Fill Out a Valid Virginia St 11A Template

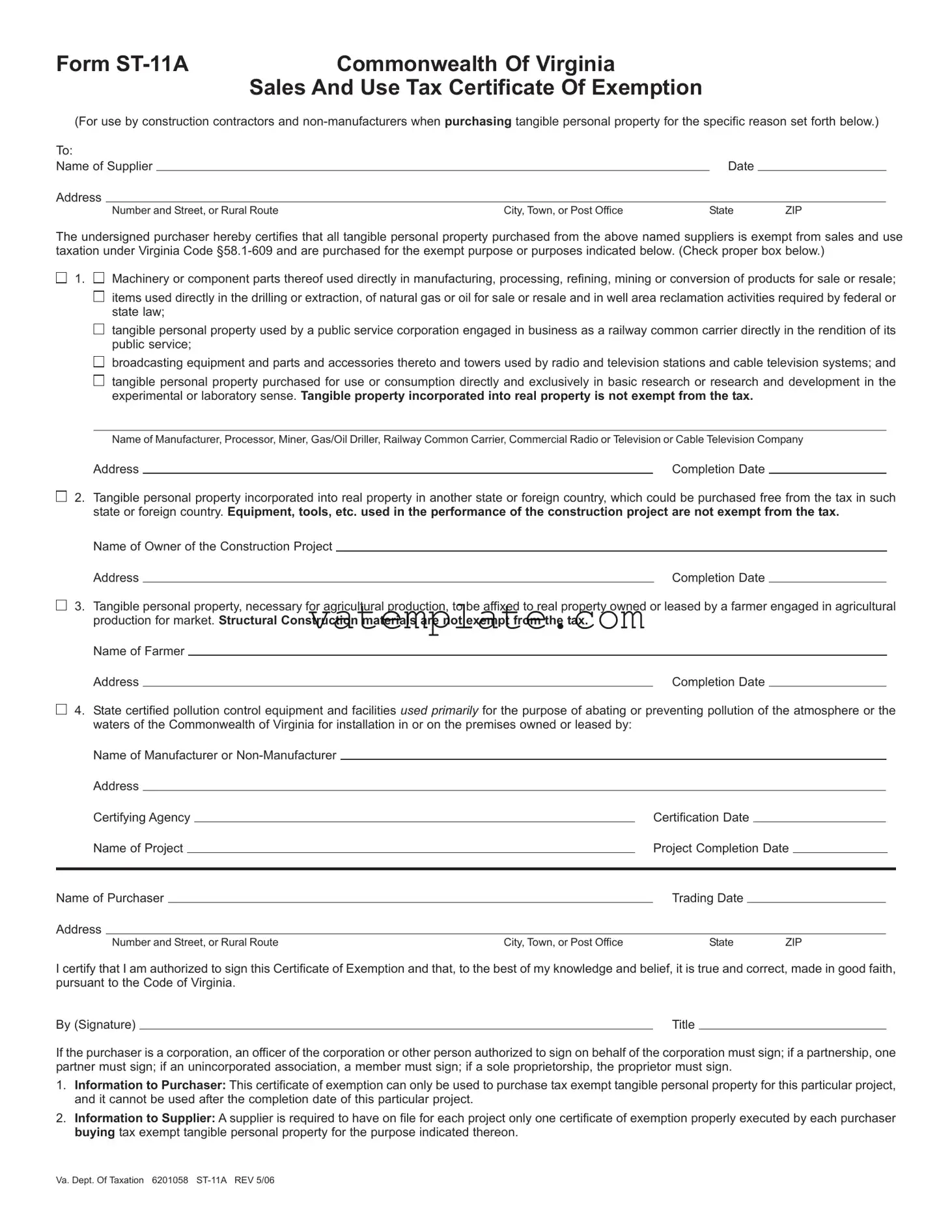

Understanding the intricacies of tax exemptions in Virginia, particularly for construction contractors and non-manufacturers, requires a clear grasp of the Virginia ST 11A form, a crucial document in the realm of sales and use tax. This form, officially titled the Commonwealth of Virginia Sales And Use Tax Certificate Of Exemption, serves a specific and vital purpose, enabling entities involved in construction and non-manufacturing activities to purchase tangible personal property without the burden of sales and use taxation, under specific conditions outlined by the Virginia Code §58.1-609. The eligibility criteria for exemption include the purchase of machinery or component parts directly used in manufacturing, items for natural gas or oil drilling and related reclamation activities, tangible personal property for public service or research purposes, and state-certified pollution control equipment, among others. On the flip side, the form clearly marks the boundaries of its applicability, emphasizing that it cannot serve for purchases beyond the intended project's completion and detailing the categories of tangible property that remain taxable. By declaring the exempt purpose at the time of purchase, this document not only outlines a pathway for tax exemption but also delineates the responsibilities and limitations attached to such purchases. It mandates the integrity of the purchaser in the certification process and asserts specific instructions for both the purchaser and the supplier, ensuring that the form is used correctly and within the legal framework set forth by the state.

Virginia St 11A Example

Form |

Commonwealth Of Virginia |

|

Sales And Use Tax Certificate Of Exemption |

(For use by construction contractors and

To: |

|

|

|

||

Name of Supplier |

|

|

Date |

|

|

Address |

|

|

|

|

|

|

Number and Street, or Rural Route |

City, Town, or Post Office |

State |

ZIP |

|

The undersigned purchaser herEby certifies that all tangible personal property purchased from the above named suppliers is exempt from sales and use taxation under Virginia Code

1.

1.

Machinery or component parts thereof used directly in manufacturing, processing, refining, mining or conversion of products for sale or resale;

Machinery or component parts thereof used directly in manufacturing, processing, refining, mining or conversion of products for sale or resale;

items used directly in the drilling or extraction, of natural gas or oil for sale or resale and in well area reclamation activities required by federal or state law;

items used directly in the drilling or extraction, of natural gas or oil for sale or resale and in well area reclamation activities required by federal or state law;

tangible personal property used by a public service corporation engaged in business as a railway common carrier directly in the rendition of its public service;

tangible personal property used by a public service corporation engaged in business as a railway common carrier directly in the rendition of its public service;

broadcasting equipment and parts and accessories thereto and towers used by radio and television stations and cable television systems; and

broadcasting equipment and parts and accessories thereto and towers used by radio and television stations and cable television systems; and

tangible personal property purchased for use or consumption directly and exclusively in basic research or research and development in the experimental or laboratory sense. Tangible property incorporated into real property is not exempt from the tax.

tangible personal property purchased for use or consumption directly and exclusively in basic research or research and development in the experimental or laboratory sense. Tangible property incorporated into real property is not exempt from the tax.

Name of Manufacturer, Processor, Miner, Gas/Oil Driller, Railway Common Carrier, Commercial Radio or Television or Cable Television Company

Address |

|

Completion Date |

2. Tangible personal property incorporated into real property in another state or foreign country, which could be purchased free from the tax in such state or foreign country. Equipment, tools, etc. used in the performance of the construction project are not exempt from the tax.

2. Tangible personal property incorporated into real property in another state or foreign country, which could be purchased free from the tax in such state or foreign country. Equipment, tools, etc. used in the performance of the construction project are not exempt from the tax.

Name of Owner of the Construction Project

Address |

|

Completion Date |

3. Tangible personal property, necessary for agricultural production, to be affixed to real property owned or leased by a farmer engaged in agricultural production for market. Structural Construction materials are not exempt from the tax.

3. Tangible personal property, necessary for agricultural production, to be affixed to real property owned or leased by a farmer engaged in agricultural production for market. Structural Construction materials are not exempt from the tax.

Name of Farmer

Address |

|

Completion Date |

4. State certified pollution control equipment and facilities used primarily for the purpose of abating or preventing pollution of the atmosphere or the waters of the Commonwealth of Virginia for installation in or on the premises owned or leased by:

4. State certified pollution control equipment and facilities used primarily for the purpose of abating or preventing pollution of the atmosphere or the waters of the Commonwealth of Virginia for installation in or on the premises owned or leased by:

Name of Manufacturer or

Address

Certifying Agency |

|

|

|

Certification Date |

|

|

|

||||

Name of Project |

|

|

|

Project Completion Date |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

||

Name of Purchaser |

|

|

|

Trading Date |

|

|

|

|

|||

Address |

|

|

|

|

|

|

|

|

|||

|

Number and Street, or Rural Route |

City, Town, or Post Office |

|

State |

ZIP |

|

|||||

I certify that I am authorized to sign this Certificate of Exemption and that, to the best of my knowledge and belief, it is true and correct, made in good faith, pursuant to the Code of Virginia.

By (Signature) |

|

Title |

If the purchaser is a corporation, an officer of the corporation or other person authorized to sign on behalf of the corporation must sign; if a partnership, one partner must sign; if an unincorporated association, a member must sign; if a sole proprietorship, the proprietor must sign.

1.Information to Purchaser: This certificate of exemption can only be used to purchase tax exempt tangible personal property for this particular project, and it cannot be used after the completion date of this particular project.

2.Information to Supplier: A supplier is required to have on file for each project only one certificate of exemption properly executed by each purchaser buying tax exempt tangible personal property for the purpose indicated thereon.

Va. Dept. Of Taxation 6201058

Form Properties

| Fact | Detail |

|---|---|

| Purpose of Form ST-11A | Allows construction contractors and non-manufacturers to certify purchases of tangible personal property as exempt from Virginia sales and use taxation for specific purposes outlined in the certificate. |

| Governing Law | Virginia Code §58.1-609 provides the legal foundation for exemptions detailed in Form ST-11A. |

| Exemption Categories | Includes machinery for manufacturing, tangible personal property for agriculture, state-certified pollution control equipment, and property for construction projects out of state, each with specific qualifications for exemption. |

| Usage Restrictions | The certificate specifically notes that it is valid only for the project described and cannot be used after its completion date. |

| Responsibilities of the Supplier | Suppliers are required to retain a properly executed certificate of exemption for each tax-exempt purchase related to a project, ensuring compliance with Virginia's tax laws. |

Steps to Filling Out Virginia St 11A

Filling out the Virginia ST-11A form can seem like a daunting task, but with clear instructions, it becomes manageable. This document is crucial for construction contractors and non-manufacturers in Virginia who plan to purchase tangible personal property exempt from sales and use taxes for specific projects. The following steps are designed to simplify the process, ensuring accuracy and compliance with Virginia’s tax laws.

- Start by entering the Name of Supplier at the top of the form, along with the Date and the supplier’s Address including Number and Street, or Rural Route, City, Town, or Post Office, State, and ZIP code.

- Under the section titled "The undersigned purchaser hereby certifies that all tangible personal property purchased from the above named suppliers is exempt," check the box that corresponds to the nature of your purchase. There are four options relating to machinery for manufacturing, tangible personal property incorporated into real property out of state, agricultural production, and state-certified pollution control equipment.

- Fill in the Name that corresponds to your exemption claim – this could be the Manufacturer, Processor, Farmer, or the entity managing the certified pollution control project. Below this, provide the specified entity's Address.

- Enter the Completion Date of your specific project, which indicates when the tangible personal property must be used by.

- For those claiming exemption for state-certified pollution control equipment, additional details are required, including the Certifying Agency, Certification Date, Name of Project, and the Project Completion Date.

- At the bottom section of the form, fill in the Name of Purchaser along with the Trading Date, and the purchaser's Address including Number and Street, or Rural Route, City, Town, or Post Office, State, and ZIP code.

- The "By (Signature)" line requires the signature of an authorized individual. Depending on the structure of your business, this will be an officer of the corporation, a partner in a partnership, a member of an unincorporated association, or the sole proprietor.

- Next to the signature, please specify the Title of the person signing the form, clearly indicating their role or position within the organization.

- Before submitting the form, review all entered information for accuracy. Ensure that the rightful person has signed the form, as this attests to the truth and correctness of the information provided, under the provisions outlined in the Code of Virginia.

Upon completion, this certificate should be kept on file by the supplier for the duration of the project. It is a key document proving eligibility for a tax exemption on tangible personal property, specifically for the project at hand. Ensure to adhere to the project completion date mentioned on the form, as purchases made after this date may not qualify for exemption under this certificate. Proper execution and filing of this form safeguard against potential misunderstandings or tax liabilities, facilitating a smoother project flow and compliance with Virginia’s tax laws.

FAQ

What is the Form ST-11A in Virginia?

Form ST-11A, known as the Commonwealth of Virginia Sales and Use Tax Certificate of Exemption, is a document specifically designed for construction contractors and non-manufacturers. It allows these parties to purchase tangible personal property tax-exempt for certain projects outlined under Virginia Code §58.1-609. The exemptions are detailed for specific use cases, such as manufacturing, agriculture, and environmental protection, among others.

Who can use the Virginia Form ST-11A?

This form can be utilized by various entities, including:

- Construction contractors buying materials for incorporation into real property.

- Manufacturers purchasing machinery or components for direct use in production.

- Agricultural producers acquiring items to be affixed to real property for production purposes.

- Businesses acquiring state-certified pollution control equipment.

How does one correctly complete the ST-11A form?

Completing the ST-11A form requires the following steps:

- Fill in the supplier's name, date, and address at the top of the form.

- Check the appropriate box that describes the purpose of the tax-exempt purchase.

- Provide the name and address of the manufacturer, contractor, or farmer, along with the expected completion date of the project or purchase.

- For pollution control equipment, include the certifying agency and certification date.

- The purchaser must sign and date the form, indicating their official capacity within the organization (e.g., officer, partner, member, proprietor).

Are there any limitations to using Form ST-11A?

Yes, there are specific limitations associated with the ST-11A form, including:

- The exemption is only applicable to tangible personal property related to the project described in the form.

- The form cannot be used once the project's completion date has passed.

- Equipment, tools, and materials not incorporated into real property, or not directly involved in manufacturing or agricultural production, are not exempt.

What responsibilities do suppliers have when accepting Form ST-11A?

Suppliers are responsible for maintaining proper documentation when accepting a Form ST-11A. They must:

- Keep a correctly executed certificate of exemption on file for each project.

- Verify the form's completeness and accuracy, including the eligibility of the purchaser for the tax exemption.

Where can one obtain the Form ST-11A?

The Form ST-11A can be obtained from the Virginia Department of Taxation. It's available on their website, allowing individuals and businesses to download and print the form for use. For those unfamiliar with the process or seeking further guidance, contacting the Virginia Department of Taxation directly or consulting a tax professional may provide additional support and clarity.

Common mistakes

Filling out the Virginia ST-11A sales and use tax exemption certificate correctly is crucial for construction contractors and non-manufacturers aiming to purchase tangible personal property tax-free for specific projects. However, people often make mistakes that can invalidate their exemption status, leading to unexpected tax liabilities. Here are ten common missteps to avoid:

Not fully completing the supplier information section, including the complete name and address, can cause delays or outright rejection of the exemption claim. It's essential to provide all the requested details to ensure smooth processing.

Omitting the date of the form can render it invalid. The date of form completion is critical as it helps in determining the eligibility period for the tax exemption.

Failing to check the appropriate box to indicate the specific exempt purpose for the purchase leads to ambiguity about the exemption claim, making it difficult to validate.

Incorrectly claiming an exemption for tangible personal property not covered under the Virginia Code §58.1-609, such as items that are not directly used in qualified activities, might result in penalties or the reversal of tax benefits.

Provided completion dates are sometimes unrealistic or incorrect, which can cause confusion regarding the exemption period. The completion date should accurately reflect the project timeline.

Omitting details about the project or purchased items, such as not listing the name of the manufacturer or construction project owner, may result in a lack of clarity and could jeopardize the exemption status.

Forgetting to sign the certificate or not having the appropriate person (e.g., an officer of the corporation, a partner of the partnership) sign it, instantly invalidates the document. The signature is a critical component that confirms the claim's authenticity.

Neglecting to specify the relationship to the purchaser when signing, which is crucial for validating the authority of the signatory.

Using the exemption certificate for purchases that extend beyond the completion date of the specific project can lead to audit issues and potential fines. The exemption certificate is project-specific and not open-ended.

Assuming the certificate covers every kind of tangible personal property or service related to the project. Some items, like equipment used in the performance of the construction but not incorporated into the property, remain taxable.

It's imperative for parties using the Virginia ST-11A form to attentively review and accurately provide all the necessary information demanded by the form. This meticulous approach not only ensures compliance with Virginia's tax laws but also safeguards the tax-exempt status of qualifying purchases, ultimately contributing to the smooth execution of exempt projects.

Documents used along the form

When filling out the Virginia ST-11A form, a construction contractor or non-manufacturer may also need to interact with a variety of other documents throughout the process. These documents support different stages of their project, from planning to completion, ensuring compliance and smooth operations. Here's a list of some common forms and documents that are often used in conjunction with the ST-11A form.

- Certificate of Good Standing: Confirms that a company is legally registered and authorized to do business in Virginia. This might be required to prove the legitimacy of your business when applying for project contracts.

- Workers’ Compensation Insurance Certificate: Shows that a contractor carries workers’ compensation insurance as required by law, protecting workers in case of job-related injuries.

- Building Permit: Required for new construction or certain renovations, ensuring that the project complies with local building codes and regulations.

- Zoning Compliance Document: Verifies that the project complies with local zoning laws, preventing issues related to land use.

- Environmental Impact Assessment: Needed for projects that might affect the environment, ensuring compliance with federal and state environmental regulations.

- Contractor License: Proof that the contractor meets state requirements for training and experience to perform the work legally in Virginia.

- Project Proposal: Outlines the scope, budget, and timeline of the project, serving as a blueprint for both the contractor and client.

- Construction Agreement: A legal document defining the terms and conditions between the contractor and the client, detailing responsibilities, timelines, and payment schedules.

- Change Order Forms: Used to document any changes to the original contract, including adjustments to cost, timelines, and materials.

- Completion Certificate: Issued once a project is finished, confirming that the work has been completed according to the contract specifications and building codes.

Together, these documents create a comprehensive foundation for managing a construction project or tangible personal property purchase in Virginia in a lawful and efficient manner. It's crucial for businesses to be aware of these documents, ensuring that each project is not only compliant with local regulations but also protected against legal and financial risks.

Similar forms

The Virginia ST-11A form, officially known as the Commonwealth Of Virginia Sales And Use Tax Certificate Of Exemption, plays a crucial role for construction contractors and non-manufacturers in exempting them from sales and use taxation on tangible personal property purchases for specific exempt purposes detailed within the form. This includes a variety of scenarios, such as purchases for direct use in manufacturing, certain agricultural productions, and pollution control projects. When drawing parallels, this form has similarities with other exemption documents utilized in different states, underscoring the uniformity in how tax exemptions are handled across the United States for specific categories of purchases.

One document that shares similarities with Virginia's ST-11A form is the New York State ST-120 Resale Certificate. Both are used to document the exemption from sales tax for certain purchases; however, the New York ST-120 is primarily focused on resellers – businesses that purchase goods to sell them unaltered to the next buyer. Like the Virginia ST-11A, the ST-120 requires details about the buyer, seller, and specific information justifying the exemption claim, such as the nature of the business and how the purchased goods will be used. The critical similarity lies in their purpose to provide documentation that supports a tax-exempt purchase, although they cater to different audiences based on the nature of the exemption.

Another analogous document is the California Sales and Use Tax Exemption Certificate for manufacturing and research and development equipment. This certificate, similar to Virginia's ST-11A form, allows eligible businesses to purchase or lease machinery, equipment, or parts tax-free, provided these are used in manufacturing or R&D. Both forms demand a detailed description of the exemption purposes, such as machinery used directly in manufacturing processes or research and development, similar to the specific exemptions outlined in the Virginia ST-11A form. The primary commonality between these forms is their role in supporting businesses by offering tax relief for certain types of purchases, directly contributing to the business’s operational efficiencies and innovations.

Lastly, the Texas Sales and Use Tax Exemption Certification bears resemblance to Virginia's ST-11A form. This Texas certification serves a broad range of exemption purposes, from manufacturing equipment to items used for agricultural and timber operations, much like the versatile exemptions covered by the Virginia ST-11A form. The requirement to accurately describe the exempt purpose of the purchased goods, along with similar declarations about the use of purchased items, showcases the forms' shared functionalities in exempting specific purchases from sales and use tax. Both documents play an essential role in clarifying the conditions under which businesses can leverage tax exemptions to reduce operational costs.

Dos and Don'ts

When filling out the Virginia ST-11A Sales and Use Tax Certificate of Exemption, it's important to approach the task with attention to detail and an understanding of the form's requirements. Here are 10 pointers to guide you through completing this form correctly and effectively:

- Do verify that the tangible personal property being purchased fits the criteria for exemption as outlined in the form and according to Virginia Code §58.1-609.

- Do ensure that every section of the form that applies to your specific exemption reason is completed fully, leaving no blank fields that could apply to your situation.

- Do check the appropriate box(es) indicating the exempt purpose or purposes for which the tangible personal property is being purchased.

- Do provide clear and accurate information for both the purchaser and supplier sections, including names, addresses, and ZIP codes.

- Do sign and date the form as this is a critical requirement for the document to be valid. The signature verifies that the information is true and made in good faith.

- Don't use this form for purchases that do not strictly adhere to the specific reasons set forth in the form for tax exemption.

- Don't forget to indicate the completion date of the particular project for which the tax-exempt tangible personal property is purchased.

- Don't overlook the requirement that equipment, tools, etc., used directly in the performance of a construction project are not exempt from the tax, except as specifically allowed by the form.

- Don't assume that all tangible personal property is exempt; only those items directly used in the qualifying activities mentioned on the form are eligible.

- Don't submit the form after the completion date of the project has passed, as the exemption is only valid for the duration of the project.

Taking these do's and don'ts into account when completing the Virginia ST-11A form can help ensure that your submission is in compliance with the relevant tax exemption regulations, thus avoiding potential issues with tax liability. Being thorough and precise in your responses supports the integrity of your tax exemption claim.

Misconceptions

Understanding the Virginia ST-11A form can be challenging, and there are many misconceptions surrounding its use and purpose. Here’s a clear breakdown of some common misunderstandings:

- Misconception 1: The ST-11A form can be used for any type of tax-exempt purchase.

In reality, this form is specifically for construction contractors and non-manufacturers buying tangible personal property for exempt purposes as detailed in the form, such as machinery used in manufacturing or items used in agriculture.

- Misconception 2: Once obtained, the exemption certificate applies to all future purchases.

The truth is, the certificate only applies to purchases related to the specific project listed on the form, and it cannot be used after the project's completion date.

- Misconception 3: All construction-related purchases are exempt if using the ST-11A.

However, equipment, tools, and other items used in the performance of the construction project are not exempt from tax, contradicting this belief.

- Misconception 4: The form automatically exempts the purchaser from all sales tax.

Actually, the purchaser must ensure the items bought are for the exempt purpose indicated; just possessing the form doesn’t grant a blanket exemption.

- Misconception 5: Any officer or employee can sign the ST-11A form.

In fact, the form must be signed by an officer of the corporation, a partner of a partnership, a member of an unincorporated association, or the proprietor if a sole proprietorship.

- Misconception 6: The exemption is valid in other states as well.

The ST-11A form is specific to Virginia; items exempt from sales and use tax in Virginia might not be exempt in other states.

- Misconception 7: Tangible personal property incorporated into real property is always exempt.

Only specific circumstances, like items used directly in manufacturing or agricultural production, qualify under this exemption, as the form indicates.

- Misconception 8: The form provides exemption for labor costs on construction projects.

Labor costs are not covered by this exemption certificate; it only applies to tangible personal property.

- Misconception 9: All agricultural production items are exempt if used on a farm.

Only the tangible personal property necessary for agricultural production affixed to real property is exempt, excluding structural construction materials.

It's important to fully understand the specifics of the Virginia ST-11A form to ensure compliance and proper usage. Misinterpretations can lead to unintended tax liabilities and legal complications.

Key takeaways

When working with the Virginia ST-11A Sales and Use Tax Certificate of Exemption, it's important to understand its specific usage and requirements to ensure compliance with Virginia tax laws. Below are seven key takeaways for effectively filling out and using this form:

- The form is designated for use by construction contractors and non-manufacturers for the purpose of purchasing tangible personal property exempt from sales and use taxation under Virginia Code §58.1-609.

- It applies to specific exempt purposes, including machinery or parts used in manufacturing, property for agricultural production, pollution control equipment, and property for use in other states or countries where it would be tax-exempt.

- Exemptions do not cover equipment, tools, etc., used in the performance of the construction project itself; they are specific to tangible personal property incorporated into real property or used directly in exempted activities.

- Each purchaser must provide detailed information about the nature of the exempt purchase, including the type of operation (e.g., manufacturing, agricultural production, pollution control) and specific project details.

- To be valid, the certificate must be properly signed by an authorized representative of the purchasing entity. The authorized signer varies depending on the business structure of the purchaser (e.g., corporate officer, partner, proprietor).

- Suppliers are required to retain a properly executed certificate for each project, ensuring that they are compliant with Virginia tax collection regulations for tax-exempt purchases.

- Finally, it's crucial to be aware that this exemption certificate is project-specific and cannot be used for purchases after the project's completion date. This limitation emphasizes the importance of timely and accurate documentation for both purchasers and suppliers.

Understanding these key points ensures that the Virginia ST-11A form is used appropriately, supporting compliance with Virginia's sales and use tax laws for qualifying purchases.

Other PDF Forms

Wv Divorce Papers - Determine if a transcript of proceedings is crucial for the appeal's fair consideration.

Land Preservation Tax Credit - Research fields eligible for the credit include biotechnology, cyber security, and more.

Unclaimed Funds Virginia - Facilitates the reporting of unclaimed funds held in trust, investment accounts, and escrow, maintaining fiduciary responsibility.