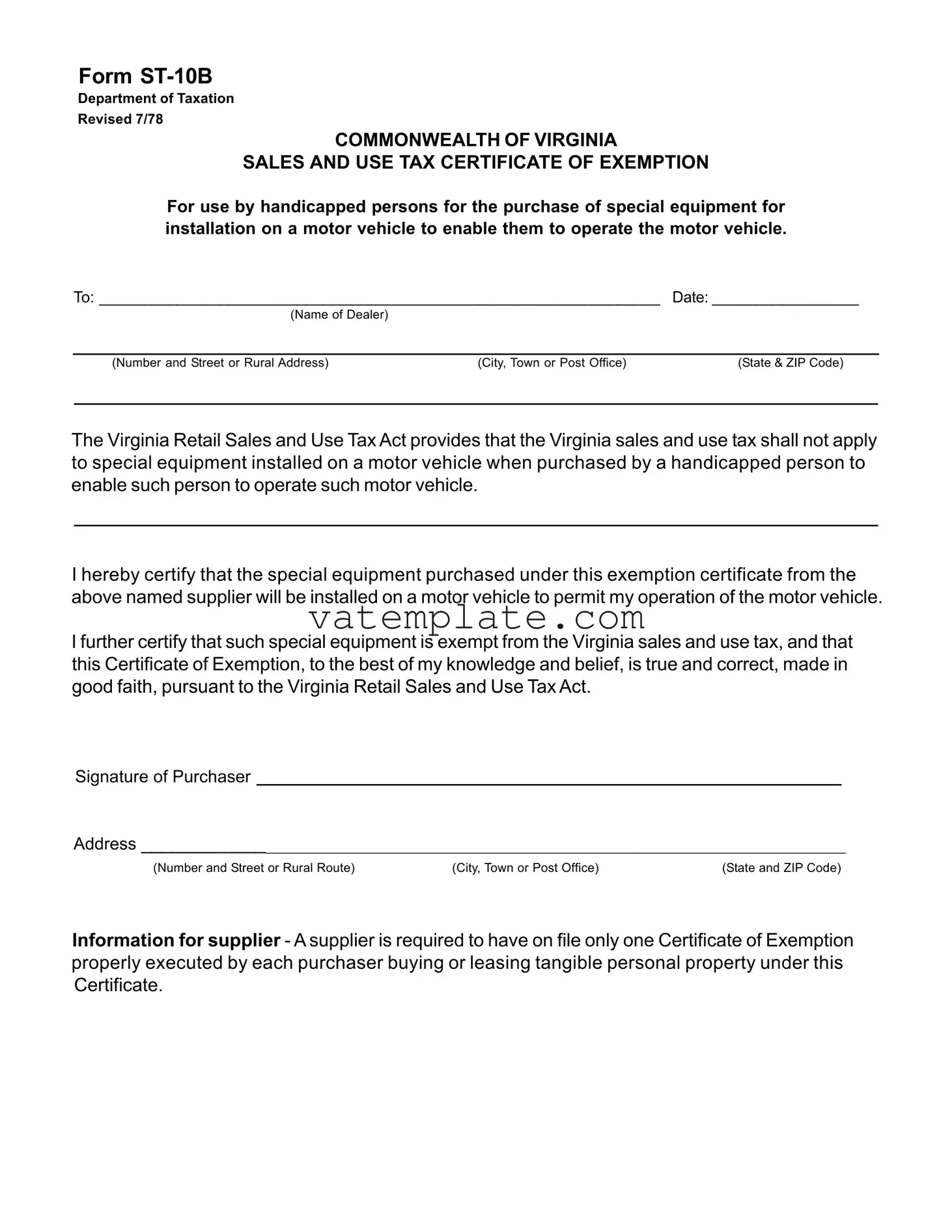

Fill Out a Valid Virginia St 10B Template

In the Commonwealth of Virginia, the ST-10B form serves a critical purpose for individuals with disabilities, providing a sales and use tax exemption for the purchase of special equipment intended for installation on motor vehicles. Engendered by the Virginia Department of Taxation and revised in July 1978, this form acts as a Certificate of Exemption, aligning with the Virginia Retail Sales and Use Tax Act. It stipulates that the requisite sales and use taxes typically levied on motor vehicle equipment do not apply when such equipment is purchased by a person with a disability, aiming to enhance their ability to operate a vehicle. By filling out and submitting this form, individuals certify that the equipment acquired will be used expressly for installing on a motor vehicle to facilitate their driving or transport needs. Furthermore, it asserts the purchaser's claim that the special equipment secures exemption from the Virginia sales and use tax, under the terms set forth by the pertinent legislation. Vital for its role, the form requires thorough execution, including the signature of the purchaser, and mandates that the supplier retains a properly completed Certificate of Exemption for each transaction exempted under this provision. The specifics delineated within the form highlight a thoughtful legislative measure designed to support the mobility and independence of people with disabilities in Virginia.

Virginia St 10B Example

Form

Department of Taxation

Revised 7/78

COMMONWEALTH OF VIRGINIA

SALES AND USE TAX CERTIFICATE OF EXEMPTION

For use by handicapped persons for the purchase of special equipment for installation on a motor vehicle to enable them to operate the motor vehicle.

To: _________________________________________________________________ |

Date: _________________ |

|

(Name of Dealer) |

|

|

|

|

|

(Number and Street or Rural Address) |

(City, Town or Post Office) |

(State & ZIP Code) |

The Virginia Retail Sales and Use Tax Act provides that the Virginia sales and use tax shall not apply to special equipment installed on a motor vehicle when purchased by a handicapped person to enable such person to operate such motor vehicle.

I hereby certify that the special equipment purchased under this exemption certificate from the above named supplier will be installed on a motor vehicle to permit my operation of the motor vehicle.

I further certify that such special equipment is exempt from the Virginia sales and use tax, and that this Certificate of Exemption, to the best of my knowledge and belief, is true and correct, made in good faith, pursuant to the Virginia Retail Sales and Use Tax Act.

Signature of Purchaser

Address __________________________________________________________________________

(Number and Street or Rural Route) |

(City, Town or Post Office) |

(State and ZIP Code) |

Information for supplier - A supplier is required to have on file only one Certificate of Exemption properly executed by each purchaser buying or leasing tangible personal property under this Certificate.

Form Properties

| Fact | Description |

|---|---|

| Purpose | Used by individuals with disabilities for the exemption from Virginia sales and use tax for the purchase of special equipment to be installed on a motor vehicle. |

| Governing Law | The Virginia Retail Sales and Use Tax Act. |

| Eligibility | Only handicapped persons purchasing special equipment for a motor vehicle enabling their operation of the vehicle are eligible. |

| Supplier Requirement | Suppliers must keep on file a properly executed Certificate of Exemption for each eligible purchaser or lessee of said special equipment. |

Steps to Filling Out Virginia St 10B

Filling out the Virginia ST-10B form is important for handicapped persons who wish to purchase special equipment for their motor vehicle, exempt from sales and use tax. By carefully going through each step, you can successfully complete the form, ensuring that the necessary tax exemptions are applied to your purchase. Below are the step-by-step instructions to fill out the form correctly.

- Begin by writing the name of the dealer to whom you are presenting this certificate in the space provided. This includes the full name of the dealership.

- Next, enter the current date in the designated space next to the dealer's name.

- Below the dealer's name and date, provide the dealer's complete address. This includes the number and street or rural address, the city, town or post office, followed by the state and ZIP code.

- In the large empty space, there is a pre-written statement that you're required to agree with by signing. This statement confirms your eligibility for the exemption on the basis of the equipment's use in a motor vehicle to enable operation by a handicapped person. Nothing is needed to be written in this section as it's pre-filled.

- At the bottom portion of the form, sign your name under "Signature of Purchaser" to certify that the information you've provided and the claim for exemption are true and made in good faith.

- Finally, enter your complete address next to your signature. This should include your number and street or rural route, your city, town or post office, and your state and ZIP code.

By following these steps, you have completed the ST-10B form. Ensure all the information is correct and legible before submitting it to the dealer. This form will allow the dealer to process your purchase without including the Virginia sales and use tax for the qualifying special equipment to be installed in your motor vehicle.

FAQ

What is the Virginia ST-10B form?

The Virginia ST-10B form is a Sales and Use Tax Certificate of Exemption. It's intended for use by handicapped individuals purchasing special equipment to be installed on a motor vehicle. This equipment must be purchased specifically to enable them to operate the vehicle. The form certifies that such equipment is exempt from Virginia's sales and use tax.

Who should use this form?

This form is for handicapped persons who are buying special equipment to install on a motor vehicle, which will enable them to operate the vehicle. It serves to certify the tax-exempt status of their purchase under the Virginia Retail Sales and Use Tax Act.

What types of equipment qualify for this exemption?

The exemption applies to special equipment purchased by a handicapped person that is necessary for them to operate a motor vehicle. This may include, but is not limited to, hand controls, wheelchair lifts, and other adaptive equipment.

How does one apply for this tax exemption?

To apply for this tax exemption, the handicapped individual must fill out the Virginia ST-10B form and present it to the vendor at the time of purchase. The form must include:

- The name and address of the vendor

- The date of purchase

- The signature of the purchaser

- A certification that the equipment is necessary for the purchaser to operate a motor vehicle

Is there a time limit for submitting this form?

There's no specified time limit mentioned for submitting the ST-10B form. However, it should be presented at the time of purchase to ensure the exemption is applied to the qualifying equipment.

Do I need to submit this form for every purchase?

No, the supplier is required to keep only one Certificate of Exemption on file for each purchaser. Once you have submitted this form for a purchase, you should not need to submit it again for future purchases of qualifying equipment from the same supplier.

What information does the supplier need to retain?

The supplier needs to retain a properly executed Certificate of Exemption for each purchaser. This includes keeping a record of:

- The exempted equipment purchased

- The name and address of the purchaser

- The date of purchase

- The signature of the purchaser, certifying the exemption

Can this form be used for leasing equipment?

Yes, this Certificate of Exemption can also be used for leasing tangible personal property that qualifies under the specified conditions for handicapped individuals. The same exemption from Virginia sales and use tax applies.

Common mistakes

When completing the Virginia ST-10B form, which is a Certificate of Exemption for handicapped persons purchasing special equipment for a motor vehicle, several common mistakes can result in incorrect or incomplete submissions. Recognizing and avoiding these errors can streamline the process and ensure compliance with Virginia's tax exemption requirements for this specific use case.

Not fully completing the dealer information section: It's crucial to provide the complete name, address (including the number, street, or rural address), city, town, or post office, state, and ZIP code of the dealer. Omissions or inaccuracies can lead to processing delays.

Omitting the date: The date field must be filled in to signify when the form is being executed. Without the date, the form may not be considered valid.

Failing to specify the special equipment: The form requires a certification that the purchased equipment is specifically for enabling the handicapped person to operate the motor vehicle. General or vague descriptions can lead to misunderstandings about the eligibility for tax exemption.

Incorrect purchaser information: The purchaser's address, including the number and street or rural route, city, town or post office, state, and ZIP code, must be accurately provided. Inaccurate details can impede verification processes.

Not signing the form: The purchaser's signature is mandatory for the form's validity. An unsigned form is not acceptable and will likely be returned or rejected.

Assuming one certificate is sufficient for multiple transactions: A new certificate is generally needed for each purchase or lease of eligible tangible personal property, unless clarified otherwise by the supplier. Reusing a certificate without confirmation can lead to denied exemptions.

Avoiding these mistakes can significantly improve the processing time and reduce the likelihood of issues arising with the exemption claim. Compliance with the form's requirements ensures that eligible handicapped individuals can receive the tax benefits they are entitled to for their vehicle modifications.

Documents used along the form

When dealing with the Virginia ST-10B form, often used by handicapped persons to purchase special equipment free from the Virginia sales and use tax for their vehicles, individuals may need to familiarize themselves with several other forms and documents. These documents are essential in ensuring a smooth process, not only for tax exemption purposes but also for legal and operational conformance related to the purchase and installation of such equipment.

- Vehicle Registration Application (Form VSA 14): Before or after purchasing special equipment, the vehicle must be properly registered with the Virginia Department of Motor Vehicles. This form registers the vehicle and indicates ownership, which is necessary for any modifications to be legally acknowledged.

- Application for Disabled Parking Placard or Plates (Form MED 10): Individuals with disabilities might also need to obtain a disabled parking placard or plates. This form proves the disability officially and allows for the issuance of parking accommodations which are crucial for the individual's mobility and access.

- Doctor’s Certification of Disability: Often accompanying the Application for Disabled Parking Placard or Plates, a certification from a licensed physician confirms the nature and extent of the disability. This documentation is important because it supports the need for special equipment and parking privileges.

- Receipts for Special Equipment Purchases: Keeping detailed receipts of all purchases related to special equipment is crucial. These receipts serve as proof of purchase for tax purposes and may be needed for any future claims or verifications, especially if questions arise regarding the exemption applied via the ST-10B form.

Together with the Virginia ST-10B form, these documents form a dossier that supports not only the legal tax exemptions but also facilitates other aspects of vehicle use and ownership for individuals with disabilities. Ensuring these documents are properly filled out and on hand can significantly streamline interactions with vehicle dealerships, the Virginia Department of Motor Vehicles, and other entities involved in this process.

Similar forms

The Virginia ST-10B form is similar to several other exemption certificates and documents used throughout the United States. These documents are designed to provide tax exemptions under specific conditions, just like the ST-10B form offers tax exemptions to handicapped persons for the purchase of special equipment for vehicles. Understanding the similarities and differences between these documents can help individuals and businesses navigate tax exemptions more effectively.

The ST-10B and the General Sales Tax Exemption Certificate

The Virginia ST-10B form closely resembles the General Sales Tax Exemption Certificate, which is used in many states to exempt certain purchases from sales tax. Both documents serve the purpose of certifying that the purchase qualifies for a tax exemption. The critical difference lies in their application; while the ST-10B is specifically designed for handicapped individuals requiring vehicle modifications, the General Sales Tax Exemption Certificate applies to a broader range of tax-exempt purchases, including but not limited to, purchases made by nonprofit organizations, resellers, and certain government agencies. Another similarity is that both forms require the purchaser's certification that the information provided is accurate and complies with the respective state's tax laws.

The ST-10B and the Motor Vehicle Sales and Use Tax Exemption Certificate

Another document that shares similarities with the ST-10B form is the Motor Vehicle Sales and Use Tax Exemption Certificate used in several states. This certificate specifically focuses on exemptions related to the purchase or use of motor vehicles. Like the ST-10B, it requires detailed information about the transaction, the nature of the exemption, and the qualifications of the purchaser. Both forms are aimed at facilitating tax exemptions on motor vehicle-related expenses, though the ST-10B is uniquely tailored for handicapped individuals purchasing special equipment to modify vehicles for personal use.

The ST-10B and the Agricultural Sales and Use Tax Exemption Certificate

While the Virginia ST-10B form and the Agricultural Sales and Use Tax Exemption Certificate cater to different audiences, they share the concept of providing a tax exemption for specific groups. The Agricultural Sales and Use Tax Exemption Certificate is designed for individuals or entities engaged in farming, allowing them to purchase supplies, equipment, and services related to agriculture without paying sales tax. The connection between these two forms lies in their targeted approach to tax exemptions: one supports handicapped persons, and the other supports the agricultural sector. Each form requires the purchaser to attest to their eligibility for the exemption and to use the purchased items in a manner that qualifies under state regulations.

Dos and Don'ts

When filling out the Virginia ST-10B form, which is designed for handicapped persons to certify the exemption of sales and use tax for special equipment installed on a motor vehicle, it is crucial to adhere to specific guidelines to ensure the form is completed accurately and legally. Below are essential do's and don’ts one must follow:

- Do ensure all the information provided on the form is accurate and truthful. Misrepresenting information can lead to legal complications.

- Do completely fill out every required section of the form to avoid delays. Incomplete forms may be rejected or returned, causing unnecessary inconvenience.

- Do clearly state the specific equipment purchased and its relevance to the disability. This clarity helps in the seamless processing of the exemption.

- Do retain a copy of the completed form for your records. Having this documentation can be crucial for future reference or in case of audits.

- Don't sign the form before ensuring all other details are filled in. The signature certifies that all the information provided on the form is accurate.

- Don't use the ST-10B form for equipment not directly related to enabling the operation of a motor vehicle by a handicapped person. Misuse of the form can lead to denial of exemption.

- Don't forget to provide the full address of the supplier from whom the equipment is purchased. This information is essential for the form's validity.

- Don't neglect the date of issuance. It is crucial to date the certificate at the time of the transaction to validate the exemption claim.

Adhering to these guidelines when completing the ST-10B form not only facilitates the efficient and lawful processing of tax exemptions but also ensures compliance with Virginia's tax laws. It is in the best interest of qualifying handicapped persons to pay meticulous attention to these details to benefit from the intended tax relief.

Misconceptions

When discussing the Virginia ST-10B form, it's essential to clarify some common misunderstandings that people might have regarding its use and application. This form plays a crucial role for individuals with disabilities, offering them a tax exemption on special equipment needed for their vehicles. Here are seven misconceptions about the Virginia ST-10B form that need to be addressed:

- The ST-10B form applies to all vehicle purchases. This misconception is widespread. In reality, the ST-10B form is specifically designed for the purchase of special equipment to be installed on motor vehicles to enable individuals with disabilities to operate these vehicles. It is not applicable to the general purchase of motor vehicles.

- Any disability qualifies for this exemption. While the form is intended to benefit individuals with disabilities, not all disabilities will qualify for the exemption. The equipment must be specifically required to enable the person to operate the vehicle.

- The exemption is applied automatically. This is not the case. Qualified individuals must actively submit the ST-10B form to the dealer at the time of purchase to receive the tax exemption on the eligible special equipment.

- The form is valid for multiple purchases without renewal. A common misconception is that once you have submitted an ST-10B form, it covers all future purchases. However, the form is transaction-specific. While a supplier must retain just one form per purchaser, each new transaction requires its proper submission and approval.

- Any dealer can process the ST-10B form. It's important to understand that not all dealers may be familiar with the ST-10B form or its processing. It is recommended to verify in advance that the dealer acknowledges the form and knows how to handle the exemption process.

- Only the purchase price is exempt from tax. Some may think the exemption only applies to the purchase price of the equipment. In truth, the exemption also applies to the sales and use tax that would otherwise be applicable to such special equipment purchases.

- The exemption certificate requires extensive documentation. There's a notion that obtaining this tax exemption is a complicated process requiring much documentation. In reality, the ST-10B form is relatively straightforward. It requires basic information about the purchaser and a certification that the equipment purchased is necessary for the individual to operate a motor vehicle. While it's essential to complete the form accurately, the process is designed to be accessible.

Clearing up these misconceptions is vital for ensuring that individuals who qualify for this tax exemption can take full advantage of it. It's always recommended to consult with a professional or the issuing authority if there are any doubts or questions regarding the ST-10B form or its application.

Key takeaways

The Virginia ST-10B form is a crucial document for handicapped individuals seeking tax exemption on special equipment for motor vehicles. Here are the key takeaways about filling out and using this form:

- This form is intended for use by handicapped persons who are purchasing special equipment for the modification of a motor vehicle.

- The purpose of the form is to certify the exemption from Virginia sales and use tax for such equipment.

- To be eligible for the exemption, the equipment must be specifically required to enable the handicapped person to operate the motor vehicle.

- The form should be submitted to the dealer or supplier from whom the special equipment is being purchased.

- When filling out the form, the purchaser must provide their address and the address of the dealer, along with the date.

- It's crucial that the purchaser certifies that the purchased equipment will be installed on a motor vehicle for their use to operate the vehicle.

- By signing the form, the purchaser declares that the information provided is true and correct, and made in good faith under the Virginia Retail Sales and Use Tax Act.

- Suppliers are required to keep only one Certificate of Exemption on file for each purchaser who buys or leases tangible personal property under this exemption.

- False claims for exemption can lead to penalties under Virginia law.

- It is advised to keep a copy of the completed form for personal records and for potential future reference.

Remember: Completing the Virginia ST-10B form accurately is essential for ensuring that handicapped individuals receive the tax exemptions they are entitled to for vehicle modifications. It's also a good practice to consult with a tax professional or legal advisor for guidance related to the use of this form.

Other PDF Forms

West Virginia Tax Forms - Features a section for updating personal address information to ensure tax correspondence reaches the correct location.

Virginia Sales Tax Exemption - Used by entities engaged in activities like drilling or extracting natural gas or oil, to obtain necessary materials without sales tax.

Virginia State Application - Includes inquiries about the applicant's willingness to travel for work, which helps agencies determine suitability for roles requiring mobility.