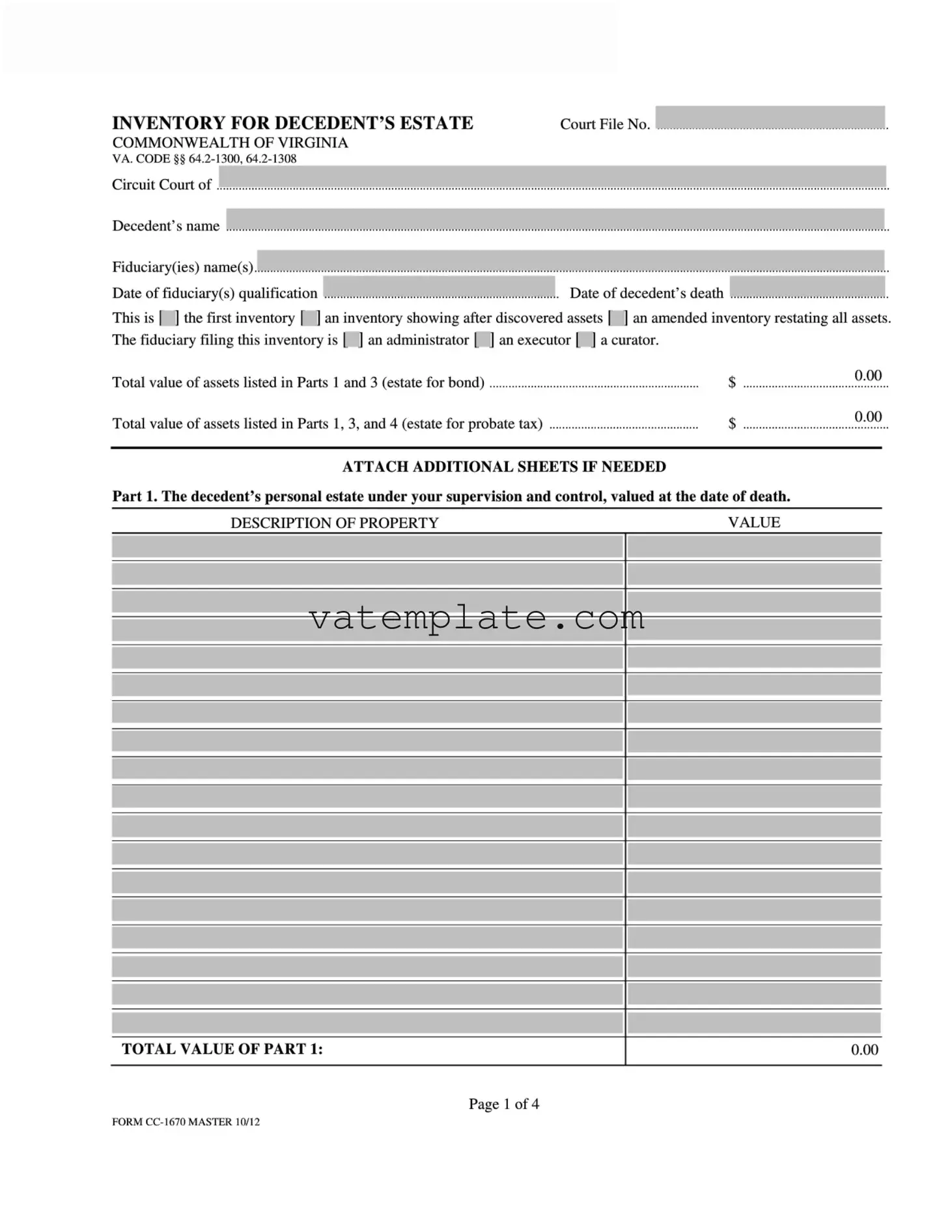

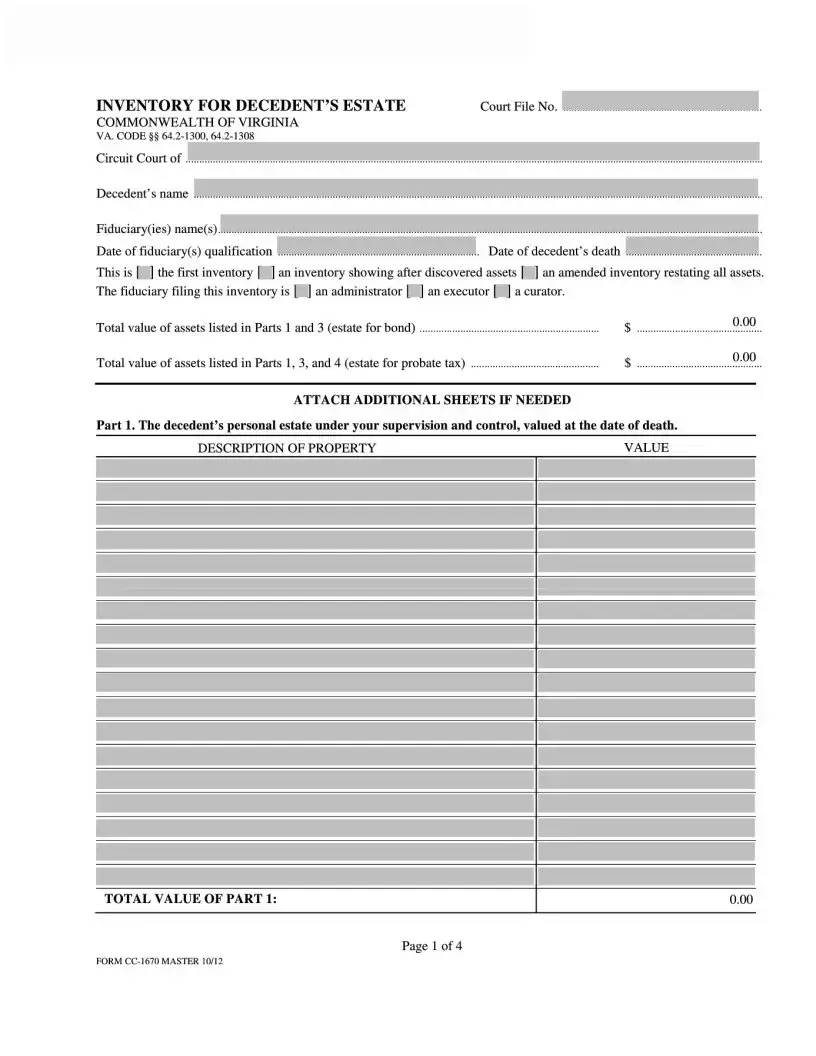

Fill Out a Valid Virginia Estate Cc 1670 Template

Navigating the complexities of estate planning and administration in Virginia can be a daunting task, particularly when dealing with the intricacies of the legal documents that form the backbone of this process. Among these, the Virginia Estate CC 167_MENU form plays a crucial role, serving as a critical tool for executors and administrators alike. This form is not only essential for cataloging the assets within an estate but also serves as a foundation for ensuring debts and taxes are properly paid, and assets are distributed according to the wishes of the deceased or by the law, should a will be absent. The importance of accurately completing and filing this form cannot be overstated, as it significantly impacts the efficacy and smoothness of estate administration. Through its detailed requirements, the form guides the executor or administrator through the meticulous asset documentation process, while also requiring information on liabilities and the specifics of asset distribution. In essence, the Virginia Estate CC 1670 form is a vital document designed to streamline the estate settlement process, making it imperative for those responsible for estate management to fully understand its function and importance.

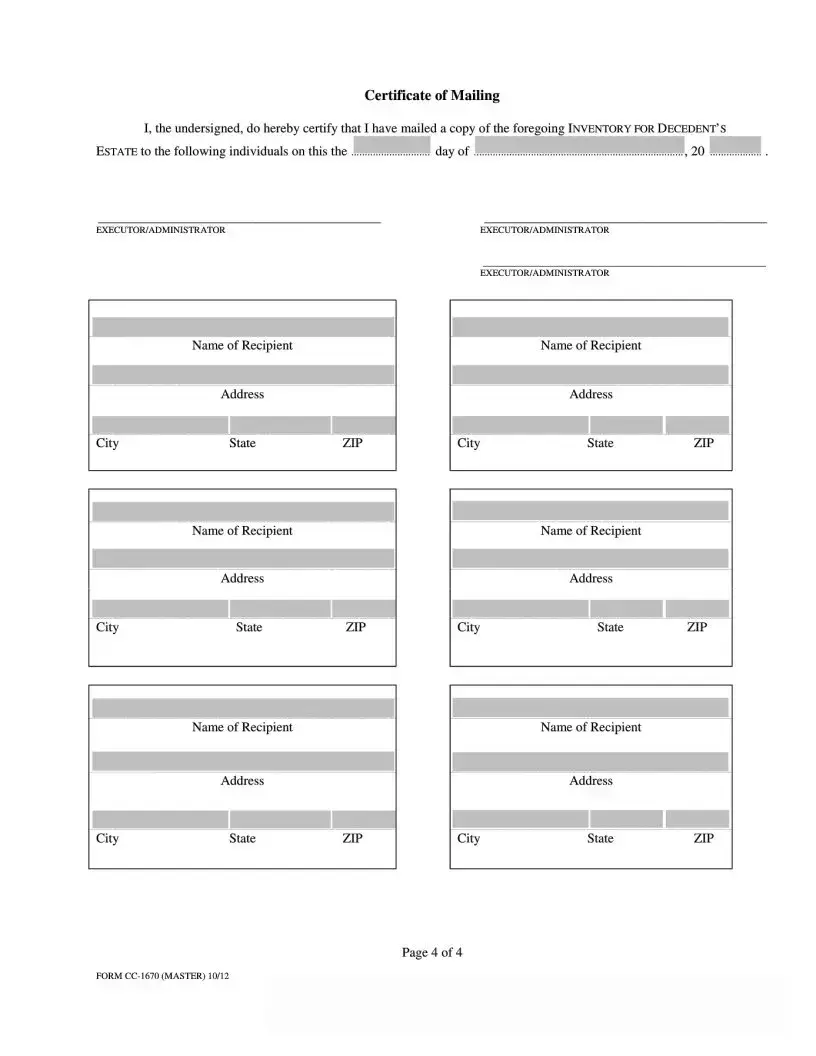

Virginia Estate Cc 1670 Example

Form Properties

| Fact | Detail |

|---|---|

| Form Title | Virginia Estate CC-1670 |

| Purpose | Used for summarizing an estate's inventory and appraisal in Virginia. |

| Governing Law | Virginia Code Title 64.2 - Wills, Trusts, and Fiduciaries |

| Who Files | Executors or administrators of estates in Virginia. |

| When to File | Within four months of qualification or as otherwise directed by the court. |

| Filing Location | Filed with the Clerk of the Circuit Court in the jurisdiction where the estate is being administered. |

| Key Components | Includes assets such as real estate, personal property, stocks, and any other valuables. |

| Penalties for Late Filing | Failure to timely file may result in penalties, including fines and possible legal action against the executor or administrator. |

| Supporting Documents | May require additional documents like appraisals, tax statements, or deeds. |

Steps to Filling Out Virginia Estate Cc 1670

Once someone passes away, handling their estate can be a complex process for their survivors. The Virginia Estate CC 1670 form is a vital step in this process, allowing executors to officially declare the assets, debts, and details of the deceased's estate to the appropriate Virginia court. Filling out this form with precision and care is essential to ensure the estate is administered correctly and in accordance with law. To help, the following is a step-by-step guide designed to navigate you through each part of the form efficiently.

- Begin by entering the full legal name of the deceased in the field marked "Decedent’s Name," ensuring it matches the name as it appears on their death certificate.

- In the "Date of Death" field, write the date the decedent passed away, using the format MM/DD/YYYY.

- Provide the decedent's last known address in the field labeled "Address" to help identify the correct estate if there are similar names.

- Fill in the decedent’s social security number in the designated "Social Security Number" section without dashes or spaces.

- Check the appropriate box to indicate whether the estate qualifies as a "Small Estate" under Virginia law, based on the total value of assets.

- For the section titled "Executor/Administrator Information," enter your full legal name, address, telephone number, and relationship to the decedent if you are responsible for managing the estate.

- If an attorney is assisting with the estate, their name, address, phone number, and Virginia State Bar number should be entered in the "Attorney for the Estate" section.

- Detail all known assets of the estate, including but not limited to bank accounts, real estate, stocks, and personal belongings, in the "Assets of the Estate" section. Be sure to describe each item clearly and provide its value at the time of the decedent's death.

- List all known debts and liabilities of the estate, including mortgages, loans, and other obligations, under the "Debts of the Estate" section.

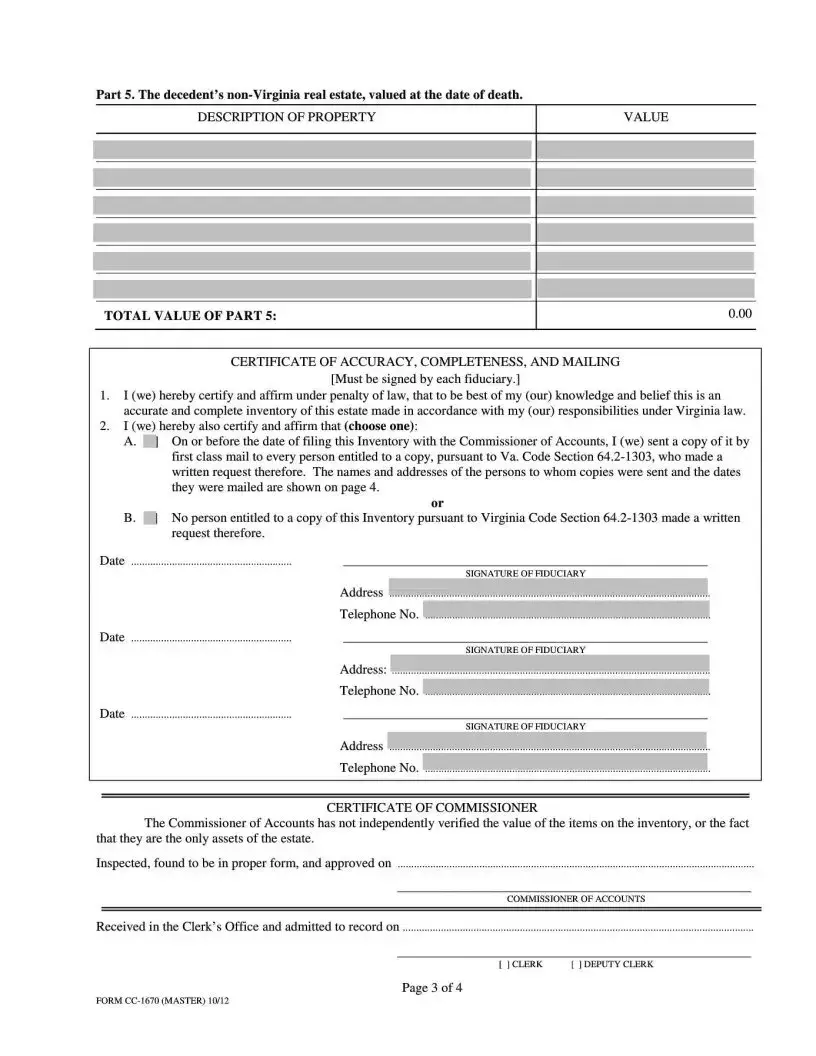

- In the "Signature of Executor/Administrator" section, sign and date the form, thereby attesting to the truthfulness and accuracy of the information provided.

After completing the Virginia Estate CC 1670 form, double-check all entered information for accuracy and completeness. Then, submit it to the appropriate Virginia Circuit Court Clerk's Office, either in person or by mail, depending on local requirements. Following submission, the court will review the form as part of the estate's probate process. Keep in mind that this form is just one step in managing an estate and additional documents or steps may be required, depending on the size and complexity of the estate. Being thorough and accurate in every detail is key to a smoother process.

FAQ

What is the Virginia Estate CC 1670 form?

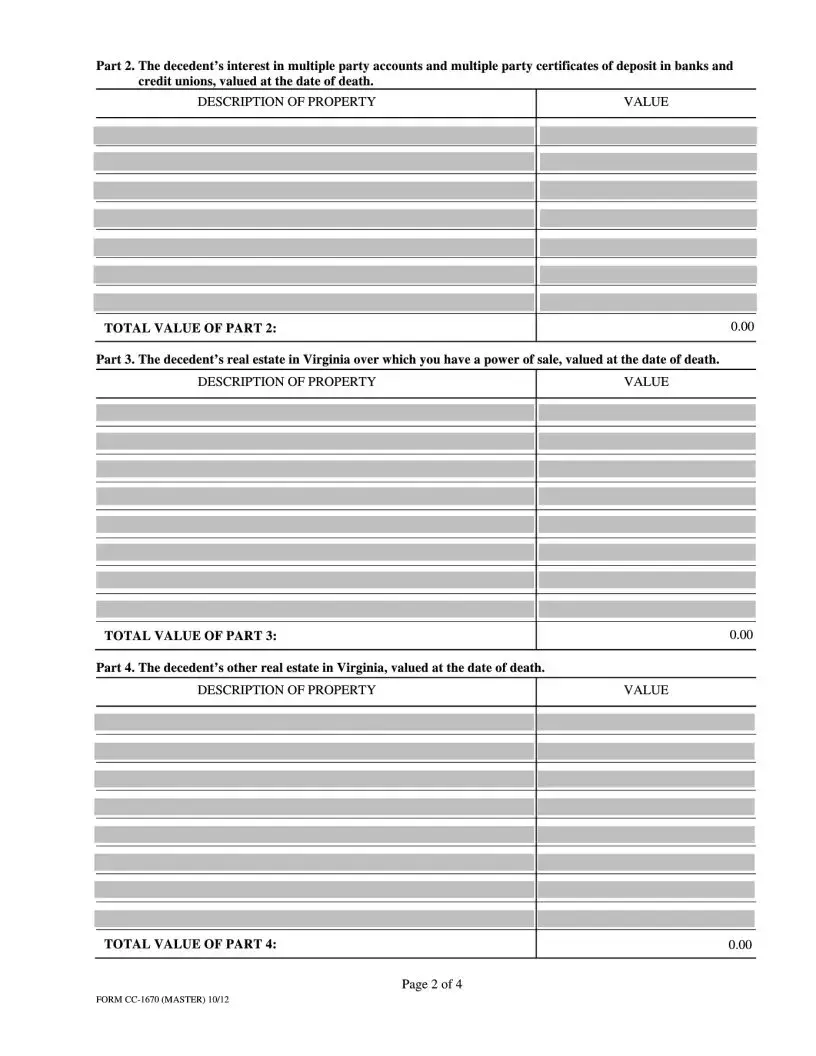

The Virginia Estate CC 1670 form, often referred to as the Inventory and Appraisement form, is an official document used in the Commonwealth of Virginia. It is designed for the executor or administrator of an estate to detail all the assets owned by the deceased at the time of their death. This comprehensive list includes real estate, personal property, stocks, bonds, and any other assets. Its purpose is to ensure a clear understanding of the estate's value for probate and tax purposes.

Who needs to file the Virginia Estate CC 1670 form?

Individuals serving as executors or administrators of estates in Virginia are required to file the CC 1670 form. This responsibility falls on them following the death of the property owner, as part of the legal process to manage and settle the deceased's estate according to the will or state law, if there's no will.

When should the Virginia Estate CC 1670 form be filed?

The filing timeline for the CC 1670 form varies; however, it is typically due within four months of the executor or administrator being appointed by the court. It's important to check specific deadlines with the local probate court to avoid any penalties or delays in the estate administration process.

Where can I find the Virginia Estate CC 1670 form?

The form can be obtained from the Virginia's Judiciary's official website or by visiting the local probate court. Ensure to use the most current version of the form to comply with the latest legal requirements.

What information is needed to complete the CC 1670 form?

Completing the CC 1670 form requires detailed information about the deceased's assets at the time of death, including:

- Real estate details (location, value)

- Personal property (vehicles, jewelry, furniture)

- Financial assets (bank accounts, stocks, bonds)

- Other assets belonging to the deceased

Accuracy is crucial, as this document plays an essential role in the probate process.

Are there any attachments or additional documents required with the CC 1670 form?

Yes, depending on the estate's complexity, additional documents may need to be attached to the CC 1670 form, including but not limited to:

- Appraisal reports for high-value items

- Deeds or titles for real estate and vehicles

- Statements for financial accounts

Check with the local probate court for specific requirements related to your case.

How is the Virginia Estate CC 1670 form submitted?

The completed CC 1670 form, along with any required attachments, should be submitted to the appropriate local probate court in Virginia. It's advisable to keep a copy for your records and to consult with a probate attorney to ensure compliance with all legal requirements.

What happens after the CC 1670 form is filed?

Upon filing, the probate court reviews the inventory and appraisement to ensure accuracy and completeness. The court may request further information or corrections. Once approved, the form becomes part of the official record for the estate, guiding the distribution of assets and resolution of debts and taxes.

Can the Virginia Estate CC 1670 form be amended?

Yes, if additional assets are discovered or if there were inaccuracies in the initial filing, an amended CC 1670 form can be submitted to the probate court. The process for amending the form is similar to the initial filing and must include any new information or corrections.

Where can I get help with the Virginia Estate CC 1670 form?

Help with the CC 1670 form can be obtained from several sources, including:

- A probate attorney experienced in Virginia estate law

- The local probate court

- Legal aid organizations in Virginia

It's essential to seek professional guidance to navigate the complexities of estate administration and ensure compliance with state law.

Common mistakes

-

Failure to thoroughly review the entire form before beginning to fill it out is a common mistake. Individuals often start completing the form without a clear understanding of all the required information, leading to errors and omissions that could have been avoided with a comprehensive initial review.

-

Many people neglect to provide accurate and complete information for all sections. The Virginia Estate CC 1670 form demands precise details, particularly regarding the decedent's assets and liabilities. Leaving sections partially filled or providing vague answers can result in unnecessary complications.

-

Not consulting with legal or financial professionals is another oversight. While the form might appear straightforward, the implications of the information it solicits can be complex. Professional advice can ensure that all legal and financial angles are properly considered, and that the form is filled out in a manner that best represents the estate's interests.

-

Overlooking the need for signatures and proper notarization is a frequently encountered issue. The form's legitimacy hinges on its adherence to procedural requirements, including the proper execution of signatures and, where necessary, notarization. Failure to comply with these requirements can invalidate the document.

-

Misunderstanding the scope of the form's requirements is common. The form is designed to capture a comprehensive snapshot of the estate's financial situation, but individuals sometimes misinterpret which assets and liabilities need to be disclosed. This misconception can lead to incomplete or inaccurate reporting.

-

Using outdated information is a mistake that can have significant repercussions. The estate's financial situation can change, and it is imperative to use the most current data available when filling out the form. Outdated information can misrepresent the estate's actual worth and liabilities.

-

Inadequately planning for estate taxes can be a critical oversight. Though not directly related to filling out the form, an understanding of how estate taxes might affect the estate's assets is essential. Without this consideration, the estate may face unexpected tax liabilities that could have been mitigated with proper planning.

Documents used along the form

When managing estates in Virginia, the CC-1670 form, also known as the Inventory for Decedent's Estate, is commonly used. It serves as a detailed list of all assets belonging to the deceased person at the time of their death. However, handling an estate involves more than just inventorying assets. Various forms and documents may also need to be completed and filed to ensure the estate is managed and distributed according to the laws of Virginia. Here's a look at six other forms and documents that are often used alongside the CC-1670 form.

- CC-1680 - The Appraisal of Estate: This form is used for listing and assigning monetary values to the estate's assets. It's an essential step for both the inventory process and for determining any taxes the estate may owe.

- CC-1671 - Account for Decedent's Estate: After assets have been inventoried and valued, this form helps in tracking the income generated by the estate, expenses paid out, and distributions to beneficiaries.

- CC-1650 - Notice of Probate: This document is sent out to heirs and known creditors, informing them of the decedent's death, the probate case, and how to file claims against the estate if necessary.

- CC-1401 - List of Heirs: Filed with the court, this form details the decedent's heirs at law, which is especially crucial in cases where there isn't a will, or the will doesn't specify all asset distributions.

- Will/Codicil(s): The original will and any codicils (amendments to the will) must be filed with the court. They guide the distribution of assets and appointment of the executor or personal representative of the estate.

- L-9 - Affidavit Terminating or Restricting Administration: This affidavit can limit the scope of the administration or even close the estate if certain conditions are met, such as the estate being small enough to qualify for simplified processing.

Together with the CC-1670 form, these documents create a comprehensive framework for handling a decedent’s estate in Virginia. By compiling accurate information and adhering to legal requirements, the process becomes smoother for executors and beneficiaries alike. Each form plays its part in ensuring that the estate is settled in a manner that honors the decedent’s wishes and meets the regulatory obligations.

Similar forms

The Virginia Estate CC 1670 form is similar to several other legal documents that are used in the administration of estates within the United States. These documents share common objectives, such as inventorying a decedent's assets, appointing a legal representative, and ensuring the proper distribution of the estate according to the laws or the will of the deceased. However, each form has its unique features and uses that cater to the specific requirements of various jurisdictions or circumstances.

The Will Inventory Form is one such document that bears resemblance to the Virginia Estate CC 1670 form. Like the CC 1670, it is designed to list all the assets of the deceased at the time of death. The key similarity lies in their function of accounting for the estate's items, which is crucial for both probate proceedings and informing beneficiaries about the contents of the estate. However, the Will Inventory form is typically used post-mortem and often requires submission to a probate court or executor of the estate, making it a critical step in the legal process of estate management.

Another document akin to the Virginia Estate CC 1670 form is the Trust Inventory Form. This form is utilized by trustees to record assets held in a trust, rather than those solely owned by an individual at death. The resemblance between the Trust Inventory Form and the CC 1670 is found in their shared objective of asset documentation. Both serve as official records that provide a transparent snapshot of either estate or trust assets. However, the Trust Inventory Form is specifically for trusts, indicating its use during life or upon the trust settlor's death, distinctly marking its purpose for managing trust-held properties.

The Estate Tax Return Form is comparable to the Virginia Estate CC 1670 form in several aspects. Primarily, it is used to report the decedent’s assets and their values for tax purposes. The Estate Tax Return Form, much like the CC 1670, requires detailed listings of the deceased's properties, investments, and other assets. While the CC 1670 form addresses the need for a comprehensive estate inventory for administrative purposes, the Estate Tax Return Form focuses on the financial implications and obligations of the estate to federal and state tax agencies, highlighting its unique role in the estate settlement process.

Dos and Don'ts

Filling out legal forms can often feel overwhelming, especially when it involves matters as crucial as estates. In Virginia, the Estate CC 167489 form is an important document that requires careful attention to detail. To assist in this process, here's a comprehensive list of do's and don'ts designed to guide individuals through the correct completion of this form.

Do's:

- Read the instructions carefully before beginning. Every form is unique, and the Virginia Estate CC 1670 form is no exception. Understanding each section fully is crucial to avoid mistakes that could result in delays or legal complications.

- Provide accurate and complete information. The details you provide are essential for the accurate processing of estate matters. Misinformation can lead to unnecessary legal challenges or the misallocation of assets.

- Use black ink and print clearly. This ensures that all the information on the form is legible, reducing the risk of errors during processing.

- Consult with a legal professional if in doubt. Estate laws can be complex, and seeking advice from someone experienced in this area can prevent costly mistakes.

Don'ts:

- Don’t rush through the form. Take your time to fill out each section thoroughly. Hasty mistakes can lead to significant setbacks.

- Don’t use pencil or colors other than black ink. Documents filled out in pencil or non-standard colors may not be accepted or can result in legibility issues.

- Don’t forget to double-check your work. Before submitting the form, review all entries to ensure accuracy and completeness. A simple review can catch errors you might have initially overlooked.

Correctly completing the Virginia Estate CC 1670 form is a responsibility that shouldn't be taken lightly. By following these guidelines, you can navigate the process more smoothly and ensure that the estate in question is handled properly and according to Virginia law.

Misconceptions

When managing the affairs of an estate in Virginia, individuals often encounter the Virginia Estate CC 1670 form. Misunderstandings about this document can lead to unnecessary complications. Here, we clarify some common misconceptions to help individuals navigate this process more smoothly.

- It's only for the wealthy: Many people believe the Virginia Estate CC 1670 form is only applicable to large estates or wealthy individuals. In reality, it's a required document for administering most estates in Virginia, regardless of the size.

- Completion is optional: Some might think that completing this form is optional. However, it is a mandatory step in the estate administration process in Virginia, necessary for both probating the will and in instances where there's no will.

- It's overly complex: While legal documents can be daunting, the Virginia Estate CC 1670 form is designed to be straightforward. It guides the executor or administrator through the necessary steps to report on the estate's assets and debts.

- Legal representation is required to fill it out: It’s a misconception that you must have an attorney to complete this form. While legal advice can be valuable, especially in complex estates, individuals can fill out and submit this form on their own.

- It only covers financial assets: Another misunderstanding is that the form is concerned solely with financial assets like bank accounts and stocks. It actually covers all types of assets, including real estate, personal belongings, and other tangible property.

- It finalizes the estate administration: Submitting this form is not the final step in administering an estate. It is part of the ongoing process that may include filing other documents, paying debts, and distributing assets according to the will or state law.

- There are no deadlines: Contrary to what some might think, there are specific deadlines for submitting the Virginia Estate CC 1670 form. Missing these deadlines can result in penalties and delays in the estate administration.

- Changes cannot be made after submission: If errors are discovered or circumstances change after the initial submission, it is possible to amend the information on the Virginia Estate CC 1670 form. Timely correction of these errors is crucial.

- It determines tax liabilities: While this form does require a listing of the estate’s assets, which can influence tax liabilities, it does not itself calculate or determine the estate's tax obligations. Tax considerations require a separate process, often involving additional forms.

Dealing with the administration of an estate can be a complex and emotional process. Clearing up common misconceptions about the Virginia Estate CC 1670 form can simplify the procedure, making it less daunting for executors and administrators. Always ensure the form is filled accurately and submitted on time to avoid potential issues in the estate administration process.

Key takeaways

- Accuracy is paramount when completing the Virginia Estate CC 1670 form. This document is a legal record, detailing the inventory and appraisal of an estate in Virginia. It requires careful, precise information about assets, including real estate, personal property, and financial accounts, to ensure the estate is accurately represented and valued.

- Timeliness is crucial in filing the form. The Commonwealth of Virginia sets specific deadlines for the submission of estate documents, including the Virginia Estate CC 1670 form. Failing to meet these deadlines can result in penalties, delays in the administration of the estate, and added stress for the executor or administrator.

- Seek professional advice when necessary. Given the complexities involved in valuing an estate and filling out legal documents, consulting with professionals such as estate attorneys or accountants can be beneficial. These experts can provide valuable assistance in navigating the legal requirements and ensuring the accuracy of the form’s details.

- The completed form must be filed with the appropriate Virginia probate court. The Virginia Estate CC 1670 form is filed in the jurisdiction where the decedent resided at the time of death. This filing is part of the estate administration process, allowing the court to oversee the proper distribution of the estate’s assets in accordance with Virginia law.

Other PDF Forms

West Virginia Police Report - The form specifies how to submit payment details securely for those opting to pay with a credit card, including the need for a 3-digit code.

Virginia Real Estate Contract for Sale by Owner - Addresses the complexities of residential sales in Virginia, ensuring both buyer and seller navigate the process with a clear understanding of their responsibilities.