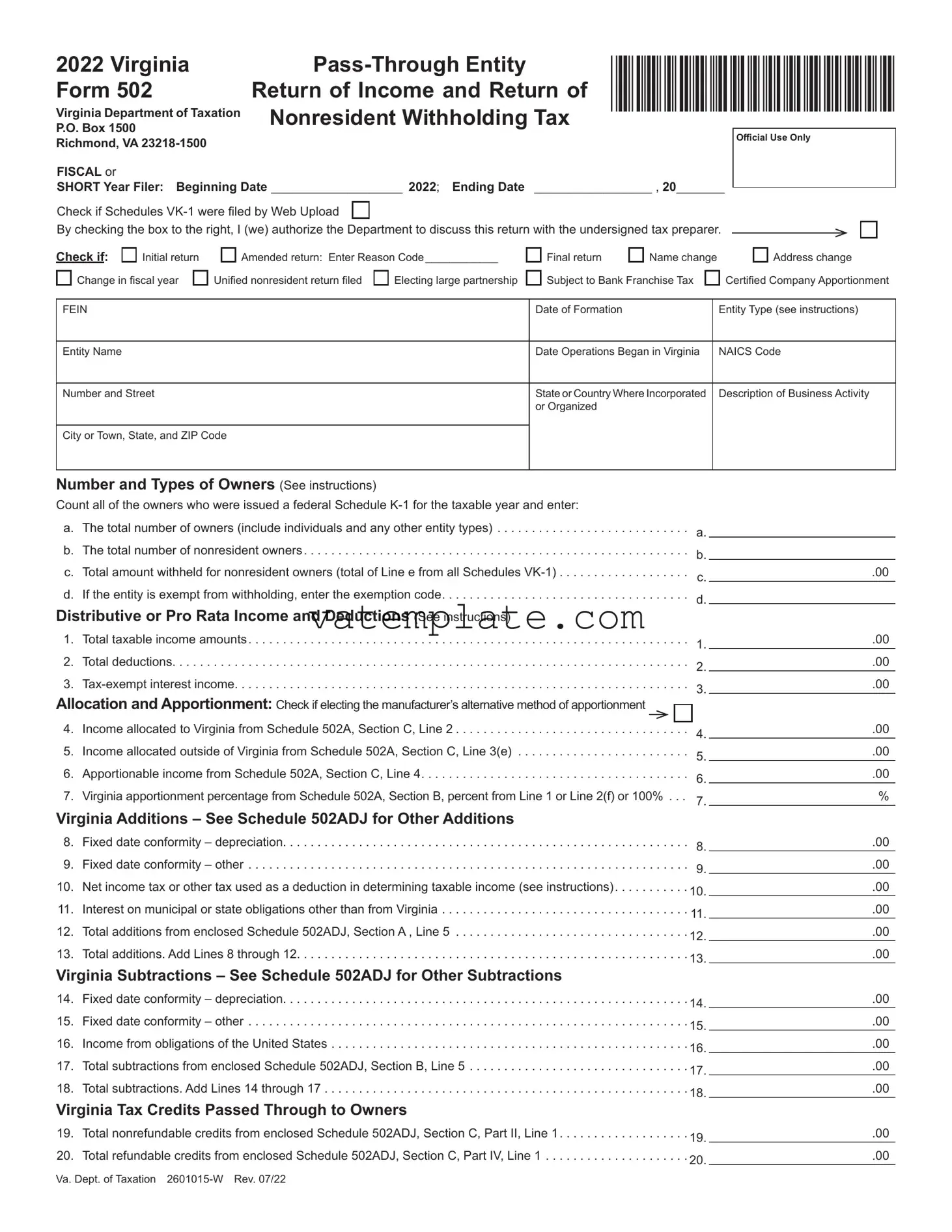

Fill Out a Valid Virginia 502 Template

The Virginia 502 form, officially titled "Return of Income and Return of Nonresident Withholding Tax," serves as a critical document for pass-through entities within the state, addressing income reporting, nonresident withholding, and various tax credits available for qualifying entities. Its broad applicability includes provisions for entities such as S corporations, partnerships, and limited liability companies that choose to pass their income, deductions, gains, losses, and credits through to their members, shareholders, or partners. Designed to be filed with the Virginia Department of Taxation, the form outlines requirements for reporting distributive or pro-rata shares of income and deductions, details on withholding tax for nonresident members, and a comprehensive approach to calculating Virginia-specific additions and subtractions to income. It also includes sections for reconciling withholding payments, detailing penalties and interest charges, and declaring eligibility for certain nonrefundable and refundable tax credits passed through to owners. This extensive form plays a pivotal role in ensuring compliance with Virginia's tax laws and facilitating the financial responsibilities of pass-through entities, thereby necessitating a thorough understanding of its components and the proper method of completion to avoid common pitfalls associated with its filing.

Virginia 502 Example

Form 502 |

Return of Income and Return of *VA0PTE122888* |

|

2022 Virginia |

||

Virginia Department of Taxation |

Nonresident Withholding Tax |

|

P.O. Box 1500 |

|

Official Use Only |

Richmond, VA |

|

|

|

|

|

FISCAL or |

|

|

SHORT Year Filer: Beginning Date ___________________ 2022; Ending Date _________________ , 20_______ |

|

|

|

||

By checking the box to the right, I (we) authorize the Department to discuss this return with the undersigned tax preparer.

Check if: |

Initial return |

Change in fiscal year

Amended return: Enter Reason Code____________

Unified nonresident return filed |

|

Electing large partnership |

Final return |

Name change |

Subject to Bank Franchise Tax

Address change

Certified Company Apportionment

FEIN |

Date of Formation |

Entity Type (see instructions) |

|

|

|

Entity Name |

Date Operations Began in Virginia |

NAICS Code |

|

|

|

Number and Street |

State or Country Where Incorporated |

Description of Business Activity |

|

or Organized |

|

|

|

|

City or Town, State, and ZIP Code |

|

|

|

|

|

Number and Types of Owners (See instructions)

a. The total number of owners (include individuals and any other entity types) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

b. The total number of nonresident owners . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

c.

d. If the entity is exempt from withholding, enter the exemption code . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Distributive or Pro Rata Income and Deductions (See instructions)

1.Total taxable income amounts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.Total deductions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

Allocation and Apportionment: Check if electing the manufacturer’s alternative method of apportionment

4.Income allocated to Virginia from Schedule 502A, Section C, Line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5.Income allocated outside of Virginia from Schedule 502A, Section C, Line 3(e) . . . . . . . . . . . . . . . . . . . . . . . . .

6.Apportionable income from Schedule 502A, Section C, Line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.Virginia apportionment percentage from Schedule 502A, Section B, percent from Line 1 or Line 2(f) or 100% . . .

a.

b. c. d.

1.

2.

3.

4.

5.

6.

7.

.00

.00

.00

.00

.00

.00

.00

%

Virginia Additions – See Schedule 502ADJ for Other Additions

8.

9.

10. Net income tax or other tax used as a deduction in determining taxable income (see instructions) . . . . . . . . . . . 10.

11. Interest on municipal or state obligations other than from Virginia . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11.

12. Total additions from enclosed Schedule 502ADJ, Section A , Line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12.

13. Total additions. Add Lines 8 through 12. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13.

Virginia Subtractions – See Schedule 502ADJ for Other Subtractions

14.

15.

16. Income from obligations of the United States . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16.

17. Total subtractions from enclosed Schedule 502ADJ, Section B, Line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17.

18. Total subtractions. Add Lines 14 through 17 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18.

Virginia Tax Credits Passed Through to Owners

19. Total nonrefundable credits from enclosed Schedule 502ADJ, Section C, Part II, Line 1 . . . . . . . . . . . . . . . . . . . 19.

20. Total refundable credits from enclosed Schedule 502ADJ, Section C, Part IV, Line 1 . . . . . . . . . . . . . . . . . . . . . 20.

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

Va. Dept. of Taxation

Form 502 |

FEIN |

_________________________ |

*VA0PTE222888* |

2022 Virginia Name |

____________________________________ |

|

|

Page 2

Section 1 – Withholding Payment Reconciliation

1. Total withholding tax due for nonresident owners . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

3. Overpayment. If Line 2 is greater than Line 1, subtract Line 1 from Line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4. Withholding tax due. If Line 2 is less than Line 1, subtract Line 2 from Line 1 . . . . . . . . . . . . . . . . . . . . . . . . .

1.

2.

3.

4.

.00

.00

.00

.00

Section 2 – Penalty and Interest Charges on Withholding Tax

5.Extension penalty (may apply to returns filed within extension period if 90% of Line 1 is not paid timely) . . . .

6.Late payment penalty on tax due (will apply if there is a balance due on Line 4 and Form 502 is being filed more than 6 months after the original due date). Enter 30% of the amount on Line 4 . . . . . . . . . . . . . . . . . . .

7.Interest (may apply if there is a balance due on Line 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8.Penalty and interest charges due. Add Line 5 or Line 6 (whichever applies) to Line 7 . . . . . . . . . . . . . . . . . . .

Section 3 – Penalty for Late Filing of Form 502

9.If Form 502 is being filed more than 6 months after the original due date, or more than 30 days after the federal extended due date, enter $1,200. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Section 4 – Withholding Overpayment

10.Net overpayment. If Line 8 or Line 9 exceeds Line 3, go to Line 13 below to compute the total payment due.

Compare Line 6 and Line 9. If Line 6 is greater than Line 9, subtract Line 8 from Line 3. If Line 9 is greater than Line 6, subtract Line 7 plus Line 9 from Line 3. Otherwise, enter overpayment amount from Line 3 . . . .

11.Amount of withholding overpayment to be credited to 2023 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12.Amount of withholding overpayment to be refunded . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Section 5 – Tax, Penalty, and Interest Due

13.Balance of tax due plus extension penalty, if applicable. If there is an amount due on Line 4, enter Line 4 plus Line 5. If there is an overpayment on Line 3 and Line 8 or Line 9 is greater than Line 3, enter Line 5 minus Line 3 . . . . . . .

14.Interest charges on withholding tax from Line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15.Late filing penalty. Enter the greater of Line 6 or Line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16.Total payment due. Add Line 13, Line 14, and Line 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Section 6 – Amount Due or Refund

17.Motion Picture Production Tax Credit to be refunded directly to PTE (see instructions) . . . . . . . . . . . . . . . . . .

18.Research and Development Expenses Tax Credit to be refunded directly to PTE (see instructions) . . . . . . . .

19.Credit to be refunded directly to PTE. Add Line 17 and Line 18 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20.Amount Due. If there is an amount due on Line 16 and the amount exceeds the amount on Line 19, subtract Line 19 from Line 16. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21.Amount of Refund. If there is an amount due on Line 16 and the amount is less than the amount on Line 19, subtract Line 16 from Line 19. If there is an amount on Line 12, add Line 12 and Line 19 . . . . . . . . . . . . . . . .

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

20.

21.

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

I, the undersigned owner and authorized representative of the

Signature of Owner or Authorized Representative |

Title |

Date |

|

|

|

Printed Name of Owner or Authorized Representative |

Phone |

|

|

|

|

Individual or Firm, Signature of Preparer, Phone Number, and Address |

|

Date |

|

|

|

Printed Name of Individual or Firm |

Preparer’s FEIN, PTIN, or SSN |

Approved Vendor Code |

|

|

|

Include a copy of your federal return with Form 502. Important: do not include a federal Schedule

a Schedule

Do not submit Form 765 with this return – Mail it to the address on Form 765.

Form Properties

| Fact | Detail |

|---|---|

| Purpose of Form 502 | Used by Virginia Pass-Through Entities to report Income and Return of Nonresident Withholding Tax. |

| Governing Law | Form 502 is governed by the tax laws of the Commonwealth of Virginia, specifically relating to the taxation of pass-through entities and withholding requirements for nonresidents. |

| Submission Information | Address for submission is Department of Taxation, P.O. Box 1500, Richmond, VA 23218-1500. |

| Filing Options | Form 502 allows for either Fiscal Year or Short Year filing, and includes checkboxes for indicating an initial return, a change in fiscal year, an amended return, filing a unified nonresident return, and other specific conditions. |

| Penalties and Interest | Penalties and interest may apply for late filing or underpayment of the withholding tax due. Extension penalties apply if 90% of the tax due is not paid timely, and late payment penalties apply if the tax due is paid more than 6 months after the original due date. |

Steps to Filling Out Virginia 502

Filling out the Virginia Form 502 is crucial for pass-through entities, like S corporations and partnerships, to properly report their income, distribute shares to their members, and comply with nonresident withholding tax requirements. This step-by-step guide aims to simplify the process, ensuring accuracy and timely compliance with the Virginia Department of Taxation's requirements.

- Begin with the Fiscal or SHORT Year Filer section at the top of the form. Enter the beginning and ending dates of your fiscal year.

- If you filed Schedules VK-1 by Web Upload, check the corresponding box.

- In the section marked for official use only, authorize the Department to discuss the return with the tax preparer by checking the appropriate box.

- Indicate if this is an initial return, a change in the fiscal year, an amended return, an electing large partnership return, or if it’s the final return with a name or address change. Also, enter the reason code for an amended return if applicable.

- Provide the Entity Information, including FEIN, date of formation, entity type, entity name, date operations began in Virginia, NAICS code, and address. Also, state where the entity was incorporated or organized and give a brief description of business activity.

- Under Number and Types of Owners, count all of the owners who were issued a federal Schedule K-1 for the taxable year. Enter the total number of owners, the total number of nonresident owners, the total amount withheld for nonresident owners, and if the entity is exempt from withholding, the exemption code.

- Fill out the section on Distributive or Pro Rata Income and Deductions with total taxable income amounts, total deductions, and tax-exempt interest income.

- In the Allocation and Apportionment section, elect the manufacturer’s alternative method of apportionment if applicable and fill in the income allocated to Virginia, allocated outside of Virginia, and the Virginia apportionment percentage.

- Complete the sections on Virginia Additions and Virginia Subtractions according to Schedule 502ADJ for other additions or subtractions you might have.

- For entities passing through tax credits to their owners, provide totals for nonrefundable and refundable credits from the enclosed Schedule 502ADJ.

- On Page 2, in the Withholding Payment Reconciliation section, calculate the total withholding tax due for nonresident owners, total withholding tax paid, overpayment, and withholding tax due.

- Address any Penalty and Interest Charges on Withholding Tax and Penalty for Late Filing of Form 502 as applicable.

- Determine if you have a Withholding Overpayment and decide the amounts to be credited to 2022 or to be refunded.

- In the Tax, Penalty, and Interest Due section, calculate any balance of tax due, interest charges on withholding tax, and late filing penalty.

- Complete the Amount Due or Refund section, including any specific tax credits to be refunded directly to the PTE.

- Sign and date the form with the title and contact information of the authorized representative. If a preparer is involved, ensure they also sign and provide their information, including their FEIN, PTIN, or SSN and approved vendor code.

- Attach a copy of your federal return with Form 502. Remember, if Schedules VK-1 were filed online, do not include copies with the Form 502.

After completing these steps, review the form to make sure all information is accurate and complete. Then mail the form to the Virginia Department of Taxation at the address provided on the form. This careful preparation ensures compliance and helps the pass-through entity avoid any potential penalties or issues.

FAQ

What is the Virginia 502 form used for?

The Virginia 502 form is a tax document used by pass-through entities, such as partnerships, S corporations, and limited liability companies, to report income, deductions, and taxes withheld for nonresident owners. It is also the form through which the entity concurs with the state's Department of Taxation about its income and deductions for the tax year, ensuring the correct apportionment and allocation of income for Virginia tax liability purposes.

Who needs to file the Virginia 502 form?

Pass-through entities operating in Virginia, including partnerships, S corporations, and limited liability companies that have Virginia source income, are required to file the Virginia 502 form. This requirement holds regardless of whether these entities have nonresident owners for whom income tax was withheld.

What is the deadline for filing the Virginia 502 form?

The deadline for filing the Virginia 502 form typically falls on the 15th day of the 4th month following the close of the tax year for the entity. For most entities operating on a calendar year, this deadline is April 15th of the following year. Entities should take note of the specific tax year's deadline to avoid penalties.

What information is required to complete Form 502?

To complete Form 502, entities need to provide comprehensive information including:

- The entity's federal Employer Identification Number (FEIN).

- The name, address, and NAICS code of the entity.

- The total number of owners and the total number of nonresident owners.

- Details of distributive or pro rata income, deductions, and Virginia-specific additions or subtractions.

- Allocation and apportionment percentages if applicable.

- Details on tax credits, withheld taxes, and any overpayment or dues.

How does a pass-through entity file Form 502?

Pass-through entities can file Form 502 either electronically through the Virginia Department of Taxation's website or by mailing a paper form to the Department. Electing the electronic filing method may expedite the processing of the form. When filing by mail, it's critical to use the correct address provided by the Virginia Department of Taxation to avoid delays.

Are any attachments required with Form 502?

When submitting Form 502, the entity must include a copy of its federal tax return. However, individual federal Schedule K-1 forms for each owner should not be attached if these schedules were filed electronically via Web Upload. However, the form does not require submission of Form 765; this form has a separate mailing address if needed.

What should an entity do if it needs to amend a previously filed Form 502?

If an entity discovers an error or omission in a previously filed Form 502, it should file an amended return. To do this, the entity must indicate on the Form 502 that it is an amended return by checking the appropriate box and including the reason code for the amendment. All changes should be clearly indicated on the form, and any additional documentation supporting the amendment should be attached.

Common mistakes

Filling out the Virginia 502 form, which is used for income reporting and nonresident withholding tax by pass-through entities, can seem straightforward. However, certain common mistakes can lead to issues with the Department of Taxation. Here are ten errors to avoid:

- Not including the fiscal year or incorrectly stating the beginning and ending dates. This oversight can cause confusion about the applicable tax year.

- Failure to check the box if Schedules VK-1 were filed by Web Upload, leading to incomplete information about how the return was prepared.

- Omitting the authorization checkbox for discussion with the tax preparer can hinder communication between the tax department and the preparer if questions arise.

- Incorrectly marking the return type, such as initial, amended, or final. This mistake can affect the processing and understanding of the return's purpose.

- Forgetting to enter the Reason Code on amended returns. Without this, it's unclear why the return is being amended.

- Failing to accurately count and report the number of owners, including both resident and nonresident owners. Accuracy here is crucial for correct tax calculation.

- Miscalculating the total amount withheld for nonresident owners, leading to potential underpayment or overpayment of taxes.

- Not correctly detailing the entity's income and deductions. Each item needs to be accurately reported for proper tax assessment.

- Forgetting to check the box if electing the manufacturer’s alternative method of apportionment. This election can significantly impact the tax calculation.

- Incomplete or missing information on tax credits passed through to owners, which can lead to beneficiaries not receiving entitled credits.

By avoiding these mistakes, you can help ensure that the Virginia 502 form is completed accurately and in compliance with state tax regulations.

Documents used along the form

When filing the Virginia Form 502 for Pass-Through Entity Income Tax Returns, additional forms and documents are often required to provide comprehensive details about your entity's income, deductions, and tax responsibility. Understanding these supplementary documents ensures a smoother filing process and helps in maintaining compliance with the Virginia Department of Taxation's requirements. Let's delve into some of these key forms and documents.

- Schedule VK-1: This form provides detailed information about the distributive share of income, deductions, and credits for each member or partner of the pass-through entity. Each owner's share is reported separately, which helps in preparing their individual state tax returns.

- Schedule 502ADJ: This schedule is used for adjusting income. It includes additions and subtractions to income as reported on the federal return, such as state income tax refunds or interest from non-Virginia municipal bonds. This form ensures that only income taxable by Virginia is considered in calculating the tax owed.

- Schedule 502A: Necessary for reporting the allocation and apportionment of income. This schedule is particularly important for entities operating both inside and outside Virginia, as it determines the portion of income attributable to Virginia.

- Form 765: Though not to be submitted with Form 502, it is relevant for pass-through entities. Form 765, Unified Nonresident Individual Income Tax Return, is filed separately and used when a pass-through entity has nonresident members and elects to file a composite return on their behalf.

- Federal Tax Return: A copy of the pass-through entity's federal tax return is often required to be submitted along with Form 502. It provides a reference point for the state tax return and helps validate the income and deductions reported for state tax purposes.

These documents play a crucial role in the tax filing process for pass-through entities in Virginia. By ensuring that these forms are accurately completed and appropriately attached, entities can effectively report their income, calculate their taxes due, and claim any eligible deductions and credits. Always check the latest requirements and instructions from the Virginia Department of Taxation to stay compliant and avoid any potential issues.

Similar forms

The Virginia 502 form is similar to the Federal Form 1065, used by the United States Internal Revenue Service for partnership tax returns. Both forms require detailed income, deductions, and tax information related to the operation of partnerships and pass-through entities. They collect data on the entity's financial performance over the fiscal year, including total income, deductions, and taxable income. However, the Virginia 502 form specifically caters to the requirements of the Virginia Department of Taxation, incorporating state-specific tax considerations, such as allocations and apportionments relevant to Virginia, and nonresident withholding tax obligations. Consequently, while both forms serve the tax reporting needs of partnerships, the Virginia 502 form includes additional sections and considerations specific to Virginia state tax laws.

Another document similar to the Virginia 502 form is the Virginia Schedule VK-1. This schedule is an integral component of the Virginia 502 form, providing detailed information about each owner's share of income, deductions, and credits from the pass-through entity. The Schedule VK-1 mirrors the function of the federal Schedule K-1, which is attached to the Federal Form 1065 for similar purposes at the federal level. Both schedules intend to report each partner's or member's distributive share of the pass-through entity's income and other tax items. They play a crucial role in ensuring that income from pass-through entities is accurately reported and taxed on the individual owners' returns, aligning the entity's reporting requirements with those of its owners at both the state and federal levels.

Dos and Don'ts

When completing the Virginia Form 502, it's crucial to pay attention to details to ensure accuracy and compliance. Here are some do's and don'ts that can help streamline the process:

- Do ensure all information matches your federal return, including income amounts and deductions.

- Do check that Schedules VK-1 were filed by Web Upload if applicable, to avoid unnecessary paperwork.

- Do accurately count and report the number of owners and nonresident owners, as this affects withholding amounts.

- Do check if your entity is subject to specific considerations, such as Bank Franchise Tax or the Unified Nonresident Return, and mark appropriately.

- Do carefully calculate your Distributive or Pro Rata Income and Deductions to ensure the correct taxable income is reported.

- Don't forget to include your FEIN and the date of formation, as these are critical identifiers for your entity.

- Don't overlook the need to enter a reason code if filing an amended return. This helps clarify the changes made.

- Don't ignore the Penalty and Interest Charges sections if you have a balance due or are filing late; accurately calculate any amounts owed.

- Don't submit without reviewing the entirety of the form for accuracy and completeness, including the authorization section at the end.

By adhering to these guidelines, you'll help ensure a smoother filing process, reduce the risk of errors, and comply with Virginia's tax laws.

Misconceptions

Many people have misconceptions about the Virginia 502 form, which can lead to confusion during the tax filing process. Understanding these misconceptions can help ensure that the form is completed accurately and efficiently. Here's a look at some common misunderstandings and the truths behind them:

Only businesses in Virginia need to file: Even if a pass-through entity is not based in Virginia, it must file Form 502 if it has income, gains, losses, or deductions sourced from the state.

Filing the form is the only requirement: In addition to filing Form 502, pass-through entities may need to submit other documents, such as federal returns or schedules detailing nonresident withholding tax.

Every owner needs to submit a federal Schedule K-1: While information from federal Schedule K-1s is crucial for completing Form 502, these schedules do not need to be submitted with the form if schedules VK-1 were filed by Web Upload.

Form 502 is only for reporting income: This form is used not only to report income but also to document deductions, losses, and tax-exempt interest, as well as to calculate and report nonresident withholding tax.

Electronic filing isn’t an option: Pass-through entities can file Form 502 electronically through Web Upload, which is encouraged for its efficiency and convenience.

Amendments can’t be made after submission: If an error is discovered after filing, an amended Form 502 can be submitted by indicating the amendment reason code and providing the corrected information.

There is no penalty for late filing: Late filing can result in penalties and interest charges, so it's important to submit Form 502 by the due date, or within any extension period granted.

All entities must withhold tax for nonresident owners: While generally true, there are exceptions based on specific criteria, such as exemption codes, that can exempt an entity from this requirement.

Clarifying these misconceptions helps ensure a smoother filing process and compliance with Virginia state tax regulations.

Key takeaways

When filling out and using the Virginia 502 form, there are several key points to keep in mind to ensure the process goes smoothly and in compliance with state tax regulations. Understanding these aspects can help individuals and entities accurately manage their nonresident withholding tax obligations.

- Proper identification and reporting: Ensure that the Federal Employer Identification Number (FEIN), the exact name of the entity, and the type of entity (as per the instructions) are correctly provided. This foundational information is critical for the proper identification and processing of the return.

- Detailed income reporting: Accurately report all taxable income, deductions, and tax-exempt interest income. These figures are essential for determining the correct amount of tax due or the refund claimable. Misreporting can lead to discrepancies and potential penalties.

- APportionment and withholding: Clearly understand and correctly apply the rules for income allocation and apportionment. It's vital to properly calculate the income allocated to Virginia and the required withholdings for nonresident owners to avoid underpayment or overpayment of taxes.

- Penalties and interest: Be aware of the potential for penalties and interest charges for late filings or payments, including the specific conditions under which these penalties apply. Knowing these details can help in planning submissions and payments to avoid unnecessary charges.

In summary, diligently gathering and reporting all necessary information, understanding the allocation/apportionment rules, and being mindful of deadlines and potential penalties are critical when dealing with the Virginia 502 form. This approach ensures compliance and minimizes the likelihood of errors or issues with the state's Department of Taxation.

Other PDF Forms

Virginia 801 - For brokers who prefer paper filing, Form 801 can also be downloaded as a PDF, ensuring accessibility for all compliance preferences.

How to Fill Out W9 - A request form for taxpayer identification and certification specifically for individuals and entities engaging in transactions with the Commonwealth of Virginia.

Va Doc Visitation - It includes a section for specifying one's legal relationship to the offender, which helps in determining the eligibility for visitation.