Fill Out a Valid Virginia Rdc Template

In the Commonwealth of Virginia, businesses pursuing research and development activities are offered a financial incentive through the Research and Development Expenses Tax Credit, as detailed in the Virginia Application for Research and Development Expenses Tax Credit Form, commonly known as Form RDC. This form, essential for the fiscal year in question, must be submitted by September 1 alongside relevant supporting documentation to claim the credit. Form RDC outlines the necessary taxpayer information, including business name, contact information, and crucial financial details. To calculate the credit, businesses can opt for either the primary credit computation method, involving a detailed breakdown of Virginia qualified research and development expenses in relation to college or university partnerships, or an alternative simplified method for those without expenses in the preceding three tax years. Additionally, Form RDC requires information on full-time employment, gross receipts, and any engagements with Virginia colleges or universities, further emphasizing the state's encouragement of innovative research partnerships. The form also inquires about any federal credits received for similar activities, indicating a comprehensive approach to supporting business innovation within Virginia. Through its structured sections and detailed instructions, Form RDC mediates the application process for businesses seeking to leverage their research and development efforts into tax incentives, reflecting Virginia's commitment to fostering a vibrant, technology-driven economic environment.

Virginia Rdc Example

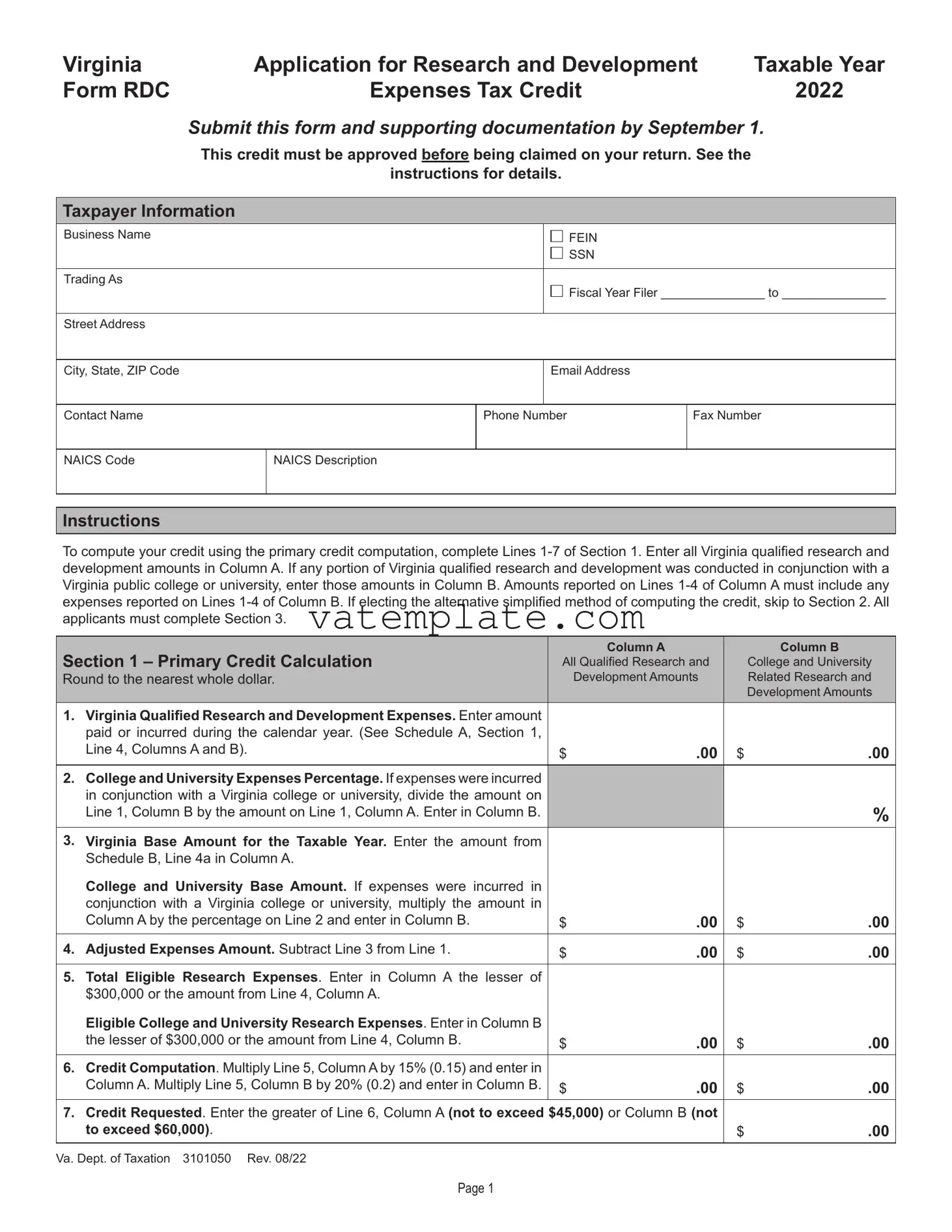

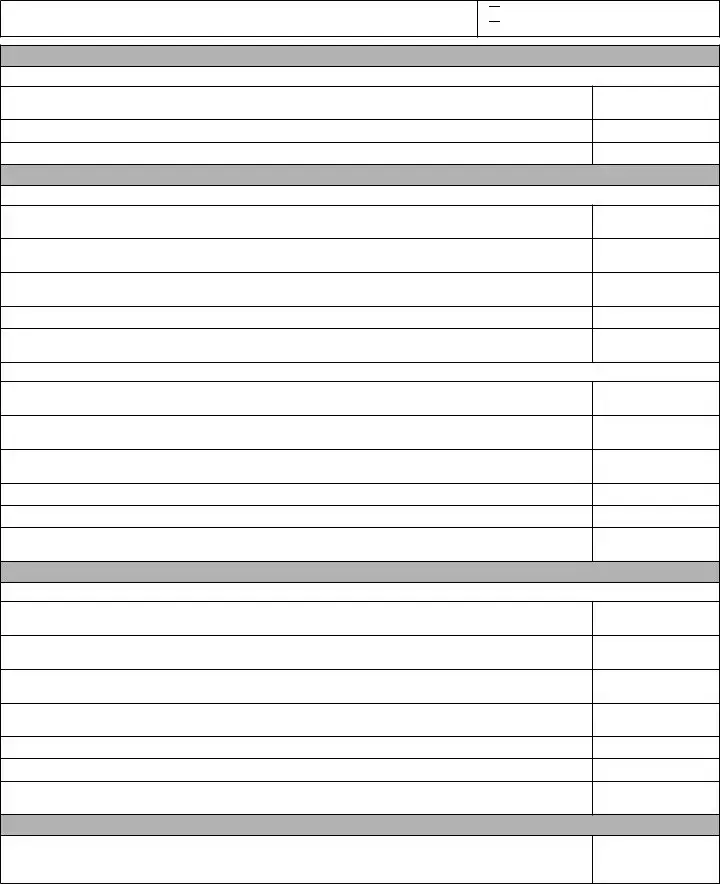

Virginia |

Application for Research and Development |

Taxable Year |

Form RDC |

Expenses Tax Credit |

2022 |

Submit this form and supporting documentation by September 1. This credit must be approved before being claimed on your return. See the instructions for details.

Taxpayer Information

Business Name

Trading As

FEIN

FEIN

SSN

SSN

Fiscal Year Filer _______________ to _______________

Fiscal Year Filer _______________ to _______________

Street Address

City, State, ZIP Code

Email Address

Contact Name

Phone Number

Fax Number

NAICS Code

NAICS Description

Instructions

To compute your credit using the primary credit computation, complete Lines

Virginia public college or university, enter those amounts in Column B. Amounts reported on Lines

applicants must complete Section 3.

|

Column A |

Column B |

Section 1 – Primary Credit Calculation |

All Qualified Research and |

College and University |

Round to the nearest whole dollar. |

Development Amounts |

Related Research and |

|

|

Development Amounts |

1.Virginia Qualified Research and Development Expenses. Enter amount paid or incurred during the calendar year. (See Schedule A, Section 1,

Line 4, Columns A and B). |

$ |

.00 |

$ |

.00 |

|

2.College and University Expenses Percentage. If expenses were incurred

in conjunction with a Virginia college or university, divide the amount on

Line 1, Column B by the amount on Line 1, Column A. Enter in Column B. |

% |

3.Virginia Base Amount for the Taxable Year. Enter the amount from Schedule B, Line 4a in Column A.

|

College and University Base Amount. If expenses were incurred in |

|

|

|

|

|

conjunction with a Virginia college or university, multiply the amount in |

|

|

|

|

|

Column A by the percentage on Line 2 and enter in Column B. |

$ |

.00 |

$ |

.00 |

|

|

|

|

|

|

4. |

Adjusted Expenses Amount. Subtract Line 3 from Line 1. |

$ |

.00 |

$ |

.00 |

|

|

|

|

|

|

5. |

Total Eligible Research Expenses. Enter in Column A the lesser of |

|

|

|

|

|

$300,000 or the amount from Line 4, Column A. |

|

|

|

|

|

Eligible College and University Research Expenses. Enter in Column B |

|

|

|

|

|

the lesser of $300,000 or the amount from Line 4, Column B. |

$ |

.00 |

$ |

.00 |

|

|

|

|

|

|

6. |

Credit Computation. Multiply Line 5, Column A by 15% (0.15) and enter in |

|

|

|

|

|

Column A. Multiply Line 5, Column B by 20% (0.2) and enter in Column B. |

$ |

.00 |

$ |

.00 |

7.Credit Requested. Enter the greater of Line 6, Column A (not to exceed $45,000) or Column B (not

to exceed $60,000). |

$ |

.00 |

|

|

|

Va. Dept. of Taxation 3101050 |

Rev. 08/22 |

|

PAGE 1

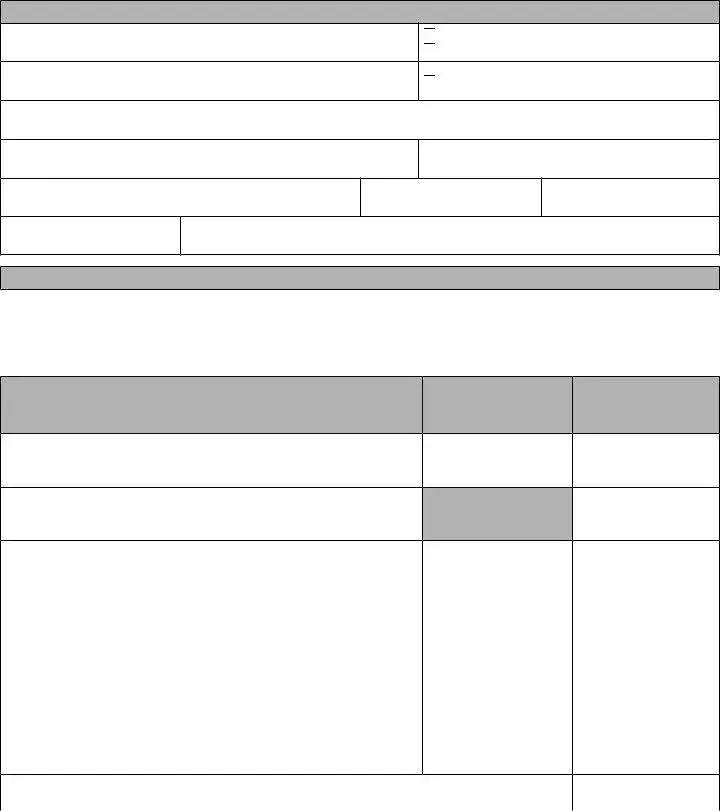

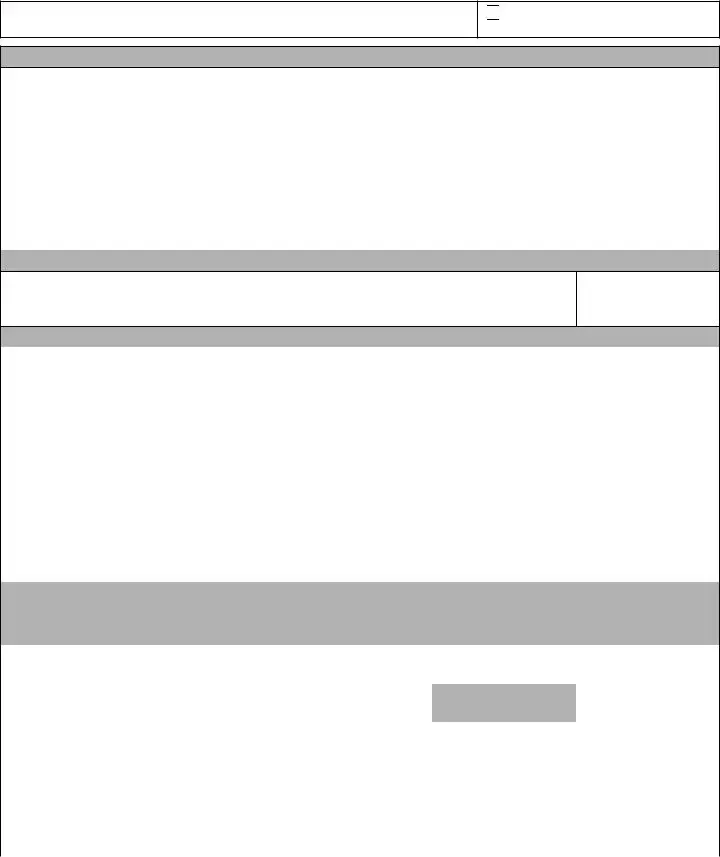

Virginia |

Application for Research and Development |

|

Taxable Year |

||

Form RDC |

Expenses Tax Credit |

|

|

2022 |

|

Page 2 |

|

|

|

|

|

|

|

|

|

|

|

Section 2 – Alternative Simplified Credit Calculation |

|

Column A |

|

Column B |

|

|

|

|

|

||

See instructions and Schedule C for information on calculating the Adjusted |

All Qualified Research and |

|

College and University |

||

|

Development Amounts |

|

Related Research and |

||

Calendar Year Qualified Research and Development Expenses. |

|

|

|

Development Amounts |

|

1. Total Adjusted Calendar Year Qualified Research and Development |

|

|

|

|

|

Expenses. Enter the amount(s) from Schedule C, Line 4e in the applicable |

|

|

|

|

|

column(s). Taxpayers without qualified research and development |

|

|

|

|

|

expenses for the preceding 3 taxable years, enter the applicable amount(s) |

|

|

|

|

|

from Schedule C, Line 1a in the applicable column(s). |

$ |

.00 |

$ |

.00 |

|

|

|

|

|

|

|

2. Credit Computation. |

|

|

|

|

|

If you incurred research and development expenses for the 3 preceding |

|

|

|

|

|

taxable years, check here and multiply the amount on Line 1, Column |

|

|

|

|

|

A and Line 1, Column B (if applicable) by 10% (0.1). |

|

|

|

|

|

If you did not incur research and development expenses for the |

|

|

|

|

|

3 preceding taxable years, check here and multiply the amount on |

|

|

|

|

|

Line 1, Column A and Line 1, Column B (if applicable) by 5% (0.05). |

$ |

.00 |

$ |

.00 |

|

|

|

|

|

|

|

3.Credit Requested. Enter the greater of Line 2, Column A (not to exceed $45,000) or Column B (not

to exceed $60,000). |

$ |

.00 |

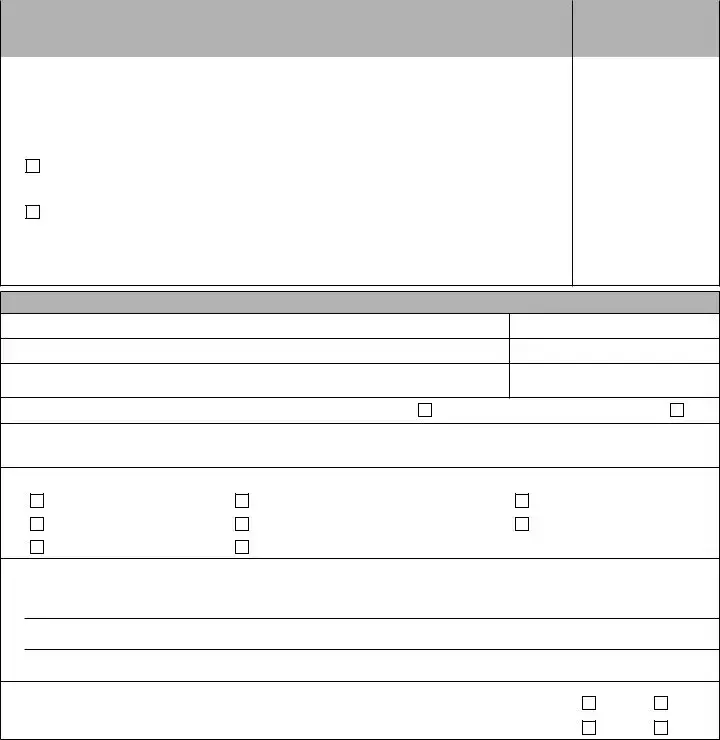

Section 3 – Credit Information

1.Number of full time employees during the year for which the credit is sought.

2.Total gross receipts or anticipated gross receipts for the taxable year the credit is sought.

3.If research was conducted in conjunction with a Virginia public or private college or university, enter name of college or university. Enclose a copy of the agreement.

4. Have you ever received a federal credit for these research activities? |

Yes (If yes, enclose federal Form 6765) |

No |

5.If you applied for any other Virginia tax credits this year, identify the credit(s) below.

6.Research Field:

Biotechnology

Engineering

Medical

Cyber Security

Food & Beverage Development

Technology

Industrial

Other ______________________

7.Provide: (1) A description of your research project(s).

(2)A summary of how this research qualifies as defined in IRC § 41(d).

8.Do you conduct research and development in Virginia on human cells or tissue derived from

induced abortions or from stem cells obtained from human embryos? |

Yes |

No |

|

|

|

9. If you are a |

Yes |

No |

I (we) the undersigned declare, under the penalties provided by law, that this form (including any accompanying schedules, statements, and enclosures) has been examined by me (us) and is, to the best of my (our) knowledge and belief, a true, correct, and complete application, made in good faith pursuant to the income tax laws of the Commonwealth of Virginia.

Authorized Signature |

Title |

Date |

|

|

|

Printed Name |

Phone Number |

|

|

|

|

Email Address |

Fax Number |

|

|

|

|

PAGE 2

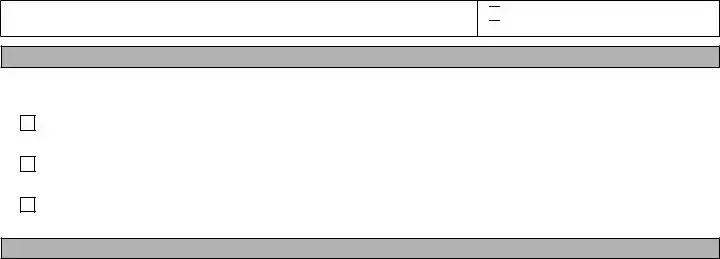

Form RDC |

Research and Development Expenses Tax Credit |

Taxable Year |

Schedule A |

Summary of Qualified Expenses |

2022 |

Name as it Appears on Form RDC

FEIN

FEIN

SSN

SSN

Supplemental Forms Checklist

Prior to completing the Form RDC Schedule A, qualified expenses must be recorded on the applicable expense forms. Check the boxes below to indicate which supplemental forms have been used to complete this schedule. See the instructions on these forms for details.

Schedule

submit this schedule if claiming the credit on the basis of contract research expenses.

Schedule

Schedule

Instructions for Schedule A

Do not include expenses incurred in relation to research conducted in Virginia on human cells or tissue derived from induced abortions or stem cells obtained from embryos. See the Form RDC instructions and IRC § 41 for additional requirements regarding qualified research

and development expenses.

Section 1 – Summary of Expenses: All filers must complete Section 1. In Column A, enter the total amount of qualified research and development expenses that were reported on the expense schedule(s) listed above. If claiming the Research and Development Expenses Tax Credit for expenses incurred in connection with a college or university, enter those amounts in Column B. The amounts reported in

Column A must include the amounts entered in Column B.

Section 2 – List of Colleges & Universities: Filers who are claiming the credit based on college and university related expenses must report the names of the institutions in Section 2. A copy of the research agreement must also be enclosed with the Form RDC. See the R&D Enclosure Checklist on Page 8 for additional information.

Section 1 – Summary of Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

Column A |

|

Column B |

|

|

Expense Type |

|

|

|

College and University |

|

||

|

|

|

|

All Virginia Expenses |

|

|||

|

|

|

|

|

|

Related Expenses |

|

|

|

|

|

|

|

|

|

|

|

1. |

Contract Research Expenses |

|

|

|

|

|

|

|

|

Column A: Enter amount from Schedule |

|

|

|

|

|

||

|

Column B: Enter the amount associated with a college or university. |

$ |

.00 |

$ |

.00 |

|

||

2. |

Supply Expenses |

|

|

|

|

|

|

|

|

Column A: Enter the amount from Schedule |

|

|

|

|

|

||

|

Column B: Enter the amount associated with a college or university. |

$ |

.00 |

$ |

.00 |

|

||

3. |

Wages |

|

|

|

|

|

|

|

|

Column A: Enter the amount from Schedule |

|

|

|

|

|

||

|

Column B: Enter the amount associated with a college or university. |

$ |

.00 |

$ |

.00 |

|

||

4. |

Total Qualified Expenses |

|

|

|

|

|

|

|

|

Column A: Add Column A, Lines |

|

|

|

|

|

||

|

Column B: Add Column B, Lines |

$ |

.00 |

$ |

.00 |

|

||

|

|

|

|

|

|

|

|

|

Section 2 – List of Colleges & Universities |

|

|

|

|

|

|

|

|

1. |

|

|

6. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

|

|

7. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

|

|

8. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

|

|

9. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

|

|

10. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Va. Dept. of Taxation 1600041 Rev. 08/22 |

PAGE 3 |

|

|

|

|

|

||

Form RDC |

Research and Development Expenses Tax Credit |

Taxable Year |

Schedule B |

Worksheet for Computing Virginia Base Amount |

2022 |

|

(Primary Method) |

|

|

Use this schedule when computing the credit using the Primary Credit Calculation. |

|

Name as it Appears on Form RDC

FEIN

FEIN

SSN

SSN

Section 1 – VA Qualified Research and Development Expenses

Fiscal year filers: Include expenditures and gross receipts for Calendar Year 2022 (CY), regardless of fiscal year (FY) incurred.

1a. VA Qualified Research and Development Expenses in CY 2022. For FY filers, this will include a portion of 2 taxable years.

1b. Short year filers only: Enter the number of months included in the short year.

1c. Short year filers only: Divide the number of months in Line 1b by 12.

.00

.00

.00

Section 2 – Determine the Fixed Base Percentage

The Average Qualified Research and Development Expenses for the 3 taxable years ending before the CY 2022.

2a. Expenses for the 3rd preceding taxable year. CY filers: enter expenses for Taxable Year 2019.

FY filers: enter expenses for Taxable Year 2018.

2b. Expenses for the 2nd preceding taxable year. CY filers: enter expenses for Taxable Year 2020. FY filers: enter expenses for Taxable Year 2019.

2c. Expenses for the preceding taxable year. CY filers: enter expenses for Taxable Year 2021.

FY filers: enter expenses for Taxable Year 2020.

2d. Total Expenses. Add Lines

2e. Average Qualified Research and Development Expenses for the Prior 3 Taxable Years. Divide amount on Line 2d by 3.

The Average Total Gross Receipts for the 3 taxable years ending before the CY 2022.

2f. Gross receipts for the 3rd preceding taxable year. CY filers: enter the gross receipts for Taxable Year 2019.

FY filers: enter gross receipts for Taxable Year 2018.

2g. Gross receipts for the 2nd preceding taxable year. CY filers: enter gross receipts for Taxable Year 2020. FY filers: enter gross receipts for Taxable Year 2019.

2h. Gross receipts for the preceding taxable year. CY filers: enter gross receipts for Taxable Year 2021.

FY filers: enter gross receipts for Taxable Year 2020.

2i. Total Gross Receipts. Add Lines 2f through 2h.

2j. Average Gross Receipts for Prior 3 Taxable Years. Divide Line 2i by 3.

2k. Percentage of Virginia Qualified Research and Development Expenses. Divide Line 2e by 2j

(round to 4 decimal places).

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

%

Section 3 – Determine the Virginia Base Amount

The Average Total Gross Receipts for the 4 taxable years ending before the CY 2022.

3a. Gross receipts for the 4th preceding taxable year. CY filers: enter gross receipts for Taxable Year 2018.

FY filers: enter gross receipts for Taxable Year 2017.

3b. Gross receipts for the 3rd preceding taxable year. CY filers: enter gross receipts for Taxable Year 2019.

FY filers: enter gross receipts for Taxable Year 2018.

3c. Gross receipts for the 2nd preceding taxable year. CY filers: enter gross receipts for Taxable Year 2020. FY filers: enter gross receipts for Taxable Year 2019.

3d. Gross receipts for the preceding taxable year. CY filers: enter gross receipts for Taxable Year 2021.

FY filers: enter gross receipts for Taxable Year 2020.

3e. Total Gross Receipts. Add Lines 3a through 3d.

3f. Average Gross Receipts for Prior 4 Taxable Years. Divide Line 3e by 4.

3g. Base Amount. Calendar Year Filers: Multiply Line 2k by Line 3f.

Short Year Filers: Multiply Line 2k by Line 3f. Then multiply the product by Line 1c.

.00

.00

.00

.00

.00

.00

.00

Section 4 – Virginia Base Amount

4a. Virginia Base Amount. Your Virginia Base Amount is the greater of the amount on Line 3g OR 50% (0.5) of the 2022 Virginia Qualified Expenses from Line 1a. Enter here and on Form RDC, Section 1, Line 3,

Column A. |

|

Va. Dept. of Taxation 1600042 Rev. 08/22 |

PAGE 4 |

.00

Form RDC |

Research and Development Expenses Tax Credit |

Taxable Year |

Schedule C |

Worksheet for Determining Adjusted |

2022 |

Research and Development Expenses

(Alternative Simplified Method)

Use this schedule when computing the credit using the Alternative Simplified Credit Calculation.

Name as it Appears on Form RDC

FEIN

FEIN

SSN

SSN

Section 1 – Virginia Qualified Research and Development Expenses

Fiscal year filers: Include expenditures for Calendar Year 2022 (CY), regardless of fiscal year (FY) incurred.

1a. |

Virginia Qualified Research and Development Expenses in CY 2022. |

Line 1a – Column A |

Line 1a – Column B |

|

In Column A, enter total qualified research and development expenses |

|

|

|

from Schedule A, Section 1, Line 4, Column A. In Column B, enter the total |

|

|

|

qualified college and university related research expenses from Schedule A, |

|

|

|

Section 1, Line 4, Column B (if any). For FY filers, this will include a portion |

|

|

|

of 2 taxable years. |

.00 |

.00 |

|

|

|

|

1b. |

Short year filers only: Enter the number of days included in the short year. |

|

.00 |

|

|

|

|

|

|

|

|

1c. |

Short year filers only: Divide the number of days in Line 1b by 365 (366 if a leap year). |

.00 |

|

|

|

|

|

|

|

|

|

Section 2 – Determination of How to Compute the Credit

2.Were research and development expenses paid or incurred for the 3 taxable years immediately preceding the taxable year for which the credit is being claimed? If “Yes,” complete Sections 3 and 4 below. If no, stop here and enter the amount(s) on Line 1a above on Form RDC Section 2, Line 1.

Yes

Yes  No

No

Section 3 – Average Qualified Research and Development Expenses Calculation |

|

||||

|

The Average Qualified Research and Development Expenses for the 3 taxable years ending before the CY 2022. |

||||

|

|

|

|

||

3a. |

Expenses for the 3rd preceding taxable year. CY filers: enter expenses for Taxable Year 2019. |

|

|||

|

FY filers: enter expenses for Taxable Year 2018. |

|

|

.00 |

|

3b. |

Expenses for the 2nd preceding taxable year. CY filers: enter expenses for Taxable Year 2020. |

|

|||

|

FY filers: enter expenses for Taxable Year 2019. |

|

|

.00 |

|

|

|

|

|

|

|

3c. |

Expenses for |

the preceding taxable year. CY filers: enter expenses |

for Taxable Year 2021. |

|

|

|

FY filers: enter expenses for Taxable Year 2020. |

|

|

.00 |

|

3d. |

Total expenses from preceding 3 taxable years. Add Lines |

|

.00 |

||

|

|

|

|

|

|

|

|

|

|

||

3e. |

Average qualified research and development expenses for the preceding 3 taxable years. |

|

|||

|

Divide amount on Line 3d by 3. If the credit year is a short taxable year, multiply the average qualified |

|

|||

|

research and development expenses for the preceding 3 taxable years by the amount determined in |

|

|||

|

Line 1c. |

|

|

|

.00 |

|

|

|

|

|

|

Section 4 – Adjusted Expenses Calculation |

|

Column A. |

Column B. |

||

|

All Qualified Research |

College and University |

|||

For filers with Virginia qualified research and development expenses for the |

|||||

preceding 3 taxable years |

|

and Development |

Related Research and |

||

|

Amounts |

Development Amounts |

|||

|

|

|

|

||

4a. |

Enter the current year expenses. Column A must include the amount |

|

|

||

|

reported in Column B, if any. |

|

.00 |

.00 |

|

|

|

|

|

||

4b. |

If expenses were incurred in connection with a Virginia college or university, |

|

|

||

|

divide the amount on Line 4a, Column B by the amount on Line 4a, Column A. |

|

% |

||

|

|

|

|

|

|

4c. |

Column A – Enter the amount from Line 3e. |

|

|

|

|

|

Column B – If expenses were incurred in connection with a Virginia college or |

|

|

||

|

university, multiply the amount on Line 4c, Column A by the percentage on |

|

|

||

|

Line 4b, Column B. |

|

.00 |

.00 |

|

|

|

|

|

|

|

4d. |

Multiply the amount(s) on Line 4c by 50% (0.5). |

|

.00 |

.00 |

|

|

|

|

|

||

|

|

|

|

||

4e. |

Subtract Line 4d from Line 4a. Enter here and on Form RDC, Section 2, |

|

|

||

|

Line 1 in the applicable column(s). |

|

.00 |

.00 |

|

|

|

|

|

|

|

Va. Dept. of Taxation |

1600043 Rev. 08/22 |

PAGE 5 |

|

|

|

|

|

|

|

|

|

2022 Instructions for Form RDC

Application for Research and Development Expenses Tax Credit

General Information

The Research and Development Expenses Tax Credit

may be claimed against individual and corporate income taxes for qualified research and development expenses for taxable years beginning on or after January 1, 2011, but before January 1, 2025. The credit may also be claimed against the bank franchise tax for taxable years beginning on or after January 1, 2021, but before January 1, 2025.

If the taxpayer elects the primary method of computing the credit, the tax credit amount is equal to (i) 15% of the first $300,000 in Virginia qualified research and development expenses, or (ii) 20% of the first $300,000 of Virginia qualified research and development expenses if the research was conducted in conjunction with a Virginia public or private

college or university, to the extent the expenses exceed the

base amount. The credit amount cannot exceed $45,000 or $60,000 if the Virginia qualified research was conducted in conjunction with a Virginia public or private university.

At the election of the taxpayer, an alternative simplified

calculation may be used to determine the Research and Development Expenses Tax Credit. The alternative

simplified calculation of the Research and Development Expenses Tax Credit is equal to: 10% of the difference of (i) the Virginia qualified research and development expenses

paid or incurred by the taxpayer during the taxable year

and (ii) 50% of the average Virginia qualified research and

development expenses paid or incurred by the taxpayer

for the three taxable years immediately preceding the taxable year for which the credit is being determined. If the taxpayer did not pay or incur Virginia qualified research and

development expenses in any one of the three taxable years

immediately preceding the taxable year for which the credit

is being determined, the tax credit is equal to 5% of the

Virginia qualified research and development expenses paid

or incurred by the taxpayer during the relevant taxable year.

The aggregate amount of credits allowed to each taxpayer cannot exceed $45,000 or $60,000 if the Virginia qualified research was conducted in conjunction with a Virginia public

or private university.

There is a $7.7 million cap on the total amount of credits allowed in any fiscal year. If the total amount of tax credits exceeds the $7.7 million limit, credits will be apportioned on

a pro rata basis.

If the total amount of approved tax credits is less than the $7.7 million credit cap, the Department will allocate

the remaining amount, on a pro rata basis, to taxpayers

already approved for the credit that were subject to the

$45,000 and $60,000 credit limitations. Supplemental

credits will be in the following amounts: if a taxpayer elected

the primary computation, an amount equal to 15% of the second $300,000 in qualified research expenses (or 20% of such expenses if the research is conducted in conjunction with a Virginia public or private college or university); or if

the taxpayer elected the alternative simplified method of

computing the credit, in an amount equal to the excess of the limitation. The maximum supplemental credit amount

is $45,000, or $60,000 if the research is conducted in conjunction with a Virginia public or private university.

Any taxpayer who is allowed a research and development expenses tax credit is not allowed to use the same expenses

as the basis for claiming any other Virginia tax credit. No

taxpayer may claim both this credit and the Major Research

and Development Expenses Tax Credit.

For additional information regarding the credit, see the Research and Development Expenses Tax Credit

Guidelines, which are available on the Department’s website at www.tax.virginia.gov.

Determining the Virginia Base Amount for the Primary Research and Development Expenses

Tax Credit

In order to determine the Virginia Base Amount for the

primary credit computation, follow these steps:

Determine Fixed Base Percentage:

Step 1 Determine the average amount of Virginia qualified

research and development expenses for the 3

taxable years preceding the year in which the tax

credit is being claimed. If the taxpayer has been in business for less than 3 years, but at least 1, use the number of years in business instead of 3.

Step 2 Determine the average of the total gross receipts for the 3 taxable years preceding the taxable year that the tax credit is being claimed, or the number of years used in Step 1a, if less.

Step 3 Calculate the percentage of Virginia qualified

research and development expenses by dividing

the average amount determined in Step 1 by the average amount determined in Step 2. This is the “Fixed Base Percentage.”

Do not make any adjustments to account for a short taxable year when computing the

Determine the Virginia Base Amount:

Step 4 Determine average of the total gross receipts for the 4 taxable years preceding the taxable year

that the tax credit is being claimed, or the number of years used for Step 2, if less. For purposes of

determining the Virginia base amount, if any of the

taxable years preceding the credit year that must be accounted for when computing the credit is a short

taxable year, the gross receipts for such year(s) are

deemed to be equal to the gross receipts actually derived in that year, multiplied by 12, and divided by

the number of months in that year.

PAGE 6

Step 5 Multiply the fixed base percentage in Step 3 by the average gross receipts in Step 4.

Step 6 Determine the greater of the amount in Step 5 or

50% of Virginia qualified research expenses for the credit year. This is the “Virginia Base Amount.”

RefertoFormRDC,ScheduleB,ResearchandDevelopment

Expenses Tax Credit Worksheet for Computing Virginia

Base Amount (Primary Method), for detailed instructions on calculating the base amount.

Computing the Average Amount of Virginia Qualified Research and Development Expenses for Determining the Credit Using the Alternative Simplified Method

If electing to compute the Research and Development

Expenses Tax Credit using theAlternative Simplified Method,

the taxpayer must complete Form RDC, Schedule C to determine the average amount of Virginia qualified research and development expenses on which the credit amount will be calculated. Taxpayers who calculate the credit based on less than 3 years of qualified research and development expenses must complete Sections 1 and 2 on Form RDC, Schedule C. Taxpayers who calculate the credit based on qualified research and development expenses for the 3

taxable years preceding the credit year must complete all sections of Form RDC, Schedule C.

When determining the average amount of Virginia qualified

research and development expenses for the 3 years preceding the credit year, if 1 or more of the 3 taxable years preceding the credit year is a short taxable year, then the

Virginia qualified research and development expenses for that year must be modified by multiplying that amount

by 365 (366 in a leap year) and dividing the result by the number of days in the short taxable year.

Definitions

Virginia gross receipts – whole, entire, total receipts, without deduction.

Virginia qualified research – qualified research, as defined in IRC § 41(d), as amended, that is conducted in Virginia. In general, this is research that is undertaken for the purpose

of discovering information that is technological in nature and the application of which is intended to be useful in the development of a new or improved business component of

the taxpayer.

Virginia qualified research and development expenses

–qualified research expenses, as defined in IRC § 41(b), as amended, incurred for Virginia qualified research. In general, this is the sum of the

Stem Cell Research

Research and development expenses that are paid or incurred for research conducted in Virginia on human cells or tissue derived from induced abortions or from stem cells obtained from embryos do not qualify for the credit.

However, if a taxpayer engaged in research in Virginia

on human cells or tissue derived from induced abortions

or from stem cells obtained from human embryos, it may receive a nonrefundable credit for other Virginia qualified

research and development expenses. If the amount of nonrefundable credit that a taxpayer is allowed to claim exceeds the taxpayer’s tax liability for the taxable year, then the excess amount of credit will not be refunded to

the taxpayer and cannot be carried over to future taxable years. Research and development expenses that are paid or incurred for research conducted in Virginia on nonhuman embryonic stem cells may qualify for the credit.

When to Submit Application

Form RDC and any supporting documentation must be completed and mailed no later than September 1.

For any application received without a postmark, the date received by the Department will be used to determine if the application was received by the filing deadline.

What to Enclose

To allow us to process this application, provide the following:

•Outline of the type of research and development being conducted in Virginia.

•Form RDC, Schedule A to summarize the information reported on the supplemental expense schedules. You must retain a copy of any supporting documentation of these expenditures.

•The following supplemental expense schedules, as applicable:

–Schedule

–Schedule

–Schedule

•Form RDC, Schedule B and details regarding the calculation of your Virginia base amount, if electing the primary credit computation.

•Form RDC, Schedule C if electing the alternative simplified computation. Enclose a copy of the research agreement if reporting expenses in connection with a

Virginia public or private college or university.

Upon request, you may be required to provide proof of

purchase, such as an invoice, receipt, cancelled check, bank

statement, or credit card statement.

Where to Submit Application

Submit Form RDC and enclosures to the Virginia

Department of Taxation, ATTN: Tax Credit Unit, P.O. Box 715, Richmond, VA

PAGE 7

What to Expect from the Department |

If the Department needs additional information the agency will contact you by November 1 and you will have until

November 15 to respond. If you have not received acknowledgement of your application by November 15, call (804)

The Department will issue the credit by November 30. If you have not received your credit certification by December 15, call (804)

What Does the Taxpayer Need to Do

Upon receiving notification of the allowable credit amount, taxpayers may claim the allowable credit amount on the applicable Virginia income tax return. Taxpayers who do not receive notification of allowable credit amounts before their Virginia income tax return due date may file during the extension period or file their regular return without the credit and then file an amended tax return after receipt of notification of the allowable credit amount to claim the tax credit. As an enclosure with their return, a corporation must file Schedule 500CR; an individual must file Schedule CR; a

IMPORTANT

Online Worksheet: Spreadsheet template is available for download on our website, www.tax.virginia.gov. Use these spreadsheets to compute the Virginia Base Amount when

using the primary calculation method to compute the Research and Development Expenses Tax Credit.

All business taxpayers should be registered with the Department before completing Form RDC. If you are not registered, complete Form

If the tax return upon which this credit will be claimed is due

on or before November 30, you may need to either submit an extension payment for any tax due or file an amended return once you have received the credit certification.

A partnership, limited liability company, or electing small business corporation (S corporation) may elect to receive and claim the credit at the entity level. If this election is not

made, credits must be allocated to the individual partners, members, or shareholders in proportion to their ownership interests in such entities or in accordance with a written

agreement entered into by such individual partners, members, or shareholders.

Each

All

members, must give each such participant a Schedule

Owner’s Share of Income and Virginia Modifications and

Credits.

Where To Get Help

Write to the Virginia Department of Taxation, ATTN: Tax Credit Unit, P.O. Box 715, Richmond,VA

PAGE 8

Form RDC |

Research and Development Expenses Tax Credit |

Taxable Year |

|

Checklist |

Enclosure Checklist |

2022 |

|

|

Must be included with Form RDC |

|

|

|

|

|

|

Name as it Appears on Form RDC |

FEIN |

|

|

|

|

|

|

|

|

SSN |

|

|

|

|

|

All expenses must be for the calendar year of the application, regardless of fiscal year incurred.

Provide:

1)A description of your research project(s).

2)A summary of how this research qualifies as defined in IRC § 41(d).

Check the applicable box on Form RDC to indicate whether you conduct research and development in Virginia on

human cells or tissue derived from induced abortions or from stem cells obtained from human embryos.

The Form RDC Schedule A. Include the applicable expense schedule(s) that have been used to complete the Schedule A.

The Schedule

Note: For purposes of computing your qualified research expenses, contract research expenses are included

as follows: 1) 65% of any amount paid to a nonemployee for qualified research; 2) 75% of any amount paid to a qualified research consortium for qualified research; and 3) 100% of any amount paid to an eligible small business, an institution of higher education as defined in IRC § 3304(f), or an organization that is a federal laboratory as defined in IRC § 3304(f).

Any individual who receives a Form 1099 is considered an independent contractor and his/her payroll expenses

must be reported at 65%.

The Schedule

The Schedule

The Form RDC Schedule B Worksheet and details regarding the calculation of your Virginia base amount, if electing the primary credit computation. To obtain the worksheet in a spreadsheet format, visit www.tax.virginia.gov.

The Form RDC Schedule C Worksheet, if electing the alternative simplified computation of the Research and

Development Expenses Tax Credit.

A copy of the research agreement if any of the Virginia qualified research was conducted in conjunction with a

Virginia public or private college or university.

Proof of payment, such as a copy of a cancelled check or statement of electronic transfer, for

A copy of federal Form 6765, if you have ever received a federal credit for these research activities.

The Department will be unable to process the application until all of the required enclosures have been submitted.

PAGE 9

Form Properties

| Fact | Detail |

|---|---|

| Form Type | Virginia Application for Research and Development Expenses Tax Credit (Form RDC) |

| Deadline for Submission | September 1 of the tax year for which the credit is sought |

| Approval Requirement | This credit must be approved before it can be claimed on a tax return |

| Eligibility for Credit Calculation | Both primary credit computation and alternative simplified credit calculation methods are available |

| Maximum Credit Amount | $45,000 under the primary method; $60,000 if expenses are with a Virginia public college or university |

| Expense Types Considered | Includes contract research expenses, supplies, and qualified wages directly tied to R&D activities |

| Unique Requirements | Prohibits inclusion of expenses related to research conducted on human cells or tissue derived from induced abortions or from stem cells obtained from human embryos |

| Governing Law(s) | Virginia Code, specifically with respect to research and development tax incentives |

Steps to Filling Out Virginia Rdc

Navigating the Virginia Research and Development Expenses Tax Credit application can open doors to beneficial tax credits for eligible businesses. As September 1st marks the deadline, ensuring completeness and accuracy in the application is critical. It's helpful to gather all necessary documentation beforehand, including supplemental forms and schedules that support your credit calculation. Whether opting for the primary credit calculation or the alternative simplified credit calculation, each section must be filled out with careful attention to detail. Here are the considered steps to navigate through the intricacies of the Virginia RDC form.

- Begin with the "Taxpayer Information" section. Enter the business name, any alternative trading name, Federal Employer Identification Number (FEIN), or Social Security Number (SSN) if applicable. Identify if you are a fiscal year filer and provide the respective dates.

- Provide the complete street address, including the city, state, and ZIP code, along with the contact name, phone number, fax number, and email address for communication purposes.

- Identify your North American Industry Classification System (NAICS) code and describe the nature of your business in the provided fields.

- Under "Section 1 – Primary Credit Calculation," input all Virginia qualified research and development amounts in Column A. If you've partnered with a Virginia public college or university for any part of your research and development, detail those expenses in Column B.

- Proceed to calculate the percentage of college and university expenses, Virginia base amount, adjusted expenses amount, and total eligible research expenses as instructed in lines 2 through 5. Utilize the credit computation rates specified to determine the credit requested on line 7.

- If opting for the alternative simplified credit calculation, skip to "Section 2." Follow the instructions to fill out the total adjusted calendar year qualified research and development expenses, credit computation, and credit requested based on the alternative method.

- Complete "Section 3 – Credit Information" by providing details about the number of full-time employees during the tax year, total gross receipts, and other specified information including any associations with Virginia colleges or universities, receipt of federal credits, and other state tax credits applied for.

- Include a detailed description of your research projects, a summary of how this research qualifies, and answer the questions regarding the research specifics and your intentions for the tax credit allocation if applicable.

- Review the statement at the end of the form. The authorized individual should sign and date the document, listing their title and reiterating their contact information.

- Before submission, ensure you've compiled all necessary supporting documentation and supplemental forms as detailed in the "Supplemental Forms Checklist." This documentation is crucial for the validation of your claimed expenses and overall application.

After completing the form and gathering your documentation, submit the application package by September 1st to the address provided by the Virginia Department of Taxation. A comprehensive, accurately completed application enhances the evaluation process, facilitating a smoother approval for the Research and Development Expenses Tax Credit.

FAQ

What is the Virginia RDC Form?

The Virginia RDC Form, officially known as the Application for Research and Development Expenses Tax Credit, is a document businesses in Virginia use to apply for tax credits related to qualified research and development expenses. Taxpayers must submit this form alongside supporting documentation by September 1 of the tax year for which they are claiming the credit.

Who is eligible to apply for the Research and Development Expenses Tax Credit?

Businesses operating in Virginia that incur qualified research and development expenses may be eligible. These expenses must be related to research conducted within the state, and, in some cases, in conjunction with a Virginia public college or university. The form's eligibility extends to various sectors, including biotechnology, cybersecurity, industrial engineering, food and beverage development, and medical technology.

How do businesses calculate the Research and Development Tax Credit?

Businesses have two methods to calculate the credit:

- The Primary Credit Calculation requires completing Lines 1-7 of Section 1 on the Form RDC. This method involves detailed reporting of Virginia qualified research and development expenses, with a separate column for expenses in collaboration with Virginia colleges or universities.

- The Alternative Simplified Credit Calculation, outlined in Section 2 of the form, simplifies the credit computation based on adjusted research and development expenses. The choice between the two methods depends on the taxpayer’s preference and the nature of their expenses.

What are the deadlines and important dates for submitting the Form RDC?

The form and all necessary documentation should be submitted by September 1 of the tax year for which the credit is sought. This deadline is crucial for taxpayers aiming to claim the credit on their return, as the credit must be approved before it can be included.

Can this tax credit exceed the taxpayer's liability?

The tax credit can significantly reduce a taxpayer's liability, with the maximum credit requested not to exceed $45,000 for the primary calculation method or $60,000 for expenses related to research with colleges or universities. However, the exact impact on an individual taxpayer's liability varies and consulting the detailed instructions for calculating the credit is recommended.

What documentation is needed alongside the RDC Form?

Applicants must provide thorough documentation supporting their qualified research and development expenses. This includes, but is not limited to:

- Supplemental forms such as Schedule RD-CON (Contract Research Expenses), Schedule RD-SUP (Supply Expenses), and Schedule RD-WAGE (Qualified Wages).

- A copy of the agreement if research was conducted in conjunction with a Virginia college or university.

- Federal Form 6765 if a federal credit was received for these research activities.

- A comprehensive description of the research projects and a summary of how this research qualifies as defined.

All information submitted must accurately reflect the research activities undertaken within the tax year and ensure compliance with state and federal regulations.

Common mistakes

When filling out the Virginia Application for Research and Development Expenses Tax Credit, Form RDC, people often make several common mistakes. Paying attention to these errors can help ensure a smoother submission process and improve the chances of obtaining the tax credit.

- Forgetting to submit supporting documentation is a crucial oversight. The Form RDC explicitly states the need to attach supporting documents when submitting the form. This includes supplemental forms like Schedule RD-CON, RD-SUP, and RD-WAGE that detail contract research, supply expenses, and qualified wages, respectively. Also, for any research conducted in conjunction with a Virginia public college or university, a copy of the agreement must be included.

- Miscalculating expenses due to not rounding to the nearest whole dollar in the primary credit computation (Section 1) and the alternative simplified credit calculation (Section 2) is another frequent error. All amounts, including Virginia qualified research and development expenses and college and university related development amounts, should be rounded to eliminate cents.

- Incorrectly calculating the credit requested by either not applying the correct percentages (15% for general qualified expenses and 20% for expenses related to college or university engagements in Section 1, and either 10% or 5% in Section 2 depending on the situation) or by exceeding the maximum credit limits ($45,000 for Column A and $60,000 for Column B).

- Overlooking the inclusion of all qualified research and development expenses in Column A of Section 1 and Section 2, especially when some of these expenses are associated with Virginia public colleges or universities, which must also be entered in Column B. This omission could lead to underreporting eligible expenses.

- Not providing detailed project descriptions or summaries on how the research qualifies as defined in IRC § 41(d), as requested in Section 3. This section also asks for information about full-time employees, gross receipts, if the research was conducted in conjunction with a Virginia college or university, federal credit receipt status, other Virginia tax credits applied for, research field, and specific details about the nature of the research, including any ethical considerations. Neglecting these details can result in an incomplete application.

By avoiding these mistakes, applicants can improve their chances of successfully claiming the Research and Development Expenses Tax Credit in Virginia. Careful attention to detail and thorough preparation are key to a successful application.

Documents used along the form

When completing the Virginia Application for Research and Development Expenses Tax Credit, Form RDC, a range of other documents and forms may be necessary to ensure the application is accurate and comprehensive. These documents include both supplementary forms specifically designed to itemize and calculate qualified expenses, as well as general documents to support the claims made within the application.

- Schedule RD-CON, Research and Development Tax Credits Schedule of Contract Research Expenses: This schedule is essential for businesses that have incurred contract research expenses. It helps detail the expenses associated with contract research allowing for a precise calculation of the eligible tax credit.

- Schedule RD-SUP, Research and Development Tax Credits Schedule of Supply Expenses: For items used in the conduct of qualified research, this schedule itemizes supply expenses, enabling businesses to accurately record and claim the expenses towards their tax credit.

- Schedule RD-WAGE, Research and Development Tax Credits Schedule of Qualified Wages: Wages form a significant part of research expenses. This schedule is used to list eligible wages paid to employees involved in the research and development activities.

- Federal Form 6765, Credit for Increasing Research Activities: If a federal credit for research activities has been claimed, including this form with the RDC application helps demonstrate compliance and eligibility for state-level credits.

- Research Agreement(s) with Virginia Colleges or Universities: For expenses incurred in conjunction with a Virginia college or university, a copy of the research agreement must be included to validate the partnership and the expenses claimed.

- Proof of Full-time Employees: documentation to verify the number of full-time employees during the year for which the credit is sought, as mentioned in the Form RDC instructions.

- Gross Receipts Documentation: Records of total or anticipated gross receipts for the taxable year are necessary to determine the company's eligibility and the credit's amount based on the company's financial scale.

Together, these documents play a crucial role in the tax credit application process. Preparing and submitting thorough and accurate documentation helps ensure that the business's claim is valid, maximizes the potential credit, and complies with both state and federal guidelines. Not only do they provide a clear picture of the expenses incurred during research and development activities, but they also streamline the process of claiming the tax credit by offering detailed evidence of the company's investment in innovation.

Similar forms

The Virginia RDC form is similar to the federal Form 6765, used for claiming the Research and Development (R&D) tax credits at the national level. The similarities between these two documents are evident in their structure and purpose. Both forms require the taxpayer to provide detailed information about the nature of their research expenses, including wages, supplies, and contract research costs. They are designed to facilitate claims for tax credits based on expenses incurred during research and development activities. The primary difference lies in their jurisdictional application—one is for Virginia state tax credits while the other is applicable to federal taxes. The calculation methodologies, while sharing a goal of encouraging R&D through tax incentives, are tailored to the specific provisions of Virginia state law and federal tax law, respectively.

Another document similar to the Virginia RDC form is the California Form 3523, Research Credit form. This form is used by businesses in California to claim tax credits for research and development activities conducted within the state. Like the Virginia RDC form, California's Form 3523 requires detailed reporting of R&D expenditures, including the breakdown of expenses such as wages, supplies, and payments for contract research. Both forms also offer an alternative simplified credit calculation method, which simplifies the process for taxpayers who may not have detailed records of their research expenses over multiple years. The aim of both forms is to stimulate economic growth and innovation within their respective states by reducing the tax liability for businesses investing in R&D.

Dos and Don'ts

When it comes to completing the Virginia RDC form for Research and Development Expenses Tax Credit, it’s crucial to approach the process with care to ensure accuracy and compliance with tax laws. Here are recommendations to guide you through filling out the form.

What You Should Do:

- Review Instructions Thoroughly: Before filling out the form, take time to carefully read the instructions provided. This ensures understanding of the eligibility criteria, documentation requirements, and the correct method for calculating the tax credit.

- Gather Required Documentation: Collect all necessary supporting documents related to your research and development expenses, including those pertaining to any collaborative efforts with Virginia public colleges or universities.

- Report Expenses Accurately: Ensure that all qualified research and development expenses are reported accurately in the appropriate sections and columns of the form, including any expenses incurred through work with Virginia colleges or universities.

- Check Calculation Methods: Decide between the primary and alternative simplified credit computation methods based on your situation. Carefully perform the calculations as outlined in the instructions to determine your eligible tax credit amount.

- Submit Before Deadline: Ensure your completed form and all required supporting documentation are submitted by the September 1 deadline to avoid any delays or forfeitures in receiving your tax credit.

What You Shouldn’t Do:

- Don't Overlook Supplemental Forms: Failing to complete and attach necessary supplemental forms like Schedule RD-CON, RD-SUP, and RD-WAGE can lead to an incomplete application and potential rejection of your tax credit claim.

- Don't Include Ineligible Expenses: Avoid including expenses related to research conducted on human cells or tissue derived from induced abortions or from stem cells obtained from human embryos, as these are not eligible for the credit.

- Don't Miss Reporting College/University Collaboration: If your research and development expenses involve collaboration with a Virginia public college or university, do not forget to report this information and include the associated expenses correctly.

- Don't Guess on Calculations: Avoid making guesses or approximations when calculating your tax credit. Utilize the instructions and worksheets provided to accurately compute your credit.

- Don't Delay Verification: Do not wait until the last minute to ensure that all information provided is accurate and verifiable. Inaccuracies or the inability to verify claimed expenses can lead to denial of the tax credit.

Misconceptions

Many people have misconceptions about the Virginia RDC form, which can lead to confusion and errors in applying for the Research and Development Expenses Tax Credit. Understanding these will help ensure a smoother application process.

Only large businesses can apply: A common misconception is that the Virginia RDC form and the associated tax credits are only available to large corporations. In reality, businesses of any size can apply for this credit, provided they have eligible research and development expenses in Virginia. This inclusivity encourages innovation across the business spectrum, from startups to established enterprises.

Expenses must be directly related to product development: Many assume that only expenses directly related to product development qualify. However, the credit covers a broader range of research and development activities. As long as the work is part of the qualified research defined under IRC § 41(d), and expenses meet the eligibility criteria, they can be included. This encompasses a range of research activities beyond just immediate product development.

The application process is overly complex: Some potential applicants are deterred by the belief that the application process is too complicated. While the form requires detailed information, the instructions are designed to guide applicants through step by step. Understanding the layout of the form and gathering the necessary documentation beforehand simplifies the process significantly.

Credits are processed on a first-come, first-served basis: There's a misconception that tax credits are awarded on a first-come, first-served basis, causing a rush to submit applications. However, the reality is that all applications submitted by the September 1 deadline are considered equally. The key is to ensure the application is complete and accurate to avoid delays in processing.

Clearing up these misconceptions encourages more businesses in Virginia to take advantage of the Research and Development Expenses Tax Credit, fostering innovation and growth within the state's economy.

Key takeaways

The Virginia Research and Development Expenses Tax Credit, as outlined in Form RDC, presents an opportunity for businesses engaging in qualifying research activities within the state to substantially reduce their tax liabilities. Understanding the intricacies of this form and its provisions can maximize the benefit received. Here are six key takeaways to consider when filling out and using Form RDC:

- The deadline for submission is stringent, with applications and supporting documentation required to be submitted by September 1. This timeline allows the Virginia Department of Taxation time to approve the credit before it is claimed on the business's return.

- To be eligible for the tax credit, the expenses must qualify as research and development amounts under Virginia's guidelines, which closely align with federal definitions. This includes a broad spectrum of costs, from wages and supplies to contract research expenses.

- Businesses have the option to compute their credit using either the primary credit computation method detailed in Section 1 or the alternative simplified credit calculation outlined in Section 2. The choice between these methodologies can significantly impact the amount of credit received.

- A notable feature of this tax credit is the additional incentive offered for research conducted in conjunction with Virginia public colleges or universities. Such collaboration can increase the credit rate, underscoring the state's commitment to fostering partnerships between businesses and higher education institutions.

- The form requires detailed taxpayer information, including the business name, contact details, and financial specifics like the number of full-time employees and total gross receipts. This information aids in the verification process and ensures the accurate allocation of tax credits.

- There is a cap on the credit amount that can be claimed, with the maximum set at $45,000 for the primary credit computation and the same limit for the alternative simplified credit, unless expenses are incurred in conjunction with a Virginia college or university, in which case, the cap increases to $60,000. This cap ensures that the tax credit benefits are spread across a broad range of applicants.

By understanding these key aspects, businesses can navigate the complexities of the Virginia RDC form more effectively, ensuring they maximize their potential tax savings while complying with the necessary regulations.

Other PDF Forms

Form 502 Virginia - The requirement to include a copy of the federal return, but not federal Schedules K-1, reduces redundancy and streamlines filing.

Wv Property Tax Rebate - If claiming a refund or reporting additional taxes owed, the form provides clear instructions on calculating these amounts.

Va4 Form - Designed to streamline the exemption process for both the employing agency and the applicant.