Fill Out a Valid Virginia St 13 Template

In the intricate landscape of legal and financial obligations, the Commonwealth of Virginia introduces a pivotal tool for entities seeking relief from sales and use tax through the Form ST-13, or the Sales and Use Tax Certificate of Exemption. Aimed predominantly at medical-related purchases, this form outlines specific exemptions that range from prescription medicines and medical devices to specialized equipment for the handicapped. Enacted under the Virginia Retail Sales and Use Tax Act, the form meticulously details seven distinct categories of tangible personal property eligible for exemption when procured for designated purposes. These include, but are not limited to, medicines and drugs dispensed on a professional prescription, durable medical equipment designed for home use, and various aids for the handicapped such as wheelchairs, special typewriters, and vehicular modifications. Equally important, the form mandates comprehensive completion, including a certification by the purchaser regarding the accuracy and legitimacy of the exemption claim, to ensure validity. Moreover, it underscores the requirement for dealers to retain a properly executed certificate to justify the tax exemption on eligible transactions. Within this regulatory framework, Form ST-13 not only facilitates tax relief for eligible entities and individuals but also delineates the responsibilities and due diligence required from both purchasers and dealers, embedding a system of checks and balances in the procurement of exempt medical-related goods.

Virginia St 13 Example

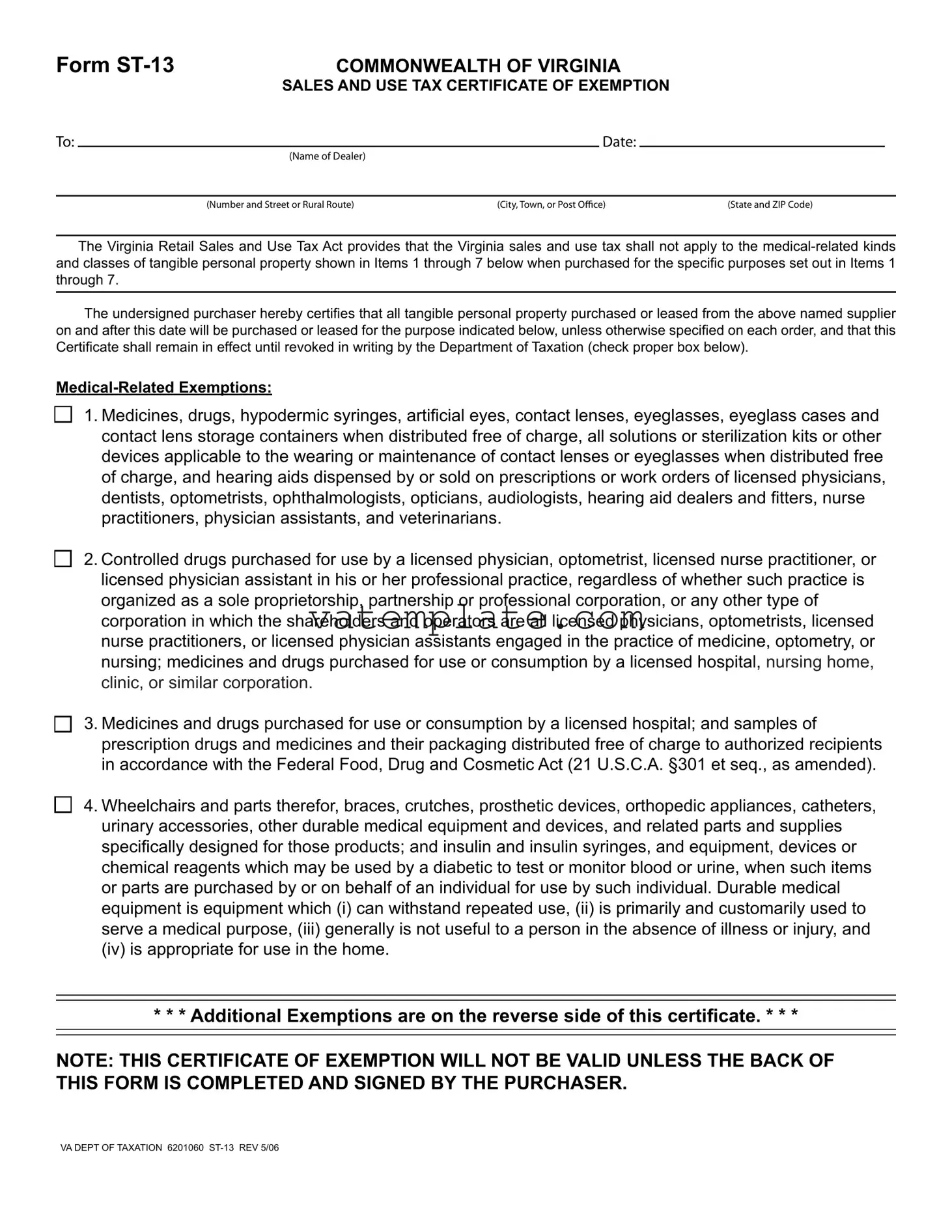

Form

COMMONWEALTH OF VIRGINIA

SALES AND USE TAX CERTIFICATE OF EXEMPTION

To: |

|

|

Date: |

|

|

|

(Name of Dealer) |

|

|

|

|

|

|

|

|

|

|

|

(Number and Street or Rural Route) |

(City, Town, or Post Oice) |

(State and ZIP Code) |

|

|

The Virginia Retail Sales and Use Tax Act provides that the Virginia sales and use tax shall not apply to the

through 7.

The undersigned purchaser hereby certiies that all tangible personal property purchased or leased from the above named supplier on and after this date will be purchased or leased for the purpose indicated below, unless otherwise speciied on each order, and that this Certiicate shall remain in effect until revoked in writing by the Department of Taxation (check proper box below).

1. Medicines, drugs, hypodermic syringes, artiicial eyes, contact lenses, eyeglasses, eyeglass cases and

contact lens storage containers when distributed free of charge, all solutions or sterilization kits or other devices applicable to the wearing or maintenance of contact lenses or eyeglasses when distributed free

of charge, and hearing aids dispensed by or sold on prescriptions or work orders of licensed physicians, dentists, optometrists, ophthalmologists, opticians, audiologists, hearing aid dealers and itters, nurse

practitioners, physician assistants, and veterinarians.

2. Controlled drugs purchased for use by a licensed physician, optometrist, licensed nurse practitioner, or licensed physician assistant in his or her professional practice, regardless of whether such practice is organized as a sole proprietorship, partnership or professional corporation, or any other type of corporation in which the shareholders and operators are all licensed physicians, optometrists, licensed nurse practitioners, or licensed physician assistants engaged in the practice of medicine, optometry, or nursing; medicines and drugs purchased for use or consumption by a licensed hospital, nursing home, clinic, or similar corporation.

3. Medicines and drugs purchased for use or consumption by a licensed hospital; and samples of

prescription drugs and medicines and their packaging distributed free of charge to authorized recipients in accordance with the Federal Food, Drug and Cosmetic Act (21 U.S.C.A. §301 et seq., as amended).

4. Wheelchairs and parts therefor, braces, crutches, prosthetic devices, orthopedic appliances, catheters, urinary accessories, other durable medical equipment and devices, and related parts and supplies speciically designed for those products; and insulin and insulin syringes, and equipment, devices or

chemical reagents which may be used by a diabetic to test or monitor blood or urine, when such items or parts are purchased by or on behalf of an individual for use by such individual. Durable medical equipment is equipment which (i) can withstand repeated use, (ii) is primarily and customarily used to serve a medical purpose, (iii) generally is not useful to a person in the absence of illness or injury, and (iv) is appropriate for use in the home.

* * * Additional Exemptions are on the reverse side of this certiicate. * * *

NOTE: THIS CERTIFICATE OF EXEMPTION WILL NOT BE VALID UNLESS THE BACK OF THIS FORM IS COMPLETED AND SIGNED BY THE PURCHASER.

VA DEPT OF TAXATION 6201060

Form

5. Drugs and supplies used in hemodialysis and peritoneal dialysis.

6. Special equipment installed on a motor vehicle when purchased by a handicapped person to enable

such person to operate the motor vehicle.

7. Special typewriters and computers and related parts and supplies speciically designed for those products used by handicapped persons to communicate when such equipment is prescribed by a

licensed physician.

|

|

|

|

Certiicate of |

|

Name of purchaser |

|

|

|

Registration No., if any |

|

|

|

|

|

||

|

(Number and Street or Rural Route) |

(City, Town, or Post Oice) |

(State and ZIP Code) |

||

I certify that I am authorized to sign this Certiicate of Exemption and that, to the best of my knowledge and belief, it is

true and correct, made in good faith, pursuant to the Virginia Retail Sales and Use Tax Act.

By

(Signature) |

(Title) |

INFORMATION FOR DEALER

Form Properties

| Fact | Detail |

|---|---|

| Governing Law | The Virginia Retail Sales and Use Tax Act |

| Purpose | To exempt certain medical-related tangible personal property from sales and use tax when purchased for specific purposes. |

| Exemption Categories | Includes medicines, drugs, medical equipment, and certain devices used by licensed professionals, hospitals, clinics, or directly by patients for specific medical purposes. |

| Validity Requirement | The certificate must be completed, signed by the purchaser, and kept on file by the dealer to be considered valid. |

Steps to Filling Out Virginia St 13

Filling out the Virginia ST-13 form is a straightforward process designed to certify your purchase or lease as tax-exempt under specific medical-related exemptions outlined by the Virginia Retail Sales and Use Tax Act. This document is essential for individuals and organizations that qualify for such exemptions, ensuring that they are not charged sales tax on eligible medical-related tangible personal property. Completing this form correctly is crucial to secure your exemption status.

Steps for Completing the Virginia ST-13 Form:

- Enter the Date at the top of the form.

- Write the Name of the Dealer from whom you are purchasing or leasing the exempt items.

- Fill in the dealer's Number and Street or Rural Route, City, Town, or Post Office, State, and ZIP Code.

- Select the medical-related exemption category that applies to your purchase or lease by checking the appropriate box. The categories are:

- Medicines, drugs, and various medical supplies as outlined in section 1.

- Controlled drugs for professional practice by licensed professionals as described in section 2.

- Items for use or consumption by licensed hospitals and clinics, detailed in section 3.

- Wheelchairs, braces, and similar durable medical equipment listed in section 4.

- Drugs and supplies for dialysis in section 5.

- Special equipment for motor vehicles for the handicapped, detailed in section 6.

- Special typewriters, computers, and related parts for handicapped persons listed in section 7.

- Include the Name of Purchaser and, if available, the Registration No., along with the purchaser's Address (Number and Street or Rural Route, City, Town, or Post Office, State, ZIP Code).

- Sign the form in the provided field to certify that all information provided is accurate and true, to the best of your knowledge. Include your Title next to your signature.

- Remember to complete and sign the back of the form as required for the certificate to be valid. This includes any additional information or declarations as per the form's instructions.

Once completed, keep a copy for your records and provide the original to the dealer to ensure your purchase or lease is processed without the inclusion of sales tax, where applicable. It's important to note that this exemption certification remains effective until officially revoked in writing by the Department of Taxation.

FAQ

What is the Virginia ST-13 form?

The Virginia ST-13 form, also known as the Sales and Use Tax Certificate of Exemption, is a document that permits qualified individuals or entities to purchase or lease certain medical-related items without paying the Virginia sales and use tax. This exemption is specifically outlined under the Virginia Retail Sales and Use Tax Act and applies to a list of tangible personal property intended for particular medical uses.

Who is eligible to use the Virginia ST-13 form?

The form can be used by individuals or entities purchasing or leasing medical-related items for specific purposes outlined in the form. Eligible parties include:

- Healthcare providers such as licensed physicians, optometrists, nurse practitioners, and physician assistants

- Hospitals, nursing homes, clinics, or similar establishments

- Individuals purchasing medical equipment for personal use, as prescribed by a licensed healthcare provider

What items qualify for the exemption?

The exemption applies to several medical-related items, including but not limited to:

- Medicines, drugs, and certain medical devices dispensed by prescription

- Controlled drugs for professional practice use

- Wheelchairs, braces, prosthetic devices, and other durable medical equipment

- Insulin, syringes, and diabetic testing supplies

- Special equipment installed in vehicles for use by handicapped individuals

- Specifically designed typewriters and computers for use by handicapped persons

How does one apply for the exemption using the form ST-13?

To apply for the exemption, the purchaser must fill out the form ST-13, providing details about the type of exempted items they are purchasing or leasing and their intended use. The back of the form must be completed and signed by the purchaser, certifying that the information provided is accurate and that the purchase is made in good faith pursuant to the Virginia Retail Sales and Use Tax Act. This completed form should then be presented to the dealer from whom the purchase is made.

Is there an expiration for the Virginia ST-13 form?

Once submitted to and accepted by a dealer, the ST-13 form remains in effect until it is revoked in writing by the Virginia Department of Taxation. This means the purchaser does not need to submit a new form for every transaction, as long as the purchases or leases continue to fall under the same exemption categories.

What responsibilities do dealers have regarding the form ST-13?

Dealers are required to have on file a properly executed ST-13 form for each purchaser buying or leasing tax-exempt tangible personal property under the exemption. This form serves as proof that the transaction was eligible for the sales and use tax exemption. Dealers must ensure that the forms are fully completed and are responsible for maintaining these records in case of an audit by the Virginia Department of Taxation.

Common mistakes

When filling out the Virginia ST-13 form, individuals frequently encounter a few common pitfalls. Identifying and avoiding these mistakes can streamline the exemption process, ensuring efficient and accurate compliance with the Commonwealth of Virginia's Sales and Use Tax Act. Below are four mistakes often made:

- Incomplete Information: One of the most significant errors is submitting the form with incomplete information. Every section of the form needs to be filled out thoroughly. This includes the complete address of the purchaser, the name of the dealer, and the specific exemption being claimed. Leaving any part blank can result in the rejection of the application.

- Incorrect Exemption Claims: Choosing the wrong exemption category is a common mistake. The form lists specific medical-related exemptions such as medicines, drugs, and durable medical equipment. The purchaser must check the appropriate box that aligns with the items being purchased. Misidentifying the exemption category can lead to unnecessary tax charges or the denial of the exemption.

- Failure to Sign: Another critical oversight is the failure to sign the back of the form. The Virginia Department of Taxation requires a signature to validate the Certificate of Exemption. Without a signature, the document is considered invalid, and the tax exemption will not be granted.

- Misunderstanding the Scope of Exemptions: Some applicants might not fully understand which items are exempt and which are not. For instance, while certain medical devices and prescriptions are exempt, others might not be covered under the exemptions listed. It's important for purchasers to review the list of exempt items carefully and ensure that their purchases qualify under the specified categories.

To avoid these pitfalls, attention to detail is paramount. Proper completion and understanding of the Form ST-13 require careful reading of the instructions and a clear grasp of what is required for a successful exemption claim. By steering clear of these common mistakes, purchasers can better navigate the process of claiming their entitlement to tax exemptions for medical-related items.

Documents used along the form

When handling the Virginia ST-13 form, which is a Sales and Use Tax Certificate of Exemption, there are several additional forms and documents that might often be used alongside it. These ancillary documents support various transactions and declarations for exemption purposes under specific conditions, ensuring compliance with the Commonwealth of Virginia's tax laws.

- Form R-5E: Certificate of Exemption for Virginia Retail Sales and Use Tax for Governmental Entities: This form is used by governmental entities to purchase goods or services without paying the retail sales and use tax. It certifies that the transaction is exempt due to the nature of the purchasing body.

- Form CU-7: Certificate of Exemption for a Certified Pollution Control Equipment and Facilities: The CU-7 form is applicable to organizations purchasing equipment designed specifically for pollution control. It acknowledges that such purchases are exempt from sales and use tax as they contribute to environmental protection efforts.

- Form ST-10: Sales and Use Tax Certificate of Exemption for Purchasers for Resale: This document is critical for businesses that purchase goods only to resell them. By submitting this form, the purchasing party can claim exemption from paying sales tax on these items at the time of purchase, provided they are resold and sales tax is collected then.

- Form ST-11: Commonwealth of Virginia Sales and Use Tax Certificate of Exemption for a Church: Designed specifically for religious institutions, this form enables churches to certify their tax-exempt status when purchasing goods and services for use in their religious and charitable functions.

Each of these forms plays a pivotal role in ensuring that eligible transactions are properly documented and exempted from sales and use tax, complementing the Virginia ST-13 document. It's pivotal for organizations and individuals to understand the specific purpose and requirements of each form to maintain compliance and benefit from the applicable exemptions under Virginia's tax codes.

Similar forms

The Virginia ST-13 form is similar to several other documents in the realm of tax exemption and medical supplies certification across various jurisdictions. These documents, while tailored to specific state laws or purposes, share common ground with the Virginia ST-13 form in terms of their role in facilitating tax exemptions for medical-related purchases.

Uniform Sales & Use Tax Exemption/Resale Certificate - Multijurisdiction: This form, designed for use across multiple jurisdictions, serves a purpose akin to the Virginia ST-13 form by allowing businesses to purchase goods tax-free that are intended for resale or that qualify for exemptions under specific conditions. Like the ST-13, it requires purchasers to certify their eligibility for the exemption. Both forms play crucial roles in the supply chain of medical and other tax-exempt goods, ensuring that exemptions are properly claimed and documented to comply with tax laws. However, the Multijurisdiction form's broader application across states makes it more versatile for businesses operating in multiple states, unlike the Virginia-specific ST-13 form.

California Resale Certificate (BOE-230): This certificate, specific to California, is utilized by purchasers when buying goods they intend to resold in the course of business operations. Similar to the Virginia ST-13, the California Resale Certificate is pivotal for transactions that are exempt from sales tax. Both documents necessitate the buyer to declare their intent at the time of purchase and to provide evidence of their eligibility for such an exemption. While the California Resale Certificate focuses more broadly on resale items, the ST-13 highlights exemptions specifically related to medical-related tangible personal property.

Exemption Certificate for Government and Other Exempt Organizations (ST-5 form) in New Jersey: The ST-5, while serving a general purpose of tax exemption for qualifying organizations such as government entities or nonprofits, mirrors the ST-13's structure in obtaining tax-exempt purchases. The main distinction lies in the scope—whereas the ST-5 targets a wide range of exempt organizations for a broad category of purchases, the Virginia ST-13 strictly pertains to medical-related goods. Both forms, however, simplify the process for eligible parties to acquire necessary items without the additional financial burden of sales tax, emphasizing the procedural similarity in claiming exemptions within different contexts.

Each of these documents, though tailored to the specific tax laws and needs of different states or purposes, aligns with the Virginia ST-13 form's objective to provide tax relief for eligible purchases. They underscore the importance of precise documentation in availing of tax exemptions, drawing a common thread through their usage across various jurisdictions and scenarios.

Dos and Don'ts

Filling out the Virginia ST-13 form, which is a Sales and Use Tax Certificate of Exemption, requires careful attention to detail to ensure that your submission is accurate and compliant with Virginia tax laws. Below is a list of things you should and shouldn't do when completing this form:

-

Do:

- Ensure that all information provided on the form is accurate and matches the records of your business or personal identification.

- Clearly check the appropriate box that corresponds with the exemption category for your purchase.

- Complete both sides of the form, as the certificate will not be valid unless all required sections are filled out.

- Keep a copy of the completed form for your records, as this serves as proof of your eligibility for exemption.

- Have the form signed by an individual who is authorized to represent the purchaser or the business.

- Provide detailed descriptions of the exempt purchases when necessary, ensuring clarity on how they fit the exemption criteria.

- Update or revoke the certificate in writing to the Department of Taxation if there are any changes in your exemption status.

- Review the certificate for any corrections or additional information that might be required before submission.

- Ensure that your registration number, if applicable, is included and accurate.

- Submit the form before or at the time of purchase to ensure the exemption is applied.

-

Don't:

- Leave any required fields on the form blank; incomplete forms may not be processed.

- Assume the exemption applies without checking the specific qualifications listed under the Virginia Retail Sales and Use Tax Act.

- Use this form for purchases that do not fall under the medical-related exemption categories specified.

- Forget to sign and date the back of the form, as an unsigned certificate is considered invalid.

- Assume that the certificate covers all purchases automatically; specify on each order if the exemption does not apply.

- Forgo reading the additional exemptions on the reverse side of the certificate that may apply to your situation.

- Fail to retain a copy of the form for future verification or audit purposes.

- Misrepresent your eligibility for exemptions, which can lead to penalties and interest.

- Expect dealers to accept an improperly completed form.

- Overlook the requirement to renew or update the certificate as needed or upon request by the Virginia Department of Taxation.

Misconceptions

Understanding the Virginia ST-13 form, a Sales and Use Tax Certificate of Exemption, can sometimes be challenging due to various misconceptions that float around. Here’s a clarification of some common misunderstandings:

- It's only for medical purchases: While the Virginia ST-13 form does largely pertain to medical-related exemptions, it encompasses a wide range of tangible personal property categories under medical purposes, not just medicines but also durable medical equipment, special vehicles for the handicapped, and more.

- Any business can use it to avoid sales tax: This certificate is specifically for purchases that fall under the enumerated medical-related exemptions. It cannot be used broadly by any business to bypass sales tax on regular purchases outside the scope of these exemptions.

- Once you fill it out, you’re set forever: The form remains effective until it's revoked in writing by the Department of Taxation. However, this doesn’t imply a lifetime validity without any need for updates or renewals. Changes in business status, exemptions categories, or updates from the Department of Taxation may necessitate a new submission.

- The form covers all purchases made by the business: Purchases or leases made under this exemption must specifically fit the categories listed on the form. Not all purchases by the business, even if they are for medical-related purposes, are automatically exempt.

- Completion of the front side is enough: For the certificate to be valid, the back of the form must also be completed and signed by the purchaser. Many overlook this requirement, potentially invalidating their exemption claim.

- Any product for a medical office is exempt: The exemption applies to very specific items, even within a medical office setting. General office supplies, even if used in a medical office, do not typically qualify under this exemption.

- It's applicable only to purchases within Virginia: While primarily meant for transactions within Virginia, the principles of the exemptions could be considered by vendors outside Virginia, especially if they're shipping taxable items into the state. However, compliance with Virginia’s laws remains crucial.

- Nonprofits automatically qualify for exemptions: Nonprofit status does not automatically exempt an organization from sales and use tax on eligible items. The specifics of the purchases must still fall within the guidelines of the ST-13 exemptions, and certain criteria need to be met.

Understanding the nuances of the Virginia ST-13 form is key for eligible organizations to make the most of their exemptions legally and effectively, avoiding common pitfalls and misconceptions.

Key takeaways

Filling out and using the Virginia ST-13 form appropriately is crucial for ensuring compliance with Virginia's sales and use tax exemption regulations. This form is designed to certify that purchases of certain medical-related items are exempt from state sales and use taxes, under specific conditions. Here are four key takeaways to understand about this process:

- The ST-13 form is applicable for a range of medical-related items, including medicines, certain medical devices, and specialized equipment for handicapped persons. This encompasses everything from prescription drugs to durable medical equipment and devices specifically designed for use by individuals with medical needs.

- Exemptions are not automatic; the purchaser must certify their eligibility by correctly completing and signing the back of the ST-13 form. The document must detail the purpose of the exemption, and the purchaser needs to assert their authority to claim this exemption by signing the form.

- This certificate must be kept on file by the dealer from whom the exempt purchases are made. It is the dealer's responsibility to ensure that they have an up-to-date and properly executed ST-13 form for each purchaser claiming exemption. Without this form on file, the dealer cannot exempt sales from the Virginia sales and use tax.

- Certain exemptions are also provided for items distributed free of charge, such as prescription drug samples or medical devices like syringes and eyeglasses. Additionally, special equipment for handicapped individuals to operate motor vehicles or use computers and typewriters is covered under these exemptions.

Having a comprehensive understanding of the form ST-13 and its appropriate usage is essential for both dealers and purchasers. This ensures that tax exemptions are applied correctly, supporting both compliance with Virginia tax laws and the facilitation of necessary medical purchases. Always ensure that the form is filled out accurately and retained for record-keeping purposes.

Other PDF Forms

Filing Status 3 - The Schedule ADJ simplifies the process of aligning your federal adjusted gross income with what's taxable in Virginia.

Virginia State Police Crash Reports - Detailed driver information, including fleeing status and licensing details, aids in legal and insurance proceedings.