Fill Out a Valid West Virginia Cd 3 Template

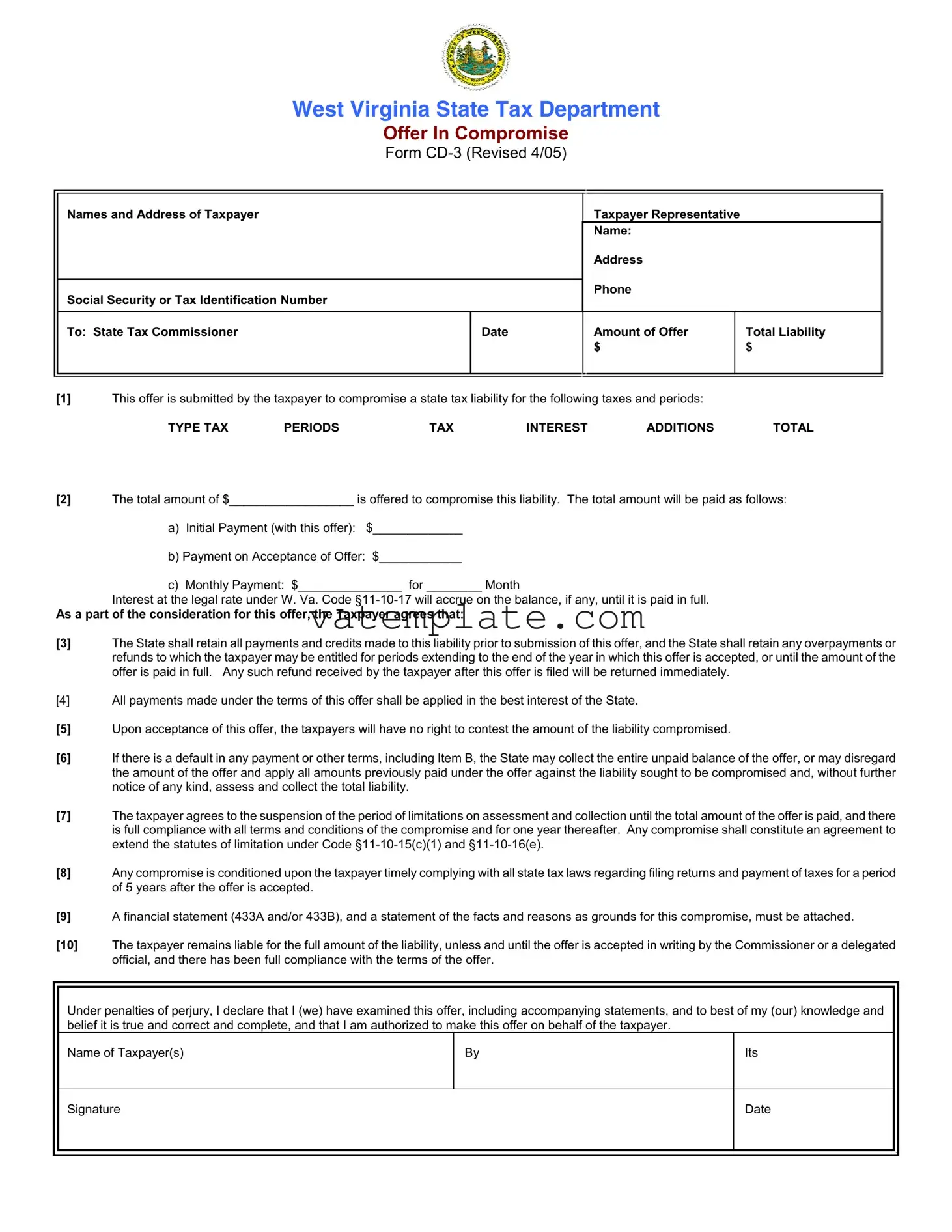

The West Virginia CD-3 form, a comprehensive document issued by the State Tax Department, outlines the procedure for taxpayers wishing to propose an Offer in Compromise to settle state tax liabilities. This option provides individuals and business entities a potential pathway to negotiate their outstanding taxes, penalties, interests, or additions, under circumstances where there's doubt about their ability to pay the full amount owed or the accuracy of the liability itself. Revised in April 2005, the form requires detailed information about the taxpayer, including names, addresses, and social security or tax identification numbers, alongside a clear declaration of the tax types, periods involved, and the total amount offered for compromise. The offer's acceptance hinges on several stringent conditions: upfront and subsequent payments as proposed, adhering to future state tax laws, and a complete suspension of any rights to contest the agreed-upon tax liability amount. Additionally, taxpayers are obliged to comply with a range of detailed instructions and requirements, such as submitting a financial statement and detailing the reasons behind the compromise offer, to outline their financial incapability to pay in full, thereby justifying the state's acceptance of a lesser sum. By signing the CD-3 form under penalty of perjury, taxpayers commit to a legal agreement with the state, encompassing future tax compliance and potential reconsideration of the offered amount, aimed at facilitating a more manageable resolution for those overwhelmed by outstanding tax liabilities.

West Virginia Cd 3 Example

|

West Virginia State Tax Department |

|

|||

|

Offer In Compromise |

|

|

|

|

|

Form |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Names and Address of Taxpayer |

|

|

Taxpayer Representative |

|

|

|

|

|

Name: |

|

|

|

|

|

Address |

|

|

|

|

|

Phone |

|

|

Social Security or Tax Identification Number |

|

||||

|

|

|

|||

|

|

|

|

|

|

To: State Tax Commissioner |

|

Date |

Amount of Offer |

|

Total Liability |

|

|

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

[1]This offer is submitted by the taxpayer to compromise a state tax liability for the following taxes and periods:

TYPE TAX |

PERIODS |

TAX |

INTEREST |

ADDITIONS |

TOTAL |

[2]The total amount of $__________________ is offered to compromise this liability. The total amount will be paid as follows:

a)Initial Payment (with this offer): $_____________

b)Payment on Acceptance of Offer: $____________

c)Monthly Payment: $_______________ for ________ Month

Interest at the legal rate under W. Va. Code

As a part of the consideration for this offer, the Taxpayer agrees that:

[3]The State shall retain all payments and credits made to this liability prior to submission of this offer, and the State shall retain any overpayments or refunds to which the taxpayer may be entitled for periods extending to the end of the year in which this offer is accepted, or until the amount of the offer is paid in full. Any such refund received by the taxpayer after this offer is filed will be returned immediately.

[4]All payments made under the terms of this offer shall be applied in the best interest of the State.

[5]Upon acceptance of this offer, the taxpayers will have no right to contest the amount of the liability compromised.

[6]If there is a default in any payment or other terms, including Item B, the State may collect the entire unpaid balance of the offer, or may disregard the amount of the offer and apply all amounts previously paid under the offer against the liability sought to be compromised and, without further notice of any kind, assess and collect the total liability.

[7]The taxpayer agrees to the suspension of the period of limitations on assessment and collection until the total amount of the offer is paid, and there is full compliance with all terms and conditions of the compromise and for one year thereafter. Any compromise shall constitute an agreement to extend the statutes of limitation under Code

[8]Any compromise is conditioned upon the taxpayer timely complying with all state tax laws regarding filing returns and payment of taxes for a period of 5 years after the offer is accepted.

[9]A financial statement (433A and/or 433B), and a statement of the facts and reasons as grounds for this compromise, must be attached.

[10]The taxpayer remains liable for the full amount of the liability, unless and until the offer is accepted in writing by the Commissioner or a delegated official, and there has been full compliance with the terms of the offer.

Under penalties of perjury, I declare that I (we) have examined this offer, including accompanying statements, and to best of my (our) knowledge and belief it is true and correct and complete, and that I am authorized to make this offer on behalf of the taxpayer.

Name of Taxpayer(s)

By

Its

Signature

Date

OFFERS IN COMPROMISE - INSTRUCTIONS

Authority

W. Va. Code

Reason for Compromise

We are allowed to compromise a liability for one or both of the following two (2) reasons: (1) doubt as to whether the taxpayer owes the liability; (2) doubt that we can collect the full amount of the liability. This form and instructions is only used in cases of doubt as to collectibility.

Policy

We will accept an offer in compromise when it is unlikely that we can collect the tax liability in full, and the amount offered reasonably reflects the amount we can collect. An offer in compromise is a legitimate alternative to declaring a case as currently not collectible or to a

The success of the compromise will be assured only if taxpayers make adequate compromise proposals consistent with their ability to pay the State. Taxpayers are expected to provide reasonable documentation to verify their ability to pay. The goal is a compromise which is in the best interest of both the taxpayer and the State. Where an offer in compromise appears to be a workable solution, the employee assigned the case will discuss the compromise with the taxpayer and, when necessary, assist in preparing the required forms. The taxpayer will be responsible for making the first offer for compromise.

Practical Consideration

It is the taxpayer's responsibility to show us why it would be in our best interest to accept your proposal. When we consider your offer we ask the following questions: (1) Could we collect the amount owed through liquidation of your assets or through an installment agreement? (2) Could we collect more from your assets and future income than is offered? (3) Would collection in the future result in more payment than is offered? (4) Would the public believe that the acceptance of your offer was a reasonable action?

The fact that you have no assets or income at this time from which the State could collect the liability does not mean that the State should simply accept any offer because it is all we can collect now. It would generally be better for us to reject a nominal amount and wait to see what collection potential would arise during the remainder of our

Additional Consideration

We believe that you benefit if we accept your offer because you can manage your finances without the burden of a tax liability. Therefore, we may require either: (1) A written agreement that will require you to pay a percentage of future earnings; and/or (2) A written agreement to give up present or future tax refunds.

Tax Compliance

(1)We will not accept your offer if you have not filed all tax returns. (2) We will also require that the taxpayer comply with all future filing and payment requirements. The terms of the offer require future compliance for a period of five (5) years.

Collection and Payments

The submission of an offer does not automatically suspend collection. If it appears the offer was filed to delay collection of the tax or that delay would hinder our ability to collect the tax, we will continue collection efforts. If you have agreed to make installment payments before you made the offer, those payments should continue.

Special Instructions for Offer in Compromise Form

(1)The Offer in Compromise form must be used to submit an offer. The form must be filed with the Compliance Division. If you have been working with a specific employee on your case, file the offer with that employee.

(2)Your full name, address and taxpayer identification number(s) must be entered at the top of the Offer form. If this is a joint liability (husband and wife) and both wish to make an offer, both names must be shown. If you are individually liable for a liability and are also jointly liable for another liability, and only one person is submitting an offer, only one offer must be submitted. If you are individually liable for one liability and jointly liable for another and both joint parties are submitting an offer, two (2) Offers must be submitted, one (1) for separate liability and one (1) for the joint liability.

(3)You must list all liabilities to be compromised in item (1). The types of tax, the periods, and the amounts must be specifically identified.

(4)The total amount you offer must be entered in item (2). The amount must not include any amount which has already been paid or collected on the liability. The amount submitted with the offer is entered in 2(a); the amount is to be paid on acceptance of the offer is entered in (2) (b) and any amount to be paid in installments, is entered in 2(c) in item 2. You should pay the amount of the offer in the shortest time possible, or we will reject your offer. Under no circumstances should the payment extend beyond two (2) years. Interest is due at the legal rate from the date of acceptance to the date of full payment.

(5)You must state in detail in item (9) why the State should accept your offer. Attach additional pages as necessary. Describes in detail why you believe the State cannot collect more than offered from your assets and your present and future income.

(6)The taxpayer(s) must sign and date the offer. If a person other than the taxpayer signs the offer, a power of attorney must be submitted with the offer.

(7)Form

What You Are Agreeing To

Please read the Offer in Compromise Form carefully so that you understand that you are agreeing to:

(1)The period for collection is suspended while the offer is pending, while any amount offered remains unpaid, and for one (1) year after all terms and conditions of the offer are fulfilled.

(2)You won't contest or appeal the amount of the liability if your offer is accepted.

(3)You give up of overpayments (refunds) for all tax periods through the year the offer is accepted, and until the amount of the offer is paid in full.

(4)The collection of the entire tax liability, if you do not comply with all the terms of the offer, i.e. payment, future compliance.

Form Properties

| Fact | Detail |

|---|---|

| Purpose | The West Virginia CD-3 form is designed for taxpayers to offer a compromise to the State Tax Department to settle state tax liabilities, which include taxes, penalties, interest, or additions to tax. |

| Governing Law | West Virginia Code §11-10-5q(c) allows the State Tax Commissioner the authority to compromise tax liabilities. Additionally, interest on balances is governed by W. Va. Code §11-10-17. |

| Payment Terms | Payment terms include an initial payment with the offer, a payment upon acceptance, and an option for monthly payments. Interest accrues on any unpaid balance until paid in full. |

| Requirements and Consequences | Submitting an offer requires detailed financial statements (Forms 433A and/or 433B) and reasons for the compromise. Acceptance hinges on future compliance with state tax laws for five years, and failing to adhere to the agreement allows the State to collect the full unpaid balance or disregard the offer. |

Steps to Filling Out West Virginia Cd 3

Once you've decided an Offer in Compromise with the West Virginia State Tax Department might be a helpful step for resolving your state tax liability, completing the CD-3 form correctly is crucial. This form is your formal proposal to settle your tax debts under specific conditions, and a well-prepared offer increases your chances of acceptance. Here's a step-by-step guide on filling out the West Virginia CD-3 form to ensure you provide all necessary information clearly and accurately.

- Start by entering the Names and Address of the Taxpayer at the top of the form. This includes the full name(s) of the taxpayer(s) making the offer and their current address.

- Fill in the Taxpayer Representative Information section if you have a legal or tax representative. Include their name, address, and phone number.

- Provide your Social Security or Tax Identification Number next to the taxpayer representative section.

- Specify to whom the offer is directed, which in this case is the State Tax Commissioner, and include the Date next to it.

- Enter the Amount of Offer you’re proposing to settle your tax liability in both the designated spots.

- Under the section marked (1), list each Type of Tax, Period you are seeking to compromise, accompanied by the respective amounts of Tax, Interest, Additions, and the Total owed for each period.

- In the section (2), explain how you will pay the total offer amount, including any Initial Payment, Payment upon Acceptance of the offer, and the schedule for any Monthly Payments.

- Review the conditions listed from (3) to (10) under what you are agreeing to by submitting this offer. These include stipulations about prior payments, applying payments, not contesting the liability, and requirements for future tax compliance.

- Complete the declaration statement at the bottom of the form, ensuring that the Name of Taxpayer(s) is printed, followed by the taxpayer’s Signature and the Date.

- If applicable, attach a completed Form 433-A (Collection Information Statement for Individuals) and/or Form 433-B (Collection Information Statement for Business) to support your offer, along with any additional documentation requested in item (9).

After submission, your Offer in Compromise will undergo a review process where the State Tax Department will assess the feasibility of your proposal based on your financial situation and the likelihood of collecting the full amount of the tax liability. Ensure you continue to comply with all tax filing and payment obligations during the review process. Remember, submitting an offer does not guarantee acceptance, but a thoughtful and accurately completed form, supported by concrete evidence of your financial condition, will aid in the evaluation of your proposal.

FAQ

What is the West Virginia CD-3 form?

The West Virginia CD-3 form is used for an Offer in Compromise with the State Tax Department. It allows taxpayers to settle their tax liabilities for less than the full amount they owe under certain conditions. This form is revised as of April 2005 and requires detailed information about the taxpayer, including names, address, social security or tax identification number, and the amount of the offer to compromise the tax liability.

Who can use this form?

The form is designed for taxpayers who believe they will not be able to fully pay their tax liabilities or those who have legitimate doubts about the amount of the tax liability. It is applicable when there are doubts about the collectibility of the full amount owed.

What conditions must be met to submit an Offer in Compromise?

To submit an Offer in Compromise, the following conditions must be met:

- Submission of a detailed offer stating the reason for compromise, which generally relates to doubts about collectibility or liability.

- Completion and inclusion of financial statement forms 433-A and/or 433-B, depending on whether the taxpayer is an individual or a business.

- Agreement to comply with all state tax laws for a period of five years after the offer is accepted.

- Full disclosure under penalty of perjury that the information provided is correct and complete.

What happens after submitting the form?

After submitting the form, the State Tax Department will review the offer considering several factors, including the taxpayer's ability to pay and the State's interest. The taxpayer remains liable for the full amount of the liability unless the offer is accepted in writing by the Commissioner or a delegated official, and there has been full compliance with the terms of the offer.

What are the payment terms under the Offer in Compromise?

The total amount offered to settle the liability must be paid according to the specifics laid out in the form, including an initial payment with the offer, payment upon acceptance, and possibly monthly payments. Interest at the legal rate may accrue on any unpaid balance until it is paid in full.

Can an Offer in Compromise be revoked?

Yes, the State can revoke the Offer in Compromise and collect the entire unpaid balance or disregard the offer and apply all amounts previously paid under the offer against the liability if there is a default in payment or other terms, including failure to comply with future state tax laws.

Are there any special considerations for certain taxpayers?

Yes, taxpayers are expected to provide reasonable documentation to verify their ability to pay. The State Tax Department aims for a compromise in the best interest of both the State and the taxpayer, taking into consideration the potential for future collection of the liability.

Common mistakes

Completing the West Virginia State Tax Department Offer in Compromise Form CD-3 can be complex and requires attention to detail. Mistakes in this process can lead to delays or rejection of the offer. Here are four common errors people make when filling out this form:

- Incorrect Information: One of the most frequent errors is providing incorrect information. This can relate to personal details such as names, addresses, and taxpayer identification numbers. The form explicitly requires accurate data at the top, including for joint liabilities. Inconsistencies or errors in this section can cause confusion and complications in processing the form.

- Failure to List All Liabilities: Another error involves failing to list all tax liabilities comprehensively. Item (1) on the form necessitates a detailed listing of all taxes, periods, and amounts owed. Leaving out any liabilities can result in an incomplete compromise that does not fully address the taxpayer's obligations.

- Inappropriate Payment Terms: The form also specifies that the total amount offered excludes any already paid or collected amounts and requires an initial payment with the offer, a payment upon acceptance, and any installment payments thereafter. Setting payment terms that extend beyond two years, or proposing payments that do not align with the stated conditions can result in the offer’s rejection.

- Inadequate Explanation of Circumstances: Under item (9), the taxpayer must explain why the State should accept their offer. This includes detailing why the State cannot collect more than the offered amount from the taxpayer's assets and future income. A common mistake is not providing a detailed or convincing enough explanation, or failing to attach required documentation such as forms 433-A and/or 433-B. Inadequate reasoning or lack of documentation can undermine the rationale for the compromise, causing the offer to be viewed unfavorably.

To mitigate these issues, it is imperative that taxpayers closely adhere to the form's instructions, provide all necessary information accurately, fully explain their financial situation, and ensure that the payment arrangement proposed is realistic and complies with the guidelines provided by the State Tax Department.

Documents used along the form

When dealing with the complexities of managing tax liabilities, specifically using the West Virginia State Tax Department Offer in Compromise Form CD-3, individuals often have to navigate through additional forms and documents. These documents play a crucial role in ensuring that taxpayers can accurately and effectively negotiate their tax obligations. A well-documented offer showcases a taxpayer's sincere effort to comply with state tax laws and provides a structured path toward resolving tax liabilities. The list below highlights nine critical forms and documents frequently used alongside Form CD-3 to facilitate these processes.

- Form 433-A: Collection Information Statement for Individuals - This document provides detailed information about a taxpayer’s financial situation, including income, expenses, assets, and liabilities. It is essential for assessing an individual’s ability to pay.

- Form 433-B: Collection Information Statement for Businesses - Similar to Form 433-A but specifically designed for businesses, this form captures the financial health and operational expenses of a company, key for determining compromise terms for business tax liabilities.

- Power of Attorney and Declaration of Representative (Form WV-2848): Authorizes a specific individual, such as a tax attorney or accountant, to represent the taxpayer in dealings with the West Virginia State Tax Department, ensuring that expert advice is applied to the negotiation process.

- Form IT-140: West Virginia Personal Income Tax Return - Often reviewed in conjunction with the offer in compromise to ensure that all income has been accurately reported and to gauge the taxpayer's annual financial obligations to the state.

- Form WV/CST-200CU: Combined Sales and Use Tax Return - For businesses making an offer in compromise, this form helps to assess sales and use tax liabilities, critical for understanding the full scope of tax obligations.

- Employment Tax Returns (such as Form WV/UC-A-154): Required for businesses with employees; these forms provide insight into wage-based taxes that might influence the business's overall tax liability and ability to pay.

- Bank Statements and Asset Documentation: Essential for substantiating the financial statements made in Forms 433-A or 433-B, including proof of income, expenses, and the value of assets claimed on these forms.

- Proof of Current Tax Compliance: Documentation that ensures all necessary tax returns have been filed and recent tax obligations have been met, reinforcing the taxpayer’s commitment to compliance.

- Written Agreement to Future Income or Tax Refunds: While not a standardized form, this agreement may be requested to earmark a portion of the taxpayer’s future earnings or tax refunds towards settling the compromised tax liability.

Each document plays a pivotal role in building a comprehensive case for an Offer in Compromise with the West Virginia State Tax Department. By accurately completing and providing pertinent additional documentation, taxpayers increase their chances of a favorable outcome. A thorough understanding and strategic use of these forms ensure that both the taxpayer's interests and the state's requirements are met, leading to equitable tax liability settlements.

Similar forms

The West Virginia Cd 3 form, known officially as the West Virginia State Tax Department Offer in Compromise Form CD-3, serves a particular function in the realm of tax resolution. This form is utilized by taxpayers who wish to settle their tax liabilities for less than the full amount owed under specified conditions. It is designed to propose a compromise to the State Tax Commissioner, detailing the taxpayer's financial situation, the offer to settle the tax liability, and the reasons behind the offered amount. The form is comprehensive and requires a meticulous presentation of the taxpayer's financial condition, including income, expenses, assets, and liabilities.

Similar to the IRS Form 656, the Offer in Compromise, the West Virginia CD-3 form allows taxpayers to propose a settlement for outstanding tax liabilities. Both forms are designed to collect detailed information about the taxpayer's financial situation to assess their ability to pay the debt. The main similarity lies in their purpose: to offer a structured way for taxpayers to negotiate their tax debts and pay a reduced amount that reflects their current financial capabilities. IRS Form 656 also requires a thorough documentation of the taxpayer's finances, including Form 433-A (OIC) for individuals or Form 433-B (OIC) for businesses, much like the CD-3 form, which requires accompanying documentation to substantiate the offer.

Another document closely related to the West Virginia CD-3 form is the Form 433-A (Collection Information Statement for Wage Earners and Self-Employed Individuals) or Form 433-B (Collection Information Statement for Businesses), as applicable in the federal context. While these are not offer forms in themselves, they are integral to the offer-in-compromise process, providing the IRS with detailed information about the taxpayer's financial condition. These forms assess the taxpayer's ability to pay and are a prerequisite for submitting IRS Form 656. In the case of the West Virginia CD-3 form, a similar financial statement is required to support the offer in compromise, illustrating the interconnectedness of these forms in facilitating tax resolution strategies.

Dos and Don'ts

When dealing with the West Virginia CD-3 form for an Offer in Compromise, careful attention to detail can significantly impact the outcome of your application. Here are essential dos and don'ts to consider:

Do:- Ensure all required documentation is attached. The success of your offer heavily depends on the completeness of your submission, including necessary financial statements (Forms 433A and/or 433B) and a detailed statement of facts supporting your offer.

- Accurately list all tax liabilities. Specify the types of taxes, periods, and amounts you aim to compromise clearly in item 1. Accuracy here prevents delays or rejections due to discrepancies or omissions.

- Make a realistic offer. Your offer should reflect the maximum amount reasonably collectible by the State, considering your assets and income. Realism and honesty in your offer can lead to more favorable considerations.

- Understand all terms and conditions. Before submitting, thoroughly review your obligations under the offer, including the agreement to extend the statute of limitations and compliance with future state tax laws for five years post-acceptance.

- Exclude any unpaid tax amounts from your total offer. You must report the complete liability you’re seeking to compromise, excluding previously paid or collected amounts to avoid underestimating your offer.

- Extend payment beyond two years. Propose a settlement plan that allows you to pay off the compromise amount in the shortest time feasible, ideally not extending past two years, to comply with the State's requirements.

- Forget to include detailed reasoning. Simply listing your debts isn't enough; explain why the State would benefit from accepting your offer. This includes a detailed financial situation and how the offered amount is the most the State can expect to collect.

- Omit signatures or required forms. A common oversight that can invalidate your submission is forgetting to sign the offer or attach the power of attorney if applicable. Similarly, ensure both Form 433-A and/or 433-B are thoroughly completed and attached.

Misconceptions

When people hear about the West Virginia CD-3 form, also known as the Offer in Compromise, many misconceptions can arise. These misunderstandings can lead to confusion about the process, the likelihood of acceptance, and the obligations of the taxpayer after submission. Here are seven common misconceptions and clarifications to help shed some light on the process:

- Any taxpayer can easily settle their tax debt for pennies on the dollar. In reality, an Offer in Compromise is intended for situations where there's doubt about the taxpayer's ability to pay the full liability or doubt as to the liability itself. Taxpayers are required to provide detailed financial information to justify their inability to pay in full.

- An Offer in Compromise will stop all collection activities. While it's true that an offer submission may postpone collection efforts, it does not automatically halt them, especially if the state believes the offer was submitted to delay or impede collection.

- The process is fast. The review process for an Offer in Compromise can be lengthy. The state tax department thoroughly examines the taxpayer's financial situation and the feasibility of the offer. Patience and timely compliance with any requests for information are key during this period.

- Acceptance guarantees a fresh start without further obligations. If an offer is accepted, the taxpayer must comply with all tax laws and filing requirements for five years after acceptance; failure to do so could result in the reinstatement of the original tax liability.

- Taxpayers must navigate the process alone. Taxpayers are encouraged to consult with or hire a tax professional or a taxpayer advocate to help them prepare their offer and guide them through the process. The state tax department can also provide assistance and clarification when needed.

- Once an offer is accepted, the terms are non-negotiable. Prior to acceptance, there's usually room for discussion between the taxpayer and the state regarding the terms of the offer. However, once an agreement is reached, the terms must be followed strictly to avoid defaulting on the offer.

- Any refund due to the taxpayer after an offer is accepted will be disbursed to them. Part of the agreement includes the state retaining any refunds or overpayments for tax periods up until the end of the year in which the offer is accepted, and until the offer amount is paid in full. Therefore, taxpayers should not expect any refunds during this period.

Understanding the complexities of the West Virginia CD-3 form and the Offer in Compromise process is crucial for taxpayers considering this route for settling tax liabilities. Dispelling these common misconceptions is the first step toward making an informed decision.

Key takeaways

Filling out and using the West Virginia CD-3 form, an Offer in Compromise (OIC), involves several important considerations for taxpayers looking to settle state tax liabilities. Here are key takeaways to ensure the process is conducted accurately and effectively:

- Submitting an Offer: Taxpayers use the CD-3 form to propose a compromise to settle outstanding state tax debts. This includes taxes, penalties, interest, and additions to tax.

- Reasons for Compromise: The State Tax Department may accept an offer based on either doubt about the liability's validity or doubt about the full amount's collectability.

- Payment Plan: The form requires detailed information on how the taxpayer proposes to fulfill the offered amount, including initial payments, payment upon acceptance, and any monthly installments.

- Non-Refundable Payments: By submitting the offer, taxpayers agree that the state will retain any payments or credits made toward the liability before the offer's submission and any tax refunds due to the taxpayer until the offer amount is fully paid.

- Compliance Terms: Acceptance of an offer necessitates the taxpayer's compliance with all state tax laws, including filing returns and paying taxes for five years after the offer is accepted. Failure to comply may result in the state collecting the full original amount.

- Documentation Requirement: Along with the CD-3 form, taxpayers must submit a completed financial statement (Form 433-A for individuals and/or Form 433-B for businesses) and a detailed explanation justifying the offer.

- Additional Considerations: Even if taxpayers currently have no assets or income, the Department may reject an offer if it believes future collection potential exists within the statutory period. Tax compliance, both past, and future, is a critical component of the offer's acceptance.

Fully understanding and correctly completing the West Virginia CD-3 form is crucial for taxpayers seeking an Offer in Compromise as a resolution to state tax liabilities. This includes clear communication of the payment arrangement, strict adherence to future tax compliance, and provision of thorough documentation to support the offer.

Other PDF Forms

Land Preservation Tax Credit - Both primary credit calculation and an alternative simplified credit calculation methods are available.

Filing Status 3 - For families with low income, the Virginia Schedule ADJ form offers a section to apply for tax credits specific to their financial situation.