Fill Out a Valid Virginia Va 6H Template

In an effort to streamline tax filing for household employers, Virginia introduced the Form VA-6H, a crucial document designed to simplify annual tax reporting. This form, specifically tailored for employers of household service workers, allows for the compilation and submission of Virginia income tax withheld from employees' earnings in one comprehensive summary. Notably, the 2014 Appropriation Act ushered in a significant amendment by adjusting the filing deadline to January 31, ensuring uniformity with federal tax deadlines and facilitating a more efficient tax process for household employers. Additionally, the mandate for electronic filing signifies a leap towards modernizing tax administration, requiring all returns and payments, including Forms W-2 and 1099, to be processed electronically. For those unable to meet this requirement, a temporary waiver can be requested, underscoring the state's commitment to accommodating all employers' needs. Moreover, the form encompasses a straightforward filing procedure, penalties for late submissions, and comprehensive instructions on addressing changes such as a change of address or cessation of employing household staff. With detailed guidelines on completing the worksheet and preparing the return, Form VA-6H embodies the Virginia Department of Taxation's vision for a streamlined, user-friendly tax filing experience for household employers.

Virginia Va 6H Example

Form

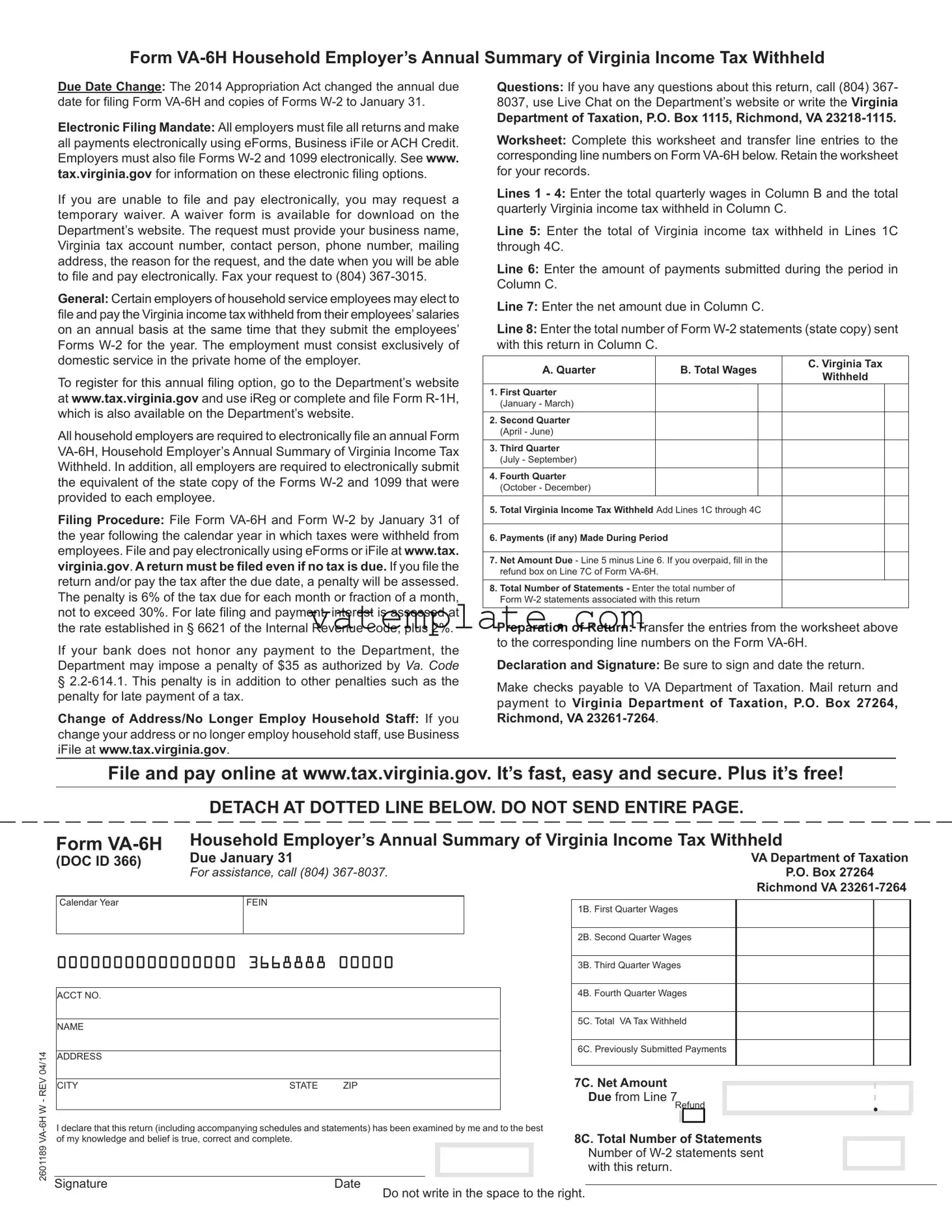

Due Date Change: The 2014 Appropriation Act changed the annual due date for filing Form

Electronic Filing Mandate: All employers must file all returns and make all payments electronically using eForms, Business iFile or ACH Credit. Employers must also file Forms

If you are unable to file and pay electronically, you may request a temporary waiver. A waiver form is available for download on the Department’s website. The request must provide your business name, Virginia tax account number, contact person, phone number, mailing address, the reason for the request, and the date when you will be able to file and pay electronically. Fax your request to (804)

General: Certain employers of household service employees may elect to file and pay the Virginia income tax withheld from their employees’ salaries on an annual basis at the same time that they submit the employees’ Forms

To register for this annual filing option, go to the Department’s website at www.tax.virginia.gov and use iReg or complete and file Form

All household employers are required to electronically file an annual Form

Filing Procedure: File Form

If your bank does not honor any payment to the Department, the Department may impose a penalty of $35 as authorized by VA. CODE

§

Change of Address/No Longer Employ Household Staff: If you change your address or no longer employ household staff, use Business iFile at www.tax.virginia.gov.

Questions: If you have any questions about this return, call (804) 367- 8037, use Live Chat on the Department’s website or write the Virginia

Department of Taxation, P.O. Box 1115, Richmond, VA

Worksheet: Complete this worksheet and transfer line entries to the corresponding line numbers on Form

Lines 1 - 4: Enter the total quarterly wages in Column B and the total quarterly Virginia income tax withheld in Column C.

Line 5: Enter the total of Virginia income tax withheld in Lines 1C through 4C.

Line 6: Enter the amount of payments submitted during the period in Column C.

Line 7: Enter the net amount due in Column C.

Line 8: Enter the total number of Form

|

A. Quarter |

|

B. Total Wages |

C. Virginia Tax |

||

|

|

Withheld |

||||

|

|

|

|

|

||

1. |

First Quarter |

|

|

|

|

|

|

(January - March) |

|

|

|

|

|

|

|

|

|

|

|

|

2. |

Second Quarter |

|

|

|

|

|

|

(April - June) |

|

|

|

|

|

|

|

|

|

|

|

|

3. |

Third Quarter |

|

|

|

|

|

|

(July - September) |

|

|

|

|

|

|

|

|

|

|

|

|

4. |

Fourth Quarter |

|

|

|

|

|

|

(October - December) |

|

|

|

|

|

|

|

|

|

|

|

|

5. |

Total Virginia Income Tax Withheld Add Lines 1C through 4C |

|

|

|||

|

|

|

|

|

|

|

6. |

Payments (if any) Made During Period |

|

|

|

|

|

|

|

|

||||

7. Net Amount Due - Line 5 minus Line 6. If you overpaid, fill in the |

|

|

||||

|

refund box on Line 7C of Form |

|

|

|

|

|

|

|

|

|

|||

8. |

Total Number of Statements - Enter the total number of |

|

|

|||

|

Form |

|

|

|||

|

|

|

|

|

|

|

Preparation of Return: Transfer the entries from the worksheet above to the corresponding line numbers on the Form

Declaration and Signature: Be sure to sign and date the return.

Make checks payable to VA Department of Taxation. Mail return and payment to Virginia Department of Taxation, P.O. Box 27264, Richmond, VA

File and pay online at www.tax.virginia.gov. It’s fast, easy and secure. Plus it’s free!

DETACH AT DOTTED LINE BELOW. DO NOT SEND ENTIRE PAGE.

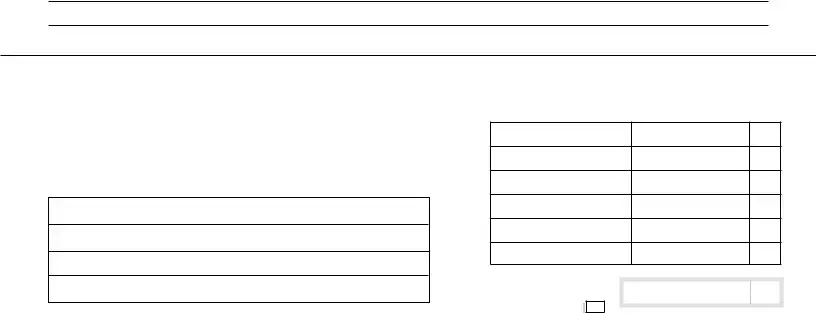

Form |

Household Employer’s Annual Summary of Virginia Income Tax Withheld |

|

(DOC ID 366) |

Due January 31 |

VA Department of Taxation |

|

FOR ASSISTANCE, CALL (804) |

P.O. Box 27264 |

Richmond VA

Calendar Year |

FEIN |

|

|

0000000000000000 3668888 00000

ACCT NO.

NAME

ADDRESS

CITY |

STATE |

ZIP |

I declare that this return (including accompanying schedules and statements) has been examined by me and to the best

1B. First Quarter Wages

2B. Second Quarter Wages

3B. Third Quarter Wages

4B. Fourth Quarter Wages

5C. Total VA Tax Withheld

6C. Previously Submitted Payments

7C. Net Amount

Due from Line 7Refund

.

2601189 VA

of my knowledge and belief is true, correct and complete. |

|

|

|

8C. Total Number of Statements |

|

|

|

|

|

|

|

|

|||

|

|

|

|||||

|

|

|

|

|

Number of |

|

|

|

|

|

|

|

with this return. |

|

|

|

|

|

|

|

|

||

Signature |

Date |

|

|

|

|||

|

Do not write in the space to the right. |

||||||

Form Properties

| Fact | Detail |

|---|---|

| Form Name | VA-6H Household Employer’s Annual Summary of Virginia Income Tax Withheld |

| Due Date | January 31 of the year following the calendar year in which taxes were withheld |

| Electronic Filing Mandate | All employers must file all returns and make all payments electronically. This includes the submission of Forms W-2 and 1099 electronically |

| Waiver for Electronic Filing | If unable to file/pay electronically, employers may request a temporary waiver by providing specific information |

| Eligibility for Annual Filing | Employers of household employees providing domestic service in the private home of the employer may opt for annual filing |

| Registration | Employers must register for the annual filing option, either online or by submitting Form R-1H |

| Filing Procedure | File Form VA-6H and Form W-2 by January 31 electronically using eForms, iFile, or ACH Credit |

| Penalties | Late filing/payment can incur penalties including 6% of the tax due per month, interest, and a $35 fee for dishonored payments |

| Change of Address or Employment Status | Updates about changes in address or employment status should be reported using Business iFile |

| Assistance | For questions, one can call, use live chat, or write to the Virginia Department of Taxation |

| Governing Law | The form and its requirements are governed by the Virginia Appropriation Act, the Internal Revenue Code § 6621, and VA CODE § 2.2-614.1 |

Steps to Filling Out Virginia Va 6H

Filing the Virginia Form VA-6H is a crucial step for household employers to summarize and report the state income tax they have withheld from their employees' wages throughout the year. This form must be submitted annually by January 31, following the calendar year the taxes were withheld. With the advent of technology and in an effort to streamline processes, Virginia mandates the electronic filing of this form as well as any accompanying Forms W-2 or 1099 for employers. The instructions below provide a simplified guide to prepare and submit the Form VA-6H, helping ensure that household employers comply with Virginia's tax regulations efficiently.

- Visit the Virginia Department of Taxation website at www.tax.virginia.gov to access eForms or Business iFile options for electronic submission.

- Before filling out the form, compile the total quarterly wages paid to employees and the Virginia income tax withheld for each quarter. Organize this information for all four quarters of the applicable tax year.

- Using the worksheet section of the Form VA-6H instructions, calculate the total Virginia income tax withheld for the year by adding the amounts from each quarter (Lines 1C through 4C).

- Determine any payments made during the period and note these in the relevant section of the worksheet (Line 6).

- Calculate the net amount due by subtracting any payments made during the year from the total Virginia income tax withheld (Line 7).

- Count the total number of Form W-2 statements you will be submitting alongside the Form VA-6H.

- Transfer the calculated totals from your worksheet to the electronic Form VA-6H on the tax department's website. Make sure to fill in each required field accurately.

- Review the form thoroughly. Before submission, ensure all information is correct to the best of your knowledge.

- Electronically sign and date the Form VA-6H. If a payment is due, prepare to submit it electronically via the available payment options on the tax website.

- Submit the Form VA-6H and all accompanying Forms W-2 or 1099 electronically before the January 31 deadline to avoid any penalties for late filing.

Remember, it is important to keep a copy of the submitted Form VA-6H and all related documents for your records. Should you encounter any difficulties or have questions regarding the filing process, assistance is available through the Virginia Department of Taxation website or by contacting their support team directly. By following these steps carefully, household employers can fulfill their tax obligations accurately and promptly, maintaining compliance with Virginia tax laws.

FAQ

What is Form VA-6H?

Form VA-6H, known as the Household Employer’s Annual Summary of Virginia Income Tax Withheld, is a document required for certain employers in Virginia. These employers have household employees and choose to file and pay withheld Virginia income tax on an annual basis. Typically, it is used by employers providing domestic services in their private homes.

When is the filing deadline for Form VA-6H?

The filing deadline for Form VA-6H and copies of Forms W-2 is January 31 of the year following the calendar year in which the taxes were withheld from employees. This change was enacted by the 2014 Appropriation Act, moving the due date earlier to help streamline the tax process.

Are there specific electronic filing requirements for Form VA-6H?

Yes, there is an electronic filing mandate for all employers, including those filing Form VA-6H. Returns and payments must be submitted electronically using eForms, Business iFile, or ACH Credit. Additionally, Forms W-2 and 1099 must be submitted electronically. Requests for a temporary waiver from electronic filing can be made if necessary, but they must include detailed information as specified by the Virginia Department of Taxation.

How can I register to file Form VA-6H?

To register for the annual filing option of Form VA-6H, employers can visit the Virginia Department of Taxation’s website and use the iReg service or complete and submit Form R-1H. Registration is a prerequisite to elect to file and pay the Virginia income tax withheld on an annual basis.

What are the penalties for late filing or payment?

If Form VA-6H is filed or the associated tax payment is made after the deadline, a penalty will be assessed. The penalty is 6% of the tax due for each month or fraction thereof that the return or payment is late, not to exceed 30%. Additionally, interest is charged on late payments at a rate established in § 6621 of the Internal Revenue Code, plus 2%. A separate penalty of $35 applies for payments not honored by your bank.

What should I do if I change my address or no longer employ household staff?

If there are changes to your address or you no longer need to file Form VA-6H because you do not employ household staff anymore, you should update your information using Business iFile on the Virginia Department of Taxation’s website. Timely updating your information ensures that you remain compliant with Virginia's tax laws.

Where can I find help or more information about Form VA-6H?

For assistance or more details about filing Form VA-6H, employers can contact the Virginia Department of Taxation by phone at (804) 367-8037, use the Live Chat feature on the Department’s website, or send a written inquiry to the provided postal address. This ensures that employers have access to the necessary resources for accurate and compliant filing.

Common mistakes

Filling out the Virginia VA-6H form, which is the Household Employer’s Annual Summary of Virginia Income Tax Withheld, requires close attention to detail. Failure to do so can lead to several common mistakes that could affect the filing process, potentially resulting in penalties. Below are six common errors to avoid when completing this form:

- Missing the Filing Deadline: The due date for submitting Form VA-6H and the accompanying Forms W-2 has been set to January 31 of the year following the tax year in question. Overlooking or misunderstanding this deadline is a critical mistake that can lead to late filing penalties, including an added interest rate on the due taxes.

- Incorrect Electronic Filing: The mandate for electronic filing requires that all returns and payments, including this form and the W-2s and 1099s, be submitted electronically via eForms, Business iFile, or ACH Credit. Failing to file electronically without having secured a temporary waiver from the Virginia Department of Taxation is a compliance error that may result in fines.

- Inaccurate Information Transfer from Worksheet: Preparation of Form VA-6H involves transferring data from a detailed worksheet onto the form itself. Errors during this transfer, such as incorrect sums of the total Virginia income tax withheld or payments made, can affect the accuracy of the reported tax obligations.

- Failure to Submit Correct Number of W-2 Statements: Each employer must report the exact number of W-2 statements sent along with Form VA-6H. Misreporting this number, whether through oversight or misunderstanding, can lead to discrepancies that may prompt further review or penalties.

- Omitting Signature and Date: A seemingly small yet significant requirement is the declaration and signature at the bottom of Form VA-6H. The return must be signed and dated to validate the information provided. Neglecting this crucial step can result in the submission being considered incomplete or invalid.

- Ignoring Changes of Circumstance: If there has been a change in address or the employer no longer employs household staff, this information must be updated through Business iFile. Overlooking the need to communicate these changes to the Virginia Department of Taxation could cause issues with future tax filings and correspondence.

By staying vigilant about these potential pitfalls and taking the necessary steps to ensure accuracy and compliance, household employers can avoid the stress and penalties associated with incorrect filings of the VA-6H form.

Documents used along the form

When handling the Virginia VA-6H form, which is crucial for household employers to summarize and report Virginia income tax withheld from their employees, it's often just one piece of the puzzle. There are several other forms and documents that are frequently needed in conjunction, each serving a specific purpose in ensuring compliance with tax and employment regulations.

- Form W-2, Wage and Tax Statement: This form reports an employee's annual wages and the amount of taxes withheld from their paycheck. It is essential for both the employer's records and the employee's tax filings.

- Form 1099: For independent contractors or those who are not traditional employees, Form 1099 is used instead of W-2 to report payments made throughout the year.

- Form R-1H, Household Employer Registration Form: This is needed to register as a household employer in Virginia. It helps the state identify businesses that employ individuals in a home setting.

- Form VA-5 Quarterly: This form is for quarterly tax filing. Even though household employers may file annually, businesses with other types of employees must submit this form quarterly.

- Form I-9, Employment Eligibility Verification: This document is used by employers to verify an employee's identity and to establish that the worker is eligible to accept employment in the United States.

- Form W-4, Employee’s Withholding Certificate: It determines how much federal income tax to withhold from the employee's paycheck. It's based on the employee's personal allowances and expected tax deductions.

- Schedule H (Form 1040), Household Employment Taxes: If the employer pays wages to a household employee, Schedule H is filled out to report Social Security, Medicare, and withheld income taxes.

- Worker’s Compensation Insurance Forms: While not a state tax form, carrying workers' compensation insurance is a legal requirement in many states for employers, including those in household employment settings. Documentation and proof of insurance are often needed.

Filing taxes and managing employment documentation can be complex, especially when it involves several forms. Whether it's for an individual household employer or a business with a diverse staff, understanding and correctly filing these documents is crucial for compliance and for ensuring that everyone's rights and responsibilities are upheld. Each document, from the VA-6H form to the employment eligibility verification, plays a vital role in the process.

Similar forms

The Virginia VA-6H form, known as the Household Employer’s Annual Summary of Virginia Income Tax Withheld, shares similarities with several other tax documents, particularly in its structure and the data it gathers. These resemblances can provide insight into how various tax forms interlink to present a comprehensive tax reporting system.

The first document similar to the VA-6H form is the Federal Form W-3, "Transmittal of Wage and Tax Statements." Both forms serve as a summary document; however, the VA-6H is used at the state level while the W-3 is used federally. They compile information on the wages paid and taxes withheld from employees, which is reported on individual W-2 forms. While the VA-6H gathers data exclusively for household employment in Virginia, Form W-3 covers all types of employment and is used to transmit W-2 information to the Social Security Administration.

Another document closely related to the VA-6H is the Form 940, "Employer's Annual Federal Unemployment (FUTA) Tax Return." Despite covering different types of taxes — Form 940 pertains to unemployment taxes while VA-6H is concerned with income tax withholding — both forms are annual summaries. They are similar in that they require the employer to report yearly totals: Form 940 reports the total FUTA tax liability, and the VA-6H reports the total state income tax withheld. Additionally, both forms are necessary for employers to reconcile yearly tax responsibilities for their employees.

The final comparable document is the Form VA-5 Quarterly, "Employer's Return of Virginia Income Tax Withheld." While the VA-5 is filed quarterly and the VA-6H is an annual summary, the essence of information they collect is the same. They both detail the amounts of Virginia income tax withheld from employees' wages. The key difference lies in their filing frequency, showcasing how the VA-6H serves as an annual wrap-up of the reports made throughout the year via Form VA-5. This connection underscores the continuous process of tax reporting and withholding that employers manage.

Dos and Don'ts

Filling out the Virginia VA-6H form, a key document for household employers summarizing annual income tax withheld, requires attention to detail and adherence to state regulations. To guide you through the process smoothly, here are four do's and don'ts:

- Do file your Form VA-6H and all required Forms W-2 electronically by January 31 of the year following the calendar year in which taxes were withheld, as mandated by the Virginia Department of Taxation.

- Do ensure that all information provided is accurate, including total quarterly wages and the total quarterly Virginia income tax withheld, to avoid penalties or delays.

- Do complete the worksheet provided in the instructions for Form VA-6H before filling out the actual form to ensure all line entries match and are transferred correctly.

- Do verify that your payment is correctly addressed to the VA Department of Taxation and that the payment method is accepted by the department.

- Don't file your return or make payments late. A late submission can result in penalties, including a 6% per month charge of the tax due, not exceeding 30%, and additional interest on late payments.

- Don't ignore the electronic filing requirement. Failing to file forms and payments electronically without a granted waiver can lead to non-compliance issues.

- Don't forget to sign and date your return. An unsigned return can be considered invalid, potentially causing processing delays or the assumption of inaccuracies in your reported information.

- Don't overlook the need to update your address or employment status if you no longer employ household staff. This information aids in keeping your records current with the Virginia Department of Taxation and ensures accurate communication.

Misconceptions

Misconceptions about the Virginia VA-6H form are common among household employers. Understanding the form's requirements is crucial to comply with state tax obligations.

- Electronic Filing is Optional: A common misconception is that filing the Form VA-6H electronically is optional. In reality, Virginia law mandates all employers to file returns and make payments electronically, using options like eForms, Business iFile, or ACH Credit unless a temporary waiver has been granted due to incapability to file and pay electronically.

- Employment Types Covered are Broad: Some believe that the VA-6H form applies to a wide range of employment types. However, it specifically targets employers of domestic service employees in private homes, making its scope much narrower than assumed.

- Manual Submission of W-2 and 1099 Forms is Allowed: Another incorrect assumption is that employers can manually submit Forms W-2 and 1099. The requirement is to electronically submit the state copy of these forms for each employee, aligning with the electronic filing mandate.

- Penalties for Late Filing are Flexible: There's a misconception about leniency in penalties for late filing and payment. The truth is, penalties are strictly imposed, with a 6% charge of the tax due per month (or fraction thereof), up to 30%, plus interest, reflecting a stringent stance on late submissions.

- Filing is Unnecessary if No Tax is Due: Some employers believe they needn't file the VA-6H form if no tax was withheld. However, a return must be filed regardless of whether tax is due, ensuring compliance with state reporting requirements.

- Change of Address Doesn’t Affect Filing: It's mistakenly believed that a change of address or cessation of employing household staff does not require notification. In fact, employers must update their address or employment status through Business iFile, maintaining accurate records with the Virginia Department of Taxation.

Dispelling these misconceptions ensures that household employers remain informed and compliant with Virginia's tax filing requirements, avoiding penalties and ensuring accurate tax reporting.

Key takeaways

When dealing with the Virginia VA-6H form, household employers have several important takeaways to consider for efficient and compliant tax filing. This list encapsulates the critical points:

- The due date for the VA-6H form, along with Forms W-2, is January 31st following the calendar year in which the taxes were withheld. This change was implemented by the 2014 Appropriation Act.

- Electronic filing is mandatory for all employers. The state of Virginia requires that returns and payments be submitted electronically through various online systems such as eForms, Business iFile, or ACH Credit.

- If an employer is unable to file and pay electronically, they must request a temporary waiver. This request involves providing detailed business information and justification for the request, which must be faxed to the provided number.

- Only certain household employers—those whose employees perform domestic services exclusively in the private home of the employer—can opt to file VA income tax withheld on an annual basis.

- To opt for annual filing, employers must either register online via the Virginia Department of Taxation’s website or complete and submit Form R-1H.

- An annual filing of Form VA-6H is required of all household employers, and this includes electronically submitting state copies of Forms W-2 and 1099 for each employee.

- Late filing and payments may incur penalties, including a 6% penalty of the due tax for each month or fraction thereof, not exceeding 30%. Additionally, interest will be charged at the rate established in § 6621 of the Internal Revenue Code, plus 2%.

- Should an employer change their address or cease to employ household staff, they must update their information through Business iFile.

Moreover, employers need to prepare carefully by completing a worksheet that helps in the preparation of Form VA-6H, ensuring accuracy in the declared quarterly wages and Virginia income tax withheld. Afterwards, the form must be signed, dated, and mailed or electronically submitted to the Virginia Department of Taxation by the stipulated deadline to avoid any penalties or interest charges. For any questions or clarifications, the Department of Taxation offers resources like a live chat service, phone support, and a mailing address for written inquiries.

Other PDF Forms

Wv Social Studies Fair - Research into the opioid crisis in West Virginia, including origins, current challenges, and efforts to combat the epidemic.

If You Have No Income Can You Get Tax Refund - This documentation process is a vital part of ensuring the efficacy and relevance of continuing legal education in Virginia.