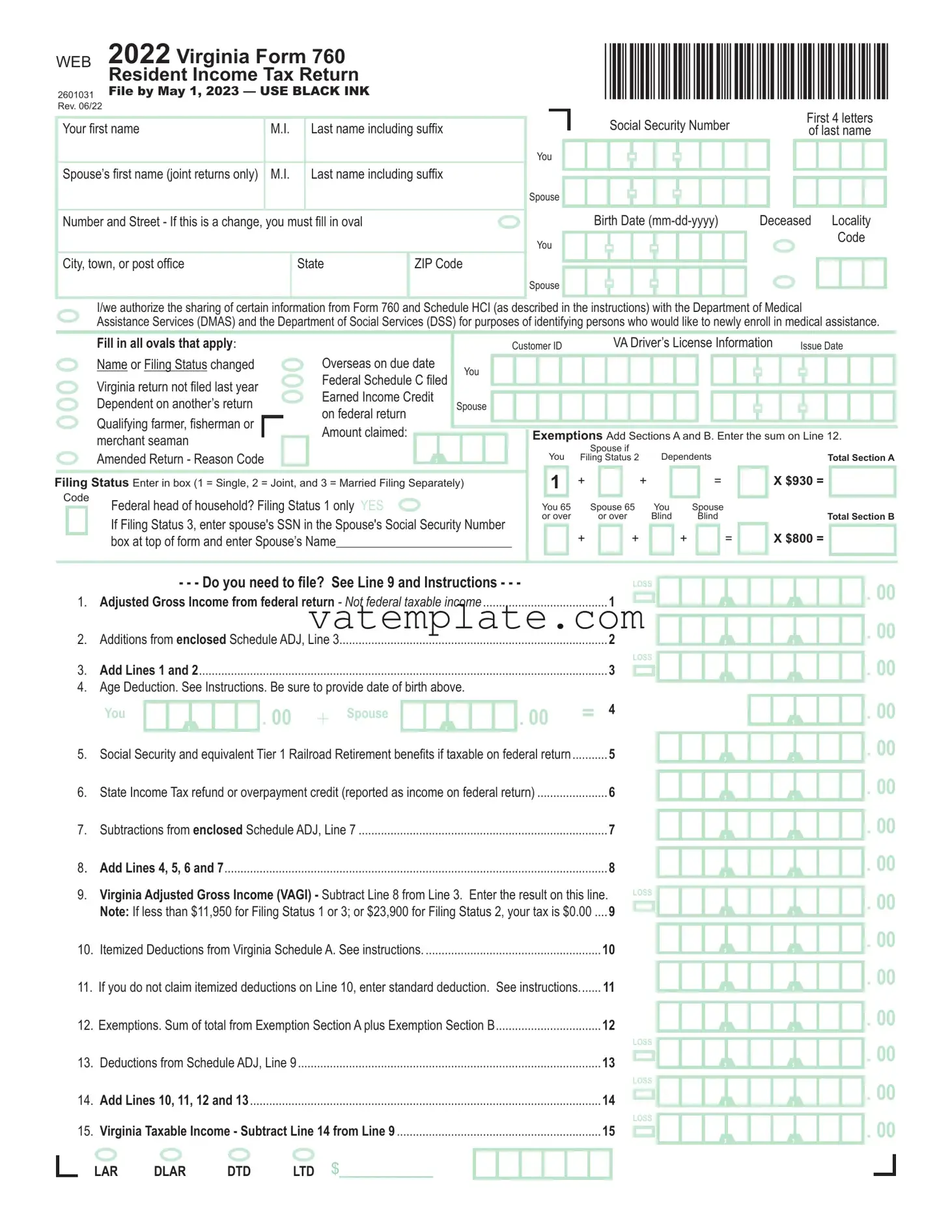

Fill Out a Valid Virginia State Tax Return 760 Template

Filing a Virginia State Tax Return using Form 760 is an essential task for residents, ensuring they meet their tax obligations accurately and timely. With a deadline of May 1, 2023, to avoid penalties, it’s crucial for Virginians to navigate this form with due diligence. Form 760, designed for Virginia residents to report their income tax for the year 2022, encompasses various sections that address different aspects of one's financial standing, from personal information, including Social Security numbers and addresses, to more detailed fields such as income, deductions, and credits. A unique feature of this form allows taxpayers to authorize the sharing of information for enrollment in medical assistance, showcasing Virginia’s integrated approach to public service. Taxpayers must accurately report their adjusted gross income, taxable income, and applicable taxes, along with any payments or credits that might affect the final tax calculation, such as estimated tax payments, withholding, and eligible credits for low-income individuals or taxes paid to another state. Additionally, the form provides avenues to contribute to Virginia529 and ABLE savings plans or make other voluntary contributions, reflecting the Commonwealth's encouragement of saving for the future. This detailed form also accounts for specific situations like amendments due to overpayments and addresses penalties for unpaid taxes. By breaking down each section, residents can navigate their state tax returns with confidence, ensuring compliance and potentially securing a favorable outcome.

Virginia State Tax Return 760 Example

2601031 |

File by May 1, 2023 — USE BLACK INK |

*VA0760122888* |

WEB |

2022 Virginia Form 760 |

|

|

Resident Income Tax Return |

|

Rev. 06/22 |

|

|

|

|

|

|

|

|

|

|

|

|

Social Security Number |

|

|

First 4 letters |

||||||||||||

Your first name |

M.I. |

|

Last name including suffix |

|

|

|

|

|

|

of last name |

||||||||||||||||||

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

You |

|

|

|

|

|

|

|

|

- |

|

|

- |

|

|

|

|

|

|

|

|

|

||

Spouse’s first name (joint returns only) |

M.I. |

|

Last name including suffix |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

Spouse |

|

|

|

|

|

|

|

|

- |

|

|

- |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Number and Street - If this is a change, you must fill in oval |

|

|

|

|

|

|

|

Birth Date |

Deceased |

Locality |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Code |

||

|

|

|

|

|

You |

|

|

|

|

|

|

- |

|

|

|

|

- |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

City, town, or post office |

|

State |

ZIP Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

Spouse |

|

|

|

|

|

|

- |

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I/we authorize the sharing of certain information from Form 760 and Schedule HCI (as described in the instructions) with the Department of Medical

Assistance Services (DMAS) and the Department of Social Services (DSS) for purposes of identifying persons who would like to newly enroll in medical assistance.

|

|

|

Fill in all ovals that apply: |

|

Overseas on due date |

|

|

|

|

|

Customer ID |

|

|

|

|

VA Driver’s License Information |

|

|

Issue Date |

||||||||||||||||||||||||||||

|

|

|

Name or Filing Status changed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

You |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

- |

|

|

|

|

|

|||||||||

|

|

|

|

Federal Schedule C filed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

Virginia return not filed last year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

Earned Income Credit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

Dependent on another’s return |

|

Spouse |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

- |

|

|

|

|

|

|

|||||||

|

|

|

|

on federal return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

Qualifying farmer, fisherman or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

merchant seaman |

|

|

Amount claimed: |

|

|

|

|

|

|

|

|

|

Exemptions Add Sections A and B. Enter the sum on Line 12. |

|||||||||||||||||||||||||||||||

|

|

|

|

|

, |

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

|

|

Amended Return - Reason Code |

|

|

|

|

|

|

|

|

|

|

|

You |

|

|

Spouse if |

Dependents |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Filing Status 2 |

|

|

|

|

|

Total Section A |

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Filing Status Enter in box (1 = Single, 2 = Joint, and 3 = Married Filing Separately) |

|

|

|

1 |

|

|

+ |

|

|

|

+ |

|

|

= |

|

|

|

|

|

X $930 = |

|||||||||||||||||||||||||||

Code |

Federal head of household? Filing Status 1 only YES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

You 65 |

|

|

Spouse 65 |

You |

Spouse |

|

|

|

|

|

Total Section B |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

If Filing Status 3, enter spouse's SSN in the Spouse's Social Security Number |

|

|

or over |

|

|

|

or over |

Blind |

|

Blind |

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

+ |

|

|

|

+ |

|

+ |

|

|

|

= |

|

|

|

|

|

X $800 = |

|

|

|

|

||||||||||||||||||

|

|

|

box at top of form and enter Spouse’s Name_______________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- - - Do you need to file? See Line 9 and Instructions - - - |

|

|

|

|

|

loss |

|||||||||||||||

1. |

........................................Adjusted Gross Income from federal return - Not federal taxable income |

|

1 |

|

|

|

|||||||||||||||||||

|

|

|

|||||||||||||||||||||||

2. |

Additions from enclosed Schedule ADJ, Line 3 |

|

|

|

|

|

|

|

2 |

|

|

|

|||||||||||||

3. |

Add Lines 1 and 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

loss |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

4. |

Age Deduction. See Instructions. Be sure to provide date of birth above. |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

You |

|

|

|

|

|

. 00 |

+ |

Spouse |

|

|

|

|

|

. 00 |

|

= |

4 |

|

|

|

|||

|

|

|

, |

|

|

|

|

|

, |

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

............ |

|

5 |

|

|

|

|||||||

5. |

Social Security and equivalent Tier 1 Railroad Retirement benefits if taxable on federal return |

|

|

|

|

|

|||||||||||||||||||

6. |

State Income Tax refund or overpayment credit (reported as income on federal return) |

|

6 |

|

|

|

|||||||||||||||||||

7. |

Subtractions from enclosed Schedule ADJ, Line 7 |

|

|

|

|

|

|

|

7 |

|

|

|

|||||||||||||

8. |

Add Lines 4, 5, 6 and 7 |

........................................................................................................................ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8 |

|

|

|

|||||

9. |

Virginia Adjusted Gross Income (VAGI) - Subtract Line 8 from Line 3. |

Enter the result on this line. |

loss |

||||||||||||||||||||||

|

|

Note: If less than $11,950 for Filing Status 1 or 3; or $23,900 for Filing Status 2, your tax is $0.00 |

9 |

|

|

|

|||||||||||||||||||

|

|

|

|

||||||||||||||||||||||

10. |

Itemized Deductions from Virginia Schedule A. See instructions |

|

|

|

|

|

|

|

10 |

|

|

|

|||||||||||||

11. If you do not claim itemized deductions on Line 10, enter standard deduction. See instructions |

|

11 |

|

|

|

||||||||||||||||||||

12. Exemptions. Sum of total from Exemption Section A plus Exemption Section B |

|

12 |

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

loss |

13. |

Deductions from Schedule ADJ, Line 9 |

|

|

|

|

|

|

|

|

|

|

|

|

13 |

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

loss |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14. |

Add Lines 10, 11, 12 and 13 |

|

|

|

|

|

|

|

|

|

|

|

|

|

14 |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

loss |

|||||||||||

15. |

Virginia Taxable Income - Subtract Line 14 from Line 9 |

|

|

|

|

|

|

|

|

15 |

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

LAR |

DLAR |

DTD |

LTD |

|

$_________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

, |

, |

, |

, |

, |

|

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

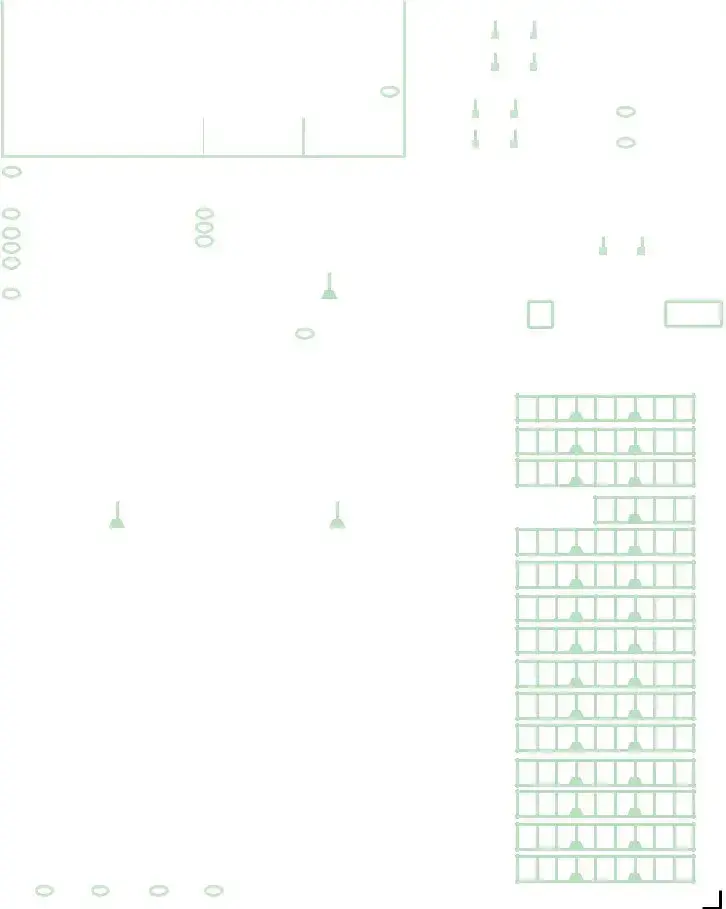

WEB Page 2 |

*VA0760222888* Your SSN |

2022 Form 760 |

-

-

16. |

Amount of Tax from Tax Table or Tax Rate Schedule (round to whole dollars) |

.................................... |

|

|

|

16 |

||||||||||||

17. |

Spouse Tax Adjustment (STA). Filing Status 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

. 00 17 |

|||

|

only. Enter Spouse’s VAGI in box here |

è |

loss |

|

|

|

, |

|

|

|

, |

|

|

|

||||

|

and STA amount on Line 17. |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

18. |

Net Amount of Tax - Subtract Line 17 from Line 16 |

|

|

|

|

|

|

|

|

18 |

||||||||

19. |

Virginia income tax withheld for 2022. Enclose copies of Forms |

|||||||||||||||||

|

19a. |

Your Virginia withholding |

........................................................................................................... |

|

|

|

|

|

|

|

|

|

|

|

|

|

19a |

|

|

19b. |

Spouse’s Virginia withholding (Filing Status 2 only) |

|

|

|

|

|

|

|

|

19b |

|||||||

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

.................................................... |

|

|

|

|

|

|

|

20 |

||||

20. |

Estimated tax payments for taxable year 2022 (from Form 760ES) |

|

|

|

|

|||||||||||||

21. |

Amount of 2021 overpayment applied toward 2022 estimated tax |

|

|

|

21 |

|||||||||||||

22. |

Extension Payments (from Form 760IP) |

|

|

|

|

|

|

|

|

|

|

|

|

|

22 |

|||

23. |

Tax Credit for |

23 |

||||||||||||||||

24. |

Credit for Tax Paid to Another State from Schedule OSC, Line 21 |

|

|

|

24 |

|||||||||||||

|

You must enclose Schedule OSC and a copy of all other state returns. |

|

|

|

|

|||||||||||||

25. |

Credits from enclosed Schedule CR, Section 5, Part 1, Line 1A |

|

|

|

25 |

|||||||||||||

26. |

Add Lines 19a through 25 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

26 |

||

27. |

If Line 26 is less than Line 18, subtract Line 26 from Line 18. |

This is the Tax You Owe |

27 |

|||||||||||||||

28. |

If Line 18 is less than Line 26, subtract Line 18 from Line 26. |

This is Your Tax Overpayment |

........... 28 |

|||||||||||||||

29. |

Amount of overpayment you want credited to next year’s estimated tax |

|

|

|

29 |

|||||||||||||

30. |

Virginia529 and ABLE Contributions from Schedule VAC, Section I, Line 6 |

|

|

|

30 |

|||||||||||||

31. |

Other Voluntary Contributions from Schedule VAC, Section II, Line 14 |

|

|

|

31 |

|||||||||||||

32. |

Addition to Tax, Penalty, and Interest from enclosed Schedule ADJ, Line 21 |

|

|

|

32 |

|||||||||||||

|

See instructions |

enclose 760C or 760F and fill in oval. |

|

|

|

|

||||||||||||

33. Sales and Use Tax is due on Internet, mail order, and

|

See instructions. |

............................ fill in oval if no sales and use tax is due |

33 |

|

34. |

Add Lines 29 through 33 |

34 |

||

35. |

If you owe tax on Line 27, add Lines 27 and 34. OR If Line 28 is less than Line 34, subtract Line 28 |

|

||

|

from Line 34. Enclose payment or pay at www.tax.virginia.gov |

AMOUNT YOU OWE |

35 |

|

|

|

fill in oval if paying by credit or debit card - see instructions |

|

|

36. If Line 28 is greater than Line 34, subtract Line 34 from Line 28 |

YOUR REFUND |

36 |

||

|

If the Direct Deposit section below is not completed, your refund will be issued by check. |

|

||

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

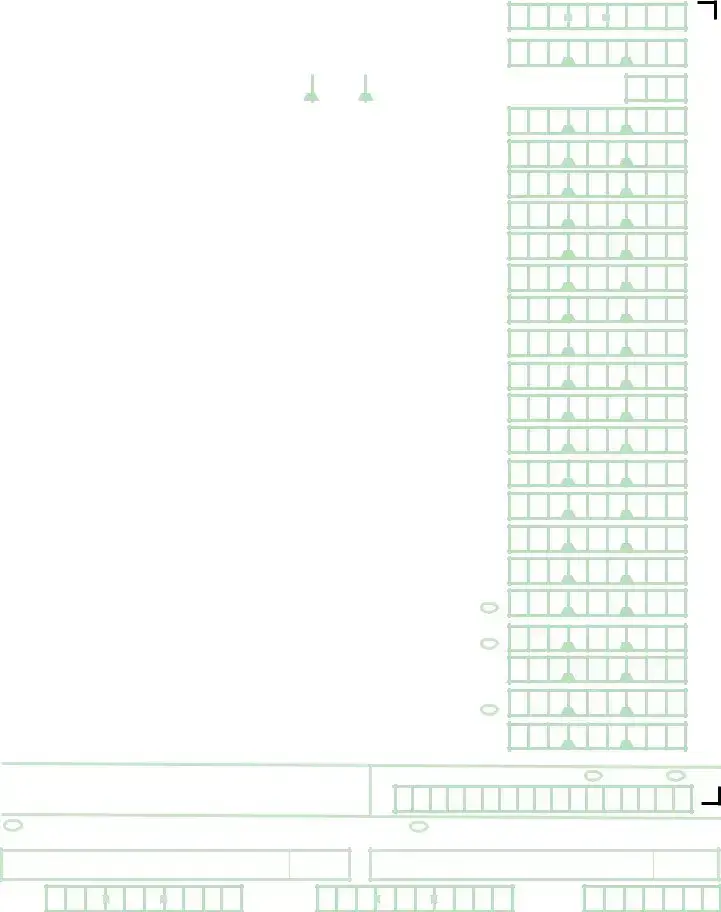

DIRECT BANK DEPOSIT |

Bank Routing Transit Number |

||||||||

Domestic Accounts Only. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

No International Deposits. |

|

|

|

|

|

|

|

|

|

I (We) authorize the Dept. of Taxation to discuss this return with my (our) preparer.

Bank Account Number |

Checking |

Savings |

I agree to obtain my Form

I (We), the undersigned, declare under penalty of law that I (we) have examined this return and to the best of my (our) knowledge, it is a true, correct, and complete return.

Your Signature |

Date |

Spouse’s Signature |

Date |

Your |

- |

- |

Spouse‘s |

- |

- |

ID Theft |

Phone |

Phone |

PIN |

|

|

Preparer’s Name |

Firm Name |

Phone Number |

Filing Election |

|

|

|

Preparer’s PTIN |

||||||

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form Properties

| Fact | Detail |

|---|---|

| Deadline | The Virginia Form 760 must be filed by May 1, 2023. |

| Ink Requirement | Applicants must use black ink to fill out the form. |

| Governing Law | The Virginia Form 760 is governed by the laws of the Commonwealth of Virginia. |

| Authorization for Information Sharing | Filers authorize sharing information from Form 760 with the Department of Medical Assistance Services (DMAS) and the Department of Social Services (DSS) for identifying new enrollees in medical assistance. |

Steps to Filling Out Virginia State Tax Return 760

Filling out the Virginia State Tax Return 760 form is a straightforward process, provided you have all necessary information handy, such as your Social Security number, any W-2 or 1099 forms, and information on deductions and credits you plan to claim. Taking this step-by-step approach ensures accuracy and compliance with state tax laws, potentially averting any delays in processing your return or receiving your refund.

- Gather all required documents, including income statements (W-2, 1099 forms) and any relevant financial records for deductions or credits.

- Provide your personal information at the start of the form. This includes your Social Security Number, name, and if filing jointly, your spouse's details as well.

- Detail your address information. If there's been a change in your address, ensure to mark the corresponding oval.

- Select the applicable ovals that describe your filing situation, such as overseas on due date, filing status changes, whether you filed a federal Schedule C, and any other conditions listed.

- Determine your Filing Status (1 = Single, 2 = Joint, and 3 = Married Filing Separately) and enter the appropriate code in the specified box.

- Fill in financial details as required on the form starting with your Adjusted Gross Income from your federal return, followed by additions and subtractions as instructed to arrive at your Virginia Adjusted Gross Income (VAGI).

- Decide whether to itemize deductions or take the standard deduction and enter the respective amounts. Include deductions for exemptions directly thereafter.

- Calculate and enter your Virginia Taxable Income by subtracting your total deductions and exemptions from your VAGI.

- Refer to the Tax Table or Tax Rate Schedule to determine your tax amount and input this figure. If applicable, compute and note the Spouse Tax Adjustment.

- Report any Virginia income tax withheld, estimated tax payments, and any credits you're eligible for, including credits for low-income individuals or tax paid to another state.

- Subtract your total credits and payments from your tax liability to determine either the tax you owe or your overpayment. Decide what to do with any overpayment: apply it to next year's estimated tax or request a refund.

- Consider any voluntary contributions, sales and use tax due, or additional taxes, penalties, and interest. Sum these amounts accordingly.

- Complete the calculation to establish either the final amount you owe or the refund due. Indicate your intended payment method if you owe tax.

- Provide your banking details for direct deposit if you are expecting a refund and prefer this payment method.

- Sign and date the form. If filing jointly, ensure your spouse also signs and dates. If someone prepared your return, include their information in the designated section.

Once you have completed all sections of the form and reviewed it for accuracy, make sure to include all required attachments, such as W-2s or copies of other state returns if you're claiming a credit for tax paid to another state. Submit the completed form and attachments by the filing deadline to the Virginia Department of Taxation, either by mail or electronically through the state’s e-filing system. Prompt submission helps facilitate a swift processing of your tax return and any applicable refund.

FAQ

Who needs to file the Virginia Form 700 Resident Income Tax Return?

Residents of Virginia who have earned income within the tax year need to file Form 760. Specifically, you must file if your Virginia Adjusted Gross Income (VAGI) exceeds certain thresholds, which vary based on filing status. For single filers or married individuals filing separately, the threshold is $11,950. For married couples filing jointly, it's $23,900. If your income is below these amounts, you may not owe any tax. However, you might still want to file to claim any refundable credits or to report any Virginia income tax withheld from your earnings.

What information do I need to complete Form 760?

You need several pieces of information to fill out Form 760, including:

- Your Social Security Number and, if filing jointly, your spouse’s Social Security Number.

- Total income for the year, which can be found on forms such as W-2s and 1099s.

- Information on deductions, exemptions, and credits you're claiming.

- Your Virginia Adjusted Gross Income.

- Amount of Virginia income tax withheld, shown on your W-2 or 1099 forms.

- Details of any estimated tax payments made during the year.

What is the deadline for filing Form 760?

The deadline to file Form 760 is May 1. If May 1 falls on a weekend or a holiday, the deadline is extended to the next business day. For those filing through mail, the postmark date is considered the date of filing. It's important to meet this deadline to avoid potential late filing penalties and interest on any taxes owed.

Can Form 760 be filed electronically?

Yes, Virginia residents have the option to file Form 760 electronically through the Virginia Department of Taxation's website or by using approved tax software. Electronic filing (e-filing) is faster, more secure, and typically results in quicker processing times for refunds compared to paper filing.

What if I make a mistake on my filed Form 760?

If you discover an error on your filed Form 760, you should file an amended return using Form 760X as soon as possible. This form allows you to correct filing status, income, deductions, or credits. Filing an amended return is important to ensure that your tax liabilities are correct, potentially avoiding interest and penalties for underpayment.

How can I claim a refund or report my tax due on Form 760?

After calculating your taxable income and applying the appropriate tax rates and credits, the form will show whether you have tax due or are entitled to a refund. If you owe tax, you can submit your payment online, by phone, or through mail. For refunds, you have the option to receive them via direct deposit or check. If expecting a refund, providing bank account information for direct deposit will expedite the receipt of your funds.

Are there any credits or deductions specific to Virginia that I should know about?

Yes, Virginia offers various state-specific credits and deductions, such as:

- Credit for Low-Income Individuals or Families

- Credit for Taxes Paid to Another State

- Deductions for Age or Blindness

- Standard Deduction or Itemized Deductions specific to Virginia

What documents should I attach with my Form 760?

When filing Form 760, you may need to attach:

- W-2 forms showing your earnings and state tax withholding.

- Any 1099 forms received if they show Virginia tax withholding.

- Schedule(s) for specific deductions or credits you're claiming.

- A copy of your federal tax return if required.

If I need more time to file, can I get an extension?

Virginia allows for an automatic six-month extension to file your tax return, moving the deadline from May 1 to November 1. Note, however, that this extension is only for filing the return, not for payment of any taxes you may owe. To avoid penalties and interest, you should estimate and pay any taxes by the original May 1 deadline.

Common mistakes

Filing your Virginia State Tax Return using Form 780 can be daunting, and it's natural to make mistakes. Here are seven common errors that can lead to headaches, delays, or even missed tax benefits.

- Not using black ink: The form specifies the use of black ink for a reason. Submissions in other colors can lead to processing errors or delays because the scanning technology used by the tax department is optimized for black ink.

- Incorrect Social Security Numbers (SSNs): A surprisingly common error is entering an incorrect SSN. This mistake can lead to significant processing delays and issues with your tax records. Double-check every digit to ensure accuracy.

- Filing Status Confusion: Carefully choosing your filing status is crucial. Each option (Single, Joint, Married Filing Separately) has its tax implications. Selecting the incorrect status can impact your tax liabilities and potential refunds.

- Forgetting to sign and date: An unsigned or undated tax return is like not filing at all. Both you and your spouse (if filing jointly) need to sign and date to validate the submission.

- Overlooking Deductions and Credits: The Virginia Form 760 provides opportunities for deductions and credits, such as those for low-income individuals or taxes paid to another state. Missing these can lead to overpayment of taxes.

- Ignoring the Direct Deposit Option: When due a refund, opting for direct deposit ensures you receive your funds faster than waiting for a check by mail. Neglecting to fill out the direct deposit section delays access to your refund.

- Miscalculating Income or Deductions: Accurately reporting your income and calculating deductions according to the instructions are pivotal tasks. Errors here can lead to underpayment or overpayment of taxes, both of which have their set of complications.

In the journey of tax filing, these mistakes can be stumbling blocks, but awareness and careful review can help you navigate around them successfully. Investing a bit more time in double-checking can save you from future difficulties.

Documents used along the form

Filing a tax return can be complex, requiring various forms and documents besides the primary form one might be familiar with. In Virginia, alongside the Virginia State Tax Return 760 form, several additional documents are usually needed or used to provide comprehensive tax information. These documents ensure that a taxpayer's information is accurate and complete, covering various aspects of one's financial situation and potential deductions or credits that could impact the tax calculation. Let's look at some of the key documents often used in conjunction with Form 760.

- Schedule ADJ (Adjustments and Deductions): This document is essential for reporting specific adjustments to income and deductions that aren't captured on the main form, enabling taxpayers to adjust their gross income accordingly.

- Schedule A (Itemized Deductions): When taxpayers choose to itemize deductions rather than take the standard deduction, they use Schedule A to list these deductions, such as medical expenses, taxes paid, and charitable contributions.

- Schedule OSC (Credit for Tax Paid to Another State): This is required for taxpayers who need to claim a credit for income taxes paid to other states, ensuring they are not taxed twice on the same income.

- Schedule CR (Credits): Taxpayers use this to claim various Virginia tax credits they are eligible for, such as credits for low-income individuals, education expenses, or certain business activities.

- Schedule VAC (Virginia Contributions): This allows residents to make contributions to certain funds or programs, like the Virginia529 plan, directly through their tax return.

- Form 760ES (Estimated Tax Payments): For those who need to make quarterly estimated tax payments throughout the year, this form helps track those payments against the final tax liability.

- Form 760IP (Automatic Extension Payment): Used when taxpayers require more time to file their return, allowing them to pay an estimated tax by the original deadline to avoid penalties.

- W-2 and 1099 Forms: These documents report income from employment, freelance work, investments, and other sources, which are necessary to complete the income section of the tax return.

- Form VK-1 (Owner's Share of Income and Virginia Modifications): Specifically for partners, shareholders, and members of pass-through entities, detailing their share of income and adjustments.

In essence, when preparing to file the Virginia State Tax Return 760, these additional forms and schedules play a pivotal role in ensuring an accurate and thorough accounting of one's financial activities over the tax year. They cater to specific situations, such as income adjustments, tax credits, multi-state taxation, and more, providing the necessary detail to fulfill one's tax obligations comprehensively and accurately.

Similar forms

The Virginia State Tax Return 760 form is similar to the federal Form 1040, which is used for filing individual income tax returns. Both forms collect essential information about the taxpayer's income, calculate deductions, and determine the amount of tax owed or refund due. They require the taxpayer's personal information, including Social Security numbers, income sources, and information on dependents. Tax credits and adjustments to income are other commonalities, ensuring that taxpayers only pay what they owe after considering specific financial circumstances.

Another document the Virginia Form 760 resembles is the Form 760ES, which is the Estimated Tax Payment form for Virginia residents. This similarity exists because both forms deal with the calculation and reporting of income for tax purposes. The 760ES is used by individuals who need to make quarterly estimated tax payments throughout the year, often by self-employed individuals or those without sufficient tax withholding. Just like the Form 760, the 760ES requires personal and financial details to calculate the estimated tax owed.

Lastly, the Virginia Form 760 shares characteristics with the Schedule ADJ for Virginia, which is used for adjustments to income. This schedule allows taxpayers to adjust their income for specific deductions and credits not accounted for on the main tax return form. It details deductions and adjustments such as deductions for higher education expenses, certain kinds of income exclusions, and other state-specific financial adjustments. Both the Form 760 and the Schedule ADJ play crucial roles in ensuring taxpayers' returns are accurate and reflective of their financial situation, allowing for a more tailored and accurate taxation process.

Dos and Don'ts

When preparing your Virginia State Tax Return using form 760, certain practices should be followed for accuracy and compliance, while others are to be avoided. Here are some guidelines to ensure that your tax return is filled out correctly:

Do:

Use black ink as indicated at the top of the form; this ensures that the document is legible and can be processed correctly by scanning equipment.

Double-check the Social Security numbers for accuracy. A mistake here could lead to processing delays or issues with your tax account.

Make sure to accurately report your income and deductions according to the instructions, including all necessary supporting documents such as W-2s, 1099s, and schedules.

Consider whether you are eligible for credits like the Credit for Low-Income Individuals or the Earned Income Credit, and claim them if applicable by including the required schedules.

Sign and date the return. Both spouses need to sign if filing jointly. An unsigned tax return is considered invalid and will not be processed.

Don't:

Overlook the necessity to enclose Schedule OSC along with a copy of all other state returns if claiming credit for tax paid to another state.

Forget to include any income tax refunds or overpayment credits reported as income on your federal return; these are required for accurate processing.

Misreport your filing status or exemptions. This can affect your taxable income calculation and thus the amount of tax owed or refunded.

Ignore the sales and use tax due on Internet, mail order, and out-of-state purchases if applicable. Completing the Consumer’s Use Tax section accurately ensures compliance with state tax laws.

Delay beyond the filing deadline. Submitting your form 760 by May 1, 2023, avoids penalties and interest charges for late filing.

Misconceptions

Many taxpayers have misconceptions about filing their Virginia State Tax Return 760 form. Understanding these misconceptions can help ensure that the filing process is done accurately and efficiently.

- Misconception 1: Social Security numbers are optional on the Form 760. In truth, Taxpayers must provide their Social Security number and, if filing jointly, their spouse’s Social Security number. This information is critical for tax identity verification purposes.

- Misconception 2: You don't need to file Form 760 if you didn’t earn any income. While there are certain income thresholds that may not require some taxpayers to file, it is important to review the specific requirements. Failing to file when required can result in penalties.

- Misconception 3: Filing a federal return means you automatically meet your state obligations. Filing a federal income tax return and a Virginia state tax return are separate processes. Taxpayers need to file both to comply with federal and state laws.

- Misconception 4: The filing status used on your federal return must be the same on the Form 760. While many taxpayers will use the same filing status, there are exceptions. The instructions provide guidance on how to determine the appropriate filing status for Virginia state taxes.

- Misconception 5: The due date for filing Form 760 can be extended for any reason. The truth is that extensions are available, but they must be specifically requested using Form 760IP, and only under certain situations does the state grant additional time to file.

- Misconception 6: Itemized deductions on your federal return are automatically accepted on your Virginia return. The Virginia Form 760 has its own rules and schedules for deductions. Some federal deductions are not allowable, and others may be calculated differently for state purposes.

Correcting these misconceptions can lead to a smoother tax filing process and help avoid common mistakes. It’s always a good practice to thoroughly review the instructions for Form 760 and consult with a tax professional if there are any uncertainties.

Key takeaways

When completing and using the Virginia State Tax Return 760 form, it's crucial to understand several key points to ensure the process is done accurately and efficiently. Here are some essential takeaways:

- The filing deadline for the Virginia Form 760 is May 1, 2023. Missing this deadline can lead to penalties.

- Use black ink when filling out the form to ensure that all information is legible and can be processed correctly by tax authorities.

- If you have had a change in your address or filing status since the last tax year, make sure to update this information on the form to avoid any processing delays.

- The form allows you to authorize the sharing of information with the Department of Medical Assistance Services (DMAS) and the Department of Social Services (DSS) for enrollment in medical assistance. This is optional but can be beneficial for those who qualify.

- Understanding your filing status and accurately calculating your income, deductions, and credits is vital for determining the correct tax liability or refund. The form requires information from federal returns and various schedules for adjustments, deductions, and credits.

- If you are due a refund, consider using the Direct Deposit option to receive your refund more quickly. Be sure to fill out the banking information section accurately to avoid any delays.

Attention to detail when completing the Virginia State Tax Return 760 form is crucial. Ensure all information is correct, attach any required documentation, and consider consulting with a professional if you have complex tax situations or questions.

Other PDF Forms

How to Get Towing License - Included is an option for one free Driver Authorization Document with the application.

West Virginia Corporate Tax Rate - This form stands as evidence of the taxpayer's choice, defending the decision to file returns in paper form.

Virginia Hpp Cloud - This form initiates the process for becoming a licensed provider with the Virginia Department of Behavioral Health & Developmental Services, essential for organizations aiming to deliver behavioral and developmental services.