Fill Out a Valid Virginia Unclaimed Property Template

Every year, countless assets in Virginia go unclaimed, from bank account balances and unclaimed wages to stock dividends and insurance proceeds. To manage and return these assets to their rightful owners, the Commonwealth of Virginia’s Department of the Treasury operates through its Division of Unclaimed Property. These efforts are facilitated the utilization of the Virginia Unclaimed Property form, an essential tool designed for entities holding property that may belong to someone else. This form gathers comprehensive details about the unclaimed assets, including the type of property, the value involved, and information about the presumed owner, if known. It aims to ensure that businesses and organizations comply with state laws regarding the reporting and transferring of unclaimed property to the state. The form serves a critical purpose in the tracking and processing of these assets, providing a structured method for holders to report them. In addition, it outlines the requirements for due diligence, ensuring that attempts are made to notify the rightful owners before the property is handed over to the state. Significant sections of the form include contact information for the reporting entity, specifics about the property being reported, and a certification by an authorized representative that the report is complete and accurate. This certification process underlines the importance of accountability and precision in reporting, helping to streamline the process of returning unclaimed property to its rightful owners. Through this structured approach, the Commonwealth aims to reduce the amount of unclaimed property and assist in the efficient return of assets, reinforcing the importance of this legal obligation for businesses and organizations within Virginia.

Virginia Unclaimed Property Example

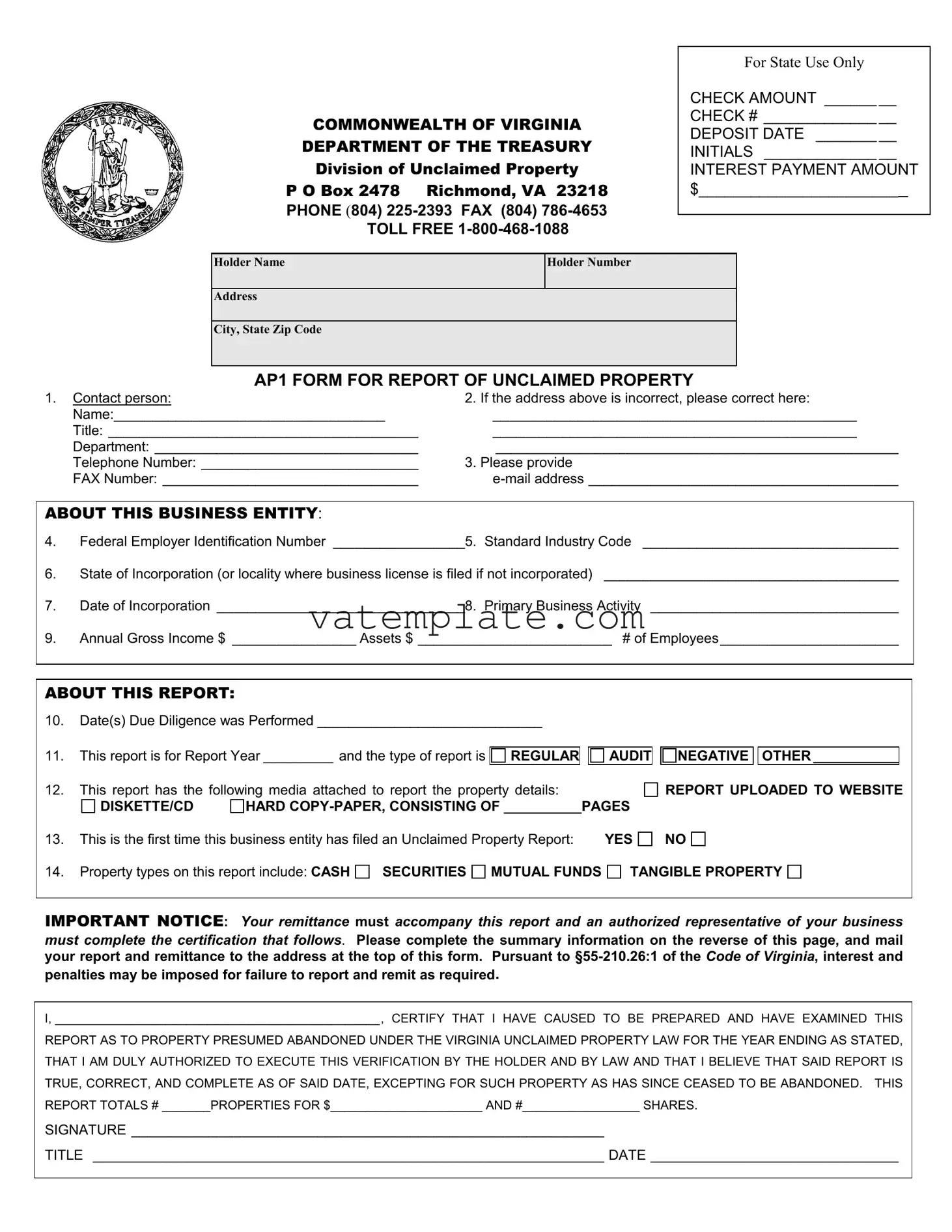

COMMONWEALTH OF VIRGINIA DEPARTMENT OF THE TREASURY Division of Unclaimed Property

P O Box 2478 Richmond, VA 23218 PHONE (804)

TOLL FREE

For State Use Only

CHECK AMOUNT ________

CHECK # _______________

DEPOSIT DATE _________

INITIALS _______________

INTEREST PAYMENT AMOUNT $________________________

Holder Name

Holder Number

Address

City, State Zip Code

AP1 FORM FOR REPORT OF UNCLAIMED PROPERTY

1. Contact person: |

2. |

If the address above is incorrect, please correct here: |

Name:___________________________________ |

|

_______________________________________________ |

Title: ________________________________________ |

|

_______________________________________________ |

Department: __________________________________ |

|

____________________________________________________ |

Telephone Number: ____________________________ |

3. |

Please provide |

FAX Number: _________________________________ |

|

ABOUT THIS BUSINESS ENTITY:

4.Federal Employer Identification Number _________________5. Standard Industry Code _________________________________

6. |

State of Incorporation (or locality where business license is filed if not incorporated) ______________________________________ |

7.Date of Incorporation ________________________________8. Primary Business Activity ________________________________

9.Annual Gross Income $ ________________ Assets $ _________________________ # of Employees_______________________

ABOUT THIS REPORT:

10.Date(s) Due Diligence was Performed _____________________________

11. |

This report is for Report Year _________ and the type of report is |

REGULAR |

|

AUDIT |

|

NEGATIVE |

|

OTHER ___________ |

|

|

12. |

This report has the following media attached to report the property details: |

|

|

|

REPORT UPLOADED TO WEBSITE |

|||||

|

DISKETTE/CD |

HARD |

|

|

|

|

|

|||

13. |

This is the first time this business entity has filed an Unclaimed Property Report: |

|

YES |

|

NO |

|||||

14.Property types on this report include: CASH

SECURITIES

SECURITIES

MUTUAL FUNDS

MUTUAL FUNDS

TANGIBLE PROPERTY

TANGIBLE PROPERTY

IMPORTANT NOTICE: Your remittance must accompany this report and an authorized representative of your business must complete the certification that follows. Please complete the summary information on the reverse of this page, and mail your report and remittance to the address at the top of this form. Pursuant to

I, _______________________________________________, CERTIFY THAT I HAVE CAUSED TO BE PREPARED AND HAVE EXAMINED THIS

REPORT AS TO PROPERTY PRESUMED ABANDONED UNDER THE VIRGINIA UNCLAIMED PROPERTY LAW FOR THE YEAR ENDING AS STATED, THAT I AM DULY AUTHORIZED TO EXECUTE THIS VERIFICATION BY THE HOLDER AND BY LAW AND THAT I BELIEVE THAT SAID REPORT IS TRUE, CORRECT, AND COMPLETE AS OF SAID DATE, EXCEPTING FOR SUCH PROPERTY AS HAS SINCE CEASED TO BE ABANDONED. THIS REPORT TOTALS # _______PROPERTIES FOR $______________________ AND #_________________ SHARES.

SIGNATURE _____________________________________________________________

TITLE __________________________________________________________________ DATE ________________________________

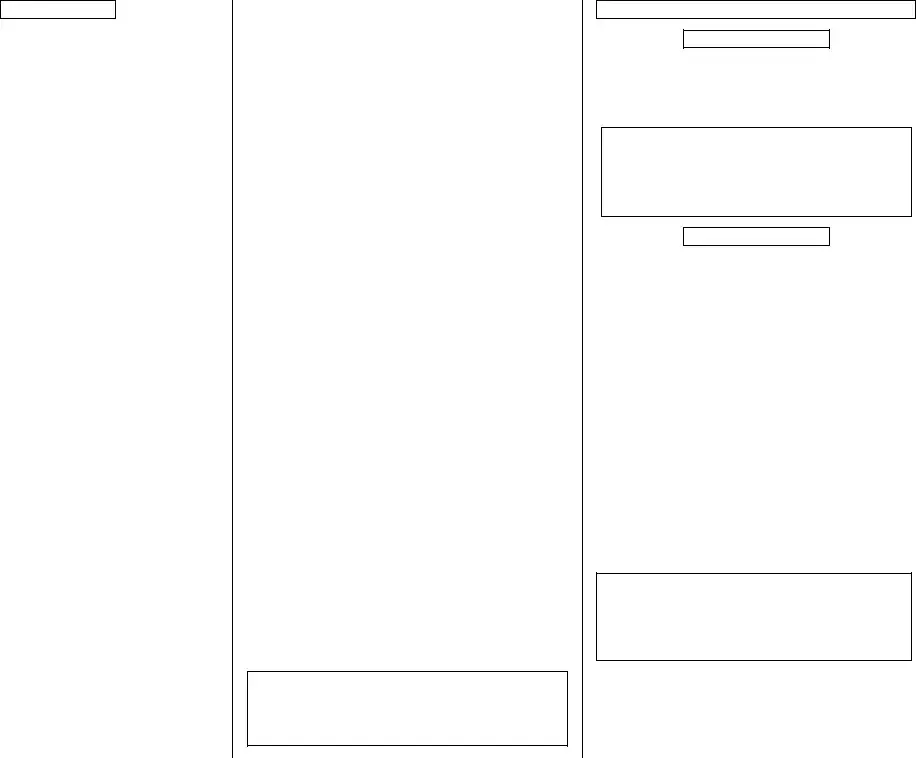

CASH PROPERTY

ACCOUNT BALANCES DUE

AC01 CHECKING ACCOUNTS

AC02 SAVINGS ACCOUNTS

AC03 MATURED CD OR SAVINGS CERTIFICATE AC04 CHRISTMAS CLUB FUNDS

AC05 MONEY ON DEPOSIT TO SECURE FUND AC06 SECURITY DEPOSIT

AC07 UNIDENTIFIED DEPOSITS

AC08 SUSPENSE ACCOUNTS AC09 SHARE ACCOUNTS

AC21 MISCELLANEOUS DEPOSITS

AC99 AGGREGATE ACCOUNT BALANCES <$100

UNCASHED CHECKS

CK01 CASHIER’S CHECKS

CK02 CERTIFIED CHECKS

CK03 REGISTERED CHECKS

CK04 TREASURER’S CHECKS CK05 DRAFTS

CK06 WARRANTS CK07 MONEY ORDERS CK08 TRAVELER’S CHECKS

CK09 FOREIGN EXCHANGE CHECKS CK10 EXPENSE CHECKS

CK11 PENSION CHECKS

CK12 CREDIT CHECKS OR MEMOS CK13 VENDOR CHECKS

CK14 CHECKS WRITTEN OFF TO INCOME CK15 OTHER OUTSTANDING OFFICIAL CHECKS CK16 CD INTEREST CHECKS

CK99 AGGREGATE UNCASHED CHECKS <$100

MISCELLANEOUS CHECKS

MS01 WAGES, PAYROLL, SALARY MS02 COMMISSIONS

MS03 WORKERS’ COMPENSATION BENEFITS MS04 PAYMENT FOR GOODS & SERVICES MS05 CUSTOMER OVERPAYMENTS

MS06 UNIDENTIFIED REMITTANCES

MS07 UNREFUNDED OVERCHARGES MS08 ACCOUNTS PAYABLE

MS09 CREDIT BALANCES – A/R MS10 DISCOUNTS DUE MS11 REFUNDS DUE

MS12 UNREDEEMED GIFT CERTIFICATES MS13 UNCLAIMED LOAN COLLATERAL

MS14 PENSION & PROFIT SHARING PLANS (IRA , KEOGH) MS15 DISSOLUTION OR LIQUIDATION

MS16 MISC OUTSTANDING CHECKS

MS17 MISC INTANGIBLE PROPERTY MS18 SUSPENSE LIABILITIES MS19 OTHER CASH

MS20 Rental Property Income

MS99 AGGREGATE MISC PROPERTY <$100

COURT & LOCALITY FUNDS

CT01 ESCROW FUNDS

CT02 CONDEMNATION AWARDS

CT03 MISSING HEIRS’ FUNDS

CT04 SUSPENSE ACCOUNTS

CT05 OTHER COURT DEPOSITS

CT07 EVIDENCE MONEY

CT08 GENERAL RECEIVER ACCOUNTS CT09 COURT ORDERED REFUNDS

CT10 PERSONAL PROPERTY TAX OVERPAYMENT CT11 REAL ESTATE TAX OVERPAYMENT

CT12 COURT HELD ACCOUNTS CT13 BONDS

CT14 ESTATE ACCOUNTS CT15 LITIGATIONS CT16 RESTITUTIONS

CT99 AGGREGATE COURT DEPOSITS <$100

INSURANCE

IN01 INDIVIDUAL POLICY BENEFITS OR CLAIMS PD

IN02 GROUP POLICY BENEFITS OR CLAIMS PAID

IN03 PROCEEDS DUE BENEFICIARIES

IN04 PROCEEDS FROM MATURED POLICIES, ENDOWMENTS

IN05 PREMIUM REFUNDS

IN06 UNIDENTIFIED REMITTANCES

IN07 OTHER AMOUNTS DUE UNDER POLICY TERMS

IN08 AGENT CREDIT BALANCES

IN09 ANNUITIES

IN10 DEMUTUALIZATION CASH

IN11 DEMUTUALIZATION SECURITIES

IN99 AGGREGATE INSURANCE PROPERTY <$100

TRUST, INVESTMENT AND ESCROW

ACCOUNTS

TR01 PAYING AGENT ACCOUNTS

TR02 UNDELIVERED OR UNCASHED DIVIDENDS TR03 FUNDS HELD IN FIDUCIARY CAPACITY TR04 ESCROW ACCOUNTS

TR05 TRUST VOUCHERS

TR06 ENDOWMENT FUNDS

TR99 AGGREGATE TRUST PROPERTY <$100

UTILITIES

UT01 UTILITY DEPOSITS

UT02 MEMBERSHIP FEES UT03 REFUNDS OR REBATES

UT04 CAPITAL CREDIT DISTRIBUTIONS UT99 AGGREGATE UTILITY PROPERTY <$100

MINERAL PROCEEDS & MINERAL

INTERESTS

Mi01 NET REVENUE INTEREST MI02 ROYALTIES

MI03 OVERRIDING ROYALTIES

MI04 PRODUCTION PAYMENTS MI05 WORKING INTEREST MI06 BONUSES

MI07 DELAY RENTALS MI08

MI99 AGGREGATE MINERAL INTERESTS <$100

CASH PROPERTY SUMMARY:

TOTAL CASH REMITTED:_______________________

TOTAL # OF ITEMS: ___________________________

TANGIBLE PROPERTY

SAFE DEPOSIT BOXES & SAFEKEEPING

SD01 SAFE DEPOSIT BOX CONTENTS

SD02 OTHER SAFEKEEPING

SD03 OTHER TANGIBLE PROPERTY

TANGIBLE PROPERTY SUMMARY:

TOTAL ITEM COUNT:________________________

TOTAL # OF OWNERS: ______________________

SECURITY PROPERTY

SECURITIES

SC01 DIVIDENDS

SC02 INTEREST (BOND COUPONS) SC03 PRINCIPAL PAYMENTS SC04 EQUITY PAYMENTS

SC05 PROFITS

SC06 FUNDS PAID TO PURCHASE SHARES SC07 FUNDS FOR STOCKS AND BONDS SC08 SHARES OF STOCK (RETURNED BY POST

OFFICE)

SC09 CASH FOR FRACTIONAL SHARES

SC10 UNEXCHANGED STOCK OF SUCCESSOR CORP SC11 OTHER CERTIFICATES OF OWNERSHIP SC12 UNDERLYING SHARES OR OTHER

STANDING CERTIFICATES

SC13 FUNDS FOR LIQUIDATION/REDEMPTION OF UNSURRENDERED STOCK OR BONDS

SC14 DEBENTURES

SC15 US GOVT SECURITIES

SC16 MUTUAL FUND SHARES

SC17 WARRANTS (RIGHTS)

SC18 MATURED BOND PRINCIPAL SC19 DIVIDEND REINVESTMENT PLANS SC20 CREDIT BALANCES

SC21 LIQUIDATED MUTUAL FUND SHARES SC97 MUTUAL FUND IRA/RETIREMENT ACCTS SC99 AGGREGATE SECURITY RELATED CASH <$100

SECURITY PROPERTY SUMMARY: TOTAL SHARES REMITTED:__________________

TOTAL # OF ITEMS: _________________________

MISCELLANEOUS

ZZZZ PROPERTIES NOT IDENTIFIED ABOVE

Form Properties

| Fact | Detail |

|---|---|

| 1. Governing Body | Commonwealth of Virginia Department of the Treasury Division of Unclaimed Property |

| 2. Contact Information | Address: P O Box 2478, Richmond, VA 23218; Phone: (804) 225-2393; Fax: (804) 786-4653; Toll Free: 1-800-468-1088 |

| 3. Form Identification | AP1 Form for Report of Unclaimed Property |

| 4. Purpose | For businesses to report unclaimed property as presumed abandoned under Virginia law |

| 5. Key Information Required | Contact person, Holder Name and Number, Address, Federal Employer Identification Number, State of Incorporation, Annual Gross Income, and Assets |

| 6. Property Types | Includes cash, securities, mutual funds, tangible property, etc. |

| 7. Reporting and Remittance | Report and remittance must accompany this form; Interest and penalties may be imposed for failure to report and remit as required by §55-210.26:1 of the Code of Virginia |

| 8. Certification Requirement | An authorized representative must certify the report's accuracy and completeness |

| 9. Annual Requirement | This report is typically filed annually for property presumed abandoned |

Steps to Filling Out Virginia Unclaimed Property

Filling out the Virginia Unclaimed Property Form is an important step in ensuring compliance with state regulations regarding unclaimed assets. This procedure is designed to safeguard these assets and potentially return them to their rightful owners. The instructions provided will guide you through the process, clarifying what information is necessary and how to submit the form correctly. Once the form is completed and submitted, the Virginia Department of the Treasury, Division of Unclaimed Property, will review the details. They may contact the reporting entity for further information or clarification as part of their effort to manage and protect unclaimed property effectively.

- Start by filling in the Holder Name, Holder Number, and Address, including City, State, and Zip Code as listed on the top of the form.

- For the Contact person section, enter the name, title, department, and telephone number of the individual responsible for the report.

- Provide the Fax Number and e-mail address in the designated boxes to ensure clear communication.

- Under ABOUT THIS BUSINESS ENTITY, input the Federal Employer Identification Number, Standard Industry Code, State of Incorporation, Date of Incorporation, Primary Business Activity, Annual Gross Income, Assets, and Number of Employees.

- In the section labeled ABOUT THIS REPORT, specify the Date(s) Due Diligence was Performed, the report year, and the type of report being filed (Regular, Audit, Negative, Other).

- Indicate whether this is the first time the business entity has filed an Unclaimed Property Report by selecting YES or NO.

- List the types of property included in this report, checking the appropriate boxes (Cash, Securities, Mutual Funds, Tangible Property).

- Complete the certification section by providing the name, signature, title, and date to verify the accuracy and completeness of the information provided in the report.

- Fill in the details regarding CASH PROPERTY, including account balances and uncashed checks, listing each item type and its respective total amount.

- Under SECURITY PROPERTY, include information about securities, dividends, interest, and other relevant property details.

- Ensure all TANGIBLE PROPERTY, such as safe deposit box contents and other safekeeping items, are accurately listed with total item counts and number of owners.

- Review the entire form for accuracy, ensuring all necessary attachments are included, and then submit the form and any remittance to the address provided at the top of the form.

Ensuring the accuracy and completeness of the Virginia Unclaimed Property Form is crucial for compliance and efficient processing. It is essential to double-check all entries and attachments before submission. The Division of Unclaimed Property takes careful steps to review each submission, striving to manage and protect unclaimed assets effectively. Following these instructions will facilitate a smooth submission process.

FAQ

What is Unclaimed Property in Virginia?

In Virginia, unclaimed property refers to a variety of assets that have been left inactive or forgotten by their owners for a set period, known as the dormancy period. These can include bank accounts, insurance policies, securities, utility deposits, uncashed checks, and safe deposit box contents. Businesses holding these assets, known as holders, are required by law to report and transfer them to the Virginia Department of the Treasury's Division of Unclaimed Property when the owner cannot be contacted after several attempts and the dormancy period has expired.

Who needs to file the Virginia Unclaimed Property Form?

Any business entity or holder operating within Virginia that has unclaimed property is required to file the Unclaimed Property Form with the Virginia Department of the Treasury's Division of Unclaimed Property. This includes financial institutions, insurance companies, corporations, state and local governments, and any organization that may have unclaimed property.

How do you file a report for unclaimed property in Virginia?

To file a report for unclaimed property in Virginia, follow these steps:

- Identify any unclaimed property your business holds by reviewing your records for assets that may be subject to Virginia's unclaimed property laws.

- Perform due diligence to attempt to contact the rightful owners of the unclaimed property as required by Virginia law.

- Complete the AP1 Unclaimed Property Form, providing all requested details about your business, the unclaimed property, and your attempts to contact the owner.

- Attach the necessary documentation, such as a detailed list of the unclaimed properties and owners' information, if applicable.

- Send your completed form along with any remittances to the address provided by the Virginia Department of the Treasury. Electronic submissions may be accepted as well.

What is the deadline for filing the Virginia Unclaimed Property Form?

The regular deadline for filing the Virginia Unclaimed Property Report is November 1st of each year. However, for life insurance companies, the deadline is May 1st. It's important to adhere to these deadlines to avoid any penalties or interest charges for late filings.

What happens if you don't report unclaimed property in Virginia?

Failing to report unclaimed property in Virginia can lead to penalties, interest charges, and audits. The Virginia Department of the Treasury's Division of Unclaimed Property has the authority to impose fines and penalties pursuant to §55-210.26:1 of the Code of Virginia, and failure to comply with the law can result in significant financial implications for your business.

Can owners claim their property after it has been reported to the Virginia Treasury?

Yes, owners can claim their unclaimed property after it has been reported and transferred to the Virginia Department of the Treasury's Division of Unclaimed Property. Owners or their rightful heirs can search the state's unclaimed property database, submit a claim request, and provide the necessary documentation to prove ownership. There is no statute of limitations on claiming unclaimed property in Virginia, meaning owners can claim their property at any time.

Common mistakes

When filling out the Virginia Unclaimed Property form, it is crucial to avoid common errors to ensure the process is completed accurately and efficiently. Here are six common mistakes:

- Incorrect or incomplete Holder Information: Often, the Holder Name, Number, and address are not accurately recorded. This information is vital for identifying the rightful owner of the unclaimed property.

- Failure to update the Contact Person details: If the contact person's information has changed (name, title, department, telephone number), not updating these details can lead to communication breakdowns.

- Omitting or incorrectly providing the Federal Employer Identification Number (FEIN) and Standard Industry Code (SIC): These codes are essential for the classification and processing of the report.

- Inaccurate Report Type selection: Not correctly specifying whether the report is a regular audit, negative, or other types can affect the processing of unclaimed properties.

- Attachment errors: Not attaching the property details properly, whether through website upload, diskette/CD, or hard copy, can lead to incomplete submissions.

- Mistakes in certification: Failing to have an authorized representative complete the certification or inaccuracies in the totals of properties, cash, and shares noted at the end of the form can lead to a rejection or delay in processing the form.

These mistakes not only delay the process but might also lead to the imposition of interest and penalties as highlighted in §55-210.26:1 of the Code of Virginia. To ensure accuracy:

- Double-check all entered information before submission.

- Ensure that all mandatory fields are filled out.

- Consult with the Division of Unclaimed Property if in doubt regarding any section of the form.

By meticulously avoiding these common errors, entities can streamline the submission process of unclaimed properties to the Commonwealth of Virginia Department of the Treasury, ensuring that they comply fully with state regulations.

Documents used along the form

When handling unclaimed property in Virginia, filling out the Virginia Unclaimed Property form is just the beginning. Easy to overlook, several other forms and documents often accompany this process, ensuring compliance and maximizing the chances of successfully returning property to its rightful owners. These documents vary in purpose and requirement, tailored to the specific nuances of unclaimed property law.

- Power of Attorney Document: This form grants an individual or entity the authority to act on behalf of another, particularly useful if the claim is being filed by someone other than the property's owner. It legalizes the representation, allowing the appointed party to make decisions, fill out paperwork, and communicate with the Virginia Department of the Treasury on the owner's behalf.

- Death Certificate: Required when the unclaimed property is to be claimed by the heirs or estate of a deceased owner. A death certificate is a legal document that certifies the death of an individual, critical for proving eligibility to claim the property belonging to the deceased.

- Will or Estate Documentation: If the unclaimed property involves an estate, or if it’s being claimed on behalf of someone who has passed away, documentation proving the claimant’s right to the estate or specific items thereof might be necessary. These documents clarify the relationship between the claimant and the deceased, ensuring that the property goes to the rightful beneficiary.

- Proof of Address: Often required to establish ownership or a connection to the unclaimed property. This could include historical utility bills, old driver’s licenses, or any official document that ties the claimant (or the original owner) to the address associated with the unclaimed property. It’s crucial for verifying the claimant’s identity and legitimacy.

- Identification Documents: Clear, government-issued identification such as a driver’s license, passport, or state ID card is typically necessary. These documents help in verifying the claimant's identity, an essential step in the process to ensure the unclaimed property is returned to its lawful owner.

Accurately completing and submitting the necessary forms and documents is crucial in the unclaimed property claim process. These documents serve various roles, from authorizing representation to proving entitlement, all aimed at facilitating the efficient return of property to its rightful owner. Attention to detail in this process not only complies with legal requirements but also honours the principle of rightful ownership, ensuring that unclaimed properties find their way back to those who have lost them.

Similar forms

The Virginia Unclaimed Property form is similar to other state and federal forms designed to manage and report specific types of assets or transactions. This paragraph elaborates on how it shares features with the IRS Form 1099, the Standard Form 3881 (ACH Vendor/Miscellaneous Payment Enrollment Form), and state-specific escheatment forms, highlighting their purpose, structure, and the type of information they collect.

IRS Form 1099: Similar to the Virginia Unclaimed Property form, the IRS Form 1099 is used to report various types of income outside of wages, salaries, and tips. Both forms require detailed information about the payer and payee (or holder and owner, in the case of unclaimed property) and focus on transactions that may not be reported through regular payroll. They share a common goal of ensuring transparency and compliance with financial reporting requirements. Each of these forms plays a vital role in the oversight of financial transactions and in maintaining accurate records for tax and regulatory purposes.

Standard Form 3881 (ACH Vendor/Miscellaneous Payment Enrollment Form): This form is used by entities to enroll in electronic payments from the federal government. Similar to the Virginia Unclaimed Property form, it collects detailed information about the entity receiving funds, including banking details, contact information, and tax identification numbers. Both forms streamline financial transactions and ensure accurate record-keeping by collecting comprehensive information upfront. While the Standard Form 3881 facilitates seamless electronic transactions directly to an entity's bank account, the Virginia form plays a crucial role in reclaiming assets that have become separated from their rightful owners, ensuring these assets are not lost to the ether but are instead accounted for and can be returned.

State-specific escheatment forms: Nearly every state has a process for reporting unclaimed property, and these forms are quite similar to Virginia's in both purpose and content. They require the reporting entity to provide details about assets that have gone unclaimed for a period of time, including the type of property, its value, and the last known owner. These forms, just like Virginia’s, are crucial for consumer protection, helping to ensure that assets are returned to their rightful owners or held safely until they can be claimed. The primary goal across all these forms is to prevent businesses from holding onto property that rightfully belongs to others, thereby promoting fairness and fiduciary responsibility.

Dos and Don'ts

To ensure the accurate and timely processing of your Virginia Unclaimed Property form, please follow these guidelines:

Do:

- Double-check the holder name, holder number, and address information to ensure they match your records.

- Accurately complete the contact person section, providing a correct phone number and email address for future communication.

- Make sure to perform and document due diligence as required, noting the date(s) the due diligence was performed.

- Attach all necessary documentation, such as reports uploaded to the website, diskette/CD, or hard copies, as specified in the form.

- Complete the certification section, with an authorized representative’s signature, title, and date.

Don't:

- Leave any field blank. If a section does not apply to your situation, indicate with "N/A" or "None" to acknowledge the question has been reviewed.

- Forget to document the due diligence process. Failing to show that due diligence was performed can lead to penalties and interest charges.

- Ignore the requirement for summarizing and attaching a detailed list of the properties including the type and amounts. Incomplete information can delay processing.

- Send your report and remittance to the wrong address. Use the exact address provided on the form to avoid misdelivery.

- Miss the filing deadline. Timely submission is crucial to avoid penalties and interest for late reporting.

Misconceptions

When it comes to the Virginia Unclaimed Property form, there are several misunderstandings that stand out. It's important to clear these up to ensure the process is as clear and simple as possible for individuals and businesses alike.

- Only physical property is considered unclaimed property: One common misconception is that unclaimed property relates solely to physical items, like real estate or items in a safety deposit box. In truth, the definition is much broader, including intangible items such as uncashed checks, insurance policy proceeds, and dormant bank accounts.

- The process is complicated and not worth the effort: Some people assume that filing a claim for unclaimed property is a complex and tedious process. However, the Commonwealth of Virginia has streamlined the procedure to make it accessible for everyone. Completing and submitting the form can be relatively straightforward if you gather all the necessary information beforehand.

- Unclaimed property is only held for a short period: Another misconception is that there's only a small window of opportunity to claim your property before the state takes permanent ownership. Virginia, like many states, holds unclaimed property indefinitely, giving owners or their heirs ample time to claim their assets.

- Businesses do not need to file unclaimed property reports: Some businesses might not realize that they are also required to report unclaimed property to the state. This includes any financial assets or interest held by the business that have gone unclaimed by the rightful owner for a specified period. It's not just an individual's responsibility but a corporate one as well.

Understanding these misconceptions can help demystify the process of dealing with unclaimed property in Virginia. Whether you're an individual or a business, it's worth checking if you have unclaimed assets waiting to be claimed.

Key takeaways

When dealing with the Virginia Unclaimed Property form, it is essential to understand the process thoroughly to ensure compliance and accuracy. The following key takeaways offer guidance on filling out and using this form effectively:

- Accurate Holder Information: Always double-check the holder's name, holder number, and contact details to avoid any discrepancies. It's crucial for the Commonwealth of Virginia Department of the Treasury to have the correct information.

- Correcting Addresses: If the address listed is not up-to-date or incorrect, promptly make the necessary corrections. This ensures that communication and any returned properties reach the rightful owners or their representatives.

- Contact Details: Clearly provide a contact person, including their name, title, department, telephone number, fax number, and email address. This detail is vital for any follow-up communication.

- Business Entity Information: The form requires detailed information about the business entity, including the Federal Employer Identification Number, Standard Industry Code, and state of incorporation among other details. This information helps categorize and process your report accurately.

- Report Attachments and Types: Clearly indicate the type of report, whether it's a regular audit, negative, or other types, and specify the media attached for reporting property details. This helps in organizing and processing the report efficiently.

- Property Types: The form lists various property types, such as cash, securities, and tangible property. Be thorough and precise when identifying and reporting the types of unclaimed property being submitted.

- Certification by Authorized Representative: An authorized representative of the business must complete the certification at the end of the form. This serves as a declaration that the information provided is true, correct, and complete to the best of their knowledge.

By carefully considering these key takeaways, individuals and businesses can navigate the process of submitting the Virginia Unclaimed Property form with greater ease and assurance. Remember, this effort plays a crucial role in returning properties to their rightful owners and maintaining compliance with Virginia's unclaimed property laws.

Other PDF Forms

How Much Tax Do You Pay on a $1,000 Lottery Ticket in Illinois - Start your Virginia Lottery adventure with this easily navigable form, designed to get you playing in no time.

How to Become a Certified Tattoo Artist - Virginia awaits your talent in tattooing—learn how to secure your apprenticeship certification with this in-depth application guide.

Virginia 801 - By diligently filing Form 801, surplus lines brokers contribute to the financial health of Virginia, underlining the importance of their role.