Fill Out a Valid Virginia 801 Template

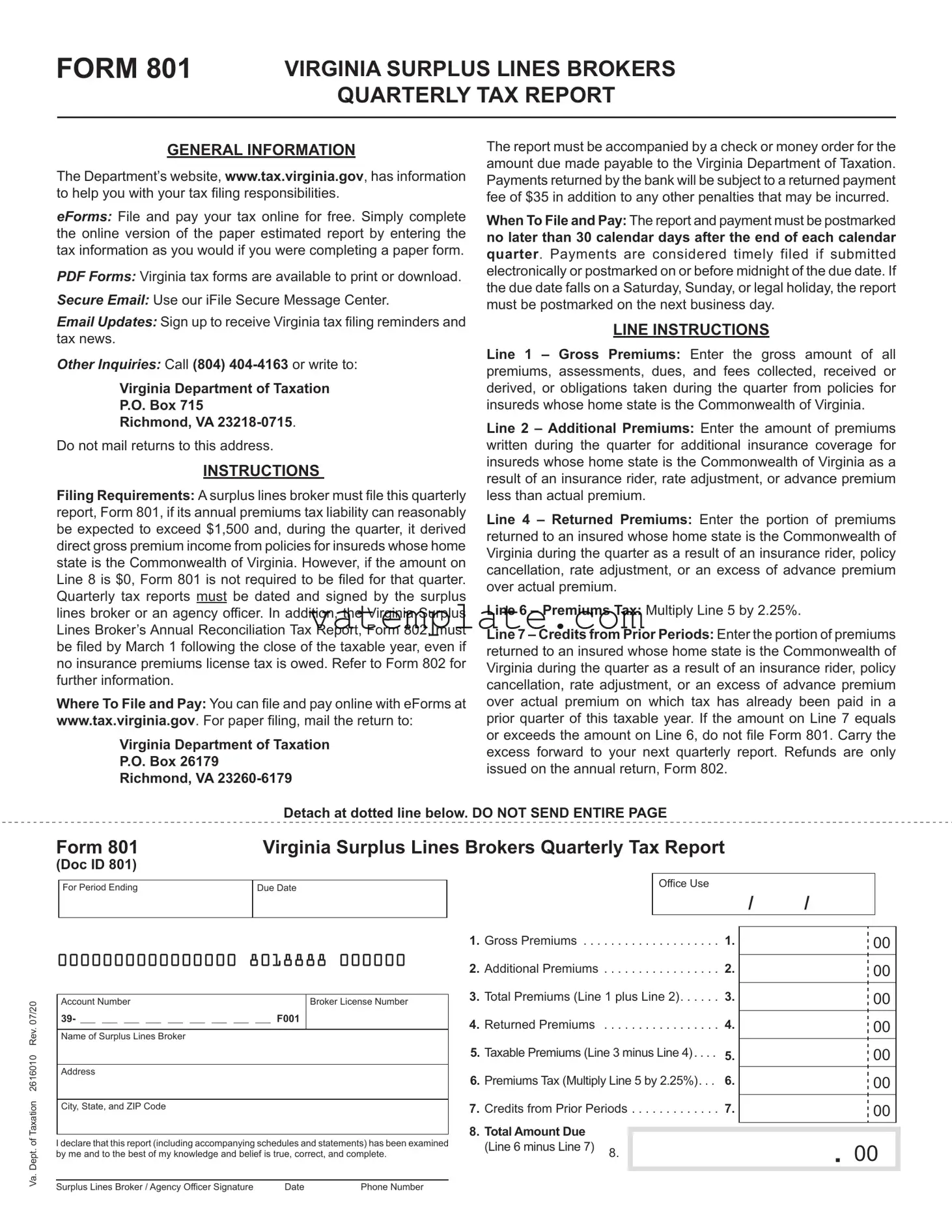

In the realm of insurance and taxation within Virginia, the Virginia 801 form stands as a crucial quarterly tax report specifically tailored for surplus lines brokers. This document, officially named the Virginia Surplus Lines Brokers Quarterly Tax Report, outlines the requisite actions surplus lines brokers must take to comply with tax obligations imposed by the state. Brokerages dealing with insurance policies for entities whose home state is Virginia, and expecting an annual premiums tax liability exceeding $1,500, are mandated to submit this report. The document provides a detailed blueprint for calculating taxes owed from direct gross premium income accrued within the quarter. Additionally, it introduces a subsequent form, the Virginia Surplus Lines Broker’s Annual Reconciliation Tax Report (Form 802), which needs to be filed by March 1 following the tax year's close. The 801 form guide extensively covers how to file and pay, emphasizing the availability of online submission via eForms on the Virginia Department of Taxation's website, alongside traditional paper filing. Moreover, it elucidates the calculation of gross premiums, amendments for additional premiums or returns, and the application of credits from past periods against the current tax obligation. The deadline for submission adheres to a strict schedule, requiring postmarking within 30 days following a quarter's end. Through detailed line instructions and dedicated sections for broker and office use, the form serves as an essential tool for ensuring that surplus lines brokers remain in good standing with Virginia's tax laws.

Virginia 801 Example

FORM 801 |

VIRGINIA SURPLUS LINES BROKERS |

|

QUARTERLY TAX REPORT |

GENERAL INFORMATION

The Department’s website, www.tax.virginia.gov, has information to help you with your tax filing responsibilities.

eForms: File and pay your tax online for free. Simply complete the online version of the paper estimated report by entering the tax information as you would if you were completing a paper form.

PDF Forms: Virginia tax forms are available to print or download.

Secure Email: Use our iFile Secure Message Center.

Email Updates: Sign up to receive Virginia tax filing reminders and tax news.

Other Inquiries: Call (804)

Virginia Department of Taxation

P.O. Box 715

Richmond, VA

Do not mail returns to this address.

INSTRUCTIONS

Filing Requirements: A surplus lines broker must file this quarterly report, Form 801, if its annual premiums tax liability can reasonably be expected to exceed $1,500 and, during the quarter, it derived direct gross premium income from policies for insureds whose home state is the Commonwealth of Virginia. However, if the amount on Line 8 is $0, Form 801 is not required to be filed for that quarter. Quarterly tax reports must be dated and signed by the surplus lines broker or an agency officer. In addition, the Virginia Surplus Lines Broker’s Annual Reconciliation Tax Report, Form 802, must be filed by March 1 following the close of the taxable year, even if no insurance premiums license tax is owed. Refer to Form 802 for further information.

Where To File and Pay: You can file and pay online with eForms at www.tax.virginia.gov. For paper filing, mail the return to:

Virginia Department of Taxation

P.O. Box 26179

Richmond, VA

The report must be accompanied by a check or money order for the amount due made payable to the Virginia Department of Taxation. Payments returned by the bank will be subject to a returned payment fee of $35 in addition to any other penalties that may be incurred.

When To File and Pay: The report and payment must be postmarked no later than 30 calendar days after the end of each calendar quarter. Payments are considered timely filed if submitted electronically or postmarked on or before midnight of the due date. If the due date falls on a Saturday, Sunday, or legal holiday, the report must be postmarked on the next business day.

LINE INSTRUCTIONS

Line 1 – Gross Premiums: Enter the gross amount of all premiums, assessments, dues, and fees collected, received or derived, or obligations taken during the quarter from policies for insureds whose home state is the Commonwealth of Virginia.

Line 2 – Additional Premiums: Enter the amount of premiums written during the quarter for additional insurance coverage for insureds whose home state is the Commonwealth of Virginia as a result of an insurance rider, rate adjustment, or advance premium less than actual premium.

Line 4 – Returned Premiums: Enter the portion of premiums returned to an insured whose home state is the Commonwealth of Virginia during the quarter as a result of an insurance rider, policy cancellation, rate adjustment, or an excess of advance premium over actual premium.

Line 6 – Premiums Tax: Multiply Line 5 by 2.25%.

Line 7 – Credits from Prior Periods: Enter the portion of premiums returned to an insured whose home state is the Commonwealth of Virginia during the quarter as a result of an insurance rider, policy cancellation, rate adjustment, or an excess of advance premium over actual premium on which tax has already been paid in a prior quarter of this taxable year. If the amount on Line 7 equals or exceeds the amount on Line 6, do not file Form 801. Carry the excess forward to your next quarterly report. Refunds are only issued on the annual return, Form 802.

Detach at dotted line below. DO NOT SEND ENTIRE PAGE

Form 801 |

Virginia Surplus Lines Brokers Quarterly Tax Report |

|

|

|||

(Doc ID 801) |

|

|

|

|

|

|

|

|

|

|

Office Use |

|

|

|

For Period Ending |

Due Date |

|

/ |

/ |

|

|

|

|

||||

|

|

|

|

|

||

|

|

|

|

|

|

|

Va. Dept. of Taxation 2616010 Rev. 07/20

0000000000000000 8018888 000000

Account Number |

Broker License Number |

39- ___ ___ ___ ___ ___ ___ ___ ___ ___ F001

Name of Surplus Lines Broker

Address

City, State, and ZIP Code

I declare that this report (including accompanying schedules and statements) has been examined by me and to the best of my knowledge and belief is true, correct, and complete.

Surplus Lines Broker / Agency Officer Signature |

Date |

Phone Number |

1. |

Gross Premiums |

1. |

00 |

||

2. |

Additional Premiums |

2. |

00 |

||

3. |

Total Premiums (Line 1 plus Line 2). . . . |

3. |

00 |

||

4. |

Returned Premiums |

4. |

00 |

||

5. Taxable Premiums (Line 3 minus Line 4). . . |

5. |

00 |

|||

6. |

Premiums Tax (Multiply Line 5 by 2.25%). . |

6. |

00 |

||

7. |

Credits from Prior Periods |

7. |

00 |

||

8. |

Total Amount Due |

|

|

|

|

|

|

|

|

||

|

(Line 6 minus Line 7) |

8. |

|

|

. 00 |

|

|

|

|

||

Form Properties

| Fact | Detail |

|---|---|

| Form Purpose | Form 801 is a quarterly tax report for surplus lines brokers in Virginia. |

| Filing Requirement | Surplus lines brokers must file this report if their annual premiums tax liability is expected to exceed $1,500 and they have income from policies for insureds in Virginia. |

| Electronic and Paper Filing | Brokers can file and pay online via eForms or mail their paper returns to the Virginia Department of Taxation. |

| Payment Information | Payments must be accompanied by a check or money order payable to the Virginia Department of Taxation. A $35 fee is charged for returned payments. |

| Governing Laws | Surplus Lines Broker's tax reports are regulated under Virginia's state tax laws, ensuring compliance with financial and insurance guidelines. |

Steps to Filling Out Virginia 801

Filling out Virginia's Form 801, the Surplus Lines Brokers Quarterly Tax Report, is essential for any broker who meets the criteria for filing. This form, required by the Department of Taxation, helps ensure that brokers accurately report their premium transactions and pay the necessary taxes on time. The following steps will guide you through the process of completing this form, ensuring compliance with Virginia tax laws and avoiding penalties that may arise from late or incorrect filings.

- Visit the Virginia Department of Taxation’s website at www.tax.virginia.gov to either file online using eForms or download a PDF version of Form 801.

- Enter the gross amount of all premiums, assessments, dues, fees collected, or obligations taken during the quarter from policies for insureds whose home state is the Commonwealth of Virginia on Line 1 – Gross Premiums.

- On Line 2 – Additional Premiums, input the amount for premiums written during the quarter for additional insurance coverage as a result of a rate adjustment, insurance rider, or advance premium less than the actual premium.

- Calculate and enter the total premiums by adding Line 1 and Line 2. This total is entered on Line 3 – Total Premiums.

- For Line 4 – Returned Premiums, input the portion of premiums that was returned to insureds during the quarter due to policy cancellation, insurance rider, rate adjustment, or excess of advance premium over actual premium.

- Deduct the returned premiums (Line 4) from the total premiums (Line 3) to get the taxable premiums. Enter this figure on Line 5 – Taxable Premiums.

- Multiply the taxable premiums (Line 5) by 2.25% to calculate the premiums tax. Write this amount on Line 6 – Premiums Tax.

- If there are any credits from prior periods, list them on Line 7 – Credits from Prior Periods. This could include taxes paid on returns or cancellations from previous quarters within the same tax year.

- To find the total amount due, subtract any credits listed on Line 7 from the premiums tax calculated on Line 6 and enter this figure on Line 8 – Total Amount Due.

- Provide your broker license number, account number, and complete the personal information section. This includes the name of the surplus lines broker or agency, address, city, state, and ZIP Code.

- Carefully review all the information for accuracy, sign and date the bottom of the form where indicated. Be sure the signature is by the surplus lines broker or an authorized agency officer.

- If filing by paper, attach a check or money order for the amount due made payable to the Virginia Department of Taxation. Ensure the report and payment are mailed to the appropriate address and postmarked no later than 30 calendar days after the end of the calendar quarter to avoid penalties.

Once the form is completed and submitted, the broker has fulfilled their tax obligations for the quarter. Regular filing keeps the broker in good standing with the Virginia Department of Taxation and ensures compliance with state regulations governing surplus lines insurance. Be mindful of the filing deadlines to prevent any late fees or penalties.

FAQ

What is Form 801 in Virginia?

Form 801, known as the Virginia Surplus Lines Brokers Quarterly Tax Report, is a required document for surplus lines brokers in Virginia. These brokers must file this report quarterly if their annual premiums tax liability is expected to exceed $1,500. The form is used to report direct gross premium income derived from policies for insureds whose home state is the Commonwealth of Virginia.

Who needs to file Form 801?

Any surplus lines broker operating in Virginia whose annual premiums tax liability can reasonably be expected to exceed $1,500 must file Form 801. This requirement applies if, during the quarter, they received direct gross premium income from policies for insureds based in Virginia.

How can I file Form 801?

Form 801 can be filed in two ways:

- Online with eForms at the Virginia Department of Taxation’s website.

- Via mail, by sending the completed form and a check or money order for any amount due to the Virginia Department of Taxation’s mailing address designated for this purpose.

When is Form 801 due?

The report and the accompanying payment must be postmarked no later than 30 calendar days after the end of each calendar quarter. If submitted electronically or postmarked by midnight of the due date, payments are considered timely. Should the due date fall on a Saturday, Sunday, or legal holiday, the report should be postmarked the next business day.

What if I do not owe any premiums tax for a quarter?

If the amount on Line 8 of Form 801 is $0, indicating no tax is owed for that quarter, the surplus lines broker is not required to file Form 801 for that period.

What information is required on Form 801?

The required information includes:

- Gross premiums

- Additional premiums due to insurance riders, rate adjustments, or advance premiums

- Returned premiums to an insured as a result of policy cancellations or adjustments

- Premiums tax calculations

- Credits from previous periods if applicable

What happens if I fail to file or pay on time?

Payments returned by the bank, as well as late filings, can incur penalties. A returned payment is subject to a $35 fee, in addition to any other penalties that may apply for the late or non-filing of Form 801.

Is there an annual report requirement in addition to the quarterly Form 801?

Yes, surplus lines brokers are also required to file the Virginia Surplus Lines Broker’s Annual Reconciliation Tax Report, Form 802, by March 1 following the close of the taxable year. This is necessary even if no insurance premiums license tax is owed for that year, ensuring that all annual revenues and tax liabilities are accurately reported.

Common mistakes

Not understanding the filing threshold: A common mistake made by surplus lines brokers when filling out Form 801 is not realizing that this report is only required if their annual premiums tax liability is expected to exceed $1,500 and they have received direct gross premium income from policies for insureds whose home state is Virginia during the quarter. If the amount on Line 8 is $0, Form 801 does not need to be filed for that quarter. This oversight could lead to unnecessary filing or missed submissions.

Incorrectly reporting gross premiums: On Line 1 of Form 801, brokers are asked to enter the gross amount of all premiums, assessments, dues, and fees collected, received, or derived, or obligations taken during the quarter from policies for insureds based in Virginia. Misinterpreting what constitutes gross premiums or failing to include all relevant financial transactions can result in inaccurate tax calculations and potential penalties.

Overlooking adjustments and returns: Lines 2 and 4 require brokers to report any additional premiums for new coverage and any returned premiums to insureds in Virginia, respectively. Failure to properly account for these adjustments can lead to an incorrect calculation of taxable premiums on Line 5, which forms the basis for the tax calculation. This mistake can either cause brokers to overpay their taxes due or underpay, leading to potential interest and penalties for underpayment.

Forgetting to deduct credits from prior periods: Line 7 allows brokers to deduct portions of premiums that were returned to insureds and on which tax was already paid in a prior quarter of the same taxable year. However, if brokers overlook this deduction, they might end up overestimating the total amount due on Line 8. This oversight not only affects the current quarter's tax liability but could also complicate the reconciliation process in their annual Form 802 filing.

Submitting Form 801 correctly is crucial for ensuring compliance with Virginia's tax regulations for surplus lines brokers. Being diligent in understanding the form's requirements, accurately reporting all premium-related transactions, and taking full advantage of deductible items can help avoid these common mistakes. Additionally, utilizing the provided eForms system for online filing can simplify the process and help minimize errors.

Documents used along the form

When dealing with the complexities of surplus lines insurance in Virginia, the Form 801 plays a critical role in ensuring compliance and accurate tax reporting. However, it's important to understand that this form does not stand alone. Several other documents and forms are often utilized alongside Form 801 to provide a comprehensive view of a surplus lines broker's obligations and financial transactions within the state. Knowing these documents can help brokers manage their reporting requirements efficiently.

- Form 802 - Virginia Surpllus Lines Broker’s Annual Reconciliation Tax Report: This is required annually and complements Form 801 by providing a year-end summary of the surplus lines tax liability, ensuring all quarterly payments are accurate and any overpayments or underpayments are addressed.

- Form SL-3 - Surplus Line Broker Bond Form: A necessary bond form that surplus lines brokers must submit to demonstrate financial security, as part of their licensing requirements in Virginia.

- Form SL-1 - Broker Transaction Form: Used by brokers to report individual transactions to the state, aiding in the tracking of all surplus lines policies written. with SL-2 being a Statement of Procurement Form, which a surplus lines broker submits to certify that diligent effort has been made to procure the required insurance from licensed insurers, and the coverage was not available, except from a surplus lines insurer.

- Form RC-1 - Request for Certificate of Authority: Necessary for companies seeking to become recognized as licensed entities able to transact business within Virginia, affecting surplus lines brokers who may place business with these entities.

- Cancellation Notice: While not a standardized form, any notice of policy cancellation is critical documentation, potentially affecting premium tax calculations and compliance statuses.

- VA SLB Declaration Page: The declaration page of every policy written by a surplus lines broker, detailing coverage amounts, premiums, and insured information, is essential for accurate reporting on Forms 801 and 802.

- Endorsement Changes: Any alterations or endorsements to existing policies must be tracked meticulously, as they can impact premium calculations and the associated tax liabilities reported through Form 801.

Keeping accurate and comprehensive records of these documents, alongside timely and correct completion of Form 801, ensures surplus lines brokers in Virginia remain in good standing while fulfilling their tax and reporting duties. It also underscores the importance of a systematic approach to managing the bureaucratic aspects of surplus lines brokerage, safeguarding against potential compliance pitfalls.

Similar forms

The Virginia 801 form, known as the Virginia Surplus Lines Brokers Quarterly Tax Report, shares similarities with several other types of financial and tax reporting documents. Chief among these is the general approach to the reporting of taxable income, the structure of the form in terms of itemizing specific categories of financial information, and the methodology for calculating taxes owed or credits due.

One document that bears resemblance to the Virginia 801 form is the Federal 941 form, the Employer's Quarterly Federal Tax Return. Both serve the purpose of quarterly tax reporting and require detailed accounting of financial transactions over the reporting period. The 941 form collects information on wages paid, tips received, and the federal income tax withheld from employees, which parallels the Virginia 801's collection of gross premiums, additional premiums, and returned premiums. Just as the 801 form calculates a tax rate on the taxable premiums — after adjustments for returns and credits — the 941 form requires the calculation of taxes owed on the total employee compensation, after allowances for credits and pre-payments. Both forms also enforce deadlines for filing and payment, emphasizing the cyclical nature of these tax responsibilities.

Another analogous document is the State Sales Tax Return utilized by many U.S. states for businesses to report and remit taxes on sales made within the state. Similar to the Virginia 801 form, state sales tax returns often require businesses to report total sales, taxable sales, and to calculate the tax due based on a specific percentage rate. Both forms might offer avenues for deductions or credits based on certain criteria, like returned goods in the case of sales tax, paralleling the returned premiums line on the Virginia 801. These returns emphasize the relationship between tax liability and actual business conducted within a specific timeframe, quarterly for Virginia 801 and often monthly, quarterly, or annually for sales tax, depending on the state and the volume of sales.

Lastly, the Virginia Surplus Lines Broker’s Annual Reconciliation Tax Report, Form 802, is intrinsically connected to the Virginia 801 form by serving as an annual compilation and reconciliation of the quarterly reports filed throughout the fiscal year. While Form 801 details premiums collected, returned, and the tax applied on a quarterly basis, Form 802 encapsulates this information for the entire year. It provides a broader overview and ensures that any adjustments or credits missed in the quarterly reports are accounted for. The necessity of filing both forms, with Form 801 serving as a more frequent, detailed report and Form 802 as an annual summary, underscores the importance of continuous versus periodic financial oversight in meeting tax obligations.

Dos and Don'ts

When completing the Virginia 801 Form, which is crucial for surplus lines brokers reporting quarterly tax, it's essential to follow specific dos and don'ts to ensure accuracy and compliance. Here’s a guide to help you navigate the form correctly:

- Do ensure that all information is up-to-date and accurate, especially the premiums collected and the corresponding taxes due.

- Do file your report and make payment online if possible; this method is more secure and faster, ensuring your compliance is timely.

- Do make sure to sign and date the form; an unsigned form may be considered invalid and can result in delays or penalties.

- Do utilize the Department of Taxation’s resources like secure email and eForms for efficient and safe communication and filing.

- Do check for any credits from prior periods that can be applied to the current quarter's tax liability to avoid overpaying.

- Don't forget to subtract returned premiums from the total premiums collected before calculating the taxable premiums; this ensures you are not overpaying your taxes.

- Don't delay filing beyond the due date to avoid penalties; remember payments and reports are due 30 calendar days after the quarter ends. If the due date falls on a weekend or holiday, make sure your filing is postmarked by the next business day.

Mindfulness in adhering to these guidelines will facilitate a smoother filing process and help avoid common pitfalls that can lead to unnecessary complications or financial penalties. It is always recommended to review your entries thoroughly before submission to ensure all information is correct and complete.

Misconceptions

Misunderstandings about tax forms can lead to errors in filing, potentially resulting in fines and penalties. The Virginia 801 Form, the Quarterly Tax Report for Surplus Lines Brokers, is not immune to this issue. Below are seven common misconceptions about this form:

Electronic filing is optional: Many believe that filing Form 801 electronically is just an alternative option and not encouraged. In fact, the Virginia Department of Taxation recommends e-filing due to its efficiency and security, offering it as a free service.

Filing is required for all brokers, regardless of income: There's a misconception that all brokers must submit a Form 801 quarterly. However, only surplus lines brokers with a tax liability expected to exceed $1,500 annually and who receive direct gross premium income from policies for Virginian insureds need to file.

Paper filing is faster: Contrary to what some may believe, filing a paper return is not quicker. Electronic submissions are processed more rapidly, facilitating a more efficient acknowledgment and resolution of your tax responsibilities.

Form 801 can be sent to any department address: It's crucial to send your Form 801 to the specified address provided in the form instructions. Other addresses can lead to delayed processing times or the return not being filed properly.

Tax payments cannot be made online: This is incorrect. The Virginia Department of Taxation enables online payment for taxes, making it convenient to fulfill tax obligations without mailing a check or money order.

All premium adjustments result in a new Form 801 requirement: Adjustments to premiums, such as due to policy cancellations or rate modifications, do not necessarily require a new Form 801 filing within the same quarter if the net effect does not alter the tax liability significantly.

Refunds are processed quarterly: Another common error is the expectation of quarterly refunds for overpayment of premiums tax. In reality, refunds are only issued with the annual return, Form 802, reinforcing the importance of accurate quarterly tax reporting.

Educating oneself about the correct procedures for filing Virginia's Form 801 can save surplus lines brokers time and protect against unnecessary penalties. It is always advisable to consult directly with the Virginia Department of Taxation or a tax professional for the most current and applicable guidance.

Key takeaways

The Virginia 801 form is an essential document for surplus lines brokers operating within the Commonwealth of Virginia, requiring careful understanding and accurate completion. Here are five key takeaways regarding filling out and using the Virginia 801 form:

- Quarterly Reporting: Surplus lines brokers must file the Virginia 801 form on a quarterly basis if their annual premiums tax liability is expected to exceed $1,500 and they have derived direct gross premium income from policies for insureds whose home state is Virginia during the quarter. However, if no tax is owed for a particular quarter (as indicated by a $0 amount on Line 8), filing the form for that quarter is not required.

- Filing and Payment Methods: Brokers have the option to file and pay online via eForms on the Virginia Department of Taxation’s website, which offers a streamlined and efficient process. Alternatively, for those preferring paper filing, the completed form and accompanying payment must be mailed to the specific address provided by the Department of Taxation.

- Due Dates: The Virginia 801 form, along with the necessary payment, must be postmarked no later than 30 calendar days following the end of each calendar quarter. Timeliness is determined by the postmark date or electronic submission timestamp. If the due date falls on a weekend or legal holiday, the next business day becomes the effective due date.

- Premiums Tax Calculation: Brokers are required to calculate the premiums tax due by applying a 2.25% rate to the taxable premiums, which are determined by subtracting any returned premiums from the total amount of premiums collected during the quarter. This calculation necessitates meticulous record-keeping and accuracy to ensure the correct tax amount is reported and paid.

- Credits and Refunds: Credits from previous periods can be applied to the current quarter’s tax obligation if they represent returned premiums on which tax has been previously paid. If these credits exceed the tax due for the current quarter, the form should not be filed; instead, the surplus is carried forward to the next quarterly report. Importantly, refunds are processed only through the annual return, Form 802.

Overall, performing due diligence in accurately completing the Virginia 801 form is crucial for surplus lines brokers to comply with tax reporting requirements and to ensure that they are correctly calculating and remitting the premiums tax due to the Commonwealth of Virginia. By adhering to the detailed instructions provided and understanding the key components of the form, brokers can fulfill their tax obligations efficiently and effectively.

Other PDF Forms

Unclaimed Funds Virginia - Utility companies can report unclaimed deposits and rebates, highlighting consumer-centric financial obligations.

Pet Addendum Virginia - A legally binding document that must be signed by both landlord and tenant, establishing rules for pet ownership in the rental.

Virginia Commercial Vehicle Registration - An indispensable requirement for Virginia trucking operations to ensure their vehicles meet IRP registration standards for interstate commerce.