Attorney-Approved Small Estate Affidavit Template for Virginia

Dealing with the aftermath of a loved one's passing can be an emotionally taxing time, and the process of settling their estate adds an additional layer of complexity. For those in Virginia, navigating the intricacies of probate law may seem daunting, especially for estates that might be considered small by legal standards. This is where the Virginia Small Estate Affidavit form comes into play, offering a simplified route for the rightful heirs to claim their inheritance without the need for a prolonged probate process. The form is designed for situations where the total value of the deceased's estate falls below a certain threshold, providing a more streamlined and cost-effective method for asset distribution. It lays out specific criteria regarding who can file it, the type of assets that can be transferred, and mandatory waiting periods. Understanding the nuances of this form, including who qualifies to use it, the process of filing, and its limitations, can be pivotal for individuals aiming to expedite the settlement of small estates in a legal and orderly manner.

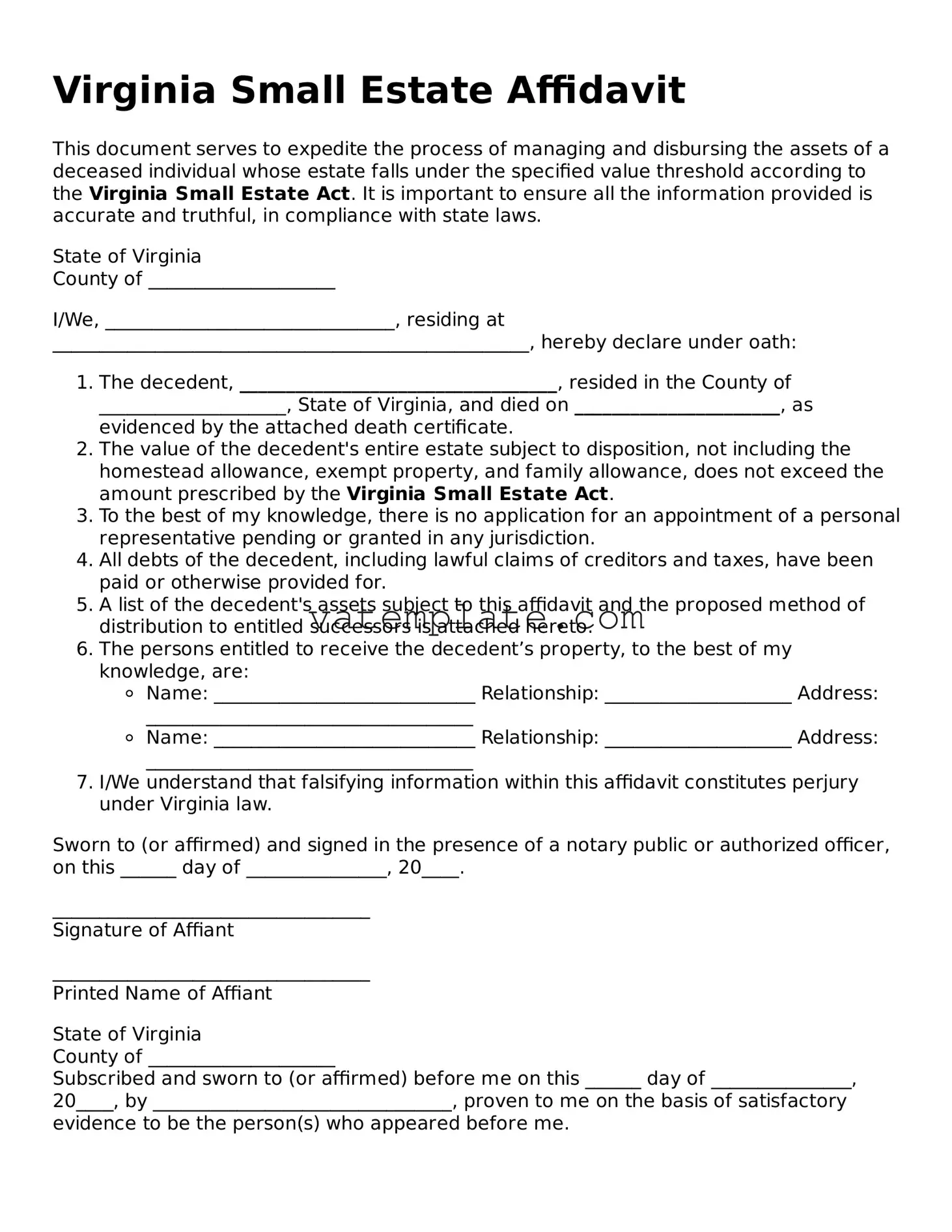

Virginia Small Estate Affidavit Example

Virginia Small Estate Affidavit

This document serves to expedite the process of managing and disbursing the assets of a deceased individual whose estate falls under the specified value threshold according to the Virginia Small Estate Act. It is important to ensure all the information provided is accurate and truthful, in compliance with state laws.

State of Virginia

County of ____________________

I/We, _______________________________, residing at ___________________________________________________, hereby declare under oath:

- The decedent, __________________________________, resided in the County of ____________________, State of Virginia, and died on ______________________, as evidenced by the attached death certificate.

- The value of the decedent's entire estate subject to disposition, not including the homestead allowance, exempt property, and family allowance, does not exceed the amount prescribed by the Virginia Small Estate Act.

- To the best of my knowledge, there is no application for an appointment of a personal representative pending or granted in any jurisdiction.

- All debts of the decedent, including lawful claims of creditors and taxes, have been paid or otherwise provided for.

- A list of the decedent's assets subject to this affidavit and the proposed method of distribution to entitled successors is attached hereto.

- The persons entitled to receive the decedent’s property, to the best of my knowledge, are:

- Name: ____________________________ Relationship: ____________________ Address: ___________________________________

- Name: ____________________________ Relationship: ____________________ Address: ___________________________________

- I/We understand that falsifying information within this affidavit constitutes perjury under Virginia law.

Sworn to (or affirmed) and signed in the presence of a notary public or authorized officer, on this ______ day of _______________, 20____.

__________________________________

Signature of Affiant

__________________________________

Printed Name of Affiant

State of Virginia

County of ____________________

Subscribed and sworn to (or affirmed) before me on this ______ day of _______________, 20____, by ________________________________, proven to me on the basis of satisfactory evidence to be the person(s) who appeared before me.

__________________________________

Notary Public/Authorized Officer

My commission expires: _______________

Document Details

| Fact | Detail |

|---|---|

| Eligibility | Estates valued at $50,000 or less may qualify for the Virginia Small Estate Affidavit process. |

| Governing Law | The Virginia Small Estate Act, specifically under Sections 64.2-600 to 64.2-605 of the Code of Virginia. |

| Waiting Period | A 60-day waiting period is required from the date of death before the affidavit can be filed. |

| Limitation | Real estate cannot be transferred using a Small Estate Affidavit; it only applies to personal property. |

Steps to Filling Out Virginia Small Estate Affidavit

When a loved one passes away, the process of managing their estate can seem daunting. In Virginia, if the estate is considered "small" by legal standards, a Small Estate Affidavit form may be used to simplify the process. This straightforward document allows for the transfer of assets without the need for formal probate, easing the burden on grieving families. The following steps will guide you through the process of correctly filling out the Virginia Small Estate Affidavit form, ensuring that all requirements are met for a smooth and lawful transition of assets.

- Gather necessary information: Before you start, collect all pertinent information such as the decedent's full name, date of death, address, and an itemized list of the assets to be transferred. Also, ensure you have the names and addresses of all heirs or beneficiaries.

- Access the form: Obtain the Virginia Small Estate Affidiff form. This can usually be found online through the Virginia Courts website or by visiting a local court office.

- Fill out the decedent’s details: Enter the full name and the date of death of the deceased, as well as their last known address. Make sure this information matches official documents.

- List the assets: Clearly itemize the assets to be transferred using the form. This may include bank accounts, stocks, and personal property. Each asset should be described in detail, including account numbers and values, if known.

- Identify the beneficiaries: Provide the names and addresses of all heirs or beneficiaries entitled to receive the assets. Relationship to the decedent should also be included to clarify entitlements.

- Sign the affidavit: The person completing the form, known as the affiant, must sign the affidavit in the presence of a notary public. The signature legally attests to the truth of the information provided and the right of the affiant to claim the estate.

- Notarize the form: The final step involves a notary public witnessing the signing of the form. The notary will fill out their section, seal the document, and officially notarize the affidavit.

- Submit the affidavit: Once fully completed and notarized, submit the form to the appropriate institution, such as a bank or brokerage where the assets are held. Follow their procedures to transfer the assets into the names of the rightful heirs or beneficiaries.

By carefully following these steps, individuals can efficiently navigate the administrative responsibilities involved in managing a small estate in Virginia. This process, while still demanding attention to detail, offers a simpler alternative to formal probate, allowing families to focus more on healing and less on legalities.

FAQ

What is a Virginia Small Estate Affidavit?

A Virginia Small Estate Affidavit is a legal document used by the successors of a deceased person to collect the person's property without formal probate. This document is particularly useful when the deceased's estate does not include real estate and the total value does not exceed $50,000.

Who can file a Virginia Small Estate Affidavit?

Successors, such as a spouse, adult children, or other family members, can file a Virginia Small Estate Affidavit. Priority is given to the spouse and then to the children if there is no surviving spouse. If neither a spouse nor children are present, other family members may qualify.

What are the requirements for using a Virginia Small Estate Affidavit?

To use a Virginia Small Estate Affidavit:

- The deceased must have died without a will, or if there is a will, it must not require going through probate.

- The total value of the estate must not exceed $50,000.

- At least 60 days must have passed since the death.

- There must be no pending application for the appointment of a personal representative in any jurisdiction.

What information is needed to complete the form?

To complete the form, the following information is needed:

- The full legal name and date of death of the deceased

- A detailed list of the property to be collected, including account numbers and values

- The names and addresses of the successors entitled to the property

- Any debts owed by the estate

Where can the Virginia Small Estate Affidavit be filed?

The affidavit must be presented to the entity holding the assets of the deceased, such as a bank, rather than being filed with a court. Each institution may have its own additional requirements or forms to be completed alongside the affidavit.

Is there a fee to file a Virginia Small Estate Affidavit?

There is no filing fee for a Virginia Small Estate Affidavit. However, the institutions holding the assets may have their own fees or requirements for releasing the assets to the successors.

What happens after the Small Estate Affidavit is presented?

After the affidavit is presented and if all is in order, the institution holding the assets will release them to the proper successors. This process can take time, so patience is advised. Successors should ensure they provide all required documents to expedite the process.

Can real estate be transferred with a Virginia Small Estate Affidavit?

No, real estate cannot be transferred using a Virginia Small Estate Affidifavit. This document is only suited for personal property such as bank accounts, vehicles, and other non-real estate assets. For transferring real estate, other legal procedures are required.

What are the risks of using a Virginia Small Estate Affidavit?

While a Virginia Small Estate Affidavit simplifies the process of asset collection, it does carry risks. Successors are personally liable to any interested party for wrongful distribution of assets. Therefore, it is advised to be certain of one's rights to the assets and, if in doubt, consult with a legal professional.

Common mistakes

When handling a loved one's estate in Virginia, the Small Estate Affidavit can simplify the process if the estate's total value falls below a certain threshold. However, mistakes in filling out this form can create delays and complications. Here are nine common errors to watch out for:

Not verifying eligibility: Before filling out the form, it’s crucial to ensure the estate qualifies as a "small estate" under Virginia law. This means the value of the estate must not exceed the specified limit after liens and encumbrances are subtracted.

Incorrectly listing the assets: All assets subject to probate must be listed accurately. This includes checking accounts, personal property, and vehicles, but does not typically include life insurance, retirement accounts, or other assets with a named beneficiary.

Forgetting to deduct debts: When estimating the estate’s value, some people forget to subtract debts and obligations, such as mortgages, personal loans, and final expenses, which can incorrectly inflate the estate value on the form.

Overlooking the waiting period: Virginia law may require a specific waiting period after the decedent's death before the affidavit can be filed. Submitting the form prematurely can lead to its rejection.

Failing to obtain necessary signatures: The form must be signed by all eligible heirs or legatees. Missing signatures can invalidate the affidavit or delay its processing.

Not getting the affidavit notarized: A common oversight is not having the affidavit notarized. This step is typically required to authenticate it as a legal document.

Miscalculating the estate value: Either overvaluing or undervaluing the estate can lead to issues. It's important to accurately assess the value of all assets to ensure compliance with Virginia's small estate threshold.

Ignoring tax considerations: Some estates may be liable for taxes even if they fall under the small estate threshold. Failing to consider or address potential tax obligations can lead to unexpected liabilities for the heirs.

Incomplete or inaccurate information: Finally, leaving sections of the form blank, or entering incorrect information, can cause significant delays. Thoroughness and accuracy are essential to expedite the process.

In conclusion, while the Virginia Small Estate Affidavit can offer a streamlined process for smaller estates, attentiveness to detail and adherence to legal requirements are paramount to avoid pitfalls. Seeking legal guidance can help navigate these intricacies effectively.

Documents used along the form

When dealing with the estate of a loved one who has passed away in Virginia, the Small Estate Affidavit form is often a starting point for settling their affairs without a full probate process. However, this form rarely travels alone. Several other forms and documents usually accompany or are required alongside the Small Estate Affidavit to ensure a smooth transition of assets and closure of the deceased's estate. Let’s explore some of these essential documents that are often used in tandem with the Small Estate Affidavit form.

- Death Certificate: This is a vital document that officially confirms the death. It is required by financial institutions, courts, and other entities to proceed with transferring assets or accessing funds.

- Copy of the Will: If the deceased left a will, a copy might need to be submitted alongside the Small Estate Affidavit to prove the rightful heirs and executors as designated by the decedent.

- Vehicle Title Transfer Forms: For the transfer of vehicles owned by the deceased, specific forms provided by the Virginia Department of Motor Vehicles might be necessary.

- Real Estate Affidavit or Real Property Transfer Form: When the estate includes real property, additional forms are required to transfer ownership pursuant to the small estate's rules.

- Bank Forms: Banks and other financial institutions often have their own forms that need to be completed to release the deceased’s funds to the rightful heirs or executors.

- Stock Transfer Forms: If the deceased owned stocks or bonds, transfer forms from the respective brokerage or company might be needed to transfer ownership.

- Proof of Heirship or Affidavit of Heirship: This document may be required to establish legal heirship, particularly when there is no will, and can be used to claim assets held by the estate.

- Letters of Administration: If an administrator is appointed by the court to oversee the estate settlement, this document proves the administrator’s authority to act on behalf of the estate.

- Notice to Creditors: This document is often published in a local newspaper and sent directly to known creditors, notifying them of the decedent's death so they can make claims against the estate.

Compiling and submitting these documents can be a meticulous process that requires attention to detail and understanding of Virginia state laws regarding estates. Working with legal professionals can provide guidance and peace of mind during this challenging time. By gathering the necessary documents and completing the required forms, families can navigate the complexities of estate settlement more efficiently, ensuring that the deceased’s assets are distributed according to their wishes or the law.

Similar forms

The Virginia Small Estate Affidavit form is similar to other legal documents designed to simplify the transfer of assets upon someone's death. Primarily, it aligns closely with Transfer on Death Deed (TODD) forms and Simple Will documents. These forms, including the Virginia Small Estate Affidavit, share a common goal: to streamline estate proceedings and allow for a quick transfer of property to beneficiaries, bypassing the often lengthy and complex probate process.

Transfer on Death Deed (TODD) forms are particularly akin to the Virginia Small Estate Affidate in intention and function. Both documents allow property to bypass traditional probate proceedings, instead directly transferring ownership to designated beneficiaries upon the death of the owner. While the Small Estate Affidavit focuses on the transfer of personal property, TODD forms are used specifically for real estate holdings. This distinction in the applicable asset types highlights the complementary roles these documents play in estate planning.

Simple Will documents, on the other hand, offer a broader scope than the Virginia Small Estate Affidavit, covering the entirety of an individual's estate rather than just small estates. They, too, specify beneficiaries and detail the distribution of assets, but require execution according to statutory formalities and often necessitate probate to some degree. The Virginia Small Estate Affidavit serves as a more targeted tool, enabling the transfer of assets for qualifying estates without the complexities and delays associated with probate, echoing the simplification purpose found in Simple Wills.

Dos and Don'ts

Filling out the Virginia Small Estate Affidavit form is an important step in managing the assets of a deceased person’s estate when those assets are valued under a certain threshold. It is a simplified process that allows for the transfer of property without the full probate process. However, there are specific do's and don'ts that need to be followed to ensure the process is completed correctly and efficiently. Here are four things you should do, followed by four things you shouldn’t do when filling out this form.

What You Should Do:Ensure you are eligible to file by verifying that the total value of the estate’s assets meets the small estate criteria set by Virginia law.

Thoroughly read the instructions provided with the form to understand all the requirements and legal implications.

Accurately and completely fill out all the sections of the form, providing detailed information about the decedent’s assets.

Sign the form in the presence of a notary public to validate its authenticity and comply with Virginia’s legal requirements.

Do not guess or estimate the value of assets. It’s important to use exact figures to prevent any legal issues.

Avoid signing the form before you have all the necessary information and documentation to support your claims.

Do not disregard state-specific requirements or deadlines for submitting the form, as these can vary and affect the legitimacy of the affidavit.

Avoid using the small estate process if the estate exceeds the value threshold set by Virginia law, as doing so could result in legal penalties.

Misconceptions

When dealing with the aftermath of a loved one's death in Virginia, the Small Estate Affidavit provides a simpler method for the transfer of assets to the rightful heirs without the lengthy probate process. However, there are several misunderstandings about this document that need clarifying:

- It's always the quickest option. While the Small Estate Affidavit can expedite the process of asset distribution, it isn't always the quickest path. The circumstances of the estate and the types of assets involved can affect the timeframe. Additionally, if there's any dispute among heirs or beneficiaries, this could slow down the process significantly.

- It allows transfer of all types of assets. The purpose of this document may seem broad, but in reality, it's limited to certain types of assets. Real estate, for instance, cannot typically be transferred using a Small Estate Affidavit in Virginia. This form is mainly used for personal property like bank accounts and vehicles.

- There's no limit to the estate size. Virginia law specifies that the total value of the decedent's estate that passes under the affidavit must not exceed a certain amount—historically, this has been $50,000 or less, but the exact limit can change. Therefore, larger estates will not qualify for this simplified process and must go through regular probate.

- Anyone can file it. Not just anyone can file a Small Estate Affidavit. Priority is given to surviving spouses and, if none exist, other heirs according to the state's succession laws. Creditors generally cannot use this form to access a decedent’s assets, and there are specific rules about who can file and under what circumstances.

- It's effective immediately. While it's true that a Small Estate Affidavit can speed up the process of distributing assets, it doesn't work instantaneously. The document often requires a certain waiting period after the decedent's death before it can be filed. This is to ensure that all potential creditors and heirs are properly accounted for.

- It replaces a will. A Small Estate Affidavit does not serve as a substitute for a will. This document is used to transfer assets without probate or supplement a probate process when a will exists but does not cover all of the decedent’s assets. If the decedent left a will, it must still be filed with the appropriate probate court, and the distribution of assets must adhere to the terms of the will as much as possible.

Key takeaways

When dealing with the aftermath of a loved one's passing, the management of their estate can become a significant responsibility. In Virginia, for smaller estates, this process is simplified through the use of a Small Estate Affidavit form. This guide provides key takeaways about completing and deploying this document to assist those navigating these waters for the first time.

- Eligibility Criteria: The Virginia Small Estate Affidavit form is intended for use when the decedent’s estate does not exceed $50,000 in value. This is a crucial criterion that determines the applicability of this streamlined process.

- Assets to Consider: Only assets that would typically pass through probate are counted toward the $50,000 limit. This includes personal property, bank accounts, and other assets not already designated to pass directly to a beneficiary (such as life insurance policies with named beneficiaries).

- Timing: The affidavit cannot be filed until at least 60 days have passed since the death of the estate’s owner. This waiting period ensures that there is adequate time to assess the full scope of the estate and for all potential claimants to come forward.

- Required Documentation: Alongside the affidavit, individuals must provide a certified copy of the death certificate and proof of their right to claim the property, which could include a will naming them as beneficiaries or proof of kinship in the absence of a will.

- Filing Location: The form must be filed with the appropriate local court. In Virginia, this is typically the circuit court in the county where the decedent lived or, if the decedent didn’t live in Virginia, where the decedent owned property.

- Declaration of No Probate Proceedings: By using this form, the filer affirms that no probate proceedings are underway elsewhere and that they are unaware of any pending probate petition for the decedent’s estate in any jurisdiction.

- Legal Liability: Individuals who falsify information on the affidavit can face legal repercussions. Accuracy and honesty in reporting are paramount to prevent potential legal challenges or allegations of fraud.

- Utilization of the Affidavit: Once properly filled out and filed, the affidavit can be presented to entities holding the decedent’s assets (such as banks) as legal proof of the right to collect these assets, without undergoing full probate.

- Distribution Among Heirs: If there are multiple eligible heirs, it is their responsibility to agree on the distribution of assets. The affidavit process does not resolve disputes between heirs; such matters may require legal intervention.

- Revocation of Affidavit: Should new information come to light or if probate proceedings commence after the affidavit's use, the affidavit may need to be revoked, and the assets dealt with according to the findings of the probate court.

Navigating the process of managing a small estate in Virginia can be significantly streamlined by utilizing the Small Estate Affidavit. It is designed to simplify the legal hurdles for estates that do not meet the threshold requiring full probate. However, it’s crucial to approach this process with a clear understanding of the requirements, responsibilities, and potential complexities involved. When in doubt, seeking legal advice can help to avoid any pitfalls and ensure compliance with Virginia law.

Other Popular Virginia Templates

Gift Deed Virginia - This document ensures compliance with state regulations, providing a valid and enforceable agreement between donor and donee.

Do You Need a Bill of Sale in Virginia - Enables a clear agreement for selling an RV by recording pertinent details such as signatures and purchase price.

Power of Attorney Virginia - A Power of Attorney form allows an individual to grant legal authority to another person to act on their behalf in specific matters.