Fill Out a Valid West Virginia Opt 1 Template

In the realm of tax filing procedures within West Virginia, an intriguing shift has emerged, spotlighting the role of digital technology in streamlining processes, yet also accommodating individuals' preferences. At the heart of this development lies the West Virginia Opt 1 form, a document that serves as a bridge between traditional paper filing and the burgeoning trend of electronic submissions. Mandated for use by the West Virginia State Tax Department, this form carves out an exception in a digital-first directive, specifically for income tax preparers responsible for more than 25 returns annually, who are otherwise required to file these returns electronically. However, recognizing the diversity in taxpayer comfort and trust levels with electronic filing, the Opt 1 form empowers taxpayers themselves to choose not to participate in electronic filing for their returns. By completing and signing this form, taxpayers can assert their preference to opt-out, citing personal reasons for their decision. Meanwhile, tax preparers must navigate this preference with transparency, ensuring that the decision to opt-out comes solely from the taxpayer without influence or suggestion on their part. Not merely a form, but a tangible representation of choice in an increasingly digitized world, the Opt 1 requirement highlights a nuanced approach to taxpayer autonomy, electronic filing mandates, and the responsibilities of tax preparers in safeguarding client preferences—all while adhering to the overarching goals of efficiency and security in tax administration.

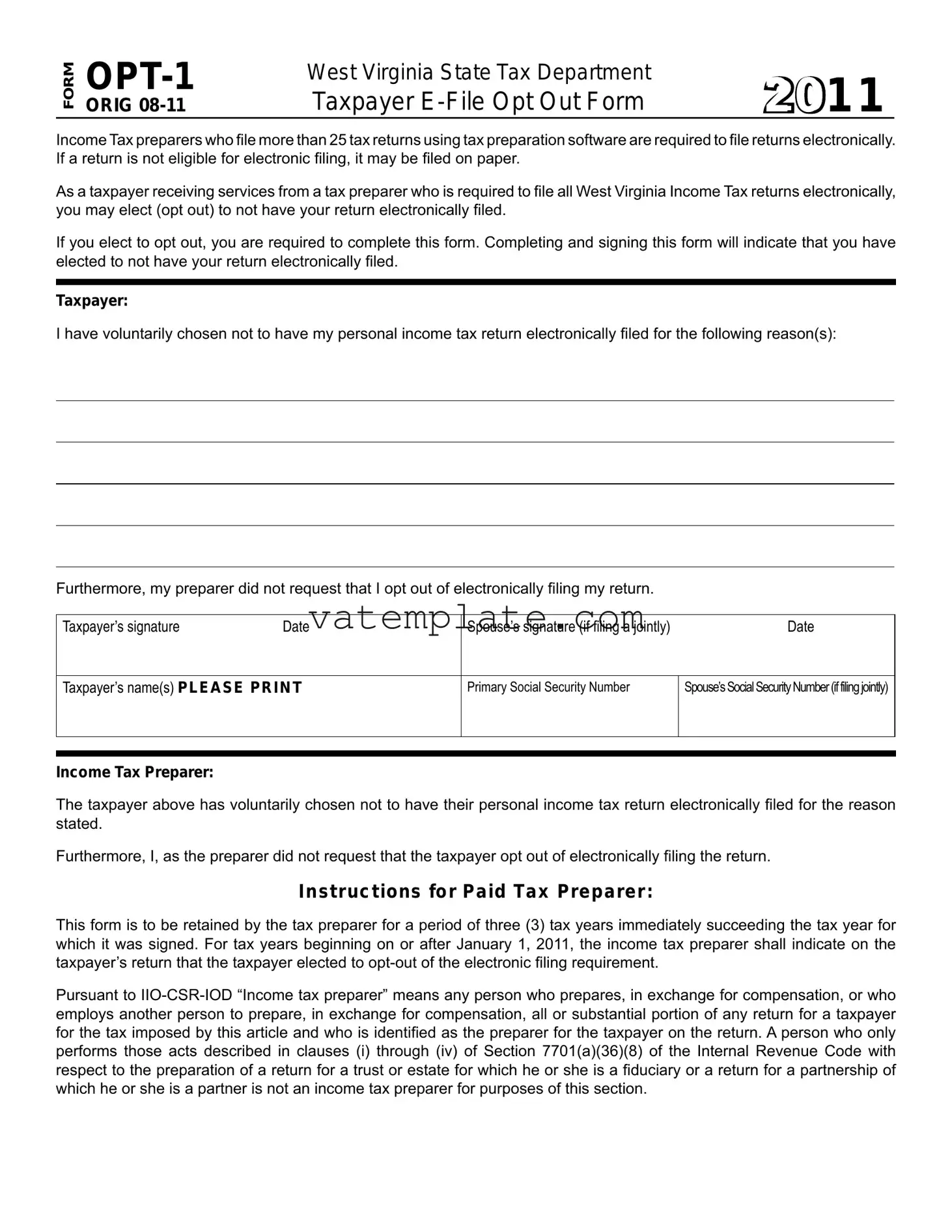

West Virginia Opt 1 Example

FORM

ORIG

West Virginia State Tax Department |

2 0 1 1 |

Taxpayer |

Income Tax preparers who ile more than 25 tax returns using tax preparation software are required to ile returns electronically. If a return is not eligible for electronic iling, it may be iled on paper.

As a taxpayer receiving services from a tax preparer who is required to ile all West Virginia Income Tax returns electronically, you may elect (opt out) to not have your return electronically iled.

If you elect to opt out, you are required to complete this form. Completing and signing this form will indicate that you have elected to not have your return electronically iled.

Taxpayer:

I have voluntarily chosen not to have my personal income tax return electronically iled for the following reason(s):

Furthermore, my preparer did not request that I opt out of electronically iling my return.

Taxpayer’s signature |

Date |

Spouse’s signature (if iling a jointly) |

Date |

Taxpayer’s name(s) PLEASE PRI N T

Primary Social Security Number

Spouse’s Social Security Number (if filing jointly)

Income Tax Preparer:

The taxpayer above has voluntarily chosen not to have their personal income tax return electronically iled for the reason stated.

Furthermore, I, as the preparer did not request that the taxpayer opt out of electronically iling the return.

I nst ruc t ions for Pa id Ta x Pre pa re r:

This form is to be retained by the tax preparer for a period of three (3) tax years immediately succeeding the tax year for which it was signed. For tax years beginning on or after January 1, 2011, the income tax preparer shall indicate on the taxpayer’s return that the taxpayer elected to

Pursuant to

Form Properties

| Fact | Description |

|---|---|

| Form Type | West Virginia OPT-1 Form |

| Purpose | To allow taxpayers to opt-out of electronic filing of their personal income tax returns |

| Applicability | Income Tax preparers filing more than 25 tax returns using tax preparation software |

| Requirement for Opting Out | Taxpayers must complete and sign the OPT-1 form to not have their return electronically filed |

| Preparer's Responsibility | Retain the form for three tax years succeeding the year it was signed |

| Indication on Return | Income tax preparer must indicate on the taxpayer’s return that the taxpayer elected to opt out |

| Governing Law | IIO-CSR-IOD; related to the definition and obligations of income tax preparers in West Virginia |

| Exemptions | Individuals performing tax preparation services for estates, trusts, or partnerships in certain capacities are not considered income tax preparers under this context |

| Effective Date | For tax years beginning on or after January 1, 2011 |

Steps to Filling Out West Virginia Opt 1

Filling out the West Virginia Opt 1 form is an important step for taxpayers who prefer not to have their tax returns filed electronically by their preparer. This choice can be due to various reasons, personal or otherwise, and ensuring that your decision is documented properly is crucial for compliance with West Virginia State Tax Department regulations. After completing this form, it becomes a formal record of your decision to opt out of electronic filing. Remember, it's essential for both the taxpayer and the tax preparer to retain a copy of this form for three tax years following the year to which it applies. The process is straightforward, but it must be done accurately to ensure that your tax return handling meets your expectations.

- Start by reading the form carefully to understand the purpose and requirements. It's important to ensure that you meet the criteria for opting out of electronic filing.

- Under the section marked "Taxpayer," clearly print your name(s) as it appears on your tax documents. If you are filing jointly with a spouse, include both names.

- Enter the Primary Social Security Number in the designated space. If filing jointly, also include your spouse’s Social Security Number in the provided area.

- Indicate your reason(s) for choosing not to electronically file your West Virginia Income Tax return. This part is crucial as it records your voluntary decision.

- Sign the form in the space provided under "Taxpayer’s signature." The date next to your signature indicates when you made the decision to opt out. If filing jointly, ensure that your spouse also signs and dates the form.

- The section titled "Income Tax Preparer" is for your preparer to complete. It confirms that you, the taxpayer, have voluntarily chosen not to e-file, and that this decision was made independently of any suggestion by the preparer.

- Review the completed form for accuracy. Both the taxpayer(s) and the income tax preparer should check that all information is correct and fully legible.

- Finally, remember that this form does not get filed with your tax return but should be retained by the tax preparer. Taxpayers are advised to keep a copy for their records as well.

After completing the West Virginia Opt 1 form, you have successfully documented your choice to opt out of electronic filing for your income tax return. Though this choice might diverge from the more common electronic filing path, it's your right as a taxpayer. Keeping a copy of the form for your records is a good practice, as it ensures you have proof of your decision should any questions arise. Understand that this action may affect the way your tax return is processed, but rest assured, complying with these steps ensures that your preference is honored..

FAQ

What is the West Virginia Opt 1 form?

The West Virginia Opt 1 form is a document designed for taxpayers who choose not to have their personal income tax returns filed electronically by their tax preparer. This form is specifically for use in situations where a tax preparer, who is obligated to file more than 25 tax returns using tax preparation software, would normally file returns electronically. By completing and signing this form, taxpayers indicate their decision to opt-out of electronic filing.

Who needs to complete the West Virginia Opt 1 form?

Taxpayers receiving services from a tax preparer required to file all West Virginia Income Tax returns electronically, but who wish to have their return filed on paper instead, need to complete the Opt 1 form. It is the taxpayer's responsibility to fill out this form if they decide against electronic filing for their personal income tax return.

Why might a taxpayer choose to opt out of electronically filing their return?

Taxpayers may have various reasons for opting out of electronic filing, ranging from personal preferences for paper records to concerns about digital security. However, the specific form itself does not require taxpayers to provide a reason for their choice to opt out. The decision is voluntary and entirely up to the discretion of the taxpayer.

What are the responsibilities of the tax preparer regarding the Opt 1 form?

Tax preparers have several key responsibilities related to the Opt 1 form, including:

- Informing the taxpayer of their eligibility to opt out of electronic filing.

- Ensuring the form is completed and signed by the taxpayer (and spouse if filing jointly) who chooses to opt out.

- Retaining the completed form for a period of three (3) tax years following the tax year for which it was signed.

- Indicating on the taxpayer's return that the taxpayer elected to opt out of the electronic filing requirement.

For how long must the tax preparer retain the Opt 1 form?

Once completed, the tax preparer must retain the Opt 1 form for a duration of three (3) tax years immediately succeeding the tax year for which it was signed. This ensures that there is record of the taxpayer's decision to opt out of electronic filing should it be required for verification in the future.

What information must be provided on the Opt 1 form?

The information required on the Opt 1 form includes:

- The taxpayer's name(s) and Social Security Number(s), including the spouse’s details if filing jointly.

- A statement by the taxpayer that they have voluntarily chosen not to have their income tax return electronically filed.

- The taxpayer’s signature (and spouse’s signature if filing jointly), along with the date of signing.

- An acknowledgment from the income tax preparer that the taxpayer has chosen to opt out of electronic filing for the reason stated by the taxpayer, and a verification that the opt-out was not at the preparer's request.

Where should the completed Opt 1 form be submitted?

Unlike forms that are filed with tax returns or sent to a specific agency, the completed Opt 1 form does not need to be submitted to the West Virginia State Tax Department or any other government entity. Instead, it should be retained by the tax preparer as part of their records for the required retention period.

Common mistakes

When filling out the West Virginia Opt 1 form, individuals often make several mistakes that can lead to delays or issues with their income tax filings. Here are the top ten mistakes:

Failing to check if they meet the criteria for needing to fill out the form, considering it is designed for those whose preparers must file electronically but choose to opt out.

Not printing their name clearly, which can cause confusion and potentially misplace their opt-out request.

Omitting their Social Security Number or incorrectly entering it, leading to identification issues with the tax department.

If filing jointly, forgetting to include the spouse’s Social Security Number, which is crucial for joint filings.

Overlooking the requirement for both the taxpayer and the spouse (if filing jointly) to sign the form, which is mandatory to validate their decision to opt out.

Neglecting to specify the reason(s) for choosing not to e-file, as stating these reasons is an essential part of the opt-out process.

Assuming the tax preparer will complete the form without their input, whereas the taxpayer must actively elect to opt out with explicit reasons.

Forgetting to date the signature, which is necessary to record when the decision to opt out was made.

Not retaining a copy of the form for their records, despite the requirement for the preparer to keep it for three tax years. It’s beneficial for the taxpayer to have their copy as well.

Misunderstanding the role of the tax preparer in the opt-out process, not realizing that the preparer must also acknowledge the taxpayer’s decision not to e-file as part of compliance.

Avoiding these mistakes will ensure that the process of opting out of electronic filing goes smoothly, without unnecessary delays or complications. It’s important for taxpayers to pay close attention to the details of the form to ensure all requirements are met.

Documents used along the form

When filing taxes, particularly in West Virginia, individuals and tax preparers might need to use several forms and documents alongside the FORM OPT-1, the Taxpayer E-File Opt Out Form. This document allows taxpayers to opt out of filing their tax returns electronically if their preparer is required to file returns through electronic means for more than 25 clients. The decision to file paper returns involves considering various factors, and accompanying documents may be necessary to ensure compliance and thoroughness in the tax filing process. Below is a list of other forms and documents often used with the West Virginia Opt 1 form, detailing each document's purpose.

- W-2 Form: Issued by employers, this form reports an employee's annual wages and the amount of taxes withheld from their paycheck. It is crucial for accurately reporting taxable income.

- Form 1040: The U.S. Individual Income Tax Return is the standard federal income tax form used to report an individual's gross income. It is often accompanied by the Opt 1 form for comprehensive tax filing.

- Schedule A: Itemized Deductions form, used for taxpayers to list potential deductions beyond the standard deduction, impacting the taxable income calculation.

- Schedule C: Profit or Loss from Business form, utilized by sole proprietors to report business income and expenses and calculate the taxable profit or loss from their business operations.

- Form 1099-MISC: Miscellaneous Income form, used to report payments made to freelance workers, independent contractors, and other non-employees. It is pertinent for taxpayers with various income sources.

- Form 4868: Application for Automatic Extension of Time To File U.S. Individual Income Tax Return, used if a taxpayer needs additional time to file their tax return beyond the deadline.

- Form 8863: Education Credits (American Opportunity and Lifetime Learning Credits) form, for taxpayers claiming education credits, offering a reduction in tax liability based on qualified education expenses.

- Form 8962: Premium Tax Credit form, used to reconcile or claim the premium tax credit for individuals who obtained health insurance through the marketplace, impacting the overall tax calculation.

- Form W-9: Request for Taxpayer Identification Number and Certification, often used in business transactions to provide the necessary taxpayer identification to report income to the IRS correctly.

The documents listed are integral to the tax filing process, offering a structured path to report income, claim deductions, and ultimately determine one's tax liability accurately. Each form serves a specific purpose and aids in compiling the comprehensive financial picture required for tax preparation, whether electronically or through paper filing, as indicated by the West Virginia Opt 1 form. It's essential for taxpayers and their preparers to understand the significance of these documents in relation to their individual filing situations.

Similar forms

The West Virginia Opt 1 form, used by taxpayers to opt-out of electronic filing for their personal income tax returns, bears similarities to several other documents in both purpose and structure. Below are two documents to which the West Virginia Opt 1 form can be compared:

-

IRS Form 8948, Preparer Explanation for Not Filing Electronically - Both the West Virginia Opt 1 form and IRS Form 8948 serve to document a taxpayer's or tax preparer's choice to file tax returns in a manner other than electronic filing, despite the general expectation or requirement to do so. The IRS Form 8948 is used nationally for federal tax returns, making it the federal counterpart to the state-specific form. They share a common purpose: providing a recorded reason for opting out of electronic filing. Each document requires signatures from the taxpayer and, if applicable, their spouse, along with a declaration from the tax preparer validating the taxpayer's decision.

-

Paper Filing Request Forms for State Tax Returns - While the name and form number might vary by state, many states offer a form similar to West Virginia's Opt 1 for taxpayers who need or prefer to file their state tax returns on paper. These forms, like West Virginia's Opt 1, often inquire about the reasons behind the taxpayer's decision to avoid electronic filing, require taxpayer and tax preparer signatures, and are kept on file by the tax preparer for a specified period. The similarity lies in their function: ensuring that taxpayers have a formal way to express their filing preferences and comply with state tax regulations, all while documenting their choice in a manner that is recognized by the state tax authority.

Dos and Don'ts

When completing the West Virginia Opt 1 form, it's important to follow specific guidelines to ensure accuracy and compliance. Below is a list of things you should and shouldn't do:

Do:- Ensure all information is accurate: Double-check taxpayer names, Social Security Numbers, and any other personal information for accuracy. This minimizes the risk of errors that could delay processing.

- Read instructions thoroughly: Before filling out the form, carefully read all instructions provided to understand the form's requirements and implications of opting out.

- Print legibly: Fill out the form using clear and legible handwriting to prevent misinterpretation of the information provided.

- Sign and date the form: Make sure the taxpayer, and if applicable, the spouse, sign and date the form to validate the opt-out election.

- Keep a copy for records: After completing and submitting the form, retain a copy for personal records in case of future inquiries or issues.

- Discuss with your tax preparer: Have a conversation with your tax preparer about your decision to opt out of electronic filing and the reasons behind it.

- Leave sections blank: Ensure all required fields are filled out. Incomplete forms may not be processed, leading to potential filing delays.

- Forget to indicate the reason for opting out: Clearly state your reason(s) for choosing not to file electronically. This information is necessary for the form's validity.

- Rush through the form: Take your time to correctly fill out each section to avoid mistakes that could necessitate corrections later.

- Use pencil or erasable ink: Fill out the form using permanent ink to prevent alterations or illegibility after submission.

- Overlook the preparer's section: Ensure that the tax preparer completes their portion of the form, confirming they did not influence the decision to opt out.

- Disregard retention requirements: Remember that the form must be retained by the tax preparer for three tax years succeeding the tax year it pertains to. This is crucial for compliance and record-keeping.

Misconceptions

There are several misconceptions floating around regarding the West Virginia Opt 1 form, which allows taxpayers to opt out of electronic filing of their tax returns. Understanding these misconceptions is crucial for both taxpayers and tax preparers in West Virginia. Here are seven common misconceptions and the truths behind them:

- Electronic filing is mandatory for all: While it's true that tax preparers who file more than 25 tax returns using tax preparation software are required to file returns electronically, the Opt 1 form provides an exception, allowing taxpayers to opt out and submit a paper return instead.

- The Opt 1 form is complicated: Some might think the Opt 1 form is complex and difficult to understand. In reality, it is a straightforward form designed to simply record a taxpayer's choice not to file electronically.

- Opting out can lead to penalties: There is a misconception that choosing not to file electronically, by using the Opt 1 form, may result in penalties. This is not the case. The form is a legitimate way to opt out without facing any penalties.

- Tax preparers can make the decision for taxpayers: The form clearly states that the taxpayer must voluntarily choose not to have their return electronically filed. It's a personal decision, and the preparer cannot make this choice for the taxpayer.

- It’s only for individuals: Although the form mentions "personal income tax return," it can be used by any taxpayer, including those filing jointly, to opt out of electronic filing as long as they are using a tax preparer who falls into the required category.

- Filing the Opt 1 form is the same as filing your taxes: This is incorrect. Completing and submitting the Opt 1 form is not the same as filing your tax return. It's simply a declaration of your choice to opt out of electronic filing. You still need to file your tax return by the appropriate method after submitting this form.

- There’s no record-keeping requirement for tax preparers: On the contrary, tax preparers are required to retain the form for three tax years following the year it was signed. It ensures compliance and verification that the taxpayer indeed opted out of electronic filing.

By correcting these misconceptions, taxpayers and tax preparers can better navigate the process of opting out of electronic filing, ensuring that all procedures are correctly followed and both parties understand their rights and responsibilities regarding the West Virginia Opt 1 form.

Key takeaways

Here are key takeaways about completing and using the West Virginia Opt 1 form:

- Eligibility for Opting Out: Taxpayers who receive services from a tax preparer mandated to file returns electronically in West Virginia can choose not to file their income tax return electronically by using the Opt 1 form.

- Required Usage for Tax Preparers: For income tax preparers handling more than 25 tax returns annually using tax preparation software, electronic filing is obligatory unless the taxpayer opts out with this form.

- Voluntary Decision: The decision to opt-out of electronic filing is solely at the discretion of the taxpayer. The preparer cannot influence this choice.

- Joint Filing Consideration: If filing jointly, both the taxpayer and the spouse must sign the form to validate the opt-out choice.

- Form Completion: Taxpayers must fill out their personal details, including primary and spouse’s Social Security Numbers if filing jointly, clearly on the form.

- Tax Preparer’s Role: Upon a taxpayer deciding to opt out, the tax preparer must acknowledge the taxpayer's choice on the form and ensure no request was made by them to influence this decision.

- Record Retention: Tax preparers are required to keep this form on file for three tax years following the year to which the form pertains.

- Indication on Tax Return: Tax preparers must mark on the taxpayer’s return that the taxpayer opted-out of electronic filing for compliance.

- Definition of Income Tax Preparer: The term "income tax preparer" encompasses any individual who prepares tax returns for compensation, or employs others for this purpose, and is identified as the preparer on the return.

- Exceptions to Preparer Definition: Individuals performing only specific tasks for trusts, estates, or partnerships, where they have a fiduciary or partnership role and are not compensated traditionally for tax preparation, are not considered income tax preparers under this regulation.

Understanding these points can significantly smoothen the process of opting out of electronic filing for both taxpayers and tax preparers in West Virginia.

Other PDF Forms

Virginia Sales Tax Exemption - Enables public service corporations like railway carriers to purchase certain items without incurring sales and use tax.

How to Get Towing License - Prospective applicants are guided to fill out the form without leaving any blanks.

Va Registration Renewal - Provides space for noting any liens at the time of registration.