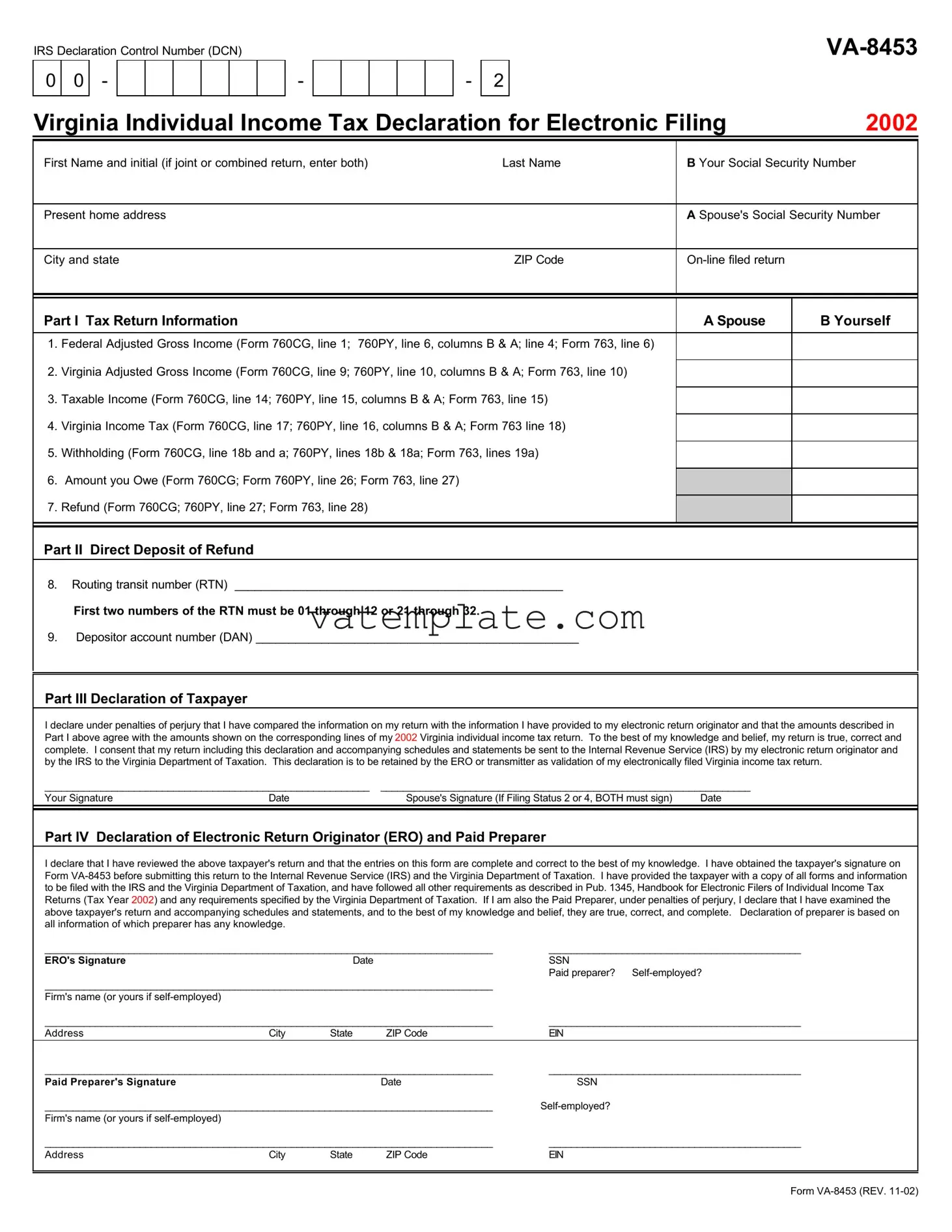

Fill Out a Valid Virginia Va 8453 Template

The Virginia VA-8453 form is a crucial document for taxpayers in Virginia who opt for electronic filing of their individual income tax returns. Serving as a declaration for electronic filing for the 2002 tax year, this form gathers essential details such as the filer's name, social security number, spouse's details if filing jointly, and present home address to ensure the proper processing of the return. Part I of the form meticulously records financial amounts related to federal and Virginia adjusted gross income, taxable income, Virginia income tax, withholdings, amounts owed, and refunds, aligning them with the corresponding lines of the Virginia individual income tax return. Furthermore, Part II addresses the direct deposit of refunds, requiring the filer to provide banking information like the routing transit number and depositor account number, ensuring the swift and secure delivery of any refunds due. The declaration section, Part III, necessitates the taxpayer’s affirmation under penalty of perjury that the information provided matches the information on their return and is complete, true, and correct. Additionally, it outlines the taxpayer’s consent for the electronic return originator (ERO) to send the return to the IRS and then by the IRS to the Virginia Department of Taxation. Part IV of the form is designated for the declaration of the ERO and, if applicable, the paid preparer, confirming that they have reviewed the taxpayer's return and verifying its completeness and accuracy. This document, therefore, plays a pivotal role in the electronic filing process, ensuring accuracy, compliance, and ease of processing for Virginia taxpayers.

Virginia Va 8453 Example

IRS Declaration Control Number (DCN)

0 0 -

-

-2

Virginia Individual Income Tax Declaration for Electronic Filing |

2002 |

|||

|

|

|

|

|

First Name and initial (if joint or combined return, enter both) |

Last Name |

B Your Social Security Number |

||

|

|

|

|

|

Present home address |

|

A Spouse's Social Security Number |

||

|

|

|

|

|

City and state |

ZIP Code |

|

||

|

|

|

|

|

|

|

|

|

|

Part I Tax Return Information |

|

A Spouse |

B Yourself |

|

|

|

|

|

|

1. |

Federal Adjusted Gross Income (Form 760CG, line 1; 760PY, line 6, columns B & A; line 4; Form 763, line 6) |

|

|

|

2. |

Virginia Adjusted Gross Income (Form 760CG, line 9; 760PY, line 10, columns B & A; Form 763, line 10) |

|

|

|

|

|

|||

3. |

Taxable Income (Form 760CG, line 14; 760PY, line 15, columns B & A; Form 763, line 15) |

|

|

|

|

|

|||

4. |

Virginia Income Tax (Form 760CG, line 17; 760PY, line 16, columns B & A; Form 763 line 18) |

|

|

|

|

|

|||

5. |

Withholding (Form 760CG, line 18b and a; 760PY, lines 18b & 18a; Form 763, lines 19a) |

|

|

|

|

|

|||

6. |

Amount you Owe (Form 760CG; Form 760PY, line 26; Form 763, line 27) |

|

|

|

|

|

|

||

7. Refund (Form 760CG; 760PY, line 27; Form 763, line 28) |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

Part II Direct Deposit of Refund |

|

|

|

|

8.Routing transit number (RTN) __________________________________________________

First two numbers of the RTN must be 01 through 12 or 21 through 32.

9.Depositor account number (DAN) _________________________________________________

Part III Declaration of Taxpayer

I declare under penalties of perjury that I have compared the information on my return with the information I have provided to my electronic return originator and that the amounts described in Part I above agree with the amounts shown on the corresponding lines of my 2002 Virginia individual income tax return. To the best of my knowledge and belief, my return is true, correct and complete. I consent that my return including this declaration and accompanying schedules and statements be sent to the Internal Revenue Service (IRS) by my electronic return originator and by the IRS to the Virginia Department of Taxation. This declaration is to be retained by the ERO or transmitter as validation of my electronically filed Virginia income tax return.

__________________________________________________________ |

__________________________________________________________________ |

||

Your Signature |

Date |

Spouse's Signature (If Filing Status 2 or 4, BOTH must sign) |

Date |

Part IV Declaration of Electronic Return Originator (ERO) and Paid Preparer

I declare that I have reviewed the above taxpayer's return and that the entries on this form are complete and correct to the best of my knowledge. I have obtained the taxpayer's signature on Form

________________________________________________________________________________ |

_____________________________________________ |

|||

ERO's Signature |

|

|

Date |

SSN |

|

|

|

|

Paid preparer? |

________________________________________________________________________________ |

|

|||

Firm's name (or yours if |

|

|

|

|

________________________________________________________________________________ |

_____________________________________________ |

|||

Address |

City |

State |

ZIP Code |

EIN |

________________________________________________________________________________ |

_____________________________________________ |

|||

Paid Preparer's Signature |

|

|

Date |

SSN |

________________________________________________________________________________ |

||||

Firm's name (or yours if |

|

|

|

|

________________________________________________________________________________ |

_____________________________________________ |

|||

Address |

City |

State |

ZIP Code |

EIN |

|

|

|

|

|

Form

Form Properties

| Fact | Detail |

|---|---|

| Form Title | Virginia Individual Income Tax Declaration for Electronic Filing |

| Form Number | VA-8453 |

| Revision Date | November 2002 |

| Main Purpose | To declare that the information on the taxpayer's electronic return is true, correct, and complete. |

| Parts of the Form | Tax Return Information, Direct Deposit of Refund, Declaration of Taxpayer, and Declaration of Electronic Return Originator (ERO) and Paid Preparer |

| Governing Laws | Subject to Virginia Department of Taxation regulations and penalties of perjury for false declaration. |

| Signature Requirement | Both the taxpayer and the ERO/Paid Preparer must sign the form. |

| Specifics for Direct Deposit | Requires routing transit number (RTN) and depositor account number (DAN) for refunds. |

Steps to Filling Out Virginia Va 8453

Filling out the VA-8453 form is an important step in electronically filing your Virginia state tax return. This document verifies the information provided in your electronic submission is accurate and matches the details in your tax return documents. It serves as a declaration by both the taxpayer and the electronic return originator (ERO) that all included data is true and complete to the best of their knowledge. Following these steps carefully will ensure that your tax return process is smooth and compliant with state regulations.

- Enter your First Name and initial. If filing a joint or combined return, include both names.

- Add your Last Name in the space provided.

- Input your Social Security Number in the designated area "B".

- For joint returns, provide your Spouse's Social Security Number.

- Fill out your Present home address, including City and state ZIP Code.

- Under Part I - Tax Return Information, report your Federal Adjusted Gross Income and your Virginia Adjusted Gross Income as well as your Taxable Income, Virginia Income Tax, Withholding amounts, the Amount you Owe, and the Refund (if applicable) by referring to the corresponding lines of your Virginia income tax return forms (Form 760CG, 760PY, or 763, as applicable).

- In Part II - Direct Deposit of Refund, enter your bank's Routing transit number (RTN) and your Depositor account number (DAN) to have your refund directly deposited into your bank account.

- In Part III - Declaration of Taxpayer, review the declaration statement. Once you've confirmed that all information is true and accurate, sign your name and enter the date. If you're filing a joint return, your spouse must also sign and date the form.

- For Part IV - Declaration of Electronic Return Originator (ERO) and Paid Preparer (if applicable), this section must be completed by the ERO or the paid preparer. It involves reviewing the return, confirming the information is correct, and signing off on the document. The ERO or preparer must provide their SSN, self-employed status, firm name (if applicable), address, city, state, ZIP Code, and EIN.

After the form is fully completed and signed by the necessary parties, retain a copy for your records. The original should be submitted as instructed by your ERO. This form does not get directly submitted to the IRS or the Virginia Department of Taxation by the taxpayer but is kept by the ERO as part of the electronic filing process records.

FAQ

What is the VA-8453 form?

The VA-8453 form is a declaration for electronic filing of an individual's Virginia income tax return. It serves as a written confirmation from the taxpayer that the information provided to the electronic return originator (ERO) matches the information on their Virginia income tax return. This form is crucial for electronically filed returns, ensuring accuracy and compliance with Virginia tax laws.

Who needs to file the VA-8453 form?

Any Virginia resident or part-year resident who chooses to file their income tax return electronically must complete and file the VA-8453 form. This includes individuals filing jointly, for whom both spouses must sign the form if they are filing under Status 2 or 4.

What information is required on the VA-8453 form?

The VA-8453 form requires detailed tax return information, including:

- Federal Adjusted Gross Income

- Virginia Adjusted Gross Income

- Taxable Income

- Virginia Income Tax

- Withholding

- Amount you Owe or Refund

What is the process for submitting the VA-8453 form?

After completing the VA-8453 form, it must be signed and dated by the taxpayer, and if applicable, the spouse. The signed form is then retained by the Electronic Return Originator (ERO) or transmitter as part of the validation process for the electronically filed Virginia income tax return. Taxpayers are advised to also retain a copy of the form for their records.

Do both spouses need to sign the VA-8453 form?

Yes, in cases of joint filing under Status 2 or 4, both spouses must sign the VA-8453 form to validate the electronic filing of their joint Virginia income tax return. This requirement ensures that both individuals agree to the information being submitted on their behalf.

How does the VA-8453 form affect the electronic filing process?

The VA-8453 form serves as an integral part of the electronic filing process, providing a declaration from the taxpayer that verifies the accuracy of the submitted income tax information. It allows the Virginia Department of Taxation to efficiently process electronically filed returns while mitigating errors and ensuring compliance.

What should I do if I find an error after submitting my VA-8453 form?

If you discover an error after submitting your VA-8453 form, you should contact the electronic return originator (ERO) or the Virginia Department of Taxation as soon as possible. Corrections may require amending your tax return or taking additional steps, as guided by the Department of Taxation, to ensure your tax obligations are accurately fulfilled.

Common mistakes

Filling out tax forms is a meticulous task that requires attention to detail. However, errors are common, especially with forms like the Virginia VA-8453, which is critical for the electronic filing of individual income tax returns. Understanding the common mistakes people make when completing this form can help in avoiding them and ensuring a smoother tax filing process. Here are five frequent errors to watch out for:

Incorrect Social Security Numbers (SSNs): A prevalent mistake is entering incorrect SSNs for the taxpayer or spouse. This error can lead to rejection of the tax return by the IRS and delay in processing. It's essential to double-check these numbers for accuracy with the Social Security Administration records.

Inaccurate Income Reports: Misreporting income, whether federal adjusted gross income or Virginia adjusted gross income, can have serious consequences. It is critical to ensure that these figures exactly match those on your federal and state tax returns to avoid any issues with the tax authorities.

Wrong Bank Account Details for Refunds: For direct deposits, entering incorrect routing transit numbers (RTNs) or depositor account numbers (DANs) can lead to delays in receiving refunds or the refund being deposited into the wrong account. Always verify these numbers with your bank before submission.

Signature Omissions: Forgetting to sign the declaration section at the end of the form is another common oversight. Electronic filing requires this validation, and without it, the return cannot be processed. Ensure that both the taxpayer and the spouse (if filing jointly) sign the form.

Errors in Tax Amounts: Incorrect entries for tax owed or refund amounts can result from simple calculation mistakes or misinterpretation of the instructions. Review these figures carefully to ensure they tally with the calculations on your full tax return.

Avoiding these mistakes necessitates a keen eye and adherence to the detailed instructions provided for the VA-8453 form. It's always beneficial to review your entries or have them reviewed by a professional before submitting to prevent the extra hassle that comes with corrections or amendments after filing. Remember, accuracy in your tax filing not only expedites processing but also minimizes complications down the line.

Documents used along the form

When filing the Virginia VA-8453 form, several additional documents and forms are often used to ensure a complete and accurate submission of an individual's tax return. These forms provide detailed information regarding income, deductions, and personal data that are critical to the electronic filing process. Below is a list of documents frequently used alongside the VA-8453 form.

- Form 760 - Virginia Resident Income Tax Return: This is the primary state tax return form for Virginia residents, detailing income, taxes owed, and payments made.

- Form 760CG - Schedule of Adjusted Gross Income: Accompanies Form 760 to provide detailed information on how federal adjusted gross income is calculated.

- Form 763 - Nonresident Income Tax Return: Used by individuals who are not residents of Virginia but have income from Virginia sources.

- Form 760PY - Part-Year Resident Income Tax Return: For those who have lived in Virginia for only part of the tax year, detailing income earned while a resident.

- Schedule ADJ - Schedule of Adjustments: Used to make any adjustments to income, deductions, or tax credits on the Virginia tax return.

- W-2 Forms - Wage and Tax Statement: Employers provide this form, detailing an employee's income and taxes withheld during the tax year.

- 1099 Forms - Various 1099 forms report income from sources other than wages, such as freelance work, interest, dividends, and retirement distributions.

- Schedule CR - Credit Computation Schedule: For taxpayers claiming any credits against their Virginia income tax.

- Schedule VAC - Virginia Contributions Schedule: Allows taxpayers to report charitable contributions made during the tax year.

- Direct Deposit Information - While part of the VA-8453 form, taxpayers must provide details for direct deposit refunds, including the routing transit number and account number.

While the Virginia VA-8453 form serves as a declaration for electronic filing, the accompanying documents ensure that the taxpayer's financial information is comprehensively represented. These forms together provide the necessary data for accurate tax processing and compliance with state and federal tax laws.

Similar forms

The Virginia VA-8453 form, functioning as a declaration for electronic filing of an individual's state income tax return, shares similarities with several other tax-related documents. Each of these documents, designed to streamline the processing of tax returns through electronic systems, plays a crucial role in ensuring the accuracy and verifiability of the information submitted to tax authorities. While the VA-8453 is specific to the Commonwealth of Virginia, its counterparts serve similar purposes in their respective contexts.

The IRS Form 8879 is akin to the VA-8453 in that it serves as the federal counterpart for authorizing e-file. Both forms act as electronic signatures for taxpayers, indicating their review and approval of the information on their tax returns before submission through electronic means. The key aspect here is the validation of the taxpayers' consent to e-file, underscoring the forms' roles in maintaining the integrity of the electronic filing process. Despite the different jurisdictions - one for federal tax returns and the other for state tax returns in Virginia - the essence of their function is fundamentally the same: to certify that the electronic submission reflects the taxpayers' accurate financial statements and tax obligations.

Form 8453-OL represents another parallel document, specifically designed for taxpayers who opt to electronically file their federal tax returns online. Similar to the VA-8453, Form 8453-OL collects taxpayer signatures to authenticate the electronic submission of the tax return. The manner in which both forms collect and use taxpayer information and consents mirrors the growing trend towards digital solutions in tax administration. As electronic alternatives to paper submissions, these forms facilitate a faster, more efficient tax return process, highlighting the shift towards more environmentally friendly and less cumbersome filing options for both taxpayers and tax authorities alike.

Dos and Don'ts

When dealing with the Virginia VA 8453 form, a crucial document for taxpayers opting for electronic filing, attention to detail and adherence to guidelines are paramount. Here's a brief, easy-to-follow guide highlighting the dos and don'ts that can help ensure a smooth filing process.

Things You Should Do- Verify the accuracy of all personal information, including your First Name, Last Name, Social Security Number, and your spouse's details if filing jointly. Mismatched or incorrect information can lead to processing delays.

- Double-check the financial figures reported, such as Federal Adjusted Gross Income and Virginia Adjusted Gross Income, against your tax documents to prevent discrepancies that may flag your return for review.

- Ensure the Routing Transit Number (RTN) and Depositor Account Number (DAN) for the direct deposit of your refund are correct. Mistakes here could result in a lost or delayed refund.

- Review the declaration section carefully before signing. Your signature attests that the information provided is true and accurate to the best of your knowledge.

- Maintain a copy of the signed form for your records. It's important to have proof of filing and a reference in case questions arise later.

- Do not leave any mandatory fields blank. Incomplete forms may be rejected, causing delays in the processing of your tax return and any potential refunds.

- Avoid using estimates or rounded numbers in the financial sections of the form. Precise figures are crucial for accurate tax processing.

- Resist the temptation to sign without reviewing. Even if a professional prepares your return, it’s your responsibility to ensure the form’s accuracy.

- Don't forget to get the ERO's or paid preparer's signature if applicable. Their declaration section must also be completed and signed to validate the electronic filing process.

- Do not submit the form without first obtaining the necessary signatures, including your spouse’s where required. Unsigned forms will not be processed.

Following these guidelines can help streamline your experience with the VA-8453 form, minimizing errors and ensuring your tax return is processed efficiently and accurately. As always, if uncertainties arise, consulting with a tax professional can provide clarity and peace of mind.

Misconceptions

Many people hold misconceptions about the Virginia VA-8453 form. It's essential to clarify these misunderstandings to ensure accurate and stress-free tax filing.

- Misconception #1: The VA-8453 form is the tax return itself.

- Misconception #2: Anyone can submit the VA-8453 form.

- Misconception #3: The form is required for paper filings.

- Misconception #4: Signing the VA-8453 form means your taxes are paid.

- Misconception #5: Details about direct deposit are optional on the VA-8453.

- Misconception #6: The IRS requires the VA-8453 for processing Federal returns.

This is incorrect. The VA-8453 is a declaration for electronic filing. It serves as a confirmation that the information provided to the electronic return originator matches the data on the Virginia individual income tax return. The actual tax return involves more detailed documents.

Actually, the VA-8453 must be submitted by the taxpayer or by a professional known as an Electronic Return Originator (ERO) who is authorized to e-file on behalf of the taxpayer. It's not a form that can be submitted by just anyone.

No, the VA-8453 form is specific to electronic filings. If a taxpayer decides to file a paper return, this form is not part of that process. Its sole purpose is to accompany the electronic submission of a Virginia tax return.

Signing the form only indicates that the taxpayer declares the information is accurate and consents to electronic filing. If any taxes are due, the taxpayer must ensure payment is made by the due date through separate means.

If a taxpayer is expecting a refund and wants it directly deposited, providing the routing transit number and the depositor account number on the VA-8453 form is essential. These details are not optional for taxpayers who prefer direct deposit.

The VA-8453 form is specific to the Commonwealth of Virginia and is used by the Virginia Department of Taxation. Although it mentions the IRS—since federal and state tax information often overlap—the form itself is not required or used by the IRS for processing federal tax returns.

Understanding the correct purposes and requirements of the Virginia VA-8453 form helps taxpayers navigate the complexities of tax season with greater ease and accuracy.

Key takeaways

When completing the Virginia VA-8453 form for electronic filing of an individual income tax return, understanding its requirements and correct completion is crucial for a smooth filing process. Below are some key takeaways regarding the form and its use:

- Personal and Income Information: Part I of the VA-8453 form requires detailed personal information, including Social Security numbers for both the taxpayer and the spouse if filing jointly. This section also calls for comprehensive income information, such as Federal and Virginia Adjusted Gross Income, taxable income, and the amount owed or expected as a refund.

- Direct Deposit: For those expecting a refund, Part II provides an option to receive it through direct deposit. It is essential to enter accurate banking information, including the Routing Transit Number (RTN) and Depositor Account Number (DAN), to avoid any delays.

- Declaration of Taxpayer: Part III is a declaration by the taxpayer, made under penalties of perjury, that the information provided is true, correct, and complete to the best of their knowledge. This section emphasizes the accuracy of the information matching the amounts on the Virginia individual income tax return.

- Electronic Return Originator (ERO) and Paid Preparer’s Declaration: In Part IV, the ERO or paid preparer must declare that they have reviewed the taxpayer's return and the entries on this form are complete and correct. This involves verifying the taxpayer’s signature, providing them with all necessary copies, and adhering to specific guidelines outlined in IRS publications and by the Virginia Department of Taxation.

- Retention of Form: After the electronic filing, the declaration (VA-8453 form) should be retained by the ERO or transmitter. This serves as validation of the electronically filed Virginia income tax return.

- Accuracy is Essential: Given that the taxpayer’s declaration is under penalties of perjury, ensuring the accuracy of every piece of information entered on this form is imperative. Discrepancies could result in processing delays or inquiries from the Virginia Department of Taxation.

- Penalties for Perjury: The declaration of the taxpayer and the preparer (if applicable) is made under penalties of perjury. This underscores the legal responsibility to provide accurate and truthful information on the VA-8453 form and the accompanying tax return.

Understanding these key points can help taxpayers and professionals navigate the process of electronically filing Virginia individual income tax returns efficiently and accurately.

Other PDF Forms

Virginia Individual Income Tax Return - Facilitates donations to charitable causes through the tax return, including a section for Other Voluntary Contributions.

Wv Property Tax Rebate - The form also accommodates changes in personal information, such as updated addresses or corrected social security numbers.