposit $_________________ ("Deposit") into the escrow account of _________________. The Deposit shall be applied towards the Purchase Price at closing.

2. Financing

- This Agreement is ☐ contingent upon ☐ not contingent upon the Buyer obtaining financing. If contingent, the Buyer agrees to apply for a mortgage loan within _________________ days of executing this Agreement.

- If the Buyer cannot obtain financing and notifies the Seller in writing within _________________ days of executing this Agreement, either party may cancel this Agreement, and the Buyer's Deposit shall be returned in full.

3. Inspection and Due Diligence

- The Buyer has the right to inspect the Property within _________________ days of executing this Agreement ("Inspection Period").

- If the Buyer is not satisfied with the results of the inspection, the Buyer may terminate this Agreement by providing written notice to the Seller before the end of the Inspection Period. Upon termination, the Buyer's Deposit shall be returned in full.

4. Closing and Possession

- Closing shall take place on or before _________________, at which time ownership of the Property shall transfer from the Seller to the Buyer.

- Possession of the Property shall be granted to the Buyer at closing.

5. Signature

This Agreement shall be deemed executed when both the Buyer and the Seller have signed it. Facsimile or electronic signatures are considered as valid and binding.

Buyer's Signature: _____________________ Date: _____________

Seller's Signature: _____________________ Date: _____________

It is strongly recommended that both parties seek independent legal counsel to ensure this Agreement complies with all Virginia state laws and requirements.

Document Details

| Fact | Detail |

|---|---|

| Governing Law | The Virginia Real Estate Purchase Agreement is governed by Virginia state laws, including those covering real estate transactions, property disclosures, and contract agreements. |

| Purpose | This form is used to outline the terms and conditions under which a property will be sold and purchased in Virginia. |

| Components | It typically includes details such as the purchase price, property description, financing, closing details, inspections, and buyer and seller disclosures. |

| Disclosures | Sellers are required to make certain disclosures about the property's condition, including any known material defects that could affect the property's value or safety. |

| Contingencies | The agreement may contain contingencies that must be satisfied before the sale is completed, such as financing approval, home inspections, and the sale of the buyer's current home. |

| Binding Effect | Once both parties sign the agreement, it becomes a legally binding contract, obligating both the buyer and seller to fulfill their respective duties as outlined in the document. |

Steps to Filling Out Virginia Real Estate Purchase Agreement

Filling out a Virginia Real Estate Purchase Agreement form is a pivotal step in the process of buying or selling property. This document legally records the terms and conditions of the sale, ensuring both the buyer's and seller's interests are protected. It is critical to complete this form accurately, as it outlines important details such as the offer price, closing date, and any contingencies that must be met before the sale can finalize. Following a step-by-step guide can simplify this process, making it less daunting for all parties involved.

- Identify the Parties: Start by filling in the full legal names of both the buyer(s) and seller(s) along with their current addresses. This defines who is involved in the real estate transaction.

- Describe the Property: Enter the legal description of the property being sold. This information can usually be found on the deed to the property and should include the address, parcel number, and sometimes a detailed description of the land and its boundaries.

- Offer Price and Deposit: Write down the offer price for the property and the amount of earnest money deposit the buyer is offering. The deposit shows the buyer's good faith in proceeding with the purchase and is usually held in escrow until closing.

- Financing: Specify the terms of financing, indicating whether the purchase will be made with cash, a mortgage, or a combination of both. If a mortgage is involved, include details such as the type of loan, the down payment amount, and loan approval contingency terms.

- Closing Date and Possession: Decide on a closing date, which is when the transaction is expected to be finalized, and state when the buyer will take possession of the property. This could be immediately after closing or at another agreed-upon time.

- Inspections and Repairs: Outline any inspections the buyer is permitted to conduct (such as home, pest, radon) and the timeframe for these. Also, detail how repair negotiations will be handled if issues are found.

- Contingencies: List any conditions or contingencies that must be met for the sale to proceed. These might include the sale being subject to the buyer obtaining financing, the sale of another property, or satisfactory inspection reports.

- Closing Costs: Clarify who is responsible for covering various closing costs, including titles, recording fees, and any state taxes. This section can significantly affect the net proceeds for the seller and the total amount paid by the buyer.

- Signatures: Both the buyer(s) and seller(s) must sign and date the agreement. These signatures legally bind the parties to the terms of the contract. Witnesses or a notary public might also be required, depending on state laws.

Once the Virginia Real Estate Purchase Agreement form is filled out and signed by both parties, it is submitted for processing. The next stages typically involve carrying out the agreed-upon inspections, securing financing, and preparing for the closing day when the final documents are signed, and ownership is officially transferred. Remember, this agreement is a binding contract, so all parties should review every section carefully to ensure a clear understanding of the obligations and responsibilities outlined in it.

FAQ

What is a Virginia Real Estate Purchase Agreement?

A Virginia Real Estate Purchase Agreement is a binding contract between a buyer and seller for the purchase and sale of real estate in Virginia. This document outlines the terms and conditions of the sale, including the purchase price, financing, inspections, and closing details. It serves as a roadmap for the transaction, ensuring that both parties understand their obligations and the steps necessary to complete the sale.

Who needs to sign the Virginia Real Estate Purchase Agreement?

The Virginia Real Estate Purchase Agreement must be signed by all legal owners of the property and the prospective buyers. If the property is owned by more than one person, all owners must sign the agreement to indicate their consent to the sale. Additionally, if buyers are purchasing the property together, each buyer should sign the agreement to ensure they are legally obligated to the terms of the sale.

Are there contingencies commonly included in this agreement?

Yes, there are several contingencies typically included in a Virginia Real Estate Purchase Agreement:

- Financing Contingency: This allows the buyer to terminate the contract if they are unable to secure financing from a lender.

- Home Inspection Contingency: This gives the buyer the right to have the property inspected and to request repairs or back out of the purchase based on the findings.

- Appraisal Contingency: This ensures that the property must appraise for at least the purchase price for the financing to be approved.

- Title Contingency: This requires a clear title to be provided before the sale can be completed.

How can a buyer or seller terminate the agreement?

The agreement can be terminated by either party under certain conditions, which are typically outlined in the contingencies. For instance, if a buyer is unable to obtain financing despite good faith efforts, the financing contingency allows them to terminate the contract. Similarly, if significant issues are discovered during a home inspection, the buyer may choose to terminate the agreement based on the inspection contingency. Sellers have fewer opportunities to terminate the agreement but can do so if the buyer fails to meet specific deadlines or breaches the terms of the contract.

What happens if either party breaches the agreement?

If either party breaches the Virginia Real Estate Purchase Agreement, the non-breaching party has legal remedies available. These may include seeking specific performance, which is a court order requiring the breaching party to fulfill their contractual obligations, or pursuing damages for financial losses incurred as a result of the breach. The specific remedies will depend on the nature of the breach and the terms of the contract.

Is a real estate attorney required for the transaction?

While Virginia law does not explicitly require the involvement of a real estate attorney in the purchase or sale of real estate, consulting with one is highly recommended. Real estate transactions are complex and involve significant legal and financial implications. An attorney can provide valuable guidance, ensure the contract is legally sound, and help navigate any issues that arise during the transaction process.

Common mistakes

When completing the Virginia Real Estate Purchase Agreement form, several common mistakes can jeopardize the transaction, potentially causing delays or legal complications. Attention to detail and thoroughness are crucial in avoiding these common errors.

Not reviewing the entire document carefully. Many people rush through filling out the form without thoroughly reviewing each section. This oversight can lead to incomplete or inaccurate information, affecting the validity of the agreement.

Incorrectly identifying the property. A significant error is the failure to accurately describe the property being purchased, including its full address and legal description as recorded in public records. This mistake can lead to disputes or complications in establishing the property's rightful ownership.

Omitting financial details. Some individuals neglect to include important financial terms, such as the purchase price, earnest money deposit amounts, and details regarding the closing costs. This absence can create ambiguities and misunderstandings between the buyer and seller, complicating the transaction process.

Failing to specify contingencies. It's essential to clearly state any conditions that must be met for the transaction to proceed, such as home inspections, financing, and appraisals. Without explicitly defining these contingencies, the parties lack a clear understanding of their rights and obligations, which can lead to disputes if unforeseen issues arise.

By avoiding these mistakes, parties can ensure a smoother transaction process. It is often advisable to seek professional advice or assistance when filling out legal documents related to real estate transactions to avoid these and other potential errors.

Documents used along the form

In Virginia, when engaging in real estate transactions, it’s vital to have a complete understanding of all the forms and documents that may accompany a Real Estate Purchase Agreement. This contract is foundational, outlining the terms between the buyer and seller. However, to ensure a smooth and legally sound transaction, several other important documents are often used in conjunction with this agreement. Each document plays a critical role in clarifying, verifying, and legally solidifying the components of the real estate transaction.

- Title Search and Title Insurance Commitment: This document reviews the history of the property to ensure the title is clear of liens, disputes, or other encumbrances. It also outlines the conditions under which title insurance will be provided.

- Property Disclosure Statement: Sellers provide this form to openly disclose material facts about the property’s condition, including any known defects or problems that could affect the property's value.

- Loan Estimate and Closing Disclosure: Required for real estate transactions involving mortgages, these documents summarize the terms of the loan, closing costs, and the final details of the loan agreement.

- Home Inspection Report: This comprehensive assessment, conducted by a professional home inspector, provides a detailed examination of the property’s condition, including structural, electrical, and plumbing systems.

- Pest Inspection Report: This report outlines the presence or absence of wood-destroying insects or organisms, which could significantly impact the property’s structure.

- Appraisal Report: An important document for the lending process, this report provides an assessment of the property's market value prepared by a licensed appraiser.

- Homeowners' Association (HOA) Documents: For properties governed by an HOA, these documents detail the association’s rules, regulations, and fee structures, and financial health.

- Contingency Removal Form: This form is used to document the removal of contingencies outlined in the Purchase Agreement, such as those related to financing, home inspections, or the sale of another property.

The compilation of these documents, alongside the Virginia Real Estate Purchase Agreement, creates a thorough and legally binding framework for real estate transactions. Each document serves to inform, protect, and facilitate the interests of both parties involved, making them indispensable components of the process. By understanding and properly utilizing these forms, participants can ensure a more transparent, efficient, and successful real estate transaction.

Similar forms

The Virginia Real Estate Purchase Agreement form is similar to various other legal documents designed to facilitate real estate transactions, albeit with some nuances specific to Virginia state laws. Among these, there are documents like the Residential Lease Agreement, the Bill of Sale, and the Disclosures document that share commonalities yet serve distinctly different purposes in the realm of real estate.

Residential Lease Agreement: This document, although used for renting or leasing property rather than buying or selling, shares similarities with the Virginia Real Estate Purchase Agreement in terms of outlining terms and conditions between parties. Like the purchase agreement, it lists the duties, rights, and responsibilities of each party involved. However, its primary function is to establish a temporary tenant-landlord relationship, as opposed to transferring ownership of the property.

Bill of Sale: Typically associated with the sale of personal property, cars, or equipment, the Bill of Sale shares common ground with the Virginia Real Estate Purchase Agreement in that it legally documents the transfer of ownership. Both documents require detailed descriptions of the property being transferred, information on both the buyer and seller, and the agreed-upon price. Nevertheless, the Real Estate Purchase Agreement encompasses more complex terms due to the nature of real estate transactions, including financing terms, closing dates, and property inspections.

Disclosures Document: In real estate transactions, the Disclosures document plays a crucial role by providing the buyer with important information about the property's condition. It resembles the Virginia Real Estate Purchase Agreement in its legal importance, ensuring transparency and honesty in the transaction. However, while the purchase agreement sets the transaction's terms, the Disclosures document specifically focuses on revealing any known issues that could affect the property's value or habitability.

Dos and Don'ts

Filling out a Virginia Real Estate Purchase Agreement requires attention to detail and a clear understanding of what you're agreeing to. It's crucial to approach this task with careful consideration to ensure a smooth real estate transaction. Here are some do's and don'ts to guide you:

Do:

Review the entire agreement carefully before you start filling it out. Understand each section to ensure that all terms and conditions are clear and fair.

Use clear and concise language to fill in the details. Ambiguities can lead to disputes or misunderstandings later on.

Ensure all financial figures, such as the purchase price, deposit amounts, and any adjustments, are accurate. Double-check these figures to avoid any potential issues.

Have a witness or legal professional review the agreement. A second set of eyes can help catch mistakes or unclear terms you might have missed.

Don't:

Leave any sections blank. If a section doesn't apply, write "not applicable" or "N/A". Blank spaces can lead to confusion or manipulation of the agreement.

Use vague language or terms that are open to interpretation. Be as specific as possible to avoid ambiguity.

Forget to include all necessary attachments or addenda that are part of the agreement. These additional documents are integral to the full understanding of the agreement.

Sign the agreement without fully understanding every term and condition. If there's anything you're unsure about, seek clarification from a real estate professional or attorney before signing.

Misconceptions

In the realm of buying or selling property in Virginia, the Real Estate Purchase Agreement form is a pivotal document that outlines the terms and conditions of the sale. Misunderstandings about its nature and functions, however, are quite common, leading to confusion and misrepresentations. Below are six misconceptions that frequently arise regarding the Virginia Real Estate Purchase Agreement form.

It's just a standard form; details can be worked out later: Many believe that the Virginia Real Estate Purchase Agreement is a mere formality, assuming that specifics can be negotiated after its signing. In truth, this document is legally binding, and all essential details of the transaction should be explicitly stated within it before any party signs.

Only the price matters: While the sale price is indeed a crucial aspect of the real estate transaction, other elements such as the closing date, contingencies (like financing, home inspection, or sale of another property), and items included in the sale (appliances, furniture, etc.) are equally significant and must be clearly mentioned in the agreement.

Verbal agreements are enforceable: Some parties might believe that verbal agreements made during negotiations are binding. However, in Virginia, the Statute of Frauds requires that real estate purchase agreements be in writing and signed by both parties involved to be enforceable.

The form is the same across all properties: There's a misconception that a single version of the Virginia Real Estate Purchase Agreement is applicable to all types of properties. The truth is, different provisions may be needed depending on whether the property is residential, commercial, undeveloped land, or a condominium, necessitating customization of the form to fit the specific transaction.

Buyers are always responsible for closing costs: The assumption that buyers are inherently responsible for covering closing costs is incorrect. While it is common, all terms related to the allocation of closing costs must be negotiated between the buyer and seller and then detailed in the agreement.

Signing the agreement binds you to buy: It's often mistakenly believed that once the Real Estate Purchase Agreement is signed, the buyer is obligated to proceed with the purchase under any circumstances. In reality, the agreement typically includes contingencies that allow either party to legally withdraw from the transaction under predefined conditions without penalty.

Understanding these misconceptions is critical for anyone involved in a real estate transaction in Virginia. It ensures that both buyers and sellers are adequately informed about their rights and obligations, thereby facilitating a smoother transaction process.

Key takeaways

When it comes to buying or selling property in Virginia, the Real Estate Purchase Agreement is a critical document. This legal form outlines the terms and conditions of the sale, from the purchase price to closing details. Here are seven key takeaways to consider when filling out and using the Virginia Real Estate Purchase Agreement:

- Accuracy is crucial. Every detail in the agreement, from the names of the parties involved to the description of the property, needs to be accurately represented. Mistakes can lead to delays or even nullify the agreement.

- Understand all terms and conditions. Before signing, all parties should fully understand every condition specified in the agreement. This includes sales price, deposit amounts, closing dates, and any contingencies such as the sale being subject to the buyer obtaining financing.

- Legal requirements must be met. The agreement must comply with Virginia’s real estate laws. This includes disclosures about the condition of the property, lead-based paint disclosures for older homes, and any other state-specific requirements.

- When in doubt, seek professional advice. The process and language of real estate transactions can be complex. Consulting with a real estate attorney or agent can provide clarity and help avoid potential legal issues.

- Negotiations are part of the process. The initial agreement is often not the final word. Buyers and sellers can negotiate terms such as price, closing costs, and the move-in date until both parties reach a satisfactory agreement.

- Contingencies protect both parties. Including contingencies for financing, inspections, and appraisals can protect both the buyer and seller. If any of these conditions aren't met, the agreement can be voided or renegotiated.

- Proper execution and delivery. For the agreement to be legally binding, it must be signed by all parties involved and properly delivered. Electronic signatures are often accepted, but it’s important to confirm that this method is valid for real estate transactions in Virginia.

By keeping these key points in mind, parties can ensure that the Virginia Real Estate Purchase Agreement accurately reflects their intentions and protects their interests throughout the buying or selling process.

Other Popular Virginia Templates

Do Not Resuscitate Form Virginia - A crucial aspect of healthcare planning, enabling individuals to state their preference for no artificial life support.

What Is Hold Harmless Agreement - It can also be a critical component in agreements involving the use of another party's property, ensuring the property owner is not held liable for accidents or damages.