Fill Out a Valid West Virginia Estate Template

Embarking on the journey of settling a decedent's estate in West Virginia involves navigating through a comprehensive legal procedure that includes the utilization of specific forms mandated by the state's law. The West Virginia Estate Appraisement and Nonprobate Inventory Forms, supplied alongside thorough instructions by the Tax Account Administration Division of the West Virginia State Tax Department, play a pivotal role in this process for estates of individuals deceased on or after July 13, 2001. This initiative underscores a vital message that upon a person’s passing, an estate comprising their owned property is formed, imposing a necessity for designated representatives—termed as either executors or administrators—to faithfully administer the estate. This administration entails filing an Appraisement and Nonprobate Inventory within a set timeframe, finalizing the decedent’s debts, and judiciously disbursing the remainder property. Additionally, the booklet aims to aid estate representatives across three mandated tasks under West Virginia law: estate administration, inventory filing for all real and probate property, and nonprobate personal property inventory filing. Highlighted steps guide representatives through reading instructions, completing the relevant forms, and correctly submitting them to the appropriate authorities, facilitating a structured approach to estate management. Moreover, the inclusion of various forms, from general information questionnaires to detailed asset inventories and an oath of fiduciary, underscores the effort to ensure a comprehensive appraisal and reporting of the decedent’s estate, thereby adhering to legal protocols and fostering transparency throughout the estate settlement process.

West Virginia Estate Example

West Virginia

EstatE appraisEmEnt & nonprobatE inVEntory

Forms and instructions

his booklet is furnished by the Tax Account Administration Division of the West Virginia State Tax Department for use in iling the Appraisement and Nonprobate Inventory Forms for estates and decedents dying on or after July 13, 2001.

an important mEssagE For EstatE rEprEsEntatiVEs:

When a person dies an estate is created. An estate includes property which the decedent owned. he law requires that someone must administer the estate by iling the Appraisement and Nonprobate Inventory Forms within 90 days of qualiication and completing inal settlement in the decedent’s county of domicile. administration is the process of paying the decedent’s outstanding debts and distributing the remaining property. he person in charge of the administration is called an administrator (if there is no will) or an executor (if there is a will). Also, because the administrator or executor holds a position of trust, a person with either title is often called a iduciary. If there is no will, the decedent is said to have died intestate, and his property passes by statutes called the laws of intestacy. hus you will also see the phrase “transfers by will or intestacy”.

this booklEt is intEndEd to hElp you With thrEE dutiEs

rEquirEd by WEst Virginia laW:

•he administration of the estate (also called the process of probating the estate).

•he iling of an inventory of ALL real estate and probate property with the County Clerk’s Oice using Form ET 6.01 (recorded with the County Clerk’s oice).

•he iling of an inventory of nonprobate personal property with the County Clerk’s Oice using Form ET 6.02 (not recorded with the County Clerk’s oice).

Beginning the legal process to settle the business and personal afairs of a decedent involves a series of steps, outlined below and explained in detail in this booklet:

STEp 1 |

rEAD ThESE INSTruCTIONS. |

STEp 2 |

COmpLETE ApprAISEmENT FOrm ET 6.01. |

STEp 3 |

COmpLETE NONprOBATE INVENTOry FOrm ET 6.02 (IF rEquIrED). |

STEp 4 |

mAIL Or DELIVEr ThE FOrmS TO ThE prOpEr AuThOrITIES |

a more detailed look at these four steps begins on the next page.

WV Estate Appraisement and Nonprobate Inventory – Forms and Instructions – page 1

stEp 1: rEad thEsE instruCtions For Filing Form Et 6.01 and Form Et 6.02.

you should read these introductory instructions completely before beginning any work on the forms. you will notice references to other speciic instructions that also must be understood before completing related parts of the forms.

To qualify as iduciary, a person must visit the oice of the Clerk in the courthouse of the county where the decedent lived. Any person who has an interest may administer the estate. however, the husband or wife of the decedent is given preference and then other distributees (others who are entitled to a share of the estate) are considered. If no distributee applies within thirty days after the date of death, one or more creditors or any other person may be appointed. If there is a will that names an executor, then the named person has the right to serve. In any event, the Clerk is the irst person to visit, and he or she will determine who can qualify as iduciary.

his booklet is designed to help the iduciary administer the estate and ile the Appraisement and Nonprobate Inventory Forms. he iduciary is required under oath to list and appraise on the enclosed Appraisement Form (ET 6.01) all nonprobate and probate real estate and all other probate assets owned by the decedent at its fair market value on the date of the decedent’s death. he iduciary is required to complete the Appraisement and return the original and two (2) copies thereof (with all attachments) to the Clerk within 90 days of qualiication. he original Appraisement, and its attachments, must be recorded by the Clerk.

For every decedent who owned or had an interest in any nonprobate personal property, the iduciary shall, under oath, list and appraise on the enclosed Nonprobate Inventory Form (ET 6.02), all tangible and intangible nonprobate personal property owned by the decedent or in which the decedent had an interest, at its fair market value on the date of the decedent’s death. If a Nonprobate Inventory Form (ET 6.02) is required to be iled, the iduciary must complete the form and return the original to the Clerk within 90 days of qualiication.

stEp 2: ComplEtE Form Et 6.01

part 1: general information Questionnaire. his information is used to establish that an estate actually does exist, and to provide the information necessary for the Clerk and the State Tax Department to process the appraisement, determine if the estate is subject to Estate Tax, and approve the inal distribution and closing of the estate.

Question instructions for form et 6.01

ABe sure to include the decedent’s complete name. Any other names by which the decedent was known should be shown after the complete name.

CBe sure to write the date of death as shown on the decedent’s death certiicate.

address to which he would return if released from the care facility.

Ihe Internal revenue Service requires the iling of a Federal Estate Tax return (Form 706) for the estate of every citizen of the united States whose gross estate at the time of death was larger than the amount of the federal exemption equivalent. he exemption equivalents are:

year of death |

Exemption Equivalent |

2004 through 2005 |

$1,500,000 |

2006 through 2008 |

$2,000,000 |

2009 |

$3,500,000 |

2010 through 2011 |

$5,000,000 |

2012 |

$5,120,000 |

2013 |

$5,125,000 |

2014 |

$5,340,000 |

|

|

For further information concerning federal estate tax requirements, contact your local IrS oice or call their

L & m Be sure to provide the complete mailing address and phone number for both the iduciary and preparer. If the address or phone number shown is incorrect or incomplete, it may be diicult to contact you if additional information is necessary to process the appraisement.

part 2: Questionnaire of nonprobate real estate. Nonprobate real estate includes any real estate that does not pass by the will or the laws of intestacy. his includes real estate jointly held with right of survivorship, real estate held under a trust agreement or contract, life estates, or powers of appointment. his real estate passes directly to the speciied persons at the date of death according to these speciic terms and thus is not subject to administration, but is included in the gross estate for estate tax purposes. If there is any nonprobate real estate, additional information is required to be furnished as part of the appraisement to fully describe the transfer, including the type of transfer, recipient and relationship to the decedent, and the description and value (as of the date of death) of the transferred property. he Inventory of Nonprobate real Estate is included with this booklet for your convenience. he appraisement is incomplete if the iduciary fails to include this information. also, you must provide the description of all out of state real estate, including the appraised value.

Note: Oil, gas, coal and other natural resource holdings are considered as real estate for the purpose of this inventory. hese holdings should be listed either on part 2 as nonprobate real estate, or on Schedule A of part 4 as probate real estate.

part 3: summary of probate assets. All probate assets (assets in decedent’s name only) must be on record at the Clerk’s oice prior to being transferred to the heir or beneiciary. his property will be transferred under the terms of the decedent’s will, or under the laws of intestacy if the decedent died without a will. until the assets are transferred, they are required to be managed (administered) by the iduciary. probate assets are to be described

WV Estate Appraisement and Nonprobate Inventory – Forms and Instructions – page 2

in detail in part 4 of the appraisement; the total value of each type of property will then be entered in part 3.

part 4: inventory of probate assets. A complete description of ALL probate assets is to be provided in part 4. real property should include the description used on the real property tax tickets as to county, district, and physical location and description of the property. he personal representative must list the value of each probate asset at the date of the decedent’s death. Total the values of all property shown in each schedule of part 4 and enter the total on the appropriate line of part 3 (Summary of probate Assets).

sChEdulE a: INCLuDE the clear legal description of any rEAL ESTATE. he description must provide suicient information to identify the property and include, where applicable, the county, district and lot size (number of acres). Include the assessed value of the real estate as shown on the decedent’s property tax receipt. If the decedent has been given the homestead Exemption, the full assessed value (without the deduction for homestead Exemption) must be shown. Include the full appraised value of the decedent’s interest in the real estate. When the decedent owned a fractional interest, list the full value of only his or her share (for example “½ interest $000.00). he appraised value must be the mArKET VALuE as of the date of death. market value is deined as the price a willing buyer would pay willing seller for the property. his value must be used regardless of whether the property will be kept or sold by the beneiciaries. he date the property was acquired by the decedent should also be shown. also, you must provide the description of all out of state real estate, including the appraised value.

Note: Oil, gas, coal and other natural resource holdings are considered as real estate for the purpose of this inventory. hese holdings should be listed on Schedule A of part 4 as probate real estate, or on part 2 as nonprobate real estate.

IF ThE DECEDENT OWNED rEAL ESTATE IN mOrE ThAN ONE COuNTy, an appraisement containing the description of the property must be iled in each county where real estate is located. he various counties should all be listed in part 1: General Information questionnaire (question h).

sChEdulE b: INCLuDE the type and market value of all TANGIBLE pErSONAL prOpErTy. Tangible personal property consists of assets which you can touch, that is, which can be possessed physically, including goods, wares, merchandise, furniture, personal efects, and automobiles.

sChEdulE C: INCLuDE all bonds and securities OThEr than corporate stock, the date of purchase and market value as of the date of death.

sChEdulE d: INCLuDE corporate stock of every kind. List the name of the company, the number of shares, value per share and the total market value of the decedent’s interest as of the date of death. place a check mark in the “CLOSELy hELD” column if the corporation is NOT listed on a stock exchange.

sChEdulE E: INCLuDE any intangible personal property (cash, bank accounts, certiicates of deposit, notes, accounts receivable, etc.) owned by the decedent. Show a description of the property and include the market value as of the date of the decedent’s death.

sChEdulE F: INCLuDE any other assets by the decedent at the time of death EXCEpT those reported on the NONprOBATE INVENTOry FOrm (ET 6.02) of the estate. If the decedent had life insurance policies payable to the estate (rather than to individual beneiciaries), they must be included on this schedule.

part 5: beneiciaries. A complete list of the individuals who will inherit under the terms of the will, or through the laws of intestacy, is required. he relationship of each recipient to the decedent must also be provided.

part 6: oath of fiduciary. his oath must be completed in the presence of a notary. It is a sworn statement that the iduciary has made every efort to completely list and describe the assets of the estate. he signature of the iduciary and the notary must be aixed to the original appraisement. An appraisement which does not have original signatures will not be accepted by the Clerk. After completion of this oath, the iduciary must obtain two (2) complete copies and deliver the appraisements to the proper authorities, who will complete the remaining parts.

part 7: approval of fiduciary Commissioner/fiduciary supervisor. he Fiduciary Commissioner or Fiduciary Supervisor will complete and sign the appraisement in this section after he determines it to be accurate and complete.

part 8: Clerk of the County Commission. he Clerk will complete this section when the appraisement is recorded.

stEp 3: ComplEtE Form Et 6.02 (iF rEquirEd). For every decedent who owned or had an interest in any nonprobate personal property, the iduciary shall, under oath, list and appraise on the enclosed Nonprobate Inventory Form (ET 6.02), all tangible and intangible nonprobate personal property owned by the decedent or in which the decedent had an interest, at its fair market value on the date of the decedent’s death. he nonprobate personal property to be included on the Nonprobate Inventory Form includes: 1) personal property held as joint tenants with right of survivorship; 2) personal property payable on death to others; 3) personal property held by the decedent as a life tenant; 4) life insurance to named beneiciaries; 5) powers of appointment; 6) annuities; 7) transfers during the decedent’s life; 8) transfers in trust; 9) taxable gifts; and 10) all other nonprobate personal property includible in the federal gross estate of the decedent.

he iduciary is required to make the Nonprobate Inventory Form available for inspection by or disclosure to: 1) any heir at law or beneiciary under the will; 2) a creditor who has timely iled a claim against the estate with the iduciary commissioner or iduciary supervisor; 3) any party who has iled a civil action in any court of competent jurisdiction in which any assets of the decedent is in issue; or 4) the attorney for the estate or its personal representative or the

part 1: general information Questionnaire. Be sure to complete the General Information questionnaire of the NONprOBATE INVENTOry FOrm. his information should be the same as reported on the Appraisement.

part 2: Questionnaire of nonprobate personal property. Answer each question in this summary. If a question does not

WV Estate Appraisement and Nonprobate Inventory – Forms and Instructions – page 3

apply to the decedent, mark the “NO” box and enter zero for the market value for that line. For any “yES” answer, remember to complete part 3, Inventory of Nonprobate personal property. Be sure to enter the total of ALL nonprobate personal property on line 11 of part 2.

part 3: inventory of nonprobate personal property. For each “yES” answer in part 2, you must provide in part 3 the property description, the name(s) of the person(s) receiving the property and their relationship to the decedent, and the fair market value at the date of death.

part 4: oath of fiduciary. his oath must be completed in the presence of a notary. It is a sworn statement that the iduciary has made every efort to completely list and describe the assets of the estate.

stEp 4: mail or dEliVEr thE Forms to thE propEr authoritiEs

in counties where there is a fiduciary supervisor, the iduciary must deliver an original completely executed appraisement and two (2) copies thereof (including any attachments) to the Fiduciary Supervisor. he Fiduciary Supervisor will in turn deliver an original and one (1) copy of the appraisement to the Clerk’s oice after completing part 7. After completing part 8, the Clerk will admit the original appraisement (and its attachments) to record.

incountieswherethereisnofiduciarysupervisor,theiduciary must deliver an original completely executed appraisement and two (2) copies thereof (including any attachments) to the Clerk’s oice. After completing part 8, the Clerk will admit the original appraisement (and its attachments) to record and forward one

(1)copy of the appraisement to the Fiduciary Commissioner (if reference to a Fiduciary Commissioner is required).

he Fiduciary Commissioner or Fiduciary Supervisor cannot assist you in the preparation of a tax return (if one is required) or of any other report on which he must eventually pass judgment. he is also prohibited from practicing law in connection with an estate that has been referred to him (West Virginia Code

he following statements and deinitions are provided to help you understand the questions asked on Form ET 6.01 and Form 6.02.

power of appointment is authority conferred by one person (called the “donor”) by deed or will upon another (called the “donee”) to select the person who is to receive and enjoy real or personal property after the death of the donor or the donee, or after the termination of an existing right or interest.

gifts made Within hree years prior to date of death may be presumed to have been made in contemplation of death and must be listed.

life Estate means the decedent during his lifetime transferred real property by deed, grant, sale or gift but reserved an interest in the property for the remainder of his lifetime. If the recipient did not pay an appropriate consideration for the transfer of the remainder interest, the entire date of death value must be listed for estate tax purposes. If the decedent was granted a life estate or dower interest in real property, the life estate or dower interest expires at death and has no value for estate tax purposes. however, this property should still be listed to clear title.

right of survivorship means that the decedent’s share of the property automatically goes to the remaining owner(s) after his death. he entire market value of survivorship property must be listed with no exclusions or deductions.

payable on death means an asset owned by the decedent which is paid to another at the time of the decedent’s death.

If the decedent transferred assets to a trust during his lifetime, a complete inventory (with the market values) of the assets must be included.

Transfers due to the terms of an annuity, investment contract, or pension plan payable on account of death to named beneiciaries, or to a trust for the beneit of any individual must be listed. he value listed should be the date of death lump sum value of the annuity, available by contacting the sponsoring company.

IF yOu hAVE quESTIONS, INFOrmATION rEGArDING SpECIFIC CIrCumSTANCES IS AVAILABLE FrOm ThE CLErK OF ThE COuNTy COmmISSION, FIDuCIAry COmmISSIONEr, Or FIDuCIAry SupErVISOr. yOu mAy ALSO NEED TO CONTACT AN ATTOrNEy, ACCOuNTANT Or TruST OFFICEr FOr mOrE INFOrmATION.

WV Estate Appraisement and Nonprobate Inventory – Forms and Instructions – page 4

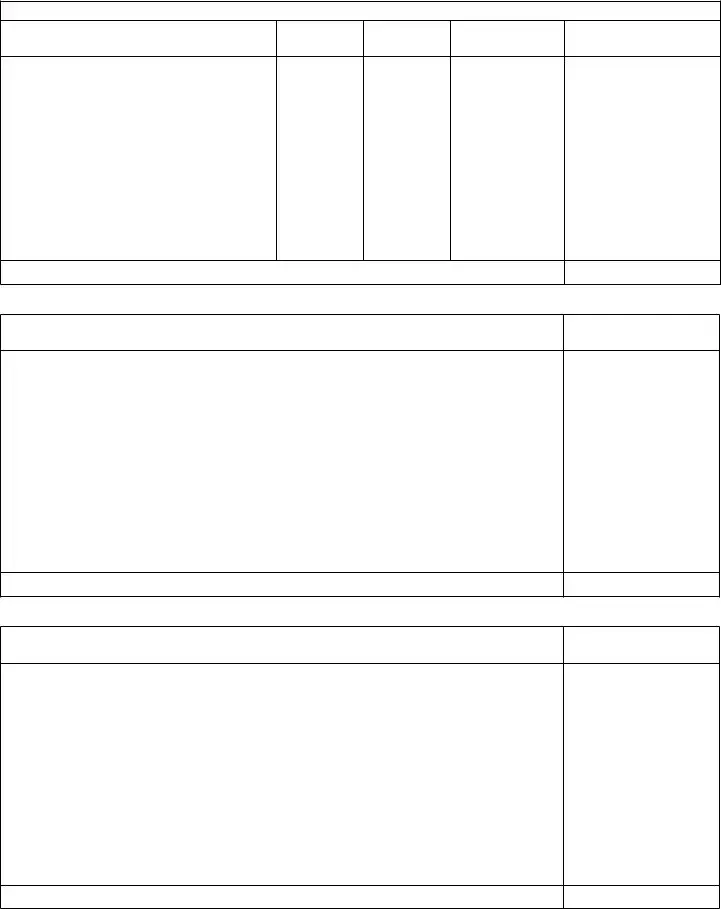

Form ET 6.01 |

ApprAisement of the estAte |

Rev. 06/14 |

for DeceDents Dying on or After July 13, 2001 |

|

|

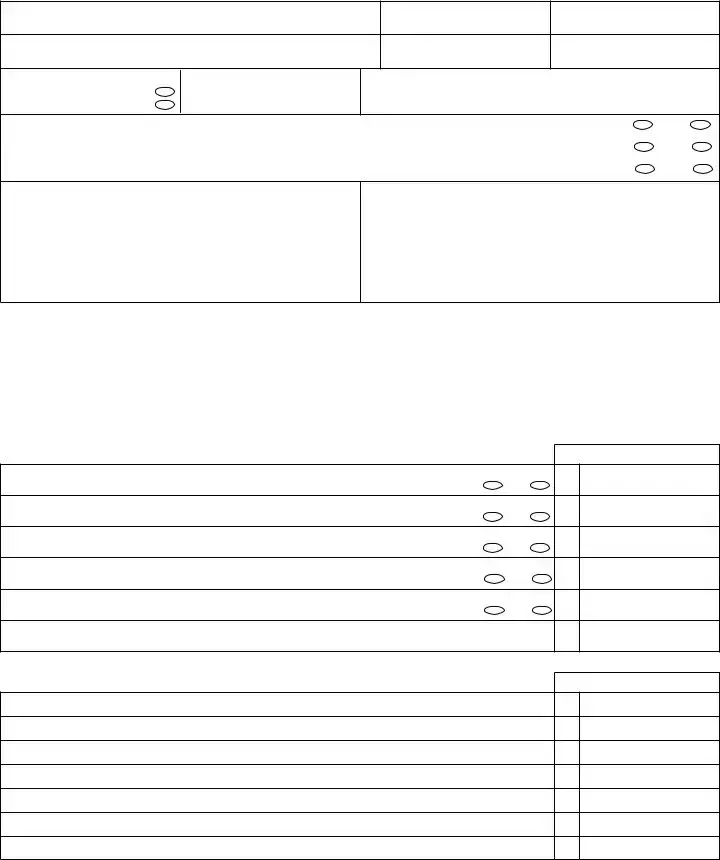

pArt 1: generAl informAtion QuestionnAire

A. Decedent’s Name

B. Social Security Number

C. Date of Death

D. Decedent’s Residence at Death

E. State

F. County

G. Marital Status at Death |

Name of Surviving Spouse |

Married |

|

Single, Widow(er) or Divorced |

|

H. West Virginia Counties Where Decedent Held Real Estate.

I. Will this estate be required to ile a Federal Estate Tax Return form 706 (see instructions on page 2)? |

YES |

NO |

|

|

|

J. Will this estate be required to ile the nonprobate inventory form et 6.02 (see instructions on page 3)? |

YES |

NO |

|

|

|

K. Did the Decedent leave a Will? |

YES |

NO |

L. Fiduciary’s Name and Mailing Address (include zip code)

________________________________________________

________________________________________________

________________________________________________

________________________________________________

Fiduciary’s Phone Number:

M. Preparer’s Name and Address CPA  Attorney

Attorney

________________________________________________

________________________________________________

________________________________________________

________________________________________________

Preparer’s Phone Number:

pArt 2: QuestionnAire of nonprobAte reAl estAte

Answer each of the following questions concerning the decedent’s interest in NONPROBATE REAL ESTATE.

if you answer “yes” to any question below, you must complete the attached inventory of nonprobate real estate provided with this form which shows:

a.the type of transfer(s) with reference to the question number below;

b.name(s) of the person(s) with an interest in the real estate as joint tenant or transferee;

c.relationship to the decedent of ALL above named persons;

d.market value at the date of death; and

e.description of the real estate including assessed value.

|

|

|

|

mArket VAlue |

1. |

Did the decedent own an interest in any real estate as joint tenant with right of survivorship? |

YES |

NO |

1 |

2. |

Did the decedent transfer an interest in any real estate without adequate consideration within three years prior to |

|

|

|

|

date of death? |

YES |

NO |

2 |

3. |

Did the decedent own an interest in any real estate in an inter vivos trust (living trust) arrangement or in which the |

|

|

|

|

decedent retained the right of use and enjoyment? |

YES |

NO |

3 |

4. |

Did the decedent own an interest in any real estate in which the decedent retained a power of appointment, |

|

|

|

|

whether special or general? |

YES |

NO |

4 |

5. |

Did the decedent own an interest in any real estate as a life estate including a dower interest? |

YES |

NO |

5 |

6. |

ToTal value of nonprobaTe real esTaTe (add lies 1 through 5 above) |

|

6 |

|

pArt 3: summAry of probAte Assets |

|

|

|

|

Complete PART 4 irst. Enter the total from each schedule of PART 4 on the appropriate line below. |

mArket VAlue |

|||

1. |

Schedule A: Real estate or any interest therein |

|

1 |

|

2. |

Schedule B: Tangible personal property of every kind |

|

2 |

|

3. |

Schedule C: Government bonds and securities of every kind |

|

3 |

|

4. |

Schedule D: Shares of corporate stock of every kind |

|

4 |

|

5. |

Schedule E: Money, certiicates of deposit, notes, accounts, etc |

|

5 |

|

6. Schedule F: All other assets not hereinbefore mentioned |

|

6 |

||

7. ToTal value of probaTe asseTs (add lines 1 through 6 above) |

|

7 |

||

Form ET 6.01 |

West Virginia State Tax Department |

Page 1 |

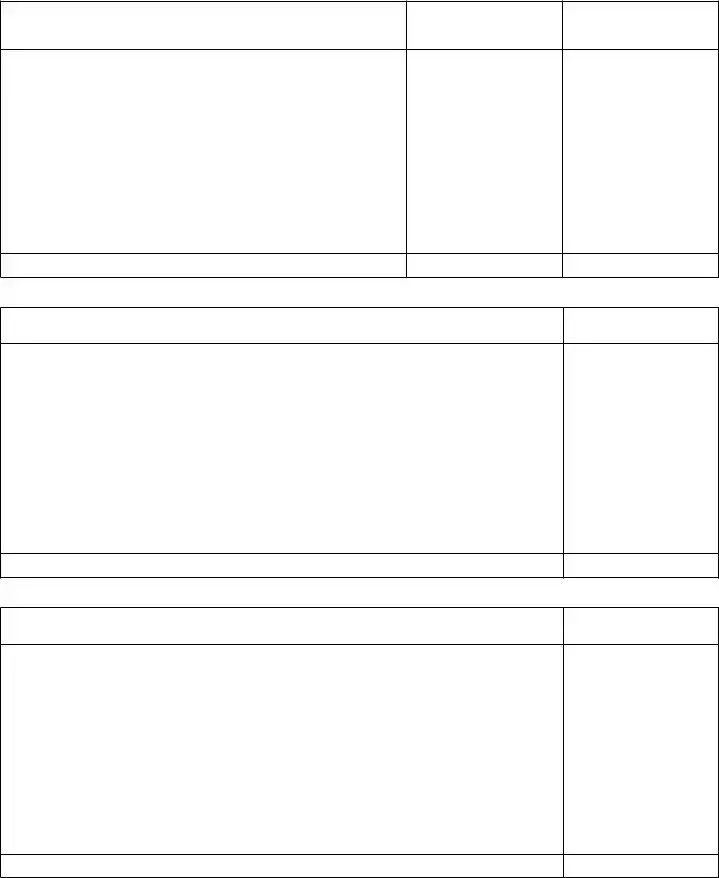

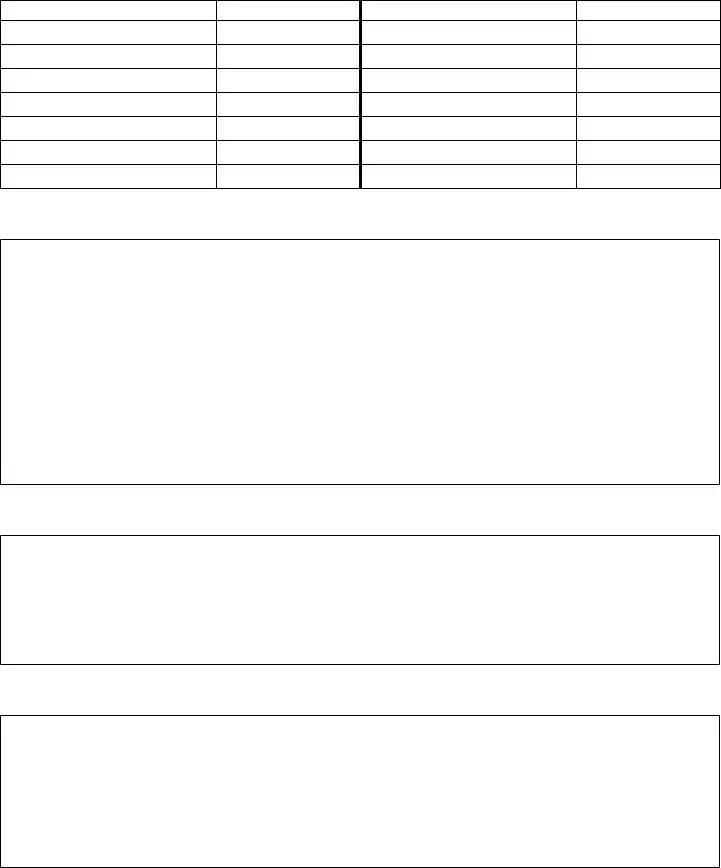

pArt 4: inVentory of probAte Assets – trAnsfers by Will or intestAcy After completing PART 4, enter the total from each schedule on the appropriate line in PART 3.

scheDule A: Describe any real estate or any interest in real estate. Include description and appraised value of out of state property, but do not include this amount in the total. See page 3 of the instructions.

AssesseD

VAlue

ApprAiseD

VAlue

totAl (enter the total appraised value on line 1 of PART 3)

scheDule b: Tangible personal property of every kind. See page 3 of the instructions.

ApprAiseD

VAlue

totAl (enter the total appraised value on line 2 of PART 3)

scheDule c: Bonds and securities of every kind. See page 3 of the instructions.

ApprAiseD

VAlue

totAl (enter the total appraised value on line 3 of PART 3)

Form ET 6.01 |

West Virginia State Tax Department |

Page 2 |

pArt 4 (continued)

scheDule D: Corporate stock of any kind. See page 3 of the instructions.

nAme of the compAny

closely

helD

number

of shAres

mArket VAlue

per shAre

totAl

mArket VAlue

totAl (enter the total market value on line 4 of PART 3)

scheDule e: Money, bank accounts, certiicates of deposits, notes, accounts receivable, etc. Show dates of notes. See page 3 of instructions.

ApprAiseD

VAlue

totAl (enter the total appraised value on line 5 of PART 3)

scheDule f: All other assets, not hereinbefore mentioned, including insurance payable to the estate. See page 3 of the instructions.

ApprAiseD

VAlue

totAl (enter the total appraised value on line 6 of PART 3)

Form ET 6.01 |

West Virginia State Tax Department |

Page 3 |

pArt 5: beneficiAries. List the names and relationships of all beneiciaries or heirs of the estate. Show the age of any life tenant after their name. See page 3 of the instructions.

beneficiAry or heir

relAtionship

beneficiAry or heir

relAtionship

pArt 6: oAth of fiDuciAry

State of _______________________________________ County of ______________________________________,

I, __________________________________, iduciary for the estate of __________________________________________

after diligent effort to ascertain the taxable property of this estate, have made answers to each of the questions and have completed, in detail, the schedules for each category of property and believe each item thereof to be correct. I thereby believe the foregoing to be the true and lawful appraisement of ALL real estate and probate property of the estate of the above named decedent.

___________________________________________________________

Fiduciary

Subscribed and sworn to before me this ____________ day of _______________________, 20________

___________________________________________________________

Notary Public

My Commission expires _________________, 20________

pArt 7: ApproVAl of fiDuciAry commissioner/fiDuciAry superVisor

I, ________________________, Fiduciary Commissioner/Fiduciary Supervisor of ___________________________ County,

West Virginia, to whom the estate of the above named decedent was referred, do hereby approve the foregoing appraisement of such estate.

Given under my hand this ___________ day of _________________________, 20______________

________________________________________________ |

By ______________________________________________ |

Fiduciary Commissioner/Fiduciary Supervisor |

Deputy |

pArt 8: clerk of the county commission

STATE OF WEST VIRGINIA

COUNTY OF _________________________________,

In the Clerk’s ofice of _____________________ County on the ________ day of ______________________, 20__________,

the forgoing appraisal of the above named decedent was presented and upon motion admitted to record. Attest___________________________________________, Clerk

By____________________________________________, Deputy

Form ET 6.01 |

West Virginia State Tax Department |

Page 4 |

Decedent’s Name: ____________________________________________________________________________________________

inVentory of nonprobAte reAl estAte

If you answered “YES” to any question under PART 2: QUESTIONNAIRE OF NONPROBATE REAL ESTATE, show the following on this page:

a.the type of transfer(s) with reference to the question number in PART 2;

b.name(s) of the person(s) with an interest in the real estate as joint tenant or transferee;

c.relationship to the decedent of ALL above named persons;

d.market value at the date of death; and

e.description of the real estate including assessed value.

Form ET 6.01 |

West Virginia State Tax Department |

Page 5 |

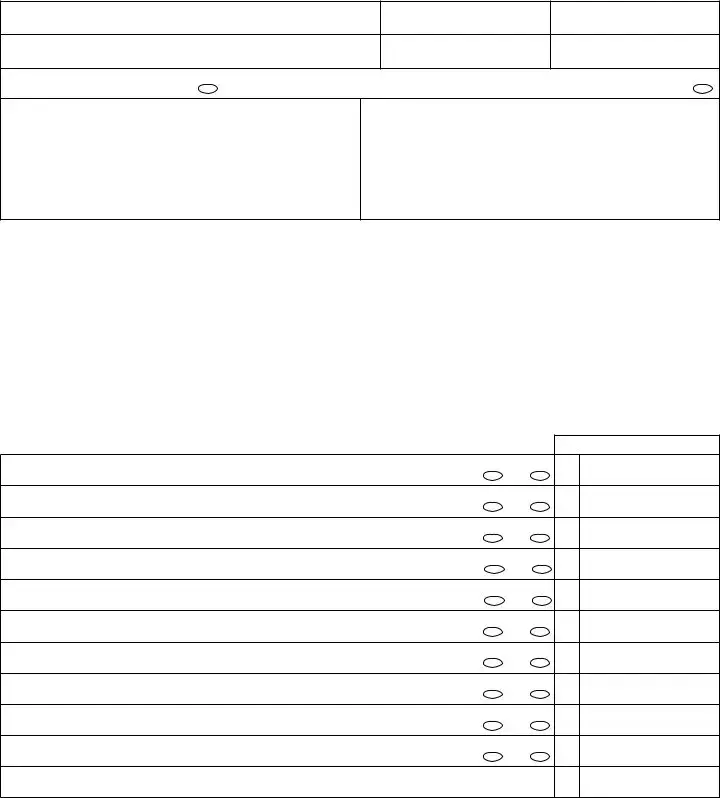

Form ET 6.02 |

nonprobAte inVentory of the estAte |

Rev. 06/14 |

for DeceDents Dying on or After July 13, 2001 |

|

|

pArt 1: generAl informAtion QuestionnAire

A. Decedent’s Name

B. Social Security Number

C. Date of Death

D. Decedent’s Residence at Death

E. State

F. County

G. Marital Status at Death Married |

Name of Surviving Spouse _________________________ Single, Widow(er) or Divorced |

H. Fiduciary’s Name and Mailing Address (include zip code)

________________________________________________

________________________________________________

________________________________________________

________________________________________________

Fiduciary’s Phone Number:

I. Preparer’s Name and Address CPA  Attorney

Attorney

________________________________________________

________________________________________________

________________________________________________

________________________________________________

Preparer’s Phone Number:

pArt 2: QuestionnAire of nonprobAte personAl property

Answer each of the following questions concerning the decedent’s interest in NONPROBATE PERSONAL PROPERTY. Nonprobate personal property means all property which does not pass by operation of the decedent’s will or by the laws of intestate descent and distribution or is otherwise not subject to administration in a decedent’s estate.

Note: All real estate and probate property are to be reported on the Appraisement of the Estate (ET 6.01) iled with the County Commission.

if you answer “yes” to any question below, you must complete pArt 3 of this form which shows:

a.the type of transfer(s) with reference to the question number below;

b.name(s) of the person(s) with an interest in the property as joint tenant or transferee;

c.relationship to the decedent of ALL above named persons;

d.market value at the death; and

e.description of the property.

mArket VAlue

1. |

Did the decedent possess any powers of appointment? |

YES |

NO |

1 |

2. |

Did the decedent make any gifts or transfers without adequate consideration within three years prior to the date |

|

|

|

|

of death? |

YES |

NO |

2 |

3. |

Did the decedent make any transfers in Trust which passed to others upon his death? |

YES |

NO |

3 |

4. |

Did the decedent own any stock, bonds, bank accounts, certiicates of deposit or other personal property as a |

|

|

|

|

joint tenant with the right of survivorship? |

YES |

NO |

4 |

5. |

Did the decedent own any life insurance policies to named beneiciaries? |

YES |

NO |

5 |

6. |

Did the decedent own any annuities? |

YES |

NO |

6 |

7. |

Did the decedent own an interest in any personal property as a life tenant? |

YES |

NO |

7 |

8. |

Did the decedent own any personal property which was payable on death to others? |

YES |

NO |

8 |

9. |

Did the decedent ile any Federal Gift Tax Returns with the IRS or make any taxable gifts under Federal Gift Tax |

|

|

|

|

law or regulations? |

YES |

NO |

9 |

10. Did the decedent own any other nonprobate personal property includible in the federal gross estate of |

|

|

|

|

|

a decedent? |

YES |

NO |

10 |

11. ToTal value of nonprobaTe personal properTy (add lines 1 through 10 above) |

|

11 |

||

Form ET 6.02 |

West Virginia State Tax Department |

Page 1 |

Form Properties

| # | Fact | Detail |

|---|---|---|

| 1 | Governing law | West Virginia State Tax Department, following laws effective for decedents dying on or after July 13, 2001. |

| 2 | Form requirement | Completion of the Appraisement and Nonprobate Inventory Forms within 90 days of fiduciary qualification. |

| 3 | Objective | Administration of the estate, including filing an inventory of all real and probate property and nonprobate personal property. |

| 4 | Eligibility for Fiduciary | Any interested person may administer the estate, with preference given to spouses and then other distributees. |

| 5 | Filing Procedure | The fiduciary must file original and copies of appraisements with the Clerk in the decedent’s county of domicile. |

| 6 | Nonprobate property inclusion | Includes tangible and intangible property not solely owned by the decedent or contractually designated. |

| 7 | Federal Estate Tax | Necessitates filing IRS Form 706 if the gross estate exceeds federal exemption equivalents, varying by year of death. |

| 8 | Asset Description and Valuation | Requires detailed descriptions of probate and nonprobate assets, their fair market value at the date of the decedent’s death. |

Steps to Filling Out West Virginia Estate

After the loss of a loved one, settling their affairs can feel overwhelming. In West Virginia, one of the first steps in this process is completing the Estate Appraisement and Nonprobate Inventory forms. These forms ensure that both probate and nonprobate assets are accounted for. Probate assets are those owned solely by the decedent, while nonprobate assets might include things owned jointly or designated to pass directly to a beneficiary on the decedent's death. The following guidelines will assist in filling out the required forms accurately and efficiently, helping to streamline the initial stages of estate administration.

- Read the instructions carefully for both Form ET 6.01 and Form ET 6.02 provided in the booklet. Understanding the instructions thoroughly before starting will help avoid any mistakes or missed sections.

- Complete Form ET 6.01 - Appraisement.

- Part 1: Fill in the General Information Questionnaire, including the decedent's full name, social security number, date of death, residence at death, state, county, marital status, name of surviving spouse if applicable, and whether the estate will require filing a Federal Estate Tax Return.

- Part 2: Answer questions regarding nonprobate real estate. If any response is "YES," complete the attached inventory with details such as type of transfer, names and relationships of persons with an interest in the real estate, market value at the date of death, and a description of the real estate.

- Part 3: Fill out the Summary of Probate Assets. For each schedule in Part 4, enter the total value of the probate assets.

- Part 4: Inventory of probate assets including details for Schedule A (Real Estate), Schedule B (Tangible Personal Property), Schedule C (Government Bonds and Securities), Schedule D (Shares of Corporate Stock), Schedule E (Money, CDs, Notes, Accounts, etc.), and Schedule F (Other Assets).

- Part 5: List the beneficiaries, their relationships to the decedent, and the specific assets they are to inherit.

- Part 6: Complete the Oath of Fiduciary in the presence of a notary affirming the accuracy of the appraisement.

- Parts 7 and 8 will be completed by the Fiduciary Commissioner/Fiduciary Supervisor and the Clerk of the County Commission, respectively, after you submit the form.

- Complete Form ET 6.02 - Nonprobate Inventory (if required).

- Part 1: Fill out the General Information Questionnaire similar to Form ET 6.01 to ensure consistency between both forms.

- Part 2: Provide a summary of nonprobate personal property. For each "YES" response, remember to fill out the details in Part 3.

- Part 3: Inventory of nonprobate personal property, noting the description, recipient names and their relationship to the decedent, and the fair market value at the date of death.

- Part 4: Complete the Oath of Fiduciary before a notary, as done in Form ET 6.01.

- Mail or deliver the forms to the proper authorities. If your county has a fiduciary supervisor, submit the original and two copies of Form ET 6.01, including attachments, to the Fiduciary Supervisor. The supervisor will forward them to the Clerk’s office. If there’s no fiduciary supervisor, submit them directly to the Clerk’s office. For Form ET 6.02, follow the instructions provided in the booklet regarding submission.

While the process may seem daunting, each step completed brings you closer to settling the decedent's affairs properly. Should you have questions or encounter specific circumstances not covered in the instructions, consider reaching out to the Clerk of the County Commission, a Fiduciary Commissioner, or a professional advisor for assistance. Remember, you are not alone in this process, and there are resources available to help you navigate these responsibilities.

FAQ

This FAQ section is designed to provide clear and comprehensive answers to common questions related to the West Virginia Estate Appraisement & Nonprobate Inventory Forms. Please review these questions and answers carefully to assist you in the estate administration process for decedents dying on or after July 13, 2001.

What purpose do the West Virginia Estate Appraisement and Nonprobate Inventory Forms serve?

These forms are crucial in the process of administering an estate, which includes identifying, valuing, and ultimately distributing or settling the decedent's assets. Form ET 6.01 captures all real estate and probate property, and must be filed with the County Clerk's Office. Form ET 6.02, which is also filed with the County Clerk's Office but not recorded, details nonprobate personal property. Together, these forms ensure a comprehensive appraisal of the decedent's estate according to West Virginia law.

Who is required to file these forms?

The responsibility falls to the estate's fiduciary, which may be an executor or administrator. This individual is appointed to oversee the estate's settlement process, including the listing and appraisal of property at its fair market value on the date of the decedent's death. The role entails significant trust, as it involves handling the decedent's affairs with rigor and integrity.

What is the timeline for filing the Appraisement and Nonprobate Inventory Forms?

These forms must be submitted within 90 days of the fiduciary's qualification date. Timely filing is critical to comply with the legal process and to facilitate the orderly settlement of the estate.

What if there is no will?

If the decedent did not leave a will, the estate is considered intestate. West Virginia laws of intestacy will then dictate how the estate's assets are distributed. In such cases, the court may appoint an administrator to handle the estate's affairs.

What is included in the Nonprobate Inventory Form (ET 6.02)?

The Nonprobate Inventory includes a wide range of personal property not directly controlled by the will or passing under probate. Such items may include assets held in joint tenancy, life insurance payable to beneficiaries other than the estate, and assets held in trusts, among others. This ensures a complete inventory of all assets that were owned or had interest in by the decedent at their time of death.

Is the completion of both forms necessary for all estates?

Yes, it is necessary if the decedent owned both probate and nonprobate assets. The administration and accurate completion of both forms are essential steps in fulfilling your duties as fiduciary, allowing for a thorough and lawful estate settlement process.

What happens if the forms are not filed within the stipulated timeframe?

Failure to file within the required 90-day period can lead to complications, including delays in the estate's settlement and possible legal repercussions for the fiduciary. It's vital to adhere to the timeline to ensure the smooth progression of estate administration.

How can a fiduciary determine the fair market value of the decedent's assets?

The fair market value is the price a willing buyer would pay a willing seller, with neither being under any compulsion to buy or sell. This valuation must reflect the asset's worth on the date of the decedent's death. Fiduciaries may need to consult with professional appraisers or evaluators for accurate assessments, especially for real estate and personal property of significant value.

Who can assist with completing these forms?

Fiduciaries may seek assistance from professionals such as attorneys, accountants, or trust officers, especially for aspects of estate management that require specialized knowledge. However, it is important to note that the Fiduciary Commissioner or Fiduciary Supervisor cannot assist in preparing tax returns or other documents on which they must pass judgment.

Common mistakes

Not reading the instructions carefully before beginning. The West Virginia Estate form comes with detailed instructions that need to be understood completely before any work on the forms begins. Skipping this step can lead to errors in filling out the form, as people may miss out on crucial information.

Failing to list and appraise all nonprobate and probate property accurately. Executors must include all real estate and other probate assets at their fair market value as of the decedent’s date of death. An incomplete or inaccurate appraisal can lead to problems down the line, such as disputes among beneficiaries or issues with tax authorities.

Incorrectly completing the General Information Questionnaire. This is the foundation of the entire form, providing necessary information for processing the appraisement. People often make the mistake of not providing complete names, incorrectly stating the date of death, or providing incorrect domicile information, leading to processing delays.

Omitting information about nonprobate real estate in Part 2. Nonprobate real estate, which passes directly to specified persons at the date of death according to specific terms, must be fully described in the appraisement. Failure to include this information can result in an incomplete appraisal and potential legal complications.

Forgetting to list all probate assets in detail in Part 4. Every probate asset must be described in detail, including the location and description of real property and the value of each asset at the date of the decedent's death. This common mistake can lead to underreporting the estate's value.

Not obtaining or improperly completing the oath of fiduciary. This sworn statement is a critical component of the form, affirming that all assets of the estate have been listed and described. A missing or incorrectly completed oath can invalidate the entire appraisement.

These mistakes can create significant challenges in the probate process, potentially leading to legal disputes or delays in distributing the estate. Executors and estate representatives should approach the task with careful attention to detail and consult with professionals if they encounter uncertainties during the process.

Documents used along the form

Establishing an estate involves more than filing the West Virginia Estate Appraisement & Nonprobate Inventory Forms. Often, multiple documents are required to accurately and thoroughly manage an estate’s affairs, providing clarity and legal standing for the diverse aspects involved in estate administration. For both the executor and the beneficiaries, understanding these documents can streamline the process, ensuring all legal and financial obligations are met. Below is a curated selection of additional forms and documents commonly used alongside the West Virginia Estate Form, each serving a unique function in the estate planning and settlement process.

- Last Will and Testament: This document specifies the decedent's final wishes regarding the distribution of their property and the care of any minor children.

- Trust Documents: Trusts can be established for various purposes, including avoiding probate, reducing estate taxes, or managing assets for minor beneficiaries.

- Death Certificate: A legal document issued by the government certifying the death's date, location, and cause, required for many estate settlement processes.

- Letter of Administration: Issued by the court when there is no will, it authorizes the administrator to settle the decedent’s estate according to the state laws of intestacy.

- Durable Power of Attorney: A document that allows an individual to appoint someone to make decisions on their behalf should they become incapacitated before their death.

- Beneficiary Designations: Forms that specify who will receive assets that do not pass through the will, such as retirement accounts and life insurance policies.

- Letter of Instruction: An informal document providing the executor with additional information and personal wishes that are not included in the will.

- Inventory of Assets: A comprehensive list of all assets owned by the decedent at the time of their death, often required to be filed with the court.

- Estate Tax Returns: Documents filed with the federal and state tax authorities, reporting the estate's assets and ensuring any taxes due are paid.

- Release and Waiver Forms: Signed by beneficiaries, these documents often indicate that they have received their inheritance and waive any further claims against the estate.

Navigating the complexities of estate administration requires a careful approach, utilizing each document appropriately to fulfill legal requirements and honor the decedent's wishes. Executors and administrators must ensure that they understand the role of each document and seek professional advice when necessary to avoid missteps that could complicate the estate’s settlement or lead to disputes among heirs and beneficiaries.

Similar forms

The West Virginia Estate form is similar to federal estate tax forms such as Form 706, used for reporting federal estate tax liabilities. Like the federal form, the West Virginia Estate Appraisement and Nonprobate Inventory Forms require an itemized list of the deceased's assets and their fair market values. Both forms are designed to account for the entirety of an estate, ensuring proper valuation for tax purposes. However, while the West Virginia form focuses on state-level estate administration, including probate and nonprobate property, Form 706 addresses the gross federal estate tax liability, accounting for deductions, exemptions, and credits to determine the net tax owed.

Similarly, the West Virginia Estate form shares attributes with state-specific real estate declaration forms. These forms, which vary by state, serve to declare the value of real estate for tax assessment purposes. The West Virginia forms require detailed descriptions of both probate and nonprobate real estate, much like state real estate forms demand comprehensive property data to establish tax values. The key difference lies in the purpose: whereas real estate declaration forms are used primarily for property tax assessments, the West Virginia Estate forms facilitate estate settlement by capturing the fair market value of real estate as part of the decedent's estate.

Dos and Don'ts

When filling out the West Virginia Estate forms, it is important to follow these guidelines to ensure accurate and efficient processing:

- Do:

- Read the instructions provided in the booklet thoroughly before starting to fill out any forms.

- Ensure all information provided is accurate, including the decedent's name, date of death, and social security number.

- List all probate and nonprobate assets with their fair market value as of the date of the decedent's death.

- Consult with the Clerk or an attorney if you have questions regarding the forms or the estate administration process.

- Don't:

- Delay reading the introductory instructions; understanding them fully is crucial before beginning.

- Ignore the requirement to file both the Appraisement Form (ET 6.01) and, if required, the Nonprobate Inventory Form (ET 6.02) within 90 days of qualification.

- Forget to include a complete inventory of real estate and personal property, whether it's probate or nonprobate.

- Overlook the necessity of getting the Oath of Fiduciary, located in part 6 of Form ET 6.01 and part 4 of Form ET 6.02, notarized before submission.

Misconceptions

When managing the aftermath of a loved one's passing in West Virginia, the Estate Appraisement and Nonprobate Inventory process can seem daunting. Complicating matters, many misconceptions circulate about these forms and their requirements. Let's address nine common misconceptions:

- Only large estates need to file the forms. In truth, West Virginia requires the filing of Appraisement and Nonprobate Inventory Forms for all estates, regardless of size, if the decedent owned property and had debts to settle.

- The process is voluntary. It's actually a legal obligation. Representatives must file these forms within 90 days of their qualification as an administrator or executor, making it a necessary step in estate administration.

- Nonprobate assets don’t need to be declared. Even though nonprobate assets pass outside of a will, details of such assets must still be reported using Form ET 6.02 to ensure a comprehensive account of the decedent’s property.

- Real estate outside West Virginia need not be included. On the contrary, all real estate, including properties outside of West Virginia, must be reported to accurately assess the estate's total value.

- A Federal Estate Tax Return isn’t required if these forms are filed. The requirement to file a Federal Estate Tax Return (Form 706) is independent of state obligations. Whether you need to file will depend on the estate's gross value relative to federal exemption limits.

- Completing the forms negates the need for an attorney or accountant. While these forms guide you through the estate appraisal and inventory process, professional advice can be invaluable, especially for complex estates or for navigating tax implications.

- The forms only need to be filed with the county clerk. The completed forms, indeed, must be submitted to the county clerk; however, copies must also be made available for inspection by interested parties, and further legal steps are necessary to complete the estate’s administration.

- Life insurance proceeds always need to be reported. Though life insurance proceeds are indeed part of an estate’s nonprobate assets, they only need to be listed if they are payable to the estate rather than directly to a named beneficiary.

- Appraisals of property values are unnecessary. Accurate appraisals at the date of the decedent's death are crucial for both the Appraisement and Nonprobate Inventory forms to ensure fair market value is reflected and to meet legal requirements.

Understanding and debunking these misconceptions is essential for effectively managing the estate settlement process. It ensures compliance with legal requirements and helps representatives fulfill their duties with diligence and accuracy. Keep in mind, the nuances of estate administration may vary, so when in doubt, seeking professional advice is always a prudent approach.

Key takeaways

Understanding the requirements and process associated with the West Virginia Estate Appraisement & Nonprobate Inventory is essential for managing the estate of a decedent. Below are key takeaways designed to guide estate representatives through this task:

- It is imperative to commence this legal process by thoroughly reading the provided instructions. These guidelines aid in understanding the necessary steps for filing the Appraisement (Form ET 6.01) and Nonprobate Inventory Forms (Form ET 6.02), which are crucial for the correct administration of the estate.

- The person responsible for the estate, known as the executor or administrator, must file these forms within 90 days of their appointment. This role requires the individual to list and appraise the decedent's real and personal property, reflecting their fair market value as of the date of death. The accurate completion of these forms helps in the proper settlement of the estate under West Virginia law.

- Completion of Form ET 6.01 is necessary for recording all real estate and probate property. This form requires detailed information such as the decedent’s complete name, date of death, domicile information, and a comprehensive listing and valuation of all probate assets and real estate. Following this step ensures the estate is managed in accordance with the decedent's wishes or state law, should a will not exist.

- Form ET 6.02 focuses on nonprobate personal property. Assets such as jointly held properties, payable on death accounts, life insurance proceeds directed to beneficiaries other than the estate, and similar nonprobate items must be listed here. The form captures the essence of the decedent's nonprobate assets, providing clear guidance on assets passing outside the probate process.

- After the meticulous preparation of these forms, they must be delivered to the appropriate authorities. Depending on county-specific protocols, this may involve the Clerk’s Office or Fiduciary Supervisor. This submission process is critical for the formal recording and processing of the estate’s appraisement and inventory.

In undertaking these duties, it's important for estate representatives to act with diligence and accuracy. Each step, from reading the initial instructions to the final delivery of completed forms, plays a vital role in the effective administration of the estate. Remember, seeking advice from professionals such as attorneys or accountants may be necessary for complex estates or if specific legal questions arise.

Other PDF Forms

Va760cg - Filing instructions detail the mailing address for submission and encourage attaching related federal documentation.

Wv Divorce Papers - Complete the certifications section to attest to the accuracy and completeness of the information provided.