Fill Out a Valid West Virginia It 140X Template

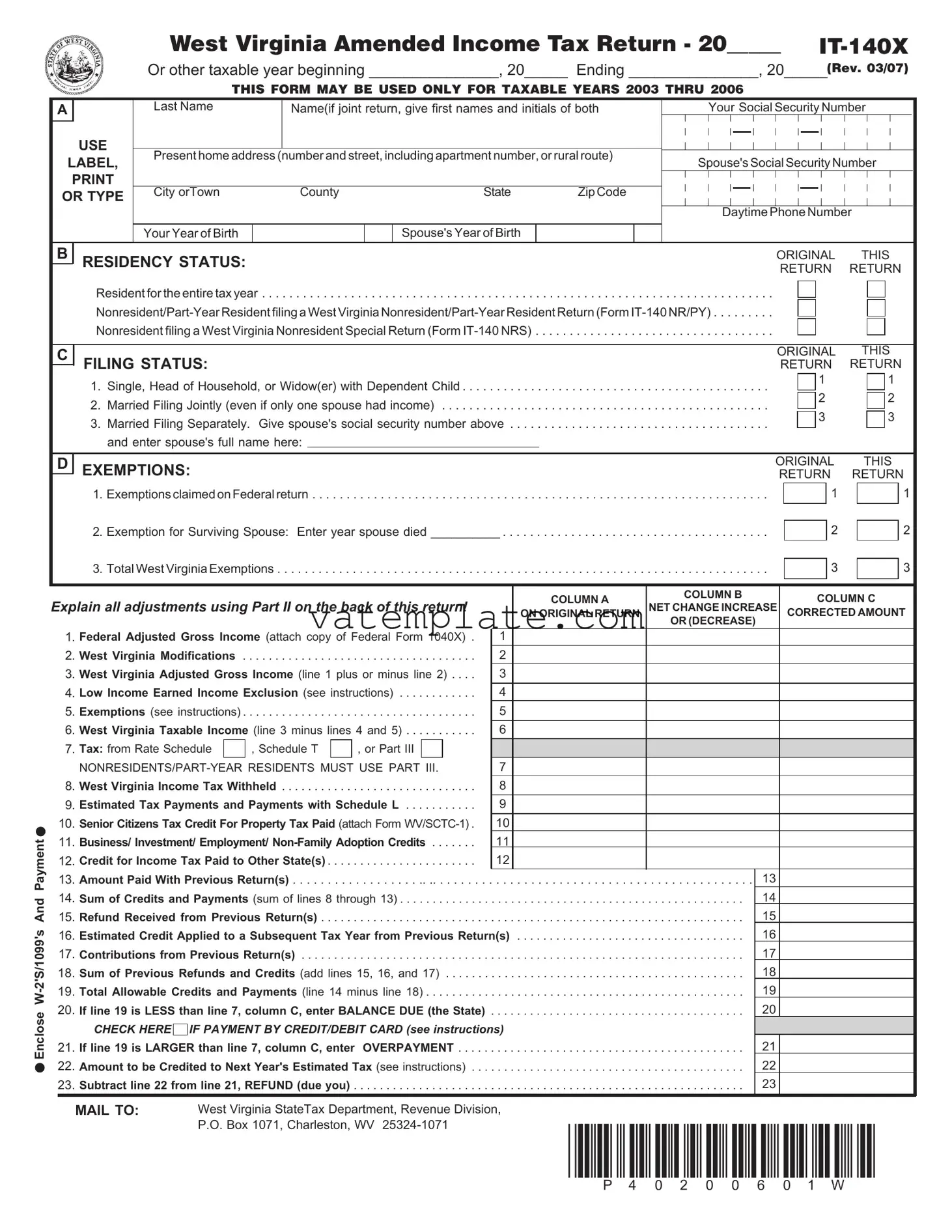

If you have found yourself in a situation where you need to amend a previously filed West Virginia income tax return for the years 2003 through 2006, the West Virginia IT-140X form is what you'll need. Primarily used for making corrections to your state income tax return, this form caters to various changes, including modifications in income, adjustments in tax calculations, updates in personal information, or even alterations in your residency status throughout the tax year. The form requires taxpayers to present detailed information about the original return alongside the specific adjustments being made, requiring a thorough explanation for each change. Additionally, it is crucial for both residents and non-residents to follow the specific instructions provided for accurately recalculating their tax obligations based on the updated information. Also, the form addresses scenarios like changing your filing status, correcting income modifications, or claiming previously unclaimed credits and deductions. Given the legal necessity to amend your tax return following any adjustments to your federal tax return, understanding the nuances of the IT-140X form becomes essential for maintaining compliance with state tax laws. Providing accurate and complete information not only ensures compliance but potentially secures favorable adjustments to your tax liabilities or refunds.

West Virginia It 140X Example

West Virginia Amended Income Tax Return - 20_____

Or other taxable year beginning _______________, 20_____ Ending _______________, 20_____(Rev. 03/07)

THIS FORM MAY BE USED ONLY FOR TAXABLE YEARS 2003 THRU 2006

A

USE

LABEL,

OR TYPE

Last Name |

Name(if joint return, give first names and initials of both |

|||||

|

|

|

|

|

|

|

Present home address (number and street, including apartment number, or rural route) |

||||||

|

|

|

|

|

|

|

City orTown |

County |

State |

ZipCode |

|||

|

|

|

|

|

|

|

Your Year of Birth |

|

|

|

Spouse's Year of Birth |

|

|

|

|

|

|

|

|

|

Your Social Security Number

Spouse'sSocialSecurityNumber

Daytime Phone Number

B

RESIDENCY STATUS:

Resident for the entire tax year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Nonresident filing a West Virginia Nonresident Special Return (Form

ORIGINAL THIS RETURN RETURN

C

FILING STATUS:

1. Single, Head of Household, or Widow(er) with Dependent Child . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2. Married Filing Jointly (even if only one spouse had income) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3. Married Filing Separately. Give spouse's social security number above . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

and enter spouse's full name here:

ORIGINAL |

THIS |

RETURN |

RETURN |

1 |

1 |

2 |

2 |

3 |

3 |

D

EXEMPTIONS: |

ORIGINAL |

|

THIS |

|||

RETURN |

RETURN |

|||||

1. ExemptionsclaimedonFederalreturn |

|

|

|

|

|

1 |

|

|

1 |

|

|

||

2. Exemption for Surviving Spouse: Enter year spouse died __________ . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

2

3. Total West Virginia Exemptions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

3

Enclose

|

COLUMN A |

COLUMN B |

COLUMN C |

|

Explain all adjustments using Part II on the back of this return! |

NET CHANGE INCREASE |

|||

ON ORIGINAL RETURN |

CORRECTED AMOUNT |

|||

|

|

OR (DECREASE) |

|

1.Federal Adjusted Gross Income (attach copy of Federal Form 1040X) . 1

2. |

West Virginia Modifications |

. . . |

. |

. . . . . . . . . . |

. . . |

. . . . . |

|

|

2 |

|

|

||

3. |

West Virginia Adjusted Gross Income (line 1 plus or minus line 2) . . . . |

|

3 |

|

|

||||||||

4. |

Low Income Earned Income Exclusion (see instructions) |

4 |

|

|

|||||||||

5. |

Exemptions (see instructions) |

. . . |

. |

. . . . . . . . . . |

. . . |

. . . . . |

|

|

5 |

|

|

||

6. |

West Virginia Taxable Income (line 3 minus lines 4 and 5) |

6 |

|

|

|||||||||

7. |

Tax: from Rate Schedule |

|

, Schedule T |

|

|

, or Part III |

|

|

|

|

|

|

|

|

7 |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8. |

West Virginia Income Tax Withheld |

. . . |

. . . . . |

|

|

8 |

|

|

|||||

9. |

Estimated Tax Payments and Payments with Schedule L |

|

9 |

|

|

||||||||

10. |

Senior Citizens Tax Credit For Property Tax Paid (attach Form |

|

10 |

|

|

||||||||

11. |

Business/ Investment/ Employment/ |

11 |

|

|

|||||||||

12. |

Credit for Income Tax Paid to Other State(s) |

. . . |

. . . . . |

|

|

12 |

|

|

|||||

13. |

Amount Paid With Previous Return(s) |

|

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

13 |

|

||||||||

14. |

Sum of Credits and Payments (sum of lines 8 through 13) |

14 |

|

||||||||||

15. |

Refund Received from Previous Return(s) |

. . . |

. . . . . . . |

|

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

15 |

|

||||||

16. |

Estimated Credit Applied to a Subsequent Tax Year from Previous Return(s) |

16 |

|

||||||||||

17. |

Contributions from Previous Return(s) |

. . . |

. . . . . . . |

|

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

17 |

|

||||||

18. |

Sum of Previous Refunds and Credits (add lines 15, 16, and 17) |

18 |

|

||||||||||

19. |

Total Allowable Credits and Payments (line 14 minus line 18) |

19 |

|

||||||||||

20. |

If line 19 is LESS than line 7, column C, enter BALANCE DUE (the State) |

20 |

|

||||||||||

|

CHECK HERE IF PAYMENT BY CREDIT/DEBIT CARD (see instructions) |

|

|

||||||||||

21. |

If line 19 is LARGER than line 7, column C, enter |

OVERPAYMENT |

21 |

|

|||||||||

22. |

Amount to be Credited to Next Year's Estimated Tax (see instructions) |

22 |

|

||||||||||

23. |

Subtract line 22 from line 21, REFUND (due you) . |

. . . . . . . . . . |

. . . |

. . . . . . . |

|

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

23 |

|

|||||

MAIL TO: West Virginia StateTax Department, Revenue Division,

P.O. Box 1071, Charleston, WV

*P40200601W*

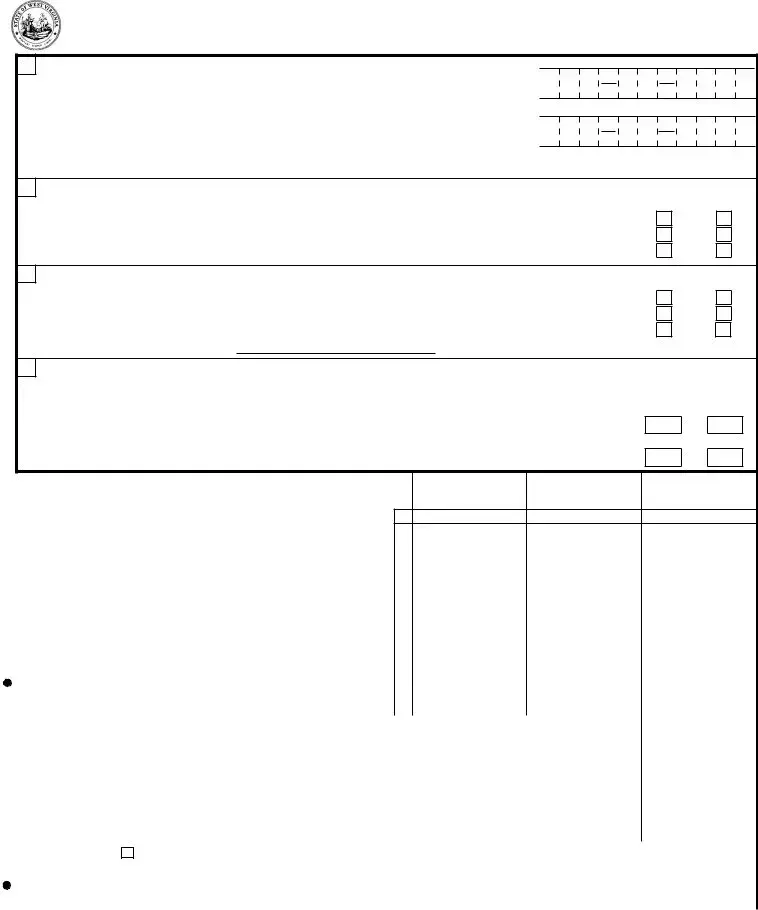

PART I: TAX RATE SCHEDULES

|

|

RATE SCHEDULE I |

|

|

RATE SCHEDULE II |

||||

|

|

|

|

|

|

||||

Single, Married filing jointly, Head of household, and Widow(er) |

Married |

filing separately |

|

|

|

||||

with dependent |

child |

|

|

|

|

|

|

|

|

Use this schedule if you checked box number 1 or 2 under "FILING STATUS" |

Use this schedule if you checked box number 3 under "FILING STATUS" |

||||||||

Less than $10,000 |

. . . . . . |

. . . . . . . . . 3% of the taxable income |

Less than $5,000 . . . |

. . . . |

. . . . . . . . . |

3% of the taxable income |

|||

At least- |

But less than− |

|

At least− |

But less than− |

|

|

|

|

|

$10,000 |

$25,000 |

. . . . . . . $ |

300.00 plus 4% of excess over $10,000 |

$ 5,000 |

$12,500 . . . . |

. . . $ |

150.00 plus 4% |

of excess over $ 5,000 |

|

$25,000 |

$40,000 |

. . . . . . . $ |

900.00 plus 4.5% of excess over $25,000 |

$12,500 |

$20,000 . . . . |

. . . $ |

450.00 plus 4.5% |

of excess over $12,500 |

|

$40,000 |

$60,000 |

. . . . . . . $1,575.00 plus 6% of excess over $40,000 |

$20,000 |

$30,000 . . . . |

. . . $ |

787.50 plus 6% |

of excess over $20,000 |

||

$60,000 |

|

. . . . . . . $2,775.00 plus 6.5% of excess over $60,000 |

$30,000 |

. . . . |

. . . $1,387.50 plus 6.5% |

of excess over $30,000 |

|||

|

|

|

|

|

|

|

|

|

|

PART II: EXPLANATION OF CHANGES TO INCOME, STATUS, EXEMPTIONS, AND CREDITS

Enter the box or line number from the front of this form for each item you are changing and give the reason for each change. Attach all supporting forms and schedules for items changed. Be sure to include your name and social security number on any attachments.

PART III:

|

|

1 |

1. |

Tentative Tax (apply the rate schedules above to the amount shown in column C, line 6) |

|

|

IF YOU WERE SUBJECT TO FEDERAL MINIMUM TAX, USE SCHEDULE T TO CALCULATE |

|

|

YOUR TAX (ATTACH SCHEDULE T TO YOUR RETURN). |

|

2.West Virginia Income (include all income during your period of residency and any

|

|

2 |

|

West Virginia source income during your nonresidency; see the instructions) |

|

3. |

Federal Adjusted Gross Income (from column C, line 1) |

3 |

|

|

4 |

4. |

Tax (divide line 2 by line 3, and multiply the result by line 1; enter here and in Column C, line 7) |

. . . . . . . . . . . . . . . . . . . . |

|

If you are claiming a federal net operating loss carryback, you must continue to Part IV. |

|

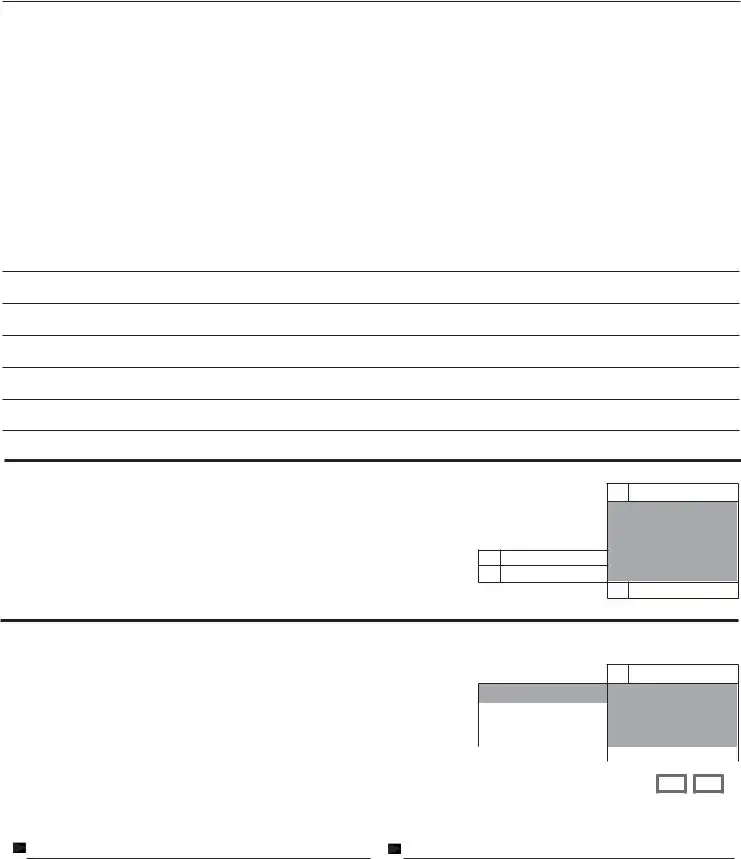

PART IV:

NET OPERATING LOSS CARRYBACK

|

|

5 |

5. |

Subtract line 2 Part III from your original Federal Adjusted Gross Income (line1, Column A) |

|

6.Income Percentage (Divide line 5 by line 3 Part III and round the result to four decimal places)

|

Note: decimal cannot exceed 1.0000 |

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

7. |

Multiply line 1 Part III by the line 6 decimal |

7 |

|

|

|

|

|

8. |

Subtract line 7 from line 1 Part III |

8 |

|

|

|

|

|

9. |

West Virginia Tax (Enter the smaller of line 4 Part III or line 8 here and on Page 1, line 7, column C and check Part IV) . . |

9 |

|

|

|||

|

|

|

|

||||

My/our initials in the boxes indicate waiver of my/our rights of confidentiality for the purpose of contacting the preparer regarding this return.

SIGN HERE - Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief it is true, correct, and complete.

Your Signature |

Date |

|

|

Signature of preparer other than taxpayer |

Date |

Spouse's Signature |

Date |

|

|

|

|

Address of preparer |

Daytime Phone Number |

Rev. 05/04

AMENDEDWESTVIRGINIAPERSONALINCOMETAXRETURN

GENERAL INFORMATION

CHANGES IN YOUR FEDERAL ADJUSTED GROSS INCOME. If the Federal Government makes any change to your Federal income tax return, you are required by law to notify the West Virginia State Tax Department of the change within ninety (90) days after the final determination of such change. If you file an amended Federal income tax return, you are required by law to file an amended West Virginia State income tax return within ninety (90) days thereafter.

WHERE TO OBTAIN FORMS AND INFORMATION. Forms and instructions may be obtained by visiting our web site at www.state.wv.us/taxdiv or by calling our Interactive Voice Response System at (304)

WHEN SHOULD FORM

SPECIAL INSTRUCTIONS FOR AMENDING A JOINTLY OR SEPARATELY FILED RETURN. If your original return was filed jointly and you are amending to file separately, your spouse must also file a separate return. If your original filing was married filing separately and you are now amending to file jointly, Column A should reflect only the primary taxpayer’s original filing. If you are changing your filing status from married filing jointly to married filing separately or from married filing separately to married filing jointly you MUST do so in compliance with federal regulations.

SCHEDULES. If any change is made on line 2 (Schedule M), line 7 (Schedule T), line 10

HOW TO COMPLETE FORM

STEP 1

Section A - Type or print your name(s), address, and social security number(s) legibly in the spaces provided. Year of birth: Enter the years in which you and your spouse, if joint return, were born. Telephone number: Enter the telephone number where you can be reached during the day.

Section B - Check only one in each column. If you were not a resident of West Virginia for the entire taxable year, you must use Part III on the back of the form to calculate your West Virginia tax.

Section C - Check only one in each column. If you are married but filing separate returns, enter your spouse’s name in the space provided and his/ her social security number in Section A.

Section D - (Block 1) If your filing status is the same on your State return as on your Federal return, enter the total number of exemptions claimed on the Federal return. If you claimed “0” exemptions on your Federal return, you must claim “0” on your State return. If you are married filing a joint Federal return but separate State returns, enter the total number of exemptions you would have been entitled to claim if you had filed separate Federal returns. (Block 2) If you are eligible to claim an additional exemption as a surviving spouse, list year of spouse’s death and enter “1” in block 2.

(Block 3) If you claimed an exemption in block 2 for being a surviving spouse, add blocks 1 and 2 and enter the result in block 3. Otherwise, enter in block 3 the number of Federal exemptions claimed in block 1.

STEP 2

Complete lines 1 through 22 of

line instructions:

or as you later amended it. If your return was changed or audited, enter the amounts as adjusted.

COLUMN B - Enter the net increase or net decrease for each line you are changing. Bracket all decreases. Explain each change on page 2, Part II, and attach any related schedules or forms. If you need more space, show the required information on an attached statement.

COLUMN C - Add the increase in column B to the amount in column A, or subtract the column B decrease from column A. Show the result in column

C.Bracket all decreases. For any item you do not change, enter the amount from column A in column C.

LINE 1: FEDERAL ADJUSTED GROSS INCOME. Enter your Federal adjusted gross income.

LINE 2: MODIFICATION(S) TO INCOME. Enter the net plus or minus amount of income modification. If your modification is being adjusted, you must attach a corrected schedule M, which may be obtained from the Taxpayer Services Division.

LINE 3: WEST VIRGINIA ADJUSTED GROSS INCOME. Enter the result of line 1 plus or minus line 2.

LINE 4:

If you are eligible for the exclusion and need the

LINE 5: EXEMPTIONS. Multiply the number entered in Section D, Block 3, by $2,000 and enter the result on line 5. If you claimed zero exemptions, enter $500 on line 5.

LINE 6: WEST VIRGINIA TAXABLE INCOME. Subtract lines 4 and 5 from

line 3 and enter the result on line 6.

LINE 7: WEST VIRGINIA INCOME TAX. If you are a resident and marked filing status “1” or "2" in Section C, you must use Rate Schedule I (on page 2, part I) to compute your tax to be entered on line 7; if you marked filing status “3” in Section C, use Rate Schedule II (on page 2, part I) to compute your tax to be entered on line 7. If you are a nonresident or a

Federal Alternative Minimum Tax- If you are subject to the Federal Alternative Minimum Tax, place an “X” in the box provided and use Schedule T to compute your total West Virginia Income Tax. Schedule T applies to both residents and nonresidents.

LINE 8: WEST VIRGINIA INCOME TAX WITHHELD. Enter the amount of West Virginia tax withheld from your wages. If you change these amounts, attach a copy of all additional or corrected forms

LINE 9: ESTIMATED TAX PAYMENTS AND/OR SCHEDULE L PAYMENTS.

Enter the total amount of estimated tax payments paid by you (and spouse, if joint return) for the taxable year you are amending. Be certain to claim any overpayment that you requested to be applied to your tax and/or any payment made with your West Virginia application for extension of time to file (Schedule L) on your original return.

LINE 10: SENIOR CITIZEN TAX CREDIT FOR PROPERTY TAX PAID. Enter

the amount of allowable credit from Form

COLUMN A - Enter the amounts from your return as originally filed

LINE 11:

TION CREDITS. If you are claiming one or more of these credits, enter the total of such credits on line 10. If you are changing this amount you must attach the appropriate corrected schedule(s). The schedules and instructions are available upon request to the Taxpayer Services Division. Failure to attach corrected schedule(s) to your return will result in any claimed credit being disallowed.

LINE 12: INCOME TAX PAID OTHER STATE(S). Enter your available Schedule E credit. If you are changing this amount, a corrected Schedule E and a copy of the income tax return filed with the state for which you are claiming credit MUST be attached to your Form

LINE 13: AMOUNT PAID WITH PREVIOUS RETURN(S). Enter the total amount paid with your original and any previous amended return(s).

LINE 14: SUM OF CREDITS AND PAYMENTS. Add lines 8 through 13 and

enter the result.

LINE 15: REFUNDS RECEIVED FROM PREVIOUS RETURN(S). The total amount of refunds received from your original and any previous amended return(s) must be entered on line 15, to be deducted from your total credits on line 14.

LINE 16: ESTIMATED CREDIT APPLIED TO A SUBSEQUENT TAX YEAR

FROM PREVIOUS RETURN(S). The total amount of estimated credit applied to a subsequent year from your original and any previous amended return(s) must be entered on line 16, to be deducted from your total credits on line 14.

LINE 17: CONTRIBUTIONS FROM PREVIOUS RETURN(S). The total amount of any contributions made with your original and any previous amended return(s) must be entered on line 17, to be deducted from your total credits on line 14.

LINE 18: TOTAL OF YOUR PREVIOUS REFUNDS AND CREDITS. Add lines

15, 16 and 17 and enter the result.

LINE 19: TOTAL ALLOWABLE CREDITS AND PAYMENTS. Subtract line 18 from line 14 and enter the result.

LINE 20: BALANCE DUE. If your total tax (line 7) is larger than your total allowable credits and payments (line 19), enter the difference as the Balance Due the State of West Virginia. A check or money order for the total balance due must be made payable to the West Virginia State Tax Department. Use your credit card! It's easy. Just call

LINE 21: OVERPAYMENT. If your total allowable credits and payments (line

19)is larger than your total tax (line 7), enter the difference as the overpayment due you.

LINE 22: AMOUNT TO BE CREDITED TO NEXT YEAR'S ESTIMATED TAX.

YOU MAY USE THIS OPTION ONLY IF YOU HAVE NOT PREVIOUSLY FILED A RETURN FOR THE TAX YEAR TO RECEIVE THE CREDIT. Enter the portion of your overpayment you wish to have credited to next year's estimated tax liability.

LINE 23: REFUND. Subtract line 22 from line 21 and enter the result on line

23as the amount of refund you are due. A refund of $2 or less will only be sent if you attach a written request to this return.

PART III. NONRESIDENT &

Nonresidents and

LINE 1: TENTATIVE TAX. Compute the tax shown on the income on line 6 of Form

use Schedule T; otherwise, apply the appropriate rate schedule to your taxable income and enter the result on line 1 as your tentative tax.

LINE 2: WEST VIRGINIA INCOME. A

Virginia tax on the following: taxable income received from ALL sources while a West Virginia resident; West Virginia source income earned during the period of nonresidence; and applicable special accruals. A nonresident is subject to West Virginia tax on any West Virginia source income earned during the year.

West Virginia source income of a nonresident includes any gain, loss, or deduction from: real or tangible personal property located in West Virginia; employee services performed in West Virginia; a business, trade, professsion, or occupation carried on in West Virginia; a corporation in which you are a shareholder which elects under federal law to be taxed as an

LINE 3: FEDERAL ADJUSTED GROSS INCOME. Enter the amount shown on line 1, column C of Form

LINE 4: TAX. Divide line 2 by line 3, and round the result to a

PART IV. NONRESIDENT &

Nonresidents and

Please note: Your West Virginia source income does not change due to a net operating loss carry back. A net operating loss carry back is a federal allowance and applies to the Federal Adjusted Gross Income, line 1 of the

Line 5: OTHER INCOME. Subtract line 2 Part III from your original Federal

Adjusted Gross Income (line 1, column A). Note: If you previously amended to correct your original return, use the corrected FAGI.

Line 6: INCOME PERCENTAGE. Divide line 5 by line 3 Part III and round the

result to 4 decimal places. Note: decimal cannot exceed 1.0000.

Line 7: WEST VIRGINIA TAX RATE APPLIED TO OTHER INCOME. Multiply line 1 Part III by the line 6 decimal.

Line 8: TAX CALCULATION. Subtract line 7 from the line 1 Part III.

Line 9: WEST VIRGINIA TAX. Enter the smaller of line 4 Part III or line 8 here and on page 1, line 7, column C and check the box for Part IV.

ATTACH A COPY OF YOUR FEDERAL RETURN INCLUDING

YOUR SCHEDULE

WHEN YOUR RETURN IS COMPLETE

SIGNATURE: SIGN YOUR RETURN! A joint return must be signed by both husband and wife even though only one had income. If you (and your spouse, if a joint return) do NOT sign your return it WILL NOT be processed. If the return is prepared by an authorized agent of the taxpayer, the agent must also sign on the line provided and enter his/her address and phone number below the signature.

Waiver of Confidentiality: If your return was prepared by someone other than yourself, initialing the box(es) will allow the department to contact the preparer regarding any questions that may arise.

Be sure to include any schedules and statements required to be submitted with the return. Mail the completed return to: West Virginia State Tax

Department Revenue Division, P.O. Box 1071, Charleston, West Virginia

Form Properties

| Fact | Description |

|---|---|

| Form Title | West Virginia Amended Income Tax Return - IT-140X |

| Applicability | For Taxable Years 2003 through 2006 |

| Revision Date | March 2007 (03/07) |

| Key Purpose | |

| Specially Noted Sections | Sections include information on residency status, filing status, and comprehensive instructions for amendments |

| Amendment Notification Requirement | Requirement to notify the West Virginia State Tax Department within 90 days of any change to Federal income tax return |

| Special Instructions Given | Instructions provided for amending returns filed jointly or separately, and for calculating tax for nonresidents/part-year residents |

| Governing Law | West Virginia State Income Tax Law |

Steps to Filling Out West Virginia It 140X

Filing an amended tax return can be necessary when you need to correct or update information on your previously filed tax return. The West Virginia IT-140X form is specifically designed for this purpose, allowing you to make adjustments to your state income tax return for the years 2003 through 2006. Carefully following the step-by-step instructions will ensure your amended return is completed accurately and efficiently.

- Section A: Provide your name(s), address, social security number(s), and other basic information. Be sure to include your year of birth, the daytime phone number, and whether this return is for a joint filing.

- Section B: Indicate your residency status during the tax year you are amending by checking the appropriate box. It's important to specify whether you were a resident for the entire tax year, a nonresident, or a part-year resident.

- Section C: Select your filing status for the tax year you're amending. You'll choose from options such as single, married filing jointly, or married filing separately. Note any changes if your status differs from the original return.

- Section D: Adjust exemptions as needed:

- Enter the total number of exemptions claimed on your original Federal return in Block 1.

- For surviving spouses, indicate the year of your spouse's death in Block 2 and tally the total in Block 3.

- For items on lines 1 through 23, follow these instructions:

- Fill in Column A with the amounts from your original tax return.

- In Column B, note the increase or decrease for each line item you're changing. Use a bracket for any decreases.

- Column C should reflect the corrected amounts. Compute these by adjusting the figures in Column A by the changes in Column B.

- Ensure that you explain all adjustments in Part II on the back of the return. Attach any required supporting documentation or revised schedules.

- If you are a nonresident or part-year resident, use Part III on the back to properly calculate your West Virginia tax liability.

- Lastly, sign the return. If you're filing jointly, both spouses must sign. If someone prepared the return on your behalf, they too should sign, providing their address and phone number.

Once completed, review your form to ensure all changes are accurately documented and supporting materials are attached. Mail your amended return to the designated address. Remember, accuracy is crucial in this process to avoid further amendments or inquiries from the tax department. Filing an amended return can help ensure your tax responsibilities are met correctly, possibly leading to a refund or resolving any discrepancies in your initial filing.

FAQ

When should I use Form IT-140X to amend my West Virginia income tax return?

Form IT-140X is designed for taxpayers who need to amend a previously filed West Virginia income tax return. This form is applicable for adjustments to returns for taxable years 2003 through 2006. You should use this form if, after filing your original return, you discover errors or omissions in your income, exemptions, deductions, or credits. Examples include reporting additional income that was not previously included, modifying the number of exemptions, or correcting the amount of West Virginia tax withheld. This form must be filed separately for each year you are amending and can only be submitted after your original return for that year has been filed.

How do I notify the West Virginia State Tax Department of changes to my Federal income tax return?

If the Federal Government makes any changes to your Federal income tax return, or if you file an amended Federal return, you are legally obligated to inform the West Virginia State Tax Department within 90 days after the final determination of such a change. You must report these adjustments by filing an amended West Virginia income tax return using Form IT-140X. This requirement exists to ensure that your state tax obligations accurately reflect any modifications made to your federal tax records.

How do I complete Form IT-140X for a change in residency status or filing status?

Completing Form IT-140X requires careful attention to changes in your personal information or tax situation. For changes in residency status, you must use Part III on the back of the form to accurately calculate your West Virginia tax based on your residency period during the taxable year. If adjusting your filing status — for example, from married filing jointly to married filing separately, or vice versa — you must comply with federal regulations. Remember to accurately reflect these changes in Section B (Residency Status) and Section C (Filing Status) of Form IT-140X. It's important to note that if your original return was filed jointly and you are now filing separately, your spouse must also file a separate amended return, and vice versa.

What attachments are required when filing an amended return with Form IT-140X?

When submitting Form IT-140X to amend your West Virginia income tax return, certain attachments are necessary to ensure the amended return is processed accurately:

- Correction Schedules: If you are making adjustments to income modifications, tax credits, or deductions, you must attach the corrected schedules, such as Schedule M for modifications or Schedule T if subject to Federal Alternative Minimum Tax.

- Supporting Documents: Attach all relevant supporting documents for the changes made, such as W-2 forms, 1099 forms, or federal schedules if adjusting your federal adjusted gross income or claiming credits.

- Copy of Federal Amended Return: If your amendment is due to changes in your federal return, attach a copy of the amended federal return (1040X or applicable form).

Common mistakes

Not updating personal information: Taxpayers often forget to update their personal details, such as address or name change, which can lead to misdirected refunds or correspondence from the West Virginia State Tax Department.

Incorrect residency status selection: Misidentifying residency status (full-year resident, nonresident, or part-year resident) can affect tax calculations and liabilities.

Incorrectly reporting exemptions: Failing to accurately report exemptions based on the federal return or misunderstanding the exemption qualifications for surviving spouses or dependents can lead to errors in the exemption section.

Errors in income reporting: Not accurately transferring the Federal Adjusted Gross Income or incorrectly adjusting for West Virginia Modifications can distort the West Virginia Adjusted Gross Income computation.

Failure to calculate adjustments properly: Taxpayers commonly make mistakes in computing the Low Income Earned Income Exclusion or misreport other adjustments, which impacts the taxation amount.

Miscalculating taxable income: Errors in deducting exemptions and adjustments from the adjusted gross income to determine the taxable income often occur, resulting in either overpayment or underpayment of tax.

Omitting to attach required schedules: Not attaching or incorrectly filling out required schedules, such as the corrected Schedule M for modifications, can lead to the disallowance of the reported adjustments.

Sign and date errors: The form may be left unsigned or undated, which will result in the West Virginia State Tax Department not processing the form. In case of a joint return, both spouses must sign. Additionally, if an authorized preparer completes the form, their signature and contact information are also required.

Note: Always ensure to review the entire form for accuracy, attach all necessary documentation, and consult the instruction manual or a tax professional for guidance on complex tax situations.

Documents used along the form

When filing the West Virginia IT-140X Amended Income Tax Return, individuals might need to include additional documentation to support their amendments or to ensure accurate processing of their return. Understanding these documents can simplify the filing process and ensure compliance with state requirements.

- W-2 Form: This shows the amount of money earned and taxes withheld for an employee. It’s provided by employers and is essential for proving income and tax withheld if adjusting income or tax withholding amounts.

- 1099 Form: This form is issued to independent contractors, freelancers, and other non-employees for work performed. It's important for individuals amending returns that involve changes in reported freelance or contractor income.

- Schedule L: Used for reporting certain adjustments to income. It might be necessary if you’re amending your return due to changes in your adjusted gross income and need to document these adjustments.

- Copy of Federal Form 1040X: If changes to the federal tax return necessitate amendments to the state return, a copy of the amended federal return (Form 1040X) must be attached to the IT-140X to justify the changes made at the state level.

- Form WV/SCTC-1: West Virginia Senior Citizen Tax Credit for Property Tax Paid. This form is crucial if amending a return to claim or correct a senior citizen tax credit for property taxes paid.

- Corrected Schedules: If any credits or deductions are altered that involve schedules like Schedule M (Modifications to Income) or Schedule E (Credit for Income Tax Paid to Other State(s)), corrected versions of these schedules must accompany the IT-140X.

- Supporting Documentation for Credits: Documents supporting claims for business, investment, employment, or non-family adoption credits need to be included if these figures are amended. This ensures that the state can verify the legitimacy of these credits.

- Proof of Payment: If the amendment involves changes to the amount of tax paid, such as estimated tax payments or taxes withheld, documentation proving these payments were made may need to be included.

Collecting and organizing these documents before beginning the amendment process can streamline filing the West Virginia IT-140X form, leading to a faster and smoother amendment experience. Keeping clear records of income, taxes paid, and credits claimed not only facilitates amendments but also aids in financial planning and tax compliance.

Similar forms

The West Virginia IT-140X form is similar to the federal IRS Form 1040X, which is used for filing an amended U.S. individual income tax return. Both forms serve the purpose of correcting or updating a previously filed tax return. For instance, taxpayers may need to adjust their income, change their filing status, or correct deductions and credits after their original tax return has been filed. The structure of the IT-140X mimics the federal form by requiring taxpayers to list their original reported figures, the changes being made, and the corrected amounts. This parallel structure simplifies the amendment process for those familiar with the federal amendment process, ensuring that taxpayers provide all necessary information to reflect accurate tax liability adjustments.

Another document related to the IT-140X form is the state-specific nonresident or part-year resident tax forms, such as the West Virginia Form IT-140NR/PY. While the IT-140X is used to amend a resident tax return, nonresidents or part-year residents who initially filed a return with West Virginia using form IT-140NR/PY may use the IT-140X to correct or update that filing. Similarities between these forms include sections addressing income sourced within the state, adjustments specific to state tax laws, and calculations for prorated tax liabilities based on residency status. Both sets of forms require detailed income information, as well as deductions and credits specific to West Virginia tax regulations, tailored to the taxpayer's residency status during the taxable year.

Dos and Don'ts

Understanding the rules for filling out the West Virginia IT-140X form is essential to ensure that your amended income tax return is accurately processed. Below are key dos and don'ts to keep in mind:

Dos:

- Use the IT-140X form for tax years 2003 through 2006, as specified, ensuring you're correcting the appropriate year.

- Clearly print or type information to prevent any misunderstandings that could arise from hard-to-read handwriting.

- Include all necessary documentation, such as W-2s or 1099s, to support income adjustments or tax withheld.

- If you've had changes to your federal adjusted gross income, attach a copy of the corrected Federal Form 1040X.

- Explain all adjustments in detail on Part II on the back of the return to provide clarity on the changes made.

- Check your math, especially when adjusting income, exemptions, and credits to ensure correct calculation of tax owed or refund due.

- Sign the form. An unsigned return is considered invalid and will not be processed.

- If changing filing status or correcting any credits, attach the necessary corrected schedules or forms.

- Make sure to notify the West Virginia State Tax Department within 90 days if the Federal Government has made any changes to your Federal return.

Don'ts:

- Don't forget to check the appropriate boxes for residency status and filing status, which are crucial for determining the correct tax liability.

- Don't leave any fields blank that are applicable to your situation. If a specific line does not apply, it's better to enter "0" or "N/A" instead of leaving it empty.

- Avoid using correction fluid on the form. Instead, if you make a mistake, it's advisable to start over on a new form to maintain legibility.

- Don’t overlook attaching a copy of your Federal Adjusted Gross Income documentation if you've made amendments to your federal return.

- Don't miss the deadline for filing an amended return, which is within 90 days after the final determination of a change to your federal return.

- Don’t send in your amended return without double-checking all entries for accuracy.

- Avoid estimating figures. Use exact amounts to ensure the accuracy of your return.

- Don’t forget to include your phone number for daytime contact. This can be crucial if there are any questions about your return.

- Don't ignore the instructions regarding payment if you owe additional taxes. Ensure you include a check or money order if you have a balance due.

Following these guidelines will help to ensure that your amended tax return is processed smoothly and accurately.

Misconceptions

When navigating tax matters, it's crucial to separate fact from fiction, especially concerning forms like the West Virginia IT-140X, an amended income tax return form. Let's address some common misconceptions surrounding this form:

- Misconception 1: The IT-140X form is only for correcting mathematical errors. Fact: While mathematical errors can be corrected with this form, its primary purpose is to amend previously filed income tax returns due to changes in filing status, income, deductions, credits, or taxes paid.

- Misconception 2: Amending a tax return with Form IT-140X will trigger an audit. Fact: Filing an amended return does not automatically initiate an audit. This form is a standard procedure for correcting or updating your tax return information.

- Misconception 3: Nonresidents cannot use the IT-140X form. Fact: Nonresidents and part-year residents can use the IT-140X form if they need to amend a previously filed West Virginia tax return.

- Misconception 4: If you filed jointly, you cannot amend to file separately with the IT-140X. Fact: Taxpayers can change their filing status from joint to separate or vice versa, but both parties must amend their tax returns if changing from a joint filing.

- Misconception 5: The IT-140X form is only for the latest tax year. Fact: The form can amend returns for specific past tax years, not just the most recent one. However, there are limits to how far back you can amend.

- Misconception 6: You must wait until the IRS accepts your federal amendment before filing a state amendment. Fact: While related, the process of amending your federal and state return is separate. You're required to notify the West Virginia State Tax Department of changes made by the IRS or if you amend your federal return, but you do not need to wait for one to be accepted to file the other.

- Misconception 7: The amended return must be filed electronically. Fact: Depending on the state's current filing options and requirements, the IT-140X may need to be filed in paper form, especially if specific documentation needs to be attached.

- Misconception 8: Corrections to your West Virginia return cannot affect your federal tax liability. Fact: While the IT-140X form specifically amends your state tax return, changes to your income or deductions that alter your federal adjusted gross income (AGI) could affect your federal tax liability and require a federal amendment as well.

- Misconception 9: Amending your return with Form IT-140X is optional. Fact: If there are changes to your filing status, income, deductions, credits, or taxes paid after you've filed your original tax return, you're legally required to amend your return to reflect accurate information.

Understanding these aspects ensures compliance and minimizes errors in the amendment process. Always consult the latest instructions or a tax professional when unsure how to proceed with amending your tax return.

Key takeaways

Filing the West Virginia IT-140X form is required under law if changes are made to your Federal income tax return. Notify the West Virginia State Tax Department within 90 days after the final determination of such a change.

When amending a return to change filing status, specific rules apply. For instance, if you're amending from jointly to separately filed returns, both partners must file separately. Compliance with federal regulations is a must if changing from married filing separately to jointly or vice versa.

Correct schedules must be attached if adjusting lines related to modifications to income, taxable income exclusions, or various credits on the IT-140X form. Without these schedules, the West Virginia State Tax Department may disallow the claimed credits.

Part III of the form is crucial for nonresidents or part-year residents for determining their West Virginia tax liability, particularly focusing on West Virginia source income during periods of residency or nonresidency.

Signing the amended return is mandatory. A return prepared by someone other than the taxpayer requires the preparer's signature alongside the taxpayer's. Unsigned returns will not be processed, emphasizing the importance of this final step.

Other PDF Forms

Virginia Pd 207 - Special conditions such as hazardous materials or pets can be noted on the form for police response considerations.

West Virginia Corporate Tax Rate - It is a legal document that supports taxpayers' choices regarding how they wish to file their state income tax returns.