Fill Out a Valid Virginia Sales Tax Exemption Template

In the landscape of fiscal regulations, the Virginia Sales Tax Exemption Form, denoted as FORM ST-12, holds particular significance for transactions involving the Commonwealth of Virginia, its political subdivisions, or the United States. Elaborated under the auspices of the Virginia Retail Sales and Use Tax Act, this document serves to delineate the circumstances under which tangible personal property, obtained either through purchase or lease, is rendered exempt from the standard imposition of sales and use taxes. Importantly, the exemption is specifically tailored for goods and services destined for use or consumption by state or federal governmental agencies, thereby excluding private entities, even those chartered by the U.S., from its purview. To qualify for this exemption, the purchase must not only fulfill a use or consumption criterion by a government agency but must also be supported by an official purchase order and be financed through public funds. The form consequently requires detailed identification of the governmental agency involved, alongside an attestation from an authorized representative confirming the veracity and compliance of the purchase with the requirements stipulated by the Act. Moreover, it imposes a clear mandate on dealers, obligating them to retain a properly executed Certificate of Exemption for each tax-exempt transaction—a stipulation that underscores the form's pivotal role in the documentation and verification process inherent to the enforcement of tax exemptions within Virginia.

Virginia Sales Tax Exemption Example

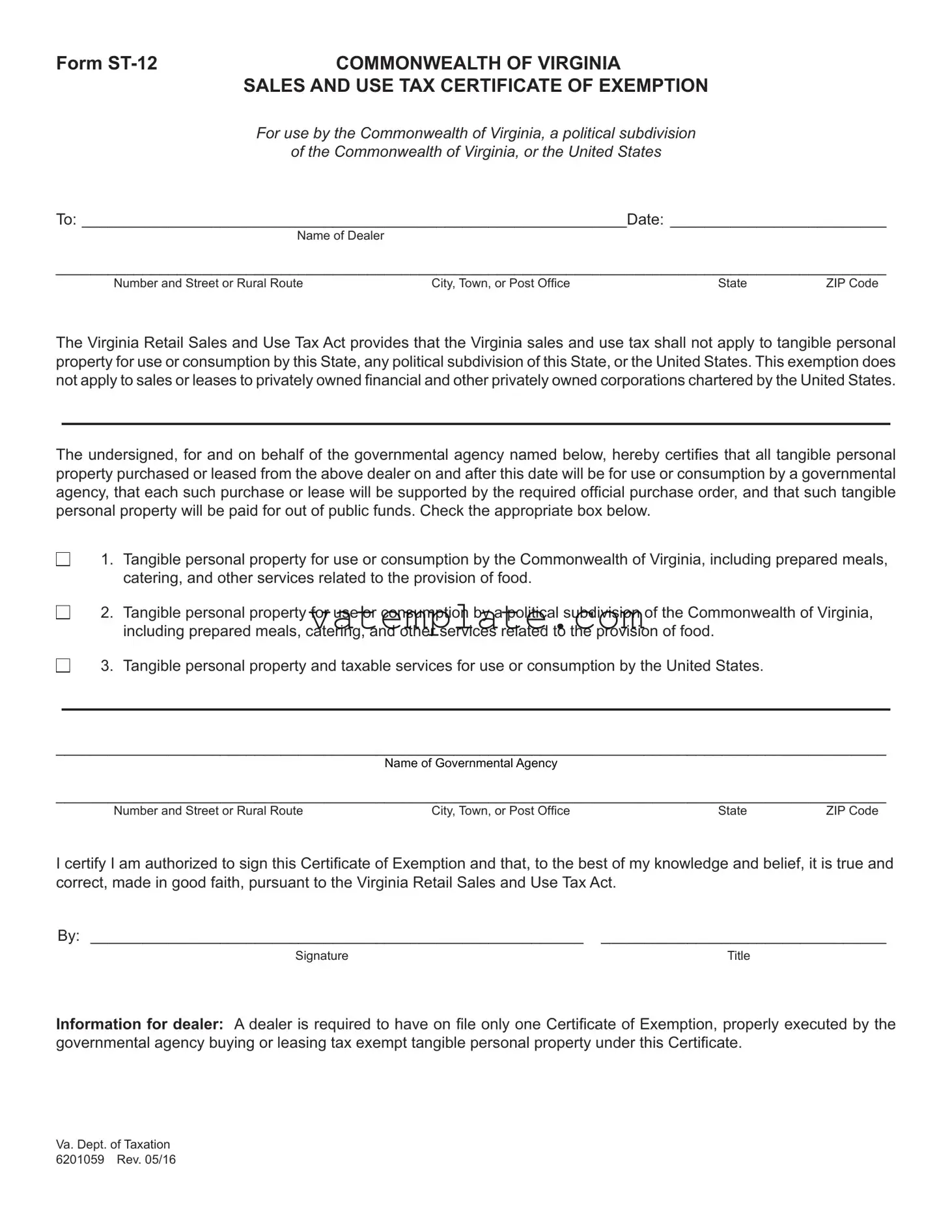

FORM |

COMMONWEALTH OF VIRGINIA |

|

SALES AND USE TAX CERTIFICATE OF EXEMPTION |

|

For use by the Commonwealth of Virginia, a political subdivision |

|

of the Commonwealth of Virginia, or the United States |

To: _______________________________________________________________Date: _________________________

Name of Dealer

________________________________________________________________________________________________

Number and Street or Rural Route |

City, Town, or Post Ofice |

State |

ZIP Code |

The Virginia Retail Sales and Use Tax Act provides that the Virginia sales and use tax shall not apply to tangible personal property for use or consumption by this State, any political subdivision of this State, or the United States. This exemption does not apply to sales or leases to privately owned inancial and other privately owned corporations chartered by the United States.

The undersigned, for and on behalf of the governmental agency named below, hereby certiies that all tangible personal property purchased or leased from the above dealer on and after this date will be for use or consumption by a governmental agency, that each such purchase or lease will be supported by the required oficial purchase order, and that such tangible personal property will be paid for out of public funds. Check the appropriate box below.

1. Tangible personal property for use or consumption by the Commonwealth of Virginia, including prepared meals, catering, and other services related to the provision of food.

2. Tangible personal property for use or consumption by a political subdivision of the Commonwealth of Virginia, including prepared meals, catering, and other services related to the provision of food.

3. Tangible personal property and taxable services for use or consumption by the United States.

________________________________________________________________________________________________

Name of Governmental Agency

________________________________________________________________________________________________

Number and Street or Rural Route |

City, Town, or Post Ofice |

State |

ZIP Code |

I certify I am authorized to sign this Certiicate of Exemption and that, to the best of my knowledge and belief, it is true and correct, made in good faith, pursuant to the Virginia Retail Sales and Use Tax Act.

By: _________________________________________________________ |

_________________________________ |

Signature |

Title |

INFORMATION FOR DEALER: A dealer is required to have on ile only one Certiicate of Exemption, properly executed by the governmental agency buying or leasing tax exempt tangible personal property under this Certiicate.

Va. Dept. of Taxation 6201059 Rev. 05/16

Form Properties

| Fact | Detail |

|---|---|

| Purpose | The form exempts eligible governmental entities from Virginia sales and use tax on purchases or leases of tangible personal property and certain services. |

| Eligible Entities | It applies to the Commonwealth of Virginia, its political subdivisions, or the United States for their use or consumption. |

| Exclusions | Private financial and other privately owned corporations chartered by the United States are not eligible for this exemption. |

| Requirements for Exemption | Purchases or leases must be made with official purchase orders and paid for with public funds. |

| Governing Law | The Virginia Retail Sales and Use Tax Act. |

Steps to Filling Out Virginia Sales Tax Exemption

Filing a Virginia Sales Tax Exemption form is a straightforward process that governmental entities must complete to purchase or lease tangible personal property without the added burden of sales tax. This privilege is afforded to the Commonwealth of Virginia, its political subdivisions, and the United States, reflecting the intent to support public service operations by minimizing costs. By following the steps below, authorized representatives can ensure their entities are properly registered for sales and use tax exemptions on qualifying purchases.

- Enter the current date in the space provided next to "Date:" at the top right of the form.

- Fill in the "Name of Dealer" section with the full name of the vendor or seller from whom the tangible personal property or services are being purchased or leased.

- Provide the address of the dealer, including the number and street or rural route, city, town, or post office, state, and ZIP code in the fields under the dealer's name.

- Check the appropriate box to indicate whether the tangible personal property or services purchased or leased are for the use or consumption by:

- The Commonwealth of Virginia, including prepared meals, catering, and other services related to the provision of food.

- A political subdivision of the Commonwealth of Virginia, including prepared meals, catering, and other services related to the provision of food.

- The United States, including tangible personal property and taxable services.

- Under the check boxes, enter the name of the governmental agency making the purchase or lease.

- Provide the address of the governmental agency, including the number and street or rural route, city, town, or post office, state, and ZIP code in the designated fields.

- Sign the form in the space provided next to "By:" to certify that you are authorized to claim the exemption on behalf of the governmental agency. Print your title next to your signature.

- Ensure that the form is dated, signed, and retained by the dealer for their records, as indicated in the "INFORMATION FOR DEALER" section at the bottom of the form.

Once the form is properly completed and submitted to the dealer, it enables the governmental agency to procure necessary goods and services exempt from Virginia sales and use tax. This exemption simplifies the procurement process and ensures that public funds are utilized efficiently. Keep in mind, the dealer is only required to have one correctly executed Certificate of Exemption on file per governmental entity. Therefore, it's crucial to accurately fill out the form to avoid any issues with tax-exempt purchases in the future.

FAQ

What is the Virginia Sales Tax Exemption form?

The Virginia Sales Tax Exemption form, designated as FORM ST-12, is a certificate that allows specified entities—namely the Commonwealth of Virginia, its political subdivisions, or the United States government—to purchase or lease tangible personal property without paying the sales and use tax. This certificate attests that the purchases are for official use and will be paid for with public funds.

Who can use the Virginia Sales Tax Exemption form?

This exemption form can be used by:

- The Commonwealth of Virginia,

- Political subdivisions of the Commonwealth of Virginia, and

- The United States government.

What purchases qualify for the exemption?

Qualifying purchases include tangible personal property and certain services that are for use or consumption by the eligible entities mentioned above. Examples include prepared meals, catering, and related food provision services.

How does one apply for the exemption?

To apply for the exemption, an authorized representative of the governmental agency must fill out and sign the FORM ST-12, indicating the type of entity making the purchase and providing specific details about the governmental agency. This certificate should then be presented to the dealer at the time of purchase.

Is there an expiration date for the Virginia Sales Tax Exemption form?

The form does not list an expiration date. However, it is important to ensure that the information remains current and accurate. If any details change, a new exemption certificate should be submitted to the vendor.

Does the exemption form need to be renewed?

No formal renewal is necessary as long as the entity remains eligible for the exemption and the information on the certificate is current. Nonetheless, it is recommended that entities periodically review and update their information as needed.

What responsibilities does the dealer have in accepting the exemption certificate?

Dealers are required to retain a properly executed exemption certificate on file. This allows them to exempt eligible purchases from sales tax without further verification for each transaction, provided the certificate remains valid and up-to-date.

What happens if the tax-exempt status is questioned?

If the exemption status is questioned, the entity should be prepared to provide supporting documentation to confirm their eligibility. This might include official purchase orders and proof of payment by public funds.

Can the exemption be applied to any purchase made by the eligible entities?

No, the exemption only applies to purchases of tangible personal property and specific taxable services for use or consumption by eligible entities. It does not cover all purchases or leases made by these entities.

Where can one obtain the Virginia Sales Tax Exemption form?

The form can be obtained from the Virginia Department of Taxation’s website or by contacting the department directly. It is important to use the most current form available to ensure compliance with the latest tax laws.

Common mistakes

Filling out the Virginia Sales Tax Exemption form requires careful attention to detail. Mistakes can lead to the denial of tax-exempt status, which could result in unnecessary tax liabilities and complications. Below are common mistakes people make when completing this form:

- Incorrectly identifying the purchasing entity: Not accurately specifying whether the purchase is for the Commonwealth of Virginia, a political subdivision of the Commonwealth, or the United States.

- Leaving date fields blank: Failing to provide the date of the transaction can lead to processing delays or even rejection of the exemption certificate.

- Insufficient details on purchased items: Not clearly describing the tangible personal property or specifying if the transaction includes taxable services related to food provision impacts the exemption's applicability.

- Overlooking signature and title sections: An unsigned form or missing the title of the authorized signatory will render the certificate invalid.

- Misuse of the form for non-governmental agencies: Utilizing the form for sales or leases to privately owned financial and other corporations chartered by the United States, which aren't eligible for this tax exemption.

- Incorrect address or contact information: Providing inaccurate or incomplete address details for the governmental agency or dealer can lead to issues in record-keeping or communication.

- Not checking the appropriate box: Failing to indicate which type of entity the purchase is for—it's important to specify if the property is for the Commonwealth, a political subdivision, or the US government.

- Forgetting to provide an official purchase order: The lack of an official purchase order to support each purchase or lease agreement can question the legitimacy of the tax exemption claim.

To avoid these errors, it's crucial to:

- Review the form thoroughly before submission.

- Ensure all required fields are completed accurately.

- Include detailed descriptions of the purchased or leased property.

- Verify the form is duly signed and dated by an authorized representative.

Adhering to these guidelines will help ensure the successful processing of your Virginia Sales Tax Exemption form, securing the tax benefits rightfully available to qualifying governmental purchases.

Documents used along the form

When dealing with the complexities of tax exemption for governmental entities in Virginia, the Virginia Sales Tax Exemption form, known as FORM ST-12, serves as a pivotal document. It's often just one piece of a broader compilation of forms and documents required for comprehensive compliance and record-keeping. The array of additional forms and documents commonly used alongside this exemption certificate are vital for ensuring that transactions remain transparent, compliant, and adequately reported. Below is a list illustrating some of these essential documents, each serving its unique purpose in the procedural tapestry of sales tax exemption.

- Purchase Order: A formal document submitted by a governmental agency to a vendor, outlining the types and quantities of products or services purchased. It serves as authorization for the expenditure.

- Invoice: Provided by the seller to the buyer, this document details the items or services sold, including quantities and prices. It requests payment and often accompanies the delivery of goods or services.

- Delivery Receipt: A record acknowledging the receipt of goods by the purchasing entity. It confirms the physical delivery of items listed in the purchase order.

- Exemption Certificate for Federal Government: This document is similar to FORM ST-12 but is specifically used for purchases made by federal government entities, evidencing their exempt status.

- Contract Agreement: A legally binding agreement between a government entity and a supplier, detailing the goods or services to be provided, terms, conditions, and payment agreements.

- Vendor’s License: A document that verifies the seller is authorized to conduct business in the jurisdiction where the transaction occurs, ensuring they comply with local business regulations.

- Annual Tax Exempt Review Form: Used by organizations to review and renew their tax-exempt status annually to ensure continued compliance with state tax laws.

- Certificate of Authority: Authenticated evidence that a governmental agency is authorized to conduct transactions and operations within the scope of its jurisdiction.

- Financial Statement: A document illustrating the financial status of the governmental entity, including assets, liabilities, and fund balances, providing insight into its purchasing capabilities.

- Maintenance Contract: If applicable, this agreement ensures the upkeep and service of tangible personal property, evidencing ongoing costs associated with the exempted purchases.

Each document serves a distinct function, from establishing the legal and financial frameworks within which transactions occur, to the detailed tracking and reporting of those transactions. Together, they ensure not only the lawful execution of tax-exempt purchases but also maintain the integrity and accountability of governmental fiscal practices. While the Virginia Sales Tax Exemption form is critical for tax-exempt purchases by governmental entities, it's the collective documentation that provides a full picture of each transaction, contributing to a transparent, organized, and compliant procurement process.

Similar forms

The Virginia Sales Tax Exemption form is similar to the Uniform Sales & Use Tax Exemption/Resale Certificate facilitated by the Multistate Tax Commission. Both forms serve to certify exemption from sales tax under specific conditions, yet they differ by scope and applicability. The Virginia form explicitly caters to governmental entities within the state or the U.S. government making tax-exempt purchases or leases. In contrast, the Uniform Certificate spans a broader range of entities, including nonprofits and resellers, and can be used across multiple states that accept it. While the Virginia form is strictly for use within Virginia, the Uniform Certificate simplifies the exemption process for eligible organizations operating in or across states that recognize the form, streamlining the exemption claim process for interstate commerce.

Additionally, the Virginia Sales Tax Exemption form shares commonalities with the Exemption Certificate for Government Agencies issued by several states. These state-specific forms, much like Virginia’s, require that purchases be made directly by the government agency and paid for with government funds to qualify for the exemption. However, the details and conditions stipulated can vary widely from state to state, reflecting different tax codes and definitions of eligible entities. For example, some states may include or exclude certain types of organizations, such as educational institutions or charitable organizations, under their definition of a government agency. Both the Virginia form and these other state-issued exemption certificates are instrumental in helping eligible governmental and quasi-governmental entities navigate sales tax exemptions on purchases made for official use.

Dos and Don'ts

When filling out the Virginia Sales Tax Exemption form, consider the following list of dos and don'ts to ensure accuracy and compliance:

- Do ensure you are authorized to sign the Certificate of Exemption on behalf of the governmental agency.

- Do accurately fill in the name and address of the dealer from whom you are purchasing or leasing the tangible personal property.

- Do accurately enter the date of the transaction at the top of the form.

- Do check the appropriate box indicating the type of tangible personal property or taxable services for use or consumption.

- Do clearly print the name of the governmental agency purchasing or leasing the property.

- Do not leave any required fields empty; ensure all relevant sections of the form are completed.

- Do not use this form for purchases or leases by privately owned financial and other privately owned corporations chartered by the United States.

- Do not forget to sign and title the form, certifying that the information provided is true and correct to the best of your knowledge.

- Do not submit the form without ensuring all information reflects current and accurate details about the purchase or lease and the governmental agency.

Misconceptions

Understanding the Virginia Sales Tax Exemption form (FORM ST-12) is crucial, yet there are common misconceptions that require clarification.

- Only for tangible personal property: A prevalent misconception is that the exemption solely applies to tangible personal property. While the form primarily addresses tangible goods, it also encompasses taxable services consumed by eligible government agencies, as outlined in the check boxes related to food services.

- Applies to all government purchases: Another misunderstanding is the belief that all government purchases, regardless of the governmental level, are exempt. However, the exemption specifically applies to purchases made by the Commonwealth of Virginia, its political subdivisions, or the United States. It explicitly does not cover sales or leases to privately owned financial entities and corporations chartered by the United States.

- One-time use: There's a notion that the exemption form must be completed with every purchase. The truth is, dealers are required to keep only one form on file, properly executed by the governmental agency. This form then covers all future purchases or leases by that agency, simplifying the process for both parties.

- Immediate application: Some believe that the exemption is automatically applied to all eligible purchases upon submission of the form. In reality, each purchase or lease must be supported by an official purchase order, ensuring that the transactions are duly authorized and documented for tax exemption purposes.

- Unrestricted use of exemption: A final misconception is that the tax exemption can be applied indiscriminately for any kind of purchase made by a government agency. The form makes it clear that the purchased or leased tangible personal property must be for use or consumption by a governmental agency, aligning with the stipulated conditions of the Virginia Retail Sales and Use Tax Act.

Dispelling these myths is essential for both dealers and government agencies to accurately apply the Virginia Sales and Use Tax Certificate of Exemption, ensuring compliance and proper utilization of public funds.

Key takeaways

Understanding the Virginia Sales Tax Exemption form is crucial for entities eligible to benefit from tax-exempt purchases or leases. Here are key takeaways about filling out and using this form:

- The form is specifically designed for use by the Commonwealth of Virginia, its political subdivisions, or the United States, highlighting its exclusivity to governmental agencies.

- It explicitly states that sales or leases to privately owned financial institutions and other privately owned corporations chartered by the United States are not eligible for this exemption, underscoring the importance of understanding the scope of eligibility.

- To utilize the exemption, the form requires the governmental agency to certify that all tangible personal property purchased or leased will be for use or consumption by a governmental agency, ensuring that the exemption is applied correctly and to the right entities.

- Upon completing the form, an official purchase order must support each purchase or lease, emphasizing the need for proper documentation and adherence to procedural requirements.

- A dealer is required to keep on file only one Certificate of Exemption properly executed by the governmental agency, simplifying the documentation process for repeat transactions and establishing a straightforward method for validating tax-exempt status.

By adhering to these guidelines, eligible governmental agencies can effectively navigate the process of applying for and utilizing the Virginia Sales Tax Exemption, ensuring compliance and proper use of the exemption for eligible purchases or leases.

Other PDF Forms

How Long Do You Have to File Probate After Death in Virginia - Contributes to the peace of mind for all parties involved by ensuring a legal and orderly process.

How to Fill Out W9 - Encourages government entities, nonprofits, and other exempt organizations to correctly identify their status on the form.