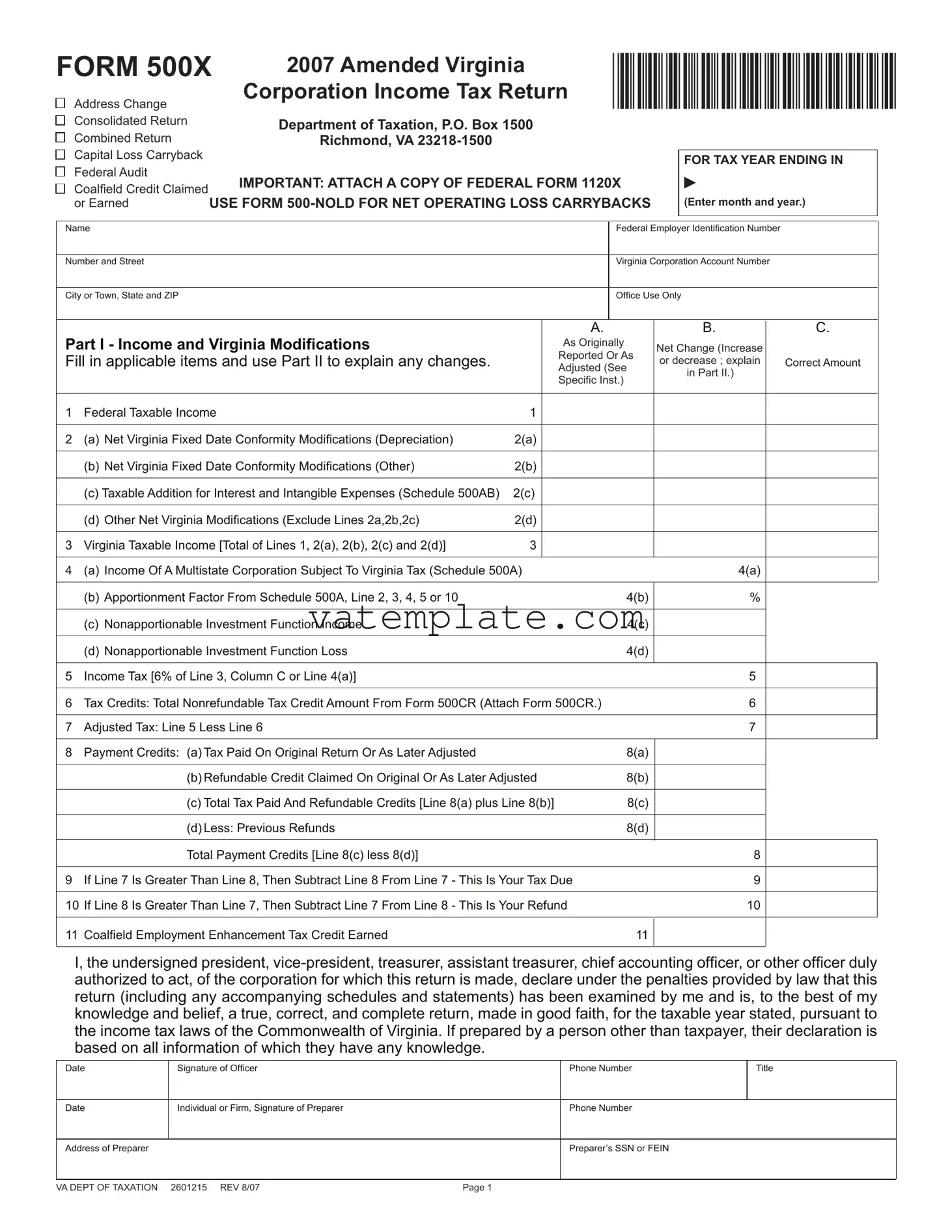

Fill Out a Valid Virginia 500X Template

Coping with the intricacies of corporate taxation can be daunting, especially when amendments are involved. The Virginia 500X form serves this exact purpose for corporations in the commonwealth; it's a tool for amending previously filed income tax returns. This form, tailored for the year 2007, is vital for correcting any aspect of a corporation's initial tax return, including but not limited to reporting changes in income, claiming missed deductions, or updating the amount of tax owed or refund due to the state. Utilized not just for reporting basic amendments, the 500X form is integral for handling more complex issues such as capital loss carrybacks and adjustments stemming from federal audits. Moreover, it accommodates claims for various credits like the Coalfield Employment Enhancement Tax Credit. Corporations need to attach a copy of the corresponding federal amendment, Form 1120X, to ensure that both state and federal tax records align. The detailed sections within the form allow for precise reporting of income modifications, adjustments to tax credits, and recalculations of the tax owed or refund due. With clear guidelines on when and how to file, coupled with specific instructions for each part of the amended return, the Virginia Department of Taxation aims to streamline the amendment process. However, navigating these requirements demands a close reading of both the form itself and its accompanying instructions to ensure accurate and compliant amendment submissions.

Virginia 500X Example

Address Change |

Corporation Income Tax Return *VA500X107888* |

FORM 500X |

2007 Amended Virginia |

Consolidated Return |

Department of Taxation, P.O. Box 1500 |

|

|

||

Combined Return |

Richmond, VA |

|

Capital Loss Carryback |

|

|

Federal Audit |

IMPORTANT: ATTACH A COPY OF FEDERAL FORM 1120X |

|

Coalield Credit Claimed |

||

|

||

or Earned |

UsE FORM |

FOR TAX YEAR ENDING IN

'

(Enter month and year.)

Name |

|

|

Federal Employer Identiication Number |

|

|||

|

|

|

|

|

|

|

|

Number and Street |

|

|

Virginia Corporation Account Number |

|

|||

|

|

|

|

|

|

|

|

City or Town, State and ZIP |

|

|

Ofice Use Only |

|

|||

|

|

|

|

|

|

|

|

Part I - Income and Virginia Modiications |

|

A. |

|

B. |

|

C. |

|

|

As Originally |

Net Change (Increase |

|

|

|||

|

|

|

|

|

|

||

Fill in applicable items and use Part II to explain any changes. |

|

Reported Or As |

or decrease ; explain |

|

Correct Amount |

||

|

Adjusted (See |

|

|||||

|

|

|

in Part II.) |

|

|

||

|

|

|

Speciic Inst.) |

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

1 |

Federal Taxable Income |

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

(a) Net Virginia Fixed Date Conformity Modiications (Depreciation) |

2(a) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(b) Net Virginia Fixed Date Conformity Modiications (Other) |

2(b) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(c) Taxable Addition for Interest and Intangible Expenses (Schedule 500AB) |

2(c) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(d) Other Net Virginia Modiications (Exclude Lines 2a,2b,2c) |

2(d) |

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

Virginia Taxable Income [Total of Lines 1, 2(a), 2(b), 2(c) and 2(d)] |

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

(a) Income Of A Multistate Corporation Subject To Virginia Tax (Schedule 500A) |

|

4(a) |

|

|

||

|

|

|

|

|

|

|

|

|

(b) Apportionment Factor From Schedule 500A, Line 2, 3, 4, 5 or 10 |

|

|

4(b) |

% |

|

|

|

|

|

|

|

|

|

|

|

(c) Nonapportionable Investment Function Income |

|

|

4(c) |

|

|

|

|

|

|

|

|

|

|

|

|

(d) Nonapportionable Investment Function Loss |

|

|

4(d) |

|

|

|

|

|

|

|

|

|

|

|

5 |

Income Tax [6% of Line 3, Column C or Line 4(a)] |

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

6 |

Tax Credits: Total Nonrefundable Tax Credit Amount From Form 500CR (Attach Form 500CR.) |

|

6 |

|

|

||

|

|

|

|

|

|

|

|

7 |

Adjusted Tax: Line 5 Less Line 6 |

|

|

|

7 |

|

|

|

|

|

|

|

|

|

|

8 |

Payment Credits: (a) Tax Paid On Original Return Or As Later Adjusted |

|

|

8(a) |

|

|

|

|

|

|

|

|

|

|

|

|

(b) Refundable Credit Claimed On Original Or As Later Adjusted |

8(b) |

|

|

|

||

|

|

|

|

|

|

|

|

|

(c) Total Tax Paid And Refundable Credits [Line 8(a) plus Line 8(b)] |

8(c) |

|

|

|

||

|

|

|

|

|

|

|

|

|

(d) Less: Previous Refunds |

|

|

8(d) |

|

|

|

|

|

|

|

|

|

|

|

|

Total Payment Credits [Line 8(c) less 8(d)] |

|

|

|

8 |

|

|

|

|

|

|

|

|

|

|

9 |

If Line 7 Is Greater Than Line 8, Then Subtract Line 8 From Line 7 - This Is Your Tax Due |

|

9 |

|

|

||

|

|

|

|

|

|

|

|

10 |

If Line 8 Is Greater Than Line 7, Then Subtract Line 7 From Line 8 - This Is Your Refund |

|

10 |

|

|

||

|

|

|

|

|

|

|

|

11 |

Coalield Employment Enhancement Tax Credit Earned |

|

|

11 |

|

|

|

|

|

|

|

|

|

|

|

I, the undersigned president,

Date |

Signature of Oficer |

Phone Number |

Title |

|

|

|

|

Date |

Individual or Firm, Signature of Preparer |

Phone Number |

|

|

|

|

|

Address of Preparer |

|

Preparer’s SSN or FEIN |

|

|

|

|

|

VA DEPT OF TAXATION 2601215 REV 8/07 |

Page 1 |

PART II. — Explanation of Changes to Income and Modiications.

Enter the line reference from page 1 for which a change is reported, and give the reason for each change.

Show any computation in detail. Attach any schedules needed.

Check here if this amended return is due to changes on Schedule 500A . Attach an amended Schedule 500A with appropriate explanation.

Check here if this amended return is due to changes on Schedule 500A . Attach an amended Schedule 500A with appropriate explanation.

Check here if this amended return is due to changes on Schedule 500AB. Attach amended Schedule 500AB.

Check here if this amended return is due to changes on Schedule 500AB. Attach amended Schedule 500AB.

Check here if federal approval has been received. Attach a copy of the IRS Statement of Adjustment to Your Account.

Check here if federal approval has been received. Attach a copy of the IRS Statement of Adjustment to Your Account.

Check here if this change is due to a nonrefundable or refundable tax credit (attach explanation and corrected Form 500CR).

Check here if this change is due to a nonrefundable or refundable tax credit (attach explanation and corrected Form 500CR).

GENERAL INsTRUCTIONs

Purpose of Form: Use Form 500X to correct your Form 500, Virginia Corporation Income Tax Return, as you originally iled it or as it was later

adjusted by an amended return or an examination. Do not use this form for the carryback of a net operating loss; use Form

Application For Refund. If amending for a capital loss carryback in addition to other changes, ile two amended returns (Form 500X); one to report the

capital loss carryback and the second for all other changes.

When to File: File Form 500X only after you have iled your original return. Attach a copy of federal Forms

Statement of Adjustment to Your Account or other form or statement show- ing the nature of any federal change and the date that it became inal. If the

amount of a corporate taxpayer's federal taxable income as reported on its federal income tax return for any taxable year is changed or corrected by

the IRS (or other competent authority), or is changed as the result of a re- negotiation of a contract or subcontract with the United States, the taxpayer

must report this change to the Virginia Department of Taxation within one

year. A corporation may ile an amended return, Form 500X, and claim a refund within the later of:

(1)three years from the due date of the return or extended due date (whichever is later);

(2)one year from the inal determination of any change or correction in taxpayer liability for any federal tax upon which state tax is based, provided the refund does not exceed the amount of the decrease in Virginia tax attributable to such federal change or correction;

(3)two years from the iling of an amended Virginia return resulting in the payment of additional tax, provided that the amended return raises is- sues relating only to the prior amended return and the refund does not exceed the amount of the tax payment made with the prior amended return; or

(4)two years from the payment of an assessment, provided the amended return raises issues relating only to the prior assessment and the refund does not exceed the amount of tax paid on the prior assessment.

Where to File: Mail this form to Virginia Department of Taxation, P.O. Box 1500, Richmond, Virginia

Information on Modiications: Refer to the instructions for the year you

are amending concerning adjustments to items of income or deductions that might constitute a Virginia modiication to federal taxable income for

that taxable year.

Note: The Department of Taxation will compute any interest due and will either include it in your refund or bill you.

For additional information, call (804)

of Taxation, P.O. Box 1115, Richmond, VA

sPECIFIC INsTRUCTIONs

Tax Year: In the space above the employer identiication number, enter the month and year in which the calendar or iscal year of the tax return you are

amending ends.

Column A

Line 1: Enter the amount from line 1 of your original return or as last ad- justed.

Line 2: (a) Enter the net Virginia Fixed Date Conformity Modiications based on depreciation as originally reported or adjusted.

(b)Enter the net of any other Virginia Fixed Date Conformity Modi- ications as originally reported or adjusted.

(c)Enter taxable addition for interest and intangible expenses as originally reported or adjusted (Schedule 500AB).

(d)Enter the total modiications, excluding ixed date conformity and the taxable addition for interest and intangible expenses, from your original return or as last amended. Savings and loan

associations must include their Virginia bad debt deduction from line 6 of Form 500 as part of this amount.

Line 3: Enter the Virginia taxable income from line 7 of your original return or as last amended.

Column B

Line 1: Enter the increase or decrease you are making. Explain any changes in Part II and attach appropriate veriication (1120X, RAR, etc.).

Line 2: (a) Enter the amount of increase or decrease of depreciation based on Virginia Fixed Date Conformity.

(b)Enter the amount of increase or decrease for other ixed date conformity modiications.

(c)Enter the amount of increase or decrease for the taxable addi- tion for interest and intangible expenses. Complete and attach Schedule 500AB.

(d)Enter the increase or decrease you are making and attach ex- planation.

Column C

Lines 1 and 2(a) - (d): Add the increase in column B to the amount in col- umn A or subtract the column B decrease from column A. Report the result in column C. For any item you do not change, enter the amount from column A in column C.

Line 3: Figure the corrected Virginia taxable income by adding the amounts

in column C, lines 1 and 2, and enter on line 3, column C.

Line 4: Corporations other than Multistate corporations, leave line 4 blank and go to line 5. Multistate corporations with no Virginia income must enter zeroes on line 4.

Otherwise:

(a)Multiply the amount on line 3, column C, by the appropriate

percentage from Schedule 500A, and enter here.Attach a copy of

Schedule 500A as originally iled for the year being amended.

(b)Enter the apportionment factor from Schedule 500A.

(c)& (d) Enter the amount of nonapportionable investment func- tion net income and loss as reported on the original return or the amended amount, as applicable. If the amount is being amended, documentation must be attached to support the

change. See Form 500 instructions for further information regarding these modiications and eligibility criteria.

Line 5: Multiply the amount on line 3 or line 4(a), as the case may be, by 6 percent and enter here.

Line 6: Enter the total nonrefundable tax credit amount from Form 500CR, line 100. Attach Form 500CR. Do not exceed the amount of tax on line 5.

Line 7: Subtract the total credits on line 6 from the amount of tax on line 5 and enter the difference here. If the credits on line 6 exceed the amount on line 5, enter zero.

Line 8: (a) Enter the amount of tax paid on the original return or as adjusted.

(b)Enter the refundable credits claimed from Form 500CR, line 108 with the original return or as later increased or adjusted. Do not include any litter tax.

(c)Enter the total of tax and refundable credits [Line 8(a) plus Line 8(b)].

(d)Enter the amount of any tax previously refunded from the amount entered on line 8(a) and/or 8(b).

Line 8: Subtract line 8(d) from line 8(c) and enter the difference in the space provided for Total Credits.

Line 9: If Line 7 is greater than line 8, subtract line 8 from line 7 and enter the difference here. This is the additional tax due.

Line 10: If line 8 is greater than line 7, subtract line 7 from line 8 and enter the difference here. This is your refund amount.

Line 11: Enter the amount of Coalield Employment Enhancement Tax Credit

earned.

VA DEPT OF TAXATION 2601215 REV 8/07 |

Page 2 |

Form Properties

| Fact | Detail |

|---|---|

| Purpose of Form 500X | To correct a previously filed Form 500, Virginia Corporation Income Tax Return, or to update it following an amended return, an examination, or a federal change. |

| Usage Restrictions | The form should not be used for net operating loss carrybacks. For those, use Form 500-NOLD instead. |

| When to File | After the original return has been filed and once any federal changes that affect the state return have been finalized. |

| Governing Law(s) | Based on the Virginia income tax laws, compliance is required with deadlines and corrections related to federal income adjustments. |

| Where to File | Submit to Virginia Department of Taxation, P.O. Box 1500, Richmond, Virginia 23218-1500, including any necessary documentation of federal adjustments. |

Steps to Filling Out Virginia 500X

For businesses needing to amend a previously filed Virginia Corporation Income Tax Return, Form 500X provides the opportunity to make corrections to the original submission. Whether adjustments are required due to an audit, a change in taxable income, or the application of credits not previously claimed, this form facilitates reporting these amendments to the Virginia Department of Taxation. It is crucial to fill out this form accurately to ensure proper processing of your amended return. The following step-by-step guidance will assist in completing Form 500X correctly.

Filling Out Form 500X:- At the top of the form, specify the tax year end date (month and year) for the return you are amending.

- Enter the corporation's legal name, Federal Employer Identification Number (FEIN), Virginia Corporation Account Number, and complete address including city, state, and ZIP code.

- Part I - Income and Virginia Modifications:

- For Column A (As Originally Reported or As Adjusted), enter the amounts from your original or last adjusted return for each line item.

- In Column B (Net Change), indicate any increases or decreases to the originally reported amounts. Each change must be explained in Part II.

- Column C (Correct Amount) should reflect the corrected amounts after adjustments. This is calculated as Column A plus or minus Column B, as applicable.

- Calculate the Virginia taxable income and enter it in line 3, Column C.

- For multistate corporations, complete line 4 with details about income subject to Virginia tax and the apportionment factor.

- Determine the income tax by applying 6% to the correct taxable income and enter this on line 5.

- On line 6, insert the total nonrefundable tax credit amount from Form 500CR, attaching the form to your return.

- Calculate the adjusted tax on line 7 by subtracting the credits on line 6 from the tax amount on line 5.

- Fill in details about payment credits in section 8, calculating the total payment credits and any previous refunds.

- Determine whether you owe additional tax or are due a refund, and fill in line 9 or line 10 accordingly.

- If applicable, enter the Coalfield Employment Enhancement Tax Credit earned on line 11.

- Complete the certification at the bottom of the form, including the signature of an authorized officer and the date. If prepared by someone other than the taxpayer, they should also sign and date the form.

- In Part II, provide detailed explanations for each change reported in Part I, including the reasons for the adjustments and any necessary computations.

- Attach a copy of the federal Form 1120X or other relevant documents if the amendments result from changes to your federal return.

After completing Form 500X, review it carefully to ensure all information is accurate and complete. Submit the form, along with any required attachments, to the Virginia Department of Taxation at the address provided on the form. Doing so in a timely manner helps in efficiently processing your amended return.

FAQ

What is Form 500X used for?

Form 500X, the Amended Virginia Consolidated Return, is utilized to correct a previously filed Form 500, Virginia Corporation Income Tax Return, whether the original submission was inaccurate or has been adjusted through an amended return or examination.

When should one file Form 500X?

The form should be filed only after the original tax return has been submitted. It's also necessary to attach a copy of the federal Forms 1120-X, 1139, or the Revenue Agent's Report if the federal taxable income reported has been changed or corrected.

Who needs to file Form 500X?

Virginia corporations needing to correct their previously filed income tax returns must use Form 500X. This includes corrections based on federal audit results, changes in taxable income, or adjustments to tax credits claimed.

What documents are required with Form 500X?

A copy of the federal adjustment documents, including Forms 1120-X or 1139, and any schedules or explanations for changes in income and modifications, such as an amended Schedule 500A or 500AB, should accompany Form 500X.

How does one report changes in income on Form 500X?

Part II of Form 500X is designed for explaining changes to income and modifications. Taxpayers should:

- Enter the line reference from Page 1 for the change.

- Provide detailed reasons for each adjustment.

- Attach any necessary computation details and schedules.

Can Form 500X be used for net operating loss carrybacks?

No, for carrying back a net operating loss, Form 500-NOLD must be used instead. Form 500X is used for all other amendments that are not related to net operating loss carrybacks.

Where should Form 500X be filed?

Completed forms should be mailed to the Virginia Department of Taxation at P.O. Box 1500, Richmond, Virginia, 23218-1500. Including a date on all attached documents, especially those related to federal adjustments, is advised.

What is the deadline for filing an amended return using Form 500X?

Amended returns using Form 500X can be filed within the later of:

- Three years from the original due date or extended due date, whichever is later.

- One year from when a federal change affecting Virginia taxable income is finalized.

- Two years from filing an amended Virginia return that resulted in additional tax due, under certain conditions.

How are tax adjustments calculated on Form 500X?

Adjustments to tax are computed by updating the net change in income or deductions as per instructions on the form. The amended tax due or refund is then calculated by comparing the adjusted tax liability to the payments and credits already made. Documentation and schedules supporting these changes must be attached.

Common mistakes

Filling out the Virginia 500X form, an amended Virginia Corporation Income Tax Return, requires careful attention to detail. Mistakes can delay processing, impact the accuracy of your tax liabilities, and affect your refund or balance due. Here are seven common errors to avoid:

- Incorrect or Incomplete Income Modifications: Not accurately reporting or adjusting federal taxable income and Virginia modifications can lead to incorrect tax calculations. It's crucial to accurately fill out income and Virginia modifications sections based on federal amendments or adjustments.

- Failure to Attach Required Documents: Many forget to attach a copy of federal Form 1120X or other relevant documents showing the nature of federal changes. This oversight can cause unnecessary delays in processing your amended return.

- Miscalculating Tax Credits and Payments: Not correctly adjusting tax credits (Form 500CR) or payment credits to reflect changes can result in incorrect calculation of the tax due or refund. Ensure all credits and previous payments are accurately accounted for.

- Not Reporting Federal Adjustments: If the IRS has made adjustments to your federal taxable income, these changes must be reported on the Virginia 500X within one year. Failure to do so could lead to discrepancies and potential penalties.

- Omission of Signatures and Dates: An unsigned or undated form is invalid. Ensure that the form is signed and dated by an authorized individual and that the preparer’s information, if applicable, is complete.

- Forgetting to Adjust Schedule 500A or 500AB: If changes in income or deductions affect apportionable and non-apportionable income, revised Schedules 500A or 500AB must be attached. Neglecting this step can result in inaccurate tax calculations.

- Incorrect Address or Identification Information: Starting with basics, incorrect or outdated address and identification information can lead to processing delays or misdirected correspondence. Always double-check these fields for accuracy.

Here are some additional tips to ensure a smooth process:

- Review the form thoroughly before submission to catch any computational or clerical errors.

- Ensure all mandatory fields are completed; do not leave any section that applies to you blank.

- Use the specific instructions for the tax year you are amending, as rules and requirements can change.

- Consider consulting a tax professional to avoid errors, especially if your amended return involves complex adjustments.

By avoiding these common mistakes and following the tips provided, you can help ensure your Virginia 500X form is processed efficiently and accurately.

Documents used along the form

When filing an amended Virginia Corporation Income Tax Return using Form 500X, several other forms and documents may be necessary depending on the specific adjustments or corrections being made. Whether you're amending your tax return due to changes in federal taxable income, claiming additional credits, or correcting previous errors, knowing which documents to include can ensure your amendment is processed smoothly.

- Federal Form 1120X: This is the form used by corporations to amend their federal income tax returns. A copy must be attached if the amendment affects any item that was also reported on the federal return.

- Revenue Agent's Report (RAR): If the IRS audits your federal return and makes changes, you must report this to Virginia by including a copy of the RAR with your Form 500X.

- Schedule 500A: This schedule is for multistate corporations to report their apportionment factor, which is required when adjusting income that is subject to Virginia tax.

- Schedule 500AB: Needed if making adjustments to interest and intangible expenses, Schedule 500AB must be amended and attached to reflect any changes.

- Form 500CR: This form is for claiming tax credits that you didn't claim on your original return or if you need to correct the amount of tax credits previously claimed. An updated Form 500CR should be attached.

- Form 500-NOLD: Used specifically for claiming a refund due to a net operating loss carryback. If your amendment involves a net operating loss, you'll need to complete and attach this form.

- Statement of Adjustment: If there’s a federal adjustment that impacts your Virginia tax return, attaching a copy of any IRS statements or official notifications is necessary.

- Coalfield Employment Enhancement Tax Credit documentation: In cases where you’re claiming or adjusting this specific credit, proper documentation or proof of eligibility must be attached.

Correctly including these forms and documents with your Form 500X can help address various amendments ranging from federal adjustments to specific state tax credits. Careful review of your specific situation and the requirements for each document will ensure that your amended return is complete and accurate, facilitating a smoother processing by the Virginia Department of Taxation.

Similar forms

The Virginia 500X form is similar to the Federal Form 1120X, commonly referred to as the Amended U.S. Corporation Income Tax Return. Both forms are utilized for the purpose of amending previously filed income tax returns. Specifically, Form 500X allows corporations to correct information or claim additional deductions or credits not claimed or reported on their original Virginia Corporation Income Tax Return. Comparably, Form 120X serves the same function at the federal level, allowing corporations to make adjustments to their previously filed Form 1120 or 1120-A. Key similarities include sections to report changes to income, deductions, tax credits, and payments, as well as areas to explain the reasons for the amendments. Both forms also require the attachment of documentation supporting the changes, such as a copy of the federally amended return and any other relevant schedules or statements.

Another document similar to the Virginia 500X form is Form 500-NOLD, designated for Corporation Application For Refund due to Net Operating Loss (NOL) carrybacks for corporations. While Form 500X addresses a wide range of amendments, including some relating to NOLs, Form 500-NOLD is specifically tailored for refund applications resulting from carrying back NOLs to prior tax years. The 500-NOLD form allows corporations to apply for refunds based on losses that could not be utilized in the year they were incurred but can be applied to reduce taxable income in preceding years. This focus on NOLs distinguishes it from the broader correction capabilities of Form 500X, though both play crucial roles in the tax amendment process for corporations seeking to optimize their tax positions or rectify previously filed information.

Additionally, the Virginia 500X form shares similarities with the Form 500CR for businesses, which is used to claim various nonrefundable and refundable business tax credits. While Form 500X allows corporations to amend previously reported income and deductions, including adjustments to claimed tax credits, Form 500CR specifically focuses on the calculation and claiming of business-related tax credits in Virginia. These credits might include incentives for research and development, job creation, green energy initiatives, and more. Form 500X would be the document to adjust any previously claimed credits through Form 500CR, making these two forms closely related in the process of ensuring correct and advantageous tax reporting for corporations.

Dos and Don'ts

When filling out the Virginia 500X form, a careful approach is required to ensure accuracy and compliance. Here are some tips on what you should and shouldn't do:

Things You Should Do:- Attach a copy of your Federal Form 1120X. It's important to include this as it shows the amendments made on your federal return, which could affect your state return.

- Explain all changes thoroughly in Part II. Any alterations to your income, deductions, or credits need a clear explanation. Providing detailed information helps in the processing of your amended return.

- Enclose any additional required schedules. If changes made to your return affect other forms or schedules, such as Schedule 500A or 500AB, make sure to include the amended versions of these as well.

- Report changes made by the IRS or due to a federal audit promptly. If the IRS has made adjustments to your federal return, ensure you submit the state amended return within the required timeframe to reflect these changes.

- Don't use the 500X form to claim a net operating loss carryback. For those cases, you need to use Form 500-NOLD, designed specifically for net operating loss carrybacks.

- Avoid delays in filing after federal adjustments. Once the IRS has made final adjustments to your federal return, don't wait too long to amend your state return. Timeliness is crucial to avoid potential interest and penalties.

- Don't submit incomplete forms or schedules. Failure to attach required documents, like the Federal Form 1120X or altered schedules, can result in processing delays or the return being sent back.

- Refrain from excluding information about refundable and nonrefundable credits. If you are claiming additional credits or need to adjust the amounts previously claimed, make sure to complete and attach the corrected Form 500CR.

Misconceptions

Discussions around the Virginia Form 500X, also known as the Amended Virginia Corporation Income Tax Return, often lead to a mix of accurate information and misconceptions. Here, we address some common misunderstandings:

- Misconception 1: You can use the 500X form for net operating loss carrybacks. Actually, the correct form for net operating losses is Form 500-NOLD. The 500X form is not designed for this purpose.

- Misconception 2: Any changes in your federal tax liability automatically update your Virginia taxes. In reality, if the IRS changes or corrects your federal taxable income, you must report this to the Virginia Department of Taxation within one year using the 500X form.

- Misconception 3: The 500X form can be filed at any time. Contrary to this belief, you should only file Form 500X after your original return has been submitted. Timing is crucial to ensure your amended return is processed correctly.

- Misconception 4: Corrections to any federal tax forms don't need to be attached to the 500X form. On the contrary, attaching a copy of federal amendments or corrections, such as Forms 1120-X, is crucial when filing your 500X.

- Misconception 5: Filing a 500X form for a capital loss carryback requires only one return. If you're amending for capital loss in addition to other adjustments, two separate 500X forms must be filed—one for the capital loss carryback and another for all additional changes.

- Misconception 6: Tax credits are automatically transferred from your original return. When filing a 500X, if there are updates to your tax credits, you need to submit these changes with the appropriate documentation, such as a corrected Form 500CR, for them to be applied.

- Misconception 7: You can claim a refund for errors found on your tax return indefinitely. Refunds based on amendments can be claimed within specific periods, such as three years from the due date of the return (or extended due date, if applicable), or under other specified conditions relating to federal adjustments and prior assessments.

- Misconception 8: The Department of Taxation will not charge interest on owed amounts discovered during the amendment process. If additional tax is owed after an amendment, the Department will calculate and bill for any applicable interest. Similarly, any refund issued may also include interest.

Understanding these facts can streamline the process of amending a Virginia Corporation Income Tax Return and help ensure compliance with state tax laws.

Key takeaways

Filing an amended Virginia Corporation Income Tax Return using Form 500X is essential for corporations that need to correct their original returns or adjust them based on new information. This crucial step ensures compliance with Virginia's tax laws and can help corporations manage their tax liabilities more effectively. Here are four key takeaways to keep in mind when preparing and submitting this form:

- Timing is Crucial: It's important to file Form 500X only after the original tax return has been submitted. Amendments can be made due to corrections, adjustments from an amended federal return, or audit adjustments. Understanding the appropriate timing for submission can help avoid compliance issues or delays in processing.

- Documentation is Key: When filing an amended return, attaching the relevant documentation, such as a copy of the federal Form 1120X, Revenue Agent’s Report, or any other documentation that explains the nature and reason for the amendments, is imperative. This documentation serves as a substantiation of the claims made on the amendment, facilitating a smoother review process by the Virginia Department of Taxation.

- Report Federal Adjustments Promptly: If a corporation’s federal taxable income is adjusted by the IRS or other federal authority, the corporation is required to report this adjustment to the Virginia Department of Taxation within one year. Failing to promptly report these changes could lead to discrepancies in tax liabilities and potential penalties.

- Understanding Modiications: Virginia’s modifications to federal taxable income, such as fixed date conformity adjustments and taxable additions for interest and intangible expenses, require careful consideration. Businesses need to accurately calculate these modifications to ensure that their amended tax return reflects the correct Virginia taxable income. Paying close attention to the specific instructions for each modification can help avoid errors.

Approaching Form 500X with thoroughness and a deep understanding of the detailed requirements will facilitate a smoother amendment process, ensuring that corporations remain compliant with Virginia tax laws while accurately reflecting their tax positions.

Other PDF Forms

How Long Do You Have to File Probate After Death in Virginia - Supports executors in fulfilling their duties faithfully, protecting them from potential legal issues.

Wv Social Studies Fair - An examination of the role of women in West Virginia's labor movements, focusing on contributions, leadership, and legacy.

501c3 Virginia - This form represents a bridge between legislation and practical benefit, translating tax laws into tangible improvements in mobility for those with disabilities.