Fill Out a Valid 760Ip Virginia Template

Navigating tax obligations can be complex, especially when it comes to ensuring all filings are done correctly and on time. The 760IP Virginia form, known formally as the Automatic Extension Payment Voucher for Individuals, plays a crucial role for taxpayers who find themselves unable to file their individual income tax return by the standard due date of May 1. This form is essentially a lifeline, allowing for the calculation and remittance of tentative tax payments to avoid penalties and interest that accrue with late payments. It's important to note that the Commonwealth of Virginia generously provides all taxpayers a six-month extension automatically, eliminating the need to file Form 760IP to secure this extension. However, this extension does not apply to tax payments, which must be settled by the May deadline to avoid extra charges. Designed for individual filers, including those with unique fiscal years, the form requires accurate completion and is coupled with a Tax Payment Worksheet to assist in calculating what might be owed. It's also tailored to those preferring or needing to pay via paper check or money order, though electronic filing is highly encouraged for its ease and efficiency. With penalties for late filing and payment clearly outlined, understanding and utilizing Form 760IP correctly is paramount for any Virginia taxpayer facing an impending filing deadline without the means to settle their tax liability in full.

760Ip Virginia Example

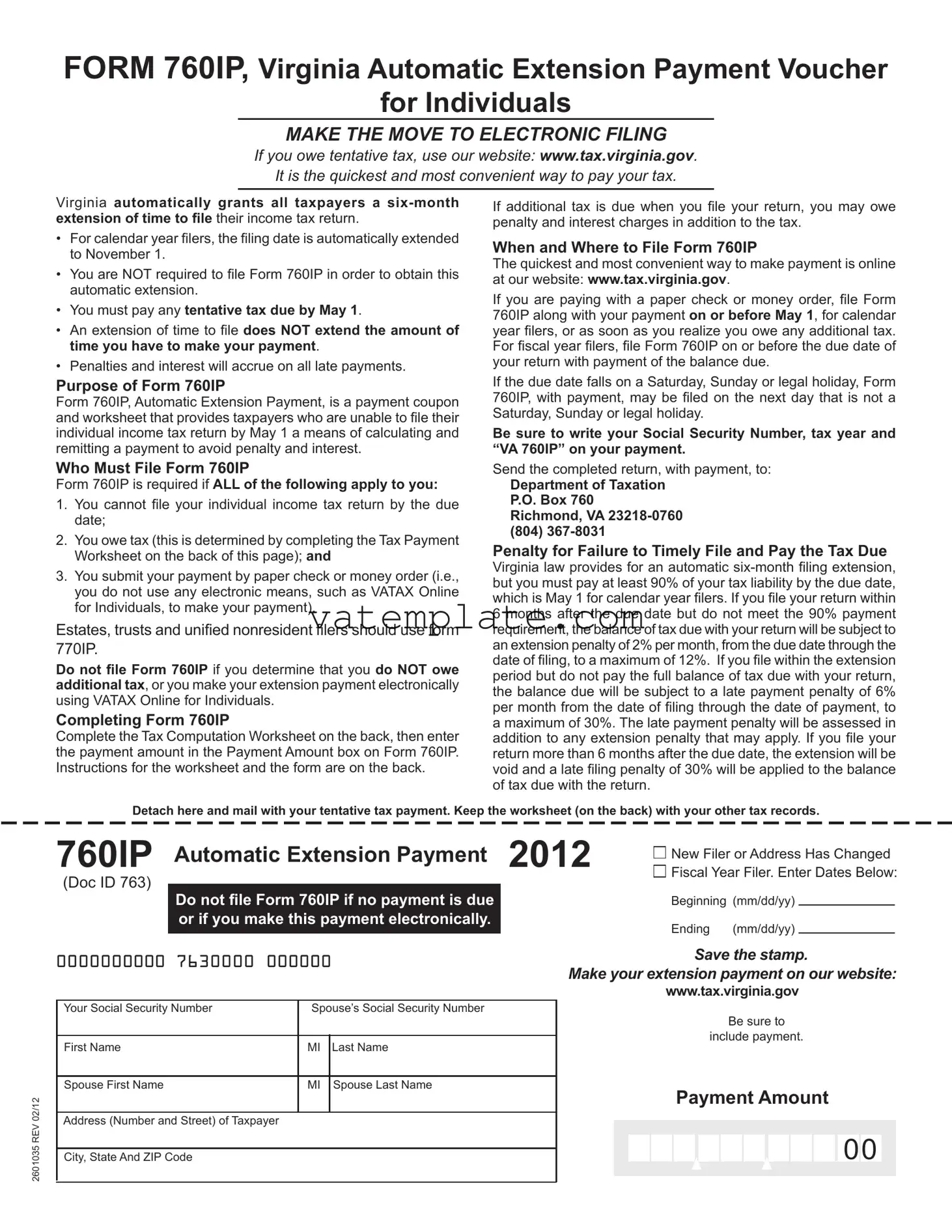

FORM 760IP, Virginia Automatic Extension Payment Voucher

for Individuals

MAKE THE MOVE TO ELECTRONIC FILING

If you owe tentative tax, use our website: www.tax.virginia.gov.

It is the quickest and most convenient way to pay your tax.

Virginia automatically grants all taxpayers a

•For calendar year ilers, the iling date is automatically extended to November 1.

•You are NOT required to ile Form 760IP in order to obtain this automatic extension.

•You must pay any tentative tax due by May 1.

•An extension of time to ile does NOT extend the amount of time you have to make your payment.

•Penalties and interest will accrue on all late payments.

Purpose of Form 760IP

Form 760IP, Automatic Extension Payment, is a payment coupon and worksheet that provides taxpayers who are unable to ile their individual income tax return by May 1 a means of calculating and remitting a payment to avoid penalty and interest.

Who Must File Form 760IP

Form 760IP is required if ALL of the following apply to you:

1.You cannot ile your individual income tax return by the due date;

2.You owe tax (this is determined by completing the Tax Payment Worksheet on the back of this page); and

3.You submit your payment by paper check or money order (i.e., you do not use any electronic means, such as VATAX Online for Individuals, to make your payment).

Estates, trusts and uniied nonresident ilers should use form 770IP.

Do not ile Form 760IP if you determine that you do NOT owe additional tax, or you make your extension payment electronically using VATAX Online for Individuals.

Completing Form 760IP

Complete the Tax Computation Worksheet on the back, then enter the payment amount in the Payment Amount box on Form 760IP. Instructions for the worksheet and the form are on the back.

If additional tax is due when you ile your return, you may owe penalty and interest charges in addition to the tax.

When and Where to File Form 760IP

The quickest and most convenient way to make payment is online at our website: www.tax.virginia.gov.

If you are paying with a paper check or money order, ile Form 760IP along with your payment on or before May 1, for calendar year ilers, or as soon as you realize you owe any additional tax. For iscal year ilers, ile Form 760IP on or before the due date of your return with payment of the balance due.

If the due date falls on a Saturday, Sunday or legal holiday, Form 760IP, with payment, may be iled on the next day that is not a Saturday, Sunday or legal holiday.

Be sure to write your Social Security Number, tax year and “VA 760IP” on your payment.

Send the completed return, with payment, to:

Department of Taxation

P.O. Box 760

Richmond, VA

Penalty for Failure to Timely File and Pay the Tax Due

Virginia law provides for an automatic

Detach here and mail with your tentative tax payment. Keep the worksheet (on the back) with your other tax records.

760IP

(Doc ID 763)

Automatic Extension Payment 2012

Do not ile Form 760IP if no payment is due or if you make this payment electronically.

New Filer or Address Has Changed

New Filer or Address Has Changed

Fiscal Year Filer. Enter Dates Below:

Fiscal Year Filer. Enter Dates Below:

Beginning (mm/dd/yy)

Ending (mm/dd/yy)

|

0000000000 7630000 |

000000 |

|

|||

|

|

|

|

|

|

|

|

|

Your Social Security Number |

|

Spouse’s Social Security Number |

||

|

|

|

|

|

|

|

|

|

First Name |

|

MI |

|

Last Name |

|

|

|

|

|

|

|

|

|

Spouse First Name |

|

MI |

|

Spouse Last Name |

02/12 |

|

|

|

|

|

|

|

Address (Number and Street) of Taxpayer |

|

||||

REV |

|

|

||||

|

|

|

|

|

|

|

2601035 |

|

|

|

|

|

|

|

City, State And ZIP Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Save the stamp.

Make your extension payment on our website:

www.tax.virginia.gov

Be sure to

include payment.

Payment Amount

00

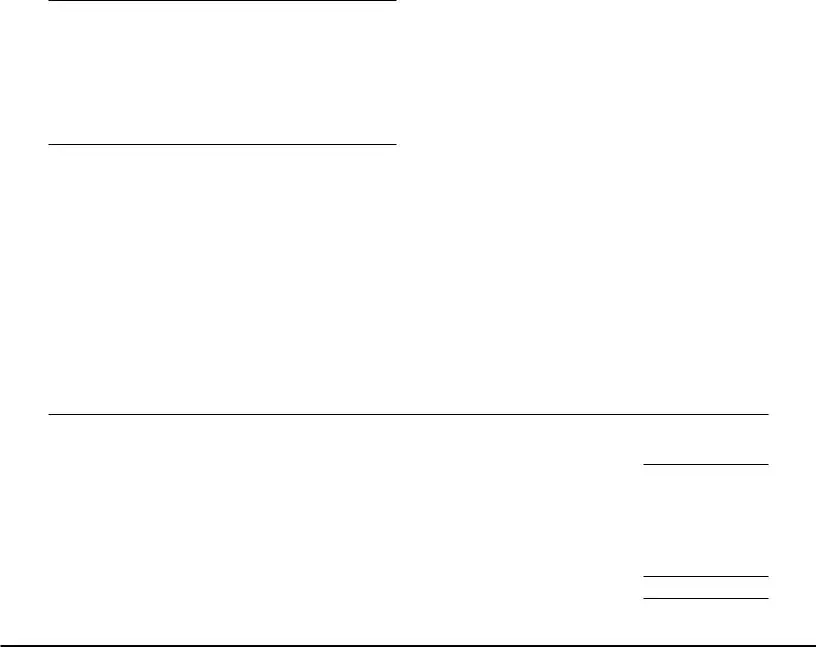

Tentative Tax Computation Worksheet Instructions

You must refer to the income tax return you will ile for the tax year to compute your tentative tax on Line 1 of the Tentative Tax Computation Worksheet. If you and your spouse ile a joint Form 760IP, but do not ile a joint income tax return for the year, the total tentative tax payment may be claimed on your separate return or the separate return of your spouse. If you and your spouse each ile a separate Form 760IP, but elect to ile a joint income tax return for the year, report the sum of all amounts paid on the joint return.

Automatic Extension Payment Instructions

•You can file electronically by using our website: www.tax.virginia.gov. It is the quickest and most convenient way to pay your tentative tax.

•Do not ile Form 760IP if no payment is due or if you make this payment electronically.

•Tenemos servicios disponible en Español.

Fiscal Year Filers

If your taxable year is for a period other than from January 1 to December 31, check the Fiscal Year Filer box and write the beginning and ending dates of your iscal year in the spaces provided.

Name, Address and Social Security Number

Please clearly print or type your name, address and Social Security

Number for which an automatic extension payment is being made.

Compute Your Tentative Tax

Transfer the information from Line 4 of the Tentative Tax Computation Worksheet to Form 760IP.

Tentative Tax

Use the Tentative Tax Worksheet to calculate your tentative tax.

Daytime Phone Number

Enter your daytime telephone number.

Where To Get Forms

Most Virginia tax forms are available from our website: www.tax.virginia.gov. Forms can be obtained from the Department of Taxation by calling (804)

Tentative Tax Computation Worksheet

1. |

Total Virginia income tax I (we) expect to owe. |

1 |

|||

2. |

Payments and credits: |

|

|

|

|

|

(a) |

Virginia income tax withheld |

2(a) |

|

|

|

(b) |

Virginia estimated tax payments |

2(b) |

|

|

|

|

||||

|

(c) |

Overpayment credit from previous taxable year |

2(c) |

|

|

|

|

||||

3. |

Total [add Lines 2(a), 2(b) and 2(c)]. |

3 |

|||

4. |

Balance due (subtract Line 3 from Line 1). Transfer to Form 760IP. |

4 |

|||

Detach here and mail with your tentative tax payment. Keep the worksheet (above) with your other tax records.

Form 760IP - Page 2

Tax Preparer’s Name |

Date |

Daytime Phone Number |

FEIN or PTIN |

Tax Preparer’s Address |

Firm Name |

|

|

Form Properties

| Fact | Detail |

|---|---|

| 1. Purpose | Form 760IP is used for taxpayers to calculate and remit payment to avoid penalties and interest if unable to file individual income tax by May 1. |

| 2. Eligibility | Required if you can't file by due date, owe tax, and pay by paper check or money order. |

| 3. Filing Requirement | Not required to file Form 760IP for an automatic extension but must pay tentative tax by May 1. |

| 4. Payment Deadline | Tentative tax due by May 1 for calendar year filers. |

| 5. Extension Period | Virginia grants a six-month extension automatically. |

| 6. Penalties | Penalties and interest accrue on late payments despite the extension to file. |

| 7. Electronic Filing | Encourages electronic payment for convenience and speed. |

| 8. Where and When to File | File with payment by May 1 online or by mail for calendar year filers. |

| 9. Fiscal Year Filers | For fiscal year filers, due date depends on their specific fiscal year calendar. |

| 10. Governing Law | Virginia state law governs the automatic filing extension and related payments. |

Steps to Filling Out 760Ip Virginia

For many individuals, managing tax obligations is a critical aspect of their financial planning. Particularly when circumstances prevent the timely filing of an income tax return, understanding how to navigate extension payments becomes essential. Virginia's Form 760IP offers a structured way for taxpayers to meet their obligations without facing unnecessary penalties. The form facilitates a straightforward process for those needing to make an automatic extension payment. Here's a simple, stepwise approach to completing Form 760IP.

- Start by determining if you meet the criteria for filing Form 760IP. This form is necessary if you’re unable to file your individual income tax return by the due date, owe tax based on the Tax Payment Worksheet available on the form, and choose to pay by paper check or money order.

- If you are filing for a fiscal year rather than the calendar year, mark the "Fiscal Year Filer" box and enter your fiscal year's starting and ending dates.

- Provide your personal information, including your Social Security Number and, if applicable, your spouse's. Add your first name, middle initial, and last name alongside your spouse’s details if you are filing jointly.

- Fill out your contact details—address, city, state, and ZIP code—ensuring that all information is accurate and up to date.

- Refer to the income tax return you plan to file for the tax year to compute your tentative tax. This calculation is done on the Tentative Tax Computation Worksheet located on the form's back. Carry the total amount to the "Payment Amount" box on Form 760IP.

- Enter your daytime phone number in the space provided. This could be useful if there are queries regarding your extension payment.

- Complete the Tentative Tax Computation Worksheet according to the instructions provided on the form. This involves estimating the total Virginia income tax you expect to owe, accounting for any Virginia income tax withheld, estimated tax payments made, and overpayment credit from the previous year to arrive at the balance due.

- Transfer the balance due amount from the worksheet to the Form 760IP.

- Verify all the information for accuracy to ensure that all necessary details are correctly filled.

- If mailing your payment, ensure your Social Security Number, the tax year, and “VA 760IP” are written on your check or money order. Send the completed Form 760IP along with your payment to the Department of Taxation at the provided address, on or before the due date.

Once you've completed these steps, you'll have successfully navigated the requirements for submitting an automatic extension payment for Virginia state taxes. Remember, this extension applies to filing your return, not to any payments due, so it's crucial to estimate and remit any owed taxes to avoid penalties. Remember, electronic filing and payment is encouraged for its convenience and efficiency.

FAQ

What is the purpose of Form 760IP in Virginia?

Form 760IP serves as an automatic extension payment voucher for individuals who are unable to file their Virginia individual income tax return by the May 1st deadline. It allows taxpayers to calculate and remit a payment to avoid penalties and interest for late payment. This form is particularly used when taxpayers need more time to file their return but expect to owe taxes.

Who needs to file Form 760IP?

To determine if you need to file Form 760IP, consider the following criteria:

- You cannot file your Virginia individual income tax return by the due date.

- You owe tax, as calculated on the Tax Payment Worksheet on the back of the form.

- You are making your payment by paper check or money order rather than electronically.

How do I complete Form 760IP?

Completing Form 760IP involves a few steps:

- Start by completing the Tax Computation Worksheet provided on the back of the form to calculate your tentative tax.

- Enter the calculated payment amount in the Payment Amount box on the form.

- Ensure you follow the instructions provided on the back for both the worksheet and the form.

When is Form 760IP due?

Form 760IP, along with your tentative tax payment, must be submitted on or before May 1st for calendar year filers. For fiscal year filers, it should be filed by the original due date of your return, along with any tax payment due. If the deadline falls on a weekend or legal holiday, you can file the form on the next business day.

Where should I file Form 760IP?

If you are paying with a paper check or money order, send Form 760IP to the Department of Taxation at P.O. Box 760, Richmond, VA 23218-0760. Remember to include your Social Security Number, tax year, and "VA 760IP" on your payment for proper identification. Alternatively, making your extension payment online at www.tax.virginia.gov is the fastest and most convenient option.

What are the penalties for failing to timely file and pay the tax due?

Virginia law mandates that at least 90% of your tax liability be paid by the due date (May 1 for calendar year filers) to avoid penalties. Failure to meet this requirement can result in:

- An extension penalty of 2% per month, up to a maximum of 12%, if you file within the 6-month extension but fail to pay at least 90% of the tax liability by the due date.

- A late payment penalty of 6% per month from the filing date through the payment date, capped at 30%, if you pay the tax balance with your return filed within the extension period but do not fully settle your due tax.

- A late filing penalty of 30% on the balance of tax due with your return if filed more than 6 months after the due date, voiding your extension.

Can I file Form 760IP electronically?

Yes, Virginia encourages taxpayers to make their extension payments electronically as it is the quickest and most convenient option. You can file electronically by using the state's tax website at www.tax.virginia.gov . If you choose this method, you are not required to file a paper Form 760IP.

Common mistakes

Filling out the Form 760IP for Virginia can be straightforward, but several common mistakes can lead to issues with your tax extension payment. It is essential to approach the form carefully to avoid unnecessary penalties or interest. Here are seven mistakes people often make:

- Not realizing an extension to file is not an extension to pay: Many taxpayers think that by getting an extension to file their tax return, they also get an extension to pay any tax due. You must pay any tentative tax due by May 1st to avoid penalties and interest.

- Filling out the form when not necessary: If you determine that you do not owe additional tax or you make your extension payment electronically, you should not fill out Form 760IP. Doing so when it's not needed can lead to confusion and unnecessary paperwork.

- Incorrect computation of tentative tax: The form requires you to calculate your tentative tax properly. Failures in accurately computing the amount you owe, by either underestimating or overlooking deductions, can result in underpayment penalties.

- Omitting personal information: A common mistake is neglecting to clearly print or type your name, address, and Social Security Number. This information is crucial for processing your payment accurately.

- Making errors in payment method details: If paying by paper check or money order, people often forget to write their Social Security Number, tax year, and “VA 760IP” on their payment, leading to processing delays.

- Forgetting to include a daytime phone number: Not providing a contact number can complicate things if there are issues with your form or payment that need quick resolution.

- Filing after the due date without meeting the 90% payment requirement: If you file within the six-month extension period but fail to pay at least 90% of your tax liability by May 1, you'll be subject to extension penalties in addition to any tax owed.

By avoiding these common mistakes, you can ensure that your filing process goes more smoothly and avoid unnecessary penalties. Always double-check your form and payment details before submission to ensure accuracy.

Documents used along the form

When dealing with Virginia state tax filings, particularly for those who need additional time beyond the regular filing deadline, the Form 760IP provides a vital mechanism for individuals to ensure they meet their tax obligations without incurring penalties. This form, by itself, plays a crucial role but is often just one piece of the tax filing puzzle. Several other forms and documents commonly accompany Form 760IP, providing a more comprehensive approach to managing tax extensions and payments.

- Form 760: This is the Virginia Resident Income Tax Return form. It's the standard document for residents to file their annual income tax. Individuals use this form to report their income, deductions, and credits to compute their tax liability or refund.

- Form 763: Nonresident individuals file this form for their Virginia income taxes. It's used by those who have earned income in Virginia but are residents of another state. This form helps calculate the tax owed based on the income earned within Virginia.

- Form 760ES: Estimated Income Tax Payments for Individuals. This form is used for making quarterly estimated tax payments. It's often necessary for self-employed individuals or those who do not have taxes withheld from their income to make estimated payments throughout the tax year to avoid underpayment penalties.

- Form 760PY: Part-Year Resident Income Tax Return. Individuals who have moved to or from Virginia during the tax year use this form to file taxes for the portion of the year they were Virginia residents.

- Form 770: Virginia Fiduciary Income Tax Returns. This document is for estates and trusts to report income, deductions, and gains. Similar to individual tax returns, it calculates the tax liability for these entities.

- Form VEC-FC-20/21: Employer's Quarterly Payroll and Tax Report. While not directly related to individual income taxes, employers in Virginia use this form to report wages paid and unemployment taxes on a quarterly basis. This can indirectly affect individual filers, particularly if adjustments need to be made to reported income or tax withholdings.

In addition to the forms listed, Virginia taxpayers may need to include payment vouchers, worksheets for calculating deductions or credits, and other supporting documents like W-2s or 1099s that substantiate income and tax withholding. Collecting and accurately completing the appropriate forms ensures compliant and timely tax filings, aiding individuals in navigating the complexities of state tax obligations. It's crucial for taxpayers to stay informed about the forms relevant to their specific situations, especially when an extension is necessary, to accurately fulfill their tax responsibilities and avoid penalties.

Similar forms

The 760IP Virginia form, focusing on Automatic Extension Payment for individuals, shares noticeable similarities with the federal Form 4868, which is the Application for Automatic Extension of Time To File U.S. Individual Income Tax Return. Both forms are designed to assist taxpayers in requesting additional time to file their income tax returns. However, while the Virginia 760IP form is specifically for residents or filers within the state of Virginia, Form 4868 applies to federal income tax returns. Furthermore, both forms emphasize that the extension applies to the filing deadline and not to any payments due. Taxpayers are encouraged to estimate and pay any owed taxes by the original due date to avoid penalties and interest.

Another document that resembles the 760IP form is the Form 7004, known as the Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns. Form 7004 is used by businesses rather than individuals to request a filing extension for various business income tax returns. Similar to the 760IP, this form does not extend the time for payment of taxes owed. Both forms require taxpayers to make an accurate estimation of the tax due and submit any payment by the original deadline. The significant difference lies in the audience they serve: Form 760IP is for individual taxpayers in Virginia, and Form 7004 targets businesses seeking extensions for their federal tax returns.

Dos and Don'ts

When filling out the Virginia Form 760IP, it is important to pay close attention to both the requirements and common practices to ensure accuracy and compliance. Below are some guidelines to assist with the process:

- Do make use of the online filing system available at www.tax.virginia.gov for the quickest and most convenient way to submit your tentative tax payment.

- Do remember that Virginia grants a six-month extension automatically for filing your income tax return, pushing the deadline to November 1 for calendar year filers.

- Do ensure to pay any tentative tax due by May 1st, as the extension to file does not extend the payment deadline.

- Do complete the Tax Payment Worksheet on the back of the form to determine the amount of tax owed if any.

- Do include your Social Security Number, tax year, and "VA 760IP" on your payment to ensure proper processing.

- Don't file Form 760IP if you do not owe additional tax or if you have chosen to make your extension payment electronically through VATAX Online for Individuals.

- Don't forget to include your daytime phone number on Form 760IP for any potential follow-up or clarification that may be needed.

- Don't overlook the penalties for not filing and paying on time. At least 90% of your tax liability must be paid by May 1st to avoid penalties.

- Don't send your form and payment after May 1st if you are a calendar year filer or after the due date of your return if you are a fiscal year filer to avoid penalties and interest accrual.

Adhering to these do's and don'ts will help ensure that your Form 760IP is filled out accurately and submitted in a timely manner, potentially saving you from unnecessary penalties and interest charges.

Misconceptions

Understanding the Form 760IP in Virginia can be challenging, leading to several common misconceptions. Below, we clarify the purpose and requirements of this form to help taxpayers navigate their tax obligations more effectively.

- Misconception 1: Filing Form 760IP Extends the Payment Deadline

- Misconception 2: Form 760IP Must Be Filed to Receive an Extension

- Misconception 3: Electronic Payments Require Form 760IP

- Misconception 4: Form 760IP Is for Individual Taxpayers Only

- Misconception 5: Penalties Are Waived with Form 760IP Submission

Some people mistakenly believe that filing Form 760IP provides an extension for both filing their tax return and paying any owed taxes. In reality, while Virginia automatically grants a six-month extension to file the individual income tax return, the payment of any tentative tax due must still be made by May 1st. Filing Form 760IP does not extend the payment deadline.

Another common misconception is that taxpayers must file Form 760IP to obtain the automatic six-month filing extension. However, this form is specifically for making an extension payment, not for requesting an extension. The extension to file is automatic and does not require any form to be filed simply to obtain the extension.

Many believe that if they make an electronic payment, they still need to submit Form 760IP. This is incorrect. Taxpayers who pay their tentative tax electronically via the Virginia Tax website or other electronic means are not required to submit Form 760IP. This form is primarily for those making payments by check or money order.

While it's true that Form 760IP is designed for individual taxpayers, it's important to note that estates, trusts, and unified nonresident filers have a different form, Form 770IP, for extension payments. Therefore, saying Form 760IP is only for individuals can be misleading without specifying that other entities have their own version for similar purposes.

Some taxpayers might think that by submitting Form 760IP, they are exempt from penalties and interest if their payment is late. Unfortunately, this is not the case. While filing Form 760IP with the necessary payment by May 1st helps avoid penalties, any late payments—even with Form 760IP—will still accrue penalties and interest.

Understanding these common misconceptions about Form 760IP can help Virginia taxpayers navigate their extension payments more smoothly, ensuring they meet their obligations without incurring unnecessary penalties.

Key takeaways

Understanding and properly utilizing the Virginia Form 760IP, the Automatic Extension Payment Voucher for Individuals, is crucial for taxpayers who cannot file their income tax return by the due date. Here are eight key takeaways to ensure compliance and minimize penalties:

- The Virginia Department of Taxation grants an automatic six-month extension to all taxpayers, allowing them to file their income tax return by November 1 for calendar year filers, without needing to file Form 760IP to secure this extension.

- Form 760IP is essential for taxpayers who are unable to file by the May 1 deadline and anticipate owing tax; it serves as a means to calculate and remit payment to avoid incurring penalties and interest.

- Taxpayers who opt to pay any owed tax electronically via VATAX Online for Individuals or determine they do not owe additional tax do not need to file Form 760IP.

- To complete Form 760IP correctly, taxpayers should use the Tax Computation Worksheet provided on the back of the form, ensuring that the payment amount entered matches the worksheet's calculations.

- Payments accompanying Form 760IP should be made by the May 1 deadline for calendar year filers, or on or before the due date for fiscal year filers, to avoid penalties. If paying by paper check or money order, personal information and specific details must be included for proper processing.

- Electronically filing and making payments is promoted as the quickest and most convenient option, with resources and forms available at the Virginia Department of Taxation's website.

- In cases where the taxpayer pays at least 90% of their tax liability by May 1 but files the return within the following six months without fully meeting the tax payment requirement, penalties will accrue based on percentages of the unpaid tax, potentially reaching significant sums over time.

- For those using the form, it’s vital to ensure all personal information is clearly printed or typed, including Social Security Numbers for both the taxpayer and spouse if applicable, to avoid processing delays.

Both timely filing and payment are critical to avoid unnecessary penalties and interest. Taxpayers should also keep a copy of the Tax Computation Worksheet with their records after detaching and mailing Form 760IP with the tentative tax payment.

Other PDF Forms

Virginia Commercial Vehicle Registration - Key document for Virginia’s interstate trucking businesses to ensure their fleet adheres to the legal requirements of the IRP.

Virginia Withholding - All household employers are legally required to both file this form and pay the appropriate taxes electronically, with very few exceptions.

Virginia 501c3 - This certificate is crucial in supporting the health needs of individuals by making medical essentials more accessible through tax exemptions.