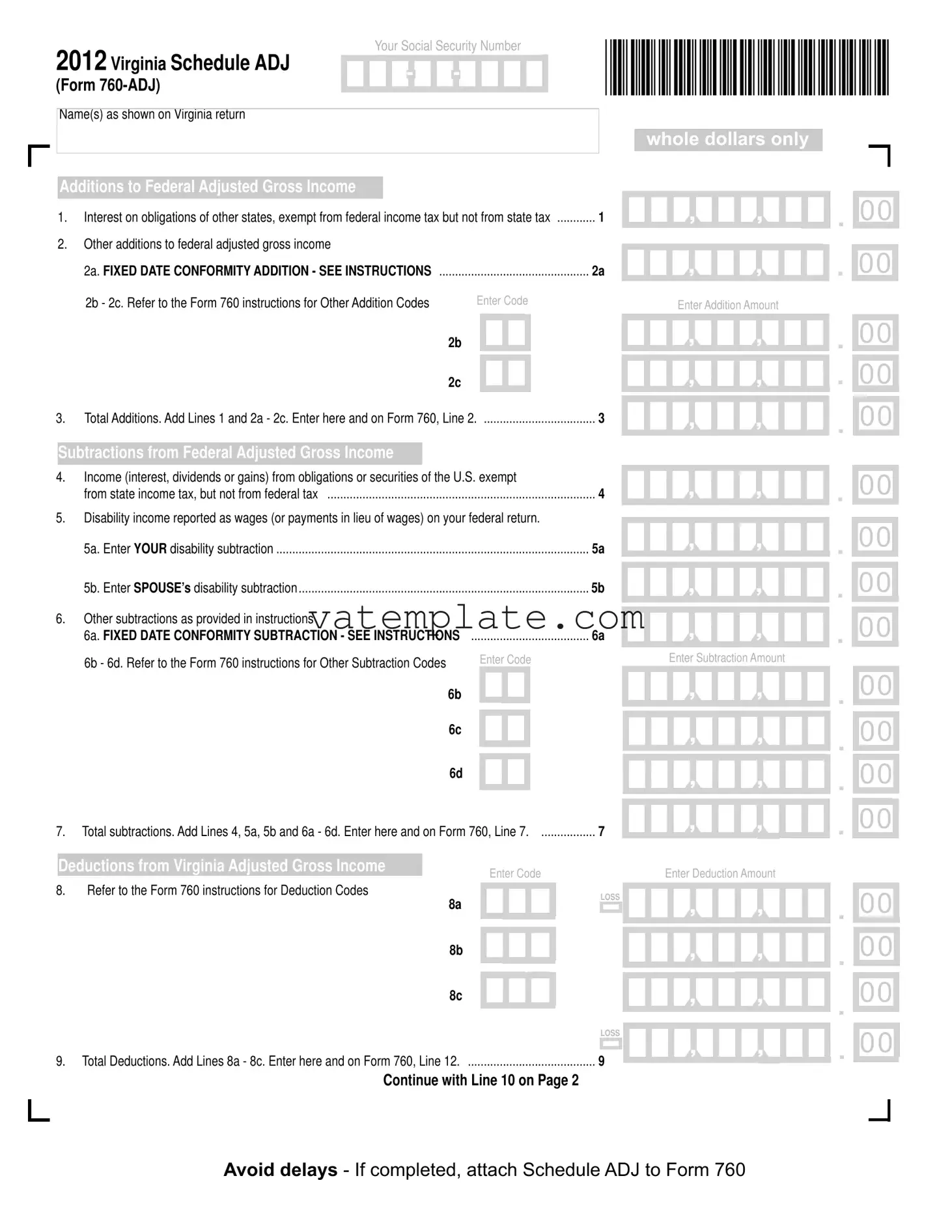

Fill Out a Valid Virginia Schedule Adj Template

Navigating the complexities of state taxes can often feel like an overwhelming task, yet understanding the nuances of specific forms such as the 2012 Virginia Schedule ADJ (Form 760-ADJ) is pivotal for residents aiming to accurately fulfill their tax obligations. This form serves as a crucial tool for modifying one’s federal adjusted gross income to align with Virginia's tax statutes, which may necessitate both additions and subtractions to the federal amount to comply with state-specific fiscal policies. The form meticulously outlines various scenarios where adjustments are warranted, including but not limited to: interest earned on obligations from other states that, while exempt at the federal level, are taxable in Virginia; differing treatments of disability income; and specified deductions that influence the Virginia adjusted gross income. Moreover, it extends into aspects such as tax credits for low-income individuals or for those who have claimed the Earned Income Credit on their federal returns, encouraging a thorough examination of eligibility for such benefits. In navigating through additions, subtractions, and potential tax credits, the form also delves into adjustments related to voluntary contributions, penalties, and interest on due taxes, providing a comprehensive framework for taxpayers to accurately calculate their state tax liabilities and contributions.

Virginia Schedule Adj Example

2012 Virginia Schedule ADJ

(Form

Your Social Security Number

- |

- |

Name(s) as shown on Virginia return |

|

|

|

|

|

|

|

|

|

whole dollars only |

|

|

|

Additions to Federal Adjusted Gross Income |

|

|

|

|

|

|

1. |

Interest on obligations of other states, exempt from federal income tax but not from state tax |

............ 1 |

, |

, |

. |

00 |

2. |

Other additions to federal adjusted gross income |

|

|

|

|

|

|

2a. FIXED DATE CONFORMITY ADDITION - SEE INSTRUCTIONS |

2a |

, |

, |

. |

00 |

2b - 2c. Refer to the Form 760 instructions for Other Addition Codes |

Enter Code |

2b

2c

3. Total Additions. Add Lines 1 and 2a - 2c. Enter here and on Form 760, Line 2 |

3 |

Subtractions from Federal Adjusted Gross Income

4.Income (interest, dividends or gains) from obligations or securities of the U.S. exempt

from state income tax, but not from federal tax |

4 |

5.Disability income reported as wages (or payments in lieu of wages) on your federal return.

5a. |

Enter YOUR disability subtraction |

|

|

|

|

5a |

|

5b. |

Enter SPOUSE’s disability subtraction |

|

|

|

|

5b |

|

6. Other subtractions as provided in instructions |

|

|

|

|

|

|

|

6a. |

FIXED DATE CONFORMITY SUBTRACTION - SEE INSTRUCTIONS |

|

|

|

|

6a |

|

6b - 6d. Refer to the Form 760 instructions for Other Subtraction Codes |

|

Enter |

|

Code |

|

||

|

|

|

|

|

|||

|

6b |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6c |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7. Total subtractions. Add Lines 4, 5a, 5b and 6a - 6d. Enter here and on Form 760, Line 7. ................. 7

Enter Addition Amount

, |

, |

. |

00 |

, |

, |

. |

00 |

, |

, |

. |

00 |

, |

, |

. |

00 |

, |

, |

. |

00 |

, |

, |

. |

00 |

, |

, |

. |

00 |

Enter Subtraction Amount |

|

|

|

, |

, |

. |

00 |

, |

, |

. |

00 |

, |

, |

. |

00 |

, |

, |

. |

00 |

Deductions from Virginia Adjusted Gross Income

Enter Code |

Enter Deduction Amount |

8.Refer to the Form 760 instructions for Deduction Codes

8a

8b

8c

9.Total Deductions. Add Lines 8a - 8c. Enter here and on Form 760, Line 12.

LOSS

LOSS

........................................ 9

, |

, |

. |

00 |

, |

, |

. |

00 |

, |

, |

. |

00 |

|

|

|

|

, |

, |

. |

00 |

Continue with Line 10 on Page 2

Avoid delays - If completed, attach Schedule ADJ to Form 760

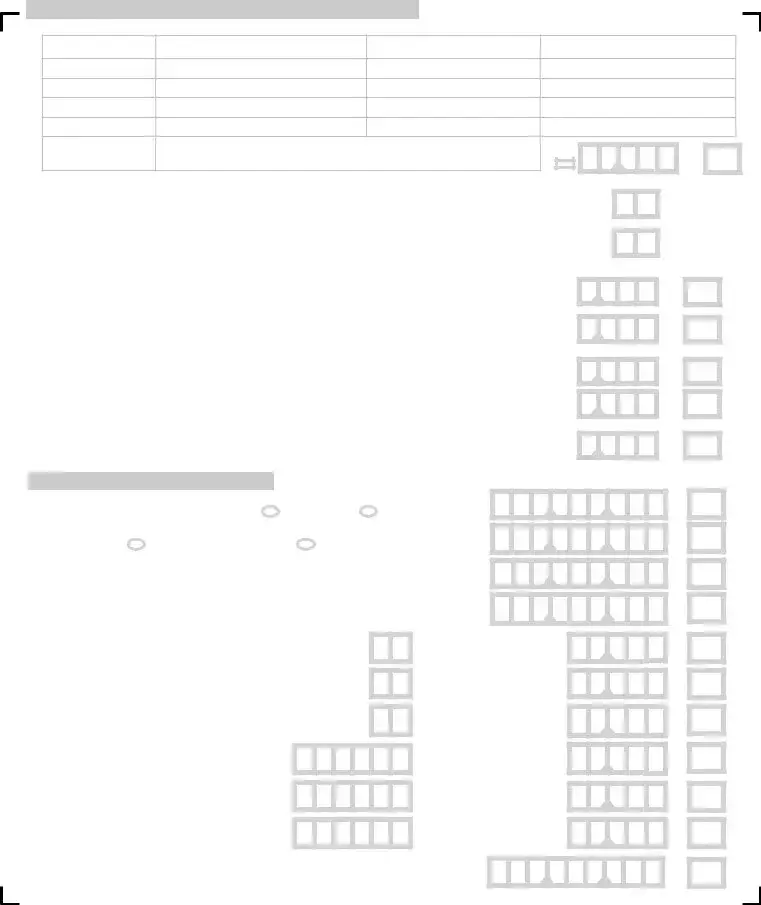

2012 Virginia Schedule ADJ Page 2

|

|

|

Your Social Security Number |

|

|

|

||||||||||||||

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

- |

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Credit for Low Income Individuals or Virginia Earned Income Credit

10.

Family VAGI |

Name |

Social Security Number |

Virginia Adjusted Gross Income (VAGI) |

You

Spouse

Dependent

Dependent

Total |

If more than 4 exemptions, attach schedule listing the name, SSN & VAGI. |

LOSS |

|

00 |

|

Enter total Family VAGI here. |

. |

||||

|

, |

||||

|

|

|

|

11.Enter the total number of exemptions reported in the table above. Next, go to the Poverty Guidelines

Table shown in the Form 760 instructions for this Line to see if you qualify for this credit |

11 |

12. If you qualify, enter the number of personal exemptions reported on your Form 760 |

12 |

13.Multiply Line 12 by $300. Enter the result on Line 13 and proceed to Line 14. If you do not qualify for the Tax Credit for Low Income Individuals but claimed an Earned Income Credit on your federal

|

return, enter $0 and proceed to Line 14 |

|

|

13 |

|

14. |

Enter the amount of Earned Income Credit claimed on your federal return. If you did not claim an |

||||

|

Earned Income Credit on your federal return, enter $0 |

.......................................................................... |

14 |

||

15. |

Multiply Line 14 by 20% (.20) |

|

|

15 |

|

16. |

Enter the greater of Line 13 or Line 15 above |

|

|

16 |

|

17. |

Compare the amount on Line 16 above to the amount of tax on Line 17 of Form 760 and enter the |

||||

|

lesser of the two amounts here and on Line 21 of Form 760. This is your credit amount |

17 |

|||

Adjustments and Voluntary Contributions |

|

|

|

||

18. |

Addition to tax. Fill in oval if addition came from: |

Form 760C |

Form 760F .... |

18 |

|

19. |

Penalty |

|

|

|

|

|

Late Filing Penalty |

|

Extension Penalty |

19 |

|

20. |

Interest (interest accrued on the tax you owe) |

......................................................................... |

|

20 |

|

21. |

Consumer’s Use Tax |

|

|

21 |

|

22. |

Voluntary Contributions. |

|

|

|

|

|

See instructions. |

|

22a |

|

|

Amended Return |

|

|

|

|

|

|

|

|

22b |

|

|

|

|

|

22c |

|

|

23. |

If contributing to a School Foundation, |

|

|

|

|

|

|

23a |

|

|

|

|

or a Library Foundation enter the code |

|

|

|

|

|

for the foundation(s) and the contribution |

|

|

|

|

|

amount(s) in boxes 23a - 23c. If contributing 23b |

|

|

|

|

|

to more than 3 school or library foundations, |

|

|

|

|

|

see Form 760 instructions. |

|

|

|

|

|

|

23c |

|

|

|

24. |

Total Adjustments (add Lines 18, 19, 20, 21, |

|

|

||

|

Enter here and on Line 28 of Form 760 |

|

|

24 |

|

, |

. |

00 |

, |

. |

00 |

, |

. |

00 |

, |

. |

00 |

, |

. |

00 |

, |

, |

. |

00 |

, |

, |

. |

00 |

, |

, |

. |

00 |

, |

, |

. |

00 |

|

, |

. |

00 |

, |

,, |

. |

00 |

, |

,, |

. |

00 |

, |

,, |

. |

00 |

, |

,, |

. |

00 |

, |

,, |

.. |

00 |

, |

, |

. |

00 |

2601050 03/12

Form Properties

| Fact | Detail |

|---|---|

| Form Title | Virginia Schedule ADJ (Form 760-ADJ) |

| Year | 2012 |

| Purpose | Used for reporting additions to and subtractions from federal adjusted gross income, deductions from Virginia adjusted gross income, and to calculate certain credits. |

| Key Sections | Additions to Federal Adjusted Gross Income, Subtractions from Federal Adjusted Gross Income, Deductions, Credit for Low Income Individuals or Virginia Earned Income Credit, Adjustments and Voluntary Contributions |

| Governing Law | Virginia State Tax Laws |

| Attachment Requirement | Must be attached to Form 760 when filed. |

| Unique Features | Includes provisions for FIXED DATE CONFORMITY ADDITION and SUBTRACTION, and considers both the taxpayer and spouse’s disability income. |

| Credits | Provides for the calculation of the Tax Credit for Low Income Individuals and the Earned Income Credit. |

| Voluntary Contributions | Offers options for making contributions to School Foundation, Library Foundation, among others. |

| Penalties and Interest | Includes sections for reporting addition to tax, penalties for late filing or extension, and interest accrued. |

Steps to Filling Out Virginia Schedule Adj

Filling out the Virginia Schedule ADJ form is essential for making specific adjustments to your income, which could influence your tax return. This form handles various adjustments, including additions and subtractions from your federal adjusted gross income, deductions, tax credits, and voluntary contributions. Carefully completing this form ensures that your tax obligations are accurately reflected, which can potentially lead to beneficial tax outcomes. Follow these steps to accurately fill out the form.

- Enter your Social Security Number in the space provided at the top of the form.

- Write your name(s) as it appears on your Virginia return.

- In the section for "Additions to Federal Adjusted Gross Income":

- For Line 1, enter the amount of interest from obligations of other states.

- On Line 2a, fill in the "FIXED DATE CONFORMITY ADDITION" if applicable and see instructions for details.

- For Lines 2b and 2c, enter other additions codes and their amounts after referring to the Form 760 instructions.

- Sum up Lines 1, 2a, 2b, and 2c for the total additions and enter this on Line 3.

- Under "Subtractions from Federal Adjusted Gross Income":

- Report interest, dividends, or gains exempt from state tax but not federal tax on Line 4.

- If you have disability income, enter your subtraction on Line 5a and your spouse’s subtraction (if applicable) on Line 5b.

- For Lines 6a to 6d, refer to the Form 760 instructions to find other applicable subtraction codes and amounts, then sum these for the total subtractions on Line 7.

- In the "Deductions from Virginia Adjusted Gross Income" section:

- Use the Form 760 instructions to fill in deduction codes on Lines 8a through 8c, and then enter the deduction amounts.

- Add these deductions for the total on Line 9.

- Complete the Credits for Low-Income Individuals or Virginia Earned Income Credit section on page 2 following the provided steps, which involve listing your family's Virginia adjusted gross income and calculating your credit based on the guidelines and your eligibility.

- Under "Adjustments and Voluntary Contributions", fill out any applicable fields from Lines 18 to 24, including any penalties, interest, consumer’s use tax, and any contributions you wish to make.

- Ensure to attach this schedule to Form 760 when completed to avoid processing delays.

By carefully following these instructions, you will accurately report adjustments to your income, which can affect your tax liabilities or refunds. It's important to double-check each entry for accuracy and refer to the Virginia Form 760 instructions for clarification on specific codes or requirements. If you're uncertain about any part of the form, consider seeking assistance from a tax professional to ensure everything is filled out correctly.

FAQ

What is the Virginia Schedule ADJ form used for?

The Virginia Schedule ADJ form is used to make specific adjustments to an individual's federal adjusted gross income for their Virginia state income tax return. These adjustments include additions and subtractions to income that are specific to Virginia tax laws, helping to determine the correct Virginia adjusted gross income (VAGI).

Who needs to fill out the Virginia Schedule ADJ?

Any Virginia taxpayer who needs to adjust their federal adjusted gross income for their state tax return must complete the Schedule ADJ. This includes those who have specific types of income that are taxed differently at the state level, or who qualify for deductions or credits unique to Virginia.

What are some examples of additions to income on the Schedule ADJ?

Examples of additions to income on the Schedule ADJ include:

- Interest on obligations of other states, which is exempt from federal income tax but not exempt from Virginia state tax.

- Fixed Date Conformity additions, which adjust for differences between federal and state tax laws regarding the taxation of certain income.

Can you explain the subtractions from income listed on the Virginia Schedule ADJ?

The Virginia Schedule ADJ allows for certain subtractions from federal adjusted gross income to calculate VAGI properly. Key subtractions include:

- Income from U.S. obligations, securities, or bonds exempt from Virginia state income tax.

- Disability income reported as wages on the federal return, which Virginia may allow to be subtracted.

- Fixed Date Conformity subtractions, reflecting differences between federal and Virginia tax law on reportable income.

How do deductions on the Virginia Schedule ADJ work?

Deductions on the Virginia Schedule ADJ are amounts that can be subtracted from VAGI to further reduce a taxpayer's taxable income. Taxpayers must reference specific deduction codes provided in the Virginia tax form instructions to properly report these deductions. Examples include certain job-related expenses, education-related expenses, and other Virginia-specific deductions.

What is the Virginia Earned Income Credit (EIC), and how is it calculated on this form?

The Virginia Earned Income Credit (EIC) is a credit for low to moderate-income working individuals and families, mirroring the federal EIC but at a state level. On the Schedule ADJ, taxpayers can calculate a portion of the credit they are entitled to, based on the amount claimed on their federal return, and then multiply this amount by 20%. The result is compared against another potential credit calculation based on the number of personal exemptions, and the taxpayer can claim the greater of the two amounts as their Virginia EIC.

What should be done if additional exemptions are not listed on the form?

If a taxpayer has more than four exemptions to report and the Schedule ADJ form does not provide enough space, they should attach a separate schedule. This schedule should list the names, Social Security Numbers (SSNs), and Virginia Adjusted Gross Incomes (VAGIs) for each additional exemption, ensuring that all qualifying individuals are accounted for.

What are the penalties and interests sections for on the Virginia Schedule ADJ?

These sections allow taxpayers to calculate and report any additional amounts owed due to penalties for late filing or payment, extensions, and any interest accrued on unpaid taxes. It's important that taxpayers accurately calculate these amounts to avoid underpaying their tax bill and incurring further penalties.

How does one contribute to a School or Library Foundation through the Virginia Schedule ADJ?

Taxpayers have the option to make voluntary contributions to designated School or Library Foundations through the Virginia Schedule ADJ by entering the code for the foundation(s) and the amount of the contribution in the specified fields. If contributing to more than three foundations, instructions on the form guide taxpayers on how to properly report and sum these voluntary contributions.

Common mistakes

When filling out the Virginia Schedule ADJ form, people often overlook details that might affect their tax returns. Avoiding common mistakes is crucial for ensuring the form is completed accurately. Here are seven common missteps:

- Not Reporting Interest on Obligations of Other States: This income, although exempt from federal taxes, must be added to your Virginia gross income.

- Ignoring Fixed Date Conformity Additions/Subtractions: If you don’t adjust for differences between federal and state tax laws, it could lead to inaccuracies in your reported income.

- Incorrectly Calculating Total Additions and Subtractions: Failing to accurately add lines 1, 2a-2c, and subtractions 4, 5a, 5b, and 6a-6d might lead to erroneous totals that affect your tax liability.

- Omitting Disability Income: Disability income that is reported as wages federally can be subtracted from your Virginia income, yet is often overlooked.

- Forgetting to Enter Other Subtraction Codes: Not including applicable codes for other subtractions, like fixed date conformity subtraction, may lead to missed tax benefits.

- Errors in Deduction Codes: Failing to accurately reference or apply the instructions for deduction codes (8a, 8b, 8c) may result in an inaccurate calculation of deductions.

- Inaccurately Claiming Credits for Low Income Individuals or Virginia Earned Income: Complex calculations and qualification criteria mean these credits are often either missed or calculated incorrectly.

- Always refer to the official Virginia Schedule Adj instructions to verify the correct codes and calculation methods.

- Ensure all income and deductions are reported in whole dollars, ignoring cents, as per the form's requirements.

- Review your form for common mathematical errors, especially in totaling line items.

- Remember to attach Schedule ADJ to Form 760 to avoid processing delays.

- Double-check your Social Security Number and name at the top of each page to ensure they match your federal return.

By avoiding these common errors, you can ensure a smoother filing process and avoid potential issues with your Virginia state tax return.

Documents used along the form

When filing taxes in Virginia, especially if you're using the Virginia Schedule ADJ form, it's important to be prepared with all the necessary documents and forms to ensure a smooth and accurate process. Here's an overview of other forms and documents that are often used alongside the Virginia Schedule ADJ (Form 760-ADJ) to provide a comprehensive picture of one's financial situation to the Virginia Department of Taxation.

- Form 760: This is the primary Virginia Individual Income Tax Return form. It serves as the foundation to which the Schedule ADJ is attached. This form gathers general income, tax, and personal information.

- Form 760C: Underpayment of Estimated Tax by Individuals, Estates, and Trusts. This form is used if you didn't pay enough taxes throughout the year through withholding or estimated tax payments.

- Form 760F: Fiduciary Income Tax Return. This might be relevant if the individual has income being reported through estates or trusts that require separate documentation.

- Form 760PY: Part-Year Resident Individual Income Tax Return. For those who have moved to or from Virginia within the tax year, this form addresses income earned while residing in the state.

- Form 763: Nonresident Individual Income Tax Return. This form is necessary for those who earned income in Virginia but are not residents of the state.

- W-2 and/or 1099 Forms: These documents report income from employment or other sources like freelance work, interest, dividends, and retirement. They are essential for accurately reporting your annual earnings and tax withholdings.

Together, these forms and documents capture a wide array of financial information that influences your state tax obligations and potential refunds. Whether you have straightforward financial affairs or a complex array of income sources and deductions, accurately completing and submitting these documents is crucial. Paying attention to the details on each form ensures that you're in compliance with Virginia's tax laws, which can ultimately help avoid delays and ensure that any refund due is processed promptly.

Similar forms

The Virginia Schedule ADJ form is somewhat analogous to the IRS Form 1040 Schedule 1. Both are utilized for adjusting income, though their objectives align with different tax systems; one serves Virginia state taxes while the other addresses federal taxes. The Schedule 1 form focuses on additional income and adjustments to income that are not directly entered on the main form 1040. Similar to the Virginia Schedule ADJ, it includes sections for reporting specific types of income not listed on the main tax form, as well as for deductions to adjust one’s taxable income. These adjustments could be for educator expenses, student loan interest deduction, or contributions to retirement accounts, paralleling the Virginia form’s adjustments for items such as income earned from other states or specific subtractions like disability income.

Another document reminiscent of the Virginia Schedule ADJ is Form 760, the primary income tax return form for Virginia residents. Specifically, the Schedule ADJ serves as an extension of Form 760, providing a detailed breakdown for adjustments to a taxpayer's income. In essence, Form 760 captures the summarised tax information, while Schedule ADJ delves into the specifics of additions or deductions to the federal adjusted gross income that are relevant under Virginia tax laws. This structure allows taxpayers to accurately compute their state taxable income by itemizing particular financial activities or situations that the base form does not explicitly account for, such as out-of-state bond interest or specific provisions for disability income.

Dos and Don'ts

When filling out the Virginia Schedule ADJ form, it's important to get it right the first time to prevent delays or issues with your tax return. Here are some do's and don'ts to keep in mind:

- Do thoroughly read the instructions provided with Form 760 and the Schedule ADJ form to ensure that you understand the requirements for additions, subtractions, deductions, and credits.

- Do report interest on obligations of other states in the additions to income section accurately, as this income is exempt from federal tax but not from Virginia state tax.

- Do use the codes provided in the instructions for reporting other additions and subtractions to ensure your entries are categorized correctly.

- Do double-check your Social Security Number and the name(s) as shown on your Virginia return to prevent mismatches or processing delays.

- Don't forget to include any required attachments if you're claiming deductions for disability income, low-income individuals, or Virginia Earned Income Credit. These may require additional documentation to verify your eligibility.

- Don't leave any fields that apply to you blank. If certain adjustments or voluntary contributions do not apply, ensure to mark them as such, rather than leaving them empty to avoid any confusion during processing.

By following these guidelines, the process of completing the Virginia Schedule ADJ form should be more straightforward, helping you avoid common mistakes that could delay the processing of your tax return or result in the need for amendments later on.

Misconceptions

Many people have misconceptions about the Virginia Schedule ADJ form, often leading to confusion during tax preparation. By clarifying these misunderstandings, taxpayers can better navigate through the filing process and potentially optimize their tax outcomes.

Only for Business Use: People sometimes mistakenly believe the Virginia Schedule ADJ form is meant only for business owners. However, it is designed for both individual taxpayers and business owners to adjust their federal adjusted gross income on their Virginia tax return.

Doesn't Impact Tax Return Significantly: Another common misconception is thinking adjustments made on the Schedule ADJ won't significantly affect their tax return. In reality, these adjustments can lead to a lower taxable income or higher tax refund, making a notable difference.

It's Complicated and Time-Consuming: The belief that the form is too complicated and time-consuming stops many from using it. While it does require attention to detail, the form includes clear instructions for each section, making it navigable for most taxpayers.

Exclusively for Deductions: Some think the form is used exclusively for deductions. However, it also includes sections for reporting certain types of income and tax credits, not just deductions.

Interest on Other States' Obligations is Tax-Exempt: A misconception exists that interest from other states' obligations is exempt from taxation. The truth is, while federally tax-exempt, this interest must be added to Virginia gross income and is taxable at the state level.

Disability Income is Always Taxable: There's a false assumption that all disability income is taxable. On the Virginia Schedule ADJ, certain disability incomes can be subtracted from federal adjusted gross income, potentially lowering tax liability.

Fixed Date Conformity Adjustments are Rare: Some believe that adjustments related to fixed date conformity are rare and not applicable to their situation. In practice, these adjustments are common due to the differences between federal and Virginia tax laws and may affect many taxpayers.

Not Worth the Effort for Small Amounts: Taxpayers often think it's not worth the effort to complete the form for small adjustments. Every eligible deduction or income adjustment, no matter the size, can contribute to a more accurate tax return and potentially better tax outcomes.

Credits for Low Income Individuals are Automatically Applied: A common misunderstanding is that credits for low-income individuals are automatically applied. Taxpayers must qualify for these credits through specific calculations on the Schedule ADJ and actively claim them.

Cleaning up these misconceptions enables better understanding and utilization of the Virginia Schedule ADJ form. By doing so, taxpayers can ensure they are correctly adjusting their income, leading to accurate and often more favorable tax results.

Key takeaways

When engaging with the Virginia Schedule ADJ (Form 760-ADJ), it's essential to be precise and detailed to ensure that your Virginia tax filing is accurate and compliant. Here are key takeaways to guide you through filling out and using the form effectively:

- Understand the Purpose: The Virginia Schedule ADJ is employed to adjust your federal adjusted gross income for specific items that affect your Virginia income tax. This includes adding or subtracting income that is treated differently at the state level than at the federal level, such as certain interest or disability income.

- Complete All Relevant Sections: You must fill out sections concerning additions to federal adjusted gross income, subtractions from federal adjusted gross income, and deductions from Virginia adjusted gross income. Each line item may not apply to every taxpayer, so review each carefully and only fill out what's applicable to your situation.

- Fixed Date Conformity Adjustments: Special attention should be paid to lines concerning fixed date conformity adjustments. These adjustments align your tax return with Virginia's adherence to the federal internal revenue code as of a specific date. It's crucial to view the most current instructions for these entries to ensure correctness, as these can impact your taxable income.

- Voluntary Contributions and Credits: In addition to adjustments, the form allows for voluntary contributions to various funds and claiming of certain credits, like the Credit for Low-Income Individuals or Virginia Earned Income Credit. If you are eligible for these credits or wish to make contributions, accurately completing the relevant sections can either reduce your tax liability or contribute to causes within Virginia.

Accuracy and attention to detail are paramount when completing the Virginia Schedule ADJ. It's recommended to refer to the official instructions for the form for the most current information and guidance. This will help you navigate the complexities of state-specific tax adjustments and ensure that your tax calculation is as advantageous and accurate as possible.

Other PDF Forms

Va Department of Revenue - Urges accurate and detailed reporting to mitigate against potential audits and penalties.

Virginia Commercial Vehicle Registration - The go-to document for Virginia commercial carriers looking to ensure their vehicles are properly registered under the IRP for interstate travel.