Fill Out a Valid West Virginia Estimated Tax Template

Navigating tax obligations is a critical aspect for residents in West Virginia, and among the essential tasks is understanding the Estimated Tax form. This document, a pivotal piece of communication between taxpayers and the State Tax Department, serves to inform individuals about their estimated income tax payments. The structure of the form, designed for clarity and efficiency, includes crucial details such as the taxpayer's name, address, and social security number, alongside specific fiscal attributes like the taxable year end and payment due dates. For those whose annual state tax is projected to exceed $600, the requirement to make estimated payments cannot be overlooked. Guidance on calculating these payments is provided through an auxiliary instruction brochure, ensuring taxpayers can determine the minimum amount due without falling foul of penalties. Additionally, the flexibility to pay more than this minimum offers a way to manage one's financial liabilities proactively. An included section for updating personal details underscorely the form's adaptability to the taxpayer's changing circumstances. Moreover, this document outlines the procedural aspects, such as where and when payments should be sent, making it an indispensable guide for maintaining compliance with state tax laws and regulations. Through the lens of the West Virginia Estimated Tax form, we can appreciate the intricacies involved in managing individual tax responsibilities.

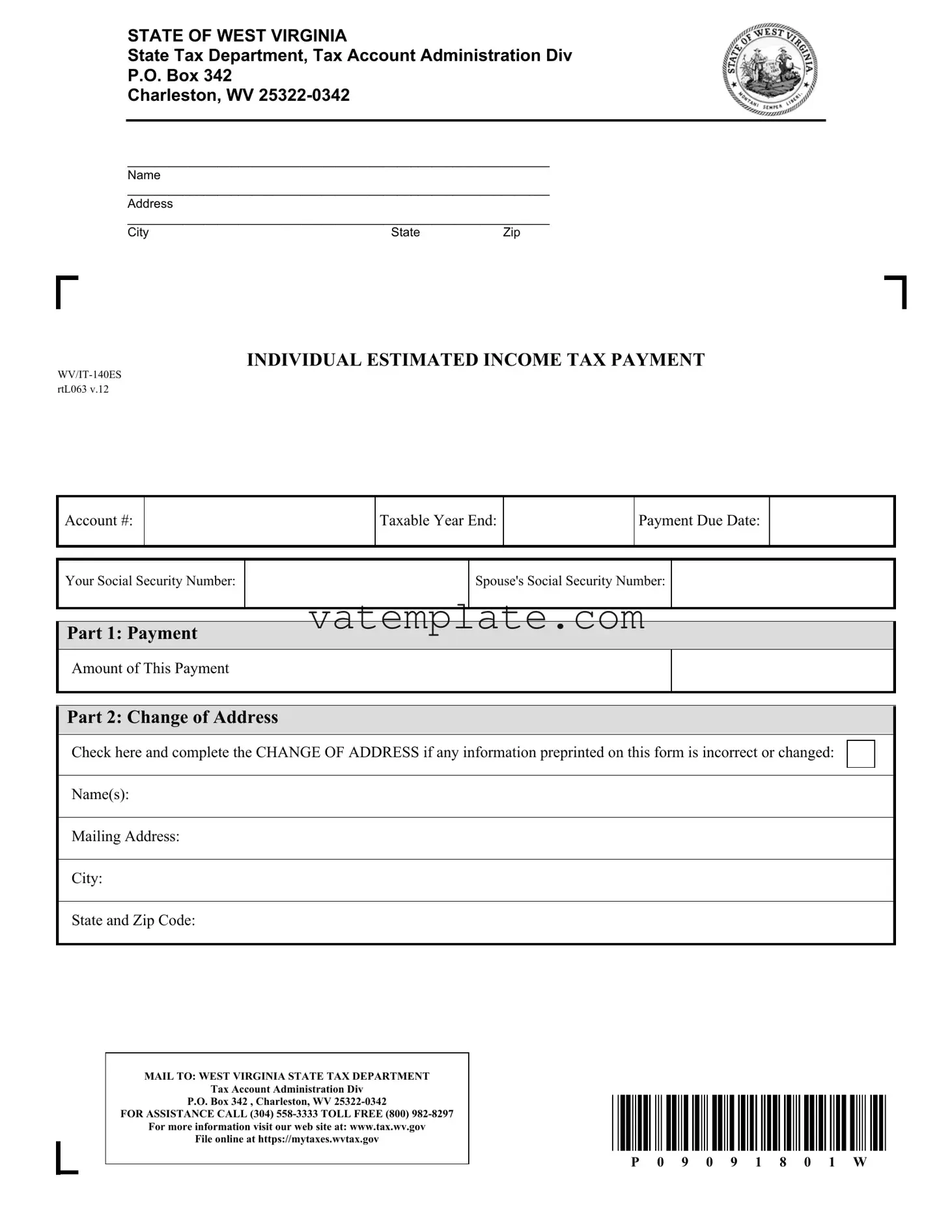

West Virginia Estimated Tax Example

STATE OF WEST VIRGINIA

State Tax Department, Tax Account Administration Div

P.O. Box 342

Charleston, WV

_____________________________________________________________ |

Letter Id: |

L0045367296 |

||

DONNA J. AAROE |

|

|

||

Name |

|

|

|

|

17 CLUB HOUSE DR |

|

|

Issued: |

02/01/2019 |

_____________________________________________________________ |

||||

EVANS WV |

|

|

Account #: |

|

Address |

|

|

|

|

_____________________________________________________________ |

Period: |

12/31/2018 |

||

City |

State |

Zip |

||

INDIVIDUAL ESTIMATED INCOME TAX PAYMENT

Account #:

Taxable Year End:

Payment Due Date:

Your Social Security Number:

Spouse's Social Security Number:

Part 1: Payment

Amount of This Payment

Part 2: Change of Address

Check here and complete the CHANGE OF ADDRESS if any information preprinted on this form is incorrect or changed:

Name(s):

Mailing Address:

City:

State and Zip Code:

MAIL TO: WEST VIRGINIA STATE TAX DEPARTMENT

Tax Account Administration Div

P.O. Box 342 , Charleston, WV

FOR ASSISTANCE CALL (304)

For more information visit our web site at: www.tax.wv.gov

File online at https://mytaxes.wvtax.gov

P 0 9 0 9 1 8 0 1 W

INSTRUCTIONS FOR MAKING ESTIMATED PAYMENTS

If you expect to owe at least $600 in State tax when you file your annual income tax return, you are required to make estimated tax payments using this form.

Determine your estimated tax using the instruction brochure (Form

Write the amount of your payment on this form. You must pay at least the minimum amount calculated using the instructions to avoid being penalized; however, you may pay more than the minimum if you wish.

Be sure to post your payment in the payment table. If you are not a calendar year taxpayer, you should see the instructions to determine the due dates of your payments.

Estimated tax payments should be mailed by the due date to:

State Tax Department

Tax Account Administration Division - EST P.O. Box 342

Charleston WV

Form Properties

| Fact | Detail |

|---|---|

| Form Purpose | This form is used for making individual estimated income tax payments in West Virginia. |

| Eligibility Requirement | Individuals expecting to owe at least $600 in state tax for the year must make estimated tax payments. |

| Payment Calculation | Payment amounts are determined using instructions provided in the Form IT-140ESI brochure available on the West Virginia Tax Department's website. |

| Mailing Address for Payments | Payments are to be mailed to the State Tax Department, Tax Account Administration Division - EST, P.O. Box 342, Charleston, WV 25322-0342. |

Steps to Filling Out West Virginia Estimated Tax

Filling out the West Virginia Estimated Tax form is a straightforward process that requires attention to detail. This guidance aims to assist individuals in accurately completing their estimated tax payments. Ensuring that the form is filled out correctly helps prevent potential penalties for underpayment. Follow these steps diligently to ensure your estimated tax payments are processed smoothly.

- Locate the section labeled Part 1: Payment. Here, write the amount of this payment based on your calculated estimated taxes.

- If you have a change of address, tick the box in Part 2: Change of Address. Fill out your new mailing address details, including the new state and zip code.

- Verify your Letter Id, which is located at the top of the form. This unique identifier is important for processing your payment.

- Confirm that your name, Address, City, State, and Zip code are correct. If any information preprinted on the form is incorrect or has changed and you have not checked the change of address box, rectify it in Part 2.

- Ensure the Account # near the top of the form matches your records.

- Check the box pertaining to the Taxable Year End, and write the ending date of your fiscal year, if you are not a calendar year taxpayer.

- Write your Social Security Number and, if applicable, your spouse's Social Security Number in the designated spaces.

- Refer to the Payment Due Date section to verify when your estimated tax payment is due and ensure your payment will be postmarked by that date.

- After completing the form and verifying all information is correct and filled out, mail your estimated tax payment to the State Tax Department Tax Account Administration Division - EST, P.O. Box 342, Charleston, WV 25322-0342.

- If you have any questions or need assistance, remember you can call (304) 558-3333 or toll-free (800) 982-8297.

- For additional guidance, including determining your estimated tax payment amount, visit www.tax.wv.gov. If applicable, you can also file online at https://mytaxes.wvtax.gov.

Making accurate and timely estimated tax payments is crucial to avoid penalties. Review the instructions and ensure you understand each step before sending in your form. If you are unsure about your estimated tax liability, consider consulting with a tax professional or utilizing resources available on the West Virginia State Tax Department website. Remember, being proactive about your tax obligations helps ensure financial stability and compliance with state laws.

FAQ

What is the West Virginia Estimated Tax Form?

The West Virginia Estimated Tax Form, also known as WV/IT-140ES, is a document used by individuals to make advance payments on their expected state tax for the year. If an individual anticipates owing at least $600 in state taxes at the end of the fiscal year, they are required to submit estimated tax payments using this form.

Who needs to file the West Virginia Estimated Tax Form?

Any individual expecting to owe $600 or more in state tax over the tax year must file the West Virginia Estimated Tax Form to avoid penalties. This typically includes self-employed persons, investors, or anyone else who does not have sufficient tax withheld from their wages or other income sources.

How do I determine the amount I need to pay?

To calculate your estimated tax, refer to the instruction brochure (Form IT-140ESI) available at the official website, www.tax.wv.gov. It is essential to follow these instructions carefully to determine the minimum amount you must pay to avoid penalties. While you must pay at least this minimum, it is possible to pay more if you prefer.

What are the due dates for making estimated tax payments?

For individuals who follow a calendar year for tax purposes, estimated tax payments are due quarterly. However, for those not adhering to the calendar year, due dates may vary. It is crucial to consult the specific instructions for non-calendar year taxpayers to ascertain their exact payment deadlines.

What should I do if my address has changed?

If your address has changed, ensure to mark the "Change of Address" checkbox on the WV/IT-140ES form. You will need to provide your new name(s), mailing address, city, state, and zip code to ensure that all future correspondence from the State Tax Department reaches you.

How can I submit my estimated tax payments?

Estimated tax payments can be mailed to the State Tax Department, Tax Account Administration Division - EST, P.O. Box 342, Charleston, WV 25322-0342. Be sure to submit your payments by the due date to avoid penalties. For convenience, you may also file online via the official web portal: https://mytaxes.wvtax.gov.

Where can I find assistance if I have questions?

If you have any questions or need assistance with your West Virginia Estimated Tax Form, you can call the State Tax Department at (304) 558-3333 or toll-free at (800) 982-8297. Additional information and resources are available on their website at www.tax.wv.gov.

Common mistakes

Not calculating the estimated tax accurately: Individuals often make the mistake of not carefully following the instructions provided in the IT-140ESI instruction brochure for determining their estimated tax. This can result in either underpayment or overpayment. The former may lead to penalties, while the latter could affect personal cash flow unnecessarily. It’s important to use the correct figures and calculations to determine the estimated tax due accurately.

Omitting Social Security numbers: A common oversight is failing to include the taxpayer's and, if applicable, the spouse's Social Security numbers on the WV/IT-140ES form. This critical piece of information is crucial for the State Tax Department to process payments correctly and attribute them to the right tax account. Omitting these numbers can result in processing delays or misapplied payments.

Ignoring the change of address section: Taxpayers often neglect to check and complete the change of address section when their mailing address has changed since the last filing. It's key to update this information to ensure that all correspondence from the State Tax Department reaches the taxpayer promptly. Failure to do so could mean missing out on important notifications or refunds.

Incorrect payment amounts or dates: It's not uncommon for taxpayers to enter the wrong amount for their payment or to use incorrect dates when making their estimated tax payments. This mistake can stem from a simple oversight or misunderstanding of the payment schedule. Ensuring the correct amount is paid on or before the due date, as indicated in the instructions, helps avoid penalties for late or insufficient payments.

Key Point: To ensure accurate and timely estimated tax payments, it's essential to meticulously follow the guidelines provided by the West Virginia State Tax Department, verify all the personal information on the form, and adhere to the payment schedules and amounts specified in the instructions. This diligence helps avoid common errors that can lead to penalties, processing issues, or delays.

Documents used along the form

When dealing with tax matters, it's important to have the right paperwork. Aside from the West Virginia Estimated Tax form, there are several other forms and documents individuals may need to use to ensure their tax-related matters are in order. Here's a look at a few of those documents.

- Form IT-140ESI Instruction Booklet: This document provides detailed instructions on how to calculate estimated tax payments, ensuring taxpayers pay the correct amount and avoid penalties.

- Form IT-140: West Virginia Personal Income Tax Return form is used for filing annual income tax. It's essential for summarizing income, deductions, and tax credits to determine the total tax owed or refund due.

- Form IT-104: West Virginia Employee’s Withholding Exemption Certificate, necessary for employers to determine the correct state income tax to withhold from employees' paychecks.

- Change of Address Form: If a taxpayer moves, this form notifies the West Virginia State Tax Department of a new address to ensure all tax-related correspondence is sent to the right location.

- Form IT-140W: Worksheet for West Virginia Withholding for personal income tax, used to calculate the proper amount to withhold, ensuring correct payments throughout the year.

- Schedule M: Modifications to Adjusted Gross Income, applicable for those who need to adjust their income due to specific deductions or additions unique to West Virginia state tax law.

Grasping the uses and functions of these documents can streamline the tax filing process, ensuring compliance with state requirements and potentially reducing the taxpayer's liability. Also, staying organized and keeping accurate records can make dealing with the West Virginia State Tax Department a smoother and more efficient process.

Similar forms

The West Virginia Estimated Tax form is similar to other tax documents in terms of its purpose and structure, helping taxpayers calculate and pay their estimated taxes. Below, we explore documents that share similarities with this form.

1. Federal Estimated Tax Form (1040-ES)

The West Virginia Estimated Tax form bears a resemblance to the Federal Estimated Tax Form, also known as the 1040-ES. Both forms are designed for individuals who expect to owe tax of at least $1,000, after subtracting withholdings and credits, and they cater to those whose income isn't subject to automatic withholding. This can include earnings from self-employment, interest, dividends, and alimony. The structure of these forms is similar, as they provide a method to calculate the amount of estimated tax due and establish the payment schedule - usually on a quarterly basis. Additionally, they guide taxpayers on how to avoid penalties by calculating the minimum required payment. The main difference lies in the jurisdiction they cover; one is for federal tax obligations, while the other focuses on state tax responsibilities in West Virginia.

2. State Change of Address Form

Another similar document to the West Virginia Estimated Tax form is the State Change of Address Form that various states use. Part 2 of the estimated tax form, where it allows for an address change, is a common feature found in the Change of Address Form. This section is crucial for ensuring that all correspondence and necessary tax documents reach the taxpayer. While the primary purpose of these forms differs—one is used for adjusting taxpayer information, and the other for calculating and paying estimated taxes—the mechanism for updating address details is quite parallel, underlining the importance of accurate taxpayer information in both cases.

3. Annual Income Tax Return (IT-140)

Finally, the West Virginia Estimated Tax form shares similarities with the Annual Income Tax Return, commonly referred to as Form IT-140 in West Virginia. Both documents are integral to the tax-paying process, where the estimated tax form is used for payments during the year, and the IT-140 is filed after the year's end to reconcile the total income earned and taxes paid. They work together, as the estimated payments made with the WV/IT-140ES form help reduce the amount owed when filing the IT-140. Moreover, they both require detailed financial information, including income and deductions, to accurately assess tax liability. Essentially, the Estimated Tax form serves as a precursor to the Annual Return, facilitating a smoother final reporting and payment process.

Dos and Don'ts

When it comes to handling your taxes, staying informed and cautious is key, especially with specific forms like the West Virginia Estimated Tax Form. Here are some do's and don'ts you should keep in mind:

Do's:- Read the instruction brochure (Form IT-140ESI) available at the official website to accurately determine your estimated tax. Understanding the guidelines can help you avoid mistakes.

- Check your information carefully. If there's any change in your address or personal information, make sure to indicate it on the form to keep your records accurate and up-to-date.

- Use the correct payment amount. Write the exact amount of your payment on the form to ensure proper processing of your payment.

- Pay at least the minimum required amount. This helps you avoid any penalties for underpayment.

- Mail your payment by the due date to the specified address on the form to avoid late fees and interest charges.

- Don't guess your estimated tax amount. Use the instructions and possibly consult with a tax professional to calculate your estimated tax accurately.

- Don't ignore changes in your personal situation. If you've moved or had other significant changes, update your information on the form to ensure you receive all the important tax documents.

- Don't forget to sign and date the form if required. An unsigned form may be considered invalid.

- Don't delay your payment. Being punctual with your estimated tax payments can save you from penalties and stress later on.

Following these guidelines can make the process smoother and help you stay compliant with your tax obligations.

Misconceptions

One common misconception is that the West Virginia Estimated Tax form is only for individuals who are self-employed. In reality, this form is utilized by anyone who expects to owe at least $600 in state tax upon filing their annual income tax return. This includes not only self-employed individuals but also those who receive income that is not subject to withholding, such as interest, dividends, and rental income.

Many believe that if their employer withholds taxes, they don't need to worry about the estimated tax form. This is not always the case. If your withholding is insufficient due to additional income not subject to withholding or significant deductions and credits, you may need to make estimated tax payments to avoid a penalty.

Another misconception is that estimated tax payments are optional. While taxpayers can choose to pay more than the minimum calculated amount, making at least the minimum estimated tax payment is required if you anticipate owing $600 or more in state taxes to avoid penalties.

Some think that the estimated tax amount is difficult to determine without professional help. Although calculating estimated taxes requires a good understanding of your anticipated income and deductions, the State of West Virginia provides instructions (Form IT-140ESI) and resources on their website to assist taxpayers in this process.

It's often assumed that all estimated tax payments are due at the beginning of the tax year. In fact, estimated taxes are typically paid in four equal amounts, with due dates throughout the tax year. These dates are provided in the instruction brochure to accommodate taxpayers who may not be calendar year taxpayers.

Some taxpayers believe that making an estimated tax payment will automatically update their address on file. If you have a change of address, you must check the appropriate box on the form and provide the new address. Simply making a payment does not update personal information in the tax department's records.

A common assumption is that late estimated tax payments are not a big deal as long as the total amount due is paid by the end of the tax year. Late payments can result in penalties, and it's important to make each estimated payment by its specific due date to avoid these charges.

Lastly, some taxpayers believe that they need to physically go to the Tax Department to make their estimated tax payments. West Virginia allows taxpayers to file their estimated taxes online via their MyTaxes website, offering a convenient and efficient way to manage tax payments.

Key takeaways

- West Virginia residents are required to make estimated tax payments if they anticipate owing at least $600 in state tax for the year. This helps in managing tax dues by spreading them over the year, rather than paying a lump sum during the tax filing season.

- The WV/IT-140ES form is the official document used for submitting these payments. This form assists in calculating the estimated tax due and facilitates proper credit towards the taxpayer’s annual state tax liability.

- It is crucial to correctly fill in personal details, including Social Security Numbers for both the taxpayer and spouse if applicable. Accurate information ensures the payments are credited to the right account, preventing future discrepancies.

- In case of a change of address or any other preprinted information being incorrect or outdated, taxpayers must check the designated box for a change of address on the form and provide the updated information to ensure ongoing communication and receipt of any tax-related correspondence.

- Payments are due quarterly, and timely submission is essential to avoid penalties. The form details the payment due dates and provides instructions for calculating the minimum payment required. However, taxpayers have the option to pay more than the calculated estimated amount if they choose.

Other PDF Forms

If You Have No Income Can You Get Tax Refund - The form asks attorneys to confirm that the courses attended had relevant written materials and offered a chance for engagement with other participants.

Business License Wv - Provides a pathway for entities holding significant land assets in West Virginia to declare this in their application, detailing fee adjustments.

Virginia Residency Requirements - Documentation such as a military ID and proof of domicile state are crucial for military spouse claims.