Fill Out a Valid Virginia St 12 Template

In the realm of tax documentation, the Virginia ST-12 form emerges as a pivotal document for specific tax-exempt transactions within Virginia. Crafted by the Virginia Department of Taxation, this form is meticulously designed to facilitate purchases or leases exempt from sales and use tax, solely under circumstances defined by the state law. This exemption specifically applies to tangible personal property intended for use or consumption by the Commonwealth of Virginia, its political subdivisions, or the United States, marking a clear boundary against application to private entities or corporations, even those federally chartered. The essence of the form lies in its ability to validate the exempt status of governmental agencies conducting transactions, given that these purchases are backed by the required official purchase orders and are guaranteed to be financed by public funds. Furthermore, the form requires validation from an authorized signatory, affirming the accuracy and compliance of the information provided, thereby underscoring the adherence to the stipulations of the Virginia Retail Sales and Use Tax Act. Dealers are mandated to retain a properly executed copy of this Certificate of Exemption, making it a crucial document in the transactional framework between vendors and qualifying governmental entities, thereby streamlining the process and ensuring compliance with Virginia's taxation laws.

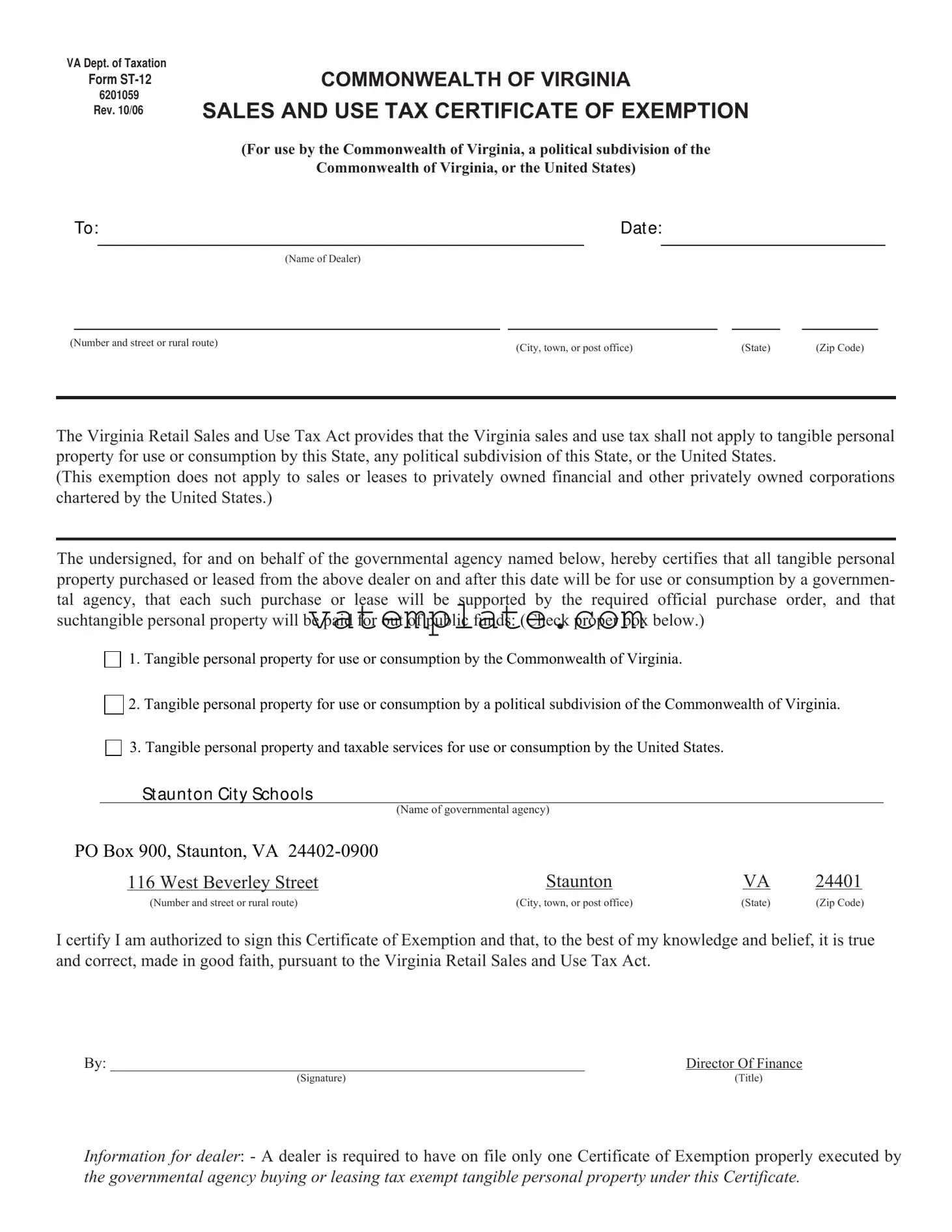

Virginia St 12 Example

VA Dept. of Taxation |

|

|

|

|

Form |

COMMONWEALTH OF VIRGINIA |

|||

6201059 |

|

|

|

|

Rev. 10/06 |

SALES AND USE TAX CERTIFICATE OF EXEMPTION |

|||

|

|

(For use by the Commonwealth of Virginia, a political subdivision of the |

||

|

|

Commonwealth of Virginia, or the United States) |

||

To: |

|

Dat e: |

||

|

|

|

|

|

|

|

(Name of Dealer) |

||

(Number and street or rural route) |

(City, town, or post office) |

(State) |

(Zip Code) |

|

The Virginia Retail Sales and Use Tax Act provides that the Virginia sales and use tax shall not apply to tangible personal property for use or consumption by this State, any political subdivision of this State, or the United States.

(This exemption does not apply to sales or leases to privately owned financial and other privately owned corporations chartered by the United States.)

The undersigned, for and on behalf of the governmental agency named below, hereby certifies that all tangible personal property purchased or leased from the above dealer on and after this date will be for use or consumption by a governmen- tal agency, that each such purchase or lease will be supported by the required official purchase order, and that suchtangible personal property will be paid for out of public funds: (Check proper box below.)

1. Tangible personal property for use or consumption by the Commonwealth of Virginia.

2. Tangible personal property for use or consumption by a political subdivision of the Commonwealth of Virginia.

3. Tangible personal property and taxable services for use or consumption by the United States.

St aunt on Cit y Schools

(Name of governmental agency)

PO Box 900, Staunton, VA |

|

|

|

116 West Beverley Street |

Staunton |

VA |

24401 |

(Number and street or rural route) |

(City, town, or post office) |

(State) |

(Zip Code) |

I certify I am authorized to sign this Certificate of Exemption and that, to the best of my knowledge and belief, it is true and correct, made in good faith, pursuant to the Virginia Retail Sales and Use Tax Act.

By: _____________________________________________________________ |

Director Of Finance |

(Signature) |

(Title) |

Information for dealer: - A dealer is required to have on file only one Certificate of Exemption properly executed by the governmental agency buying or leasing tax exempt tangible personal property under this Certificate.

Form Properties

| # | Fact |

|---|---|

| 1 | The Virginia ST-12 form is titled "Sales and Use Tax Certificate of Exemption". |

| 2 | It is issued by the Virginia Department of Taxation. |

| 3 | The latest revision of the form was in October 2006. |

| 4 | This form is specific for use by entities such as the Commonwealth of Virginia, its political subdivisions, or the United States. |

| 5 | It certifies that purchases or leases by the indicated governmental agencies are exempt from Virginia sales and use tax. |

| 6 | Exemptions do not apply to privately owned financial and other privately owned corporations chartered by the United States. |

| 7 | Every purchase or lease made under this exemption must be supported by an official purchase order and paid for with public funds. |

| 8 | Governing law for this certificate is the Virginia Retail Sales and Use Tax Act. |

Steps to Filling Out Virginia St 12

Filling out the Virginia ST-12 form is a crucial step for governmental agencies in the Commonwealth of Virginia, their subdivisions, or the United States when they need to purchase or lease tangible personal property without being charged sales and use tax. The form is straightforward but requires attention to detail to ensure it's properly executed. By following these instructions, the process will be smooth and efficient, facilitating tax-exempt transactions under the Virginia Sales and Use Tax Act.

- Start by clearly printing or typing the Date of the transaction on the designated line near the top of the form.

- Enter the Name of the Dealer (the business from which the property is being purchased or leased) in the provided space.

- Fill in the Dealer’s address, including the number and street or rural route, city, town, or post office, state, and zip code in the corresponding fields.

- Identify the type of governmental agency making the purchase by checking the appropriate box. Options include:

- Tangible personal property for use or consumption by the Commonwealth of Virginia.

- Tangible personal property for use or consumption by a political subdivision of the Commonwealth of Virginia.

- Tangible personal property and taxable services for use or consumption by the United States.

- Under “Name of governmental agency,” provide the formal name of the agency that is purchasing or leasing the property. Alongside this, enter the agency's address, including PO Box (if applicable), street address, city, town or post office, state, and zip code.

- The individual completing the form must certify their authorization to do so by signing under “By.” Make sure the person signing has the proper authority within the agency to execute tax exemption certificates.

- Enter the title of the individual signing the form, such as "Director Of Finance," in the space provided to the right of the signature.

- Review the completed form for accuracy and completeness. Ensure that all entered information is true, correct, and made in good choice, in compliance with the Virginia Retail Sales and Use Tax Act.

- Retain a copy for the agency’s records and provide the original to the dealer from whom the purchase or lease is being made. The dealer is required to keep this Certificate of Exemption on file.

Once the Virginia ST-12 form has been correctly filled out and submitted to the dealer, governmental agencies can proceed with their exempt purchases or leases knowing they are in compliance with Virginia tax law. It's essential for both parties to keep their copies of the completed form for record-keeping and future reference.

FAQ

What is the Virginia ST-12 form?

The Virginia ST-12 form is a Sales and Use Tax Certificate of Exemption. It is used by state and federal government agencies in Virginia to certify that purchases of tangible personal property or leases are exempt from Virginia sales and use tax. This exemption is specifically for goods used or consumed by these government agencies.

Who can use the Virginia ST-12 form?

This form can be used by:

- The Commonwealth of Virginia

- A political subdivision of the Commonwealth of Virginia

- The United States government

What purchases are exempt under the ST-12 form?

Purchases or leases of tangible personal property and taxable services that are used or consumed by the eligible government agencies are exempt. This means that these agencies do not have to pay sales tax on such goods or services.

How does a government agency apply for the exemption?

A government agency must complete the ST-12 form, certifying that all purchases or leases of tangible personal property made from a dealer are for official use and will be paid out of public funds. An official purchase order must support each transaction.

What is required from dealers?

Dealers selling or leasing taxable goods or services to government agencies holding a valid ST-12 form are required to keep the completed form on file. This form serves as proof that the transaction is exempt from Virginia sales and use tax.

Does the ST-12 form need to be renewed?

There is no specific renewal requirement mentioned for the ST-12 form in the instructions or statutory provisions. However, it is advisable for government agencies and dealers to ensure that the latest information and documentation are on file, especially concerning the authorized signatory and validity of the organization's tax-exempt status.

What is the penalty for misuse of the ST-12 form?

Misuse of the Virginia ST-12 form, such as using it to avoid sales tax on personal purchases, can result in penalties, fines, and revocation of the tax exemption status. Both the individual and the organization could face legal action for fraudulent use of the exemption certificate.

Where can I find the Virginia ST-12 form?

The ST-12 form is available on the Virginia Department of Taxation’s website. Government agencies can download the form, complete it, and provide it to vendors to certify purchases as tax-exempt.

Common mistakes

When individuals complete the Virginia ST-12 form, certain errors occur more frequently than others. Recognizing and avoiding these mistakes can ensure that the process is both smooth and compliant with the Commonwealth of Virginia's guidelines.

Incorrectly Checking the Box: Some individuals fail to correctly check the box that specifies the type of entity making purchases. It's crucial to select the right category for the entity to ensure compliance.

Not Including the Agency Name: Omission of the governmental agency's name is a common oversight. Full and accurate agency information is necessary for the form to be valid.

Incomplete Address Information: Filling out the address section partially or inaccurately can lead to processing delays. Complete details, including street number, city, state, and zip code, are required.

Unspecified Use of Purchases: Not specifying clearly that the purchases are for use or consumption by a governmental agency can lead to misunderstandings regarding the tax exemption status.

Failure to Sign the Form: An unsigned form is considered incomplete. The person authorized to sign on behalf of the governmental agency must do so for the form to be valid.

Incorrect Title Next to Signature: The title of the person signing the form is often incorrectly noted or omitted. This could lead to questions regarding the person's authority to make tax-exempt purchases.

Not Using Official Purchase Orders: The form requires that purchases be supported by official purchase orders. Failing to use these can invalidate the tax exemption claim.

Assuming Exemption Applies Automatically: Some individuals incorrectly assume that once the form is filled out, all future purchases will automatically be tax exempt without further verification or required documentation.

Lack of Awareness of Restrictions: There is a lack of awareness that the exemption does not apply to sales or leases to privately owned corporations, even those chartered by the United States. Understanding the scope of the exemption is key.

Mindfulness of these common mistakes can significantly streamline the process of utilizing the Virginia ST-12 form correctly to claim tax exemption for eligible governmental purchases.

Documents used along the form

When dealing with tax-exempt transactions in Virginia, especially under the circumstances outlined in the Virginia Department of Taxation Form ST-12, there are several other forms and documents often required to ensure compliance and facilitate the process. These documents work in tandem with the ST-12 form to provide a comprehensive framework for tax-exempt purchases by government agencies.

- Form ST-10: This is the Commonwealth of Virginia Sales and Use Tax Certificate of Exemption for purchasing tangible personal property for resale or for use in production. It's similar to ST-12 but caters to businesses with reseller or producer status.

- Purchase Order: A formal document issued by a governmental agency to a vendor, indicating types, quantities, and agreed prices for products or services. It serves as authorization for the vendor to proceed with the transaction under the terms specified.

- Expenditure Authorization: This document provides detailed permission from the relevant government office to make a purchase. It often includes budget allocation and is a prerequisite for releasing funds.

- Form W-9: Request for Taxpayer Identification Number and Certification. This form is essential for confirming the vendor's tax status and is required for government agencies to report the exempt transactions accurately.

- Invoice: Provided by the vendor, detailing the purchase, including a description of the items or services provided, the quantities, and the price. It is crucial for record-keeping and auditing purposes.

- Form 1099: This IRS form is used to report various types of income other than wages, salaries, and tips. Depending on the transaction, a government entity might need to issue a Form 1099 to the vendor.

- Annual Budget Report: A document that outlines the fiscal budget for the government agency, including allocated funds for various types of exempt purchases. It often accompanies requests for exemption to justify the purchase.

- Contract/agreement: A legally binding agreement between the governmental agency and the vendor, providing detailed terms and conditions of the service or purchase, including tax-exempt status acknowledgment.

- Form R-5: The Certificate of Exemption for Use by a Person with a Physical Disability. While more specific, it's another form of exemption certificate related to purchases made by or for persons with disabilities, under certain conditions.

- Vendor's License Verification: A document or online verification process to ensure the vendor is licensed and authorized to do business in Virginia, often a prerequisite for government agencies to engage in tax-exempt transactions.

Each of these documents plays a vital role in ensuring the integrity and compliance of tax-exempt transactions. Understanding the purpose and requirement for each can aid in a smooth transaction process, preventing delays and ensuring all parties meet their legal and regulatory obligations.

Similar forms

The Virginia ST-12 form is similar to other tax exemption certificates used across the United States, each designed to facilitate the process of exempting qualifying entities from state sales and use tax on purchases of tangible personal property. These forms share common features, including identification of the exempt entity, a description of the exempt transactions, and certification by an authorized individual that the purchases are for exempt purposes. Below are details on two documents that bear resemblance to the Virginia ST-12 form.

California Resale Certificate (Form BOE-230): Similar to the Virginia ST-12, the California Resale Certificate allows businesses to purchase goods without paying state sales tax, provided those goods are intended for resale. Both forms require the purchaser to identify themselves, the seller, and the nature of the exempt transaction. They also include a declaration that the information provided is accurate and that the goods qualify under the state’s specific tax exemption rules. However, the California form is specifically targeted at resellers, whereas the Virginia ST-12 encompasses a broader range of government and political subdivision purchases.

Florida Consumer's Certificate of Exemption (Form DR-14): Like the Virginia ST-12, Florida's DR-14 form is issued to government entities, nonprofit organizations, and other qualified entities to exempt them from sales tax on eligible purchases. Both documents call for similar information: the name and address of the purchaser, certification of exemption status, and a signature from an authorized representative. The key difference lies in the scope of entities eligible for exemption; Florida’s DR-14 includes a wider variety of organizations, expanding beyond just government and political subdivisions.

Dos and Don'ts

When completing the Virginia ST-12 Sales and Use Tax Certificate of Exemption, there are several do's and don'ts that individuals representing governmental agencies should adhere to, ensuring compliance and accuracy. Below is a list of these key points.

Do:- Verify authorization before completing the form, ensuring you're authorized to sign on behalf of the governmental agency.

- Choose the correct box indicating whether the purchase or lease is for the Commonwealth of Virginia, a political subdivision of the Commonwealth, or the United States.

- Provide accurate agency information, including the full name and address of the governmental agency making the purchase or lease.

- Include the dealer’s complete information, such as name, address, and any identifying number.

- Ensure all provided information is current and correct, double-checking details like zip codes and street addresses for accuracy.

- Use official documentation for reference, like the agency's official purchase order, as required by the Virginia Retail Sales and Use Tax Act.

- Sign and date the form as required, confirming the certification's completeness and accuracy.

- Leave required fields incomplete, as this could invalidate the certificate or delay processing.

- Assume exemption applies to all purchases without verifying each purchase meets the criteria outlined by the Virginia Retail Sales and Use Tax Act, especially noting the exemption does not apply to sales or leases to privately owned corporations chartered by the United States.

By following these guidelines, individuals can ensure that their filings are in compliance with Virginia's regulations, supporting simplified and accurate processing of tax exemption claims for governmental purchases and leases.

Misconceptions

There are several common misconceptions about the Virginia ST-12 form, which is designed for sales and use tax exemption purposes. Through clarification, entities eligible for these exemptions can ensure they are properly leveraging this benefit while remaining compliant with the law.

- It's applicable to all purchases: Not every purchase qualifies for the ST-12 exemption. Only tangible personal property purchased or leased by certain governmental agencies for use or consumption qualifies. Services, unless explicitly taxable, are not covered under this form.

- Private entities can use this form: The ST-12 form is strictly for use by the Commonwealth of Virginia, political subdivisions of the Commonwealth, and the United States government. Privately owned entities, even if chartered by the United States, cannot use this form to claim exemption.

- One-time documentation: A dealer is required to keep just one properly executed ST-12 form on file for each governmental agency. However, this does not mean the process is a one-time requirement. Regular updates or verifications by the dealer might be necessary to ensure continuous compliance.

- All government purchases are exempt: Some assume that all government-related purchases automatically qualify for a tax exemption. In fact, only those purchases made for use or consumption by qualifying entities are exempt. The distinction is crucial for both vendors and government purchasers to understand.

- No verification is needed: While the certificate simplifies the exemption process, it does require verification. The authorized signatory of the government agency affirms, to the best of their knowledge, the truthfulness and correctness of the information provided.

- It covers leases and all sales: The form does apply to both purchases and leases of tangible personal property by eligible government entities. However, it is important to note that not all types of leases or sales might qualify under the specific stipulations of the law.

- Immediate applicability: The form states that applicable exemptions are for purchases made on and after the date indicated. This implies that any prior transactions, even if they were for an exempt use, would not be retroactively eligible under this certificate.

- It's mainly for educational institutions: Though the form example mentions "Staunton City Schools", it's a misconception to think the ST-12 is exclusively for educational institutions. The exemption applies across a broad spectrum of government agencies, as long as the criteria are met.

Understanding these nuances of the Virginia ST-12 form can help eligible government entities and participating dealers navigate the complexities of tax-exempt purchases more effectively. Proper usage of this form ensures both compliance with tax laws and efficient allocation of public funds..

Key takeaways

Understanding how to properly fill out and use the Virginia ST-12 form is critical for ensuring tax-exempt purchases by government entities. Here are some key takeaways:

- The Virginia ST-12 form is designed explicitly for use by the Commonwealth of Virginia, its political subdivisions, or the United States federal government to certify tax-exempt purchases or leases.

- This form exempts eligible entities from the Virginia sales and use tax on tangible personal property intended for use or consumption by the governmental agency itself.

- Private entities, including privately owned financial and other corporations chartered by the United States, are not eligible for exemptions using this form.

- It is essential for the governmental agency to accurately complete the form, ensuring it includes the name and address of the dealer, as well as the date from which the certificate applies.

- The form should clearly indicate the category of exemption being claimed—whether for the Commonwealth of Virginia, a political subdivision thereof, or the United States—by checking the appropriate box.

- Every purchase or lease made under this exemption must be supported by an official purchase order from the governmental agency claiming the exemption.

- Payments for these purchases or leases must come directly from public funds, as per the certification on the ST-12 form.

- A duly authorized representative of the governmental agency, such as the Director of Finance, must sign the form, asserting the accuracy and good faith of the information provided.

- Dealers are required to keep a properly executed ST-12 form on file to validate the tax-exempt status of any purchases or leases made by the governmental agency.

Adherence to these guidelines helps ensure that tax-exempt transactions are processed smoothly and in compliance with Virginia tax laws, benefiting both governmental entities and participating dealers.

Other PDF Forms

Business License Wv - Advises on the criteria for name distinguishability, helping businesses navigate the complexities of branding within the state's legal framework.

Virginia Hpp Cloud - It is mandatory for applicants to demonstrate their financial preparedness with a 90-day operating expense coverage, showcasing the emphasis on financial stability.

Virginia 501c3 - An exemption certificate that mitigates the cost of medical care by removing sales tax from necessary medical equipment and supplies.